Author: Daniel Phillips and Stephen Gr

Translation: Plain Blockchain

For many years, the idea of public companies buying Bitcoin as a reserve was considered laughable. This top cryptocurrency was seen as too volatile, too niche, and not something any serious enterprise would accept.

However, this taboo has been completely shattered, and in recent years, many major institutional investors have been buying Bitcoin.

When cloud software company MicroStrategy purchased $425 million worth of Bitcoin in August and September 2020, the floodgates were opened. Other companies followed suit, including payment processing company Block and electric car manufacturer Tesla.

According to data from Bitcoin Treasuries, publicly traded companies holding Bitcoin now account for nearly 1.5% of the total 21 million Bitcoins.

1. MicroStrategy

MicroStrategy, a well-known business analytics platform, has made Bitcoin its primary reserve asset.

The company, which produces mobile software and cloud-based services, actively pursued the purchase of Bitcoin, acquiring millions of dollars' worth of cryptocurrency. As of May 2025, the company holds 214,400 Bitcoins, equivalent to $14.8 billion, exceeding 1% of the total Bitcoin supply.

MicroStrategy's CEO, Michael Saylor, has stated that he used to buy $1,000 worth of Bitcoin every second. During the company's Q1 2024 earnings call, Saylor claimed that the company's "Bitcoin strategy" had increased its performance in the business intelligence field by 10 to 30 times compared to its competitors, enterprise software companies.

Unlike other CEOs who typically avoid discussing personal investments, Saylor publicly disclosed that he personally holds 17,732 Bitcoins, currently valued at over $1.2 billion.

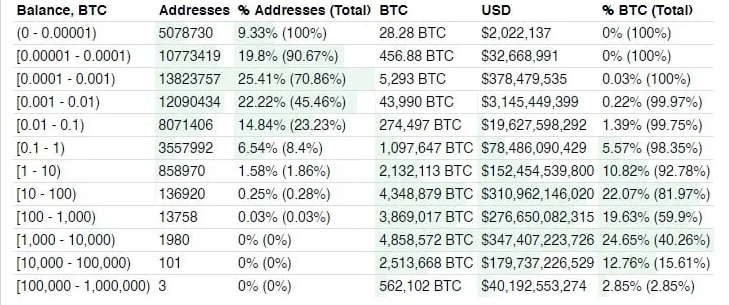

According to data from BitInfoCharts, if Saylor's Bitcoins were all stored in one address, this would make him one of the top 101 Bitcoin holders. This represents a significant shift in attitude for the CEO of MicroStrategy, as he had previously claimed in 2013 that Bitcoin's days were numbered.

During the company's Q1 2024 earnings call, Saylor stated, "We are in the early stages of institutions rapidly adopting Bitcoin as a digital asset." He added that in the future, Bitcoin would not compete with other crypto assets, but rather with gold, art, stocks, real estate, bonds, and other forms of store of value in wealth creation, wealth preservation, and capital markets.

2. Marathon Digital Holdings Inc.

Unsurprisingly, Bitcoin mining company Marathon Digital is also a significant holder of Bitcoin, with 17,631 Bitcoins in its corporate reserves (valued at approximately $1.23 billion as of May 2024). The company aims to become "one of the largest Bitcoin mining operators in North America, operating at the lowest energy cost." Prior to transitioning to crypto mining, the company was initially a patent holding company (often referred to as a "patent troll").

As of May 2024, Marathon Digital operates around 240,000 Bitcoin mining machines, capable of producing 29.9 EH/s of hash rate, with an average operational hash rate of 21.1 EH/s.

The company noted that after the Bitcoin halving in 2024, it accelerated its growth plans to "mitigate the impact" and expressed its hope to double its mining operations in 2024.

However, the company failed to meet its revenue targets for Q1 2024, citing reasons such as "unexpected equipment failures, transmission line maintenance, and weather-related restrictions at Garden City and other locations higher than expected."

3. Tesla

Electric car manufacturer Tesla joined the ranks of companies holding Bitcoin in December 2020, disclosing in an SEC filing that it had invested a total of $1.5 billion in Bitcoin.

In Q1 2021, Tesla sold 10% of its Bitcoin holdings; according to CEO Elon Musk, this was to demonstrate Bitcoin's liquidity as an alternative to holding cash.

Tesla's Bitcoin investment came after months of speculation following Musk's tweets about Bitcoin. Towards the end of 2020, MicroStrategy's Saylor expressed willingness to share his "strategy" for Bitcoin investment with Musk and suggested that Tesla's foray into Bitcoin could bring "a $100 billion benefit to Tesla shareholders."

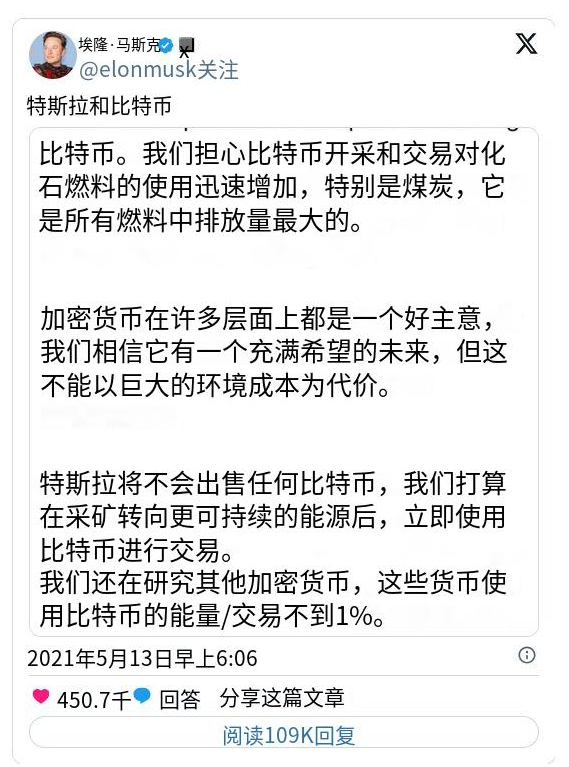

However, Musk and Tesla's relationship with Bitcoin has been volatile. After announcing that Tesla would accept Bitcoin as payment for its products and services in March 2021, just two months later, Musk suddenly announced that the company would no longer accept Bitcoin as a form of payment.

Musk cited the "rapidly increasing use of fossil fuels for Bitcoin mining and transactions," leading Tesla to announce that it would not sell any of its Bitcoin holdings and would consider using it for transactions again once mining "transitions to more sustainable energy." He later clarified that once miners use 50% clean energy, the company would resume using Bitcoin for transactions.

In July 2022, Tesla revealed in its Q2 2022 quarterly update that it had sold "approximately 75%" of its Bitcoin holdings, with its balance sheet showing total digital asset sales of $936 million. During a call with analysts, Musk stated that the company did this to bolster its cash position to address the uncertainty of COVID lockdown measures. At the time, he also added that the company "would be willing to increase our Bitcoin holdings in the future, so this should not be seen as some sort of judgment on Bitcoin."

According to data from bitcointreasuries.org, as of May 2024, Tesla held 9,720 Bitcoins in its investment portfolio (valued at approximately $677 million at current prices). The company has maintained its Bitcoin position, with its Q1 2024 balance sheet showing an estimated value of $184 million as of Q3 2023 and Q1 2024.

Musk has also been an avid supporter of Dogecoin, and Tesla allows the use of Dogecoin to purchase some goods.

4. Hut 8 Mining Corp

Bitcoin mining company Hut 8 holds 9,109 Bitcoins, valued at approximately $644 million at current prices.

The company went public on the Nasdaq Global Select Market in June 2021, with the stock symbol HUT. The company's SEC filing stated its commitment to increasing shareholder value by increasing its Bitcoin holdings and value.

The company also explained that it generates fiat currency income by utilizing its self-mined and held Bitcoin reserves through revenue account arrangements with leading digital asset prime brokerage firms.

In November 2023, the company merged with another Bitcoin mining company, US Bitcoin, and the merged company touts itself as an "energy infrastructure company focused on Bitcoin mining and data centers." These mining centers are located at six sites in Alberta, Texas, and New York, with reported self-mining capacity of 7.5 EH/s.

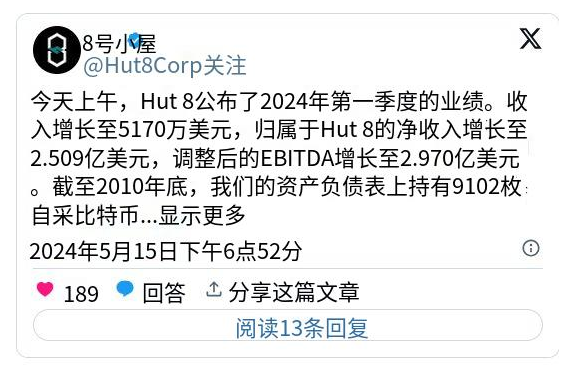

In its Q1 2024 performance report, the company reported $51.7 million in revenue for the quarter, a 231% year-over-year increase.

5. Riot Blockchain, Inc.

Another cryptocurrency mining company in the United States, Riot Blockchain, holds 9,084 Bitcoins, valued at $643 million at today's prices.

The company's valuation has surged from less than $200 million in 2020 to over $6 billion in 2021, and this Nasdaq-listed company has been actively expanding. In April 2021, the company spent $650 million to acquire a one-gigawatt Bitcoin mining facility in Rockdale, Texas; the company described this purchase as a "transformative event," making it "the largest publicly traded Bitcoin mining and hosting company in North America measured by total developed capacity."

In April 2022, Riot announced further plans to build an additional one-gigawatt mining facility in Navarro County, Texas. After the cryptocurrency market crash in 2022, CEO Jason Les told Yahoo Finance that Bitcoin mining would "continue to thrive in the United States," stating that "despite the diminished economic benefits of Bitcoin mining, there are still huge opportunities here."

By January 2023, the company rebranded as Riot Platforms, aiming to diversify its business model as the cryptocurrency mining industry faces ongoing crypto winter and rising energy prices.

In early 2024, the company warned shareholders that it "cannot guarantee" the upcoming Bitcoin halving will have a positive impact on its profitability. In June, the company became a target of short-selling firm Kerrisdale, which claimed that "Bitcoin mining is one of the dumbest business models we've encountered in our 15 years of shorting," but the company's stock price quickly recovered after an initial drop following the report.

6. Coinbase Global, Inc.

Undoubtedly, the most well-known cryptocurrency company on this list is the cryptocurrency exchange platform Coinbase, which had a landmark direct listing on Nasdaq in April 2021.

Before going public, in February 2021, Coinbase revealed it held $230 million worth of Bitcoin on its balance sheet. By June 2024, it holds 9,000 Bitcoins in its reserves, valued slightly below $642 million.

7. Galaxy Digital Holdings

Focused on cryptocurrency, the business bank Galaxy Digital Holdings holds 8,100 Bitcoins. This is a decrease from the 16,400 Bitcoins it held in July 2022, although the growth in Bitcoin prices means its Bitcoin holdings were valued at nearly $578 million in June 2024, compared to a value of $357 million for its reserves two years prior.

Galaxy Digital Holdings was founded by Michael Novogratz in January 2018 and has established partnerships with cryptocurrency companies including Block.one and BlockFi. Not surprisingly, Novogratz is a staunch supporter of Bitcoin, stating in March 2024 that Bitcoin will never drop below $50,000 and predicting a rise to $100,000 by the end of the year.

Galaxy Digital is one of the companies managing spot Bitcoin exchange-traded funds (ETFs) in the United States, which received historic approval from the U.S. Securities and Exchange Commission (SEC) in January 2024.

8. Block, Inc.

In October 2020, Block, Inc. ignited institutional investment in Bitcoin alongside Tesla, investing $50 million in Bitcoin at the time. By June 2024, the company holds 8,027 Bitcoins, valued at approximately $573 million. This may not come as a surprise, as the company's CEO, Jack Dorsey, is a vocal advocate for Bitcoin (even running his own Bitcoin node).

At the time of the initial investment, the company described it as "part of Square's ongoing commitment to Bitcoin," noting that the company plans to continuously evaluate its total investment in Bitcoin based on other investment opportunities.

The company has made investments in Bitcoin technology, launching its own Bitcoin wallet and developing Bitcoin mining ASIC chips. In April 2024, its payment services subsidiary Square announced that it would enable businesses using its Cash App to automatically convert a portion of their daily sales into Bitcoin.

In May 2024, the company announced that it would reinvest 10% of the profits from Bitcoin-related products and services into Bitcoin in a dollar-cost averaging (DCA) manner for its buying program.

The company changed its name from Square to Block in December 2021, apparently a reference to the blockchain technology on which Bitcoin is based. This rebranding came a week after Dorsey announced his resignation as CEO of Twitter, focusing on the payments company thereafter.

9. CleanSpark

U.S. Bitcoin mining company CleanSpark holds 6,154 Bitcoins, valued at approximately $439 million as of June 2024.

Before the Bitcoin halving in 2024, the company expanded its operations and acquired three Bitcoin mining facilities in Mississippi for $198 million, adding 2.4 EH/s of mining capacity. The company also added a third facility in Dalton, Georgia, adding an additional 0.8 EH/s of mining capacity.

In June 2024, CleanSpark revealed that it mined 417 Bitcoins in May and claimed to have "exceeded industry expectations" in the first full production month after the halving. The company also stated plans to further expand to a location in Wyoming in the "coming days."

10. Bitcoin Group SE

Based in Germany, venture capital company Bitcoin Group SE ranks lower on this list, holding a relatively smaller 3,830 Bitcoins, valued at $275 million at current prices.

The company's investments include the cryptocurrency trading platform Bitcoin.de and Futurum Bank. These two companies merged in October 2020, forming "Germany's first cryptocurrency bank." This move came after the German parliament decided to allow banks to sell and store cryptocurrencies. Bitcoin Group SE's Managing Director Marco Bodewein emphasized the opportunity to introduce institutional investors to the "high returns and security features" of cryptocurrencies at this bank.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。