Author: Nancy Lubale, CoinTelegraph

Translation: Deng Tong, Golden Finance

BTC prices have dropped by 2.25% in the past 24 hours, currently 16% lower than the historical high of $73,835 set on March 14.

Bitcoin/USD daily chart. Source: TradingView

The price of Bitcoin has dropped by 8.75% in the past 30 days and 5.5% in the past three months. The decline in Bitcoin prices in June has led market analysts to question whether this pioneering cryptocurrency has reached a "cycle top."

Let's take a look at some of the reasons analysts believe the Bitcoin bull market has peaked.

Bitcoin Long-Term Holder Inflation Rate Approaching Critical Threshold

Charles Edwards, founder of Capriole Investments, stated that many on-chain indicators suggest that Bitcoin's failure to set new highs after two retests is a "soft sign."

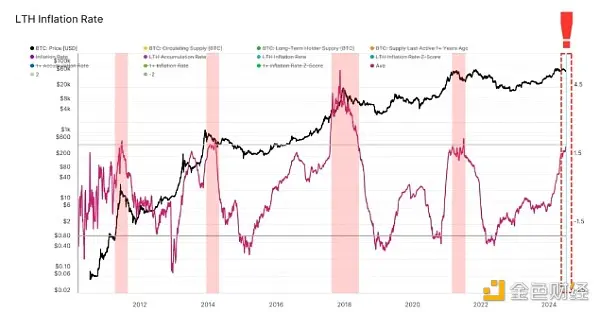

In the latest newsletter, Edwards explained that the inflation rate of Bitcoin long-term holders (LTH) has been steadily increasing over the past two years.

According to Glassnode, the LTH market inflation rate measures the annual accumulation rate or distribution rate excluding the amount issued to miners daily. A higher value indicates that as the Bitcoin held by LTH decreases, they are increasing selling pressure.

At the peak of a bull market, market inflation reaches its peak, exceeding nominal inflation (2.0), "which usually signals a high threshold for the cycle top," Edwards said.

"Today it's 1.9, we're too close to this level, I don't like it."

Bitcoin LTH inflation rate. Source: Glassnode

Bitcoin Dormant Supply Continues to Increase for Three Consecutive Months

Another indicator that helps determine market cycles and assess whether Bitcoin is bullish or bearish is the dormant supply. It is an on-chain indicator used to measure the amount of tokens spent relative to the overall trend.

Additional data from Glassnode shows that the Bitcoin dormant Z-score has suddenly increased in the past 90 days.

Edwards observed that this indicator reached a significant peak in April, indicating a significantly higher average holding time for tokens sold in 2024. "The peak of this indicator (z-score) is usually seen three months after the cycle top," the analyst explained.

"Well, it's been three months now. The price has just dropped, and the dormant Z-score peak still maintains a structure very similar to the peaks in 2017 and 2021."

Bitcoin dormant Z-score. Source: Glassnode

At the current value, the dormant supply Z-score suggests that Bitcoin is overvalued relative to the sum of tokens in circulation without trading volume support. This indicates that the Bitcoin price may have reached a cycle top, which could also be bearish for the broader cryptocurrency market.

Surge in Spending Volume Could Be Bitcoin's Ultimate Signal

Finally, the continuously growing cluster and peak spending volume help indicate the "increasingly risky area" as stated by Edwards. Historically, when the spending volume of 7-10 year-old Bitcoins suddenly increases, it could be a signal of a cycle top.

It is worth noting that the growth in volume for 2024 suggests rapid progress in this cycle.

"This chart will surprise you, slap you in the face," Edwards said in a July 2 X post.

"The entire history of this chart has disappeared because a large amount of Bitcoin has moved on-chain, 10 times more than the previous high."

Bitcoin lifecycle is 7-10 years. Source: Glassnode

Edwards also pointed out that Bitcoin worth over $9 billion has been transferred from addresses older than 10 years. He attributed this distribution to the recent move by the dissolved cryptocurrency exchange Mt. Gox—preparing to repay creditors later in July.

Bitcoin financial services company Swan shares a similar view, stating that the market is concerned about the impact of Mt. Gox's 142,000 Bitcoins (approximately $9 billion at current rates).

Swan explained that although "many creditors are long-term holders with the option to choose, institutional ownership and tax considerations indicate that the selling pressure is gradual rather than sudden, even if all tokens are simultaneously released to the market."

In a subsequent X post, the company added that ongoing government sales are increasing the supply-side pressure on Bitcoin.

Source: Swan

An earlier report from Cointelegraph showed that a cryptocurrency wallet labeled "German government (BKA)" transferred 832.7 Bitcoins (approximately $52 million) in four transactions on July 2. According to Arkham Intelligence data, the wallet sent 100 BTC to Coinbase, 150 BTC to Bitstamp, and 32.74 BTC to Kraken.

Tracking the selling patterns of Bitcoin whales can provide valuable clues to investors about the price of Bitcoin, as a large number of sell orders can foreshadow a market top.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。