Author: Luccy, BlockBeats

Last week, DeFi saw the biggest turning point of this cycle. CRV continued to fall to a low of $0.219, and founder Michael Egorov's lending position was gradually liquidated. According to Arkham statistics, in less than half a day, all of Michael's loan positions in 5 protocols were liquidated, totaling $140 million.

Although the price of CRV has since rebounded, the most noteworthy is CVX. On June 17th, according to Binance market data, CVX briefly surged to $4.66 before falling back, with a 24-hour increase of over 90%.

Is CVX the preferred target for giant whales to bottom fish?

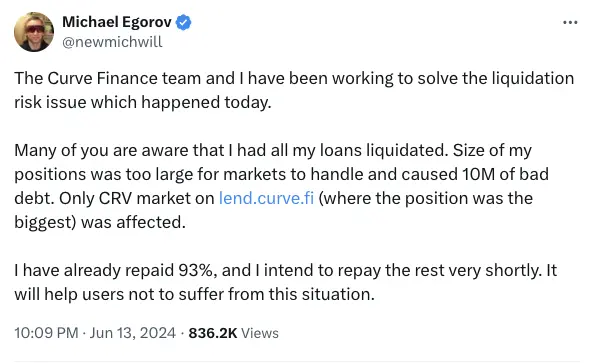

In an interview with CoinDesk, Michael Egorov stated that this liquidation was triggered by a vulnerability in UwU Lend. However, unlike in the past, when CRV fell, Michael did not replenish in time, allowing a chain of liquidations to occur. Due to the large scale of Michael's position, the market was unable to handle it, resulting in a $10 million bad debt.

In order to quickly eliminate the adverse impact of accumulated bad debts on the market, on the evening of June 13th, Christian, co-founder of the crypto fund NDV and a NFT whale, announced on social media that he had obtained 30 million CRV from Michael.

In addition to helping Michael repay, Christian also stated that the previous pressure on Curve was because Michael obtained liquidity that ordinary project parties could not obtain. Now that the liquidation is complete, it means that Michael has finally exhausted his own liquidity. Christian believes that "there will be no secondary market selling pressure at least until 2028".

This also means that now is a good time to bottom fish CRV, and the market performance indeed reflects this. According to data from the Binance platform, when CRV hit a low of $0.219, the trading volume of the CRV/USDT spot trading pair reached 463 million tokens within just 1 hour (with a trading volume of $1.115 billion), setting a new historical high for this trading pair. At the same time, CRV has also been among the top inflows on the Smart Money 24-hour list for two consecutive days.

As the largest stablecoin exchange protocol on Ethereum, most DeFi projects rely on Curve, and the Curve protocol is still effective and immutable. Therefore, we have reason to speculate that Michael's liquidation may mark the beginning of DeFi's return.

On June 17th, Curve Finance officially announced that the funds flowing into veCRV last week were 6 times the inflation for that week. These inflows include direct lockups, as well as lockups through Convex Finance, Stake DAO, and Yearn. This is the highest weekly inflow of CRV lockups in recent years.

As one of the three protocols that initiated the Curve War, Convex Finance's TVL reached $1.316 billion at the time of writing, accounting for more than half of Curve's TVL ($2.285 billion). This also means that Convex's chips are relatively concentrated, and the whales naturally have their sights set on Convex Finance.

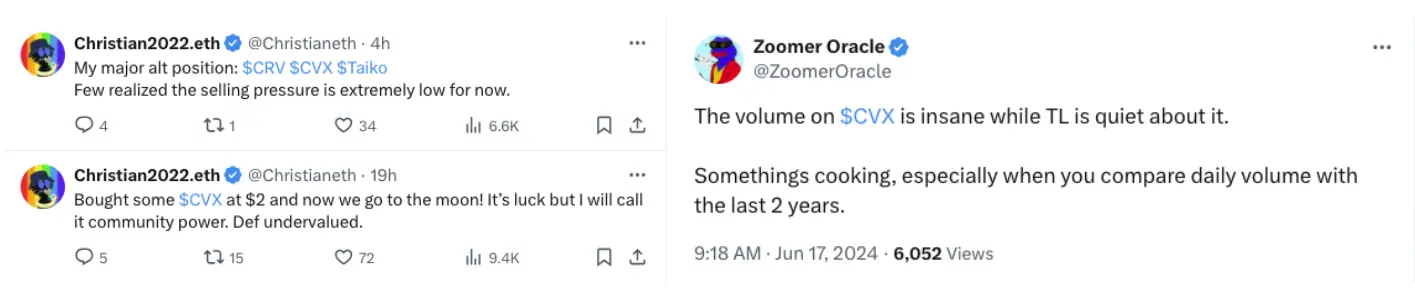

In addition to Christian mentioned earlier, kennel capital member Zoomer Oracle also explicitly stated that he bought CVX at $2.05. Zoomer Oracle believes that CRV/CVX is undervalued, and "Convex is Curve's beta, with a simple 5x potential".

Besides CVX, what other targets are there in the Curve ecosystem?

Michael's loans have disappeared, the market no longer has post-traumatic stress disorder, and bad debts have been cleared, which may be a positive development for DeFi.

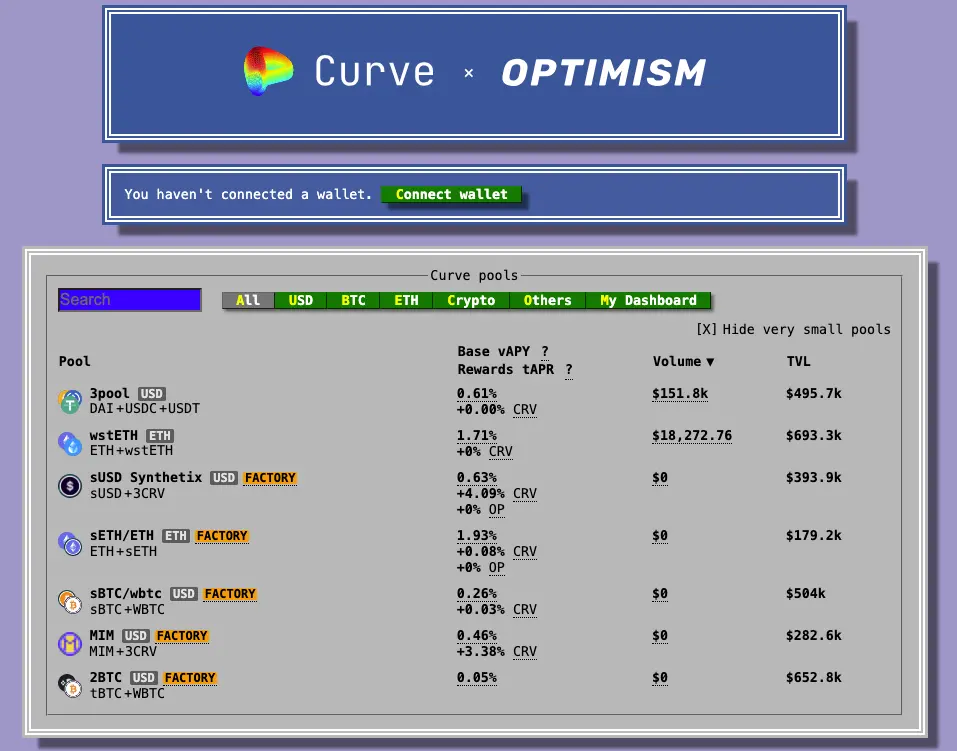

In addition to various DeFi protocols in the Curve War, such as Stake DAO, Yearn Finance, Olympus, and Frax, various stablecoin protocols are also involved, as can be seen in the article "Curve War Upgrades to the Battle of CVX, the Wonderful Power Struggle Continues". Another application of the Curve protocol is to support stablecoin projects through the Curve 3pool (DAI/USDC/USDT liquidity pool).

According to Curve data, the current trading volume and TVL data of the 3pool are less than a million, which means that the likelihood of more mainstream stablecoins using Curve for trading is relatively low. However, the liquidity of the Curve protocol itself can still support small stablecoin projects.

The modular market is gradually rising, and modularization will lead to an increase in chains. In order to continue developing use cases, stablecoins may become a necessity. Therefore, the Curve 3pool can provide liquidity for these stablecoins, especially algorithmic stablecoins. Of course, since the Curve 3pool allocates rewards in CRV, this requires CRV to have sufficient value.

After the liquidation, Michael stated that this event may help strengthen Curve's security measures and lending mechanisms, and may create better services for users in the coming months. Whether this will truly allow the flywheel of Curve to take off again remains to be seen over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。