Author: Asher Zhang

Recently, Curve founder Michael Egorov's leveraged position has been liquidated for about 100 million CRV. So, what has DeFi leader Curve recently experienced? Besides the "old wounds" that have not healed, what is the real dilemma faced by Curve and other DeFi leaders? It seems that Curve founder Michael Egorov has once again turned the crisis into an opportunity, but has the crisis really passed?

CRV triggers a liquidation crisis, Michael Egorov may pass through the danger

On June 8th, with the decline of Bitcoin, CRV began to plummet. After two days of Bitcoin volatility, on June 11th, Bitcoin once again experienced a significant drop, and CRV formed a bearish engulfing pattern on the daily chart, with the bears in a strong position. Influenced by the macro market, on June 12th, Bitcoin and others started to rebound, with most mainstream coins rising, but CRV was unable to rebound and continued to be suppressed by the bears. On June 13th, Bitcoin fell again, mainstream coins plummeted, and CRV experienced a major collapse, leading to the liquidation of a large amount of CRV tokens held by Michael Egorov.

On June 13th, according to data analysis: Curve founder Michael Egorov's leveraged position has been liquidated for about 100 million CRV, worth about 27 million US dollars. The remaining position is 39.35 million CRV on the main address, with a loan of 5.4 million US dollars, and the current health ratio is above 1, so it will not be liquidated temporarily. Subsequently, according to "比推", on June 13th, Christian, a co-founder of NextGen Venture, posted on X platform that he obtained 30 million CRV from the Curve founder.

With the support of Christian from NextGen Venture, Michael Egorov may pass through the danger. On June 13th, Curve founder Michael Egorov posted on X, saying, "The Curve Finance team and I have been working hard to resolve the liquidation risk issue. Many people know that all of my loans have been liquidated. My position size is too large for the market to bear, resulting in a bad debt of 10 million US dollars. Only the CRV pool on the Curve lending platform (lend.curve.fi) was affected. I have already repaid 93% and plan to repay the remaining bad debt soon, which will help users avoid losses in this situation."

Was Michael Egorov damaged in this liquidation? Ethereum core developer eric.eth posted on X platform that the Curve founder did not suffer "losses" due to the liquidation of CRV. He made a profit of 100 million US dollars from a position of 140 million US dollars worth of CRV, and selling it on the market would lead to the same price (drop) and cause dissatisfaction in the community. At first glance, eric.eth's statement seems reasonable, but in fact, it is not the case. Michael Egorov's liquidation is essentially passive, mainly due to the sudden change in the cryptocurrency market. If Michael Egorov wants to sell the tokens, he can completely negotiate with institutions to sell the tokens in a liquidation manner. Even if the profit change is not significant, the huge liquidation has a very large impact on the Curve ecosystem.

Why did CRV keep falling? Reviewing the crisis of Curve

As a DEX platform mainly focused on stablecoins, Curve's unique advantage lies in crvUSD being able to form trading pairs with various collateral, creating a rich scenario for exchanging assets. CRV's large-scale exchange business has always dominated the industry, and the team has been constantly updating the project, introducing new features, and gaining market trust. When Curve was first launched, the CRV token reached a peak of 63 US dollars. During the last bull market, the CRV token remained around 6 US dollars for a long time, and during the bear market, the CRV token value remained around 1 US dollar. However, during this bull market, instead of starting a bull run, CRV has been falling all the way, with the most important turning point being July 2023.

In late July 2023, due to a re-entry vulnerability caused by the Vyper programming language, four Curve Finance pools were attacked by hackers, resulting in a total loss of about 70 million US dollars. This directly led to the founder of Curve facing a huge liquidation risk. However, as this was a malicious attack by hackers, various forces in the cryptocurrency market have expressed their support for Curve. In addition to Egorov selling over 106 million CRV tokens to 19 institutions and investors for fundraising, crypto celebrities such as Justin Sun, Du Jun, and Maji Dage also purchased CRV. Justin Sun bought 5 million CRV tokens, Du Jun purchased 10 million CRV for a total of 4 million US dollars, and Maji Dage bought 3.75 million CRV tokens for 1.5 million US dollars, all of which were fully pledged and locked for 6 months.

On February 1st, Michael Egorov began unlocking the CRV he sold at a price 30% lower than the market price. On February 1, 2024, Huang Licheng transferred the 3.75 million CRV he purchased (about 1.75 million US dollars) to Binance, expecting a return of +16%; on the same day, an address named "erwwer" on OpenSea (starting with 0xb0b) transferred 2.5 million CRV (1.14 million US dollars) bought OTC from Curve founder Michael Egorov to Binance; subsequently, Cream Finance and others also sold. On February 24th, the second largest whale who bought OTC from Curve founder Michael Egorov (700 million U bought 17.5 million CRV) transferred 5 million CRV (about 3 million US dollars) to Binance, becoming the fourth OTC buyer to transfer/sell CRV. In addition to the 5 million CRV purchased OTC, 12.5 million CRV was locked in Curve in two addresses. Subsequently, many institutions and major V's also began to sell their CRV.

DeFi Summer is no more, the economic dilemma of traditional DeFi

The continuous decline of CRV is mainly related to the direct impact of Curve being attacked by hackers. From a broader perspective, this is closely related to the overall downturn of the DeFi track. If it were the DeFi Summer period of 2022, the losses incurred by CRV might not have been irreparable. So, what are the reasons for the current development dilemma of the DeFi track?

The DeFi track has changed from a blue ocean to a red ocean, and the attractiveness of DeFi leaders has begun to decline. Looking at the development of the DeFi track itself, when Uniswap, Curve, and Compound were first launched, there was obvious competition in the market. The biggest feature of the Web is that it is open source and decentralized, which has led to the emergence of various DeFi projects. Although DeFi leaders still occupy a dominant position, they are still facing significant competition, transforming the entire track from a single leader to a fiercely competitive red ocean battlefield.

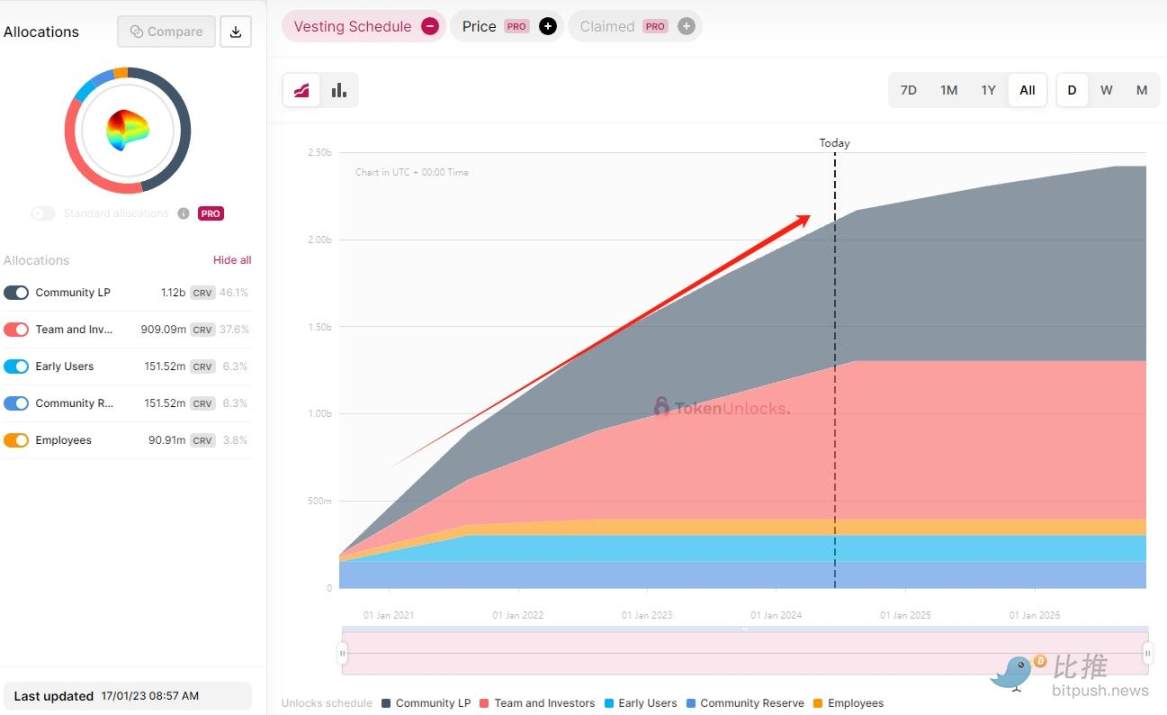

DeFi leader tokens have entered a period of release, and the market selling pressure continues to increase, causing the prices of DeFi leader tokens to be under pressure. The chart below shows the release of CRV tokens. From the chart, it can be seen that during the early stages of the last bull market, CRV unlocked a relatively small number of tokens, but over time, the supply of CRV tokens continued to decrease, which is also one of the main reasons for the pressure on the CRV token price. At the same time, the value capture ability of mainstream DeFi leader tokens is still relatively lacking.

DeFi development has hit a bottleneck, and U.S. law enforcement agencies do not recognize DeFi. Earlier, Gurbir Grewal, head of enforcement at the U.S. Securities and Exchange Commission (SEC), stated, "We don't care about labels. We care about products, and labels are not important to us. Technology is important. DeFi provides services that are neither decentralized nor financial, but purely 'fraudulent.' We will expand our jurisdiction within the limits of the law." This year, the SEC classified UNI as a security, leading to a certain degree of pessimism about its future prospects in the market. Due to the lack of recognition from U.S. regulatory authorities, DeFi is essentially limited in its path to traditional financial market development, which also limits the market size of DeFi.

Market attention has shifted to new tracks such as MEME, and there is a noticeable decrease in funding interest. In this bull market, some new tracks have emerged, such as modular blockchains, Depin, Bitcoin Layer 2, and the most unique of all, the MEME track. From 2023's Inscriptions, Runes, ERC404, to Bonk and BOME on Solana, whenever Bitcoin consolidates, there is no market rotation, but the MEME craze alternates, preventing DeFi leaders from getting a chance to catch up.

Summary

The token decline of CRV is directly related to the hacking attacks faced by Curve. Although Curve founder Michael Egorov temporarily alleviated the liquidation pressure on CRV through institutional assistance last year, this selling pressure did not disappear after the unlocking period, and institutional and major V's selling pressure has been suppressing the rise of CRV.

Fundamentally, the DeFi track has entered a stage of intense competition, making it difficult for DeFi leaders to develop. DeFi leader tokens are facing continuous selling pressure as they enter the unlocking period, making it difficult for them to rise. The lack of recognition from regulatory authorities keeps the DeFi track niche. Additionally, the unusual nature of this bull market has prevented DeFi leaders from attracting funding interest. Overall, the problems faced by DeFi leaders such as CRV may be difficult to resolve in this bull market, so CRV's darkest hour may not have arrived yet. However, in the long run, if Curve can weather the storm, as a DeFi infrastructure leader, there are still opportunities in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。