Dusk's advantage lies in its privacy-supporting blockchain, confidential smart contracts, and regulatory compliance.

Author: 0xGreythorn

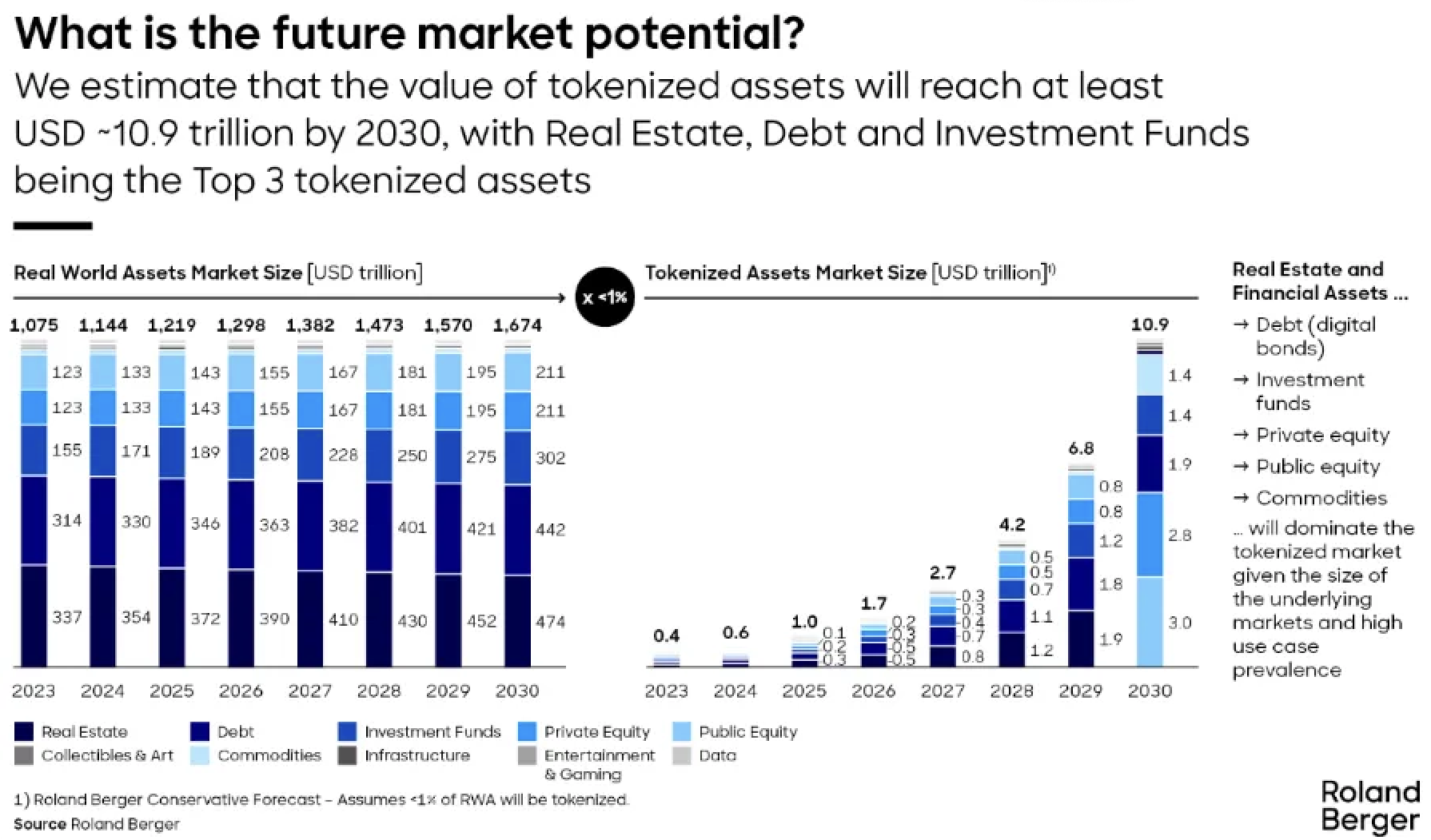

Market Opportunity

Real World Assets (RWA) as an important emerging asset class in the cryptocurrency industry are gradually gaining prominence. As of May 2024, the RWA market has exceeded $6.6 billion, demonstrating investors' strong interest and growing demand for this innovative financial product. The rise of RWA is closely related to the widespread application of blockchain technology. Through tokenization, real-world assets such as real estate, commodities, and intellectual property can be represented in digital token form on the blockchain. This process brings several key advantages:

Fractional Ownership: Previously indivisible assets can now be divided into smaller tokens, allowing a wider range of investors to participate.

Increased Liquidity: Tokenization simplifies asset trading and may increase the liquidity of traditionally illiquid markets.

Transparency and Security: Blockchain technology ensures the security and transparency of transactions, reducing counterparty risk.

By tokenizing and putting RWA on the chain, it can serve as a source of income in decentralized finance (DeFi). It is expected that by 2030, the asset tokenization market will surge to $10 trillion.

Source: Roland Berger

Ondo Finance is poised to take advantage of this growth with its treasury tokenization product, as investor interest continues to rise. RWA is gradually becoming the core of the DeFi market based on equity, real assets, and fixed income, with more and more projects emerging.

In today's article, we will delve into Dusk Network, a "infrastructure" project within the Web3 RWA field that emphasizes compliance. After extensive development, Dusk's mainnet is set to launch in the second quarter of 2024, marking a significant milestone for the project.

Network

Dusk Network is a blockchain platform designed for regulation and decentralized finance. It focuses on issuing digital securities, aiming to automate compliance while keeping user data private and auditable. By integrating privacy and compliance, Dusk Network facilitates secure on-chain transactions for RWA.

Source: Dusk Network

Using a unique consensus mechanism that combines PoS and elements of zero-knowledge encryption, Dusk Network ensures confidentiality and compliance. The platform aims to simplify regulated markets by eliminating high-cost intermediaries while still complying with regulatory standards.

Features

Regulatory-Compliant Blockchain Solution: Dusk Network aims to meet institutional regulatory requirements. It is an open-source, public, permissionless blockchain, enabling companies of all sizes to access it.

Integrated Privacy on Dusk Network: Dusk provides a privacy-focused system for tokenization, clearing, and settling financial instruments. They have developed the Citadel protocol, integrating a self-sovereign identity system into the Dusk blockchain, and have also developed an off-chain version called Shelter for institutional private KYC. Users can selectively disclose their information and protect data.

Confidential Smart Contracts: Dusk is one of the first blockchains with native confidential smart contracts, enabling the creation and issuance of privacy-enabled tokenized securities. This simplifies business operations, automates audit trails, reduces administrative and legal costs, and improves overall efficiency. Institutions can also leverage these contracts to utilize the advantages of public networks while complying with regulations.

Source: Dusk Network

Zero-Knowledge Practical Tokens

Dusk uses Zero-Knowledge Proof (ZKP) technology, which allows verification without revealing underlying data. By integrating PLONK – an advanced zero-knowledge encryption technology, Dusk ensures strong privacy protection.

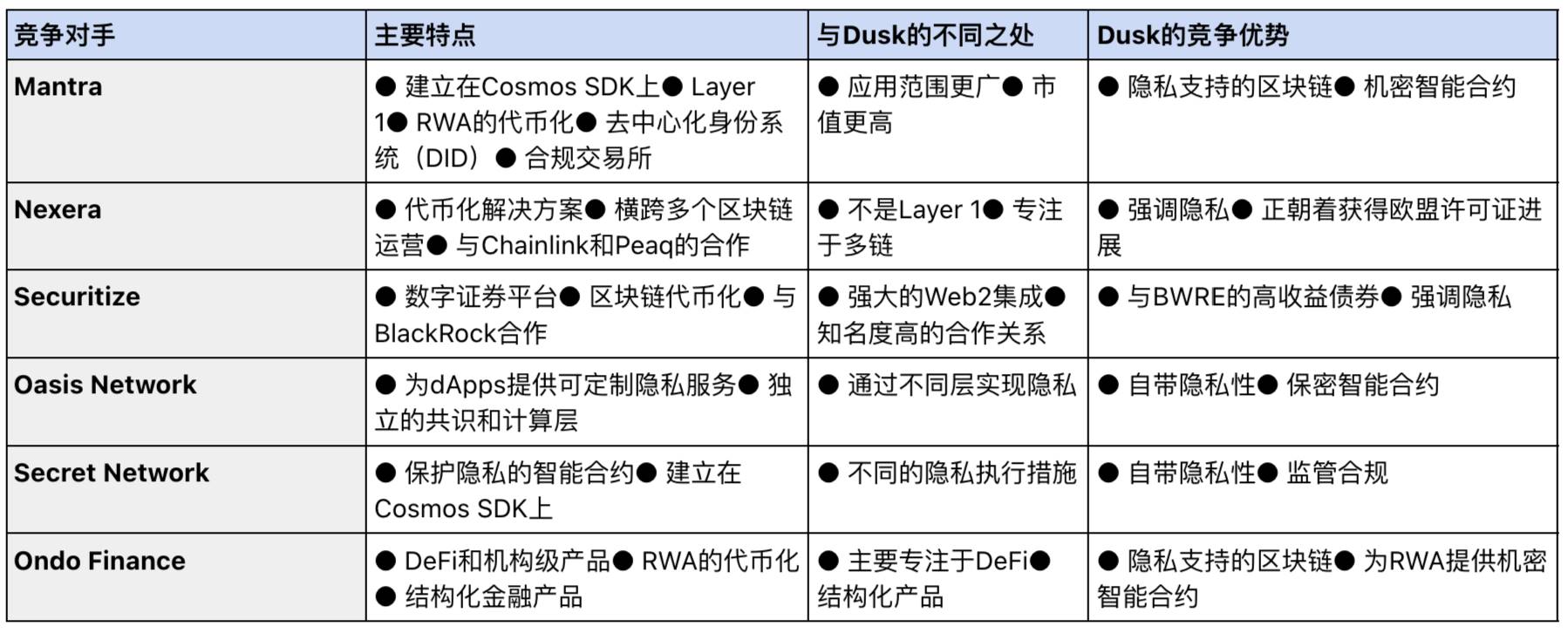

Competitors

Dusk Network is a unique participant in the Real World Assets (RWA) field, focusing on regulatory compliance and emphasizing privacy protection. Here is a comparative overview of its main competitors:

Dusk's advantage lies in its privacy-supporting blockchain, confidential smart contracts, and regulatory compliance, making it an ideal choice for financial dApps and institutions that require privacy and compliance. However, Dusk also faces several disadvantages: it has lower visibility, a smaller market value, and is still in the early stages. Additionally, its focus on privacy and regulatory compliance may limit its attractiveness to a broader range of blockchain and DeFi projects.

Token Economics

The DUSK token is at the core of Dusk Network, with the following details:

Market Metrics

● Market Cap: $220.72 million (based on circulating supply and price).

● Rank: #271

● Fully Diluted Valuation (FDV): $237.65 million (based on total supply and price)

● Rank: #350

● Circulating Supply: 469.62 million DUSK (46.96% of the maximum supply). Tokens held by the team or controlled by Dusk deployers are not considered part of the circulating supply.

● Total Supply: 500 million DUSK

● Maximum Supply: 1 billion DUSK, with 500 million issued before the mainnet and 500 million distributed to holders over 18 to 36 months during the mainnet.

● Next Unlock: Fully unlocked as of April 11, 2022

Token Utility

● Staking and Rewards: Lock DUSK tokens to earn rewards and enhance network security.

● Trading and Gas Fees: Pay transaction fees and gas costs for network interactions.

● Payments and Collateral: Use DUSK for payments within the network and as collateral for issuing digital assets.

Token Distribution

The ownership period is from May 2019 to April 2022.

Source: Dusk Network

Team, Fundraising, and Ecosystem

Dusk Network's team combines technical and business expertise, led by founders Emanuele Francioni, Fulvio Venturelli, and Jelle Pol. They bring experience from top institutions and companies. Their innovative work is supported by 17 technical team members and 9 advisory board members.

Source: Duck Network

Dusk Network has raised significant funds: the 2020 ICO raised $1 million, a private sale supported by Binance Labs in 2018 raised $8.08 million, and a seed fund from BlockVenture raised $1 million.

Through a partnership with NPEX, Dusk Network is pioneering the first blockchain-driven securities exchange in Europe. This positions Dusk for growth as digital tokenization becomes more prevalent in Europe, with an expected reach of $3.7 billion by 2032.

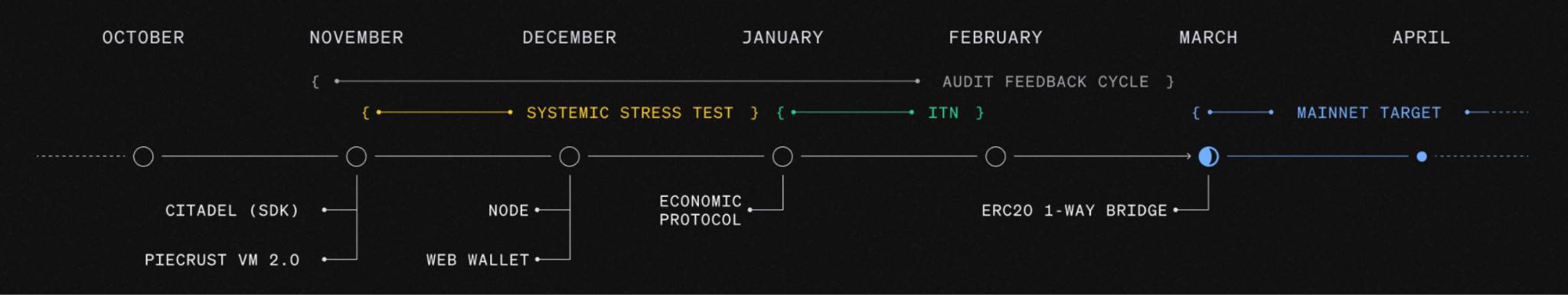

The latest Dusk roadmap announced on September 7, 2023, outlines the path to the mainnet launch in 2024. Key milestones include the incentivized testnet (ITN) and extensive audit processes.

Source: Dusk Network

Bullish Factors

● Strong RWA Narrative: Interest from large companies like BlackRock in physical RWA highlights their potential.

● Opportunities in Private Markets: Digital assets in private markets offer significant opportunities, and Dusk securely conducts on-chain RWA transactions by combining privacy and compliance.

● Europe's First Blockchain Stock Exchange: Dusk holds the title of Europe's first blockchain-based stock exchange.

● Diverse Programming Support: Dusk blockchain supports multiple programming languages, including Rust, C, C++, and Go, running on Piecrust, Dusk's ZK-friendly virtual machine, optimizing privacy and efficiency.

● Dusk Grants Program: The program named Thesan commits to providing 15 million DUSK to support developers building on the Dusk network, fostering innovation and growth.

● Mainnet Launch: Dusk Network's roadmap is progressing towards the mainnet launch in the second quarter of 2024.

Bearish Factors

● Competitive Pressure: ONDO is leading in the RWA narrative and may continue to attract most attention and market share, especially with close ties to BlackRock link.

● Lack of Smart Money Interest: Our internal team has not found significant interest from smart money in purchasing and accumulating DUSK tokens, although any changes will continue to be monitored.

● Strategic Risks: Dusk's focus on infrastructure for tokenizing physical assets may bring strategic risks due to its narrow focus.

● Regulatory Challenges: Navigating complex legal frameworks for tokenization in different jurisdictions is challenging. Dusk's use of confidential smart contracts exposes it to regulatory barriers related to smart contract executability and asset classification.

Disclaimer

This document is prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (hereinafter referred to as "Greythorn"). The information contained in this document is for general reference only and is not intended to provide investment or financial advice. This document is not an advertisement, marketing, offer, or invitation, nor is it intended to buy or sell any financial instruments or engage in any specific trading strategy. When preparing this document, Greythorn did not consider the investment objectives, financial situation, or specific needs of any recipient. Therefore, individuals or institutions receiving this document should assess their personal circumstances and consult their accounting, legal, or other professional advisors for professional advice before making any investment decisions.

This document contains statements, opinions, forecasts, and forward-looking statements based on several assumptions. Greythorn does not assume any obligation to update such information. These assumptions may be correct or incorrect. Greythorn and its directors, employees, agents, and advisors make no warranties or representations regarding the accuracy or likelihood of any forward-looking statements or their underlying assumptions. Greythorn and its directors, employees, agents, and advisors make no warranties or commitments regarding the accuracy, completeness, or reliability of the information contained in this document. To the fullest extent permitted by law, Greythorn and its directors, employees, agents, and advisors are not liable for any losses, claims, damages, costs, or expenses arising from the information contained in this document.

This document is the property of Greythorn. Individuals or entities receiving this document agree to keep its contents confidential and agree not to copy, provide, distribute, or disclose any information contained in this document in any form without the written consent of Greythorn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。