Background

With the launch of GPT-4 LLM by OpenAI, the potential of various AI text-to-image models has been witnessed, and the demand for GPU and other computing resources is on the rise as the application of mature AI models continues to increase.

An article by GPU Utils in 2023 discussing the supply and demand situation of Nvidia H100 GPUs pointed out that large enterprises involved in AI businesses have a strong demand for GPUs. Tech giants such as Meta, Tesla, and Google have purchased a large number of Nvidia GPUs to build AI-focused data centers. Meta owns approximately 21,000 A100 GPUs, Tesla owns around 7,000 A100 GPUs, and Google's data centers also have a large investment in GPUs, although specific numbers were not provided. The demand for GPUs, especially H100 GPUs, continues to grow due to the demand for training large language models (LLMs) and other AI applications.

At the same time, according to Statista's data, the AI market size has grown from $134.8 billion in 2022 to $241.8 billion in 2023, and is expected to reach $738.7 billion by 2030. The market value of cloud services has also increased by approximately 14% from $633 billion, with a significant portion of this growth attributed to the rapid increase in demand for GPU computing power in the AI market.

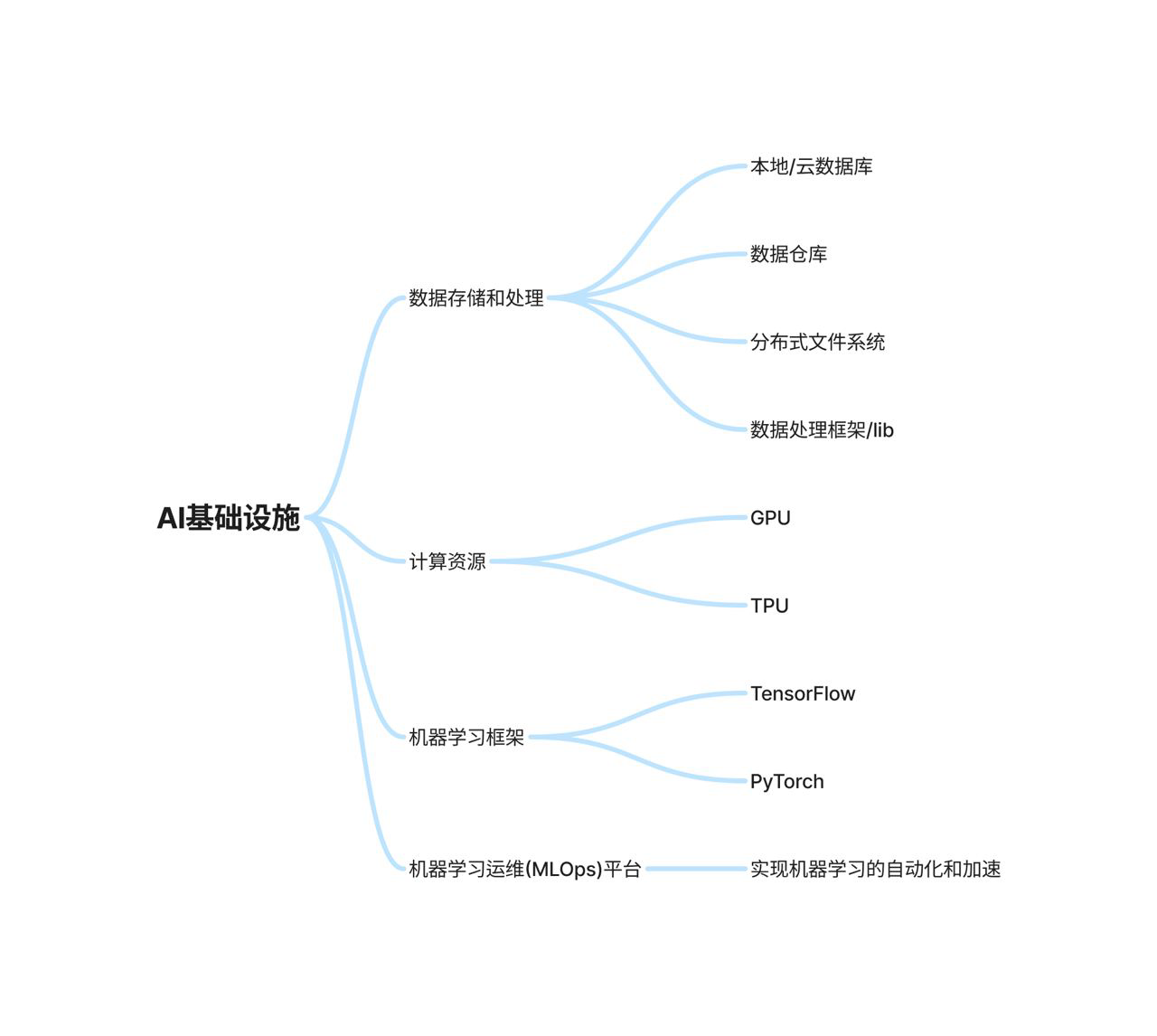

For the rapidly growing and highly potential AI market, from what perspective can we deconstruct and explore investment entry points related to it? According to a report by IBM, we have summarized the infrastructure needed to create and deploy AI applications and solutions. It can be said that AI infrastructure mainly exists to handle and optimize the large datasets and computing resources relied upon for training models, solving problems related to dataset processing efficiency, model reliability, and application scalability from both hardware and software perspectives.

AI training models and applications require a large amount of computing resources, preferring low-latency cloud environments and GPU computing power. In terms of software stack, it also includes distributed computing platforms (Apache Spark/Hadoop). Spark disperses the workflow that needs to be processed to various large computing clusters and has built-in parallel mechanisms and fault-tolerant designs. The naturally decentralized design of blockchain makes distributed nodes the norm, and the POW consensus mechanism established by BTC establishes that miners need to compete for block results through computing power (workload), which is similar to the workflow of AI requiring computing power to generate models/inferencing problems. As a result, traditional cloud server manufacturers are expanding new business models, such as renting out GPUs like renting out servers and selling computing power. By imitating the concept of blockchain, AI computing power adopts a distributed system design, which can utilize idle GPU resources and reduce the computing power costs for startup companies.

IO.NET Project Introduction

Io.net is a distributed computing power provider that combines Solana blockchain, aiming to use distributed computing resources (GPU & CPU) to solve the computational needs in the AI and machine learning fields. IO integrates idle graphics cards from independent data centers and cryptocurrency miners, and collaborates with crypto projects such as Filecoin/Render to aggregate resources from over 1 million GPUs to solve the shortage of AI computing resources.

Technically, io.net is built on the ray.io machine learning framework to achieve distributed computing resources for AI applications, including reinforcement learning, deep learning, model tuning, and model execution. Anyone can join io's computing network as a worker or developer without additional permission. At the same time, the network will adjust the computing power prices based on the complexity of the computing tasks, urgency, and the supply of computing resources according to market dynamics. Based on the distributed nature of computing power, io's backend will also pair GPU providers with developers based on the type of GPU demand, current availability, requester's location, and reputation.

$IO is the native token of the io.net system, serving as a medium of exchange between computing power providers and purchasers. Using $IO compared to $USDC can reduce the order fee by 2%. At the same time, $IO also plays an important incentive role in ensuring the normal operation of the network: $IO token holders can stake a certain amount of $IO to nodes, and node operation also requires the corresponding staked $IO tokens to earn income during idle periods.

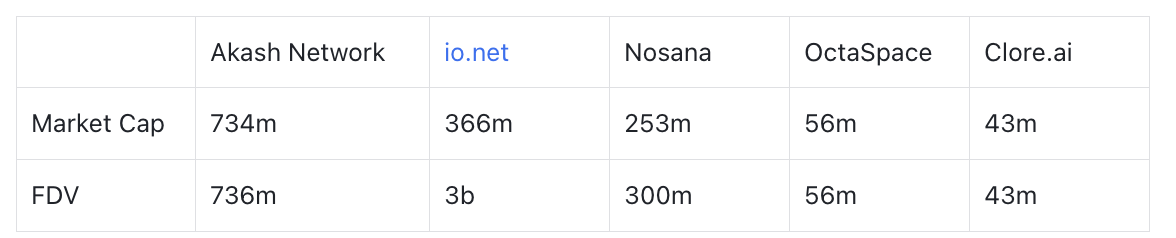

The current market value of $IO token is approximately $360 million, with a fully diluted valuation of $3 billion.

$IO Token Economics

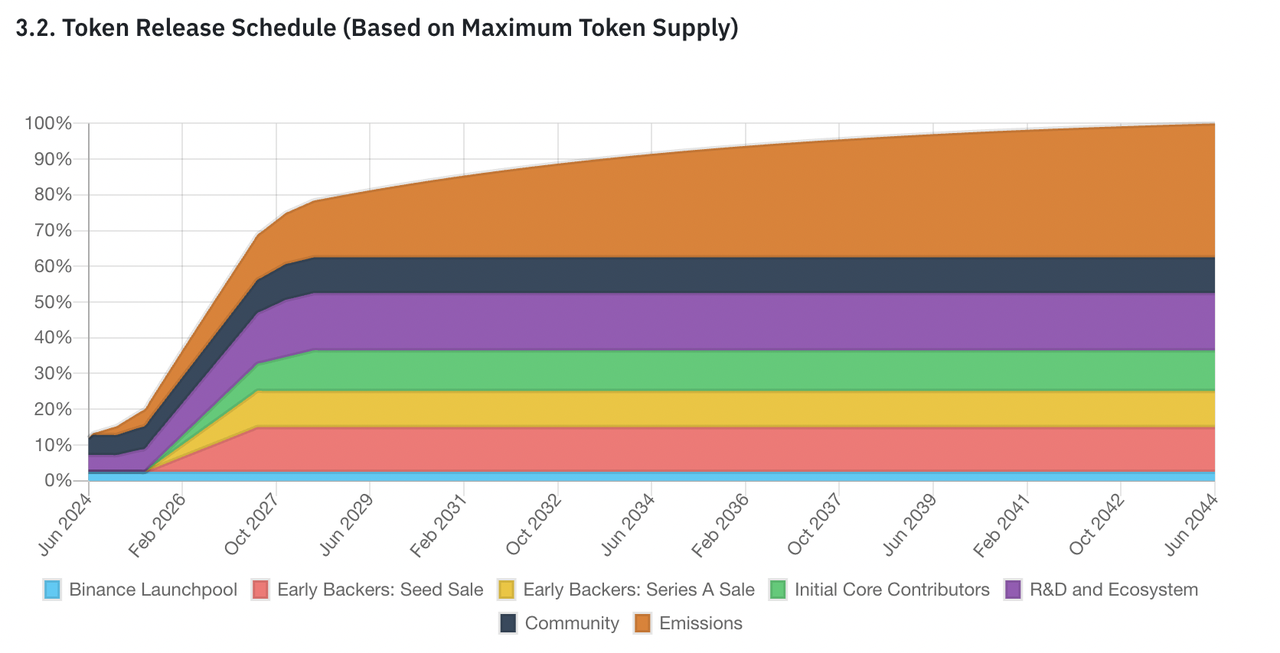

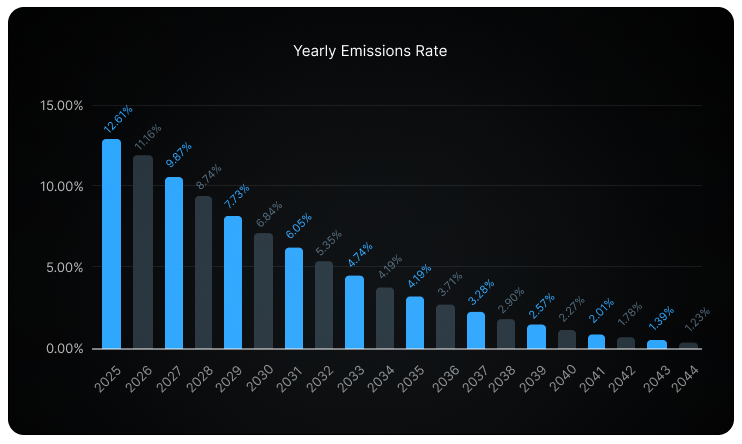

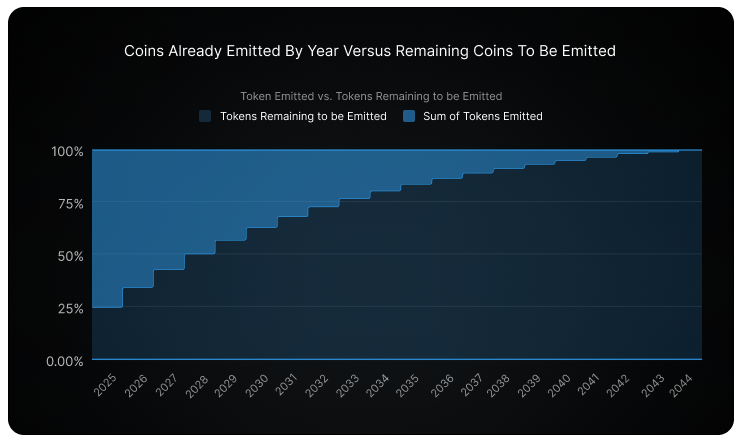

The maximum total supply of $IO is 800 million, with 500 million tokens allocated to various parties at the token generation event (TGE), and the remaining 300 million tokens will be gradually released over 20 years (with a monthly decrease of 1.02%, approximately a 12% decrease per year). The current circulating supply of IO is 95 million, consisting of 75 million unlocked for ecological research and community development at TGE and 20 million mining rewards from Binance Launchpool.

During the IO testnet period, the rewards for computing power providers are distributed as follows:

Season 1 (until April 25) - 17,500,000 IO

Season 2 (May 1 - May 31) - 7,500,000 IO

Season 3 (June 1 - June 30) - 5,000,000 IO

In addition to the testnet computing power rewards, IO also provides a portion of airdrops to creators participating in community building:

(First round) Community / Content creators / Galxe / Discord - 7,500,000 IO

Season 3 (June 1 - June 30) Discord and Galxe participants - 2,500,000 IO

The rewards for the first season of the testnet computing power and the first round of community creation/Galxe rewards have already been airdropped at TGE.

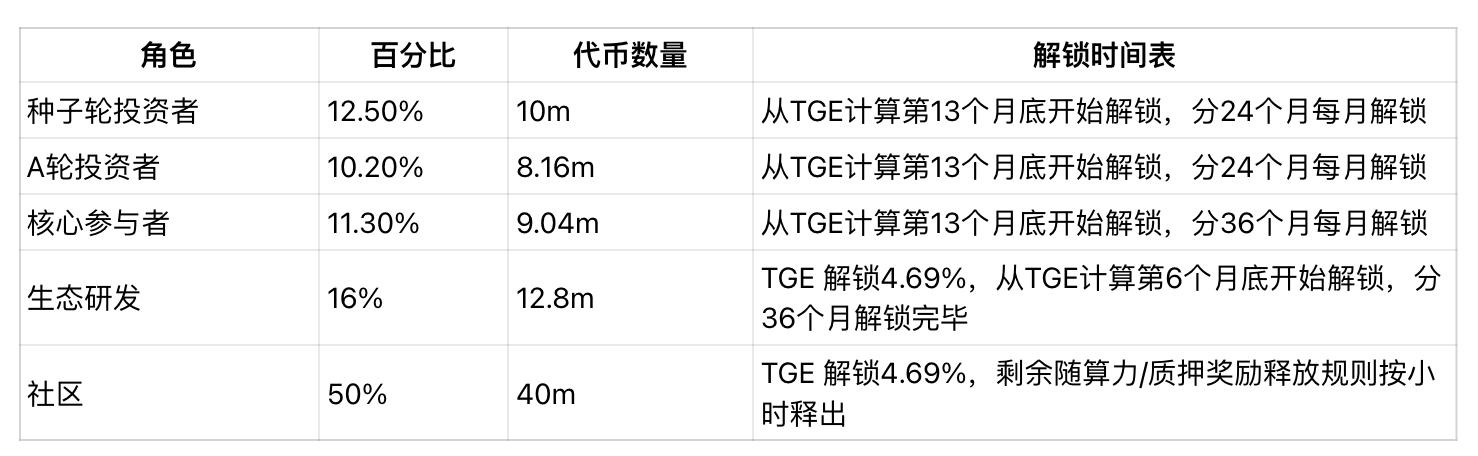

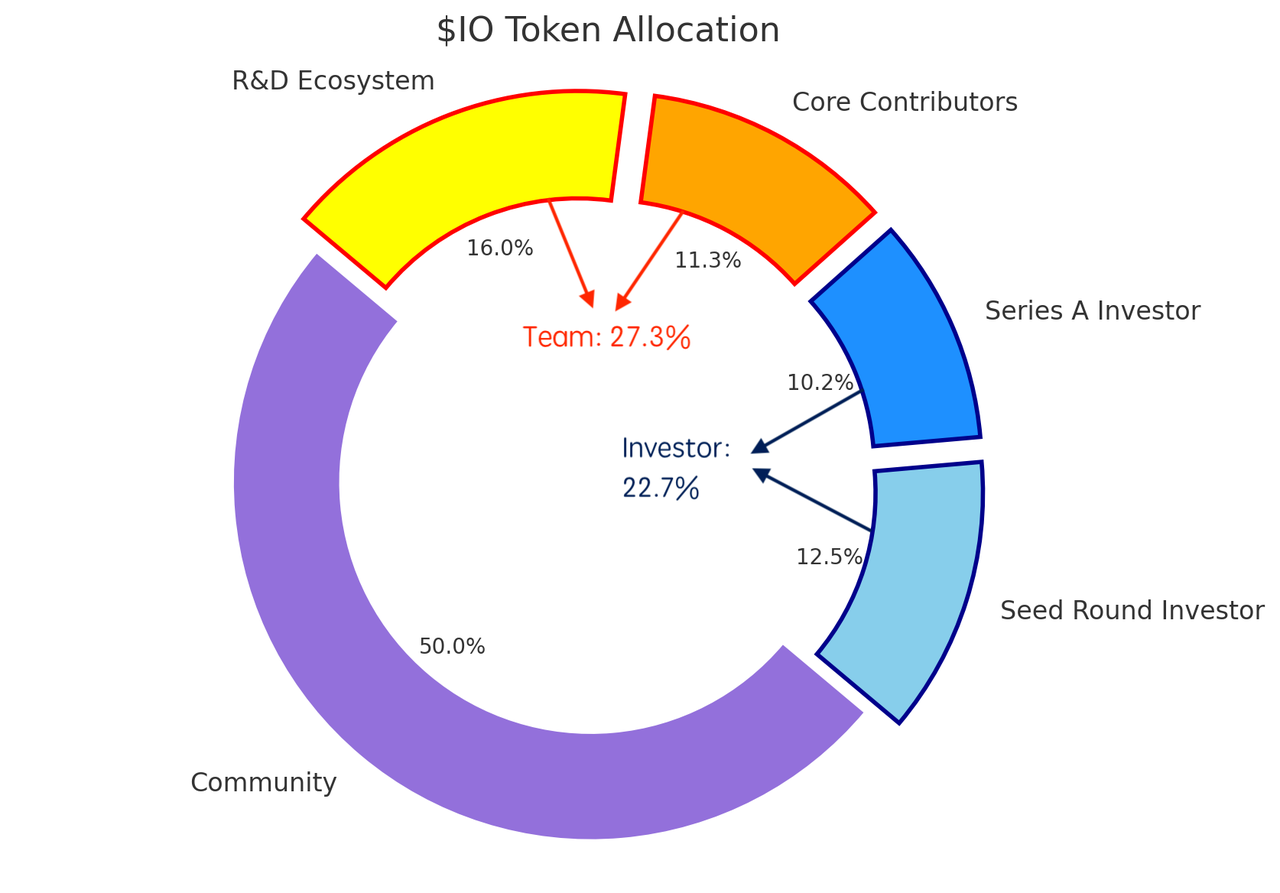

According to official documents, the overall allocation of $IO is as follows:

$IO Token Burn Mechanism

Io.net executes a fixed preset program to repurchase and burn $IO tokens, and the specific repurchase and burn amount depends on the price of $IO at the time of execution. The funds used to repurchase $IO come from the operating income of IOG (The Internet of GPUs - GPU Internet), which charges a 0.25% order booking fee from both computing power buyers and providers in IOG, as well as a 2% fee for computing power purchases using $USDC.

Competitor Analysis

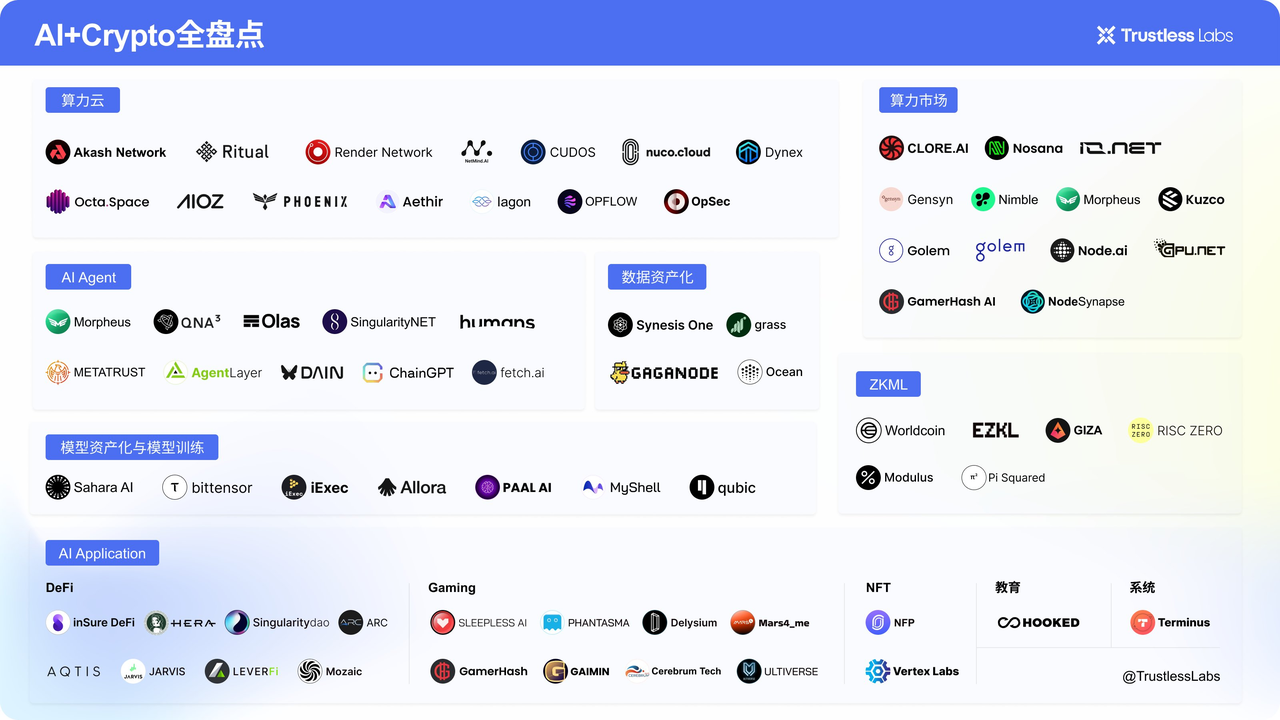

Projects similar to io.net include Akash, Nosana, OctaSpace, Clore.AI, and others that focus on decentralized computing power markets to address AI model computational needs.

Akash Network utilizes idle distributed computing resources through a decentralized market model to aggregate and rent out excess computing power. It uses dynamic discounts and incentive mechanisms to address supply-demand imbalances and achieves efficient, trustless resource allocation based on smart contracts, providing secure, cost-effective, and decentralized cloud computing services. It allows Ethereum miners and other users with underutilized GPU resources to lease these resources, creating a cloud service market. In this market, service pricing is determined through a reverse auction mechanism, allowing buyers to bid for the rental of these resources, driving competitive price reductions.

Nosana is a decentralized computing power market project within the Solana ecosystem, aiming to form a GPU grid using idle computing resources to meet the computational needs of AI inference. The project defines its computing power market operations on Solana and ensures that GPU nodes participating in the network reasonably complete tasks. Currently, during the second phase of the testnet, it provides computing power services for LLama 2 and Stable Diffusion model inference processes.

OctaSpace is an open-source, scalable distributed computing cloud node infrastructure that allows access to distributed computing, data storage, services, VPN, etc. OctaSpace includes CPU and GPU computing power, disk space for ML tasks, AI tools, image processing, and rendering scenes using Blender, among others. OctaSpace was launched in 2022 and operates on its own Layer 1 EVM-compatible blockchain. The blockchain uses a dual-chain system, combining proof of work (PoW) and proof of authority (PoA) consensus mechanisms.

Clore.AI is a distributed GPU supercomputing platform that allows users to obtain high-end GPU computing resources from globally available nodes. It supports various purposes such as AI training, cryptocurrency mining, and movie rendering. The platform provides low-cost, high-performance GPU services, and users can earn Clore tokens by renting GPUs. Clore.ai emphasizes security, complies with European laws, and provides powerful APIs for seamless integration. In terms of project quality, Clore.AI's website is relatively rough, lacking detailed technical documentation to verify the authenticity of the project's self-introduction and data. Therefore, there are doubts about the project's GPU resources and actual participation level.

In comparison with these competitors in the decentralized computing power market, io.net is currently the only project that allows anyone to join and provide computing power resources without requiring permission. Users can contribute computing power to the network using consumer-grade GPUs such as the minimum 30 series, as well as resources such as Apple chips in devices like Macbook M2 and Mac Mini. IO's more abundant GPU and CPU resources and rich API construction enable it to support various AI computing needs, such as batch inference, parallel training, hyperparameter tuning, and reinforcement learning. Its backend infrastructure consists of a series of modular layers, enabling effective resource management and automated pricing. Other distributed computing power market projects mainly collaborate with enterprise-grade GPU resources, with user participation requiring certain thresholds. Therefore, IO may have the ability to leverage token economics to unlock more GPU resources.

The following is a comparison of the current market value/FDV of io.net and its competitors:

Review and Conclusion

The listing of $IO on Binance can be considered as a well-deserved start for this highly anticipated project, and the hot testnet activity across the entire network, as well as the gradual attacks and questioning of the opaque scoring rules during the delayed testing, have put a fitting end to a heavyweight project. The token was listed during a market correction period, opening low and rising high, eventually returning to a relatively rational valuation range. However, for the participants who came to the testnet attracted by the strong investment lineup of io.net, it was a mixed bag. Most users who rented GPUs but did not persist in participating in every season of the testnet did not achieve the desired excess returns, but instead faced the reality of "anti-reward". During the testnet, io.net divided each season's prize pool into two pools for GPU and high-performance CPU, and in season 1, due to a hacking incident, the point distribution was delayed, but the exchange ratio for the GPU pool was ultimately set at nearly 90:1 at TGE, far exceeding the cost of participation for users who rented GPUs from major cloud platforms. During season 2, the official implementation of the PoW verification mechanism was completed, with nearly 30,000 GPU devices successfully participating and passing PoW verification, resulting in an exchange ratio of 100:1.

After the highly anticipated start, whether io.net can achieve its goal of providing computational needs for various stages of AI applications and how much real demand remains after the testnet, perhaps only time can provide the best proof.

References:

https://blockcrunch.substack.com/p/rndr-akt-ionet-the-complete-guide

https://www.odaily.news/post/5194118

https://www.theblockbeats.info/news/53690

https://www.binance.com/en/research/projects/ionet

https://www.ibm.com/topics/ai-infrastructure

https://gpus.llm-utils.org/nvidia-h100-gpus-supply-and-demand/

https://www.statista.com/statistics/941835/artificial-intelligence-market-size-revenue-comparisons/

https://www.grandviewresearch.com/press-release/global-cloud-ai-market

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。