Writing: Aiying

Circle announced that its USDC and EURC stablecoins have complied with the new EU stablecoin regulations, becoming the first global stablecoin issuer to be compliant under the MiCA regulations. Starting from July 1st, Circle officially issued these two stablecoins to European customers.

This marks an important milestone in the development of the internet financial system, indicating that one of the world's largest economies has established clear regulations to make stablecoins legal electronic currencies, driving the cryptocurrency market into a new stage of mainstream payment, financial, and commercial infrastructure.

Prior to this, Aiying wrote a comprehensive analysis in the article "A Comprehensive Interpretation of the Far-reaching Impact of the European MiCA Act on the Web3 Industry, DeFi, Stablecoins, and ICO Projects," which deeply analyzed the impact of the act on the industry, especially the stablecoin market. MiCA requires stablecoins supported by legal tender to have sufficient liquidity reserves and obtain an "Electronic Money Institution (EMI)" license. In addition, it also stipulates trading volume limits and other asset support requirements. June 30th was an important deadline, requiring exchanges to delist stablecoins that do not comply with the regulations.

Circle's USDC is expected to take market share from its larger competitor, Tether Holdings Ltd.'s USDT. OKX, Binance, Bitstamp, and Kraken have taken measures to change their support for USDT in the EU, recently canceling the ability to purchase or sell other cryptocurrencies using this stablecoin.

Circle's Opportunity and the Historic Similarity to the Rise of USDT

In Aiying's article "A Comprehensive Report on Stablecoin Racing: Models, Operating Principles, Trends, and Reflections on Stablecoins in Hong Kong," it was mentioned that the biggest advantage of USDT is its first-mover advantage, but its rise is mainly due to the support of exchanges and the market boom. As the cryptocurrency's wild era began, from the early Bitcoin blockchain to the later Ethereum ecosystem, USDT rightfully became the pioneer and also accurately predicted the market boom. Looking back at its holding addresses and market value, although it was established in 2014, its true rise was in 2017. That year, in addition to the bull market, USDT began massive issuance, which was criticized for manipulating Bitcoin prices.

However, in hindsight, this is a case of reversed causality. What is easily overlooked is that China closed virtual currency trading that year, and more importantly, USDT simultaneously went online with the top three exchanges.

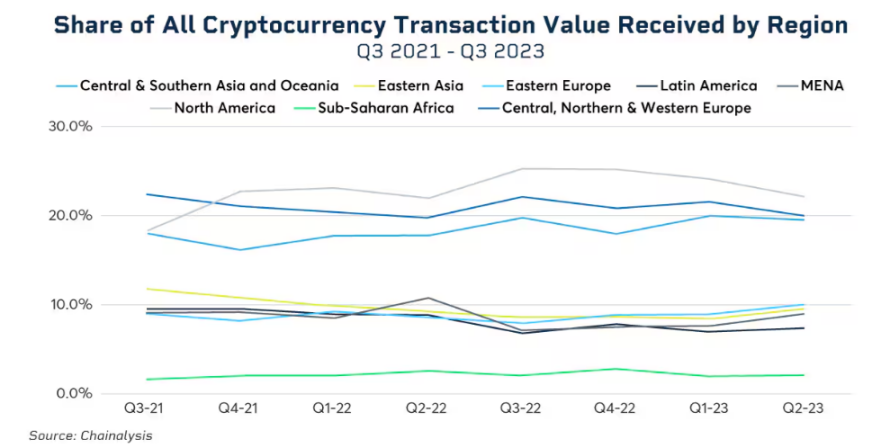

Similarly, according to Chainalysis' "2023 Geographic Report on Cryptocurrencies," the region accounted for 17.6% of global trading volume from July 2022 to June 2023. With the introduction of the Mica Act, this share has helped Circle establish a strong presence in this area.

Circle benefits from the growth and almost certain adoption of the Euro digital currency (i.e., Euro stablecoin). The MICA Act establishes clear rules for the issuance and operation of the Euro digital currency, allowing banks and electronic money institutions to make the Euro stablecoin a core part of their products and services. This means that the entire European regulated financial sector can now adopt this network, significantly expanding the use of stablecoins in commercial and financial applications. In Aiying's view, this market is very significant.

Circle's Global Compliance Vision and Starting Point Achievements

Veterans in the cryptocurrency industry are well aware that USDC rose during the USDT crisis, winning customer favor with its transparency, regulation, and more liquidity in asset reserves. Looking back at USDC's rise, the significant increase in its holding addresses usually corresponds to a decline in USDT holdings, often occurring during USDT's risk events, especially because it was initially the only stablecoin trading pair on the regulated exchange Coinbase. This regulated support brought significant benefits to the early USDC market expansion and is a major competitive advantage in challenging USDT's leading position. Due to its compliance, DeFi protocols favor USDC more, and liquidity mining has rapidly increased USDC's volume, giving it an advantage on-chain. After Maker introduced the regulated stablecoin USDC in 2020, USDC became the preferred choice for major DeFi protocols. Currently, MakerDAO, Compound, and Aave are the main supporters of USDC. Apart from the regulatory advantages, the most important aspect is that as collateral for DeFi protocols, USDC has lower volatility compared to USDT. The starting advantage of USDC can be summarized as a compliance advantage.

What Global Compliance Efforts Has Circle Made?

Circle is registered as a money services business under the U.S. Department of the Treasury's Financial Crimes Enforcement Network and operates in accordance with state laws on money transmission. It is generally regulated as a form of prepaid access. Unlike USDT, USDC's reserve assets are independent. In the event of Circle's bankruptcy, these reserve assets will be protected under New York banking law and federal bankruptcy law.

Circle is the first crypto company to obtain an Electronic Money Transmitter License from the U.S., the first company to obtain a BitLicense in New York, and has obtained an Electronic Money Issuance License in the UK. For a deeper understanding of the legal framework for U.S. cryptocurrency payments, you can read: [【Payment Section】In-depth Analysis of the Legal Basis and Requirements for U.S. Cryptocurrency Payment Licenses]

Two years ago, the EU reached the MiCA system, which was ultimately approved by the European Parliament, making it the most comprehensive regulation for stablecoins and digital assets globally. Circle subsequently announced the launch of the Euro stablecoin and made every effort to comply with the new EU regulations. France has been at the forefront of establishing cryptocurrency and digital asset regulations, and Circle's decision to choose France as its European headquarters proves to be a wise one. The company closely collaborates with the French financial regulatory authority ACPR to ensure compliance with the MiCA regulations.

Circle has now obtained an Electronic Money Issuance License from ACPR and has become the issuer of MiCA-compliant USDC and EURC stablecoins. European customers can now directly obtain USDC and EURC through Circle Mint France.

As a result, USDC has become the only major stablecoin compliant with the new European stablecoin regulatory system. Circle has worked closely with regulatory authorities in France, the EU, and the U.S., achieving full interchangeability of global stablecoins on the blockchain network, maintaining technological innovation while meeting strict regulatory standards.

Currently, all USDC and EURC in circulation in Europe comply with MiCA regulations. All EURC reserves held by Circle are managed under the supervision of regulatory authorities in France, while the USDC reserves held in Europe are managed by globally systemically important banks within the EU. European users' USDC remains fully interchangeable globally, allowing for trading, transfers, self-custody, and use in DeFi without any changes. For more details, you can refer to Aiying's previous article [Standard & Poor's] USDC Stablecoin Stability Assessment and its Reserve Fund Operation Mode.

In addition, we know that USDC does not directly exchange with individuals. For USDT, for amounts over $100,000, direct exchange with Tether is possible with only a registration fee, but Circle operates according to customer levels. Only its partners or Class A users (exchanges, financial institutions, etc.) are eligible to exchange with Circle. Ordinary individual users (Class B) need to go through third-party channels (such as Coinbase). Starting today, Circle will issue and redeem USDC and EURC directly with major institutions in the European market through Circle Mint France, including exchanges, market makers, brokerage firms, consumer wallets, fintech companies, payment institutions, banks, and large enterprises. This market sales system significantly reduces the risk of money laundering for users, effectively managing and isolating risks through large B-side entities.

Conclusion

The launch of the MICA Act heralds a significant transformation in the market structure. It is expected that within the next year, major jurisdictions globally (including Japan, the U.S., the U.K., Singapore, Hong Kong, the UAE, Brazil, etc.) will introduce comprehensive stablecoin regulations, all of which will require strict regulatory compliance. The gray market space of the wild era is continuously being compressed, ultimately merging with the regulated market. We are all witnesses to this financial era transformation, and Aiying will continue to share this integration process with everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。