Author: SWASTIK GARG

Translation: DeepTechFlow

In today's reading, we will delve into Hyperliquid, including:

- The current status of perpetual exchanges

- Hyperliquid Chain

- Hyperliquid improvement proposals

- Overview of the points program

- $PURR - Memecoin

- Analysis of success factors

- Data statistics

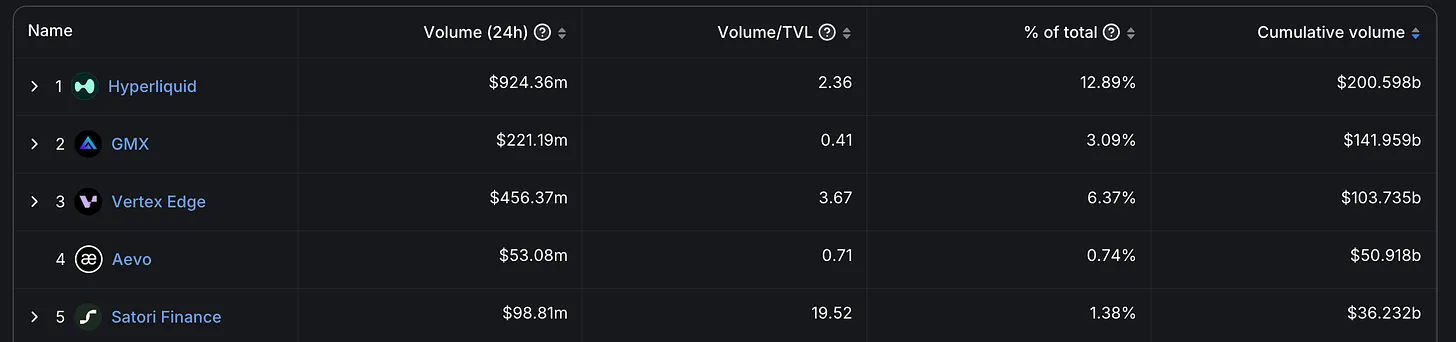

Perpetual contract trading has been a very successful product in the cryptocurrency market. Centralized exchanges handle approximately $150 billion in daily trading volume, highlighting the widespread adoption of perpetual contracts. In the decentralized perpetual contract market, according to Defillama's data, the daily trading volume is approximately $7-8 billion, accounting for about 5% of the trading volume of centralized exchanges.

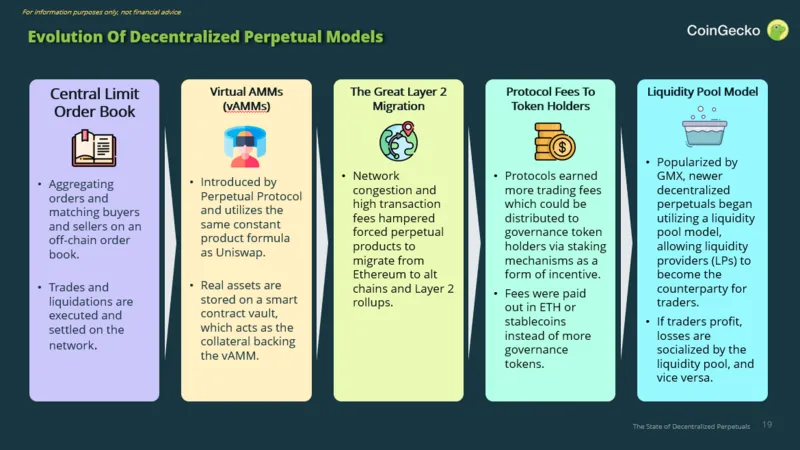

Recently, especially this year, we have observed higher trading volumes compared to previous cycles. In the world of blockchain, this began with dYdX in the DeFi summer, followed by Perpetual Protocol and GMX in 2022. Initially, it was believed that decentralized exchanges (DEX) had fully evolved, but a shift began to emerge in the mid-2023; new perpetual contract DEXs took the lead in the top five. Among them, Hyperliquid contributed to over 10% of the daily trading volume of on-chain perpetual contracts.

Perpetual decentralized exchanges (Perpetual DEX) support perpetual swaps, which are a derivative product. Perpetual swaps are a native concept in crypto, derived from futures contracts in traditional markets and have undergone several modifications. Essentially, it allows users to speculate on asset prices without holding equity.

From the above figure, it can be seen that there have been many evolutions in the perpetual space. In this cycle, the application chain theory has received more attention.

Current landscape of decentralized perpetual contract exchanges

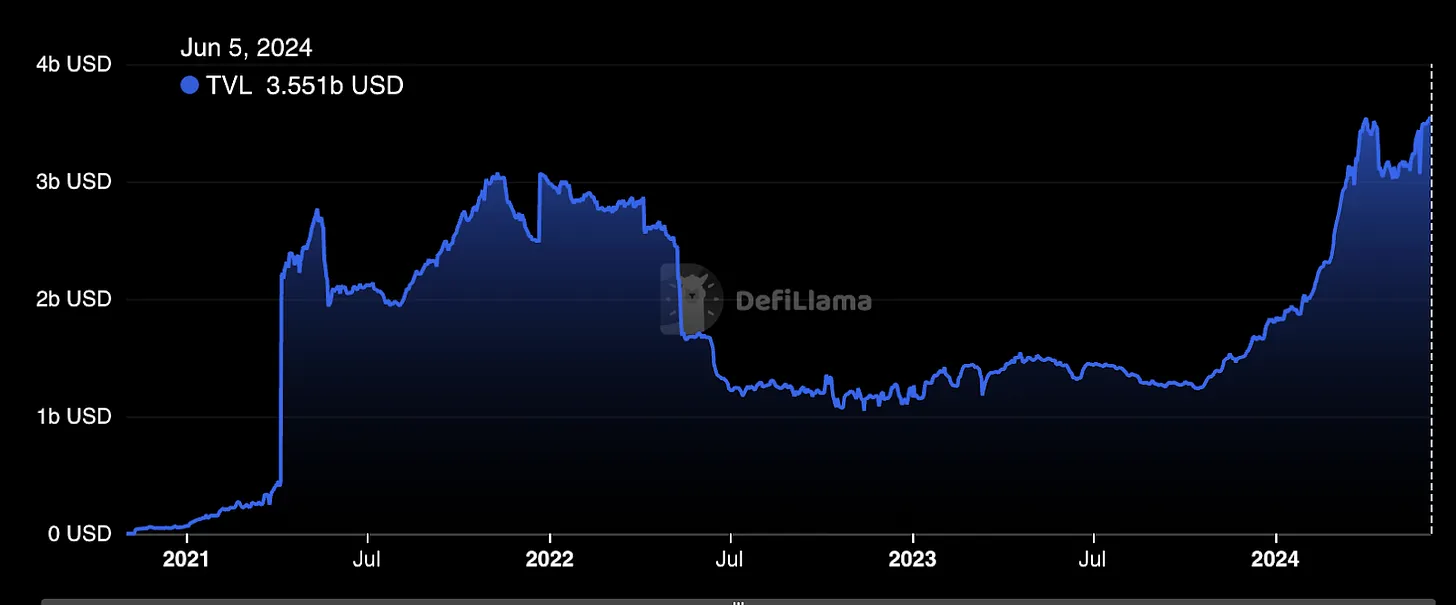

As of June 5, 2024, the total TVL of Perp DEX as a category is $3.5 billion. This chart helps us understand the interest in trading perpetual contracts over a period of time. It also reflects the cryptocurrency cycle well; we can observe that from mid-2021 to mid-2022, the TVL hovered around $3 billion. It declined in 2023, reflecting the bear market phase, and in 2024, the market began to recover, surpassing the previous cycle's peak.

If we look at the top 10 TVL rankings of perpetual exchanges, we can observe that GMX and dYdX have similar TVLs, each close to $500 million. Following closely are Jupiter, Hyperliquid, and Drift, each with approximately $400 million. These five exchanges occupy the majority of the market share, and after Drift, the TVL noticeably drops by one-third.

In-depth understanding of Hyperliquid

The Hyperliquid team has explored various trading mechanism models, including MM, RFQ, and oracle-based systems. Their analysis concluded that the order book is the best long-term solution on a larger scale. The second issue involves which blockchain to use for the application. The team evaluated existing environments such as Solana and Arbitrum, and after research, they concluded that a new chain needed to be built from scratch to address these issues.

Hyperliquid Chain

The vision of Hyperliquid is to develop an open financial system on-chain. The core of this ecosystem is Hyperliquid L1. Every interaction, whether it's orders, cancellations, or settlements, is executed on-chain.

The core idea of Hyperliquid is to achieve true decentralization. It ensures consistent transaction order through the Tendermint Byzantine Fault Tolerance (BFT) consensus mechanism, as long as two-thirds (weighted by staked/delegated tokens) of validators remain honest. It supports up to 20,000 operations per second.

The architecture of Hyperliquid is designed from scratch, allowing full-stack optimization independent of Cosmos SDK. The core state transition logic of L1 is developed using Rust and connected to Tendermint through an ABCI server. The network is secured through a proof-of-stake (PoS) mechanism. Staking and penalty functions are similar to Cosmos, and more details will be announced after the release of the native token.

Hyperliquid plans to adopt HyperBFT, a new consensus algorithm, to replace Tendermint. Currently, the implementation of HyperBFT is in the final testing stage.

Key improvements brought by HyperBFT:

- Currently, Tendermint supports up to 20,000 orders per second. With HyperBFT, the expected throughput will increase by 100 times, but in reality, it's around 200,000 orders per second.

- Unlike Ethereum and the current Tendermint, HyperBFT can continue to order transactions without waiting for the current block hash to execute.

- The block generation speed depends on the communication speed of validators reaching the quorum, which will improve and stabilize confirmation latency.

Native EVM support

Hyperliquid L1 will provide native EVM support and integrate with native L1 components (such as HIP-1 assets, spot trading, perpetual contract trading, and other DeFi primitives). The team believes this is an effective strategic approach to scaling L1. This integration will provide an advantage to builders who wish to develop on EVM, allowing them to deploy smart contracts using familiar EVM tools.

HIP-1 assets will undergo atomic transfers with their corresponding ERC-20 contracts, demonstrating the composability of L1. This feature makes Hyperliquid L1 the best platform for developing, launching, and trading tokens.

Bridging to Hyperliquid L1

HyperLiquid will be onboarded through Arbitrum. HyperLiquid operates a native bridge, protected by the same set of validators as HyperLiquid L1. Deposits are confirmed by L1 validators' signatures, and withdrawals are custodied on L1, with each withdrawal being signed by validators as a separate L1 transaction. Both deposits and withdrawals require approval from two-thirds of the staked weight to settle. During the withdrawal process, users do not need to pay gas fees on Arbitrum. Instead, HyperLiquid charges a fixed fee of 1 USDC.

In the event of malicious withdrawals that do not match L1, a dispute period will be initiated, during which the bridge can be locked. Unlocking the bridge requires cold wallet signatures from two-thirds of the staked weight validator set. The bridging and its integration with L1 staking mechanisms have been audited by Zellic.

Perpetual Exchange

Hyperliquid perpetual contracts are derivative products with no expiration date. Their prices are regulated by the funding rate mechanism to closely track the price of the underlying asset. The funding rate is recalculated every eight hours and is paid at a rate of one-eighth per hour, with a maximum cap of 4% per hour.

Hyperliquid offers a single margin option for these contracts: USDC margin, linear contracts priced in USDT. This means that the contracts are priced in USDT, while collateral is held in USDC. This setup enhances the convenience and liquidity of trading, eliminating the need for currency conversion, essentially treating these contracts as quanto contracts, where the profit and loss in USDT is calculated in USDC.

Exchange Order Book

Hyperliquid's order book is on-chain, and orders are placed in multiples of tick size and lot size. Orders follow a price-time priority system. Available order types include market orders, limit orders, stop market orders, and stop limit orders.

Margin

Traders on Hyperliquid have two margin options: cross margin and isolated margin. Cross margin is the default setting, allowing collateral to be shared across all positions, maximizing capital efficiency. Isolated margin restricts collateral to specific assets, protecting other positions from being affected by their liquidation.

Oracle

Validators play a crucial role in maintaining market integrity. The Hyperliquid oracle publishes the price of each perpetual asset every three seconds, which is used to determine the funding rate. Each validator calculates the spot oracle price by considering the weighted median prices from multiple exchanges—Binance, OKX, Bybit, Kraken, Kucoin, Gate IO, and MEXC, with weights of 3, 2, 2, 1, 1, 1, and 1, respectively.

The final oracle price used for liquidation is the weighted median of the prices submitted by each validator, with contributions weighted by their staked weight.

Liquidator Treasury

The liquidator treasury is crucial in the liquidation process on Hyperliquid. It liquidates positions below the maintenance margin and controls its margin and related positions.

Insurance Fund

As the name suggests, the insurance fund acts as a safety net. It is used to compensate for any potential user losses in the event of any platform failures that could lead to user losses. It is funded by collecting a portion of trading fees. This practice is also adopted by centralized exchanges.

Fees

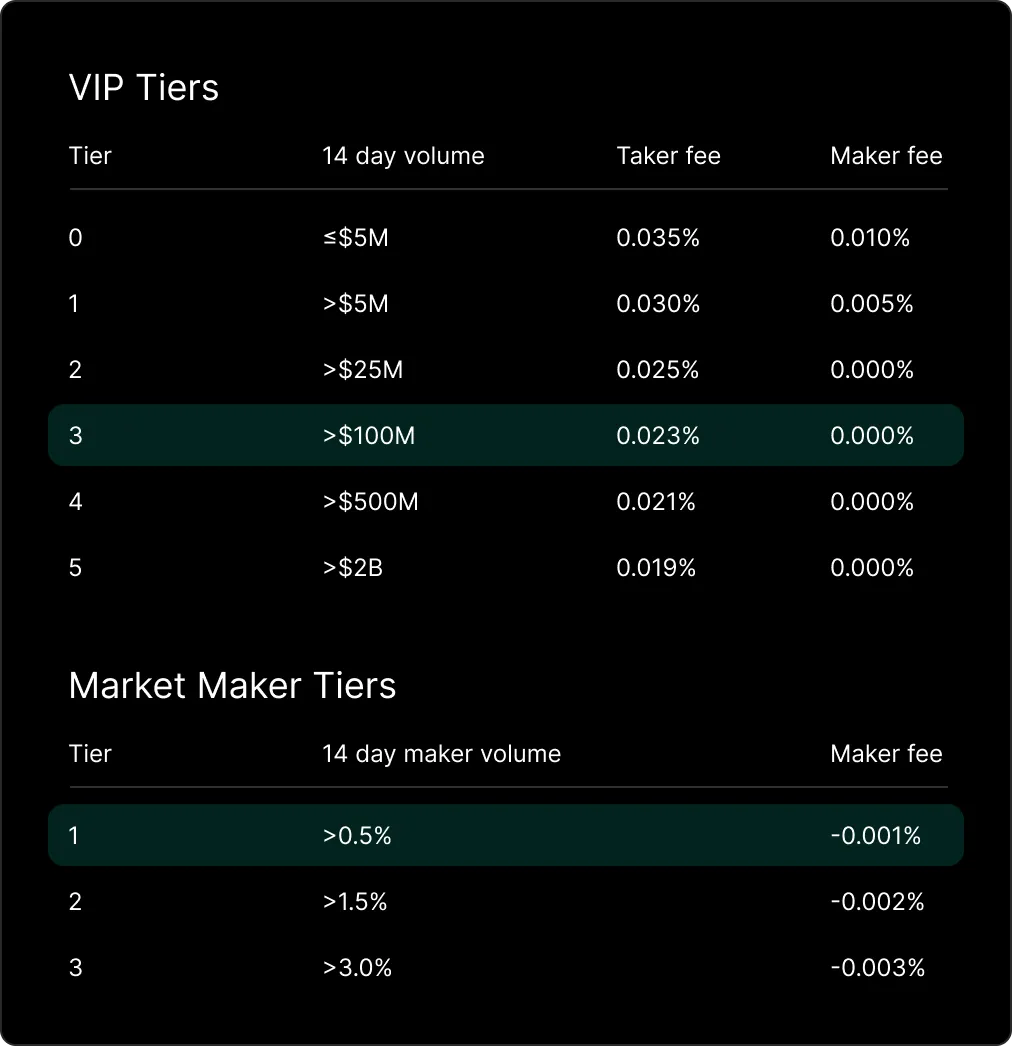

At Hyperliquid, all fees are allocated to the community, including HLP and the insurance fund. Referrers earn 10% of the trading fees from users they refer.

This image clearly helps in understanding the fees.

Sub-products

Index Perpetual Contracts

These contracts offer a new way by tracking indices derived from formulas. They are similar to traditional perpetual contracts. Users can speculate on a basket of assets through these contracts. There are two contracts available for trading: NFTI and FRIEND.

NFTI-USD

It represents an index of top NFT collections such as Bored Ape Yacht Club, Mutant Ape Yacht Club, Azuki, DeGods, Pudgy Penguins, and Milady Maker. The index is the three-minute EMA of the total floor price. The total floor price is the sum of the floor prices of each collection, with BAYC divided by 10. The floor price is calculated by aggregating OpenSea and Blur.

FRIEND-USD

Friend-USD is the first index perpetual contract listed on Hyperliquid, based on the social app Friendtech. Friendtech converts users' influence into a tokenized version called Key, which users can trade. Its core audience is crypto Twitter, where prominent CT users create profiles and trade Key with each other. The index is rebalanced every two weeks and includes the top 20 profiles on Friend.tech. Selection criteria include price, at least 5000 Twitter followers, and filtering out outliers in trading activity and holder count. FRIEND has recently been delisted.

Uniswap Perpetual Contracts

These perpetual contracts use Uniswap V2 or V3 AMM prices as the underlying spot asset. These contracts are limited to isolated margin only, meaning cross margin is not allowed. The Uniswap pool price is always converted to the USDT price based on CEX oracle prices, covering tokens such as RLB, Unibot, and others.

Introduction to Hyperp

Hyperps trade like perpetual contracts but do not require underlying spot or index oracle prices. Hyperps are used to discover the price of pre-listed tokens about to be listed. They have been widely used in this cycle, initially launched by Binance.

The operation of Hyperps is similar to regular perpetual contracts, with the difference being that the external spot/index oracle prices are replaced by an 8-hour exponential weighted moving average of the last minute's mark price. When the pre-listed token officially starts spot trading on centralized exchanges like Binance and Bybit, the Hyperp converts to a normal USD perpetual contract.

Hyperliquid Market Making - HLP

The Hyperliquid team recognized the challenge of guiding liquidity in the early stages of the project and believed that the best solution was to open market making to users. Previously, the team handled market making in its closed alpha stage.

The introduction of the Hyperliquidity Provider (HLP) treasury is at the core of Hyperliquid's market making strategy. It allows anyone to contribute liquidity and share in the profits and losses. Importantly, HLP does not charge fees and distributes profits and losses proportionally to each contributor's share in the treasury. Professional market makers can also participate in Hyperliquid using their SDK.

The market making strategy used by Hyperliquidity Provider (HLP) involves calculating fair prices based on tick data from Hyperliquid and major centralized exchanges. This fair price guides the treasury's actions, including market making and taking strategies, to provide continuous and profitable liquidity in all listed assets. The strategy is executed off-chain, but anyone can track positions, orders, trade history, deposits, and withdrawals in real-time through a browser.

Hyperliquid Improvement Proposals - HIP

Improvement Proposals are standards for specifying new features or changes to a product. This is a common practice where any community member can participate and share their ideas on how to improve the product. In Hyperliquid, these are called HIP. Currently, as Hyperliquid is not community-owned but operated by the team, anyone can participate as its operations become more democratic.

HIP-1: Native Token Standard

HIP-1 is a limited supply fungible token standard that supports on-chain spot order books between HIP-1 tokens. Each token deployment transaction generates a globally unique hash, which L1 uses to index the tokens. Gas fees currently paid in USDC will eventually be paid in the Hyperliquid native token. Native spot fees follow a volume-based fee schedule similar to perpetual contracts.

$PURR is the first HIP-1 token, serving as the native meme coin for Hyperliquid. HIP-1 is now being adopted, with over 10 tokens deployed. These tokens have a daily trading volume of approximately $17 million, with around 93,000 transactions, most of which are meme coins.

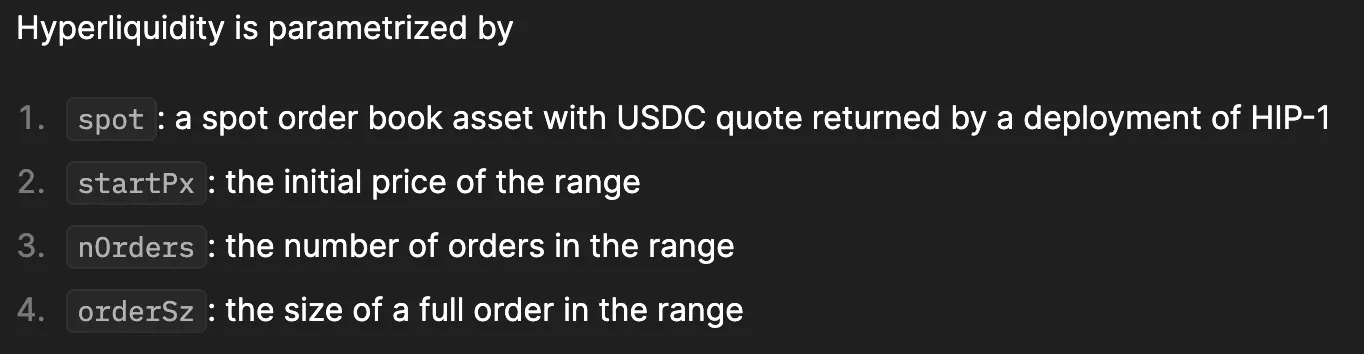

HIP-2: Hyperliquidity

One of the core design principles of Hyperliquid is that liquidity should be democratized. For the early price discovery of HIP-1 tokens, a new model has become important in guiding liquidity. Inspired by Uniswap, Hyperliquidity interoperates with the native on-chain order book to support liquidity. HIP-2 includes a fully decentralized on-chain strategy integrated into the block transformation logic of Hyperliquid L1. The strategy logic is protected by the same consensus governing the order book.

The final strategy maintains a 0.3% spread every three seconds. A significant improvement is that Hyperliquidity is part of a universal order book. This allows active liquidity providers to join and contribute liquidity at any time, enabling the market to adapt to the growing liquidity demand.

Points Program Overview

Program Start: The Hyperliquid points program began on November 1, 2023.

Duration: Six months, ending on May 1, 2024.

Weekly Distribution: One million points are distributed weekly to active Hyperliquid users.

Initial Snapshot: A special snapshot was taken of users in the closed alpha stage on October 31, 2023.

Phase One Points Distribution: Points from the initial snapshot were distributed on April 15, 2024.

Phase Two Start: Known as the "L1 Season," it begins on May 29 and lasts for four months.

Phase Two Distribution: 700,000 points are distributed weekly.

Activity Multiplier: Activity from May 1 to 28 earns an activity multiplier.

First Snapshot of Phase Two: Covers the period from May 29 to June 4.

Additional Points: 2 million points were distributed for activities from May 1 to 28, as the new phase begins a month after the first one ends.

It also has an alliance program, where alliances benefit by earning one point for every four points earned by their referred users. Point allocation standards are regularly reviewed, and distribution is based on weekly activity records, ending on Wednesdays and distributed on Thursdays.

Meme Coin Airdrop - $PURR

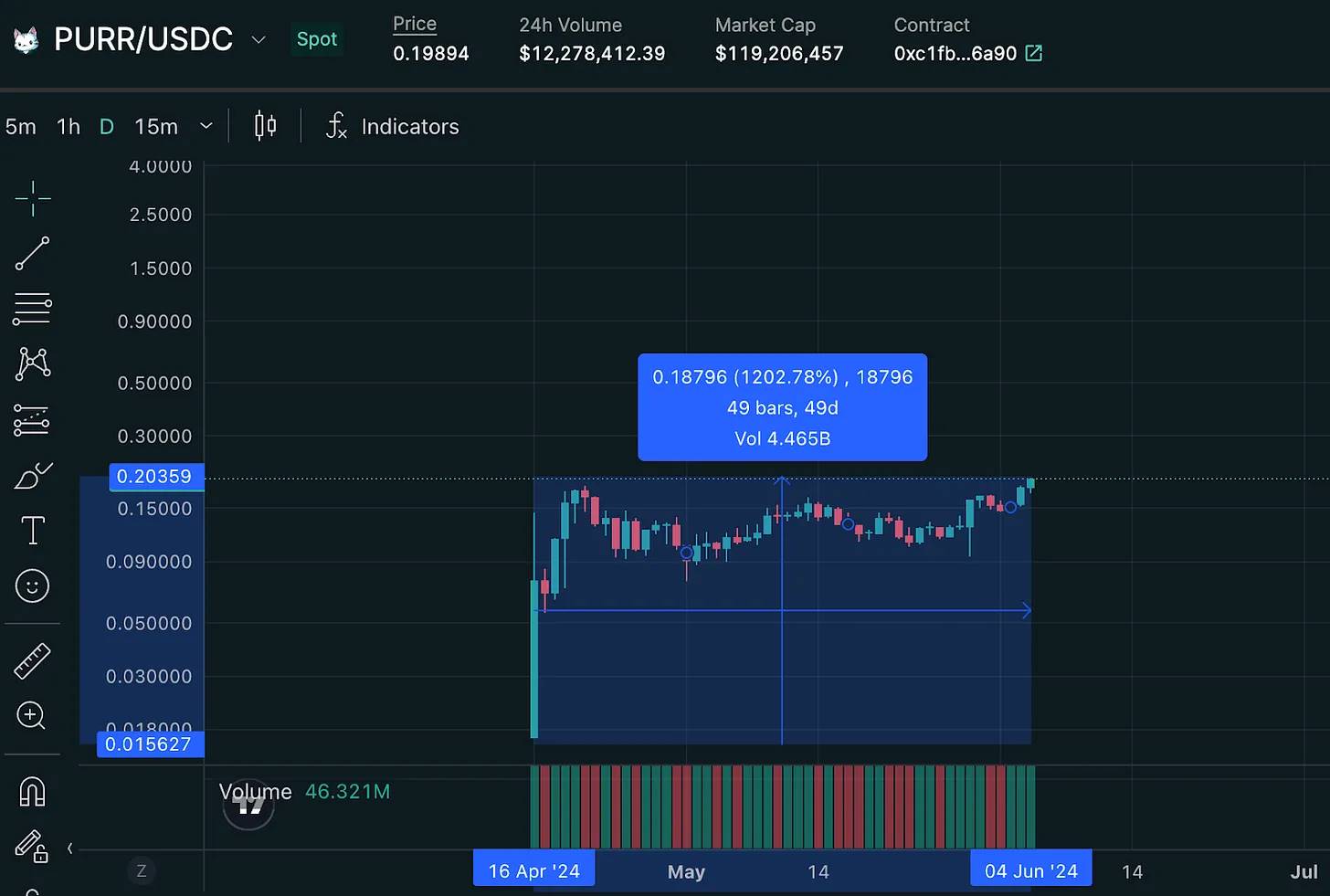

PURR is the first spot token on the Hyperliquid native token standard (HIP-1). Hyperliquid has taken an interesting approach by airdropping its native meme coin to users. It went live on April 16. There was no token sale, and no planned utility.

A total of 1 billion $PURR tokens are available. 50% of $PURR tokens are airdropped proportionally to points holders. The remaining 50% will be permanently provided as PURR/USDC pairs for Hyperliquidity. Community feedback suggested that 50% is too much of the total supply, so the team decided to burn 40% of the originally allocated total supply to HIP2.

PURR has been hugely successful. Typically, the outcome of meme coins is predictable, but the chart of PURR tells a different story—it's "only going up." With Hyperliquid delaying the release of its native token, PURR has now become a way to bet on Hyperliquid, as shown in its chart.

What factors have contributed to the growth of Hyperliquid? Clearly, Hyperliquid has done many things right to achieve its current success.

Integration

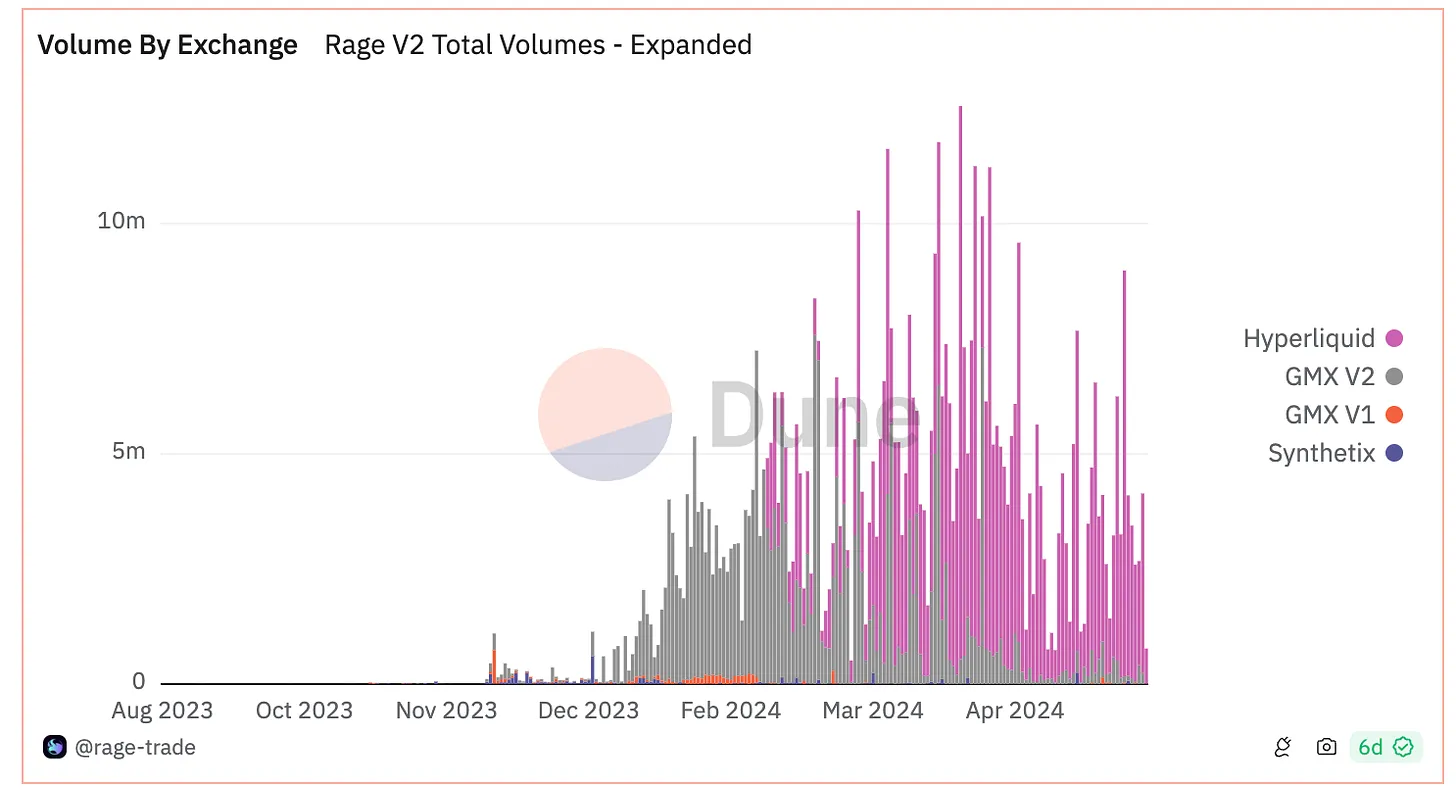

Rage Trade

Rage Trade is an aggregator for on-chain perpetual exchanges. Hyperliquid integrated with Rage Trade on February 15 this year. Rage Trade's total trading volume is approximately $641 million, with about 57.5% of the volume coming solely from Hyperliquid. Rage Trade also integrates with other perpetual exchanges like GMX and Synthetix. However, Hyperliquid's trading volume alone surpasses them, with a total trading volume of approximately $370 million to date.

Octo

Octo, similar to a super wallet, has integrated Hyperliquid into its mobile app. Octo is a product of the Indian centralized exchange CoinDCX. While there is no data indicating its trading volume contribution, these marketing efforts through integration provide discovery opportunities and add value to Hyperliquid.

Hyperliquid Market Making

The Hyperliquid treasury is a significant factor driving the adoption of Hyperliquid. Initially, offering users the option to participate in profits created a very positive impression. Additionally, the platform allows professional and individual market makers to participate and execute their own strategies, which helps guide liquidity. This, in turn, attracts more traders, creating a virtuous cycle. The highest total deposits in the treasury reached $178 million, currently around $150 million.

Targeting Centralized Exchange Traders

The majority of cryptocurrency derivatives trading volume comes from centralized exchanges. To attract these users to Hyperliquid, the team offered a 50% discount of up to $50 million. These marketing efforts are noteworthy.

Finally, the Hyperliquid product itself.

Onboarding to Hyperliquid: The onboarding process is simple, thanks to Privy. Privy is an embedded wallet provider that supports registration through social login and standard wallet login, which is a significant breakthrough.

Bridge Selection: Hyperliquid has chosen Arbitrum as its bridge, where most major DeFi activities take place.

Deposits: Hyperliquid accepts USDC as collateral. Through its in-app widget Lifi integration, converting any other stablecoin to USDC becomes very easy for users.

Bridge Speed: The speed of bringing funds into Hyperliquid is fast. Although there are no official statistics on the required time, the process feels instantaneous.

User Experience: Hyperliquid provides a gas-free experience, and its user interface resembles that of centralized exchanges, providing an enhanced experience for users.

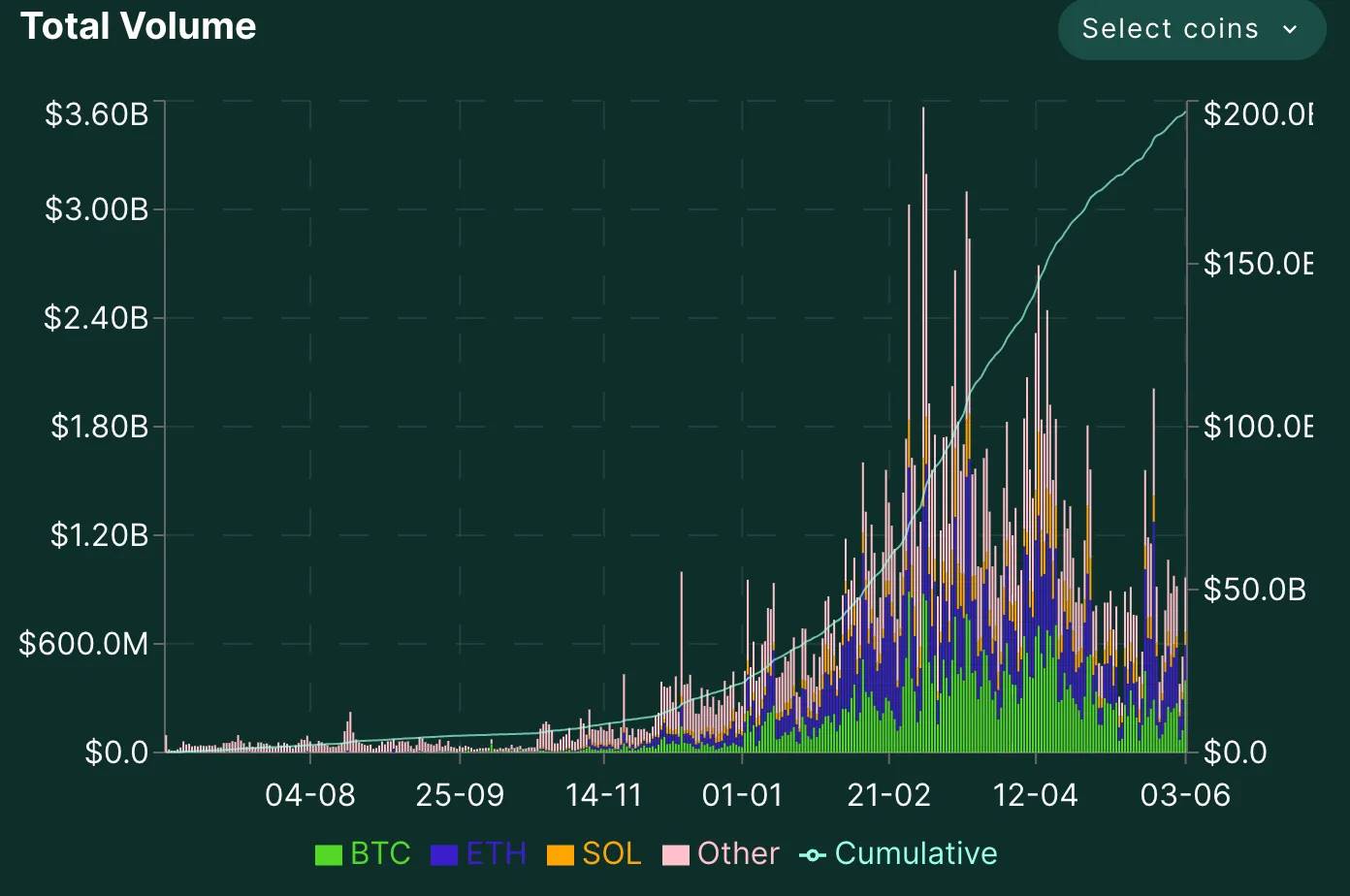

Statistics

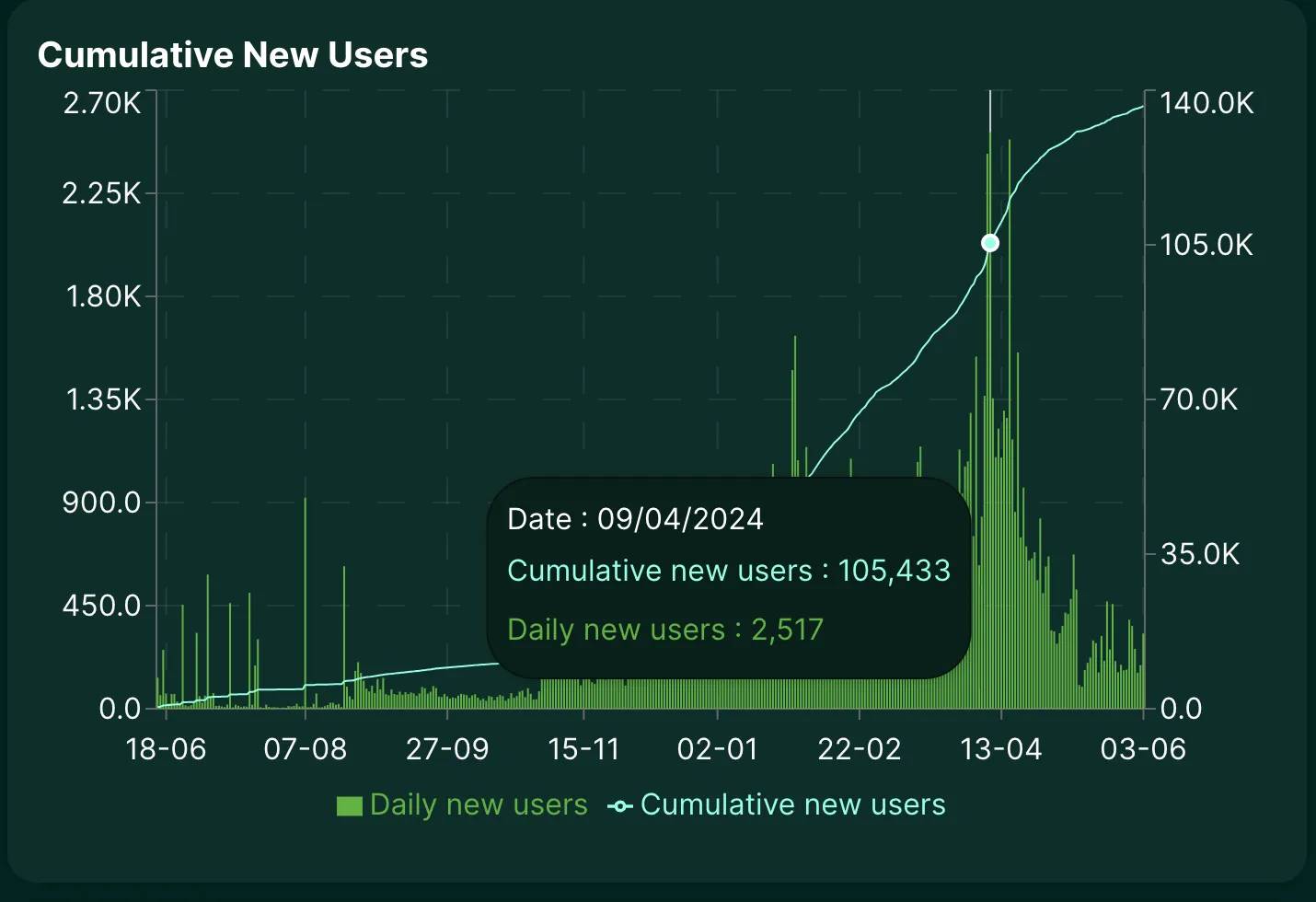

As of June 3, 2024, Hyperliquid's total trading volume has reached $196.8 billion, with approximately 136,000 users. During its operation, deposits exceeded $20 billion, and withdrawals were around $17.5 billion. It ranks first in the cumulative trading volume leaderboard of on-chain exchanges.

The total number of transactions on Hyperliquid is approximately 8.5 billion. A significant surge in trading volume occurred from January to May this year, coinciding with the early bull market phase. This period saw increased market activity due to factors such as the approval of BTC ETF.

The total number of users on Hyperliquid is approximately 136,000. The average number of new users per year from June of last year to June 3 of this year is 385.

Hyperliquid has performed well in product and marketing. Its product has attracted significant adoption, and further developments such as spot trading for HIP-1 and democratized market making have excited the community. Additionally, Hyperliquid has no external investors, which is also a plus. However, with the launch of the second season points program instead of a token generation event (TGE), there has been some opposition within the community. As stablecoin adoption regains momentum, more people are becoming enthusiastic about on-chain trading. Hyperliquid has expanded from being a trading product to building its own ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。