Original Title: "Shikata Ga Nai"

Author: Arthur Hayes

Translation: Ismay, BlockBeats

Editor's Note: Against the backdrop of global economic turmoil and financial market volatility, Hayes delves into the challenges faced by the Japanese banking system during the Fed's interest rate hike cycle, as well as the profound impact of US fiscal and monetary policies on the global market. Through a detailed analysis of the forex hedging of Japan's Norinchukin Bank and other Japanese commercial banks in their US Treasury investment strategies, the article reveals the reasons why these banks have to sell US Treasuries as interest rate differentials widen and forex hedging costs rise. Hayes further discusses the role of the FIMA repurchase mechanism and its impact on US-Japan financial relations, and predicts the crucial role of this mechanism in maintaining market stability. The article ultimately calls on investors to seize investment opportunities in the crypto market in the current situation.

I just finished reading the first book in Kim Stanley Robinson's trilogy, "Red Mars." In the book, a character, Japanese scientist Hiroko Ai, often says "Shikata ga nai" when referring to situations that the Martian colonists cannot control, meaning "it can't be helped."

When I was thinking of a title for this "short" article, this phrase came to mind. This article will focus on the Japanese banks that have become victims of the "American peace" monetary policy. What have these banks done? In order to earn decent returns on yen deposits, they engaged in USD-JPY arbitrage trading. They borrowed from elderly savers in Japan, looked around Japan, and found that almost all "safe" government and corporate bonds offered zero returns, so they concluded that lending to the "American peace" through the US Treasury (UST) market was a better use of capital, as these bonds could generate higher returns even when fully hedged against exchange rate risk.

However, when massive cash bribes to the public led to rampant inflation in the US, in an attempt to pacify the public accepting being locked at home and injected with experimental drugs to combat the "baby boomer flu," the Fed had to take action. The Fed raised interest rates at the fastest pace since the 1980s. As a result, it was bad news for anyone holding US Treasuries. From 2021 to 2023, rising yields led to the worst bond selloff since the War of 1812. It can't be helped!

In March 2023, the losses of the first batch of banks seeped through the underlying financial system. In less than two weeks, three major banks collapsed, leading the Fed to provide full support for all US Treasuries on the balance sheets of any US or foreign bank's branches in the US. As expected, Bitcoin surged significantly in the months following the bailout announcement.

Since the announcement of the bailout on March 12, 2023, Bitcoin has risen by over 200%.

To consolidate the approximately $4 trillion bailout plan (my estimate of the total amount of US Treasuries and mortgage-backed securities held on the balance sheets of US banks), the Fed announced in March this year that the discount window is no longer a "kiss of death." If any financial institution needs to quickly inject cash to cover the unmanageable holes on its balance sheet due to the drop in prices of "safe" government bonds, it should use the window immediately. When the banking system inevitably resorts to debasing the currency and undermining human labor dignity for a bailout, what can we say? It can't be helped!

The Fed did the right thing for US financial institutions, but what about the foreigners who heavily bought US Treasuries during the global liquidity surge from 2020 to 2021? Which country's banking balance sheet is most likely to be brought down by the Fed? Of course, it's Japan's banking system.

The latest news shows that the fifth-largest Japanese bank will sell $63 billion worth of foreign bonds, most of which are US Treasuries.

Norinchukin Bank to sell $63 billion of US and European bonds

"Rising rates in the US and Europe have led to a drop in bond prices. This has reduced the value of Norinchukin Bank's previously purchased high-priced (low-yield) foreign bonds, leading to an expansion of its book losses."

Norinchukin Bank is the first bank to succumb and announce the necessity of selling bonds. All other banks are engaged in the same trade, which I will explain below. The Foreign Relations Committee has provided us with an idea of the massive scale of bonds that Japanese commercial banks may sell.

According to the International Monetary Fund's coordinated portfolio investment survey, Japanese commercial banks held around $850 billion in foreign bonds in 2022. This includes nearly $450 billion in US Treasuries and approximately $75 billion in French bonds—this figure far exceeds their holdings of bonds issued by other major Eurozone countries.

Why is this important? Because Yellen will not allow these bonds to be sold on the open market, causing US Treasury yields to soar. She will demand that the Bank of Japan (BOJ), supervised by Japanese banks, buy these bonds. Then, the BOJ will use the Foreign and International Monetary Authorities (FIMA) repurchase mechanism established by the Fed in March 2020. The FIMA repurchase mechanism allows central bank members to pledge US Treasuries and obtain newly printed US dollars overnight.

The increase in the FIMA repurchase mechanism indicates an increase in US dollar liquidity in the global currency market. Everyone knows what this means for Bitcoin and cryptocurrencies… This is why I believe it is necessary to remind readers about another hidden way of printing money. I only understood how Yellen prevents these bonds from entering the open market after reading a dry report from the Atlanta Fed called "Offshore Dollars and US Policy."

Why Now

The Fed signaled at the end of 2021 that it would start raising policy rates in March 2022, and since then, US Treasuries (USTs) have begun to collapse. It's been over two years, so why would a Japanese bank choose to confirm its losses now after enduring two years of pain? Another strange fact is that, according to the consensus view of economists you should listen to, the US economy is on the brink of a recession. Therefore, the Fed may cut rates after a few meetings. Rate cuts will drive bond prices up. Since all the "smart" economists are telling you that relief is just around the corner, why sell now?

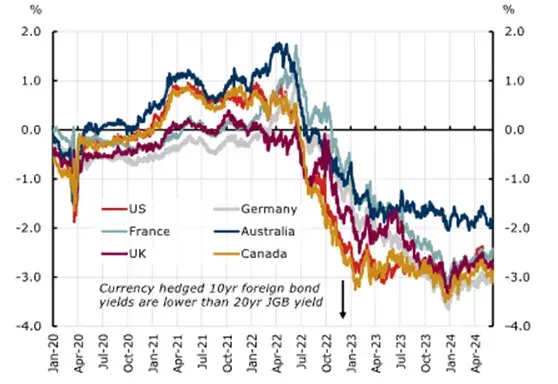

The reason is that Norinchukin Bank's forex hedged purchases of US Treasuries have gone from slightly positive returns to significantly negative returns. Before 2023, the interest rate differential between the US dollar and the Japanese yen was minimal. Then, the Fed diverged from the Bank of Japan (BOJ) by raising rates, while the BOJ stuck to a -0.1% rate. As the gap widened, the cost of hedging the embedded US dollar risk in US Treasuries exceeded the higher yield.

Here's how it works. Norinchukin Bank is a Japanese bank holding yen deposits. If it wants to buy higher-yielding US Treasuries, it must pay in US dollars. Norinchukin Bank sells yen today and buys dollars to purchase bonds; this is done in the spot market. If Norinchukin Bank only does this step and the yen appreciates before the bond matures, Norinchukin Bank will lose money when selling dollars back for yen. For example, if you buy dollars today at USDJPY 100 and sell dollars tomorrow at USDJPY 99, the dollar depreciates and the yen appreciates. Therefore, Norinchukin Bank typically sells dollars and buys yen in the three-month forward market to hedge this risk. It rolls over every three months until the bond matures.

Usually, three-month forward contracts are the most liquid. This is why banks like Norinchukin use rolling three-month forward contracts to hedge ten-year currency purchases.

As the USD/JPY interest rate differential widens, the forward points become negative because the Fed's policy rate is higher than the Bank of Japan's rate. For example, if the spot USD/JPY is at 100 and the USD has a 1% higher yield than the JPY over the next year, the one-year forward price for USD/JPY should be around 99. This is because if I borrow 10,000 JPY today at a 0% interest rate to buy 100 USD, and then deposit the 100 USD to earn 1% interest, I will have 101 USD after a year. What should the one-year forward price of USD/JPY be to offset this 1 USD interest income? It should be approximately 99 USD/JPY, according to the no-arbitrage principle. Now, imagine I did all this just to buy a US Treasury bond with a yield only 0.5% higher than a similar maturity Japanese Government Bond (JGB). In this case, I am effectively paying a negative yield of 0.5% in this transaction. If this is the case, Norinchukin Bank or any other bank would not engage in this trade.

Returning to the chart, as the differential widens, the three-month forward points become so negative that the yield on US Treasuries hedged back to JPY is lower than directly purchasing JGBs priced in JPY. From mid-2022, you will see the line representing the USD below the 0% on the X-axis. Remember, Japanese banks holding JGBs priced in JPY have no currency risk, so there is no reason to pay for hedging costs. The only reason to engage in this trade is when the hedged yield > 0%.

Norinchukin Bank's situation is worse than that of the long participants in FTX/Alameda from a market value perspective. The US Treasuries purchased in 2020-2021 may have dropped by 20% to 30%. Additionally, the forex hedging costs have increased from negligible to over 5%. Even if Norinchukin Bank believes the Fed will cut rates, a 0.25% rate cut is not enough to lower the hedging costs or boost bond prices to stop the bleeding. Therefore, they have to sell US Treasuries.

Any plan that allows Norinchukin Bank to exchange US Treasuries for newly printed USD cannot solve the cash flow problem. From a cash flow perspective, the only way for Norinchukin Bank to return to profitability is for the policy rate differential between the Fed and the Bank of Japan to significantly narrow. Therefore, any plan using the Fed, such as the standing repurchase mechanism, allowing the US branches of foreign banks to exchange US Treasuries and mortgage-backed securities for newly printed USD, is ineffective in this case.

As I wrote this article, I racked my brain trying to think of any other financial means to help Norinchukin Bank avoid selling bonds. But as mentioned above, existing plans are some form of loans and swaps. As long as Norinchukin Bank holds bonds in any form, currency risk still exists and must be hedged. Only after selling the bonds can Norinchukin Bank unwind the forex hedge, which is a huge cost for them. This is why I believe the management of Norinchukin Bank has explored all other options, and selling bonds is the last resort.

I will explain why Yellen is unhappy with this situation, but for now, let's turn off Chat GPT and use our imagination. Is there a public institution in Japan that can purchase bonds from these banks and bear the USD interest rate risk without fear of bankruptcy?

Ding dong.

Who's there?

It's the Bank of Japan.

Rescue Mechanism

The Bank of Japan (BOJ) is one of the few central banks that can use the FIMA repurchase mechanism. It can hide the price discovery of US Treasuries in the following way:

The Bank of Japan "gently suggests" any Japanese commercial bank that needs to sell US Treasuries to directly sell these bonds to the Bank of Japan's balance sheet instead of selling them on the open market, settling at the current last traded price, without impacting the market. Imagine being able to sell all your FTT tokens at market price because Caroline Allison is there to support the market and can provide support at any necessary scale. Obviously, this is not effective for FTX, but she is not a central bank with a printing press. Her printing press can only handle $10 billion of client funds, while the Bank of Japan deals with an unlimited amount.

Then, the Bank of Japan uses the FIMA repurchase mechanism to exchange US Treasuries for newly printed USD.

One, two, tie your shoelaces. It's that simple to bypass the free market. Boy, this is worth fighting for freedom!

Let's ask a few questions to understand the impact of this policy.

Someone has to lose money here; the bond losses due to rising rates still exist. Who is the scapegoat?

Japanese banks will still confirm losses by selling these bonds to the Bank of Japan at the current market price. The Bank of Japan now bears the future USD Treasury term risk. If the prices of these bonds fall, the Bank of Japan will have unrealized losses. However, this is the same risk the Bank of Japan currently faces on its portfolio of JGBs worth trillions of JPY. The Bank of Japan is a quasi-government entity, it will not go bankrupt, and it does not need to comply with capital adequacy requirements. It also does not have a risk management department to force a reduction in positions when the risk value (Value-at-Risk) rises due to a huge DV01 risk.

As long as the FIMA repurchase mechanism exists, the Bank of Japan can roll over the repurchase every day and hold US Treasuries until maturity.

How is the USD supply increasing?

The repurchase agreement requires the Fed to provide USD to the Bank of Japan in exchange for US Treasuries. This loan rolls over every day. The Fed obtains these USD through its printing press.

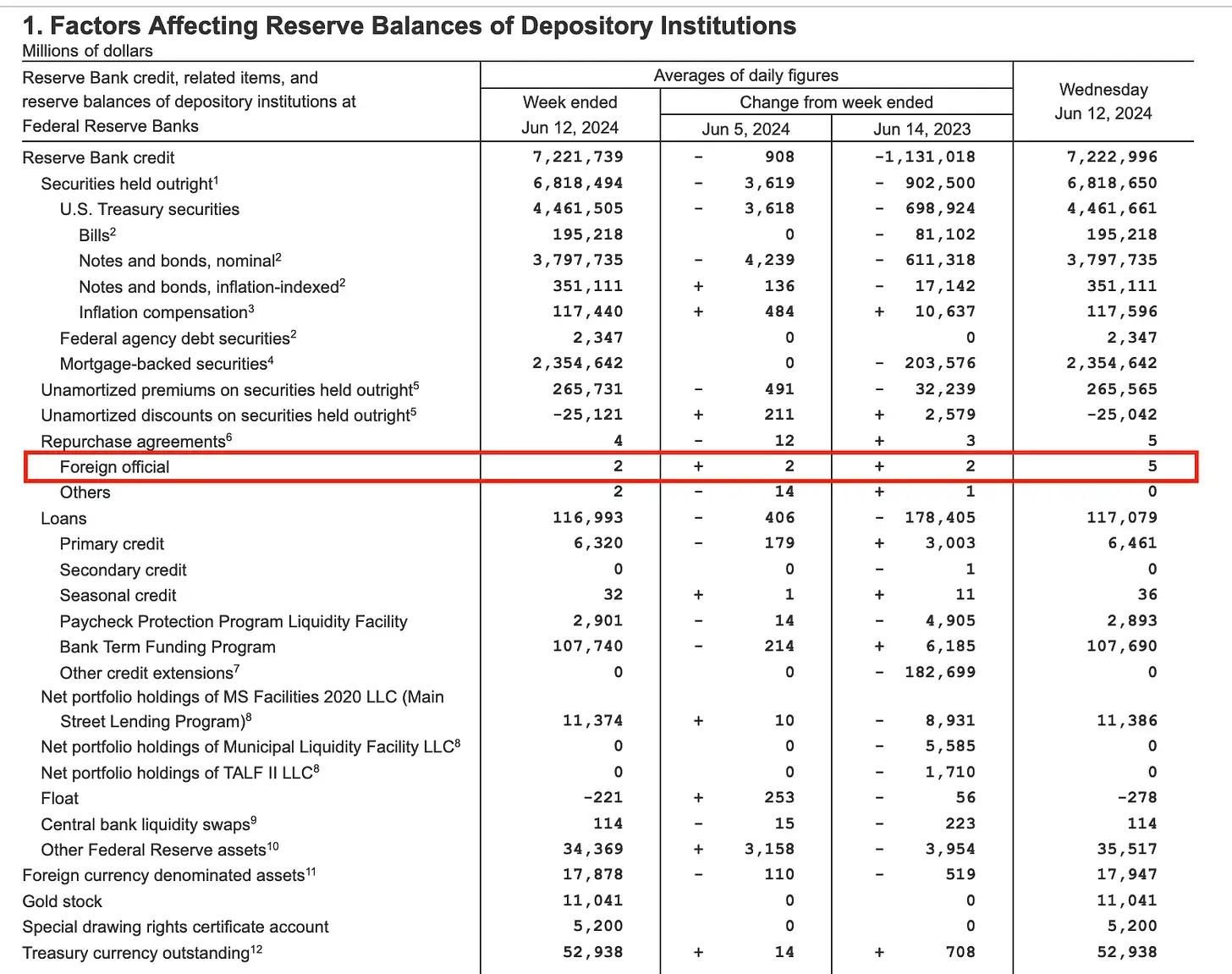

We can monitor the USD injected into the system weekly. The project is called "Repurchase Agreements - Foreign Official."

As you can see, the FIMA repurchase is currently very small. But the selling has not started yet, and I think there will be some interesting phone calls between Yellen and Bank of Japan Governor Ueda. If I'm not mistaken, this number will increase.

Why Help Others

Americans are not known for their sympathy towards foreigners, especially those who don't speak English and look strange. The appearance issue is relative, but to the rednecks living in Flyover State, the Japanese look off. And you know what? These uncouth people will decide who the next emperor is in November this year. It's really speechless.

Despite potential xenophobia, Yellen will extend a helping hand because if there are no new USD to absorb these junk bonds, all the major Japanese banks will follow in the footsteps of Norinchukin Bank and sell their US Treasury investment portfolios to alleviate the pain. This means that US Treasuries worth $450 billion will quickly enter the market. This cannot be allowed because it will cause yields to soar, making financing for the federal government very expensive.

As the Fed itself says, this is why the FIMA repurchase mechanism was created:

"During the 'cash grab' period in March 2020, central banks simultaneously sold US Treasuries and deposited the proceeds in overnight repurchase agreements at the New York Fed. In response, the Fed in late March agreed to provide central banks with overnight loans using US Treasuries held in custody at the New York Fed as collateral, at a rate higher than private repurchase rates. This loan will allow central banks to raise cash without being forced to sell in an already tight Treasury market."

Do you remember September to October 2023? In those two months, the US Treasury yield curve steepened, causing the S&P 500 index to drop by 20%, and the yields on 10-year and 30-year US Treasuries exceeded 5%. In response, Yellen shifted most debt issuance to short-term government bonds to drain cash from the Fed's reverse repurchase program. This boosted the market, and from November 1, all risk assets, including cryptocurrencies, began to rise.

I am very confident that in an election year, when her boss faces the threat of being defeated by the hands of the Orange Man (referring to Trump), Yellen will fulfill her duty to "democracy" and ensure that yields remain low to avoid a financial market disaster. In this case, all Yellen needs to do is call Ueda and instruct him not to allow Japanese banks to sell US Treasuries on the open market, but to use the FIMA repurchase mechanism to absorb the supply.

Trading Strategy

Everyone is closely watching when the Fed will finally start cutting interest rates. However, the USD/JPY interest rate differential is +5.5% or 550 basis points, equivalent to 22 rate cuts (assuming the Fed cuts rates by 0.25% at each meeting). In the next twelve months, one, two, three, or four rate cuts will not significantly reduce this difference. Furthermore, the Bank of Japan has not shown any willingness to raise its policy rate. At most, the Bank of Japan may reduce the speed of open market bond purchases. The reasons for Japanese commercial banks to sell their forex-hedged US Treasury bond portfolios have not been resolved.

This is why I am confident in accelerating the pace of transferring USD (sUSD e) staked on Ethena, currently earning 20-30% returns, to crypto risk assets. Given this news, the pain has reached a point where Japanese banks have no choice but to exit the US Treasury market. As I mentioned, in an election year, the ruling Democratic Party least needs a significant rise in US Treasury yields, as it would affect the major financial issues that the median voter cares about, such as mortgage rates, credit card rates, and car loan rates. If Treasury yields rise, all these rates will increase.

This is exactly why the FIMA repurchase mechanism was established. Now all that is needed is for Yellen to firmly demand that the Bank of Japan use it.

Just as many people began to wonder where the next USD liquidity shock would come from, the Japanese banking system sent a brand new USD made up of origami cranes to crypto investors. This is just another pillar of the crypto bull market. To maintain the current USD-based dirty financial system of the United States of America, USD supply must increase.

Say with me, "Shikata ga nai," and then buy the dip!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。