Source: Owen.btc X Account

Author|@OwenJin12, authorized repost by Wu Shuo

The author has previously worked in overseas related institutions, mainly in the area of risk management at the trading level. He has had direct or indirect contact with large market makers, project parties, and institutional users. Recently, there have been many small market value contract pumps. Based on his experience, the author decrypts and discusses how project parties, market makers, and institutional investors interact in spot and contract markets to make markets, and why it is unfair competition for retail investors.

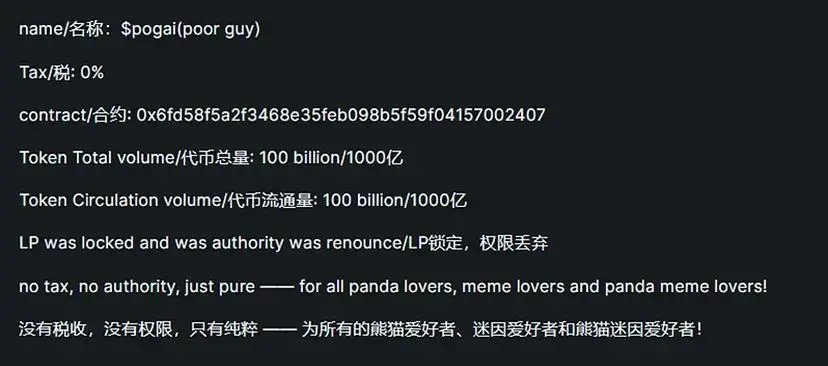

This article is not aimed at $P****, I just randomly picked a project with obvious abnormal secondary market data to make the argument more convenient.

This article discusses a common strategy for manipulating spot and contract coin prices, which may be the project party's own market value management team, professional market makers, or large speculative investors. Therefore, the following text uniformly refers to them as "whales," a term commonly used by everyone.

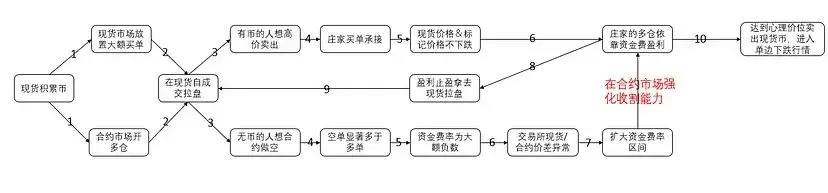

1. Simple process written first

2. Phenomenon

Do you often see the following unreasonable situations on exchanges?

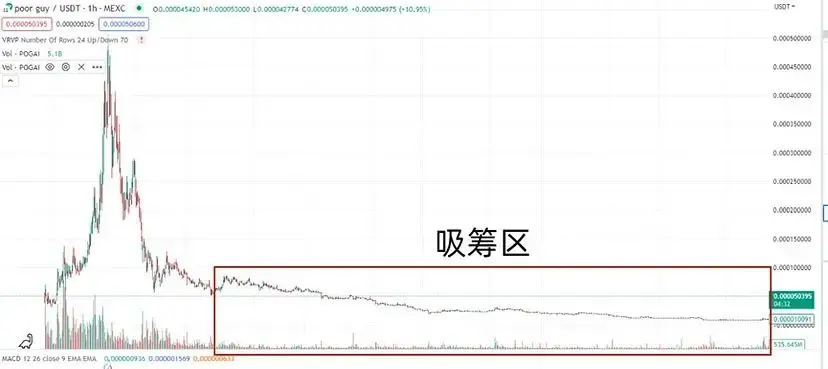

Phenomenon 1: Low on-chain and spot trading volume, but high contract trading volume

Taking Gate as an example, the contract trading volume is about 60 times the spot trading volume.

Phenomenon 2: Prices are rising but trading volume is gradually decreasing?

Prices continue to rise, but the trading volume is decreasing, and the MACD is clearly diverging.

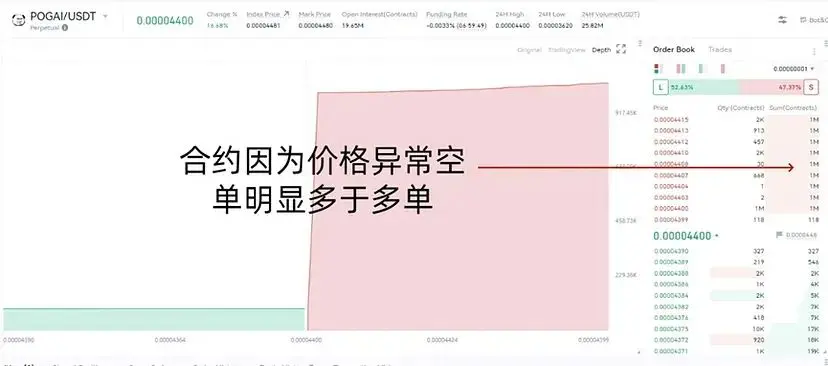

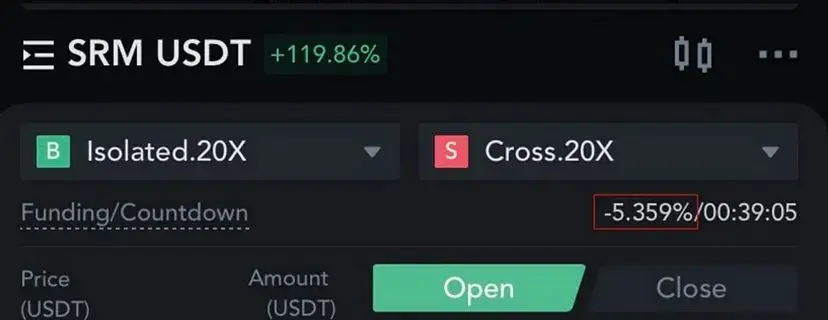

Phenomenon 3: The buy and sell orders for spot and contract trading are completely opposite, resulting in a negative funding rate

The rising price has led to a collective bearish sentiment among users, but since they do not have the coins to sell, they can only open short positions in the contract market. As a result, the spot and contract markets have completely opposite market sentiments.

The completely opposite market sentiments have led to a funding rate of -0.66%, settled every 8 hours, which means -1.98% for 24 hours.

For example, trading derivatives (contracts) is like buying and selling houses. I am a real estate developer, and my houses mainly serve wealthy person A, who has bought all of my properties at once. The pricing power only exists between me and A, and we are the two parties that will affect the supply and demand of house prices.

While B is not the homeowner, they believe that the price of this property will fall. Therefore, B puts up 1 million to bet against A, believing that A's investment will definitely lose money. So, B is unlikely to succeed because the circulating price of the house is controlled by me and A, and the transactions between me and A will truly affect the circulating price. We can just negotiate the transaction price between me and A, and B will definitely lose. The bet between B and A is similar to derivative trading, and will not affect the spot price.

Even if B believes that the house price is overvalued and actually worth only 1 yuan per square meter, it is impossible to achieve because their trade is not a spot trade, but a derivative trade. And derivative trading bets on the spot price, so those who control the spot price (me and A) can largely determine derivative trading.

In the above example, the real estate developer is the project party, A is the "whale" that controls the spot circulation (possibly controlling the spot price), and B is the contract user.

This is also why it is often said that engaging in naked short selling in the derivatives market is a very dangerous behavior.

3. Some essential contract basics to know

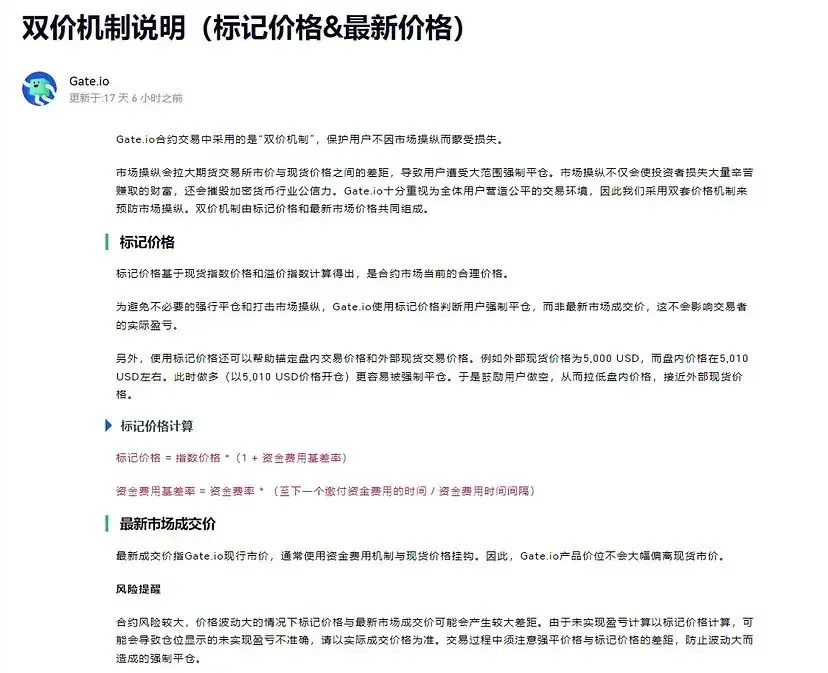

Point 1: What are the mark price and last traded price of a contract?

A contract has two prices: the last traded price and the mark price. When users buy and sell, they generally default to using the last traded price. However, liquidation uses the mark price, which is calculated objectively using the latest traded price from an external exchange through an algorithm.

Explanation of Gate's contract mark price:

https://www.gate.io/help/futures/futures_logic/22067/instructions-of-dual-price-mechanism-mark-price-last-price

In other words, as long as the spot price is controlled, the mark price can be controlled, thereby controlling whether the contract market is liquidated.

Point 2: What is the funding rate of a contract?

To prevent the latest traded price of the contract from deviating from the latest traded price of the spot, a funding fee is paid every 8 hours from long position users to short position users, or from short position users to long position users, and the gap between the latest traded price of the spot and the latest traded price of the contract is narrowed.

Point 3: What is the circulating market value of a project?

The economic mechanism of a project depends on the white paper. It generally includes the project party, early investors, community airdrops, and project treasuries, among others. If a project's white paper is not transparent enough, it is more likely to be manipulated. For example, although the white paper gives the community enough freedom, it also gives market makers/institutional investors enough freedom—they can easily acquire low-priced chips at low levels, and once acquired, they cannot be diluted because there is no issuance or linear unlocking mechanism.

4. Process of controlling small market value contracts

Step 1: Find a project with relatively low circulating market value and has a contract on a CEX

Generally, a small project with a circulating market value of 1-10M USDT is chosen, and the contract leverage ratio is usually 20-30 times.

Step 2: Prepare funds, with funds > external circulating market value

Million-level speculative investors prefer to control the market in small market value contracts. Taking $P**** as an example, with a circulating market value of 5M. During a long period of decline, if the whale acquires 60% of the circulating quantity at a low price, they only need to prepare 2M USDT and hold 3M coins without moving, to completely control the spot and contract prices of this coin.

Step 3: Control the spot market price

As long as the 3M coins are not sold, there will be at most 2M sell orders in the spot market. Therefore, as a "whale" who wants to manipulate the coin price, they will need to prepare 2M USDT as funds to maintain the spot price.

It is obvious that even if all the $P**** held by the "whales" are sold at the same time, the price will not drop.

Step 4: Control the contract mark price

As mentioned earlier, the contract's mark price is the spot price of various exchanges, which means the contract's mark price remains unchanged.

Step 5: Open long positions in the contract

After ensuring that the mark price is under control, use own funds to open leveraged positions in the contract. It can be conservative or aggressive—either way, since the mark price has been controlled, the whale's long positions will never be liquidated.

Step 6: Pump funds or use small accounts for trading

For coins with low liquidity and market value, it doesn't require much capital to pump the spot market by 100% in a day. If it cannot be pumped, create a high sell order on a small account at +100% of the price, and after the transaction, it will naturally show a 24-hour price change of +100%.

Upon seeing this news, retail investors will rush in, creating a large amount of short demand.

Step 7: Profit from the funding rate stability

At this time, there are very few sell orders in the spot order book, but there are many short positions in the contract, causing the spot price to be higher than the contract price, resulting in a negative funding rate. The larger the difference, the more negative the funding rate, meaning that even if the mark price remains unchanged, the short positions will have to pay a high funding rate to the long positions every 8 hours.

Under this game mechanism, the "whales" continuously profit from the funding rate. In an extreme example, SRM can earn a 16% return every 24 hours without moving the position.

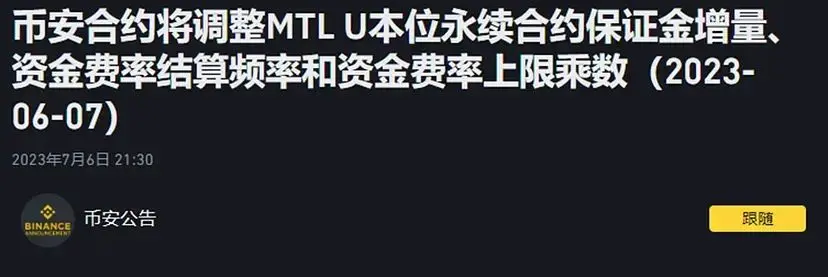

Coincidentally, exchanges have recently been frequently adjusting the funding rates in an attempt to help narrow the price difference between the spot and contract markets. However, they have not found the root cause of the abnormal funding rate, and expanding the rate range will not solve the problem, but rather help project parties/market makers/institutional investors to exploit retail investors through the funding rate.

Adjusting the funding rate for LINA

Adjusting the funding rate for MTL

It can also be observed that LINA and MTL were recently pumped coins, with significantly negative funding rates in the contract market.

5. How do "whales" profit

First profit point: Buy low and sell high in the spot market.

Please remember, market manipulation is not charity. The coins bought are not gold or BTC, and ultimately, profits will be made through selling. The so-called pump is all for the subsequent dump.

Second profit point: Contract funding rate.

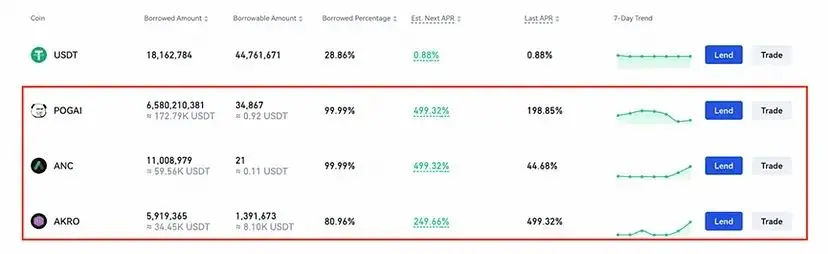

Third profit point: Holding coins without selling and directly borrowing in the leveraged lending market. For example, on Gate, it can be placed in the Coin Balance to earn an annualized return of 499%+.

After understanding the process, it is clear that the premise is to control the circulation of spot coins. Coins with a linear unlocking mechanism cannot be manipulated in the long term. Each unlocking will change the circulation.

6. Where is the problem?

Problem 1: Can the Open Interest (OI) of contracts exceed the spot circulating market value?

Contracts only require USDT to open positions, while spot trading requires coins to sell. Acquiring coins creates selling pressure in the spot order book, while shorting in the contract order book, and the difficulty of these two actions is different.

Returning to the third step of the third part, the "whale" users have already brought the coins back into their own hands. Even if users believe that the coin is significantly overvalued, they cannot create selling pressure in the spot order book. At this point, users will turn to shorting in the contract market. In other words, due to the scarcity of coins, users' trading demand cannot be reflected in the spot market and can only go short in the contract market.

Returning to the mark price mentioned in the second part, the contract's mark price is the spot's latest traded price, which has already been controlled by the project party/market makers/institutional investors. Therefore, how the contract is liquidated has also been controlled.

Therefore, when the contract OI > spot circulating market value, it means that due to the scarcity of coins, users' trading demand cannot be reflected in the spot price. The excess contract OI will exacerbate the phenomenon of price deviation between the futures and spot markets.

Problem 2: When the funding rate is abnormal, can expanding the upper and lower limits of the funding rate really promote fairness?

The current solution by exchanges is to expand the funding rate, which superficially solves the problem of price difference between the spot and contract markets. However, in reality, it increases the ability of project parties/market makers/institutional investors to exploit retail investors. The funding rate range on exchanges is generally [-2%, +2%], and further expansion actually increases the profits of the "whales".

Therefore, although the existing funding rate mechanism helps anchor the derivative market price to the spot market price, it does not make the trading market fairer and may even make it more unfair.

7. How can retail investors hedge

Point 1: Be wary of projects with high leverage contracts and low market value. This gives a significant competitive advantage to large holders compared to retail investors.

When users choose to buy in the spot market and open long positions in the contract, it accumulates enough buyers for the project party/market makers/institutional investors to start selling in batches and once again exploit retail investors.

Point 2: Projects with high absolute funding rates

Point 3: "Whales" are not charitable, and the cost of pumping will ultimately be recovered through dumping

Exit early and be careful not to become the "whales'" bagholders. When the thought of "this coin is valuable, I want to hold it long-term until the next bull market" arises, it is not far from the "whales" dumping. The purpose of their pumping is to cultivate this user psychology and have them become bagholders.

When trading against "whales" in the small market value contract market, it's like playing Texas Hold'em with them while they are both players and dealers with open cards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。