Author: Asher Zhang, BiTui

The road to compensation for Mt.Gox has been particularly long, and has recently sparked heated discussions once again. So, how will this round of Mt.Gox compensation affect the cryptocurrency market? How low could the price of BTC be driven? Can the cryptocurrency market turn the tables? Why is it said that now may be the best time for Mt.Gox compensation?

The road to compensation is long and arduous, and Mt.Gox creditors have finally come out on top this time

In 2014, Mt.Gox, the world's largest exchange that once accounted for 70% of Bitcoin trading volume, was exposed to a hacker attack and filed for bankruptcy three days later. Subsequently, Mt.Gox embarked on a long road of bankruptcy compensation, entering into a substantial stage during the previous bull market.

According to "BiTui" reports, the bankrupt Bitcoin exchange MT.Gox (also known as "Gate of the Valley") originally planned to submit a liquidation compensation plan for the trading platform by March 31, 2020, but this plan was subsequently postponed to July 1, 2020. On October 20, 2021, the Mt.Gox compensation plan finally obtained the approval of the vast majority of claimants.

According to official information, the compensation provided by Mt.Gox includes basic and proportional payments. After the 2021 compensation plan was confirmed, Mt.Gox did not immediately start the compensation process. According to an announcement on the Mt.Gox official website, creditors must register and choose a repayment method by March 10, 2023, in order to receive compensation, with the final deadline for the first batch of compensation being September 30, 2023. The latest compensation plan provided by Mt.Gox to creditors includes basic and proportional payments. The basic payment allows each creditor to claim the first 200,000 yen to be paid in yen, while the proportional payment provides two flexible options for creditors, namely "early lump sum repayment" or "mid-term and final repayment." In the case of the lump sum repayment method, creditors can only receive partial compensation (approximately 21% of the funds they had locked on the platform during the hacker attack), and the portion exceeding 200,000 yen allows creditors to choose a mixed method of BTC, BCH, and yen, or to receive the entire amount in legal tender. According to one creditor, the proportion is approximately 71% in cryptocurrency and 29% in cash. "Mid-term and final repayment" provides a higher amount of repayment than the previous method, but the mid-term payment will only be made on September 30, and the final payment will be made in the coming years.

Mt.Gox creditors, who have been passively locked in, have finally come out on top this time. According to Japanese bankruptcy regulations, the value of Mt.Gox's BTC claims will be calculated based on the price at the time of the company's bankruptcy in April 2014 — the fixed value of each BTC claim is 50,058.12 yen (approximately $314 at the current exchange rate). This is mainly used for basic compensation. For proportional compensation, each creditor will receive compensation based on the proportion of their claim. Currently, the price of Bitcoin is $62,059 (as of June 26), which is 197.6 times higher than the fixed claim value recognized by the Japanese court.

Massive selling pressure, how low could the BTC price be driven

This is the first time that Mt.Gox will repay in the form of BTC and BCH, with its holdings of 141,686 BTC (and a similar amount of BCH) accounting for 0.72% of the total circulating supply of Bitcoin, worth approximately $8.54 billion. From a numerical perspective, this selling pressure is significant, but how much of an impact will it actually have? Let's analyze this from a data perspective.

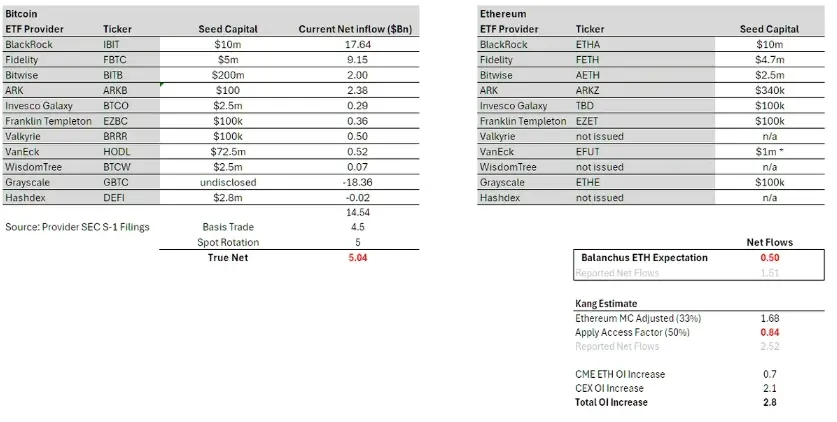

Andrew Kang, co-founder of Mechanism Capital, roughly estimated the inflow of BTC funds from this round of institutional holdings in a previous article. Andrew Kang believes that overall, Bitcoin spot ETFs have now accumulated over $50 billion in AUM (assets under management). This is a quite optimistic figure. However, if we exclude the funds related to GBTC, the net inflow of funds will be reduced to approximately $14.5 billion. In fact, this figure still needs to be further reduced, as it still includes many "delta neutral" trades, especially some "basis trades" (such as selling futures while buying ETFs) and "spot rotation" (selling spot and buying ETFs). Based on CME data and analysis of ETF holders, there is approximately $4.5 billion in funds related to "basis trades"; in addition, some ETF experts have pointed out that large institutions such as BlockOne have conducted substantial "spot rotation" operations, with the expected scale of such trades being around $5 billion. Excluding these "delta neutral" trades, we can speculate that the net inflow of Bitcoin spot ETFs is approximately $5 billion.

In the early hours of January 11, Beijing time, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs for the first time in history, authorizing 11 ETFs to begin trading on Thursday. After the news was announced, the price of Bitcoin soared by over $2,000, re-surpassing the $47,000 mark. Subsequently, due to profit-taking pressure, Bitcoin once again fell to around $43,000, and after a period of consolidation, BTC once again embarked on a significant upward trend, briefly surpassing $70,000.

This also means that Wall Street institutions may have pushed Bitcoin from around $43,000 to nearly $70,000 with approximately $5 billion. Currently, the value of BTC compensation from Mt.Gox is as high as $8.5 billion, so if about half of the BTC is sold into the market, the price of BTC will likely fall to around $47,000.

Some in the market believe that these BTC creditors are all long-time OGs, and the selling pressure may be relatively controllable. However, in fact, in 2014, many speculators participated in Bitcoin trading, and this article believes that the Pareto principle is generally applicable. Many people do not change their speculative nature just by waiting long enough. The author has also seen many old-timers in the coin circle ultimately ending up with meager gains, and there has been a lot of back and forth during that time. Therefore, when a huge fortune arrives, the selling pressure may even exceed 50%, and if panic selling and cascading liquidation occur, it will be even more frightening. Overall, this article believes that it is very likely that BTC will be driven to around $47,000, with the specific range perhaps being between $42,000 and $48,000. Why this range? The following text will further elaborate on this range prediction.

Can the cryptocurrency market turn the tables

Based on a simple data comparison, we believe that Bitcoin could possibly be driven to $47,000. Next, let's explore this issue from a broader perspective.

In the article "Bitcoin Repeatedly Jumps, Four Key Players Influence the Market" the author discussed four factors that affect the Bitcoin market: Bitcoin ETFs, Bitcoin miners, macro finance, and Bitcoin technical development. Overall, the macro market is expected to see a rate cut by the Federal Reserve in September, and the market is expected to remain weak in July; from the perspective of Bitcoin ETF fund inflows, the author believes that Wall Street institutions have gradually transitioned from the stage of aggressive fundraising to a period of washing, with a significant event being BlackRock's Bitcoin holdings surpassing Grayscale, which means that the short-term motivation for continued institutional holdings is significantly weakening; from the perspective of Bitcoin technical development, the OP_CAT proposal in the Bitcoin ecosystem is worth paying attention to, but there will not be a major breakthrough in the short term; from a data perspective, there is currently continuous selling pressure from miners, which undoubtedly adds pressure to BTC's upward movement. Overall, BTC lacks the momentum to sustain its upward trend; at the same time, it faces massive selling pressure, so a prolonged period of correction and consolidation is very likely.

From a technical chart perspective, this article believes that there is strong support near $57,600 (MA200), and at the same time, the shutdown price of the Avalon A1366 miner is around $57,000, which also provides the first major support for Bitcoin.

However, if, as we anticipate, Mt.Gox creditors start selling off, the MA200 defense line is essentially likely to be breached. From a technical chart perspective, the $43,000-47,000 range is a stronger support range formed after the Bitcoin ETF approval, and it is also the lowest cost range for many institutions to build positions. At the same time, $43,000-47,000 is also the shutdown price for the majority. Theoretically, if BTC plunges to this level, it will receive strong support, and this situation will not last long, which means that a "V" shaped rebound is likely to occur, followed by a prolonged period possibly maintaining at the MA200 level. In a sense, after the "V" shaped reversal, institutions will be able to thoroughly wash out, and for bottom-fishing users, it may be an opportunity for a turnaround.

Mt.Gox compensation at this time may also be the best opportunity

In a sense, the current Mt.Gox compensation is actually a relatively good opportunity, mainly because of the significant entry of institutions such as Wall Street in the United States. Only after the Bitcoin from Mt.Gox compensation flows into the market will there be buyers. For creditors, the price of BTC is still in a historically high range, and although there may be losses in terms of the coin's value, the passive lock-in gains are still considerable.

In the current market situation, the increase in Bitcoin's cost after the halving in a sense determines the maximum downside potential for Bitcoin. In addition, the Federal Reserve has not yet cut interest rates, and the market remains optimistic. For Wall Street, it is a good opportunity to once again accumulate at a low level, and they may also welcome this. Overall, Mt.Gox compensation at this time may also be the best opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。