The total market value of stablecoins increased from $1.42 trillion in March to $1.618 trillion, with the main growth coming from USDT, USDC, and USDe.

Written by: Shawn, E2M Research

Overall Data

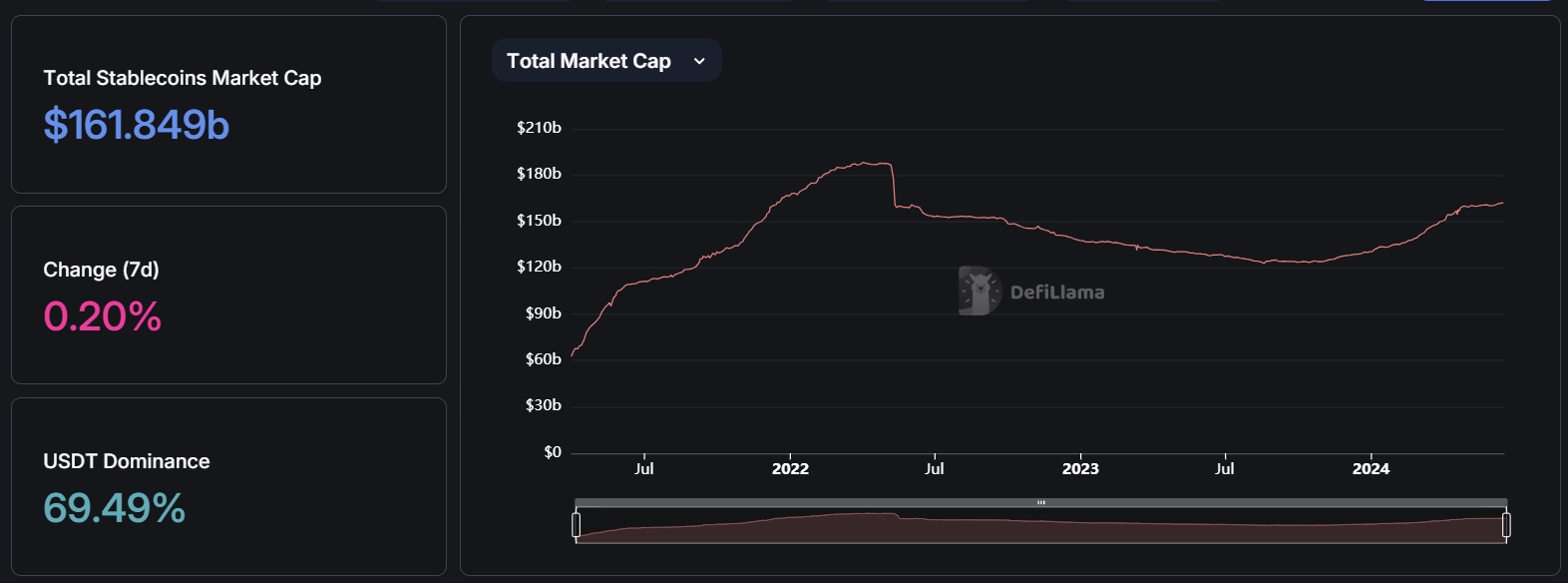

In March 2024, we conducted an analysis of stablecoin data. Now, a quarter has passed, and the entire stablecoin market has undergone some changes. According to DefiLlama data, the current total market value of stablecoins has reached $1.618 trillion, an increase of approximately $200 billion from the total market value of $1.42 trillion in March. The main growth comes from USDT ($157 billion), USDC ($30 billion), and USDe ($29 billion). The main decreases come from TUSD (-$800 million) and FDUSD (-$700 million).

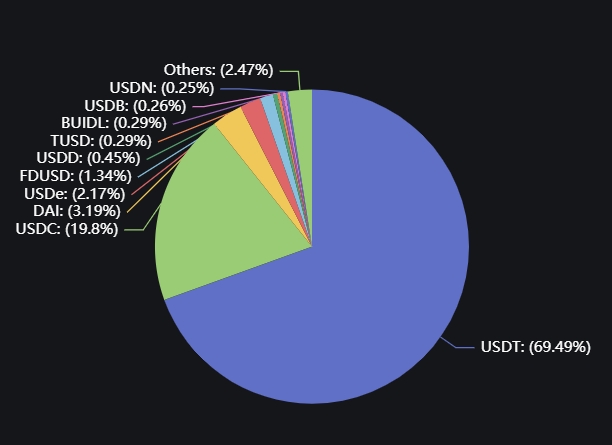

In terms of proportion, USDT and USDC still occupy close to 90% of the market share, accounting for 69.49% and 19.8% respectively, which is similar to the proportion in March.

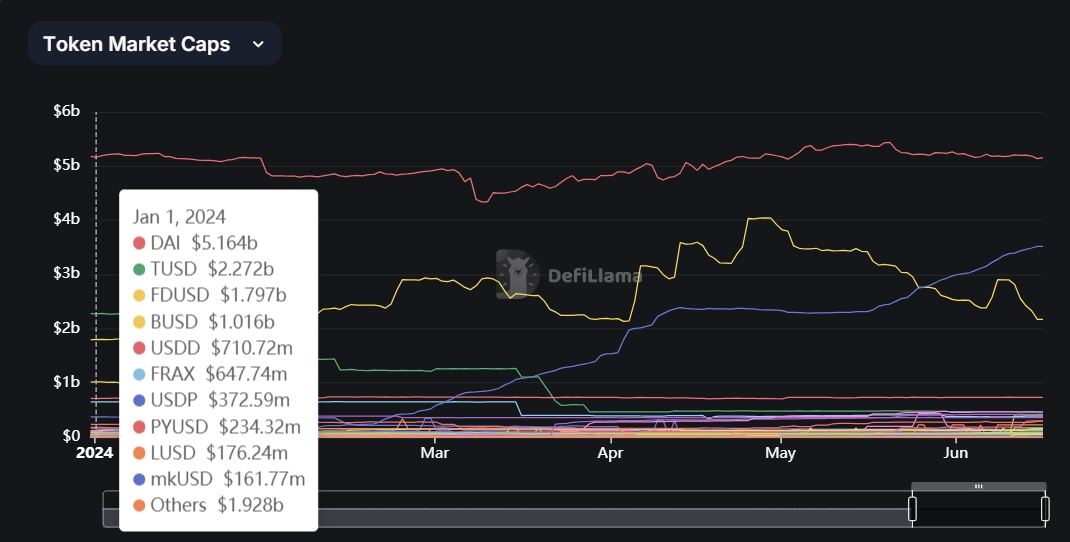

Excluding USDT and USDC, the remaining stablecoin data from January 1, 2024, to the present is shown in the line chart:

It can be seen that the market value of DAI has not changed much. The market value of USDe has increased from $600 million in March to the current $3.5 billion, an increase of about 6 times. The market value of FDUSD reached a peak of $4 billion at the end of April and has since fallen to around $2.17 billion, a decrease of $1.83 billion in market value. TUSD decreased from $1.26 billion to the current $460 million.

USDT Data

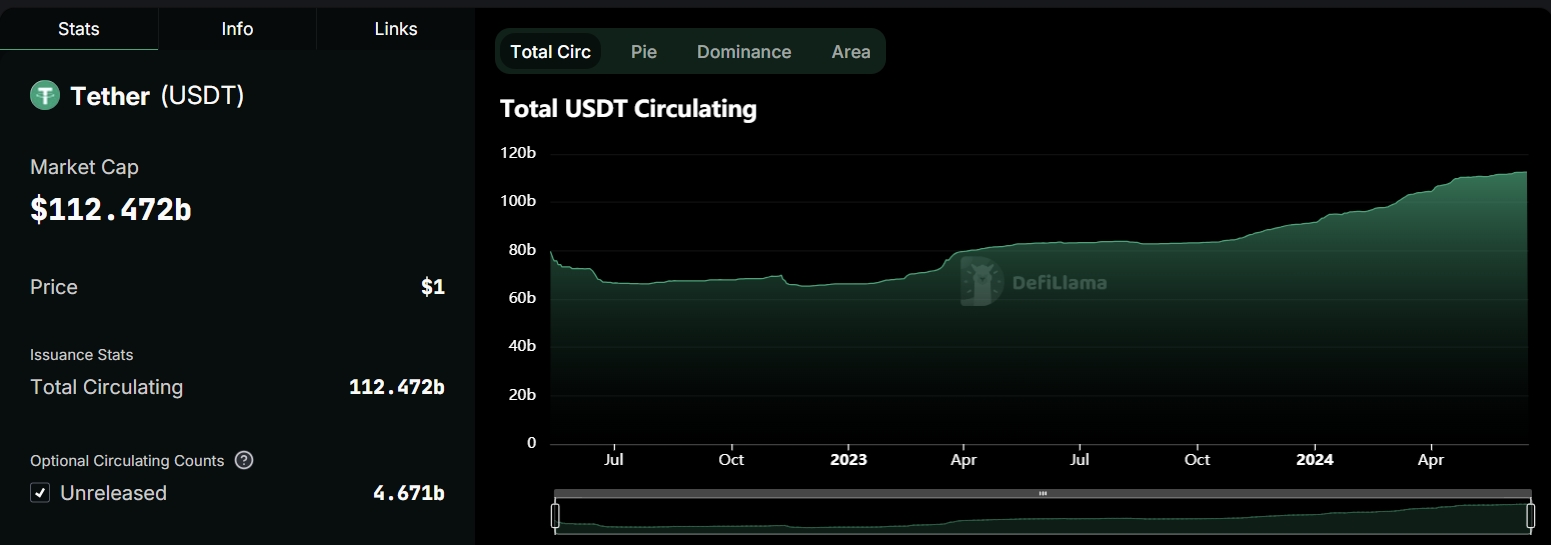

The total market value of USDT continues to grow, breaking a new historical high and maintaining around $110 billion since early May, with a recent slight increase.

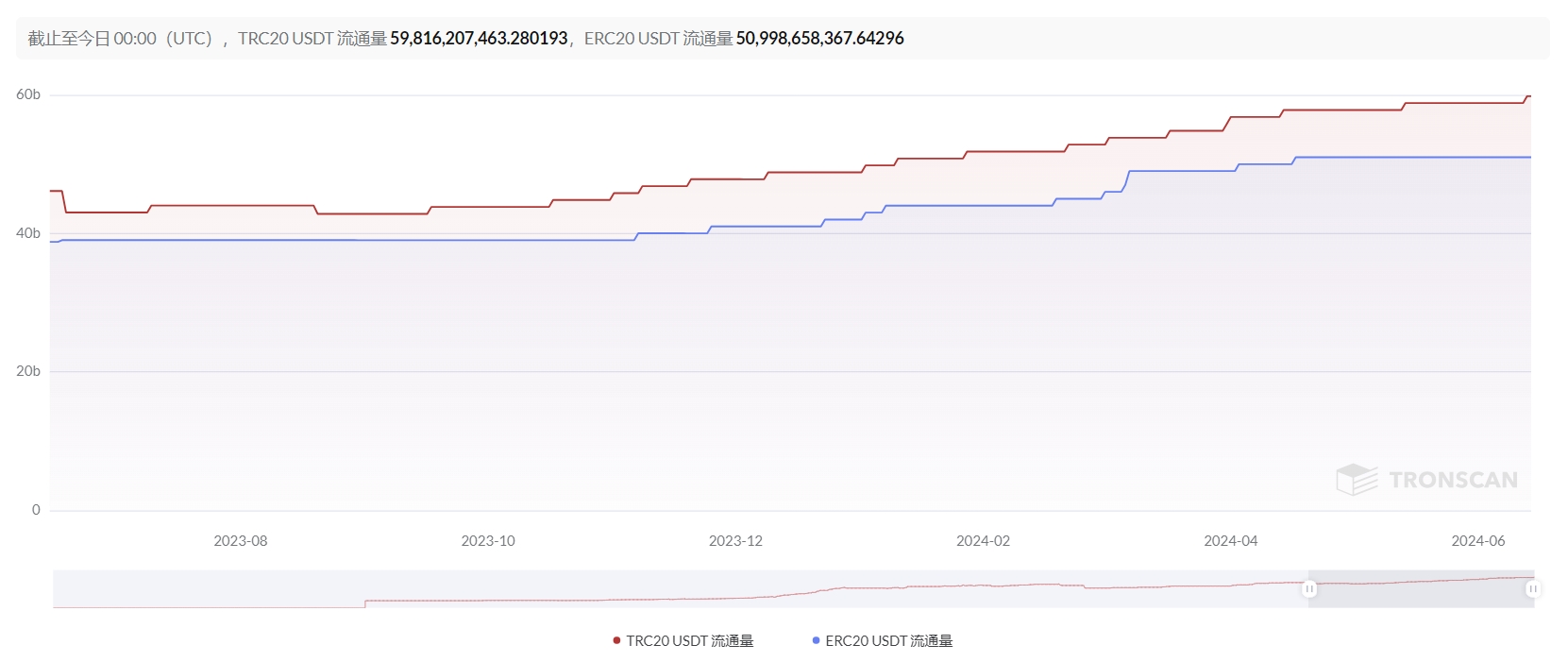

The main issuance is still concentrated on Tron and Ethereum, with $59.8 billion on Tron and $51 billion on Ethereum. As shown in the following figure, the amount of USDT on Ethereum has not changed since reaching $51 billion at the end of April, while the amount of USDT on Tron continues to increase.

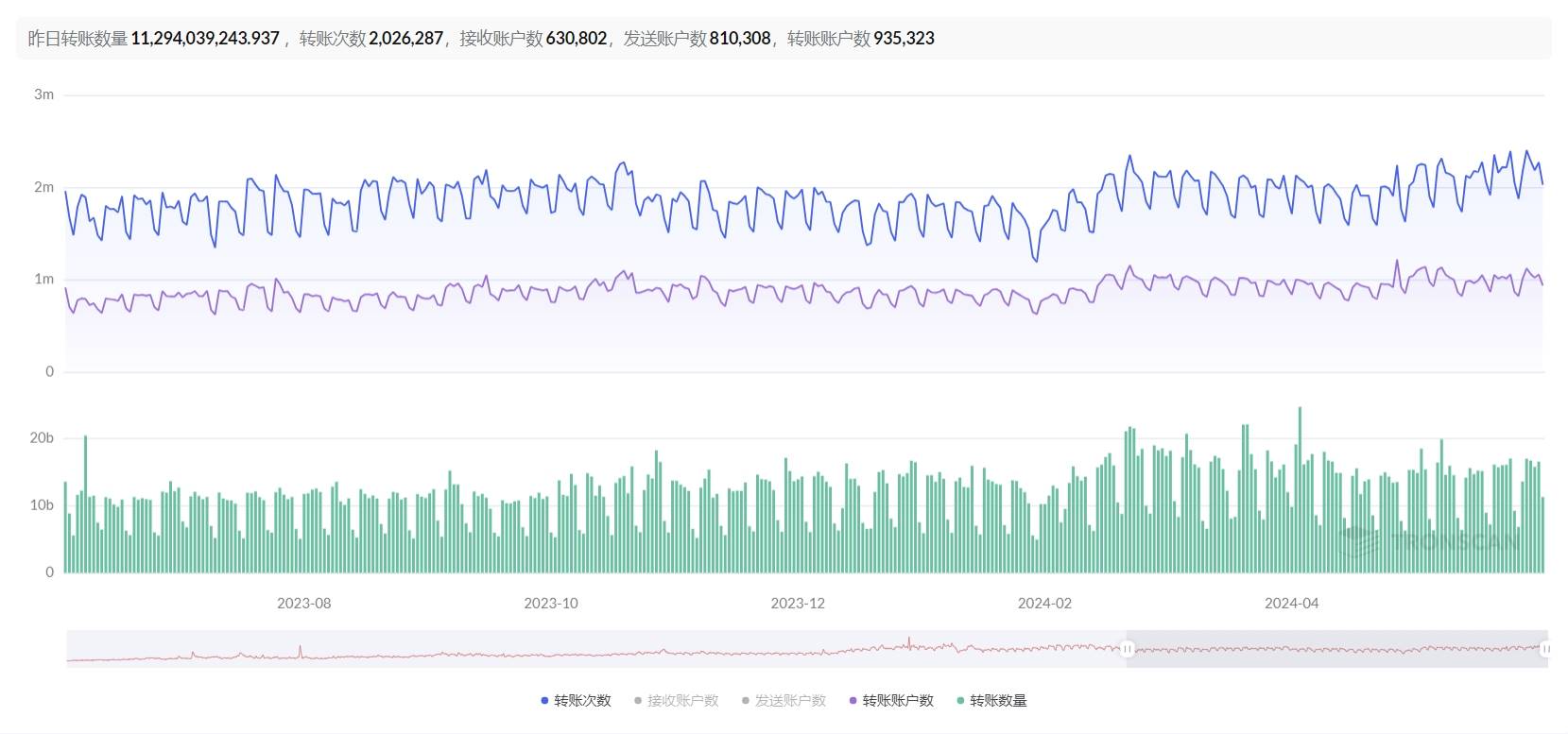

There have been no significant changes in the number of transfers, number of transfer accounts, and transfer amounts.

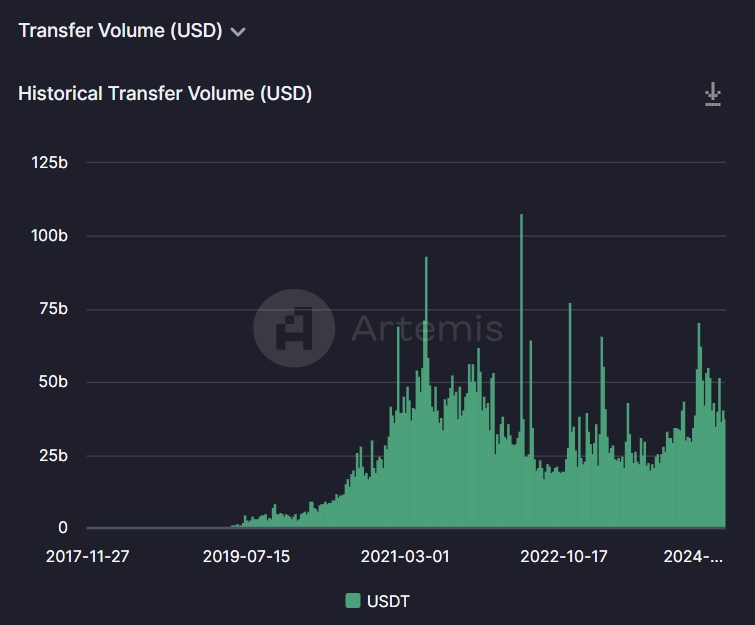

For USDT on Ethereum, the transfer volume has decreased from $50 billion per week in March to the current $40 billion per week, a slight decrease.

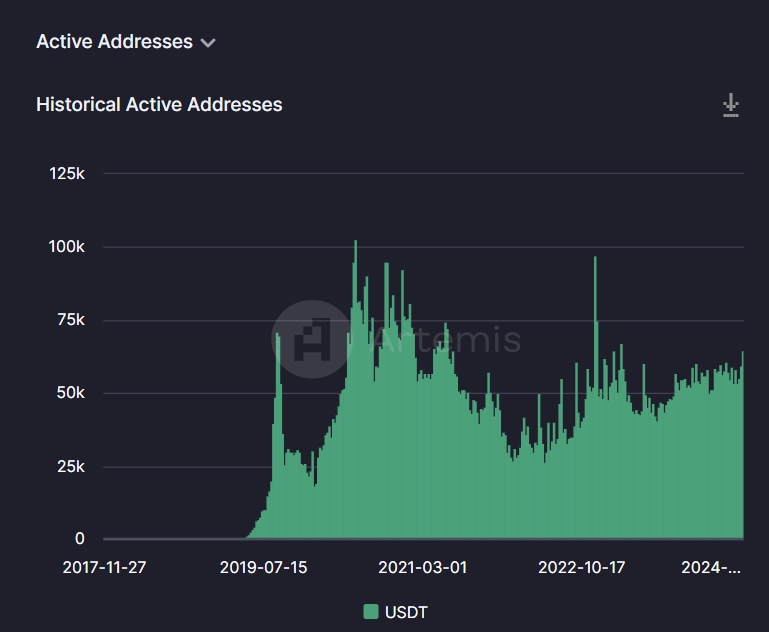

In terms of active addresses, the number has increased from over 50,000 weekly active addresses to over 60,000.

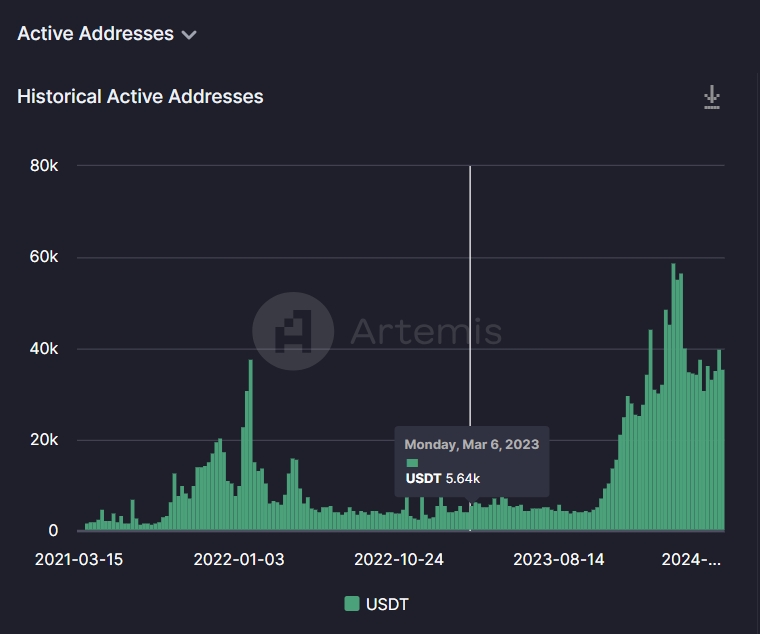

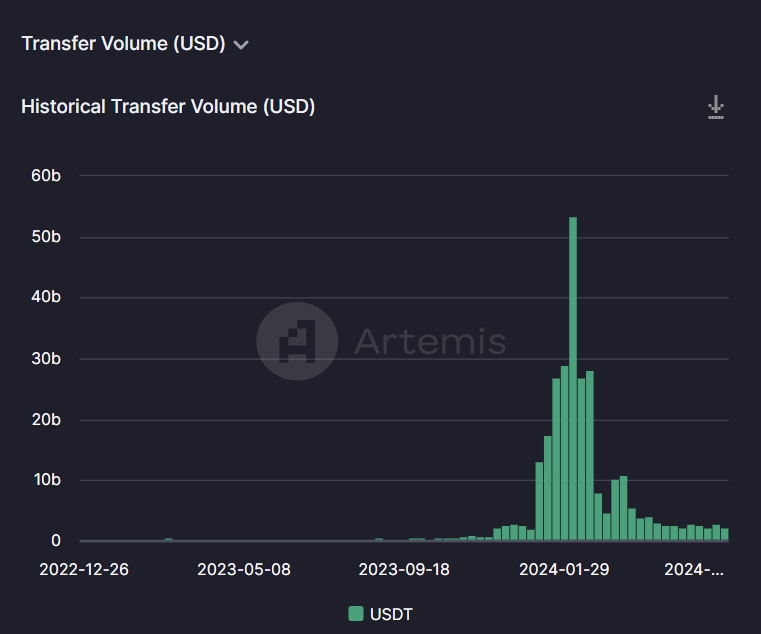

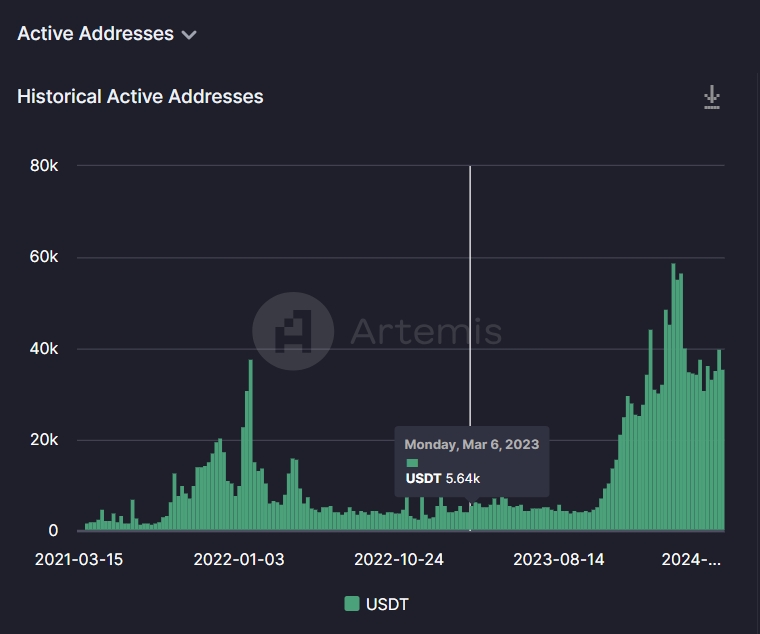

For USDT on Solana, the transfer volume and active address count have been decreasing continuously since reaching a peak at the beginning of the year:

An important change is that USDT began to be issued on Ton on April 19 and has grown to $580 million in two months.

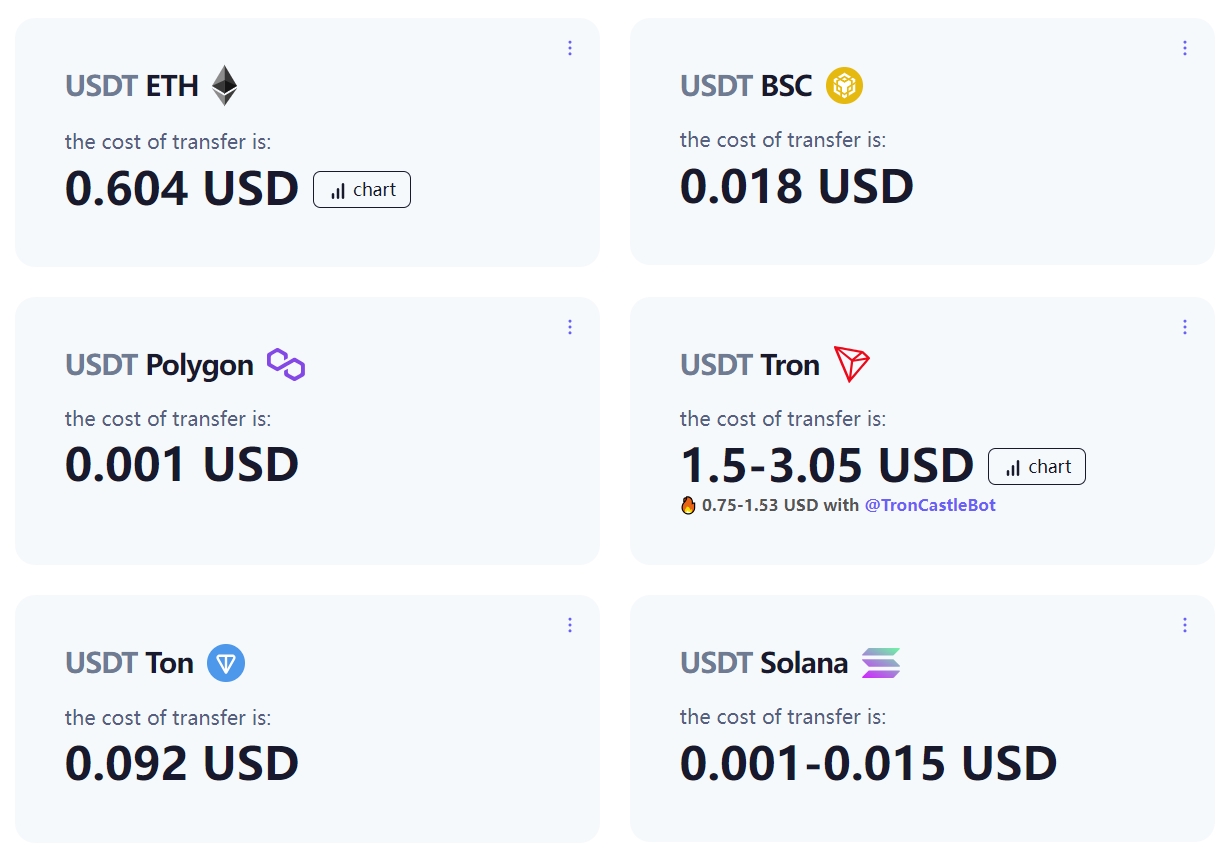

According to data from gasfeenow.com, the Gas fees required for USDT transfer transactions on mainstream blockchains were compared:

It can be seen that the Gas fees for USDT transfers on Tron are the highest, even exceeding Ethereum's by more than 3 times. In comparison, the transfer costs on Polygon and Solana are the lowest, while Ton's consumption is at a moderate level. With the help of Telegram's large user base, whether the application of USDT on Ton will seize market share from Tron remains to be observed.

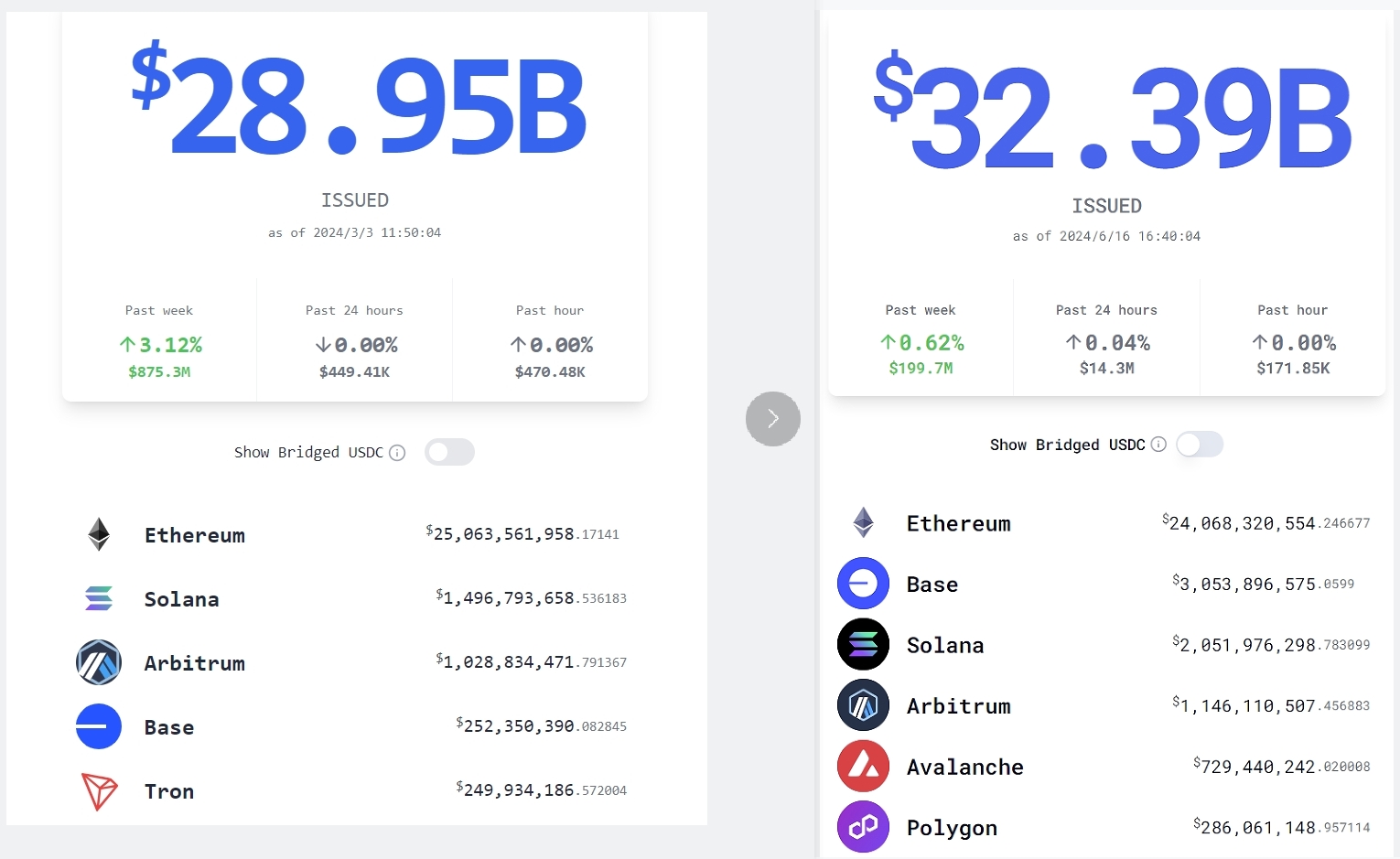

USDC Data

There have been significant changes in USDC data compared to March, as shown in the following figure, with the left side showing the data from March and the right side showing the data from June. It can be seen that the total amount has increased from $28.95 billion to $32.39 billion, an increase of approximately $3.4 billion. The amount of USDC on Ethereum has decreased by $1 billion, while the amount of USDC on Base has increased by $2.8 billion, and the amount of USDC on Solana has increased by $550 million, with minor changes on other chains.

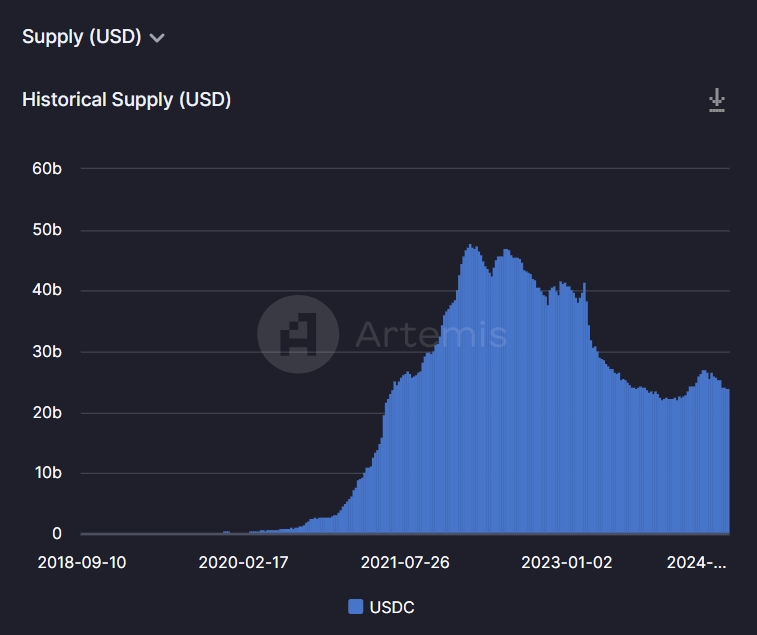

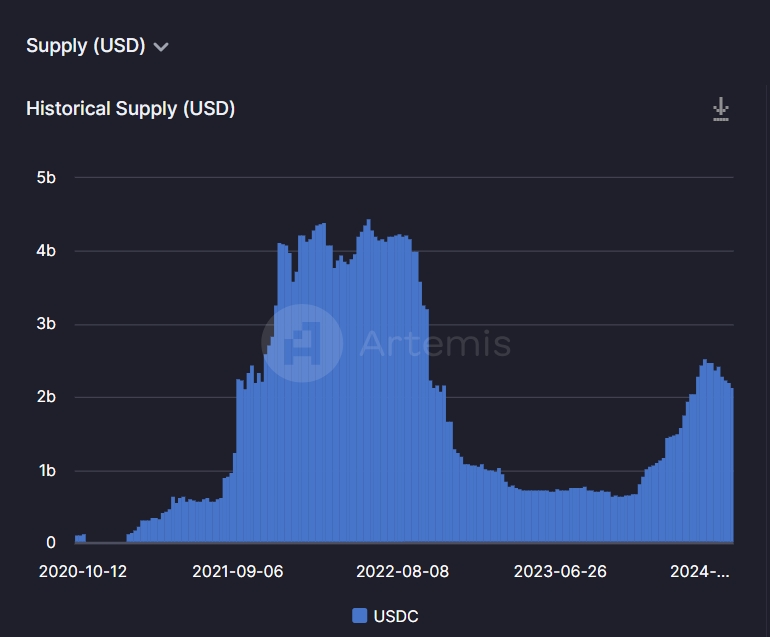

For the supply of USDC on Ethereum, the overall trend has continued to decline after rebounding in March, possibly related to the limited number of playable and income-generating projects on the mainnet. Currently, activity on the Ethereum mainnet is very inactive, and Gas Prices often drop to below 5 Gwei.

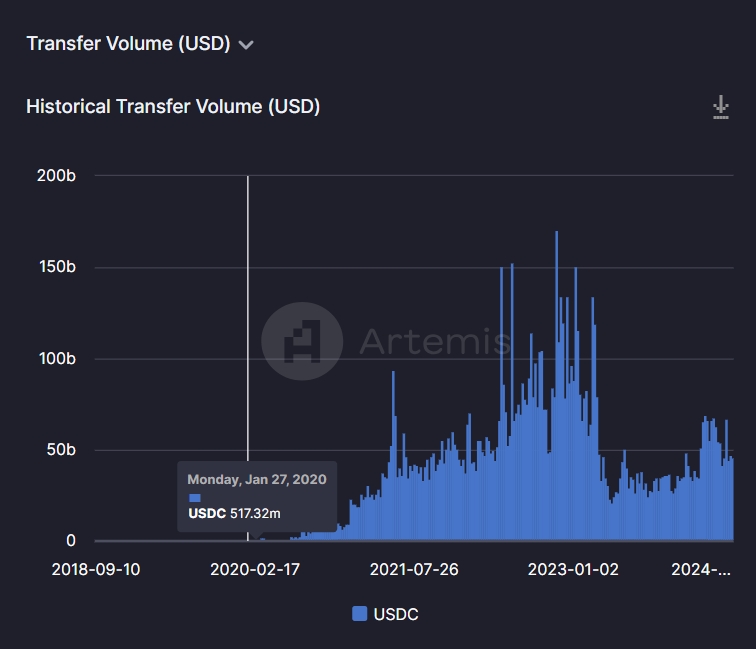

The transfer volume has also decreased:

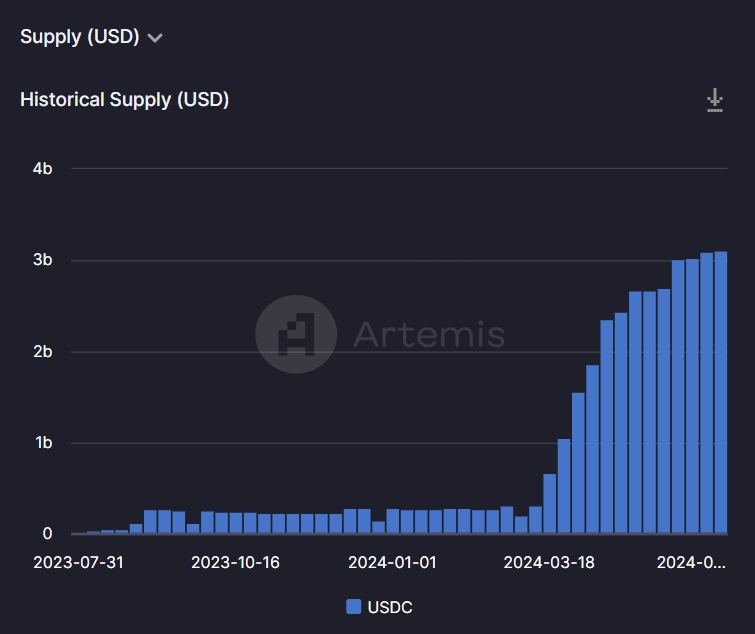

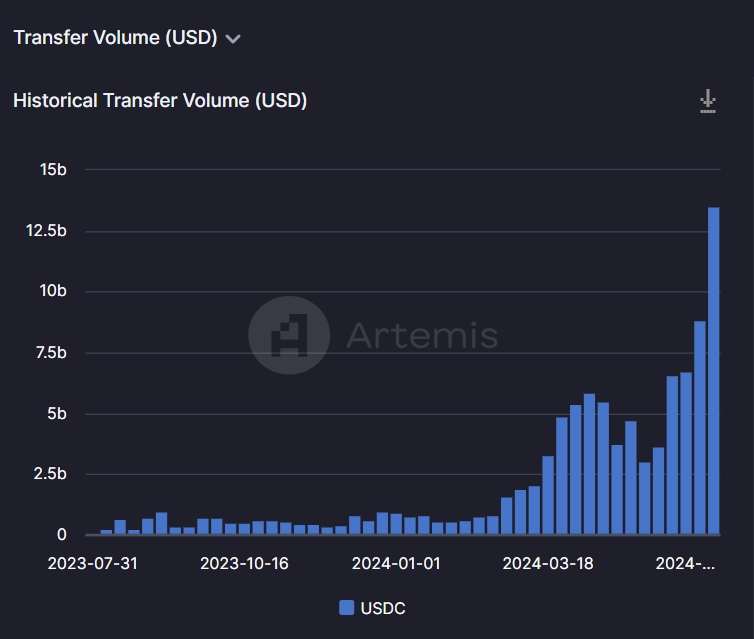

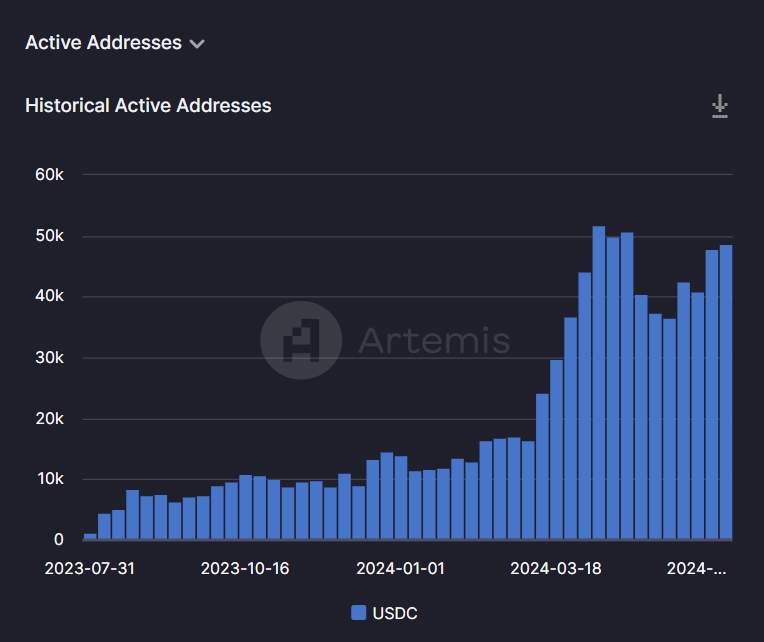

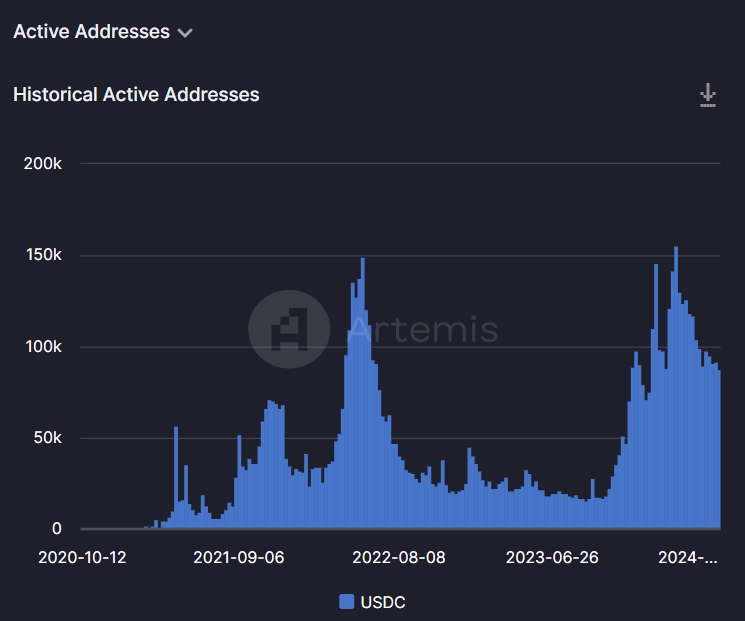

In contrast, the supply and transfer volume of USDC on the Base chain have continued to increase since March, with the number of active addresses decreasing and then rebounding.

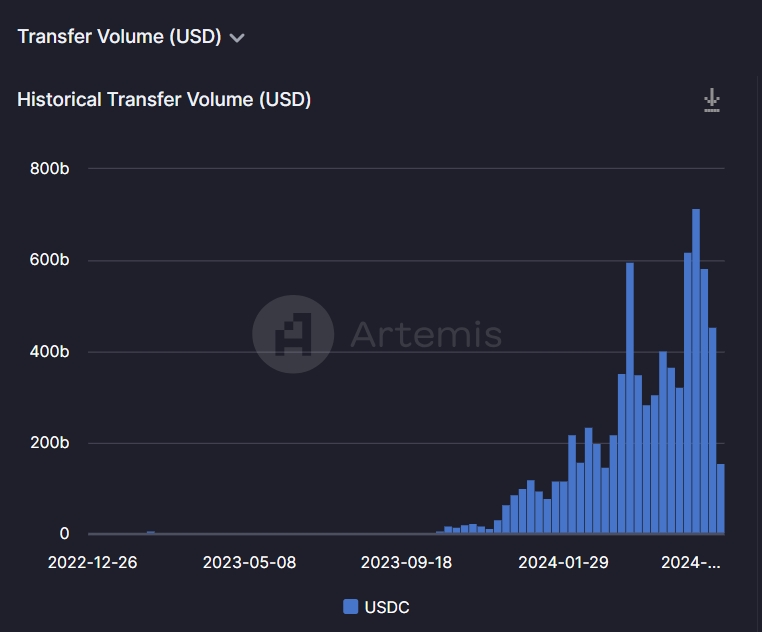

For USDC on Solana, its supply, transfer volume, and active address count all peaked at the end of April and have since declined:

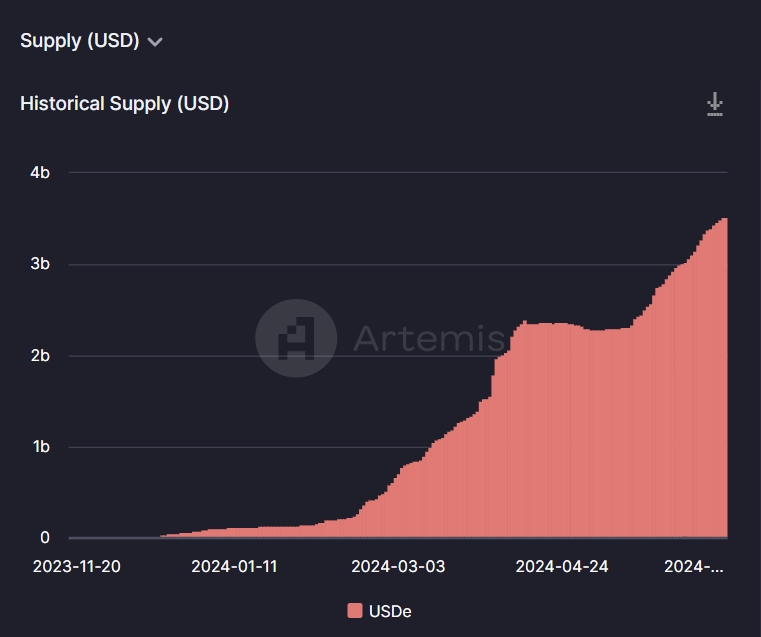

USDe Data

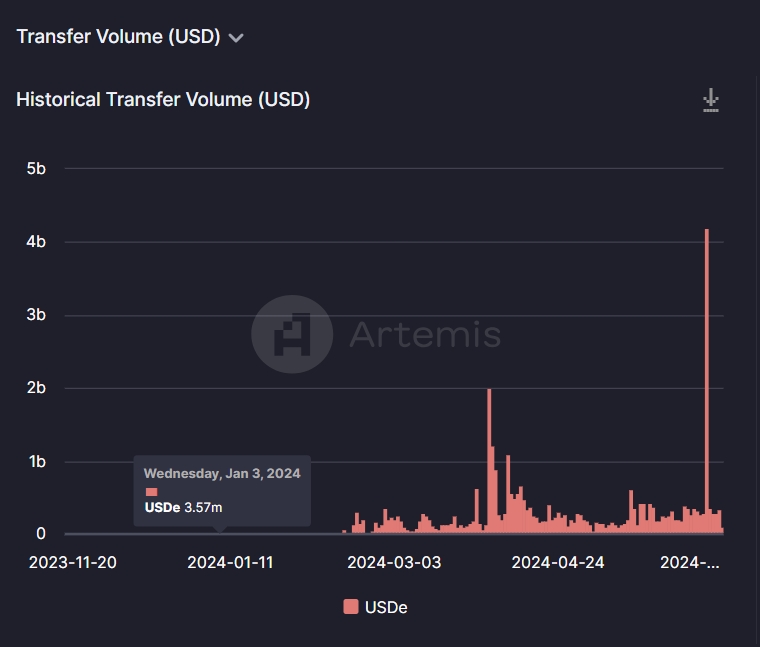

The supply of USDe has grown rapidly over the past few months, continuously increasing from $3 billion in March to the current $35 billion.

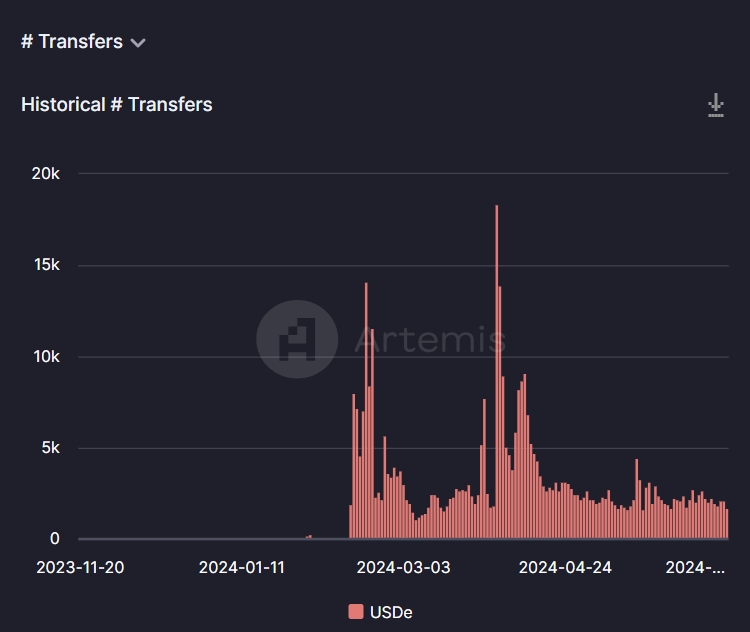

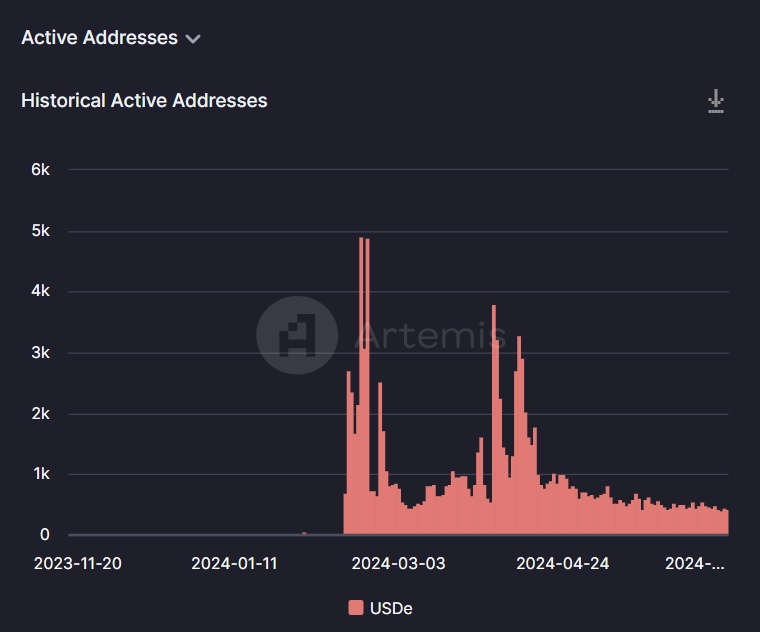

However, the transfer volume, number of transfers, and active user count are not very high:

The daily transfer volume is $200-300 million, with approximately 2,100 transfers and around 500 daily active users.

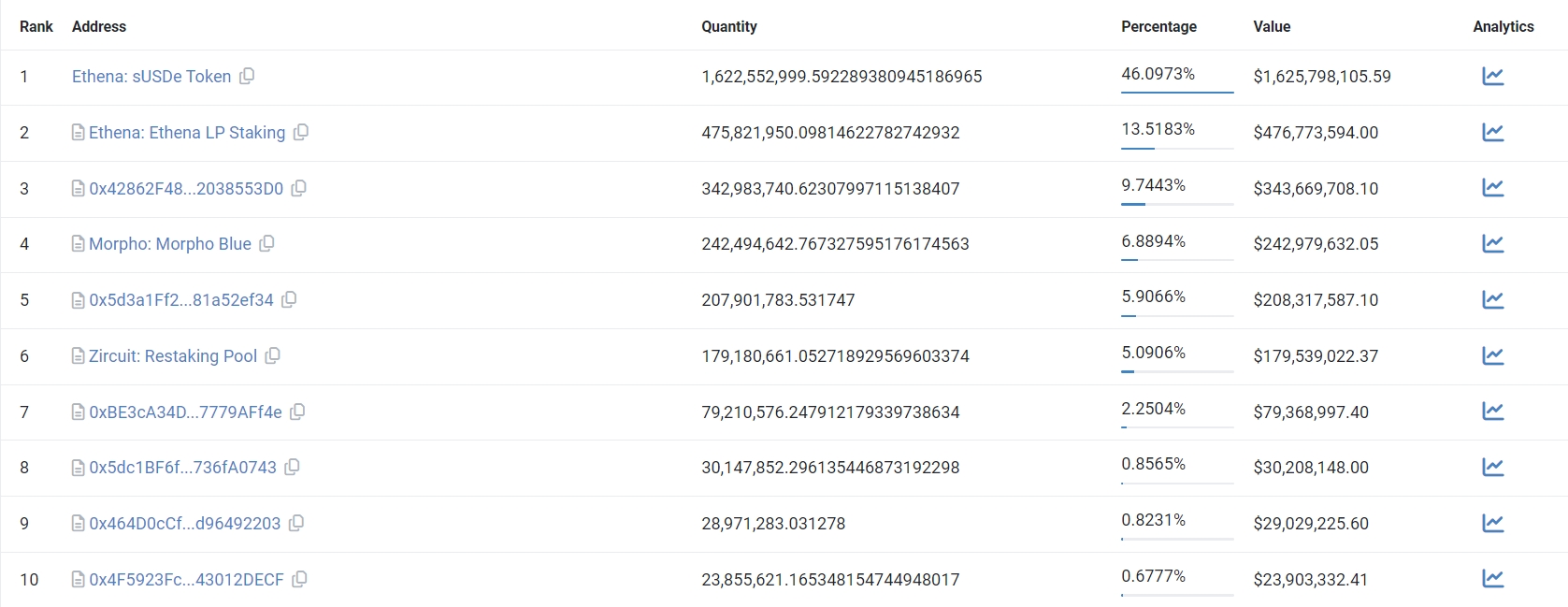

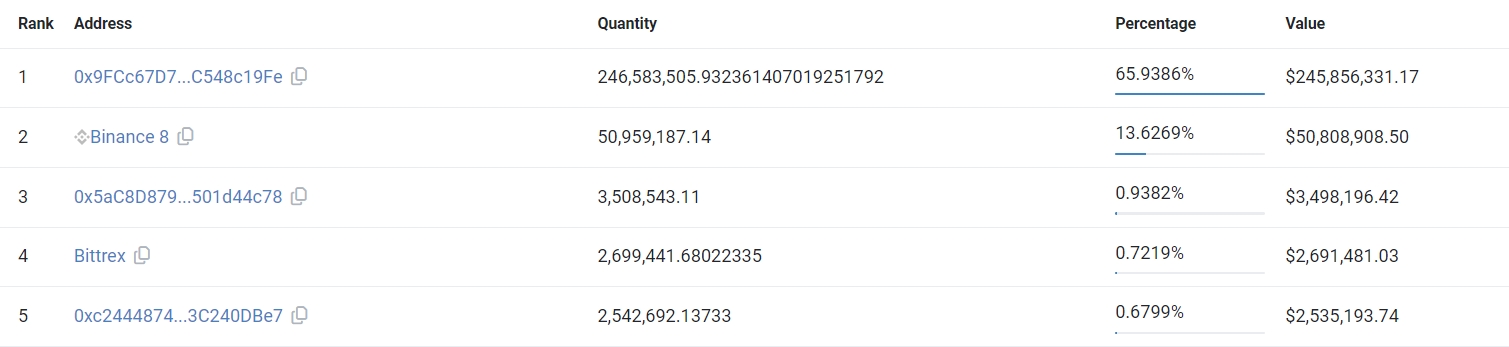

According to Etherscan data, the top ten addresses holding USDe tokens are as follows:

The first address is the USDe staking address, holding 46% of USDe.

The second address is the locked address for ENA, USDe, and related LPs, with LPs mainly concentrated on Curve. This address holds 13.5% of USDe.

The third address is the corresponding SY contract address for USDe on Pendle, holding 9.7% of USDe.

The fourth address is the contract address for the lending contract Morpho Blue. Morpho Blue is a trustless and efficient lending primitive that allows users to create a lending market without permission, where users can customize loan assets, collateral assets, loan-to-liquidation value ratio (LLTV), oracles, and interest rate models (IRM).

The reason this address holds a large amount of USDe is that users can collateralize USDe and sUSDe to borrow DAI and USDT on Morpho:

Using Morpho to collateralize USDe and borrow DAI can easily leverage. This address holds approximately 6.9% of USDe.

The fifth address is the LayerZero cross-chain contract address for USDe, holding 5.9% of USDe.

From the on-chain activity and holdings data of USDe, it can be seen that USDe is currently mainly circulating within the entire system, and there are very few real use cases for USDe as a means of payment or transaction medium, which has been a problem faced by many stablecoins in the past.

FDUSD and TUSD Data

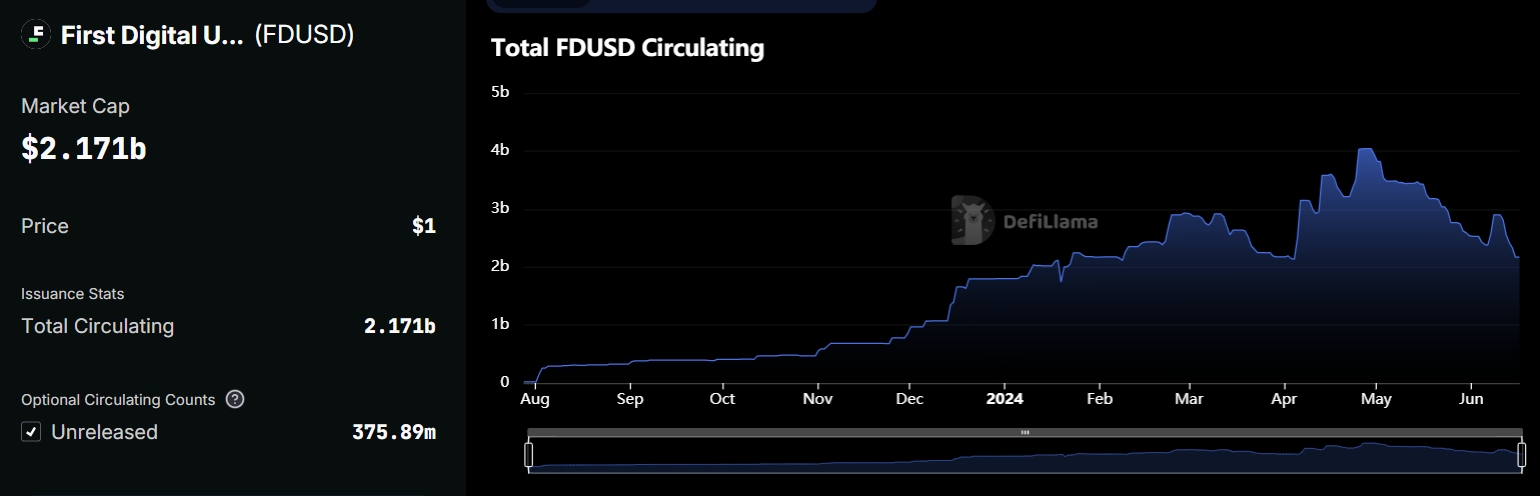

The supply trend of FDUSD is shown in the following chart. After reaching a peak of $4 billion at the end of April, it has continued to decrease to $2.17 billion.

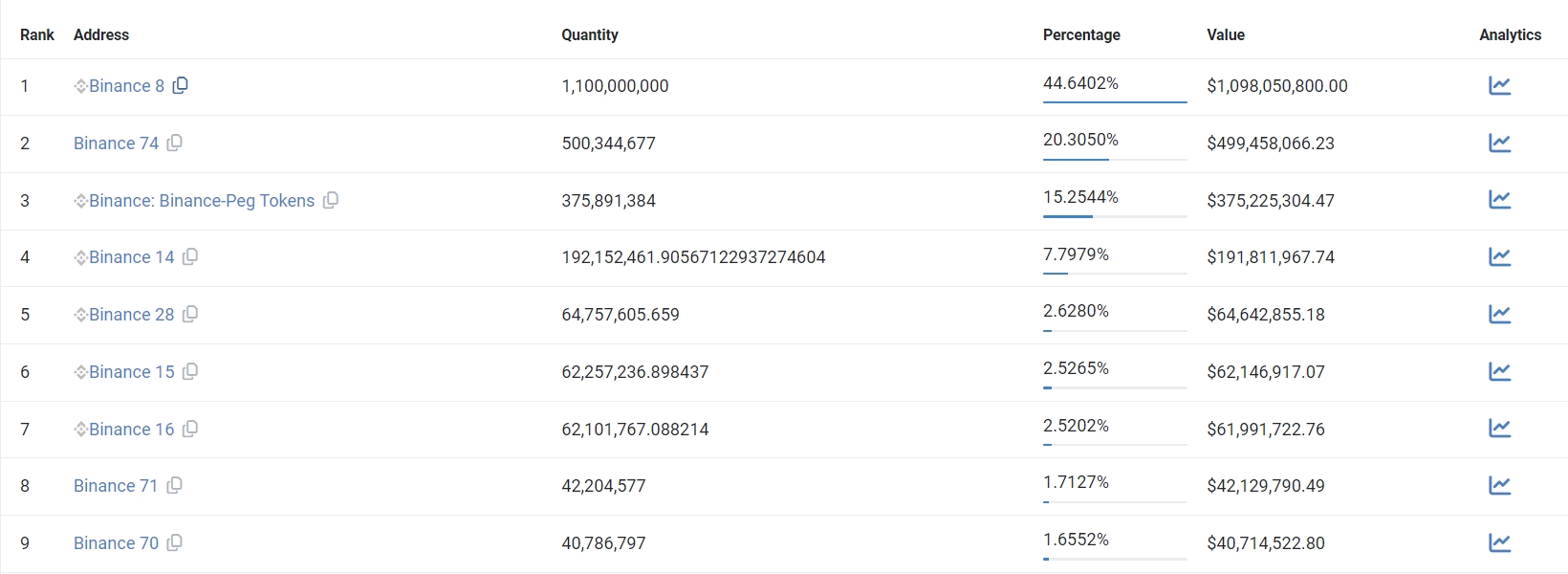

The majority of FDUSD is held by Binance and is mainly used for internal trading on the Binance exchange and for LanchPool rewards. The decrease in the total supply of FDUSD can to some extent reflect the reduced activity of users on the Binance exchange.

As for TUSD, the total supply has remained basically unchanged after a continuous decrease in March:

The top holding address is held by "Sun Brother," accounting for 66%, followed by Binance at 13.6%.

【Disclaimer】The market is risky, and investment should be cautious. This article does not constitute investment advice, and users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this information is at your own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。