Author: Marshal Orange

Reviewed by: Kyle

Arweave officially released the AO token economics at 23:00 on June 13th, Beijing time. This article analyzes how to maximize the efficiency of obtaining AO tokens based on the existing information. This article is for cryptocurrency economic analysis only and does not provide any investment advice!

Interpreting the AO Token Economics Model

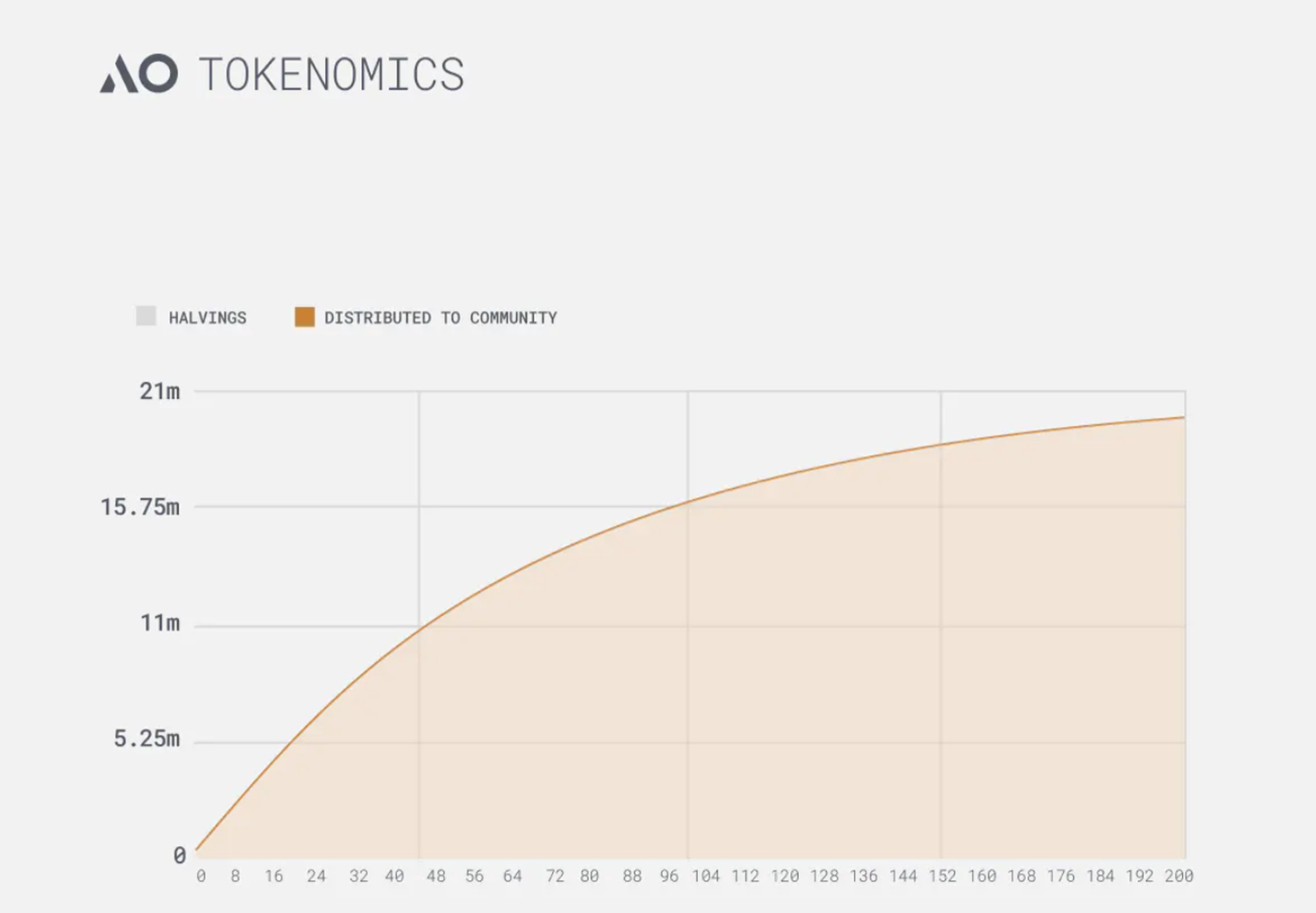

According to the AO token economics, AO is a token that follows the 100% fair launch model of Bitcoin. Similar to Bitcoin, the total supply of AO is 21 million tokens, with a halving cycle of 4 years. AO is distributed every 5 minutes, with a monthly allocation of 1.425% of the remaining supply. Unlike Bitcoin, AO's halving is a relatively stable process that reduces the token supply on a monthly basis, rather than having a sudden "halving event" every 210,000 blocks (approximately every 4 years) as in the case of Bitcoin. Although this does not have a significant impact on the efficiency of obtaining AO, the early acquisition of AO should not be overlooked, as the earlier the acquisition, the greater the returns.

The official statement emphasizes that AO tokens are launched 100% fairly. Currently, the official understanding of "100% fair launch" is that AO tokens can only be obtained by holding specific assets (currently $AR, $AOCRED, $stETH). This highlights the project's broad vision compared to many other cryptocurrency projects in the market, as the official team, investment institutions, and ecosystem projects have not reserved any shares for themselves. It also indicates that obtaining AO depends entirely on the size of the funds and the type of token assets held. Our goal is to seek the most efficient way to obtain AO tokens with limited funds.

The acquisition of AO tokens is currently divided into two stages. The first stage ended on June 18, and the second stage has begun. The first stage of acquisition was known to everyone from the moment the token economics was announced on June 13. From the day the AO public test network went live on February 27, 2024, until June 18, AO tokens were 100% distributed to $AR token holders based on their respective balances held every 5 minutes. As of June 13, 2024, each $AR could obtain approximately 0.016 AO tokens, with a total distribution of over 1 million tokens in the first stage.

Strategies to Maximize Obtaining AO Tokens

The first stage's circulation accounts for only about 5%, and the second stage is the main event. Our main focus is on how to maximize obtaining AO tokens in the second stage. 33.3% of AO tokens will be distributed to AR token holders, and 66.6% of AO will be used for assets staked in AO (currently only stETH). Additionally, AOCRED will be exchanged for AO at a ratio of 1000:1 (this portion of AO will be provided from the AO tokens generated from AR held by Forward Research).

After the second stage starts, each AR can receive 0.016 AO in the first year, while the quantity of AO tokens obtained by staking other eligible cross-chain assets (non-AR assets) in the AO network is determined by the ratio of the cross-chain asset's trading volume multiplied by its annual staking yield to the total cross-chain asset amount. Currently, stETH is the only eligible cross-chain asset, so 66.6% of the AO allocated to assets staked in AO will be given to the stETH pool. Therefore, the exact quantity of AO tokens received for staking stETH depends on the value of the stETH staked relative to the total asset value of the pool.

If staking your assets accounts for 0.01% of the total pool assets, staking for one year can yield 210 AO. Currently, the pool is worth over 20 million USD (can be viewed here). If, after the second stage opens, the TVL of the pool reaches 1 billion USD and remains constant for a year, staking 1000 USD worth of stETH would yield 2.1 AO after one year. If the market value of AR is 2 billion USD and remains constant for a year, holding 1000 USD worth of AR in your wallet would yield 0.485 AO after one year. It seems that staking stETH is more cost-effective at the moment, but the stETH pool and the market value of AR are unlikely to remain constant for a year. Therefore, it is important to constantly calculate based on the ratio of the TVL of other asset pools to the market value of AR (calculated in USD):

- When TVL / AR market value ≈ 2, staking other assets of the same value as holding AR yields a similar amount of AO.

- When TVL / AR market value > 2, holding AR of the same value yields more AO than staking other assets of the same value.

- When TVL / AR market value < 2, staking other assets of the same value yields more AO than holding AR of the same value.

Note that the AO tokens minted after the second stage starts will not be unlocked until February 8, 2025, with a circulation rate of 15%, totaling approximately 3 million tokens.

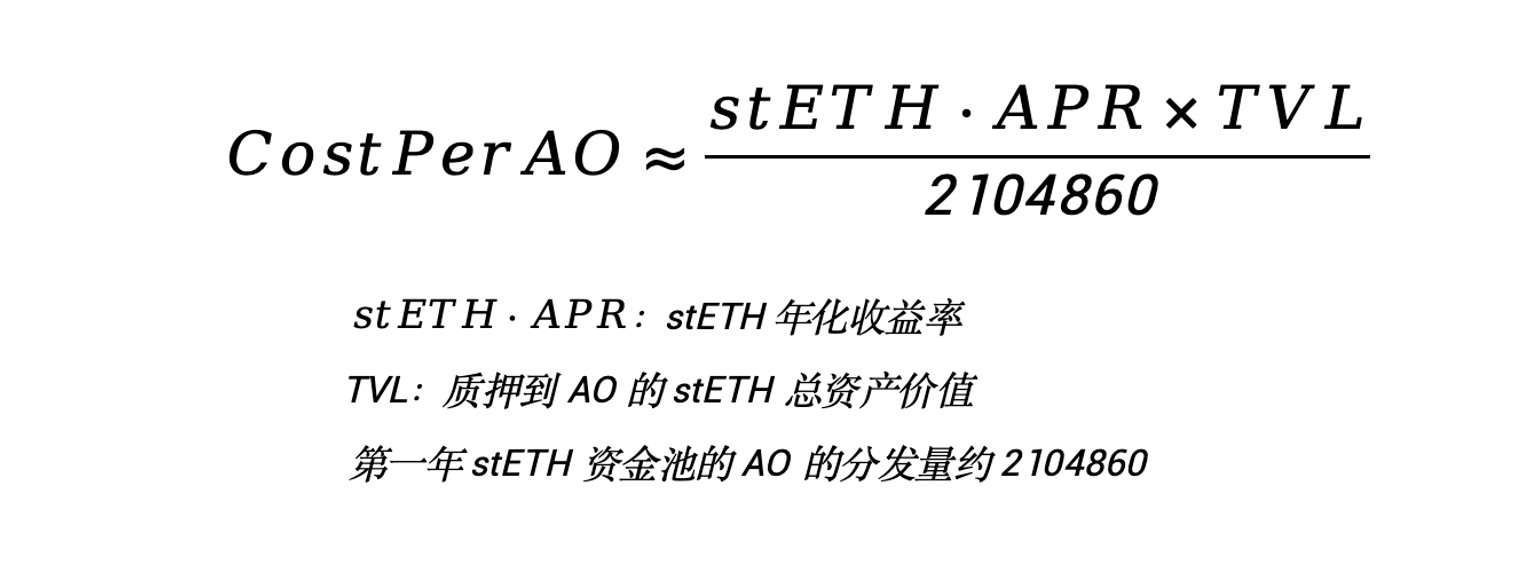

In addition, we can also calculate the risk and cost of obtaining AO, which greatly affects the future price of AO. AR holders only need to hold, while stETH is obtained by staking ETH in Lido. Currently, the APR (annual percentage rate) of stETH is 3.3%. Since staking stETH in AO requires giving this portion of the annual interest income to the AO project team, which was originally the vested interest of stETH holders, the APR of stETH can be considered as the cost for stETH stakers. If the TVL of the pool reaches 1 billion, the cost for stETH stakers to obtain AO is 15.7 USD. However, this is the result of a controlled variable calculation, and the specific calculation formula is (considering that stETH is currently the only eligible cross-chain asset):

For short-term investors, both staking stETH and holding AR carry the risk of price decline. Many centralized exchanges (CEX) offer 0 leverage borrowing services, with borrowing rates typically not exceeding 1%. However, considering the longer reward period for obtaining AO incentives, please make your decision after weighing the options. Additionally, the current cost of exchanging AOCRED for AO is approximately $50 - $60 per AO (please ensure to exchange AOCRED for AO before June 27, 2024, as it will be invalidated after the deadline). Similarly, the unlocked date is February 8, 2025, so the price of 1000*AOCRED can be considered as the futures price of AO. However, after the release of the AO test network, it is expected to bring significant growth to the market value of AR, far exceeding a market value of 1 billion, and at that time, the total circulation will be only slightly over 3 million. This leaves a lot of room for imagination regarding the price of AO.

For long-term investors, time eliminates the risk of market fluctuations. Not only can they benefit from the increase in principal, but they can also continue to earn AO interest (including AO growth dividends).

Conclusion

The above is the analysis of the AO token. In summary, it is important to monitor the changes in the TVL of the asset pool and the market value of AR, and adjust strategies based on the cost of obtaining tokens to maximize capital efficiency. In addition to considering costs, the potential risk of price fluctuations should not be overlooked. Strategies such as 0 leverage borrowing can help mitigate some risks, and the cost of exchanging AOCRED for AO and the unlocking time are also important factors to consider when making decisions. Of course, long-term coin holders just need to wait patiently for the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。