Authors: Weizhi, Luccy, BlockBeats

In the past 24 hours, the total market value of the cryptocurrency market has dropped by 91 billion US dollars.

After experiencing 12 hours of long and short game at $60,000, Bitcoin began to "waterfall" at 9 am today, falling below $58,000 in a short time, once again probing the low point of a week ago, with a 24-hour decline of 5.72%. As of the time of writing, Bitcoin has returned to above $59,100.

In addition to Bitcoin, mainstream altcoins have also started to decline. The liquidation in the cryptocurrency market in the past hour was close to 100 million US dollars, accounting for half of the past 12 hours. The 24-hour decline of mainstream tokens in the Ethereum ecosystem such as LDO, ETHFI, ENS, etc. ranged from 8% to 20.46%. The Solana ecosystem also did not escape, with JTO, WIF, TNSR all experiencing around 15% decline.

At the bottom, but there is always a reason for the decline

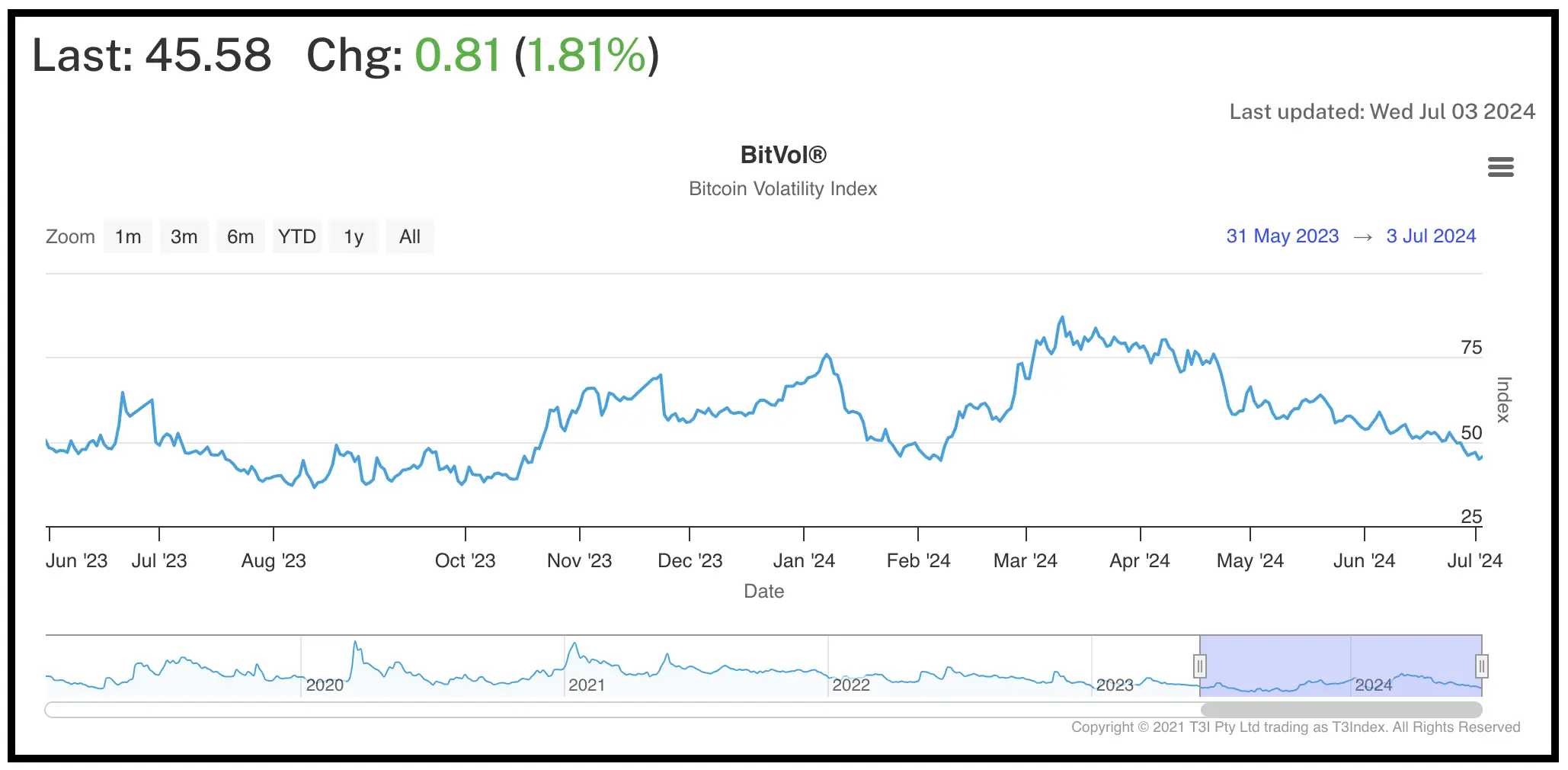

Although the overall market has been sluggish for a month, the cryptocurrency community has accepted the current "long callback bottom" stage. The volatility of Bitcoin has approached a new low since February, but signals of continued decline still exist.

David Lawant, research director of FalconX, wrote in a report: "The current characteristic of the cryptocurrency market dynamics is low volatility and weak trading volume. When the price starts to move towards the edge of the range, the order book will lose balance."

Bitcoin spot ETF is an important reference for judging the market trend. According to Farside Investors data, Bitcoin ETF has seen net outflows for two consecutive days, with a total outflow of 34.2 million US dollars over the two days.

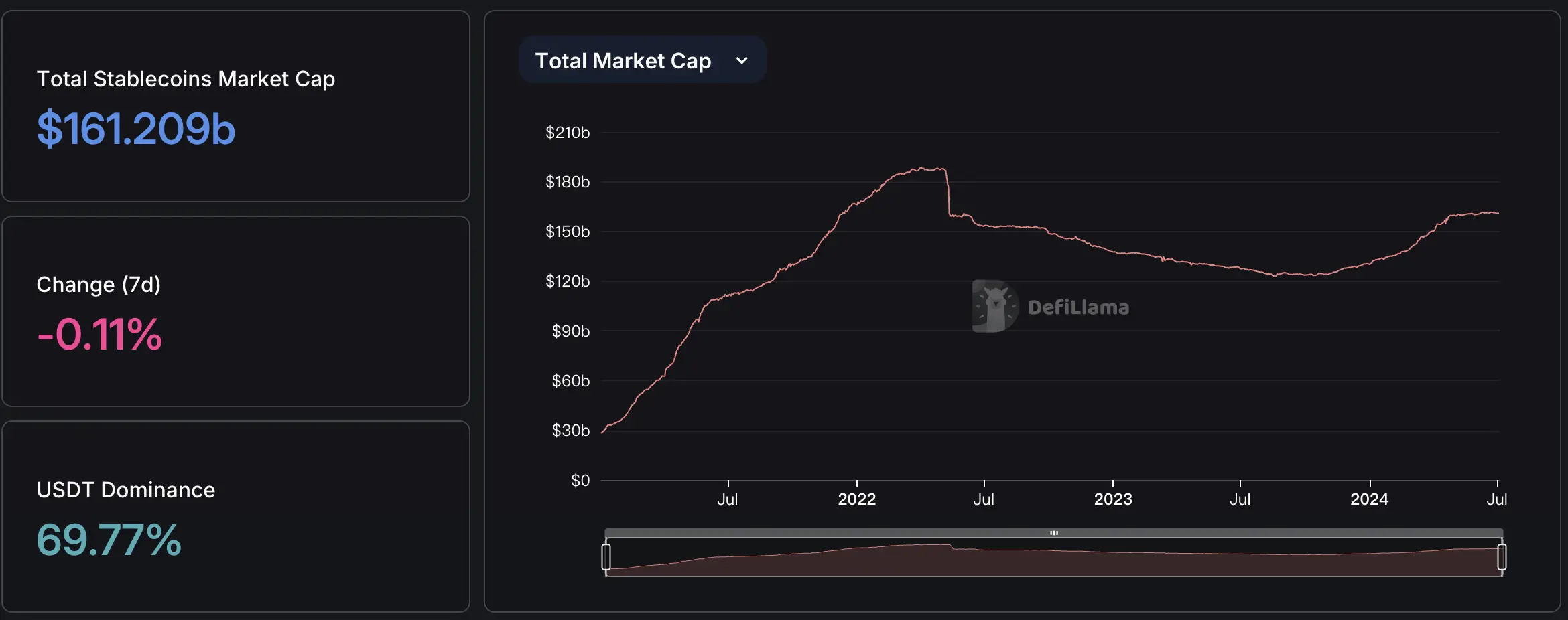

In addition, the lack of new funds entering the market is also an important reason why the overall market is unable to meet market expectations.

The total market value of stablecoins in the cryptocurrency market has been steadily increasing since the middle of last year, corresponding to the continuous rise of the overall market at that time, indicating a clear signal of a bear-to-bull transition. However, since early May, there has been no new money entering the cryptocurrency market, and the market value of stablecoins has been hovering around 160 billion US dollars for more than two months. In the case of insufficient liquidity in the market, there is no buying power to drive the market up.

Emotions continue to be depressed, is it time to buy?

A week ago, Bitcoin touched $58,000. After a week, Bitcoin once again fell to this level. Is it a callback clearance or the end of a bull market? The market views are divided.

From a technical analysis perspective, Bitcoin has shown a divergence at the bottom on the 4-hour and daily RSI (Relative Strength Index). This means that the price of Bitcoin may have fallen too much in the short term, and today's selling pressure is not as strong as on June 24, which may lead to a rebound.

Is it time to buy when market sentiment is overly pessimistic? According to analysis by crypto KOL Ignas, he stated that the price of Bitcoin is being artificially suppressed, inducing retail and institutional investors to sell for hedging through deceptive sell orders by whales.

Just yesterday, CryptoQuant released a report pointing out that for most of the time since the halving, Bitcoin miners' rewards have been "extremely low," and transaction fee income has dropped to only 3.2% of the daily total income, the lowest share in three months. With insufficient incentives, miners will start to "surrender" one after another, shutting down underperforming equipment and starting to sell Bitcoin to hedge risks, which historically usually signals the bottom of Bitcoin.

However, there are also various signals indicating that Bitcoin may continue to decline.

From the net flow of Bitcoin ETF, Markus Thielen, founder of 10x Research, stated in his latest report that the average entry price of Bitcoin ETF buyers is estimated to be between $60,000 and $61,000. Therefore, when Bitcoin fell below $60,000 yesterday, it may trigger an ETF liquidation wave, further lowering the price of Bitcoin.

For example, Markus Thielen believes that the weekly and monthly reversal indicators of Bitcoin indicate a more extensive callback, and its price may further decline to $55,000. Andrew Kang, co-founder of cryptocurrency venture capital firm Mechanism Capital, sees an even lower bottom position, believing that Bitcoin may experience an extreme callback to the $40,000 range.

Regarding the long-term price of Bitcoin, the market still maintains confidence. Standard Chartered Bank predicts that Bitcoin may reach a new historical high in August and reach $100,000 during the US presidential election in November. The bank's analysts expect that if Trump wins, it will push up the price of Bitcoin, while maintaining the target prices for the end of the year and 2025 at $150,000 and $200,000, respectively. Tom Lee, co-founder of Fundstrat, also insists that Bitcoin will reach the forecast of $150,000.

"Making money is too difficult," "Sorry to the family," these are the discussions that have been frequently appearing in the community over the past month. For retail investors, this bull market is really tough.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。