The Solana ecosystem is unexpectedly "not so exciting" in terms of airdrops.

By: Deep Tide TechFlow

Recently, almost every major project's airdrop has been criticized. From Layer 0, which plays with human nature, to Zksync, which secretly engages in insider trading, and Blast, which not only doesn't reward you but also lectures you on it…

Whether you are a large holder or a small retail investor, everyone is disgusted by these projects that play with human nature. The negative view that "airdrops have no future" is not unrelated to these speechless airdrop distribution rules. Perhaps the existence of these projects has turned the airdrop world from a pure land of Web3 revenue value into an EdV (expected value) hell.

From the results, airdrop projects in the Ethereum ecosystem have become increasingly competitive: high participation thresholds, low investment returns, from depositing to withdrawing, not to mention the struggle with the project team just to claim an airdrop. I came here to make money, why did I end up not making any money and feeling so frustrated?

Instead of this, it's better to change the environment and focus on the interaction with projects on the Solana chain.

Today, we are introducing the Solana ecosystem's liquidity aggregation management platform Meteora, which provides a large portion of liquidity for Jupiter's trading. Meteora's innovation in liquidity pools — DLMM Pools (Dynamic AMM), provides zero slippage trading for users.

As a member of the Solana ecosystem, Meteora is likely to continue the "generous" coin issuance style of the Solana ecosystem, allowing for relatively generous returns without having to pay too much in interaction costs (although the token $MET has always been in a "soon to be issued" state).

In short, everything is still possible before the official announcement of the snapshot.

Meteora interaction, start

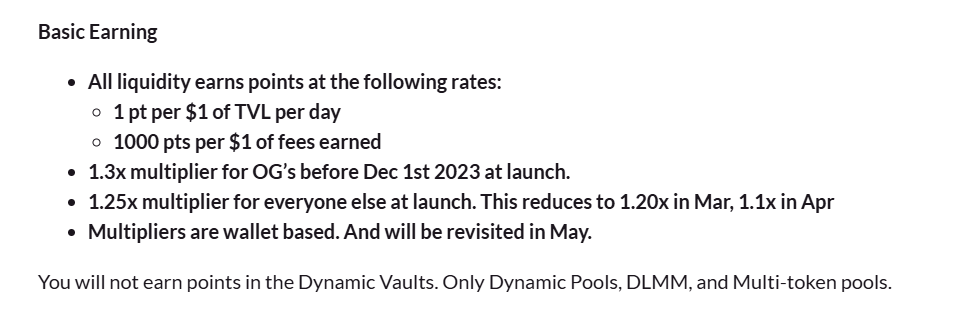

Points Rules

According to the approved community proposals, LP providers can only earn points by adding liquidity in dynamic pools, DLMM, and multi-token pools.

The rules for earning points by adding liquidity are as follows:

Each $1 of TVL added can earn 1 point per day.

Each $1 earned in LP can earn 1000 points.

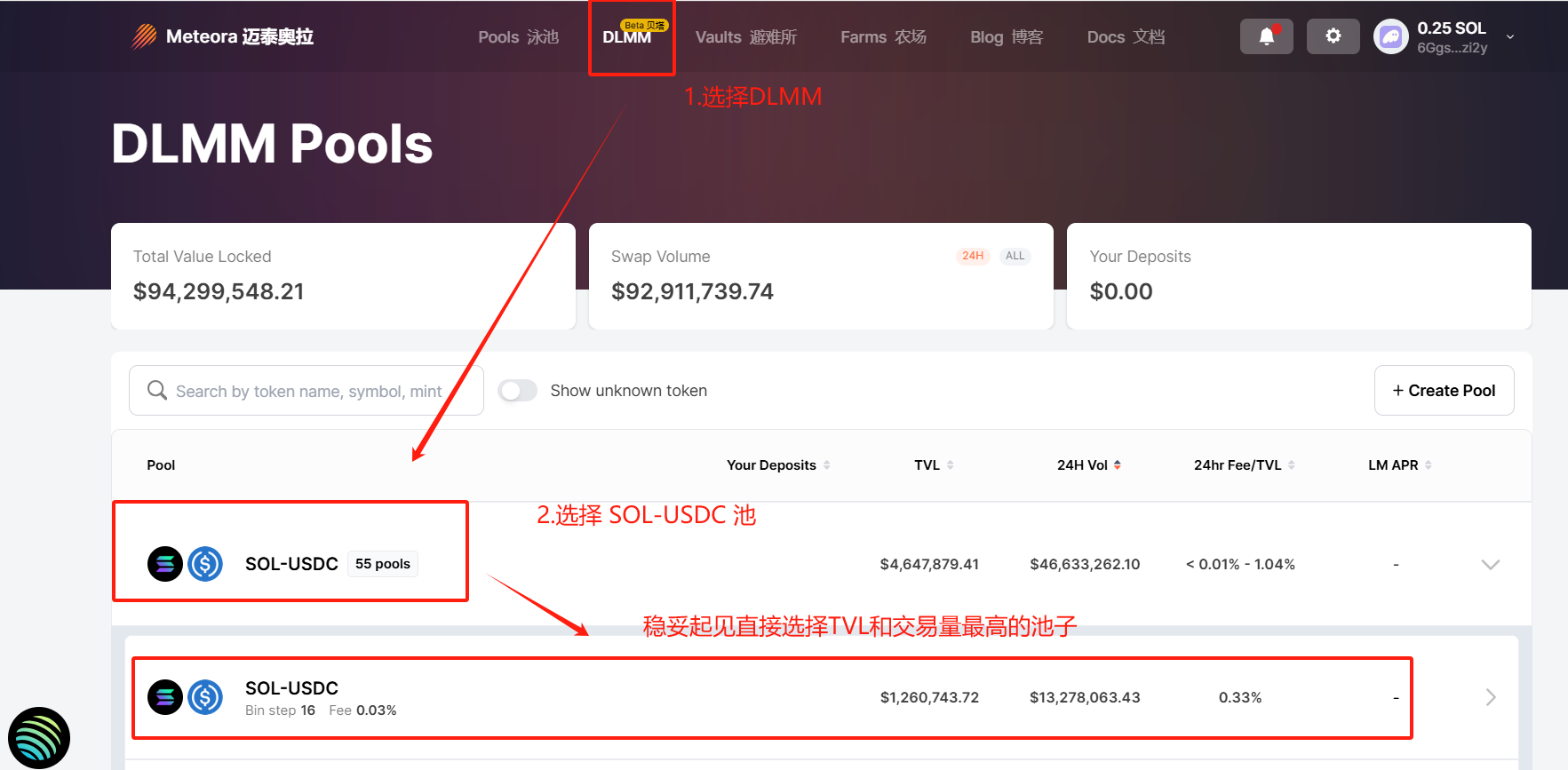

Experience DLMM Pools

Here, we take SOL-USDC LP as an example. The specific practice can be adjusted based on the tokens you hold when adding LP.

First, we enter the Meteora DLMM Pools interface: https://app.meteora.ag/dlmm

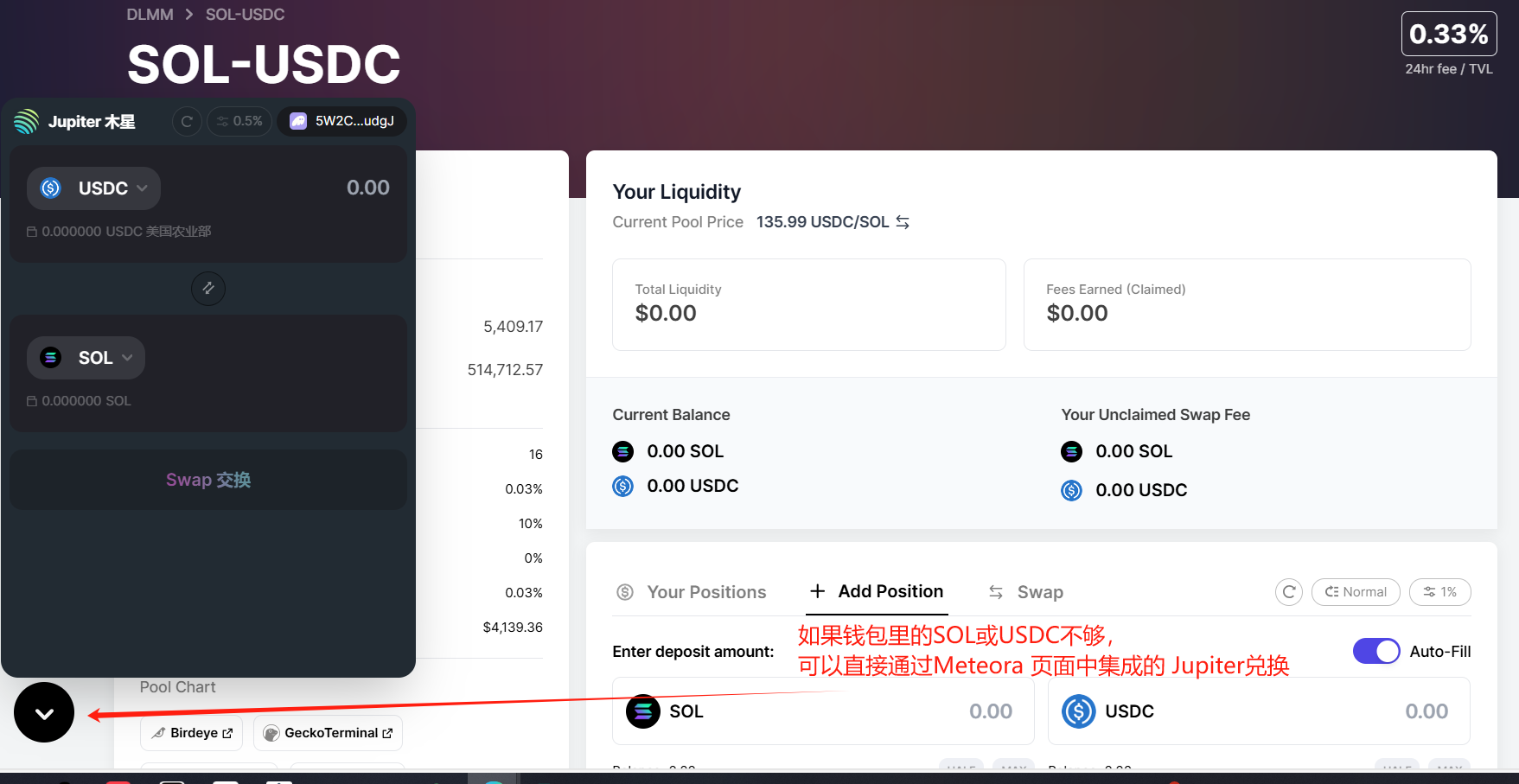

If you only have USDC or SOL on hand, you can directly exchange them through Jupiter integrated on the Meteora page.

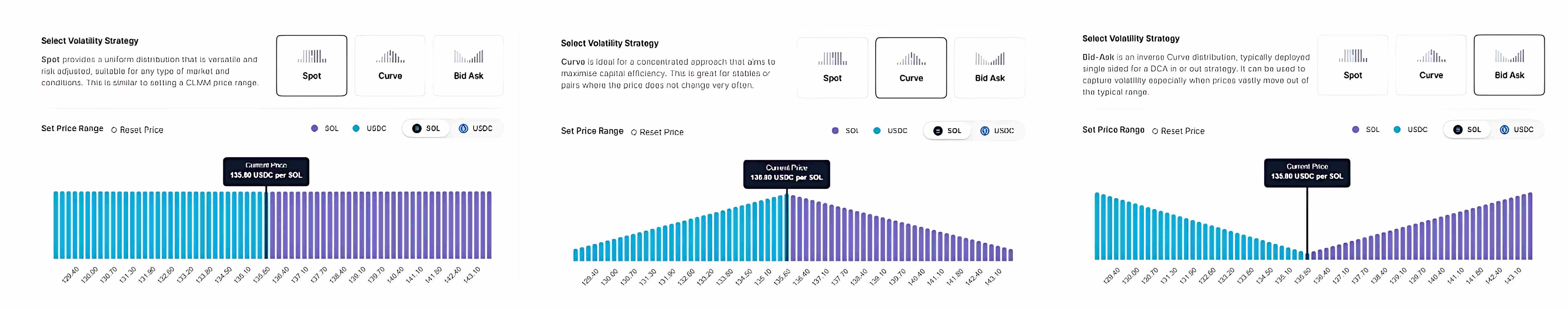

Continue to choose to add liquidity. Here, DLMM provides three liquidity yield strategies:

- Spot: evenly distribute earnings in the selected price range.

If you are unsure about the future market trend, it is recommended to choose the most stable Spot strategy.

- Curve: the smaller the fluctuation within the selected liquidity price range, the higher the earnings.

If you predict that the market trend will fluctuate within a certain price range, you can choose the Curve strategy to maximize earnings within a certain price range.

- Bid Ask: the greater the fluctuation within the selected liquidity price range, the higher the earnings.

If you predict that the price of SOL will rise or fall in the future, and if you are correct, the Bid Ask strategy can maximize your earnings.

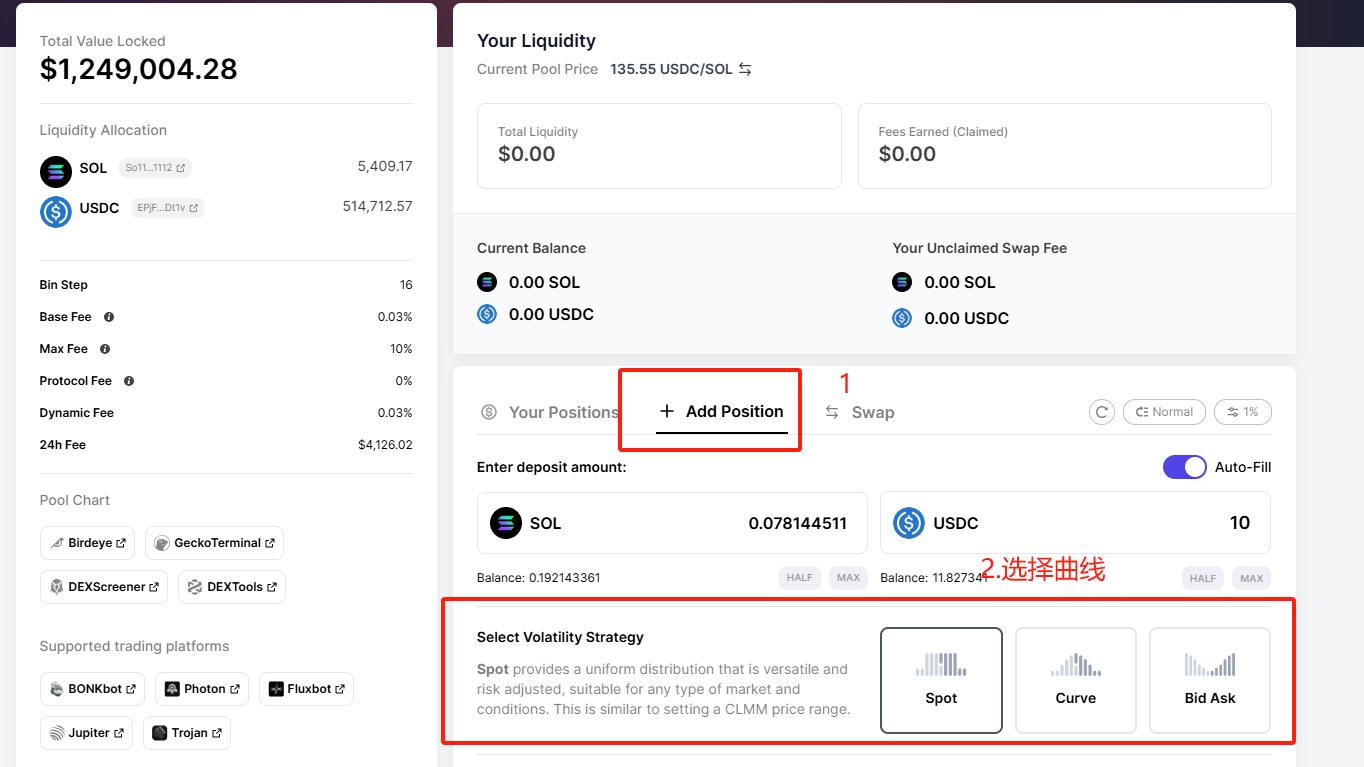

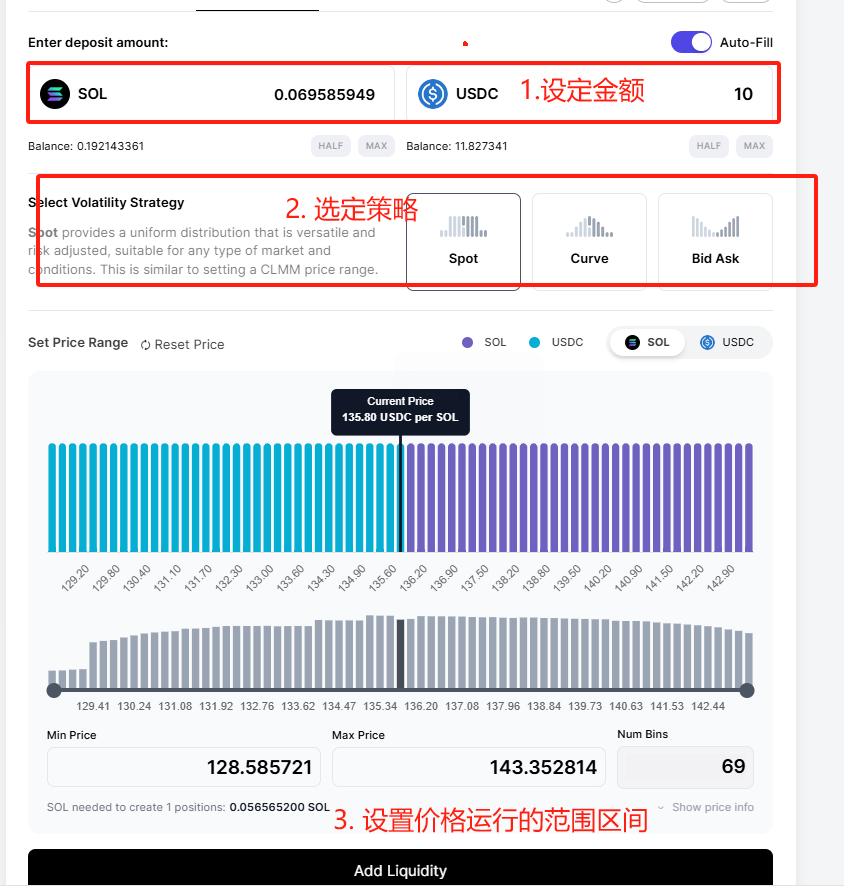

Deposit LP

First, determine the amount to be deposited into LP. For demonstration purposes, the amount deposited by the author is small. In actual operation, the amount should be based on individual circumstances.

Choose the yield strategy. Here, we use the relatively stable Spot strategy as an example.

Set the price range. This range refers to the price range in which the deposited LP can generate earnings. If the SOL/USDC trading pair exceeds the set price range, the deposited LP will also stop generating earnings.

Hedging Risk with Shorting Tools

The SOL/USDC LP pair is composed of 50% SOL and 50% USDC. When the SOL/USDC exchange rate fluctuates, two situations may occur:

When SOL rises beyond the set range, all SOL in the LP will be exchanged for USDC.

When SOL falls beyond the set range, all USDC in the LP will be exchanged for SOL.

This means that when the price of SOL falls below the LP profit range, users with USDC-based value will bear some of the losses from the price drop of SOL.

Since Meteora's airdrop points require users to deposit LP for a minimum of 7 days (one cycle), in order to obtain certain points and avoid losses caused by price fluctuations during this period, the "limit short" strategy can be used to hedge risks.

Taking Binance's SOLUSDT Perpetual Contract as an example:

PS: Shorting has risks, use with caution.

Conclusion

The popularity of the Solana ecosystem goes without saying, but it is unexpectedly "not so exciting" in terms of airdrops.

Ecosystem projects such as Jupiter and Tensor can receive substantial airdrops with only a small amount of interaction. Compared to the chaotic Ethereum ecosystem, the airdrop environment in the Solana ecosystem seems to still be in a pleasantly surprising stage in terms of returns.

With Jupiter setting an example, the market expectations and distribution methods of Meteora may not disappoint, and the way to participate in the airdrop is relatively simple.

However, forming LP is not without risks and enjoying returns without worries. But it's not a big problem, as long as you understand the operating mechanism and use tools skillfully, you can minimize the risks (why not consider it a form of "zero slippage").

Welcome to join the official community of Deep Tide TechFlow

Telegram subscription group:

Official Twitter account:

English Twitter account:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。