Title: How to Check for Token Scams and Increase Profit Opportunities?

Author: GeekTop, Web3 Insights

The modern blockchain space is filled with promises of quick and easy money. However, it is crucial to understand whether the tokens you hold are part of a carefully planned scam aimed at taking your hard-earned money. With thousands of different meme coins being regularly issued, determining the safety and legitimacy of tokens has become increasingly challenging.

In this article, we will explore effective methods for checking the legitimacy of tokens and projects to help you avoid scams and increase opportunities for profit growth!

To verify the legitimacy of a token, you can always start with the easiest methods, such as searching on Google and Twitter. This includes researching the token and its team, checking for danger signals or warning signs, and looking for reliable sources of information, such as official websites, news articles, and verified social media accounts.

Checking Tokens on Twitter and Telegram

Verified Twitter accounts can often help prove the legitimacy of a project. Additionally, you can engage in token discussions to understand the community's viewpoints and opinions.

Exercise caution with projects that have a large number of social media followers but minimal activity. Automated comments from spam accounts should also raise concerns. If all comments are "This is a great project" and "To the moon," be cautious.

To check token information on Twitter, enter: $TICKER in the search bar.

Alternatively, use #TOKEN_NAME to find more information about the project:

If the token has recently launched, first check the first news about the token. To do this, enter $TICKER in the search bar and scroll to the bottom of the summary.

Typically, the first news about the token comes from news bots or influential individuals, such as in the following example:

An important factor is to research the project's Twitter bio. If it posts repetitive news and uniform purchase calls, the likelihood of a scam increases.

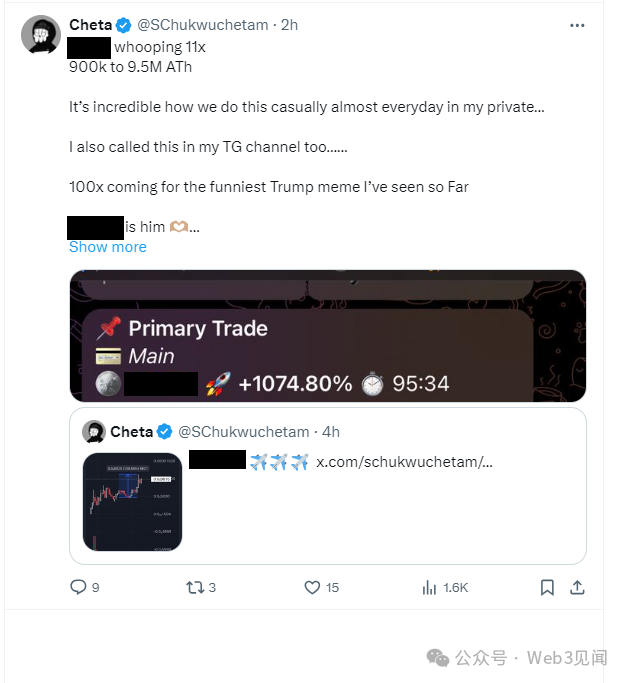

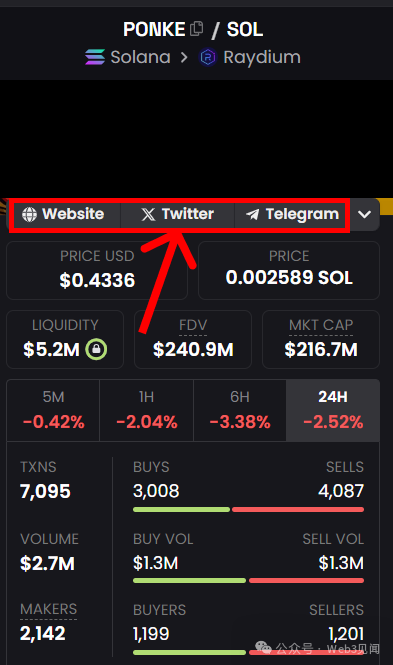

To search for token projects on Twitter, go to DexScreener and insert the token's contract (e.g., Ponke - not financial advice):

In the top right corner, you will see the project's website, Twitter, and Telegram. By visiting these links, you can research the project:

If you cannot find any project links (no website, Twitter, or Telegram), this is a clear danger signal indicating a higher likelihood of a scam.

When analyzing a project's Telegram, pay attention to the community's attitude towards the project. If the community strongly believes in and supports the project, it is a positive signal for potential short-term growth.

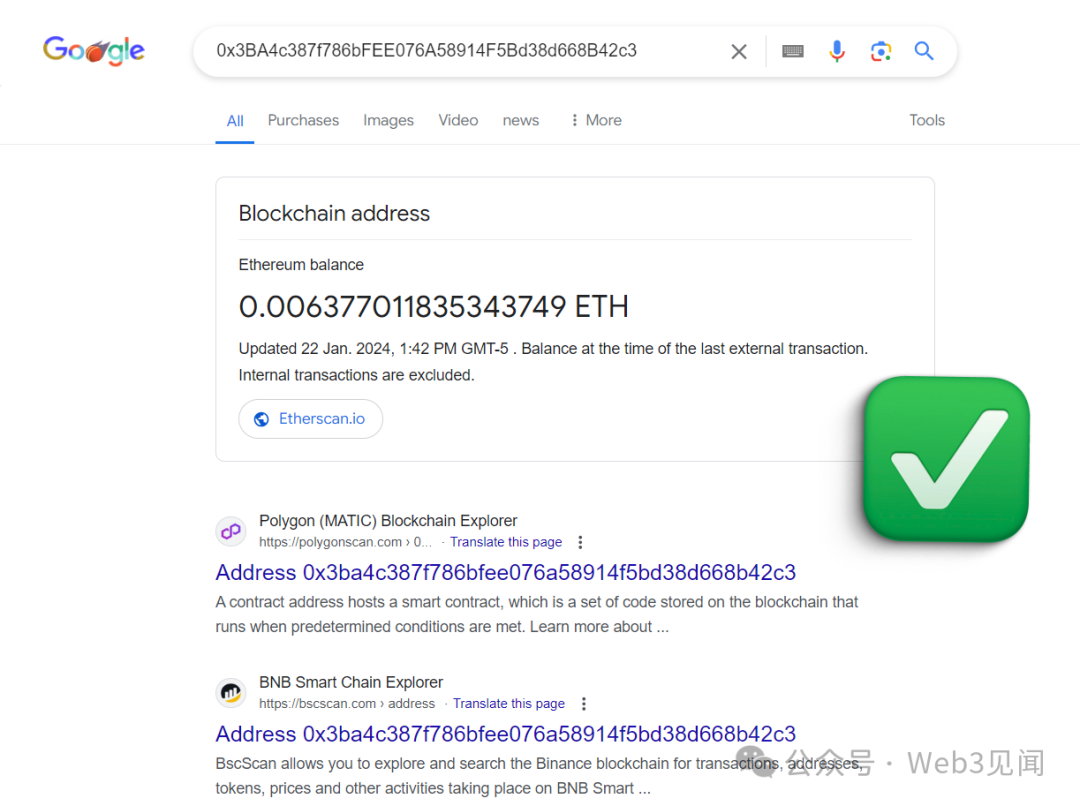

Checking Token Address in Google Search

If you search on the internet and cannot find a clear homepage, "white paper," or apparent use for the token, it is likely a scam. When you search for the token address, you should easily find links to a block explorer, official website, and white paper. If not, consider it a danger signal.

Also, note that Google ads are often free areas for fraudulent websites. Do not click on the top ads in Google search results. Make sure you visit the official website to avoid clicking on wallet cleaners or other hacker software.

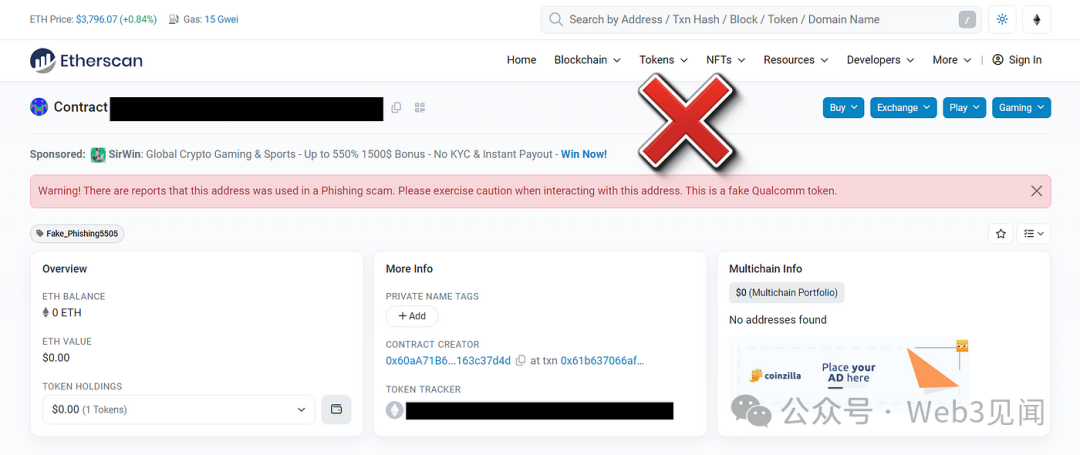

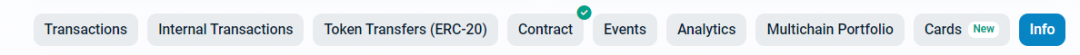

Checking in Explorer

Visit the block explorer of the selected chain and check if the source code has been verified. For example, on Ethereum's Etherscan block explorer, it should look like this. The code displayed below is unverified, which should be a clear warning signal. If the code is unverified, you may be dealing with a scam.

If you want to check tokens deployed on another network, use the following explorers:

Avalanche — https://basescan.org/

Solana — https://solscan.io/

Ton — https://tonscan.org/

BSC — https://bscscan.com/

Why don't scammers verify their code?

Because once the contract's source code is public, anyone can understand the intent behind the contract. Then they will see a ridiculous tax system or a method for developers to steal all your tokens.

Check the Comments Section

This is simple, but most block explorers usually have a comments section. In most cases, there are no comments, but if the project is a scam, you are likely to find a group of angry mobs in the comments section. So be sure to check. If someone calls it a scam, 99% of the time, it is a scam. If you have become a victim of such activity, do not hesitate to leave a comment.

When analyzing tokens, you can find the comments section in this line (example on Etherscan), but it is hidden for most tokens.

Check DappRadar Blacklist

DappRadar allows the community to help identify scam tokens. Once identified, you can add them to the token blacklist on GitHub.

Additionally, when researching a token, you can check the blacklist to see if your token is listed. If the token address is on the list, then the token is definitely a scam.

Check How Many Exchanges the Token is Listed On

If a token is only traded on a few decentralized exchanges (DEX), then it is almost certainly a scam. Listing on centralized exchanges requires KYC and additional trust, and the larger the exchange, the better the reputation of the listed tokens.

Does this mean that tokens listed only on decentralized exchanges are always scams? No. Some projects do not require a large volume of trading, and others may only offer tokens to Web3 users, not token traders.

Since most meme coins show significant gains before appearing on CEX, having a token on CEX is not a strict criterion for token analysis.

However, cryptocurrencies listed only on decentralized exchanges represent higher-risk investments.

Please find the English translation below:

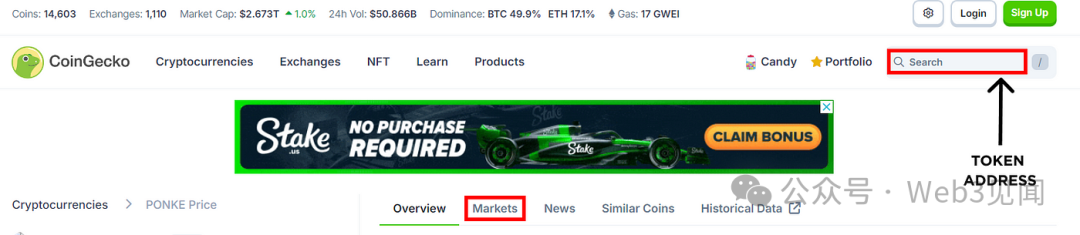

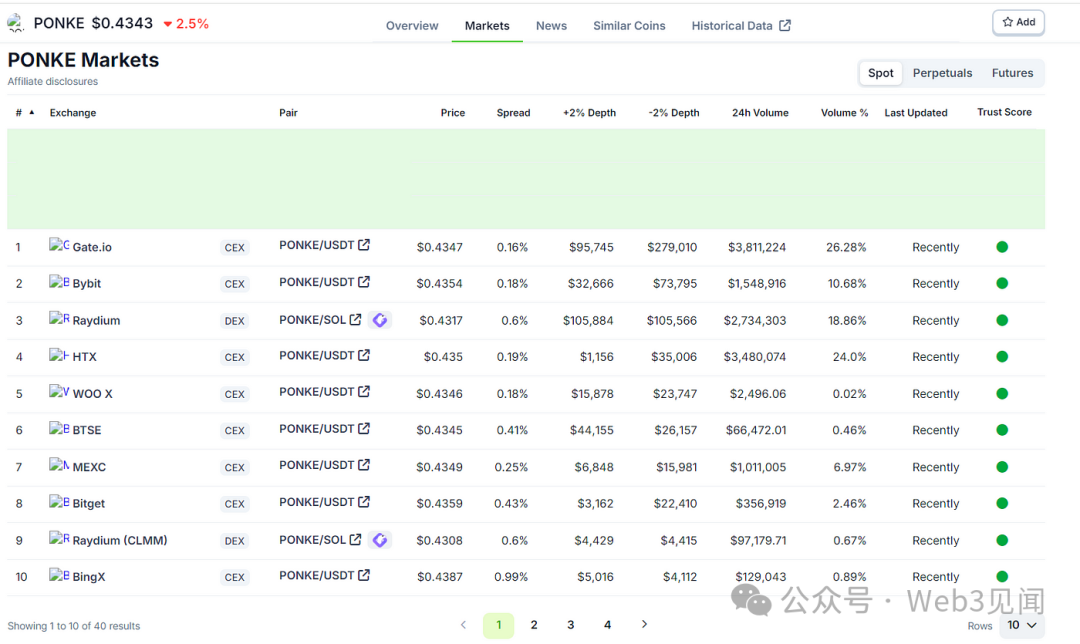

To find out which exchanges list the token, go to Coingecko, enter the token address in the "Search" bar, and then select "Markets":

If the token is listed on at least one CEX, it's a green signal. In this case, the token is listed on CEXs: Bybit, BingX, Bitget, Gate.io:

Checking Token Liquidity

Before investing in a token, you can check the overall demand and available liquidity. Checking the liquidity of a token on platforms like Uniswap V2 or other decentralized exchanges is very easy.

Liquidity refers to the amount of cryptocurrency or tokens locked in smart contracts that allow people to buy and sell assets through (decentralized) exchanges. If liquidity is below $100,000 or has significantly decreased, you are likely dealing with a scam.

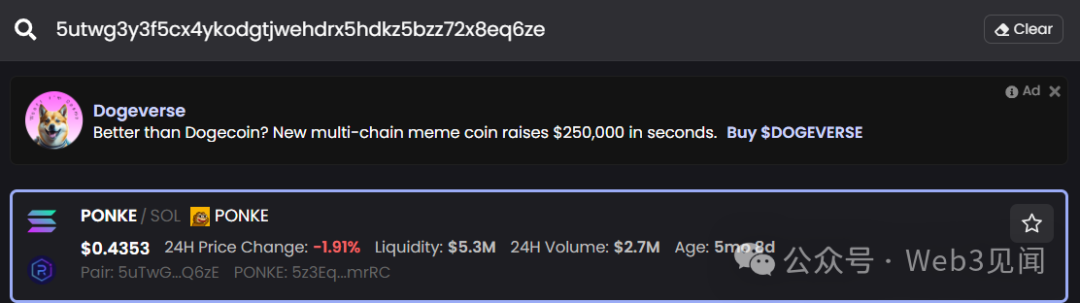

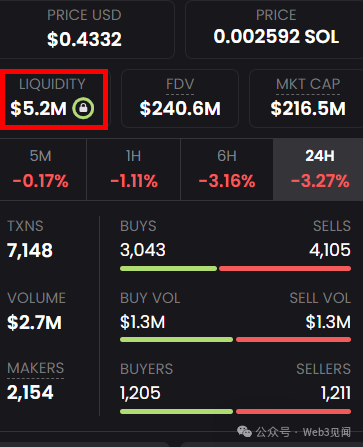

You can check the liquidity amount on well-known DexScreener, after entering the token contract, the liquidity amount can be seen in the middle right section:

If there is a lock symbol inside a green circle next to the liquidity amount, it indicates that the liquidity has been locked – another green flag for the project.

Additionally, considering the Fully Diluted Valuation (FDV) or market cap is important. The larger these numbers, the greater the amount of buying required for the token price to rise.

Good indicators for such tokens are liquidity amounts starting from $1 million, token age over 2 days, and a liquidity/FDV ratio of about 1:10.

Checking Third-Party Analysis Tools

Here are some token analysis tools:

Sniff Test – an automated audit of the token. The lower its score (out of 100), the higher the likelihood of the token being a scam.

Check for tokens on honey pots. Honey pots are smart contracts intentionally created with obvious software flaws. When attackers attempt to exploit the vulnerability, it triggers another hidden code, essentially attacking the attacker. Whether you intend to become a crypto hacker or not, always avoid using honey pots.

Understanding the Basics of DEXScreener

It records the current token price and helps you assess the real value of the token in real-time and identify major holders.

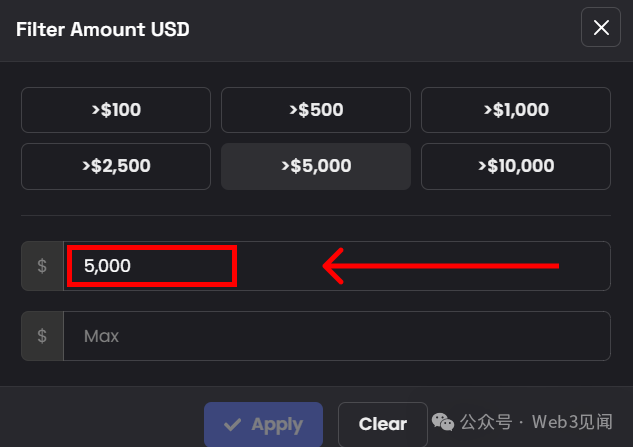

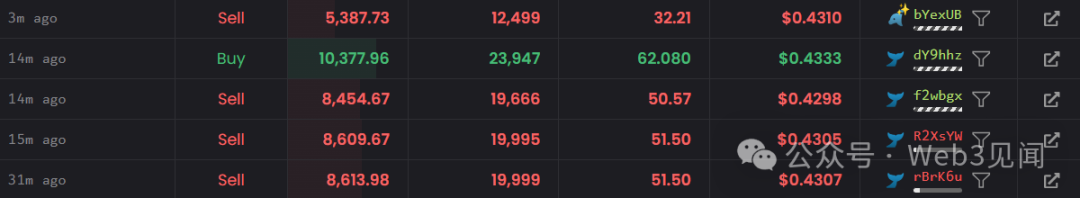

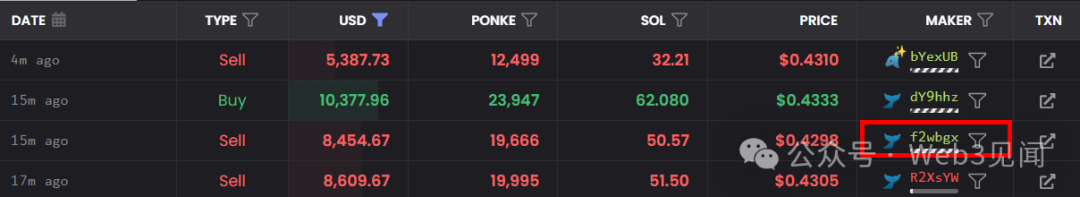

For example, to identify users who have recently purchased the token for over $5,000, click on "USD" at the bottom of DEXScreener:

Enter the amount $5,000 (optional, you can specify the maximum token purchase amount) and press "Enter" or "Apply":

After that, all buyers who have recently purchased the token for $5,000 or more will be displayed:

You can also view the purchase areas of certain wallets. To do this, click on the cup icon next to the desired wallet, and then view all purchase areas and token purchase levels on the wallet chart:

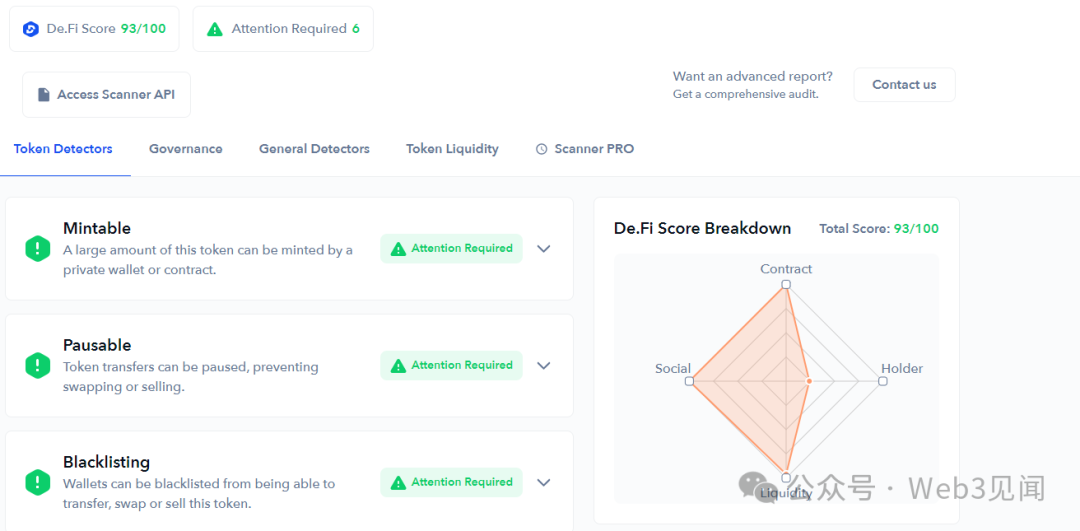

Using De.Fi Antivirus Software to Analyze Tokens

De.Fi is a project that recently distributed airdrops to its community, acting as an antivirus by evaluating token contracts based on various parameters and providing an estimated security balance for tokens:

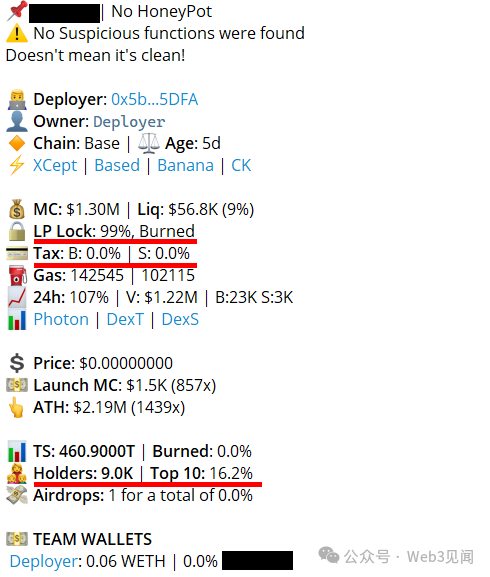

Using TTF Bot

This multi-functional bot can quickly and automatically analyze tokens, which is very convenient for token hunters. Pay special attention to the amount of locked or destroyed liquidity. If liquidity has been destroyed, it's a green signal.

Additionally, pay attention to the token's tax scale. If the tax is zero, it's a definite fact.

Also, consider the number of holders and their share of the supply:

If the top 10 holders hold over 30-50% of the token supply, the likelihood of encountering a scam is higher.

Conclusion

By using the above analysis tools, you can learn how to avoid scam tokens and profit from legitimate ones. However, always remember to do your own research (DYOR).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。