In the field of blockchain social, projects are rapidly emerging like mushrooms after the rain, and every emerging platform is trying to leave its mark in the Web3 world. Recently, TrueFi, as a new type of credit protocol, has attracted widespread attention. According to Lookonchain monitoring, an important news has recently emerged: a large holder withdrew 14.43 million TRU worth $2.45 million from Binance and pledged it on the TrueFi platform. This move not only highlights TrueFi's influence in the digital asset field, but also reflects the market's recognition of its potential.

TrueFi is not just a credit protocol, it has recently launched the TRI token based on the US dollar, aiming to drive the real-world asset trading market. This innovation has injected new vitality into TrueFi, making it a highly anticipated player in the digital asset field. With the growing market demand, TrueFi is redefining the rules of the credit market through its unique protocol and innovative products.

However, with TrueFi's rapid development, it also faces many challenges. In this competitive field, how to maintain continuous innovation and user trust, as well as how to respond to market fluctuations and changes in the regulatory environment, will be key issues that TrueFi needs to overcome in its future development.

Next, this article will analyze in depth TrueFi's current market strategy and the challenges it faces, and explore its potential and prospects in the Web3 social field.

Background Information on the RWA Track:

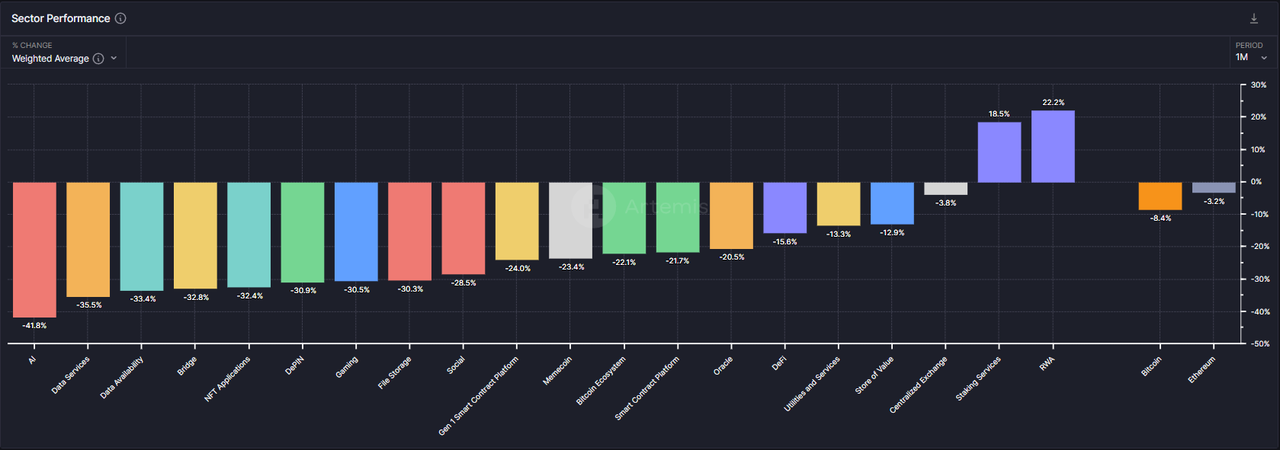

In the DeFi field, the RWA (Real World Assets) track, as the forefront of digitizing traditional financial assets, is rapidly attracting the combination of capital and technology. Currently, the global RWA market size has exceeded billions of dollars, and is expected to further grow in the coming years. According to the latest data and industry analysis:

Market Size Growth: The market size of the RWA track has grown from approximately $1 billion at the end of 2021 to over $3 billion in early 2023. This growth is mainly due to the continuous advancement of blockchain technology and the increasing demand for digital asset management and transparent lending on a global scale.

Lending Market Potential: The lending market in the RWA track is rapidly developing. According to analysis, by 2023, the annual growth rate of the RWA track lending market has exceeded 50%. This reflects the increasing desire of asset owners and capital providers for more efficient and transparent lending opportunities.

Industry Trends and Challenges: Although the RWA track shows tremendous growth potential, its development still faces challenges in terms of regulatory uncertainty, asset auditing complexity, and security. With the continuous improvement of technology and legal frameworks, these challenges are gradually being alleviated, promoting wider market adoption and investment.

Overall, the flourishing development of the RWA track in the DeFi field reflects the profound impact of blockchain technology on the traditional financial sector. As a representative of the RWA track, TrueFi's lending protocol has successfully handled millions of lending transactions. By 2023, the TrueFi platform has attracted capital from different regions around the world and provided efficient and secure lending solutions for borrowers and lenders.

With the promotion and innovation of platforms like TrueFi, the RWA track will continue to be an important channel for attracting global capital into blockchain, injecting new impetus into the progress and innovation of the future financial market.

Understanding the TrueFi Project from Various Dimensions:

1. Introduction and Unique Advantages of TrueFi:

TrueFi is a modular on-chain credit infrastructure that connects lenders, borrowers, and portfolio managers through smart contracts, governed by $TRU. It is a DeFi uncollateralized lending protocol developed by the TrustToken team (now renamed Archblock), aimed at providing infrastructure for the digital asset credit market.

TrueFi seamlessly connects lenders, borrowers, and portfolio managers using smart contracts managed by the TRU token. Lenders can borrow cryptocurrencies at predictable loan rates without the need for collateral, unlike platforms such as Aave, Compound, and Venus.

2. Advantages of the Unsecured Lending Model:

Compared to the traditional over-collateralized lending model, TrueFi provides a more flexible and widely applicable solution. Traditional DeFi lending platforms typically operate with over-collateralization, meaning borrowers need to provide collateral far exceeding the loan amount, leading to low asset utilization and increased liquidation risks. In addition, over-collateralization requires borrowers to hold a large amount of crypto assets, which is not friendly to off-chain users.

TrueFi's unsecured lending implements credit assessment through a decentralized autonomous organization (DAO) model. Borrowers submit loan applications, undergo whitelisting after review by the TrustToken team, and then TRU token holders vote on whether to approve the loan. This model not only reduces intermediary risks but also utilizes collective wisdom for decision-making, enhancing the platform's transparency and trust.

3. Highly Transparent and Automated Lending Process:

In terms of transparency, TrueFi emphasizes that all lending transaction details are publicly traceable on the blockchain, including interest rates, repayment conditions, and transaction history. This transparency enhances user trust in the platform, improving overall market stability and development. At the same time, TrueFi's automated process makes lending transactions more efficient, reducing uncertainties brought about by human intervention.

4. Integration of the DeFi Ecosystem, Providing Diversified Financial Options:

TrueFi also provides users with more financial choices and investment opportunities by integrating multiple elements of the DeFi ecosystem, such as decentralized exchanges and stablecoins. This integration not only increases the platform's flexibility and market responsiveness but also provides users with more avenues for fund flow and investment strategies. In contrast, traditional centralized lending platforms are often constrained by strict market access restrictions and regulatory requirements, making it difficult to provide the same level of financial innovation and market inclusiveness.

5. Financing Achievements and Future Prospects:

In terms of financing, TrueFi's unique design and strong community support have set it apart in the DeFi field. TrueFi has successfully raised $32.5 million in funding, demonstrating investors' high confidence in its business model and future prospects. TrueFi aims to become a market-driven, automated credit rating, and lending system, which requires surpassing strict, conservative restrictions such as minimum/maximum APY and high TRU participation coefficients, while also requiring users to take on a higher level of responsibility, especially for new borrowers and approved new loan types beyond the pre-approved whitelist.

Overall, TrueFi, with its decentralized, transparent, and integrative characteristics, has not only improved user experience and transaction efficiency but also provided a wider range of financial services and innovative opportunities for global users. As the DeFi ecosystem continues to develop, TrueFi will continue to play an important role in promoting financial inclusiveness and technological innovation.

With the Blessing of the Trinity Protocol and the TRI Token, Can TrueFi Achieve a Qualitative Change?

TrueFi recently launched the Trinity protocol, an innovative initiative aimed at improving the capital efficiency of real-world assets (RWA) on-chain. The protocol uses the USD-based TRI token, supported by collateral assets, to provide users with a simple way to obtain leverage and hedge risks. The interest-bearing tfBILL, a tokenized short-term US Treasury bill product, is one of the first collateral assets supporting TRI. In addition, other assets in the TrueFi pool, RWAs from different protocols, and native crypto assets can also be used as collateral.

The Trinity protocol allows users to mint TRI tokens on the protocol using tfBILL or other assets, and then exchange them for stablecoins through an automated market maker. Users can repeatedly mint TRI and exchange for stablecoins through smart contracts, achieving net returns of up to 15-20%. Another option is to swap stablecoins for TRI and deposit them into the sTRI insurance pool to earn fees close to or higher than the Treasury bill rate. The TRI token can also be traded on the secondary market, increasing user flexibility and profit potential.

The Trinity protocol has been launched on the Optimism Sepolia testnet, and initial users will be selected after verification. TrueFi plans to launch Trinity on Coinbase's Layer 2 Base network, although initially, US users will not be able to use it. The company notes that Base includes approximately 150,000 verified addresses to confirm that users are not in the US, and institutions have been whitelisted.

Since the launch of the first protocol in 2020, TrueFi has been continuously innovating and expanding, having issued $1 billion in loans to date. The launch of the Trinity protocol demonstrates TrueFi's ambition in the on-chain asset trading field and provides users with more financial tools and opportunities. TrueFi's unsecured lending model implements credit assessment through a decentralized autonomous organization (DAO) model. After borrowers submit loan applications, TRU token holders vote on whether to approve the loan. This model not only reduces intermediary risks but also utilizes collective wisdom for decision-making, enhancing the platform's transparency and trust.

However, despite TrueFi's strong growth and innovation potential, the future of the on-chain RWA market remains uncertain. The market size has dropped to one-third of its peak in April 2022, reflecting market fluctuations and challenges. Whether TrueFi can lead the capital efficiency improvement of RWA assets through the Trinity protocol will depend on market development and TrueFi's performance in addressing these uncertainties. Can TrueFi's innovation ultimately change the landscape of the DeFi market and usher in a more open, secure, and promising future? Time will tell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。