Although the form of stablecoins will not change significantly, the utility of stablecoins has yet to be fully explored.

Author: Jack Chong

Translation: Deep Tide TechFlow

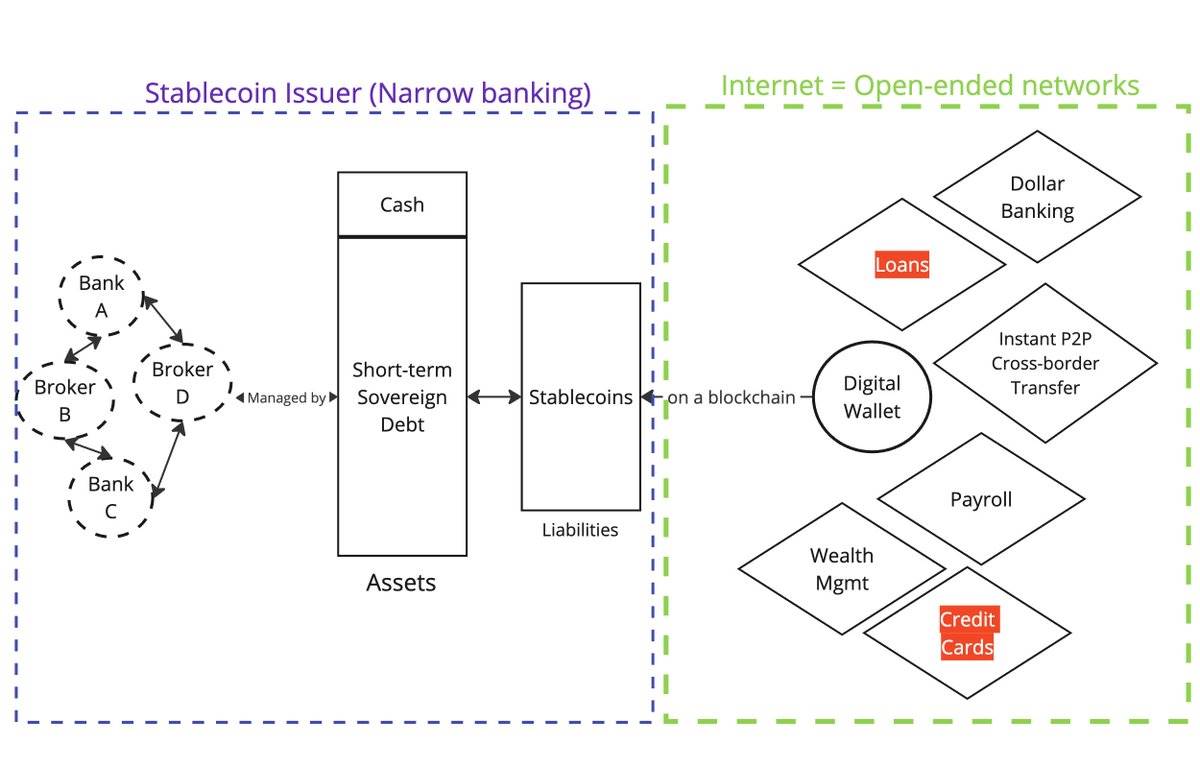

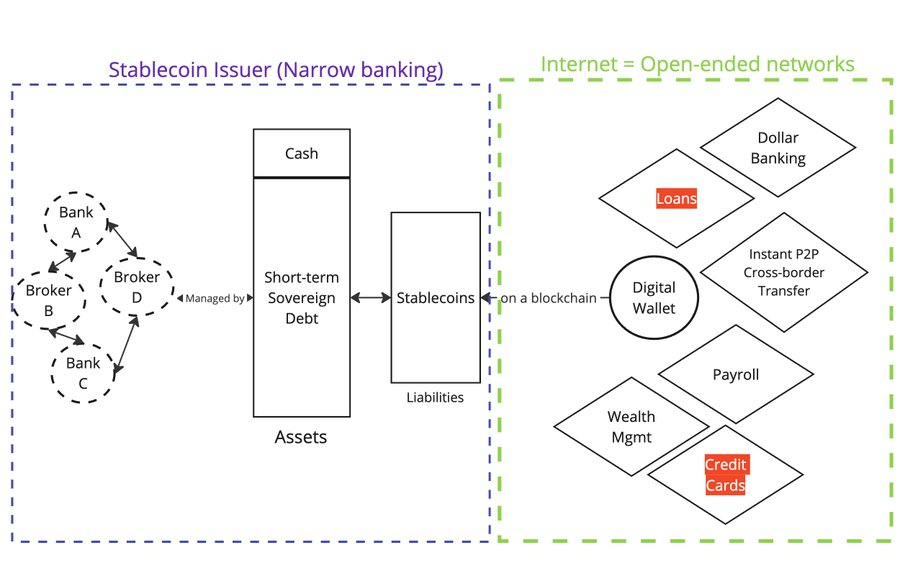

Stablecoin is a native internet currency liability form and is the new generation of Banking as a Service (BaaS).

The form (asset) of stablecoin will not change, we are just beginning to explore its utility. Here are some models for predicting the future development of stablecoins:

1. Stablecoin is the new generation of Banking as a Service (BaaS)

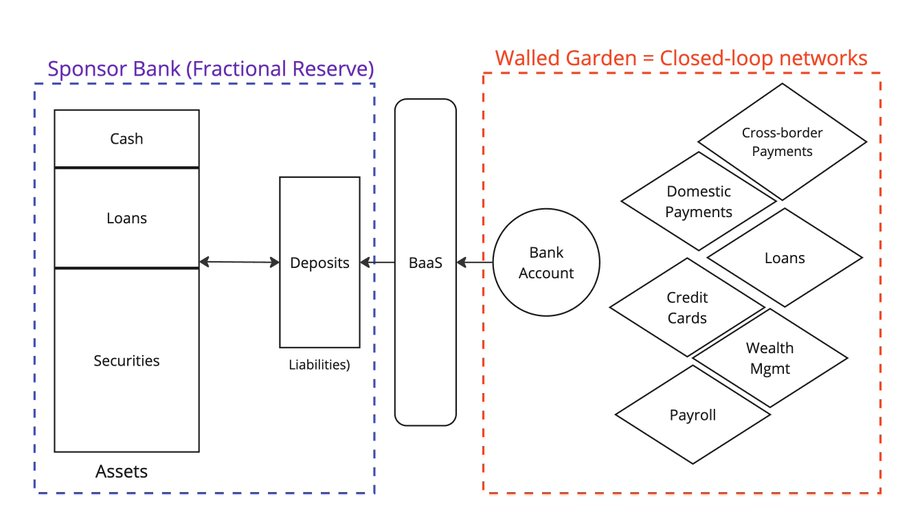

In Web2 fintech, a wave of startups provides Banking as a Service (BaaS) for building new applications on top of it.

These BaaS companies act as middleware, simplifying the complexity of interacting with traditional banks. For example, companies like @Venmo, @wise, @CashApp, @Affirm have benefited from BaaS and launched new types of products such as new P2P payments, Buy Now Pay Later (BNPL), and cross-border payments.

All account holders deposit their funds into partial reserve banks, bearing the risk that the bank will not fail. However, the collapse of Silicon Valley Bank tells us that nothing is absolutely certain.

Unfortunately, one of the leaders, Synapse, has gone bankrupt, causing huge trouble for its customers and partners.

And one of the main sponsoring banks, Evolve Bank, has also suffered a massive data breach as it was attacked by Russian hackers.

So, what is the alternative to Banking as a Service? If BaaS has driven the development of fintech 2.0, then stablecoins are empowering fintech 3.0.

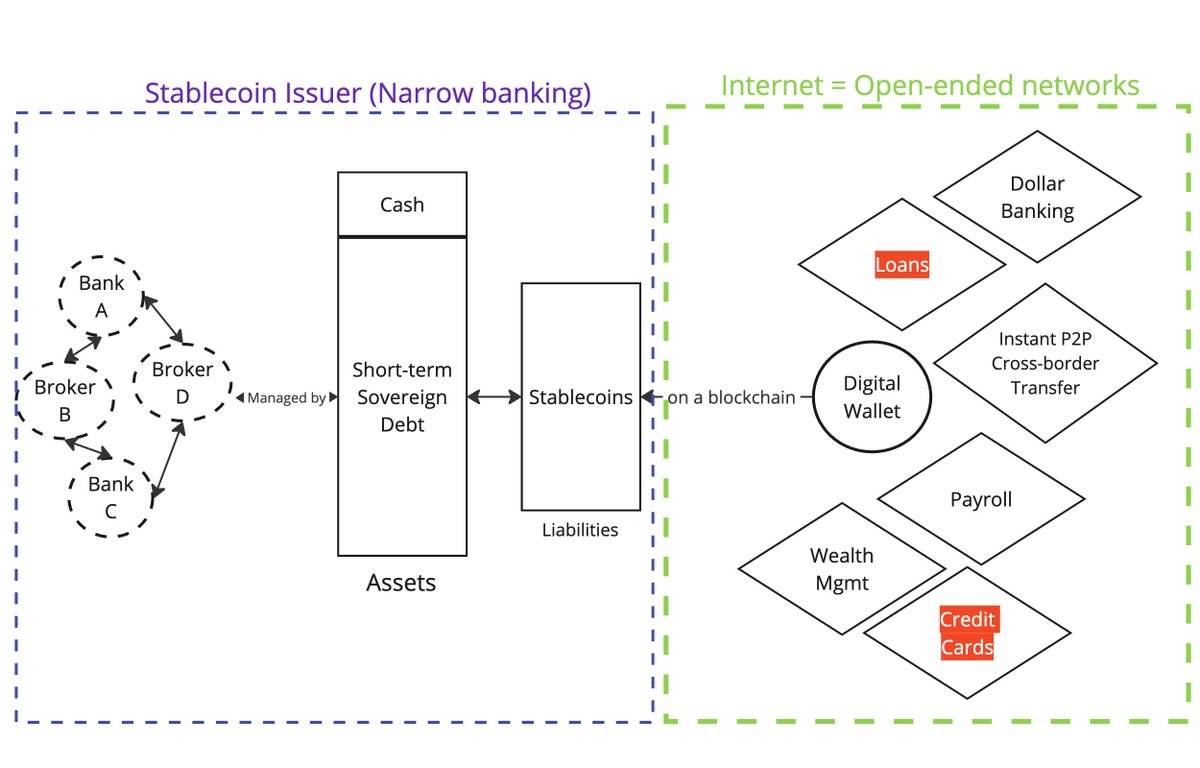

Fiat-backed stablecoins (such as @circle, @Tether_to, @Paxos) represent on-chain debt, these tokens are backed by some form of fiat collateral stored somewhere off-chain.

Assets

Issuers do not provide loans, they are narrow banks.

Liabilities

Tokens are now distributed on the blockchain. Anyone with a wallet and internet access can purchase and hold these tokens from the secondary market.

Functionally, the services provided by stablecoins to consumers are the same as Banking as a Service (BaaS).

Holding $USDC as a non-US user is equivalent to having a dollar account through @Wise.

If you hold $USDC, you face the risk of Circle as the issuer, BlackRock as the broker, and the risk of Circle's banking partners.

If you have a dollar account through @Wise, you face the risk of Wise's BaaS partners and the risk of its sponsoring bank (partial reserve).

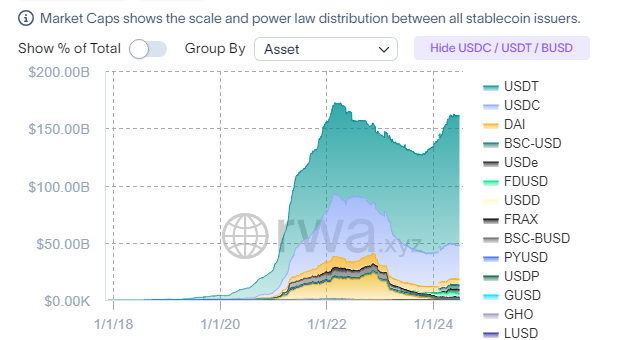

So, why have stablecoins achieved such significant growth in such a short time?

This all comes down to the distribution of liabilities (deposits in Web2 vs stablecoins in Web3).

In Web2, deposits are trapped in closed networks (e.g., domestic payment networks and SWIFT).

In Web3, stablecoins are recorded on public blockchains from the start, they are open networks.

This also explains why public blockchains may achieve the Lindy effect, as they are the focal point coordinated by all market participants.

(See tweet)

This brings me to the next point:

- ### The form of stablecoins (i.e., the asset side) will not change in the future

Because stablecoins must focus on distribution (i.e., liabilities), issuers naturally tend to the same composition of assets.

About regulation

Regulatory authorities (such as the US, EU, Hong Kong, etc.) are narrowly focusing stablecoin regulation on the asset side, specifying asset types and how to manage assets is relatively straightforward.

Regulating assets also makes sense if you want to protect consumers (see Terra/Luna's algorithmic support).

- ### While the form of stablecoins will not change significantly, the utility of stablecoins (i.e., the use of liabilities) has yet to be fully explored

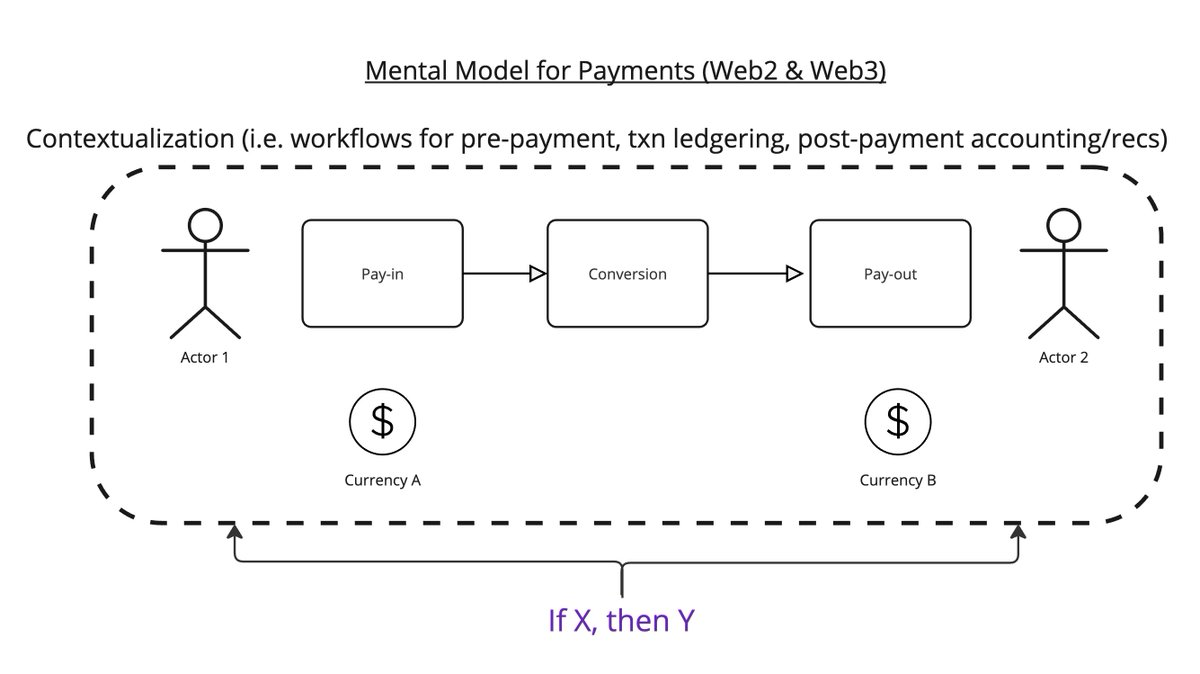

Imagine that the essence of payments is to transfer $x from one place to $y, following certain conditions in the process.

This is my model of thinking.

The payment process is divided into three steps:

Payment entry

Conversion

Payment exit

In this workflow, you need to consider, for example, what is this payment for? After the transaction is completed, you need to record it in the ledger, and upon receiving the transaction, you need to combine it with the invoice.

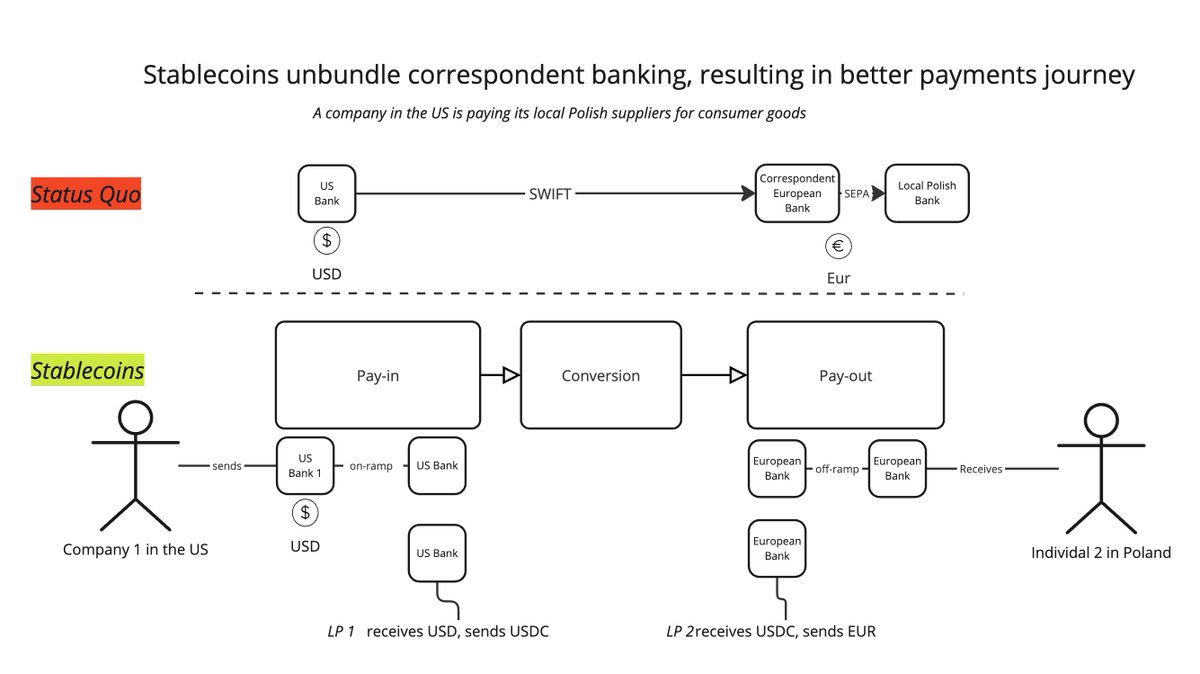

Currently, stablecoins have a very clear utility: to deconstruct the traditional correspondent banking network through a set of new service providers. Instead of relying on a single SWIFT transaction, you can now break it down into: Deposit -> BaaS -> LPs Conversion -> BaaS -> Withdrawal. This way, you can combine the best services at each step to provide a better user experience.

In fact, this is also the way described by @mgiampapa1, @will_beeson, @bkohli on @rebankpodcast.

(For more details, please refer to this link)

But is cross-border payment the only use case for stablecoins?

I don't think so.

There is a lot of untapped potential around programmable money.

If the logic of "If X, then Y" can be applied to the entire payment workflow, what about the transfer of value between machines?

(See tweet)

How can companies like @sentient_agi monetize the data source of large language models (LLM) every time they call for reasoning?

(See tweet)

Regarding regulation

How do regulatory authorities view the utility of stablecoins? In my opinion, the only important thing is to understand your customer (KYC).

The most obvious regulatory conflict I have seen is:

If stablecoins are indeed similar to Banking as a Service (BaaS), should regulatory authorities regulate stablecoins as they do BaaS? This is a question of functional equivalence.

Should stablecoins be allowed to be anonymous like cash?

If the first scenario happens, the entire stablecoin industry will collapse, and the market value and trading volume will be halved. As a result, the US will lose a significant source of demand for US Treasuries (UST).

(See tweet)

The second scenario is possible, but I expect existing businesses and offshore banks benefiting from the status quo to strongly oppose it.

(See tweet)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。