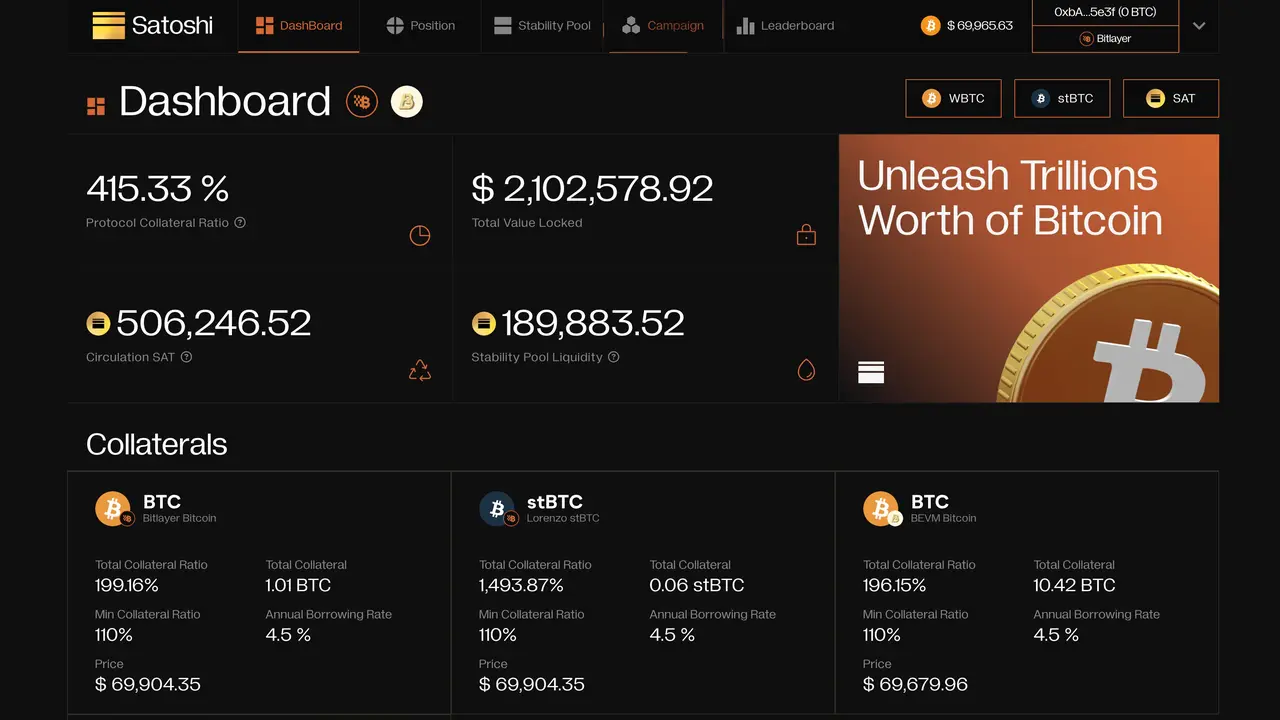

Recently, the Bitcoin ecosystem stablecoin lending project Satoshi Protocol has completed the mainnet deployment of Bitlayer, and reached a strategic cooperation with the Bitcoin liquidity financial layer project Lorenzo, supporting stBTC as collateral to mint the stablecoin SAT.

This article will provide an in-depth introduction to the development of the Satoshi Protocol and the stablecoin SAT, as well as discuss future development possibilities, and introduce its operations on Bitlayer and the efficiency of unlocking funds.

Expanding the Bitcoin Ecosystem, Supporting BTC-Related Collateral

Expanding to Bitlayer was already part of the plan, and it is an important step in expanding the full-chain stablecoin of the Bitcoin ecosystem. The support for Lorenzo stBTC also aligns with the recent hot financing of Babylon's BTC re-pledging ecosystem. With support for BTC and related LSD and LRT protocol assets, Satoshi Protocol will be able to provide better fund utilization choices for BTC assets and expand the application scenarios of SAT stablecoins to various ecosystems.

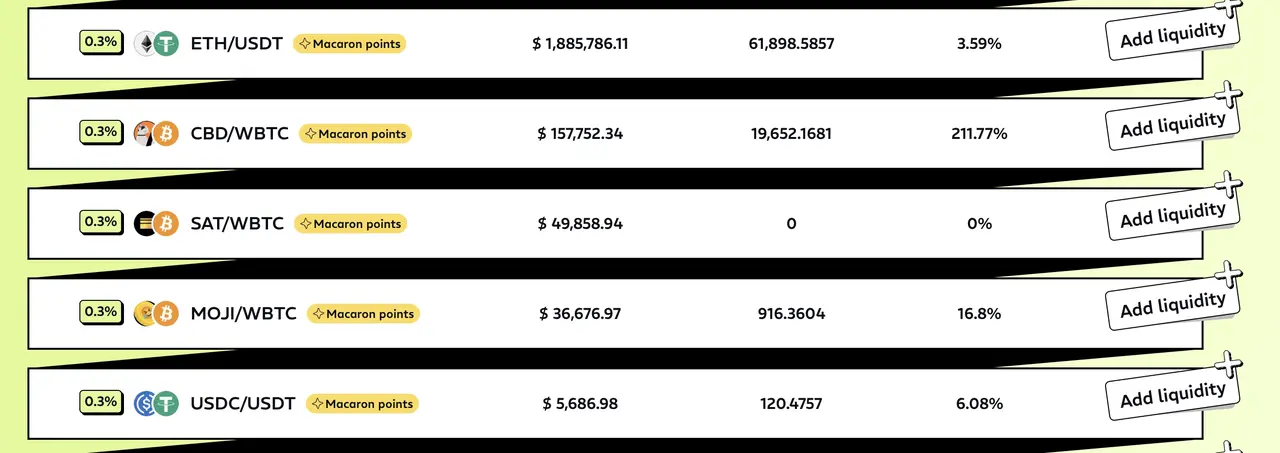

The leading DEX in the Bitlayer ecosystem, Macaron, already has an SAT-BTC liquidity pool, allowing users to trade SAT and BTC on Macaron and receive additional bonus points, which can be used to receive future token airdrops from Macaron. With the integration of more LSD and DeFi protocols, more usage scenarios and cooperative ecosystems will be expanded, creating a more solid infrastructure for BTCFi. Satoshi Protocol:

Full-Chain Stablecoin Protocol in the Bitcoin Ecosystem

Satoshi Protocol is a full-chain stablecoin protocol based on the Bitcoin ecosystem, issuing the USD stablecoin SAT using the CDP model with over-collateralization, aiming to become a universal stablecoin protocol in the Bitcoin ecosystem (including the mainnet and Layer 2). Compared to existing stablecoin lending projects, Satoshi Protocol allows users to mint stablecoins with up to 90% of the collateral value, making it the best fund utilization choice in the current ecosystem.

SAT is anchored to the value of the US dollar through over-collateralization and redemption arbitrage mechanisms. When the SAT price is below $1, users can redeem the corresponding amount of BTC through the official interface at any time, reducing the circulation of SAT in the market. When the SAT price is below $1.1, users can borrow SAT from Satoshi Protocol and sell it for arbitrage.

In addition to the USD stablecoin SAT, Satoshi Protocol is expected to launch its native token OSHI in Q3 this year, and OSHI holders will receive 100% of the protocol's income. Previously, Satoshi Protocol had initiated a points-based airdrop activity for OSHI tokens and collaborated with Binance Web3 and Bybit Web3 to allow users to complete tasks and receive a certain amount of BEVM and OSHI airdrops.

SAT: Over-Collateralized Stablecoin, 110% Collateralization Ratio as Liquidation Benchmark

The Satoshi Protocol uses the collateralization ratio (CR) to manage risk. If the value of the BTC assets collateralized by the user is less than 110%, the position will be liquidated. In this case, the user's BTC will be sold to repay the outstanding SAT debt, and the liquidity of SAT comes from the liquidity providers of the Stability Pool, as they can provide liquidity and receive a discount to purchase the liquidated BTC collateral, thereby increasing the incentive for users to participate in the protocol's liquidity.

Satoshi has now expanded to Bitlayer and supports BTC and stBTC as collateral, with plans to gradually add other BTC-related assets in the future. The support for Lorenzo stBTC this time is also to accommodate current stBTC users in the Bitlayer ecosystem. Benefiting from the protocol's maximum lending amount of up to 90%, it will further unlock the efficiency of fund utilization within the ecosystem, allowing stBTC within the Bitlayer ecosystem to have better applications and circulation scenarios.

How to Stake stBTC and Mint SAT on Bitlayer

Satoshi Protocol supports two types of collateral on Bitlayer: BTC and stBTC. This text uses stBTC as an example to explain how to mint the stablecoin SAT through Satoshi Protocol and interact with Babylon, Lorenzo, Orbiter, Satoshi Protocol, and Macaron in the process.

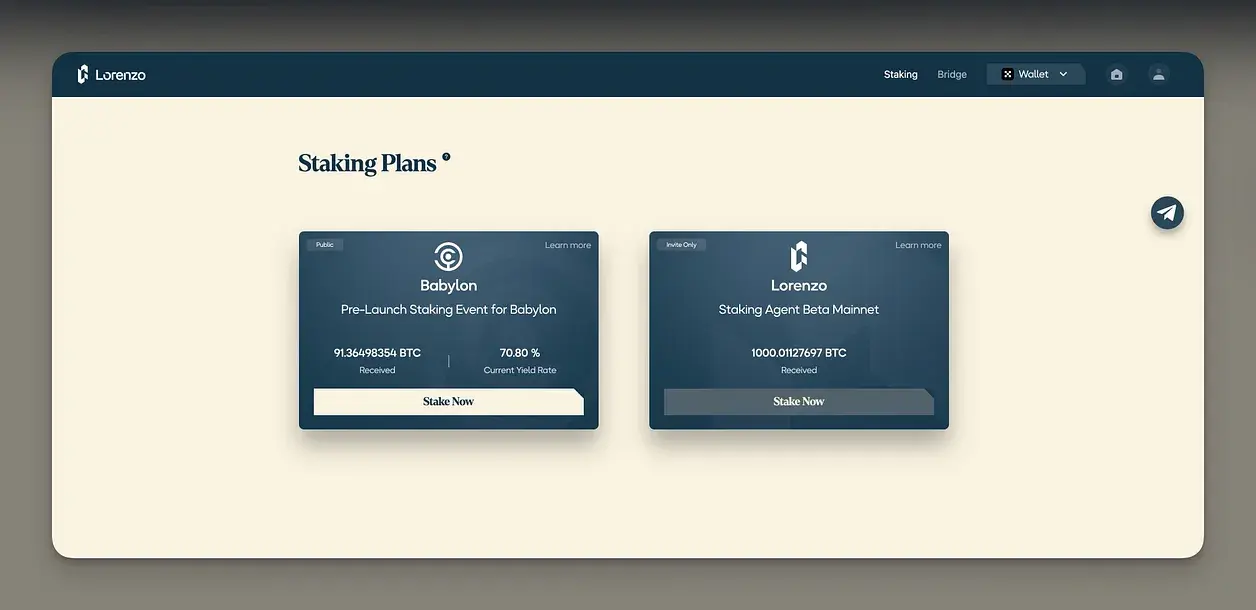

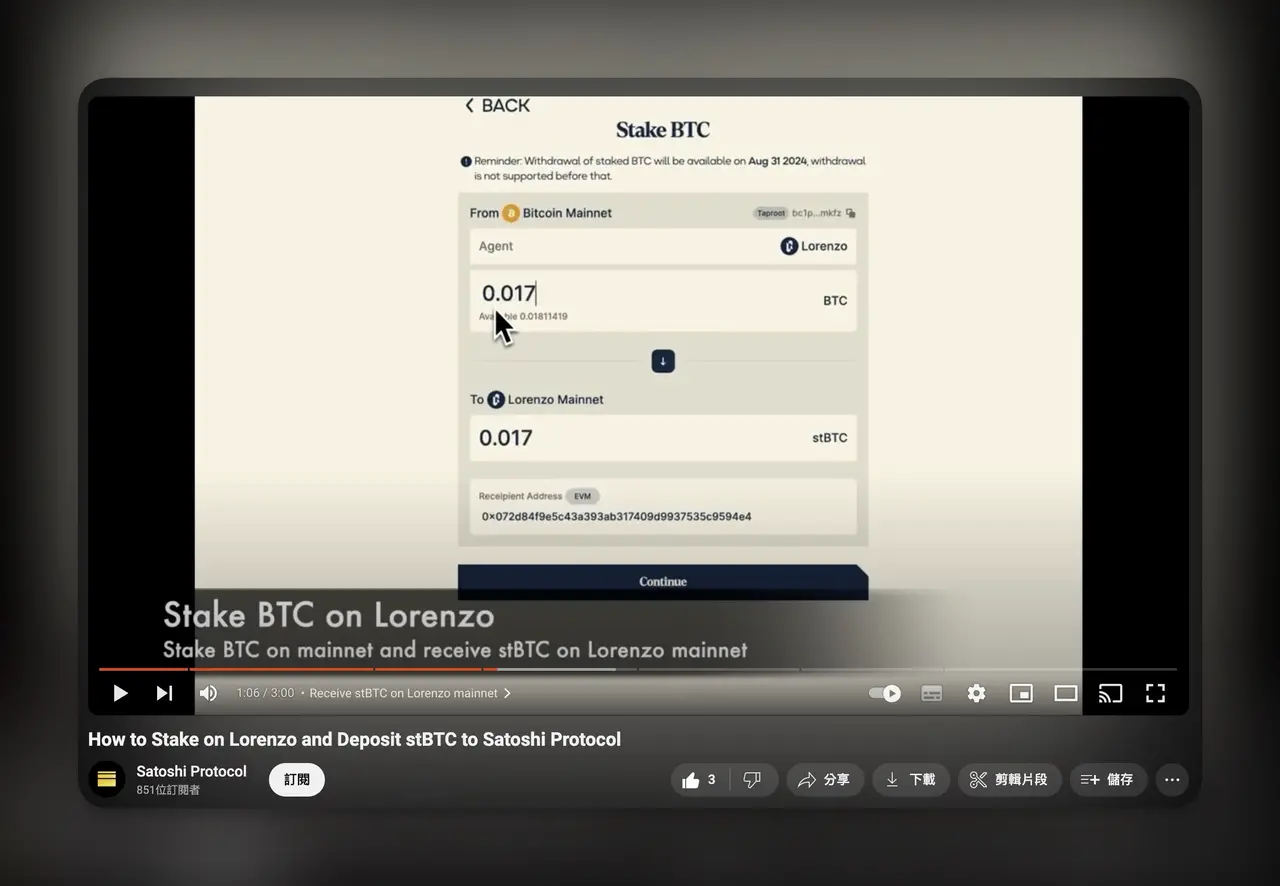

Staking BTC to Obtain stBTC from Lorenzo

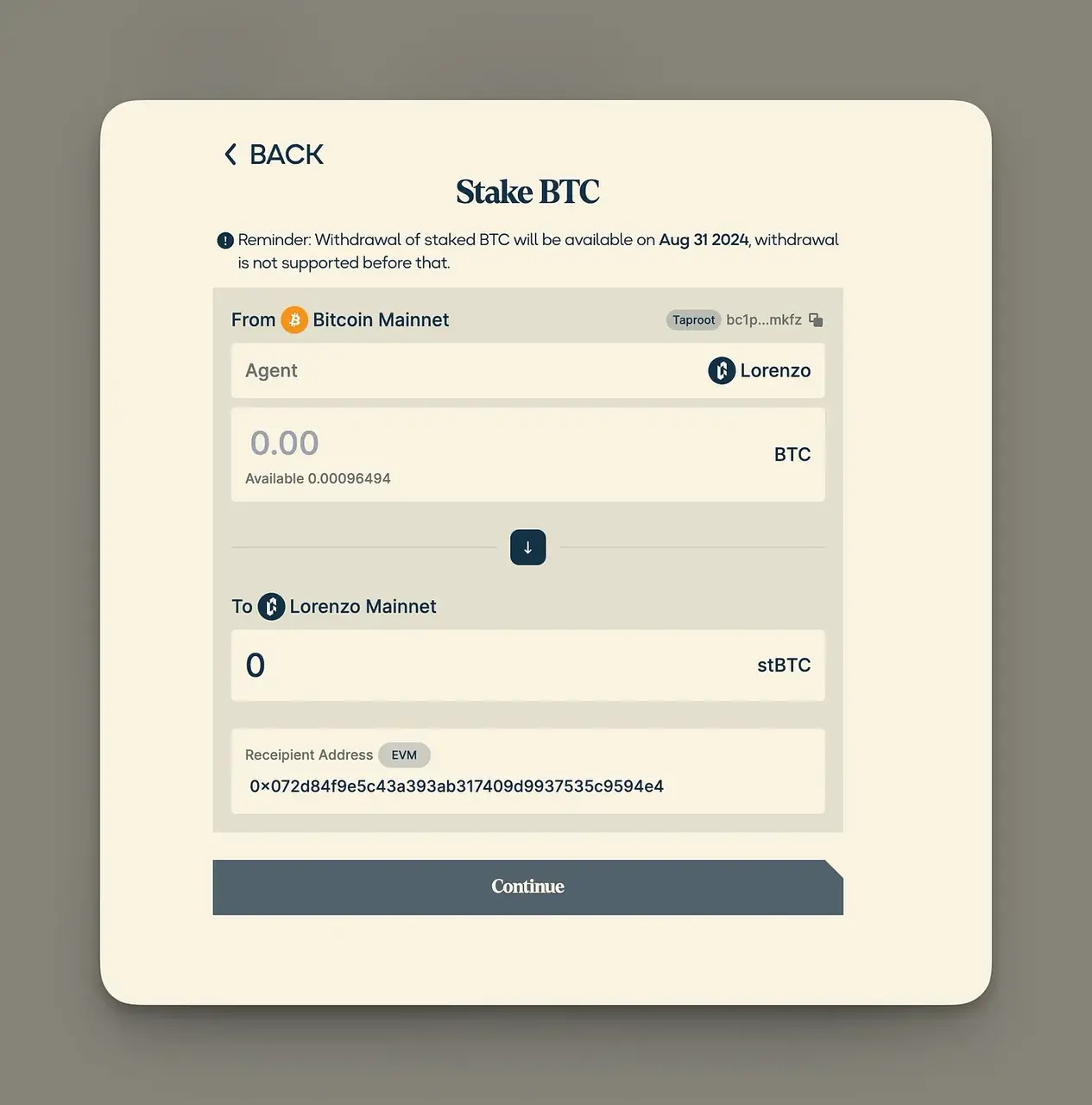

Step 1: Withdraw BTC to the Taproot address on the OKX wallet's Bitcoin mainnet (starting with bc1p)

Step 2: Visit the Lorenzo Protocol website and connect the EVM and BTC wallet

Step 3: Receive an equivalent amount of stBTC on the Lorenzo mainnet

1. Click "Start Staking," select Babylon, and click "Stake Now"

2. Enter the amount of BTC to stake

3. Click "Continue" to confirm the transaction details and click "Sign"

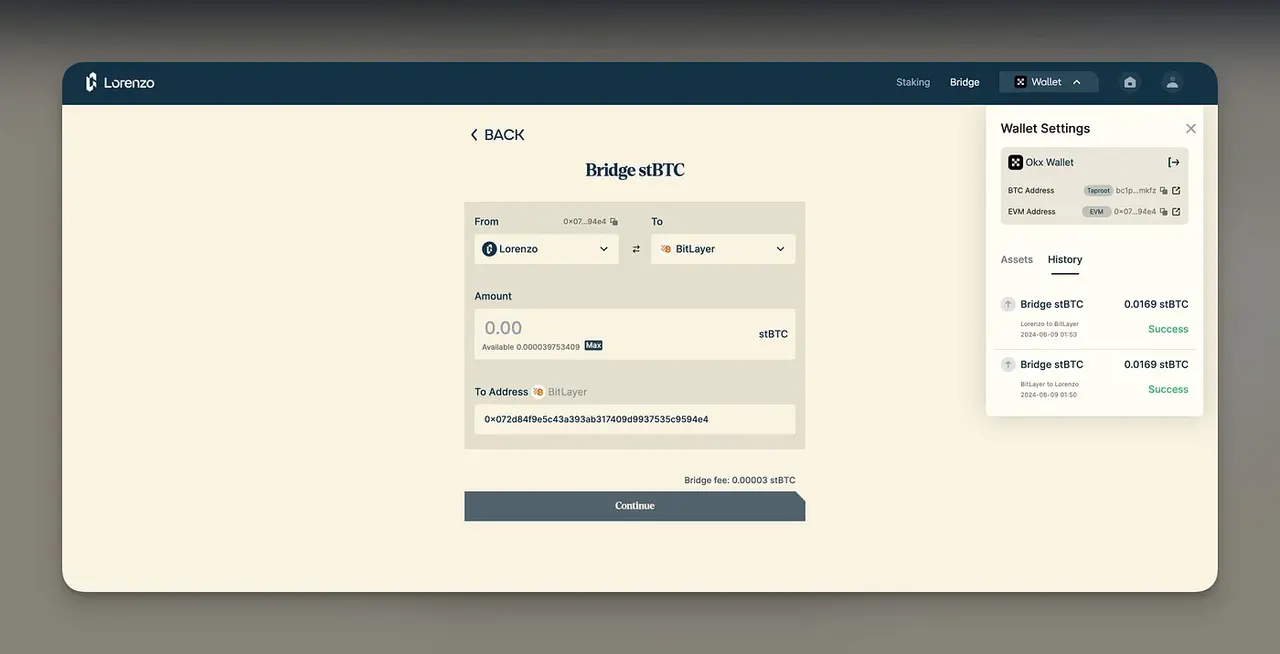

Step 4: Cross-chain the stBTC to Bitlayer

- Click "Bridge stBTC" on the Lorenzo website, enter the amount of stBTC to cross-chain to Bitlayer

- After successful cross-chain, you can then interact with Satoshi Protocol on Bitlayer using stBTC.

Using stBTC as Collateral to Borrow SAT on Satoshi Protocol

Step 1: Cross-chain a small amount of BTC to Bitlayer as gas fee (it is recommended to use Orbiter for cross-chain, as it has lower costs and expectations of airdrops)

Step 2: Visit the Satoshi Protocol website, connect your wallet, and switch to the Bitlayer network

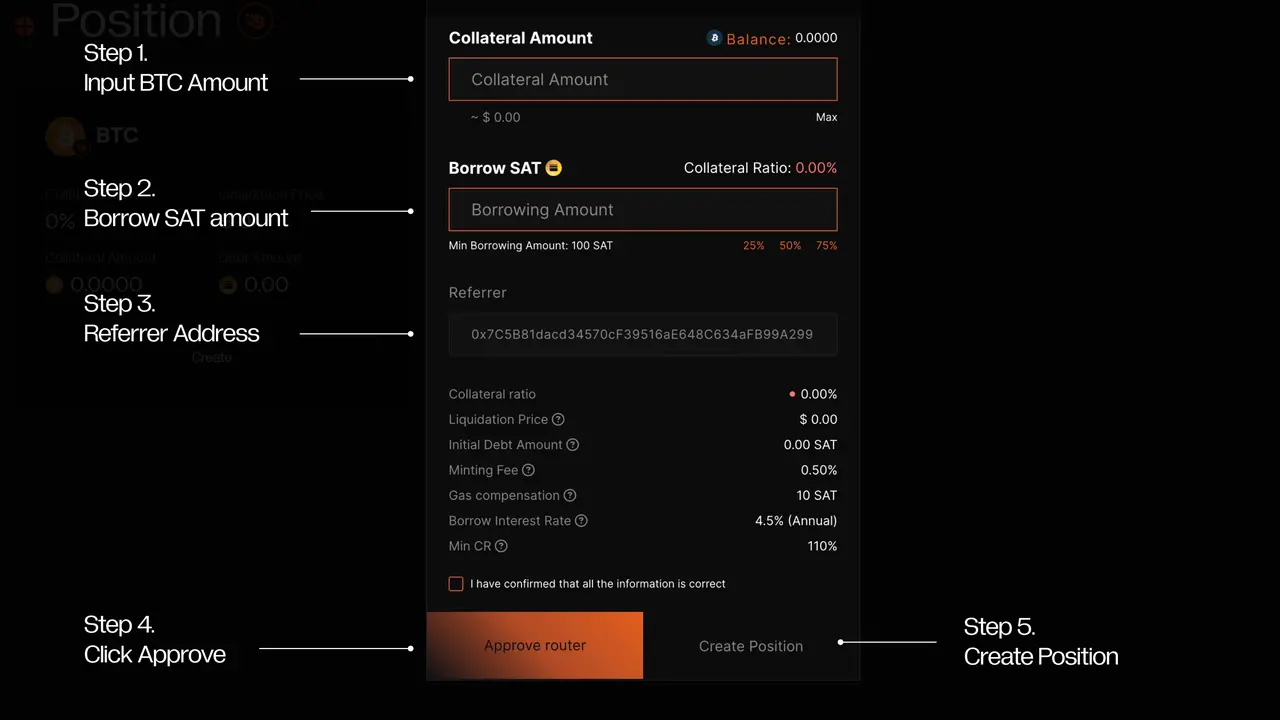

Step 3: In the top navigation bar, find "Position," select "stBTC," and click "Create Position"

Step 4: Enter the amount of stBTC to be used as collateral and the amount of SAT to be borrowed (at least 100 SAT)

Step 5: Click "Create Position"

The specific operation process can be referred to the official video guide released by the project: How to Stake on Lorenzo and Deposit stBTC to Satoshi Protocol

In the above process, users obtain stBTC through Lorenzo, complete basic interactions with Babylon and the Lorenzo protocol, and interact with Orbiter during the process of cross-chain BTC to Bitlayer. Subsequently, in the borrowing and exchange process, interactions with Satoshi Protocol and Macaron are completed. Since multiple projects in the above process are the most promising unreleased projects in the BTC ecosystem, users can maximize fund efficiency in this process and potentially receive airdrops from the Bitlayer mainnet and its multiple ecosystem projects.

Integrating with the Bitlayer Ecosystem, Expanding Use Cases for SAT

Within 3 days of launching on the Bitlayer mainnet, Satoshi Protocol has climbed to 7th place in the Bitlayer official website's voting activity leaderboard, demonstrating the attention received by Satoshi Protocol within the Bitlayer ecosystem. In the future, Satoshi Protocol will collaborate with more Bitlayer ecosystem projects to expand use cases for SAT, providing users with more flexible collateral options and more potential returns for SAT.

Upon launching on Bitlayer, Satoshi Protocol has already deployed the SAT-BTC and SAT-stBTC liquidity pools on Macaron, the leading DEX application, providing practical application scenarios for Bitlayer users in the early stages. The SAT-stBTC liquidity pool will provide a very direct interaction use case for the stBTC currently in a dormant state on the platform.

Additionally, Macaron is currently conducting a liquidity pool trading competition, where users can exchange or provide liquidity in the liquidity pool on Macaron after borrowing SAT, potentially earning higher returns. This interaction behavior can also receive additional point bonuses as rewards provided by Macaron.

Visit the official Macaron website to view the event details: https://www.macaron.xyz/#/pool?lang=en

Conclusion

After a series of events, the development of BTC Layer2 is gradually maturing, and various ecosystem protocols are emerging. As a leading stablecoin lending project in the BTC ecosystem, Satoshi Protocol has brought a user-friendly stablecoin application based on BTC assets to Bitlayer, potentially becoming an important member of Bitlayer's DeFi infrastructure. This will provide Bitlayer users with opportunities to flexibly allocate assets, improve fund efficiency, and participate in more DeFi activities, while driving innovation in the BTCFi field for Bitlayer.

With the expansion of collaborations with more Bitlayer ecosystem projects, SAT will be endowed with more use cases. In addition to collaborations with Macaron and Lorenzo, Satoshi Protocol's exploration of the Babylon ecosystem also brings greater imagination.

From building stablecoins, improving ecosystem infrastructure, to creating more use cases, and ultimately driving the development of the entire BTC ecosystem, Satoshi Protocol is focused on building a full-chain stablecoin based on BTC assets, which may spark more innovation in BTC Layer2 and the entire Bitcoin ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。