Author: CCN, Giuseppe Ciccomascolo

Translation: Felix, PANews

Key Points:

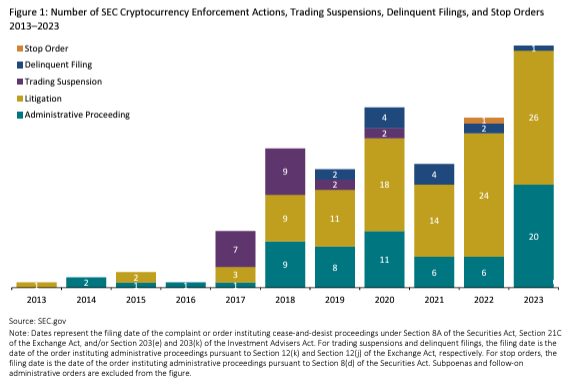

- The U.S. Securities and Exchange Commission (SEC) is increasing its enforcement efforts against participants in the crypto market, taking a record 46 actions in 2023.

- Fraud and unregistered securities issuance are the most common charges, especially against ICOs.

- The crypto community is awaiting the outcome of the lawsuit against Ripple.

Enforcement of cryptocurrency remains a top priority for the U.S. SEC. Under the leadership of Chairman Gary Gensler, the commission has intensified its enforcement efforts against cryptocurrency companies and individuals. Regulatory actions related to cryptocurrency in 2023 increased by 53% compared to 2022.

However, the attention of the crypto community is focused on the ongoing lawsuit between the U.S. SEC and Ripple, especially after the latest developments and two significant victories for Ripple in court.

SEC Enforcement Actions Against Participants in the Crypto Space

In 2023, the SEC initiated 46 enforcement actions related to cryptocurrency, a 53% increase from 2022. As of the end of 2023, the total fines imposed on participants in the crypto market amounted to approximately $2.89 billion, with $281 million coming from settlements reached that year.

Number of SEC cryptocurrency enforcement actions, trading suspensions, delinquent filings, and cease-and-desist orders from 2013 to 2023 l Source: SEC

The most common charges involve fraud and unregistered securities issuance. Of the 46 actions in 2023, 57% involved fraud, 61% involved unregistered securities issuance, and 37% involved both. Additionally, 37% of the actions were related to Initial Coin Offerings (ICOs). It is worth noting that in 2023, the SEC also took two enforcement actions related to NFTs.

In 2023, the proportion of enforcement actions targeting individuals rather than companies decreased from 50% in 2022 to 39%. Furthermore, in administrative litigation, 52% of respondents admitted to self-reporting, cooperating, or making remedial efforts, higher than the average of 44% from 2013 to 2022. In two administrative litigations, defendants' remedial efforts and cooperation with SEC staff did not result in fines.

Enforcement Actions Against Crypto Assets and Networks

Kraken

Date of Lawsuit: November 20, 2023

Case Description: Accused of operating the Kraken cryptocurrency trading platform as an unregistered securities exchange, broker, dealer, and clearing agency. Kraken agreed to cease offering or selling securities through its cryptocurrency collateral services or staking programs and to pay a civil penalty of $30 million.

Status: Resolved

Celsius Network

Date of Lawsuit: July 13, 2023

Case Description: Celsius and its former CEO Alex Mashinsky were accused of violating federal securities laws by failing to register the issuance and sale of Celsius's crypto lending product, the Earn Interest Program. Celsius is cooperating with the SEC and has agreed to the relief measures requested in the lawsuit.

Status: Ongoing

Coinbase

Date of Lawsuit: June 6, 2023

Case Description: The platform was accused of operating its cryptocurrency asset trading platform as an unregistered national securities exchange, broker, and clearing agency, and failing to register the issuance and sale of its cryptocurrency collateral or staking service plan.

Status: Ongoing

Binance and CZ

Date of Lawsuit: June 5, 2023

Case Description: The U.S. SEC filed a lawsuit in a federal court in Washington, D.C., listing 13 charges against Binance and CZ. The charges included Binance artificially inflating its trading volume, transferring customer funds, failing to restrict U.S. customer access to its platform, and misleading investors in its market monitoring. The SEC also pointed out that CZ secretly controlled customer assets, commingled and transferred investor funds. Binance agreed to forfeit $2.5 billion and pay a criminal fine of $1.8 billion, totaling $4.3 billion in fines. CZ was sentenced to 4 months in prison.

Status: Resolved

Justin Sun and His Three Wholly-Owned Companies

Date of Lawsuit: March 22, 2023

Case Description: The SEC accused Justin Sun and his companies of offering and selling the Tronix (TRX) and BitTorrent (BTT) crypto asset securities without registration, with some celebrities also implicated. Only DeAndre Cortez Way and Austin Mahone paid fines to settle this case.

Status: Ongoing

Terraform Labs and Do Kwon

Date of Lawsuit: February 16, 2023

Case Description: They were accused of orchestrating a multi-billion dollar fraud involving algorithmic stablecoins and other crypto asset securities.

Status: Ongoing

Avraham Eisenberg

Date of Lawsuit: January 19, 2023

Case Description: Avraham Eisenberg was accused of attacking the crypto asset trading platform Mango Markets by manipulating the MNGO token. Avraham Eisenberg is currently detained pending trial.

Status: Ongoing

Nexo

Date of Lawsuit: January 19, 2023

Case Description: Nexo was accused of failing to register the issuance and sale of its crypto asset lending product, the Earn Interest Product (EIP). To resolve the SEC's charges, Nexo agreed to pay a $22.5 million fine.

Status: Resolved

Caroline Ellison and Zixiao (Gary) Wang

Date of Lawsuit: December 21, 2022

Case Description: Alameda CEO Caroline Ellison and former FTX Trading CTO Zixiao Gary Wang were accused of participating in a years-long fraud scheme against FTX investors.

Status: Ongoing

Thor Technologies, Inc. and David Chin

Date of Lawsuit: December 21, 2022

Case Description: The SEC accused Thor Technologies and founder David Chin of offering and selling crypto assets designated as "Thor Tokens" without registration. The court ordered Thor Technologies to refund $744,555 and pay $158,638.06 in prejudgment interest, and ordered the company and David Chin to each pay a $150,000 fine.

Status: Resolved

SBF

Date of Lawsuit: December 13, 2022

Case Description: The regulatory agency accused Samuel Bankman-Fried (SBF) of devising a scheme to defraud FTX Trading Ltd. (FTX) equity investors. The case concluded with SBF being sentenced to 25 years in prison.

Status: Resolved

Kim Kardashian

Date of Lawsuit: October 3, 2022

Case Description: The social media influencer was accused of promoting crypto asset securities provided and sold by EthereumMax on social media without disclosing her compensation for the promotion. Kardashian agreed to settle, paying a $1.26 million fine.

Status: Resolved

Bloom Protocol

Date of Lawsuit: December 13, 2022

Block Bits

Date of Lawsuit: April 28, 2022

Case Description: The SEC accused Block Bits of raising nearly $1 million from over 20 investors based on false statements about an automated digital asset trading bot that had never been operational. The company paid a fine for this.

Status: Resolved

BlockFi

Date of Lawsuit: February 14, 2022

Case Description: BlockFi was accused of failing to register the issuance and sale of its crypto lending products. BlockFi agreed to cease offering or selling BIAs in the U.S.

Status: Resolved

Poloniex

Date of Lawsuit: August 9, 2021

Case Description: Poloniex agreed to pay over $10 million to settle charges of operating an unregistered online digital asset exchange.

Status: Resolved

Gregory Keough, Derek Acree, and their company Blockchain Credit Partners

Date of Lawsuit: August 6, 2021

Case Description: They unlawfully issued and sold securities through the DeFi market from February 2020 to February 2021. The defendants agreed to a cease-and-desist order, including disgorgement of a total of $12,849,354 in illegal gains from Keough and Acree, and a fine of $125,000.

Status: Resolved

Loci Inc. and CEO John Wise

Date of Lawsuit: June 22, 2021

Case Description: From August 2017 to January 2018, Loci and Wise raised $7.6 million from investors by offering and selling a digital token called "LOCIcoin." They paid a civil penalty of $7.6 million.

Status: Resolved

Tierion

Date of Lawsuit: December 23, 2020

Case Description: According to the U.S. Securities and Exchange Commission, Tierion raised approximately $25 million in July 2017 through the sale of "Tierion Network Tokens" (TNT). Tierion paid a fine of $250,000.

Status: Resolved

Virgil Capital

Date of Lawsuit: December 22, 2020

Case Description: The U.S. Securities and Exchange Commission froze assets of Stefan Qin for alleged securities fraud. Stefan Qin was accused of defrauding investors in the Virgil Sigma Fund LP since 2018, misrepresenting the fund's strategy, and using the proceeds for personal and undisclosed high-risk investments.

Status: Ongoing

Ripple

The legal dispute between Ripple and the SEC began in December 2020. The SEC accused Ripple of selling XRP as unregistered securities, raising over $1.3 billion. After years of litigation, the case entered the trial phase in April 2024.

Ripple's three partial victories in court last year brought optimism to the company. These victories also led to an increase in the price of XRP. If Ripple prevails, the value of the asset may be positively impacted.

Recently, after a relatively quiet period, the battle over data access rights has resumed. Ripple recently filed a motion to keep certain financial documents and sales data related to the SEC's allegations confidential. The SEC opposed the motion, stating that this information is crucial to the case.

However, Ripple argues that historical data is irrelevant due to changes in XRP sales. Now, the XRP community eagerly awaits Judge Torres's rulings on several motions, including the final judgment in the remedial phase. Despite the case lasting nearly four years, it is far from over.

Related Reading: FTX Settles with the IRS, Faces Opposition to Compensation Plan Restructuring

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。