Sui is a Layer-1 public chain created by the team members of the original Meta Diem and Novi projects (formerly the team leading the development of the Facebook Libra project). The SUI public chain was officially launched in May 2023. The core development team, Mysten Labs, raised a total of $336 million in two rounds of private investor financing in 2022, and approximately $54.3 million in several public offerings in 2023.

Sui has many technological innovations, including an object-centric data model, the Narwhal mempool protocol, the Bullshark consensus protocol, and the "Move" programming language for the Sui public chain. Sui Move is built on the original Move language created by Sam Blackshear, co-founder of Mysten Labs, during his time at Novi. Compared to other Web3 programming languages, it provides greater flexibility and security.

Sui has released a series of protocols and products, such as sponsored transactions, which allows natural gas fees to be extracted from end users; zkLogin, which enables Sui users to transact using OAuth ports; and Sui Kiosk, a decentralized system for commercial applications. The development of the Sui ecosystem is led by the Sui Foundation, and Mysten Labs is the initial contributor to the development of the Sui blockchain protocol.

Part I: SUI Overall Performance

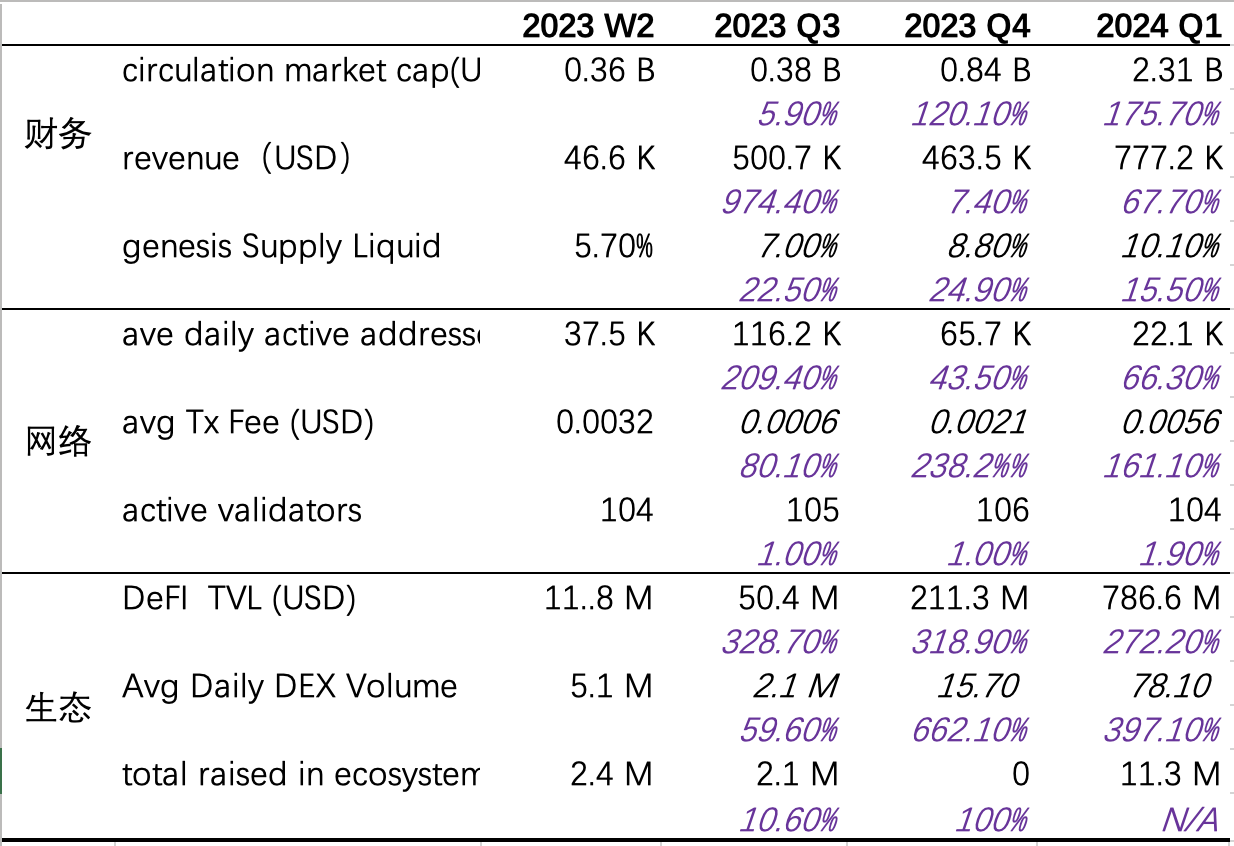

The overall performance of the SUI public chain for the first quarter of 2023 and the second quarter of 2024 is as follows:

a. During the reporting period, SUI ranked 57th in market value (a 176% QoQ increase). The crypto market transitioned from a bear market to a bull market in Q4 2023 and maintained growth in Q1 2024. SUI's performance reflected this transition, with its circulating market value increasing by 120% in Q4 2023 and by 176% in Q1 2024, reaching $2.3 billion. Its growth rate exceeded that of similar tokens, and its market value ranking rose from 81st to 57th over the past two quarters. Due to a larger quantity of tokens being unlocked, SUI's price increase was lower than its market value increase, but it still rose by 292% over the past two quarters.

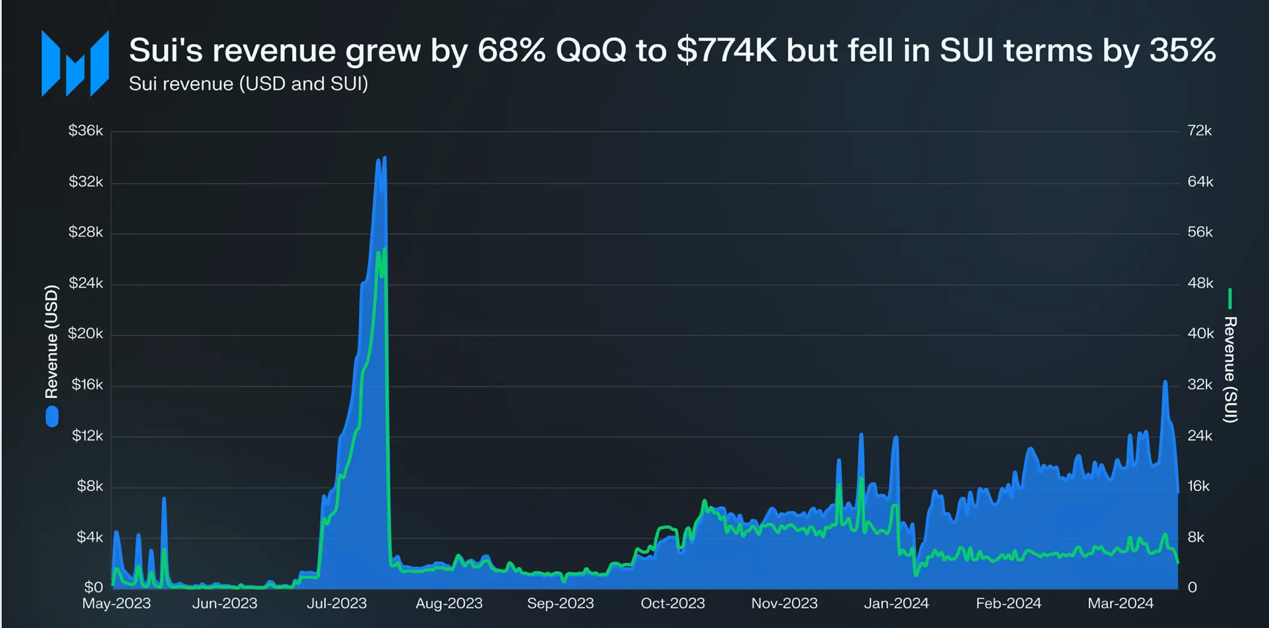

a. SUI's revenue was $807,000 in Q4 2023, a quarterly high, but it decreased by 35% to $774,000 in Q1 2024. SUI's revenue metric calculates the total fees of all protocols, and then SUI distributes the on-chain income to its validating nodes.

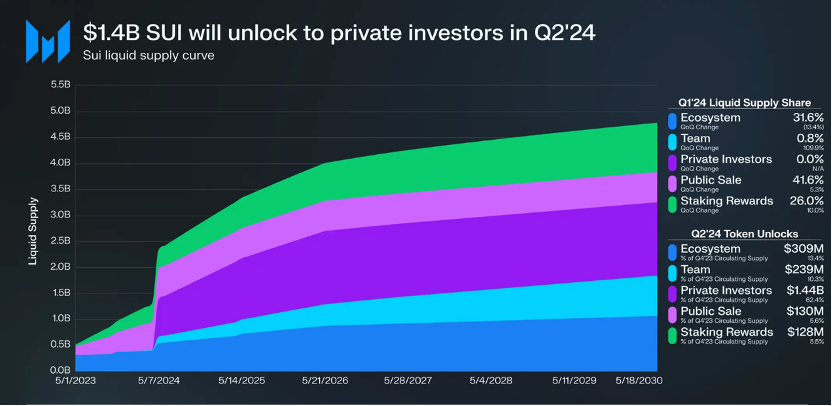

b. The current total token supply of SUI is 10 billion, with 1 billion tokens allocated for participation rewards. For the remaining 9 billion tokens, SUI's annualized inflation rate is 3.2%, primarily used for equity rewards (as of Q1 2024).

c. Regarding the unlocking of SUI's genesis supply:

1) Private investors unlocked 68% of the total unlocked amount in Q4, amounting to $1.4 billion; although FTX was an initial investor in SUI, in the first quarter of 2024, Mysten Labs completed a buyback of FTX's initial tokens for $96 million.

2) Tokens unlocked by the SUI ecosystem accounted for 15%, totaling $309 million, primarily used for on-chain activity rewards.

3) Tokens unlocked by the development team accounted for 11%, totaling $239 million.

4) Tokens unlocked for public sale accounted for 6%, totaling $130 million, and these tokens will be fully distributed by May 2024.

Part II: Analysis of the SUI Ecosystem Network

The development of the SUI ecosystem network for the first quarter of 2023 and the second quarter of 2024 is as follows:

Part III: Public Chain Usage

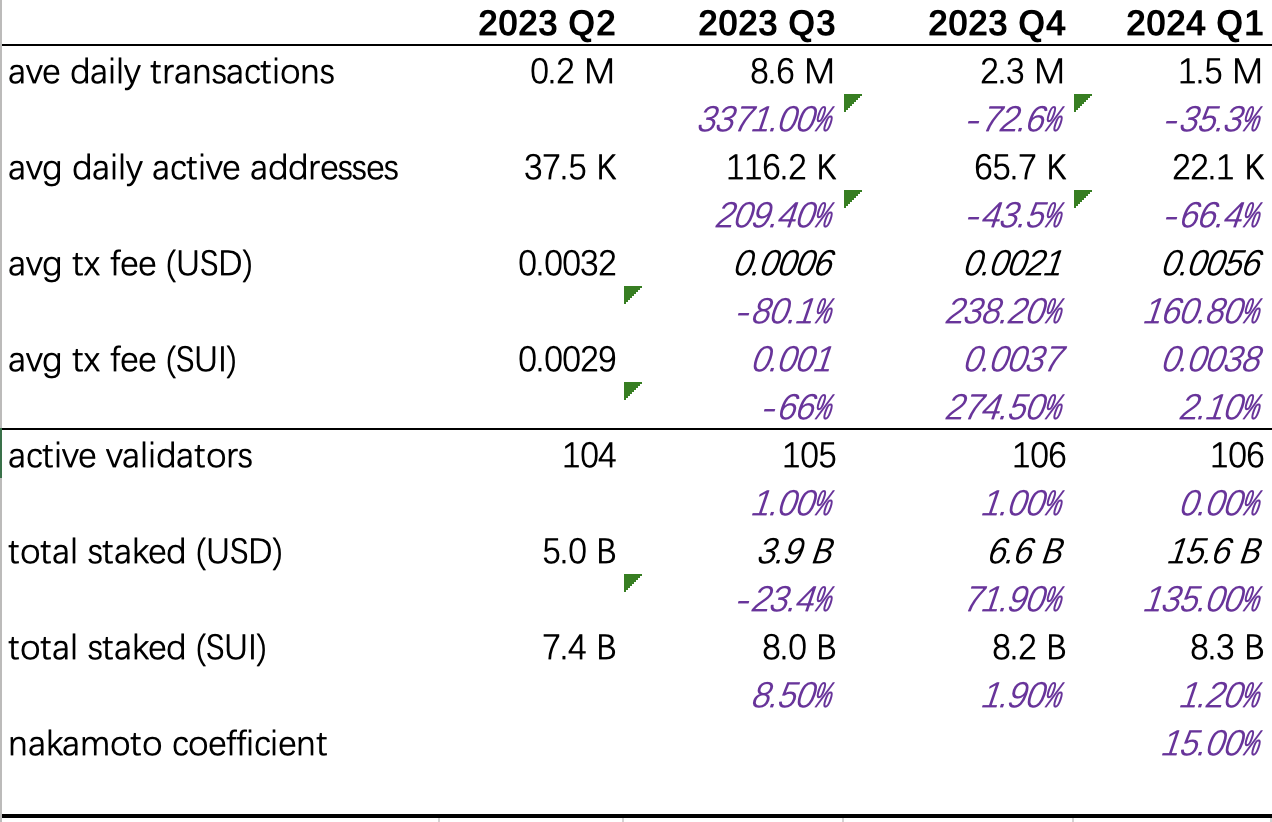

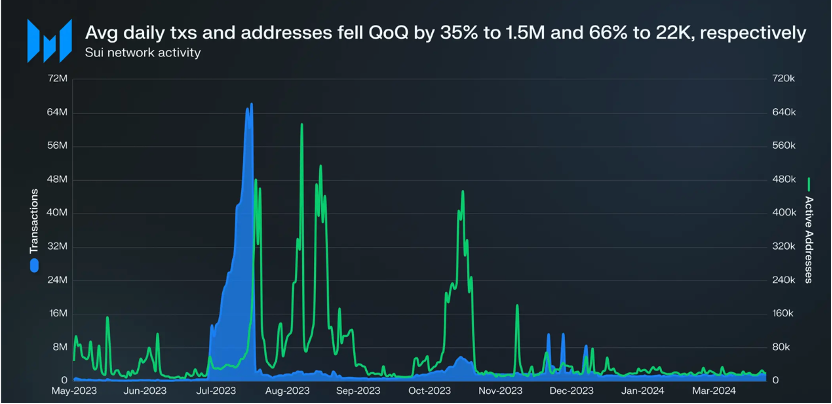

a. Network activity measured by transactions and active addresses has declined since the quarterly peak in Q3 2023. The average daily transaction volume decreased by 73% to 2.3 million transactions in Q4 and further decreased by 35% to 1.5 million transactions in Q1 2024.

b. The daily active addresses decreased by 44% to 66,000 in Q3 2023, and further decreased by 66% to 22,000 in Q1 2024. Over the past six months, the number of daily active addresses reached its peak from late October to early November 2023, with a historical peak of 453,000 daily active addresses on November 5, 2023. In Q4 2023, from October 12 to November 9, Mysten Labs' "Quest 3" encouraged players to participate in selected game projects, significantly boosting the increase in daily active addresses.

c. It is worth noting that despite the decrease in transaction volume, the average transaction fee for SUI has increased. It grew by 275% in Q4 2023 and by 2.1% in Q1 2024. However, with an average transaction fee of 0.0038 SUI in Q1 2024, SUI transactions are still relatively inexpensive compared to other public chains, at $0.0056 per transaction.

Part IV: Decentralization and Security

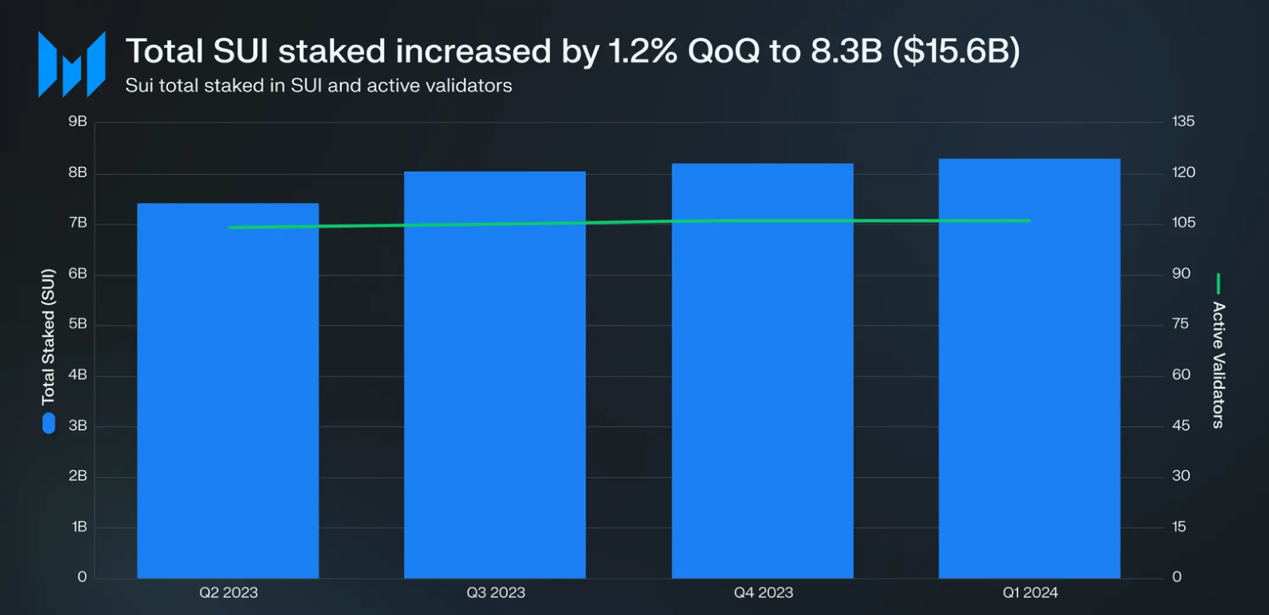

The amount of SUI staking continues to increase, reaching $8.3 billion in Q1 2024, a 1.2% increase. With the rise in the price of SUI, the total staked amount in USD reached $15.6 billion, a 135% increase. Based on the staked market value, SUI ranks third among tokens.

A notable feature of SUI is the frequent protocol upgrades. In January of this year, the Sui Foundation published a blog post focusing on additional upgrades and expansions planned for Sui Move in 2024. In late March, Mysten Labs announced a new execution scaling solution, Pilotfish. Pilotfish allocates execution work for individual validators across multiple machines. In a test environment, Pilotfish achieved 8 times the throughput with 8 execution workers compared to just 1 worker, proving linear scalability with added latency limited to tens of milliseconds. Pilotfish is still undergoing testing and design iterations.

Part V: SUI Ecosystem

At the end of June 2024, the Sui Foundation announced the upcoming consensus upgrade for Sui, called Mysticeti. Mysticeti is based on Sui's current Narwhal-Bullshark protocol and aims to further reduce latency and validator CPU requirements. Mysticeti is expected to launch on the mainnet this summer.

Part VI: DEFI Projects

a. The DeFi Total Value Locked (TVL) under Sui has shown strong growth over the past two quarters, increasing from $50 million at the end of Q3 2023 to $787 million at the end of Q1 2024. When measured in SUI, the locked amount increased from $105 million to $418 million, indicating that the increase is not solely due to the appreciation of SUI's token price.

b. The lending protocol NAVI is the leading protocol in TVL, with a value of $195 million and a market share of 25%. When NAVI launched its token program on December 27, its market share was slightly below 21%. At the end of January, NAVI announced a $2 million funding round led by OKX Ventures, dao5, and Hashed. Shortly after, it launched the token NAVX, which had a market value of $35 million at the end of June 2024.

c. The lending protocol Scallop had a net income of $162 million in the first quarter, with a market share of 21%. Scallop launched its token program on January 1. After announcing a $3 million funding round led by CMS and 6MV, Scallop introduced its native token SCA, which had a market value of $30 million at the end of June 2024.

d. Cetus is the primary DEX on Sui, with a TVL of $116 million or a 15% market share. Cetus features swap trading based on CLMM, with an average daily trading volume of $37 million in the first quarter of 2024. At the end of February, Cetus announced a strategic investment from the SUI Foundation. In mid-March, it launched Cetus vault to help users automatically manage liquidity positions.

At the end of March 2024, Cetus released the frontend of DeepBook. DeepBook is an on-chain order protocol built into Sui's codebase. In the first quarter of 2024, DeepBook had an average daily trading volume of $26 million. At the end of March, it announced its native token DEEP and airdropped a soul-bound NFT to users, with 10% of the initial airdrop allocated to users, 31% to the team and investors, and the remaining 59% for future grants, community projects, and initiatives.

e. Other top DeFi protocols on Sui in terms of TVL include Aftermath Finance, a DEX aggregator, liquidity staking protocol, and yield farming platform; KriyaDEX, a spot and perps DEX protocol; and Suilend, a borrow/lend protocol. Suilend and Solana's Solend are developed by the same team. Suilend was launched in mid-March 2024 after NFT airdrop testing in February.

f. To incentivize TVL growth, many DeFi protocols have been offering additional SUI rewards to increase yields on a bi-weekly basis. For example, in late March, 10 protocols announced the distribution of over 4.6 million SUI (equivalent to $8.7 million) as rewards over the next two weeks. As a result, the yield on Sui is significantly higher than that of other companies in the industry. The USDC lending yields of NAVI and Scallop have been maintained at 20-30%, 3-4 times higher than the median stable yield of other popular networks.

Part VII: SUI Network Growth

a. After a period of low activity during the bear market, funding activities for Sui projects have started to increase. In the first quarter of 2024, five major projects built on Sui announced funding rounds. The total amount raised in these rounds was $11.3 million, a 31% increase compared to the total funding for Sui projects in the entire year of 2023. The Sui Foundation and other organizations will continue this trend through developer resources, infrastructure, and grants, hackathons, accelerators, and other initiatives.

b. In terms of infrastructure, several protocols have been developed to simplify user logins and experiences. Notably, the SUI Foundation released zkLogin in September 2023. zkLogin allows Sui users to transact using OAuth credentials, including Google, Facebook, Twitch, Apple, and Kakao. The user's OAuth credentials are combined with random data (called Salt) to generate zero-knowledge proofs, ensuring that users can be verified with their OAuth credentials without revealing them on-chain. Many wallets and other infrastructure providers have integrated zkLogin.

c. In November 2023, Mysten Labs introduced another zk-related feature - zkSend. zkSend allows users to send and receive SUI tokens through shared links. zkSend also integrates zkLogin.

d. Other infrastructure-related developments in the fourth quarter of 2023 and the first quarter of 2024 include: Tencent Cloud’s RPC service launch, verified builds in Sui Explorer, migration to a new GraphQL RPC service, Sui Move GPT, partnerships with auditors OtterSec and Zellic, MPCVault’s Sui integration, oracle Stork’s Sui integration, Inspect’s Sui integration, MSafe’s Object Transfer feature, World Store’s Sui integration, partnership with ZettaBlock, Atomic Wallet’s Sui integration, Hello Moon’s Sui support, ChainIDE grant recipient, and Sui MetaMask Snaps’ Sui Kiosk integration.

Part VIII: Summary

The crypto market saw a rebound in the fourth quarter of 2023 and the first quarter of 2024, and Sui was no exception. Its market cap grew by 508% over the past two quarters, reaching $2.3 billion. Its growth rate exceeded that of similar tokens, and SUI's market cap ranking rose from 81 to 57 during this period. In less than a year since its launch, Sui has become the most active network in DeFi. Its TVL grew by 1459% over the past two quarters, reaching $787 million, ranking 12th in all ecosystems. Its average daily DEX trading volume grew even more, increasing by 3689% to reach $78 million.

During the past two quarters, Sui's network usage peaked at 453,000 daily active addresses during Mysten Labs' online game mission quest 3. Excluding this period, Sui averaged 24,000 active addresses and 1.8 million transactions per day in the fourth quarter of 2023 and the first quarter of 2024. The upcoming upgrade will bring further scalability improvements to the network. At the end of March, Mysten Labs launched Pilotfish, a new execution scaling solution that can allocate execution work for individual validators across multiple machines. After the end of the second quarter of 2024, the Sui Foundation announced Mysticeti, a consensus upgrade planned for this summer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。