A. Market View

I. Macro Liquidity

The currency liquidity is deteriorating. The US dollar index is approaching a new high for the year, putting significant pressure on risk assets. The current strength of the US dollar is not only due to the stickiness of US inflation and the corresponding delay in interest rate cuts, but also reflects the market's reassessment of geopolitical risks. The impressive performance of the US stock market so far this year, being an election year, has made an impression. The trend in the cryptocurrency market appears more fragile compared to the US stock market.

II. Overall Market Trends

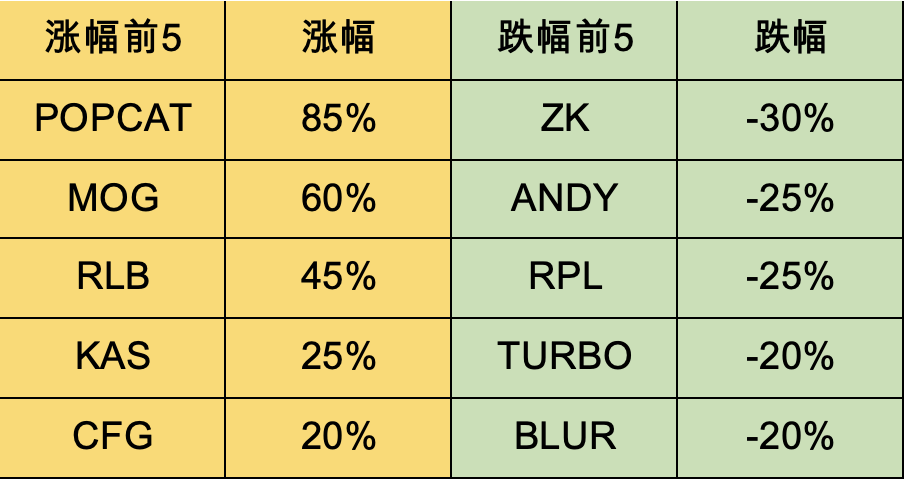

Top 100 market cap gainers:

This week, BTC fell below the weekly line, with more selling pressure from the US, Germany, and Mentougou exchanges. The ETH/BTC exchange rate strengthened, and altcoins rebounded first. The market rebound theme revolves around the ETH ecosystem.

BLAST: It is an L2 platform for NFT BLUR on the ETH network, and the recent airdrop did not have a significant impact. BLAST is the initiator of this round of point airdrop model, operated by Paradigm Fund. The L2 narrative is gradually being abandoned by the market.

KAS: It is a POW public chain, the first KRC-20 meme plan went live at the end of June, and large US miners have started mining KAS recently.

LISTA: It is a decentralized algorithm stablecoin on the Bsc chain, with almost no VC, and controlled by BN. Recently, there has been a new mining activity.

III. BTC Market Trends

1) On-chain Data

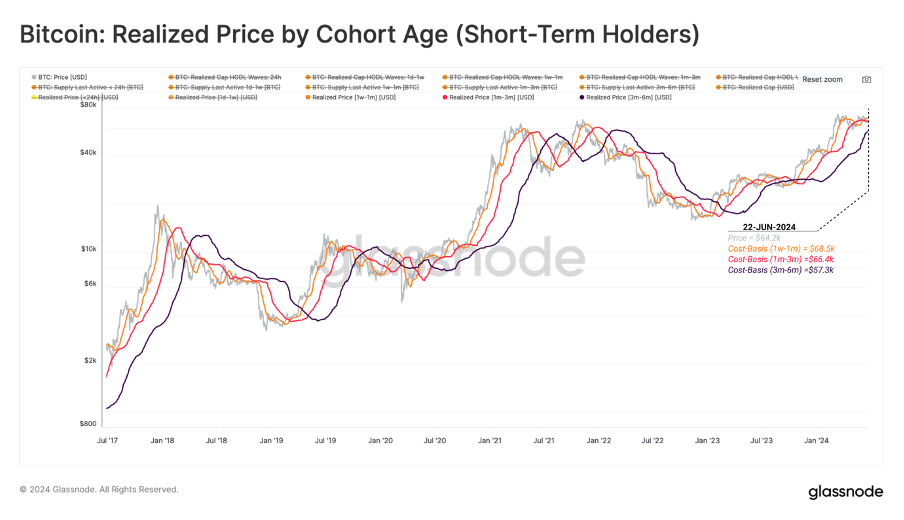

The market has entered an exhaustion stage. Since June, the BTC price has fallen below the average holding cost for three months. If this trapped structure continues, it historically leads to a deterioration of investor confidence and may deepen this adjustment, requiring more time to recover. In previous bull markets, similar large adjustments have occurred an average of five times.

The supply of stablecoin market value has slowed down, and the market lacks new capital.

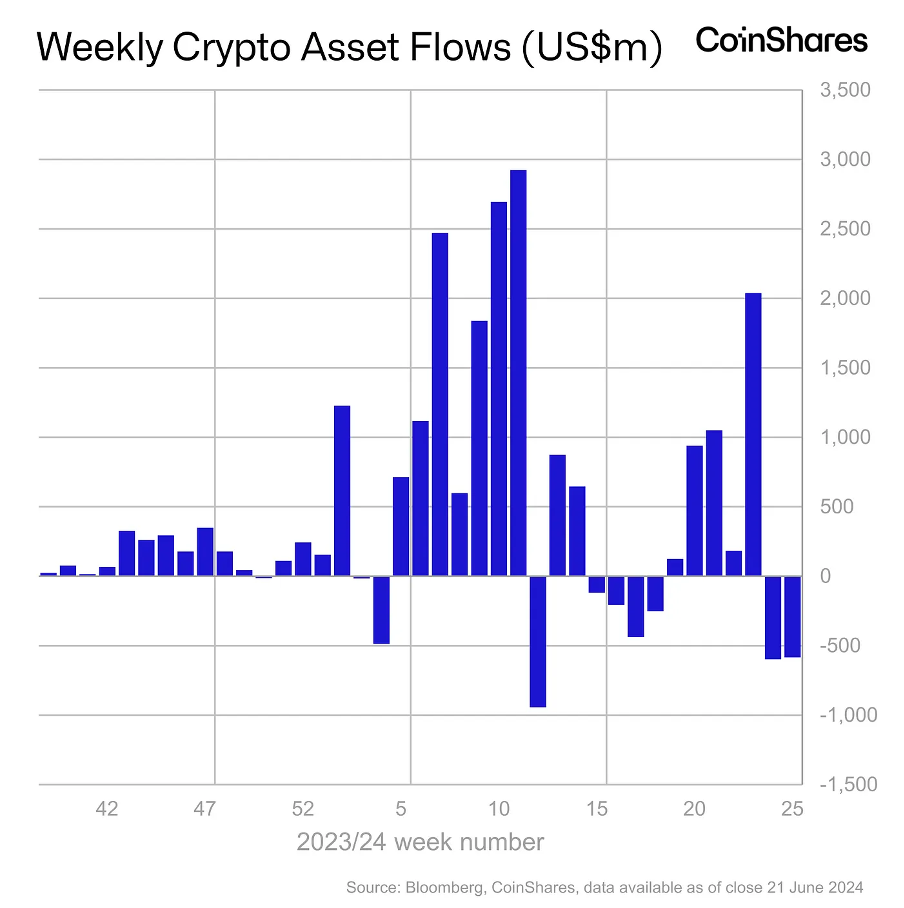

Institutional funds have been net outflows for two consecutive weeks, but there has been an increase in inflow of altcoins.

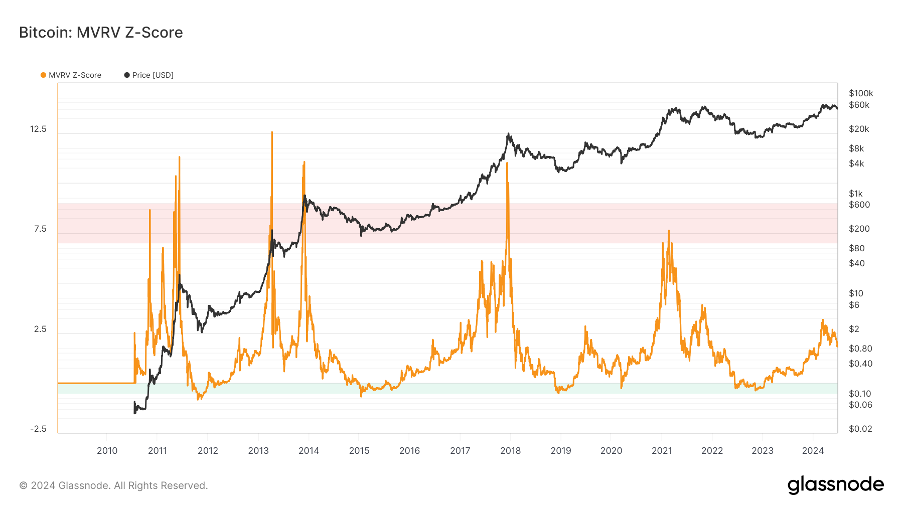

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profit status of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. MVRV has fallen below the key level of 1, and holders are generally in a loss state. The current indicator is 1.8, entering the middle stage.

2) Futures Market Trends

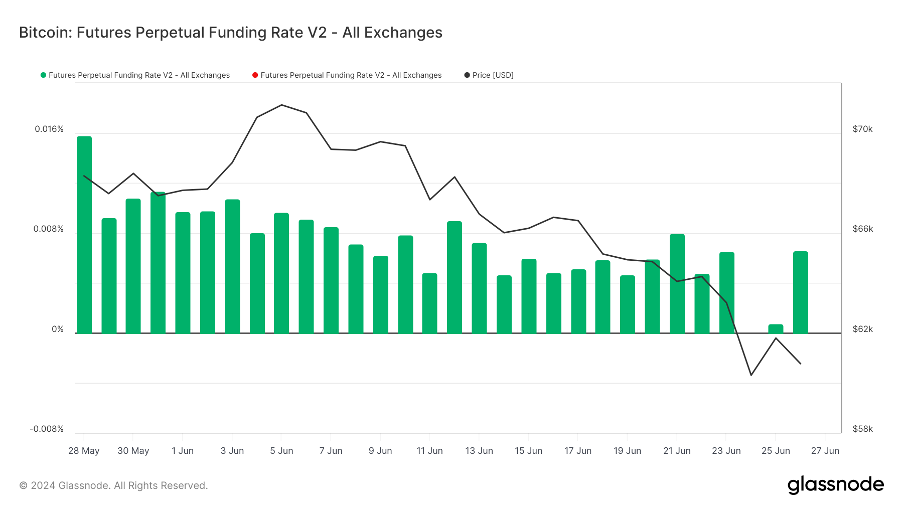

Futures funding rate: The rate has slightly decreased this week. Rates of 0.05-0.1% indicate a higher long leverage, suggesting a short-term market top; rates of -0.1-0% indicate a higher short leverage, suggesting a short-term market bottom.

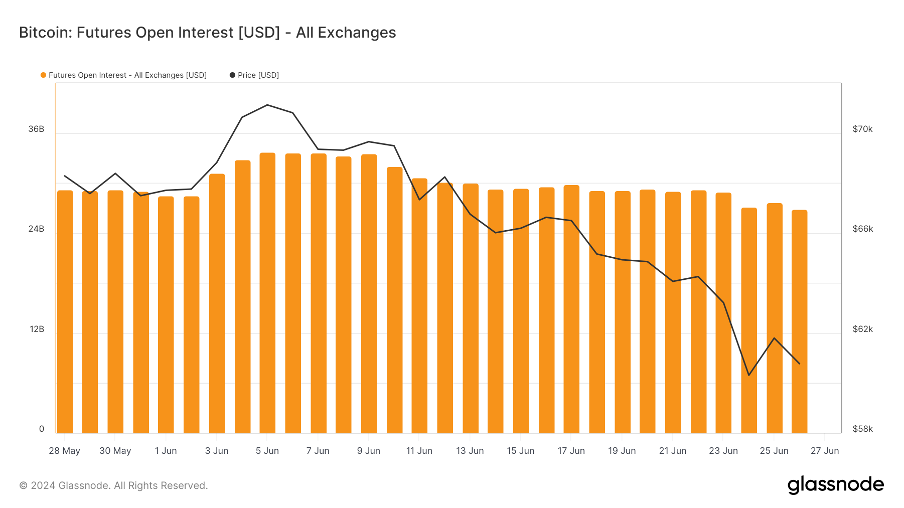

Open interest in futures: This week, BTC open interest has continued to decline.

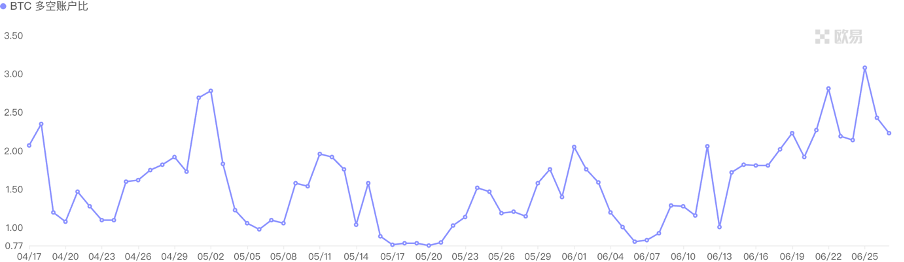

Futures long/short ratio: 2.4, indicating high retail bottom-fishing sentiment, and the market is likely not yet fully bearish. Retail sentiment is often a contrarian indicator, with below 0.7 being quite fearful and above 2.0 being quite greedy. The long/short ratio data fluctuates greatly, weakening its significance as a reference.

3) Spot Market Trends

BTC fell below the weekly line and has been in a consolidation phase since reaching a historic high of $73,000 in March. The overall trading volume of centralized exchanges (CEX) has dropped to the level at the end of 23, but on-chain DEX remains stable. The ETH/BTC exchange rate continues to be strong, and future main opportunities revolve around the ETH ecosystem.

B. Market Data

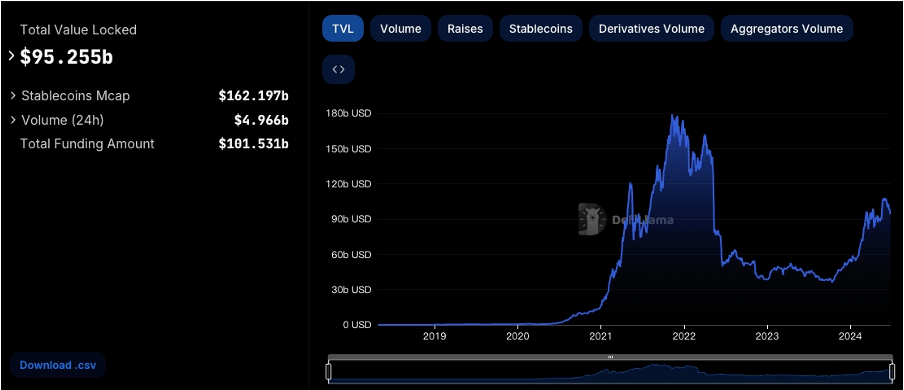

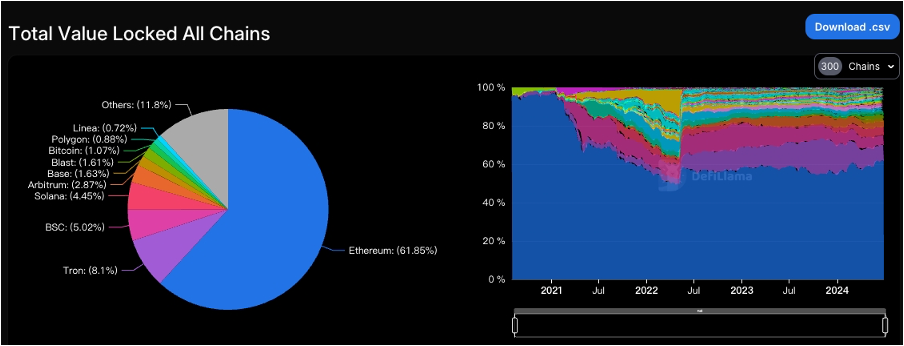

I. Total Lockup Amount of Public Chains

II. Proportion of TVL for Various Public Chains

This week, the TVL is $95.3 billion, a decrease of $5.6 billion, representing a 5.6% decline. The TVL of mainstream public chains has almost all decreased this week. ETH chain decreased by 8%, TRON chain by 6%, BSC chain by 5%, ARB chain by 9%, BASE chain by 4%, BLAST chain plummeted by 27%, POLYGON chain by 5%, and OP chain by 8%. Apart from TON chain, which increased by 107% this month, the TVL of mainstream public chains has decreased by nearly or more than 10%.

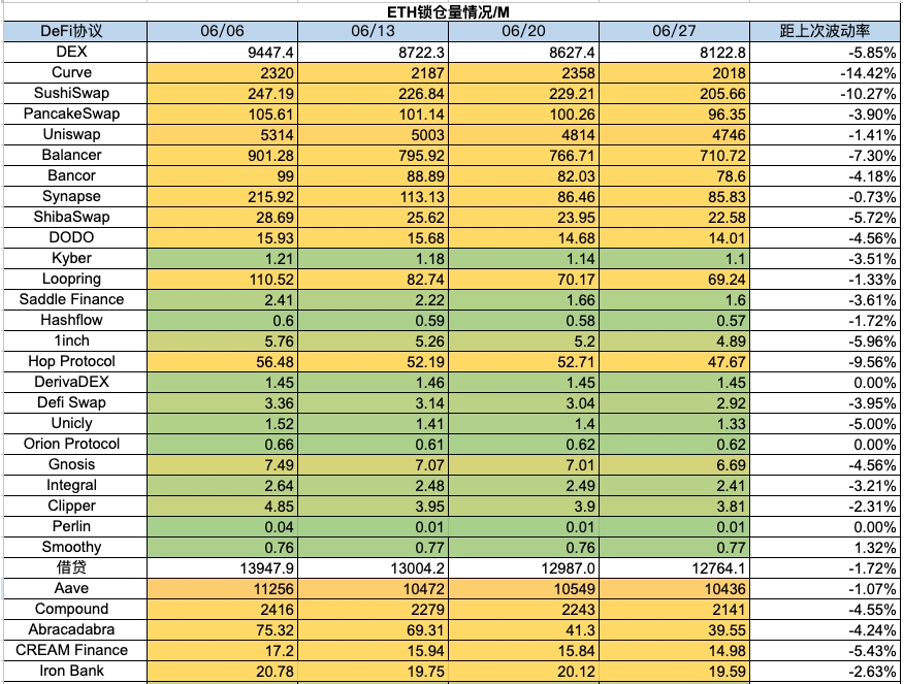

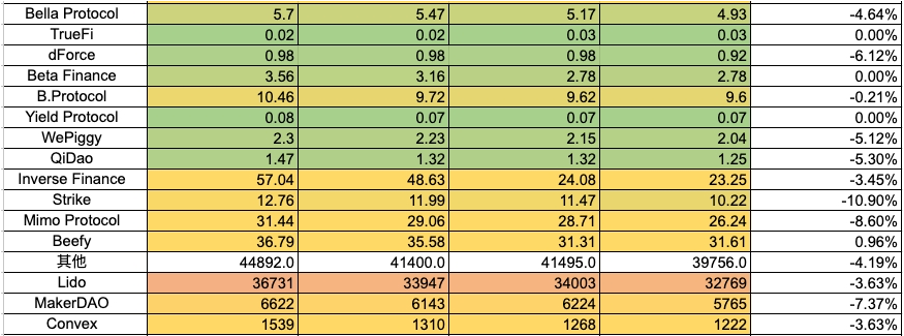

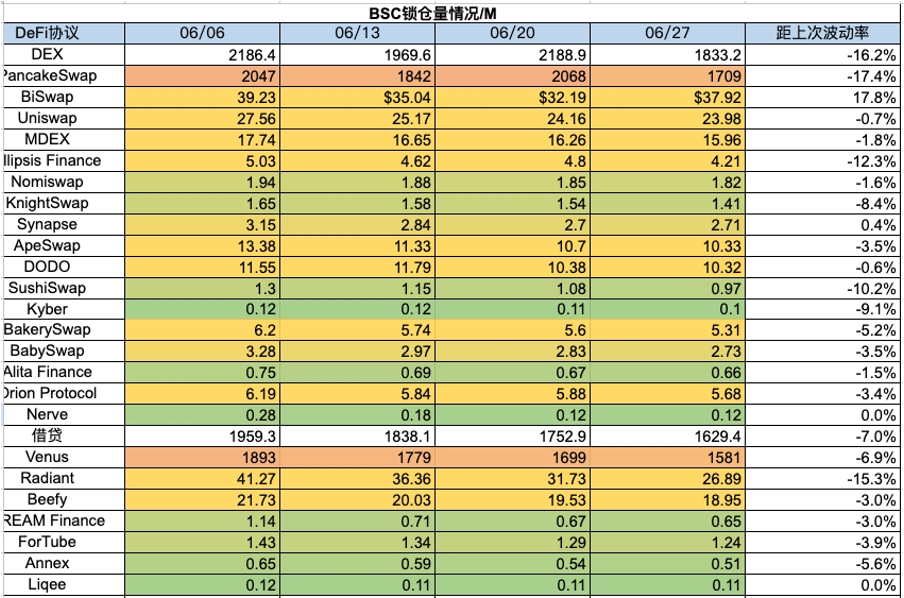

III. Lockup Amount of Various Chain Protocols

1) ETH Lockup Amount

2) BSC Lockup Amount

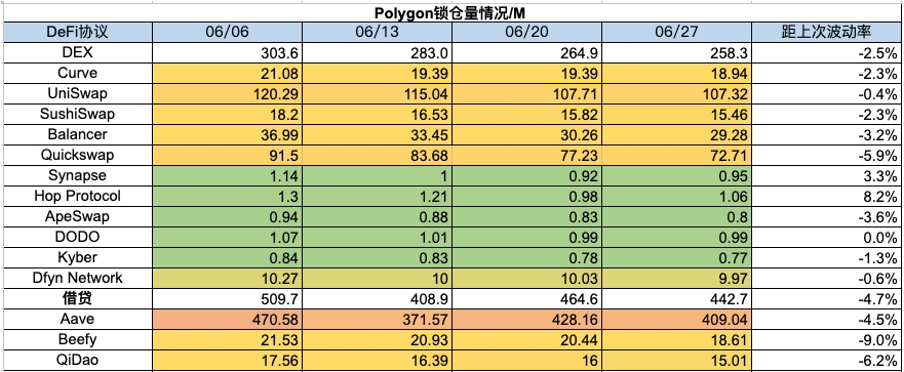

3) Polygon Lockup Amount

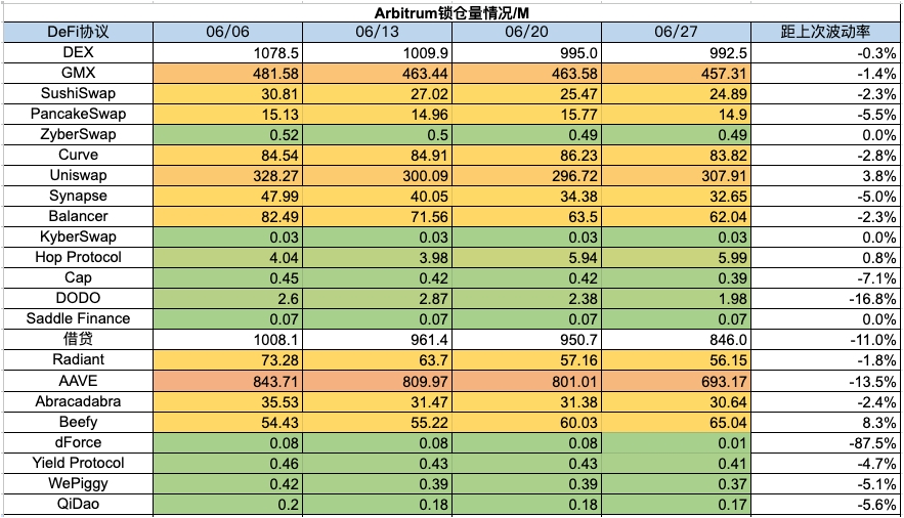

4) Arbitrum Lockup Amount

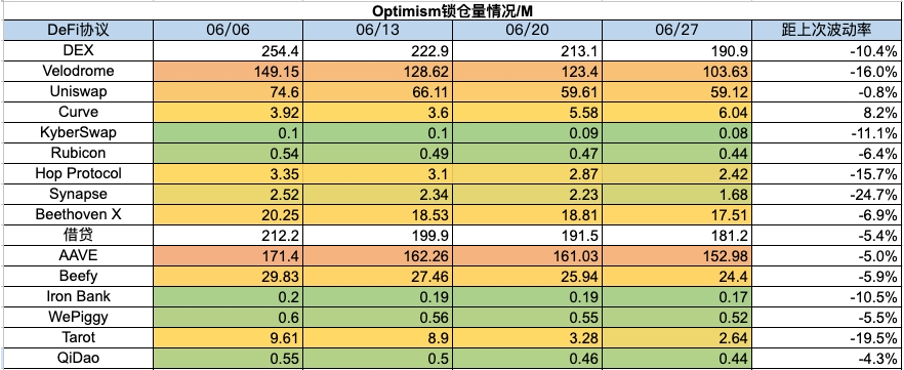

5) Optimism Lockup Amount

6) Base Lockup Amount

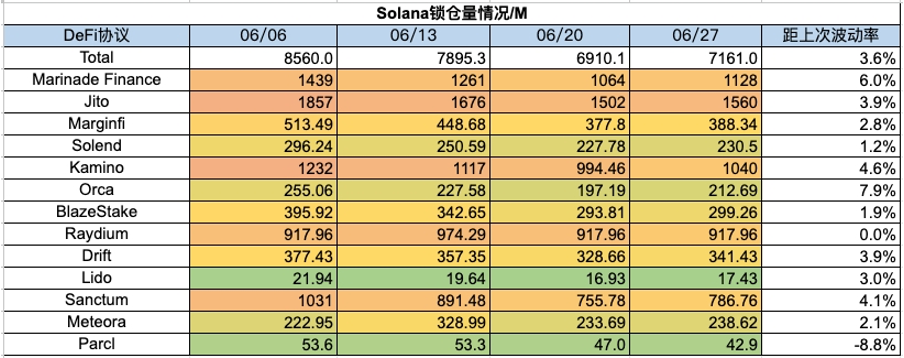

7) Solana Lockup Amount

IV. NFT Market Data Changes

1) NFT-500 Index

2) NFT Market Situation

3) NFT Trading Market Share

4) NFT Buyer Analysis

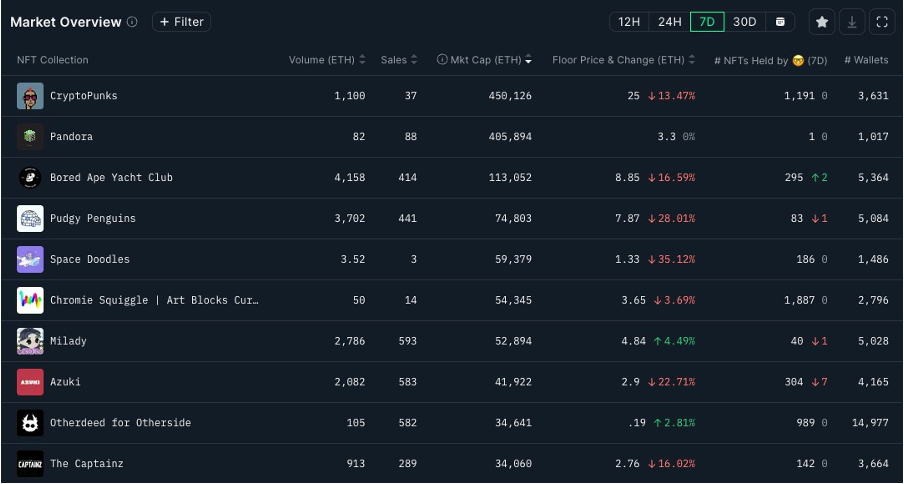

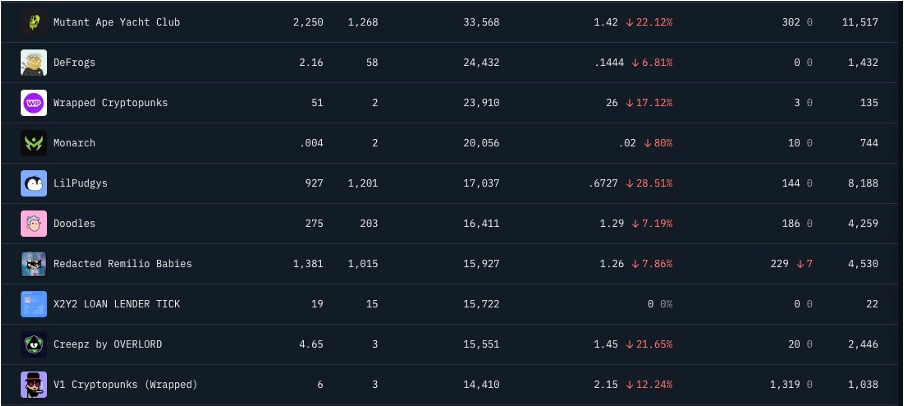

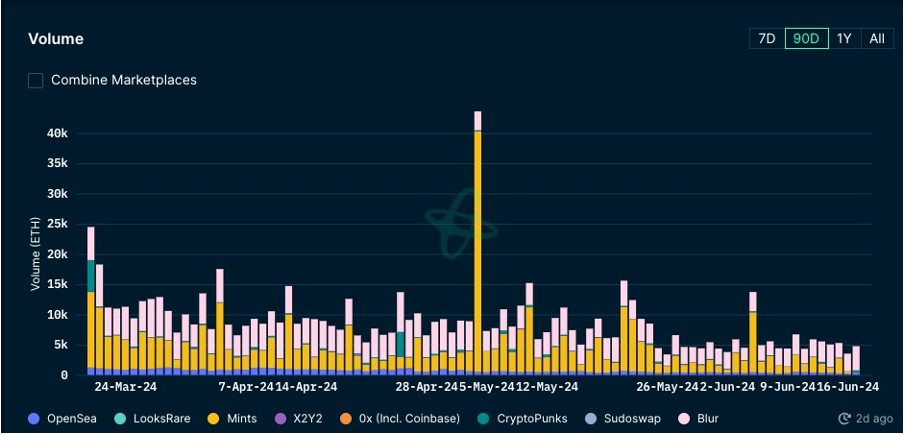

This week, the floor prices of blue-chip projects in the NFT market have dropped significantly, and the overall market is still in a continuous decline. CryptoPunks fell by 13%, BAYC by 17%, Pudgy Penguins by 28%, Space Doodles by 35%, Azuki by 23%, The Captainz by 16%, MAYC by 22%, and LilPudgys by 29% this week. Only Milady saw an increase of 4%. Overall trading volume in the NFT market has slightly decreased this week, with the trading volume of blue-chip items also decreasing by around 20% in the past week. The number of first-time buyers and repeat buyers is gradually declining. Overall, the NFT market remains extremely bleak, with an extremely adverse market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。