Author: Frank, PANews

After the failure of UST, algorithmic stablecoins were once abandoned by the market. It wasn't until Ethena adopted a perpetual contract hedging mechanism to design USDe and introduced high-yield rewards that algorithmic stablecoins once again became a hot topic in the market. In the Bitcoin ecosystem, the demand for stablecoins seems to be higher, as the current mainstream Rune valuation methods all use the smallest unit of Bitcoin, "sats," for pricing. Although this pricing method may seem more intuitive, it is still different from the fiat currency units that people are familiar with.

Recently, a new Bitcoin stablecoin protocol called NUSD has attracted attention in the Rune market. The price of the Rune token BAMK has increased by 50 times in 2 months, reaching a market value of 360 million US dollars, entering the top three in the Rune market. On June 13, UTXO, the asset management department of BTC Inc, which owns well-known Bitcoin ecosystem brands such as Bitcoin Magazine and Bitcoin Conference, announced an investment of 1 million US dollars in this protocol.

The ENA of the Bitcoin Ecosystem?

NUSD, short for Nakamoto Dollar, is issued using the BRC20-5byte protocol. Similar to Ethena's issuance mechanism, NUSD also uses a perpetual contract hedging mechanism to achieve price stability.

According to the official introduction from Bamk.fi, this mechanism is a triangular arbitrage hedging mechanism. Specifically, the minting process of NUSD involves users depositing BTC into Bamk.fi, and Bamk.fi opening a 1x perpetual contract short position on a decentralized exchange, commonly referred to as a "hedging position" in contract trading. The characteristic of such an order is that the total position value remains unchanged regardless of price fluctuations. When users redeem BTC, Bamk.fi will close out the corresponding position to return the corresponding BTC.

Compared to other algorithmic stablecoins, NUSD is anchored to the value of BTC assets, avoiding the death spiral phenomenon that occurred with UST due to the collapse of the LUNA coin price. Unlike Ethena, NUSD's perpetual contract orders are executed directly through a DEX. According to Bamk.fi, this is to avoid the security risks associated with centralized exchange custody.

According to the official introduction, the issuance of NUSD is divided into two phases. In the first phase, it is issued in a manner anchored to USDe, similar to UST, with NUSD being pegged to USDe at a 1:1 ratio. In the second phase, it begins to enter the triangular arbitrage hedging phase, using the form of perpetual contract short positions for issuance.

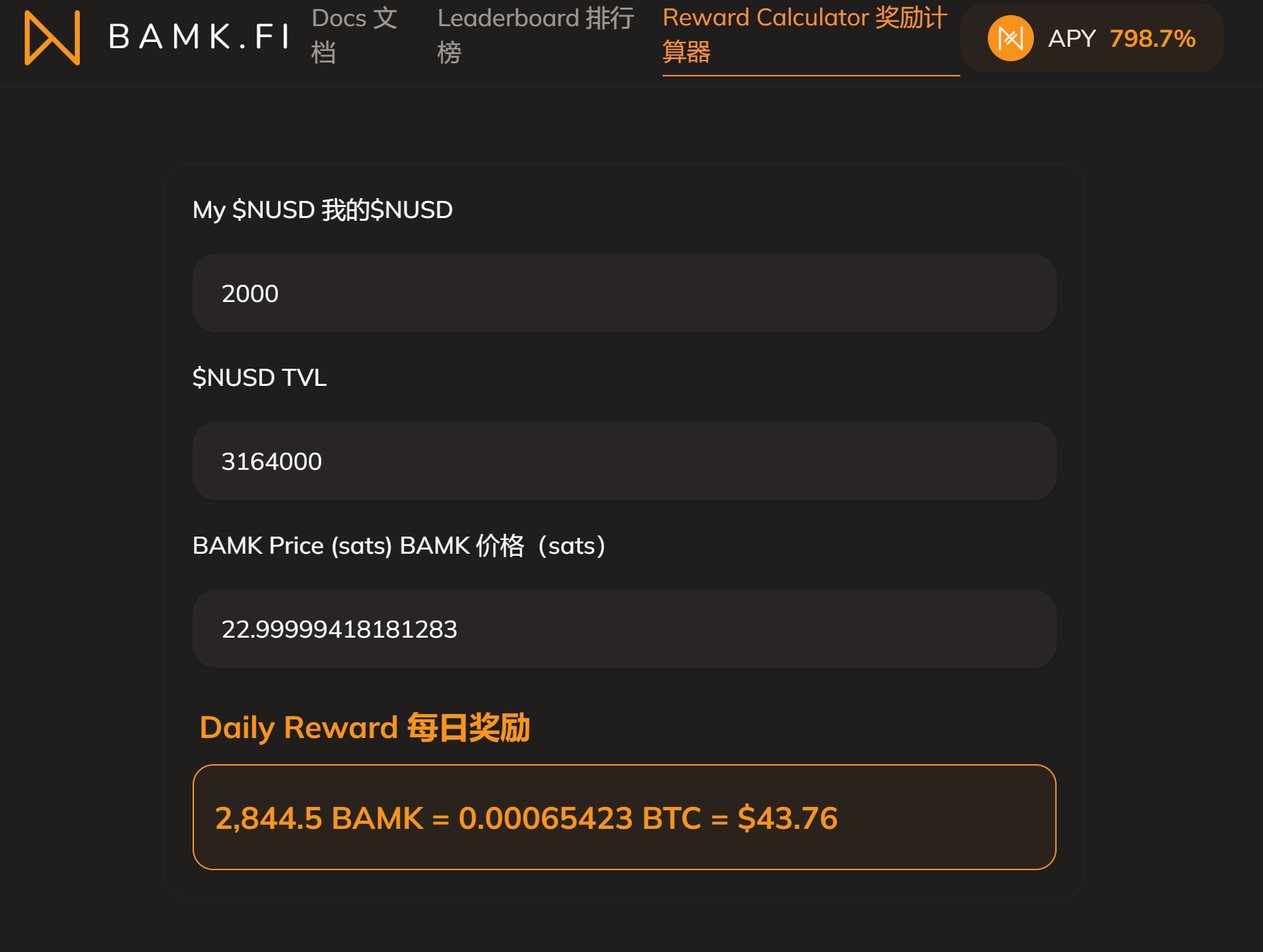

In addition to NUSD, Bamk.fi has also launched another Rune, BAMK•OF•NAKAMOTO•DOLLAR, with the codename BAMK, which is currently in the first incentive stage. The incentive method involves distributing 6.25% of the supply of BAMK, totaling 1,311,625,000, as rewards to all NUSD holders. The distribution will take place over 41,962 blocks between block heights 844,492 and 886,454, with 31,250 BAMK tokens per block distributed proportionally based on the amount of NUSD held at that block height, divided by the total NUSD TVL at that block height. According to the official calculator as of June 13, depositing 2000 NUSD currently yields a daily profit of approximately 43 US dollars, with an APY of 798.7%.

Risks Behind High Yields Should Not Be Overlooked

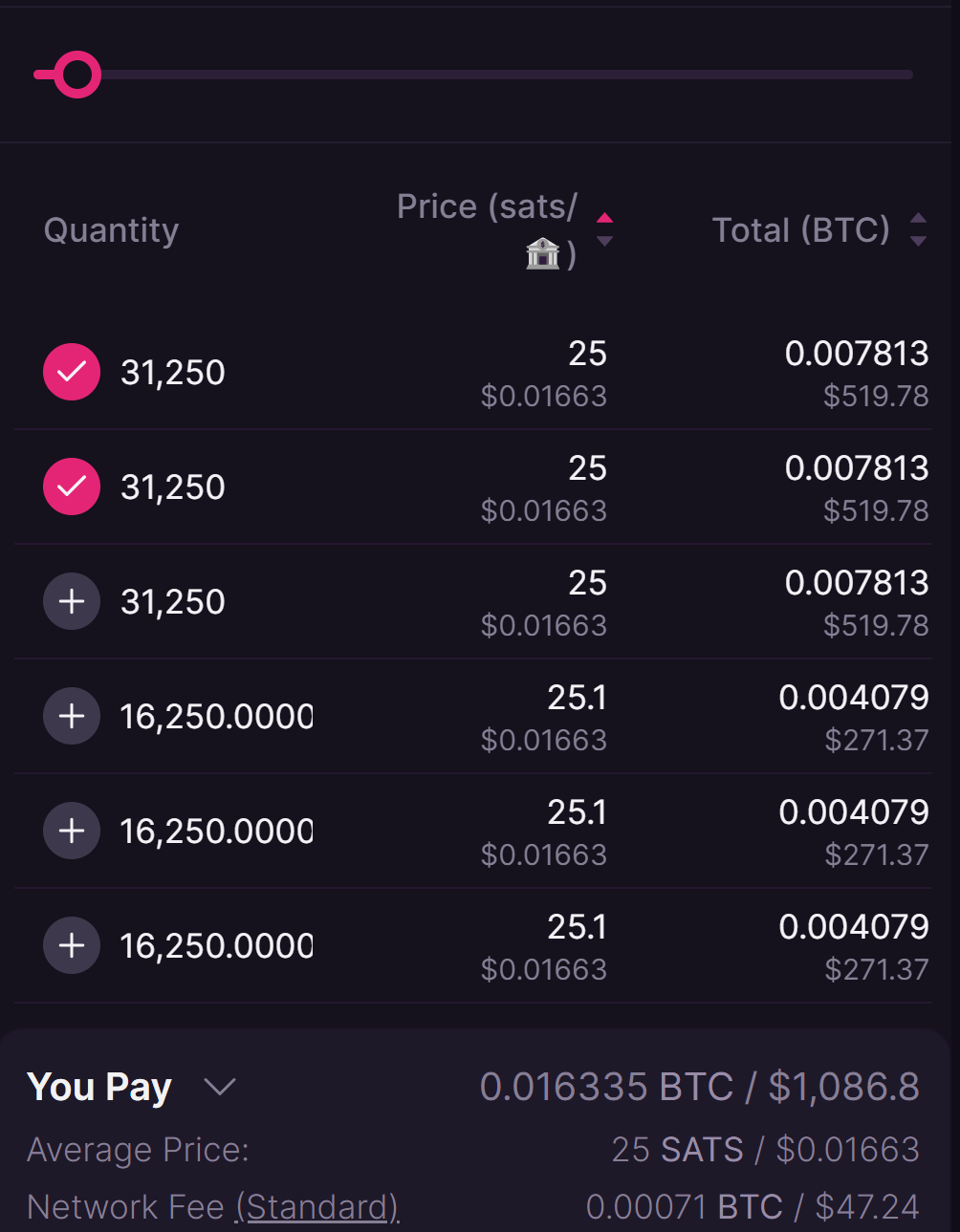

Despite the seemingly high returns, several factors need to be considered. Firstly, the mining rewards for BAMK are not stable and mainly depend on the TVL of NUSD. As the TVL increases, the rewards for BAMK tokens will correspondingly decrease. Additionally, the rewards for the first season of BAMK will not be received until approximately 9 months later, and the actual amount received by users may vary significantly. Furthermore, BAMK's price in the secondary market also exhibits high volatility, with daily fluctuations of 20-30% not being uncommon. In addition, the Bitcoin network fees cannot be ignored, with the transaction fees on June 13 averaging around 47 US dollars per transaction.

Another consideration is the stability of the project itself. The risks in this aspect may stem from two factors: the security of the team and potential vulnerabilities in the mechanism design.

According to the official introduction from Bamk.fi, their team consists of "1,177 degens and counting," which is a kind of gray humor and informal term in the crypto field, mainly referring to users who are enthusiastic about participating in early projects and highly speculative trading. They reject any venture capital. The official introduction states that most core team members have been active on X or Telegram, and their identities are already public. According to PANews' investigation on the X platform, Jack Liu @liujackc has spoken on behalf of Bamk.fi multiple times and is likely a core member of Bamk.fi. Jack Liu previously served as the Asia Pacific General Manager for Circle and the Chief Strategy Officer for OKCoin. However, the identities of other team members have not been clearly disclosed.

In terms of NUSD's mechanism, stability ultimately depends on the team. Risks related to fund management and trading operations may exist. When asked how the team prevents the withdrawal of collateral or the issuance of unsupported NUSD, Bamk.fi replied, "There is no technical way. But our own incentives prevent this. Tether, Circle, or a large amount of funds held in centralized exchanges may also withdraw deposits. But due to legal reasons and profit incentives, they do not do so. The Bamk.fi protocol has already started generating income. If we do the right thing, we can continue to make money continuously, rather than taking a large sum of money and evading enforcement forever. Tether recorded a net profit of 4.52 billion US dollars this quarter."

In another part of the document, it is revealed, "The first phase of the protocol has already started generating income, approximately 600 US dollars per day, with an annual income of about 219,176 US dollars." It seems that the current income generated by this incentive is difficult to resist compared to the temptations faced.

Another potential vulnerability in the mechanism comes from the funding rate of perpetual contracts, which constantly changes with market conditions. When the market is bullish, long positions generally require higher funding rates to be paid to short positions. In this case, for holders of short positions like NUSD, the funding rate is positive, meaning there will be funding rate income. Conversely, when the market is bearish, short positions will need to pay additional funding rates. This could potentially lead to overall value loss. The official approach is as follows: "During periods of negative interest rates in perpetual contracts, minting will be suspended until the interest rate becomes positive again, and redemption will be open, providing BAMK rewards based on the redemption ratio of each block, divided by the total NUSD TVL at that block height." From this perspective, if a prolonged downturn occurs, NUSD minting may face a long period of stagnation, making it difficult for NUSD to detach from market conditions.

Overall, the launch of NUSD has indeed provided a model case for application-based Runes in the Bitcoin ecosystem, and the attraction of high yields and the continuously rising BAMK token will likely attract more players in the short term. However, for Bamk.fi, the greater challenge lies in the performance after the formal introduction of the algorithm in the second phase. A truly stable and more reasonable governance mechanism may further advance the vision of Nakamoto for Bitcoin to become the banking system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。