Authors: CryptoVizArt, UkuriaOC, Glassnode

Compiled by: Ladyfinger, BlockBeats

Editor's note: In this in-depth analysis, we focus on several key dynamics in the Bitcoin market, from the evolution of technical protocols to macro changes in market structure. It is particularly noteworthy that despite the influx of funds from the US spot ETF bringing vitality to the market, neutral cash and carry trading strategies are balancing the buying pressure, leading to a neutralizing effect on price impact. In addition, the sharp contrast between the decrease in active addresses on the Bitcoin network and the surge in its trading volume raises intriguing questions about the underlying reasons. By analyzing the impact of emerging technologies such as the Runes protocol, we reveal its direct effect on the decrease in active addresses. At the same time, we also observe the significant role played by the amount of Bitcoin held by major entities and Coinbase in shaping the current market landscape.

While the influx of funds from the US ETF is impressive, the neutral basis trading seems to be mitigating the buying pressure, and the market needs non-arbitrage demand to further drive price increases. At the same time, we also analyze the significant differences between the decrease in active addresses and the surge in trading volume.

BlockBeats note: Basis trading, also known as cash-and-carry trade, refers to simultaneously buying (selling) spot bonds and selling (buying) bond futures. The basis trading strategy is based on the price difference of an asset in two different markets (such as the price difference between the spot market and the futures market). If executed properly, it can yield returns. Generally, traders need to manage two different contracts simultaneously when executing the basis trading strategy, making the process relatively complex and lengthy.

Abstract

With the emergence of the Runes protocol, an unexpected discrepancy has arisen between the decrease in active addresses and the increase in trading volume.

Currently, major tagged entities hold an astonishing 4.23 million BTC, accounting for over 27% of the adjusted supply, while the US spot ETF now holds a balance of 862,000 BTC.

The basis trading structure seems to be a significant source of ETF inflow demand, with ETFs being used as a tool to obtain long spot exposure, while the net short positions of Bitcoin in the CME futures market continue to accumulate.

Activity Discrepancy

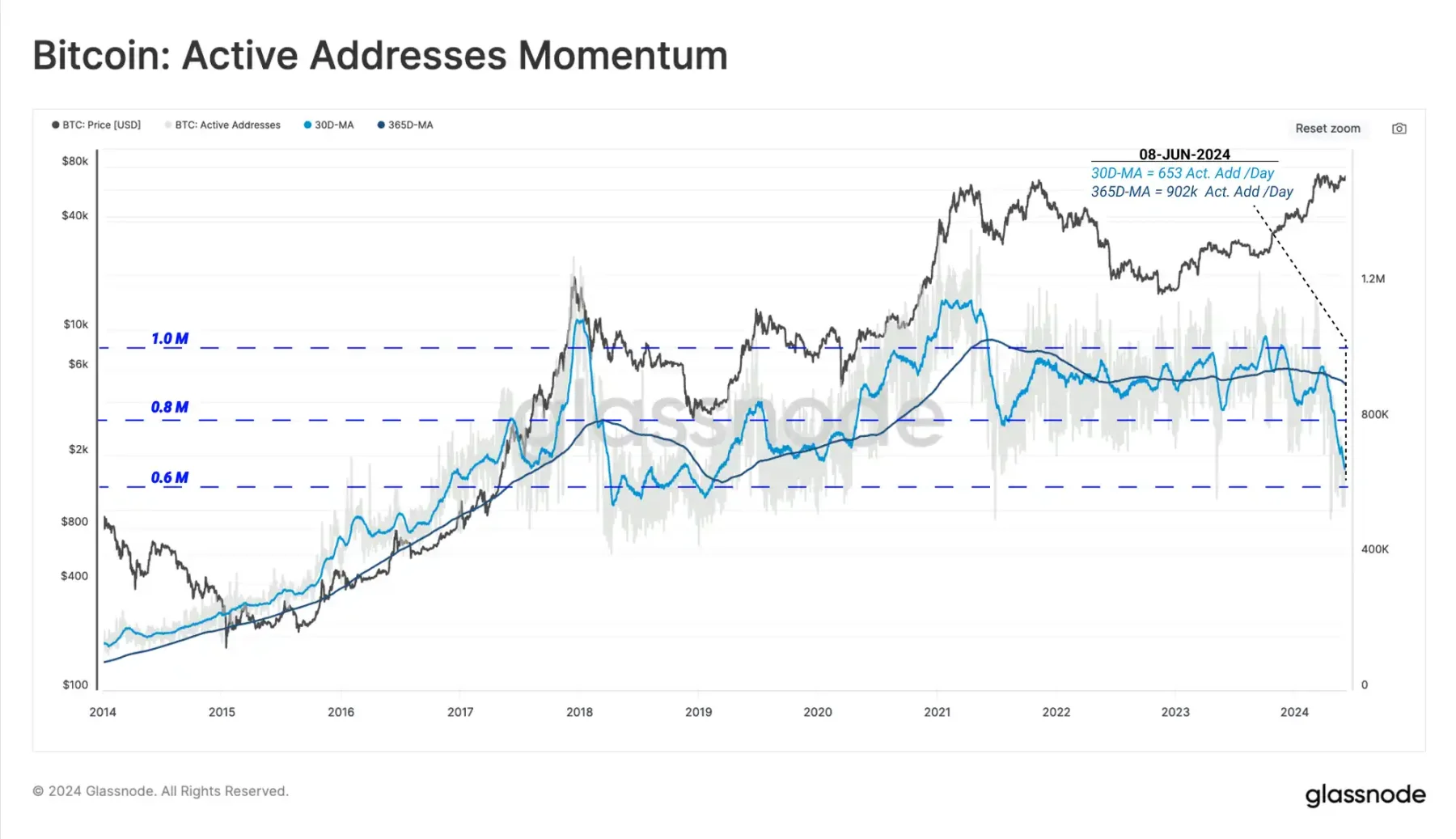

On-chain activity indicators, including active addresses, trading volume, and transaction amount, are crucial tools for evaluating the development and efficiency of blockchain networks. In mid-2021, China imposed restrictions on Bitcoin mining, leading to a sharp decrease in the number of active addresses on the Bitcoin network, with the daily average active addresses dropping from over 1.1 million to just 800,000.

The Bitcoin network is currently experiencing activity contraction, which is fundamentally different from the past. In the following chapters, we will delve into emerging concepts such as inscriptions, ordinals, BRC-20 tokens, and runes, and how they have fundamentally transformed analysts' understanding and predictions of future trends in activity indicators.

Real-time data

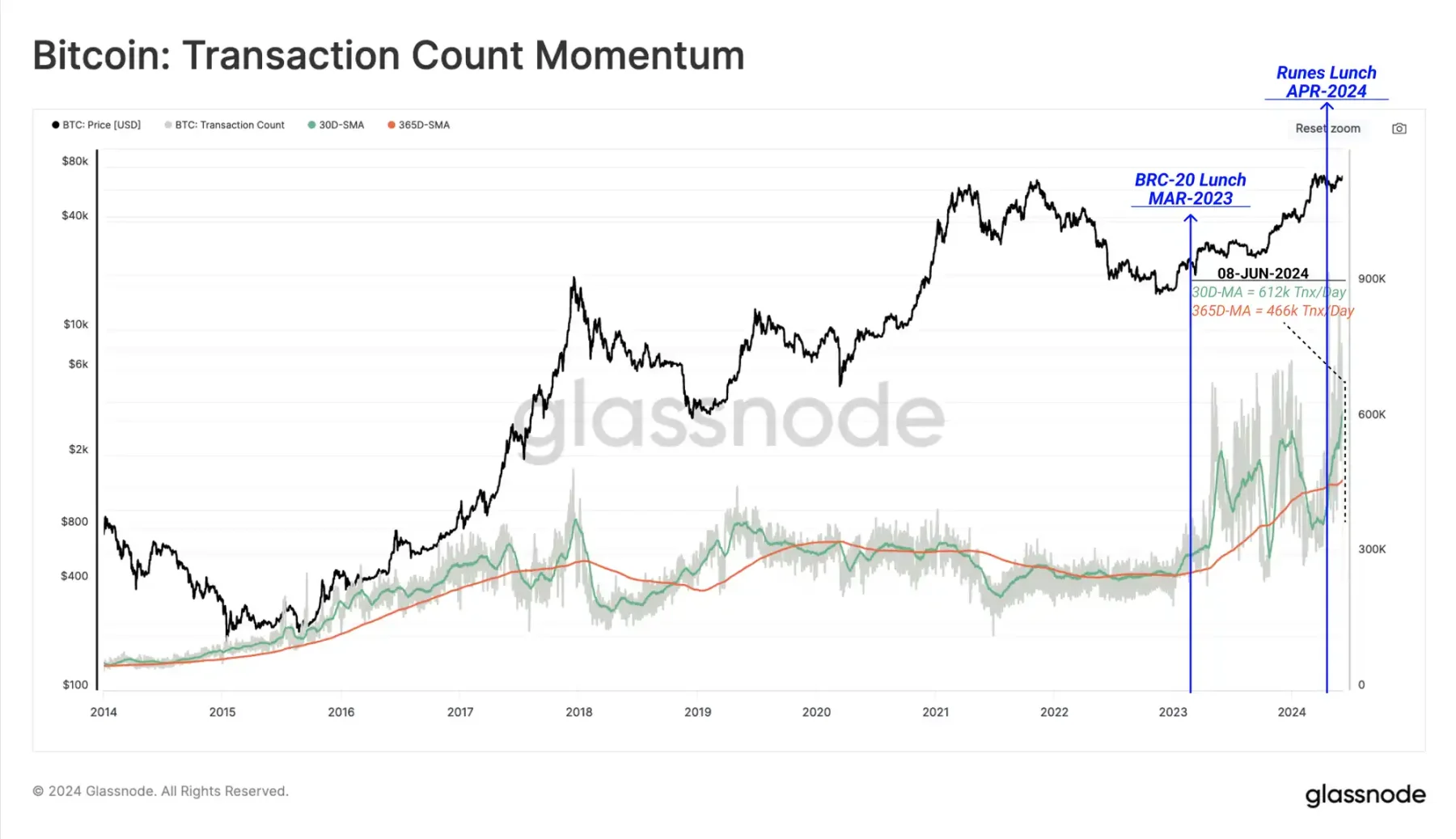

Although historically, strong market momentum is usually accompanied by an increase in active addresses and daily trading volume, this trend is currently deviating.

Despite the apparent decrease in active addresses, the Bitcoin network's transaction processing volume is approaching historical highs. The current monthly average transaction volume has reached 617,000 transactions per day, 31% higher than the annual average level, indicating a relatively high demand for Bitcoin block space.

Real-time data

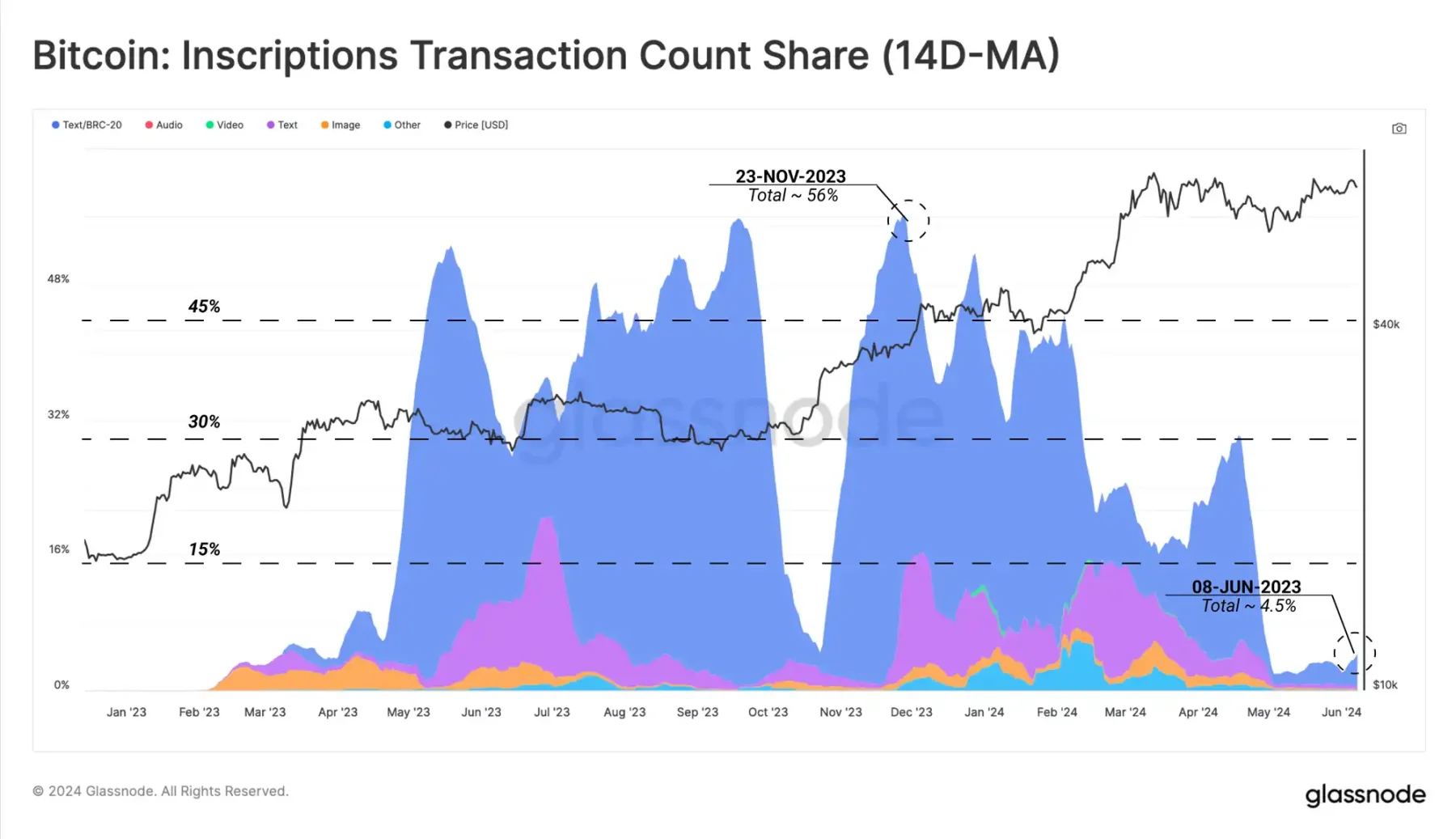

By comparing the recent decrease in active addresses with the trading share of inscriptions and BRC-20 tokens, we can observe a strong correlation. Particularly noteworthy is the sharp decline in the number of inscriptions since mid-April.

This indicates that the decrease in active addresses is mainly due to the reduced use of inscriptions and ordinals. It should be noted that in this area, many wallets and protocols will reuse the same address, and if an address has multiple activities within a day, it will not be counted multiple times. Therefore, even if an address generates ten transactions in a day, it will still only be counted as one active address in the statistics.

Real-time data

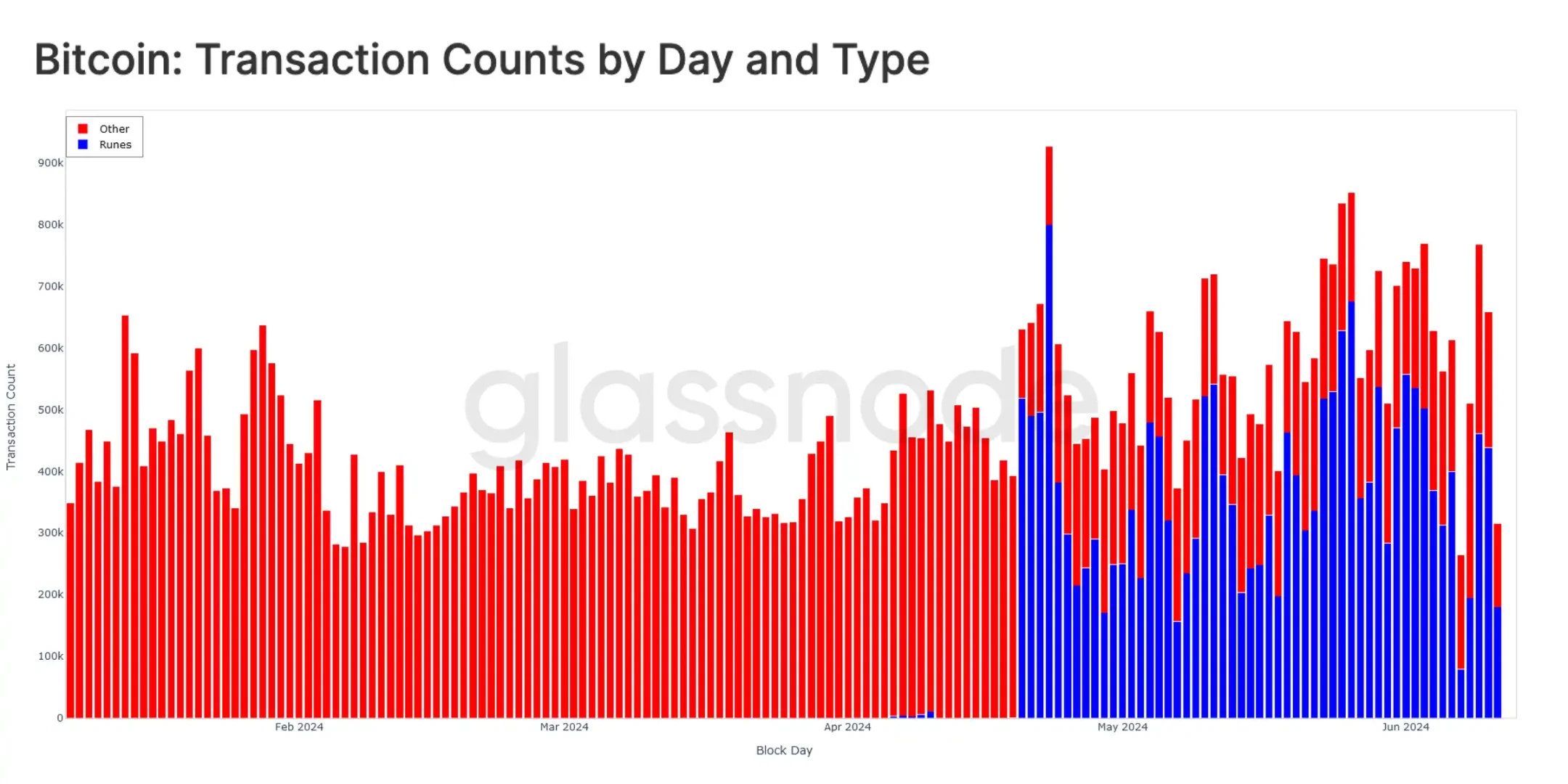

To explain the decrease in inscription activity, we can focus on the emergence of the runes protocol, which claims to introduce a more efficient method of introducing fungible tokens on Bitcoin. The runes protocol went live at the time of the Bitcoin halving, which explains the decline in the number of inscriptions in mid-April.

Runes use a different technical mechanism from inscriptions and BRC-20 tokens, utilizing the OP_RETURN field (80 bytes) to encode arbitrary data on the blockchain, significantly reducing the demand for block space while maintaining data integrity.

Since its launch on April 20, 2024, the runes protocol has rapidly gained market traction, with daily trading demand increasing to 600,000 to 800,000 transactions, and this trading volume has remained at a high level since then.

Image indicators

Currently, transactions related to runes account for as much as 57.2% of the daily trading volume, significantly surpassing BRC-20 tokens, ordinals, and inscriptions. This phenomenon indicates that user speculative interest may have shifted from inscriptions to the emerging runes market.

Image indicators

Differences in ETF Demand

A recent issue of particular market concern is that despite the massive influx of funds into the US spot ETF, the price has remained stagnant. To further analyze and evaluate the demand side of the ETF, we can compare the current holdings of the ETF (862,000 BTC) with the holdings of other major tagged entities in the market.

The US spot ETF holds 862,000 BTC, Mt. Gox creditors hold 141,000 BTC, the US government holds 207,000 BTC, all exchanges collectively hold 2.3 million BTC, and miners (excluding Patoshi) hold 706,000 BTC. The total holdings of these major entities amount to approximately 4.23 million BTC, accounting for 27% of the adjusted circulating supply of Bitcoin, where the adjusted supply refers to Bitcoin that has not been moved for over seven years being deducted from the total supply.

Real-time data

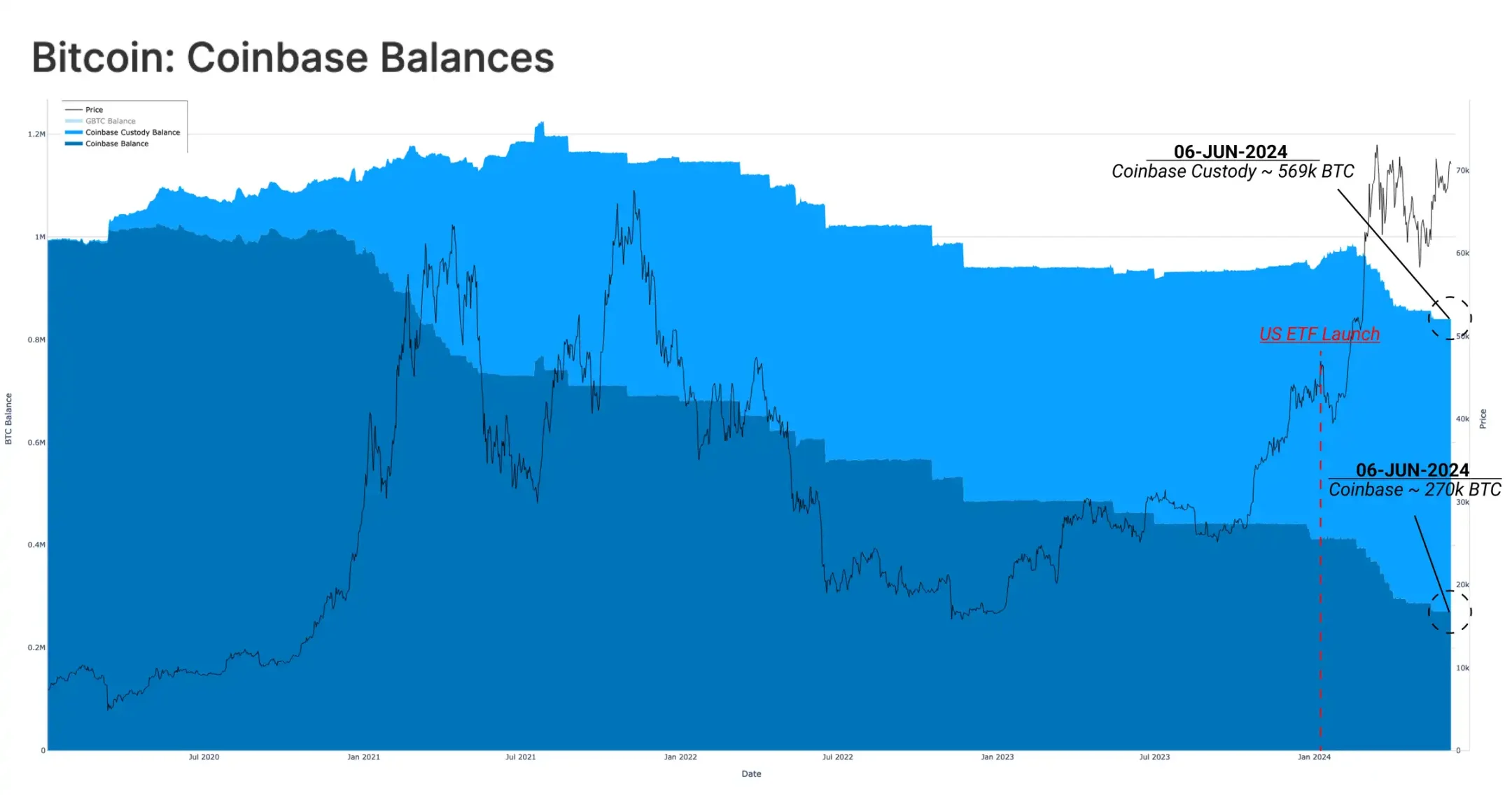

As a leading cryptocurrency platform, Coinbase controls a vast amount of exchange assets, and its custody service also manages the Bitcoin holdings of the US spot ETF. It is estimated that Coinbase Exchange and Coinbase Custody currently hold approximately 270,000 BTC and 5.69 million BTC, respectively.

Image indicators

Coinbase's influence on the market price mechanism is increasing due to its service to ETF clients and traditional on-chain asset holders. Observing the dynamics of large deposits into Coinbase exchange wallets, there has been a significant increase in deposit volume after the launch of the ETF.

The majority of the deposited Bitcoin is closely related to the continuous outflow of the GBTC address group, which has become a key reason for the excess Bitcoin supply throughout the year.

Real-time data

In addition to the selling pressure brought by GBTC in the Bitcoin market reaching historical highs, there has recently been another factor suppressing the demand for the US spot ETF.

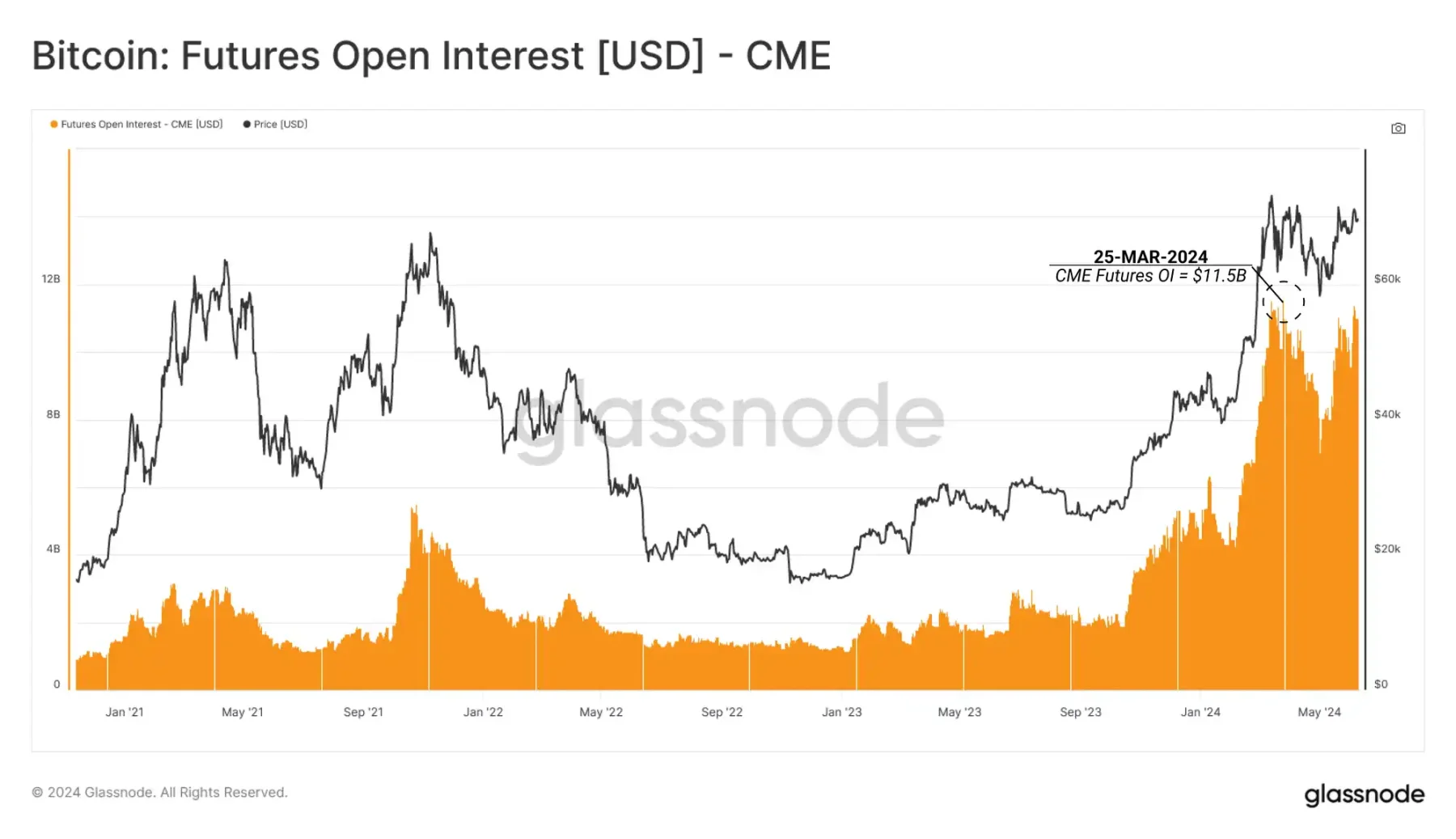

Looking at the CME Group futures market, open interest reached a record high of $11.5 billion in March 2024 and has since remained above $8 billion. This trend may reflect the increasing use of cash and carry arbitrage strategies by traditional market participants.

This arbitrage strategy takes a market-neutral position, involving the simultaneous purchase of long spot positions and the sale (shorting) of futures contracts for the same asset, the latter being the trading object due to its premium.

Real-time data

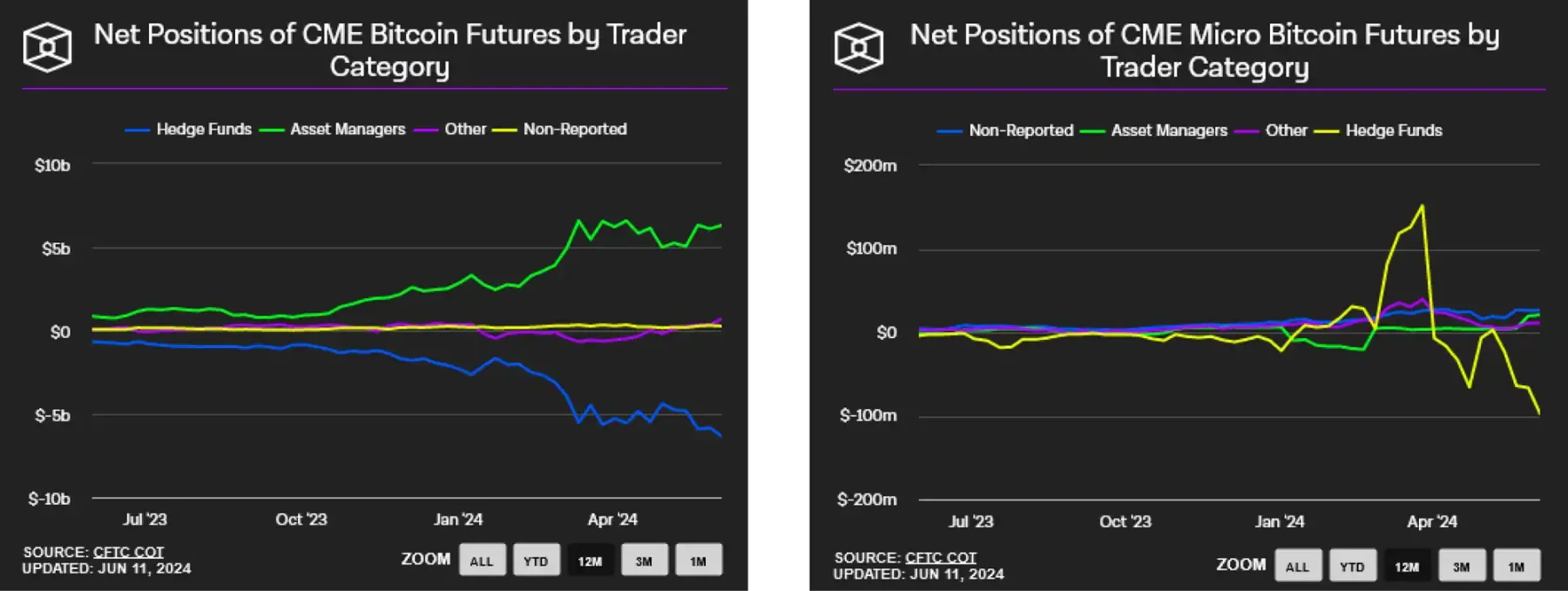

Observations show that investors classified as hedge funds are increasingly building larger net short positions in Bitcoin.

This indicates that the basis trading structure may be a key driver of ETF inflows, using ETFs as a means to acquire long-term spot Bitcoin. Since 2023, the CME Group exchange has seen significant growth in open interest and market leadership, revealing itself as the preferred platform for hedge funds to short futures.

Currently, hedge funds hold a net short position of $6.33 billion in Bitcoin futures on the CME market, and a net short position of $97 million on the micro CME Bitcoin futures market.

CME COTs - THE BLOCK

Summary

The popularity of the Runes protocol significantly exacerbates the discrepancy between activity indicators, as this protocol allows for multiple transactions from a single address through address reuse. Meanwhile, the cash and carry arbitrage behavior between the US spot ETF product and futures shorting trades through the CME Group effectively offsets the inflow of ETF funds. This market phenomenon has made the impact on prices neutral, implying the need for non-arbitrage natural buying pressure (i.e., real buyers) to drive price increases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。