Author: Hedy Bi, OKG Research

Last weekend, the OKG Cloud Chain Research Institute accepted an invitation from FT Chinese to participate as a roundtable guest in the Financial Master Class jointly hosted by FT Chinese and the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University. During the roundtable discussion, the author engaged in in-depth discussions with professors and practitioners at the forefront of financial technology innovation on the complex relationship between technology, finance, and humanity, and their far-reaching impact on the future. Of particular note, Professor Liu Xiaochun, a part-time professor at the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University, outlined the development trajectory of the financial industry over the past few decades during the master class. One of his viewpoints prompted me to think deeply: the financial industry actually bears the risk costs of the entire society, which is often misunderstood as a problem inherent to finance itself.

The picture shows the scene of the SAIF Financial MBA professor's public class and dialogue event jointly organized by FT Chinese and the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University.

Professor Liu's insight inevitably reminded me of the mixed reviews that the Web3 field has faced in recent years. As Professor Liu mentioned, emerging technologies are often rapidly exploited by unscrupulous individuals, but this is not a flaw inherent to the technology itself; instead, it should serve as a driving force for industry practitioners to accelerate innovative applications. Looking ahead to 2024, the Web3 industry is embracing new development opportunities: the United States and Hong Kong are gradually incorporating Bitcoin and Ethereum into the mainstream financial system, attracting the attention of a large number of investors. Taking the US market as an example, the total amount of funds flowing in through the spot ETF channel has reached $14.7 billion. Although this figure may seem substantial at first glance, it has not caused a significant stir in the market. Apart from the underlying logic of the entire market undergoing a transformation, the author would like to discuss where we are now and where we are heading in this article.

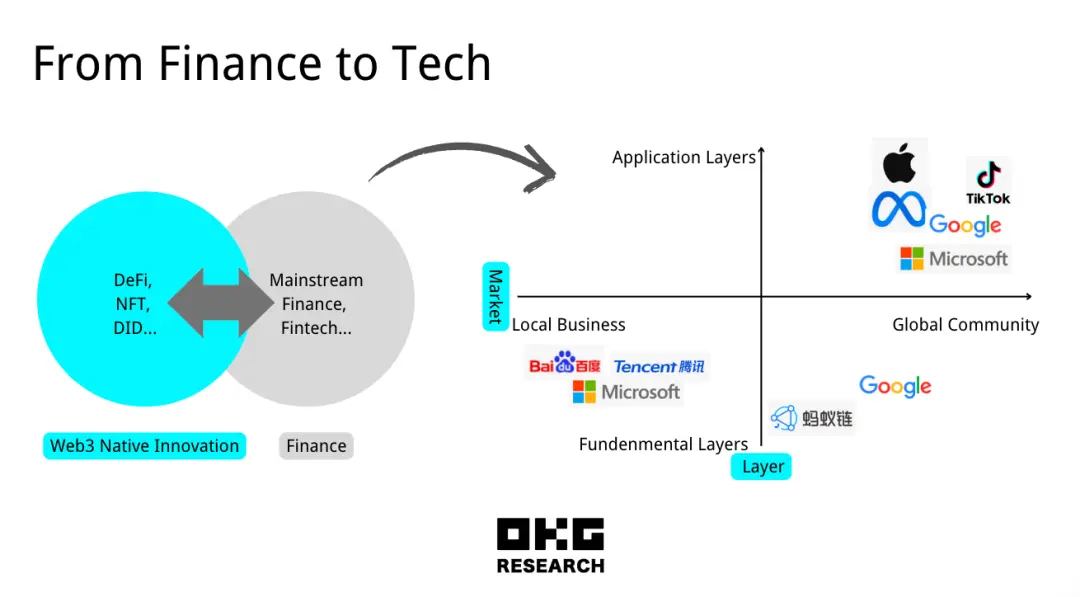

Native innovation stagnates, transitioning from financial technology to technology finance

The transition from financial technology (Fintech) to technology finance (Techfin) has been a developing trend in the internet and financial industries. Similarly, in Web3, we observe that the phase of native innovation has come to a close, with methods such as DeFi, NFTs, and tokenization being ways to enhance financial or asset flows with technology. Since the establishment of Uniswap in 2018, the total locked value of DeFi DApp on-chain assets has grown from an initial $420,000 to a peak of $179 billion in 2021, an increase of approximately 420,000 times in just 3 years. During this period, many have become wealthy through the opportunities presented by Web3, leading the younger generation to praise it as a rare opportunity for wealth creation and industry growth during an economic downturn.

At the Goldman Sachs Digital Assets Conference held this week, Yat Siu, Co-founder and Chairman of Animoca Brands, mentioned that the structure of the crypto world is similar and advanced compared to the real world. Currently, the scale of DeFi is already one of the largest central bank asset scales globally. According to specific data, this asset scale can already rank among the top 30 in nearly 200 countries worldwide.

However, since the opening of the BTC spot ETF channel this year, investors' attention has turned to mainstream trading instruments such as BTC, and it seems that native innovation in Web3 has entered a temporary stagnation period. From using technological tools to provide financial efficiency (financial technology) to using technology companies to provide financial convenience for users, OKG Cloud Chain Group has also evolved from initially providing technological tools around digital finance to solidifying various scenarios of on-chain data, and now, leveraging our user base in over 180 countries to promote the continuous integration and development of Web3 technology and finance.

In the future, we will see technology companies rapidly enter the Web3 space, especially at the application level, leveraging their large user traffic base and data advantages. In addition to the birth of cross-border cooperation products with traditional finance, we can also expect applications like ChatGPT, which can quickly gather millions of users, to open up new horizons for Web3 and bring new tools for technology finance.

Whether it's the recent news of Meta's plan to integrate more generative AI technology into VR, AR, and mixed reality games to revitalize its metaverse strategy, Microsoft's acquisition of Blizzard Games in 2022, collaboration with Aptos Labs in 2023 to develop new blockchain AI tools, or OKG Cloud Chain Group's use of AI to optimize and enhance the efficiency of its underlying platform, these are all unstoppable future trends.

Although the development of the metaverse has encountered setbacks in the past, in the future, the gaming and social branches in the metaverse field may explode with super applications as hardware becomes more complete and AI catalyzes the process. In addition, we can also observe that some technology giants native to Web3 are expanding beyond Web3 wallets and trading platforms to reach a wider user base.

Divergence in the East and West, with different choices by technology giants

We have delved into the development of several companies that have been more active in exploring the Web3 field in the East and West over the past 1-2 years. It can be observed that there are differences in strategic focus, technological implementation, and market positioning:

In terms of strategic focus, Eastern technology companies are more focused on applying blockchain technology to enterprise services and industrial digitization, such as providing enterprise-level technical solutions by companies like Baidu and Tencent; while in recent years, Western companies have shifted their focus to exploring the broader applications of blockchain and Web3 technology in consumer markets and innovation fields, including VR, NFTs, and gaming, aiming to create new digital markets and application experiences for consumers, as seen in the hardware efforts by Apple and Meta, and the support for NFT applications within existing user communities by TikTok and Google. Google's parent company, Alphabet, also continued to invest in the Web3 field at the beginning of 2024.

In terms of technological implementation, Eastern companies tend to develop their own personnel directly, while Western companies tend to favor open collaboration and ecosystem building, such as the cooperation between Microsoft and Animoca Brands, and the cooperation with Aptos Labs, to rapidly drive technological innovation and market adoption.

In terms of market positioning, Eastern companies tend to focus on deep cultivation of the domestic market, while Western companies tend to leverage the global nature of Web3 for promotion, as evidenced by Google Cloud's role as a validator on the Tezos blockchain, demonstrating its global strategy and influence.

This chart is based on limited public information and is accurate as of July 1, 2024.

Based on the borderless and global nature of the Web3 community, we can see that some technology companies have rapidly integrated into the Web3 ecosystem. Therefore, at the application level, the characteristics of the Web3 community make it easier to expand global business beyond local markets. As a leader in Web3 technology, OKG Cloud Chain has also keenly felt the globalization of the Web3 market. Currently, based on publicly available information, Western internet giants have shifted to the application layer after completing the infrastructure construction phase, while Eastern internet giants have not yet seen this clear trend.

Although we observe that Web3 has reached a crossroads: native innovation is in a state of stagnation, and technology and financial giants from the East and West are continuously entering the Web3 field. As the two forces of finance and technology continue to merge, they are lifting the Web3 industry towards vigorous development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。