Author: ABOUDI RAI

Translation: DeepTechFlow

We are pleased to announce the launch of the Sui application activity on the Artemis platform. We believe it is crucial for investors to explore the Sui platform and its on-chain activities. In this research article, we will introduce the unique features of the Sui blockchain, the economic prospects of the SUI token, and explain how investors can understand which dApps are driving on-chain usage through Sui application activities.

Abstract

- Sui is a Layer-1 blockchain based on Proof-of-Stake, with innovative features such as object data model, zkLogin, and more secure smart contracts written in Move language.

- The total supply of Sui tokens is 10 billion, released to investors, the Mysten Labs team, and community projects over time in the form of staking rewards and pre-mining unlocks. Sui can be staked on-chain, unstaked at any time, and staking rewards are distributed at the end of each epoch.

- Sui's scalability is very effective, as its object data model allows for parallelization of large-scale transactions, and as usage increases, gas prices will remain stable.

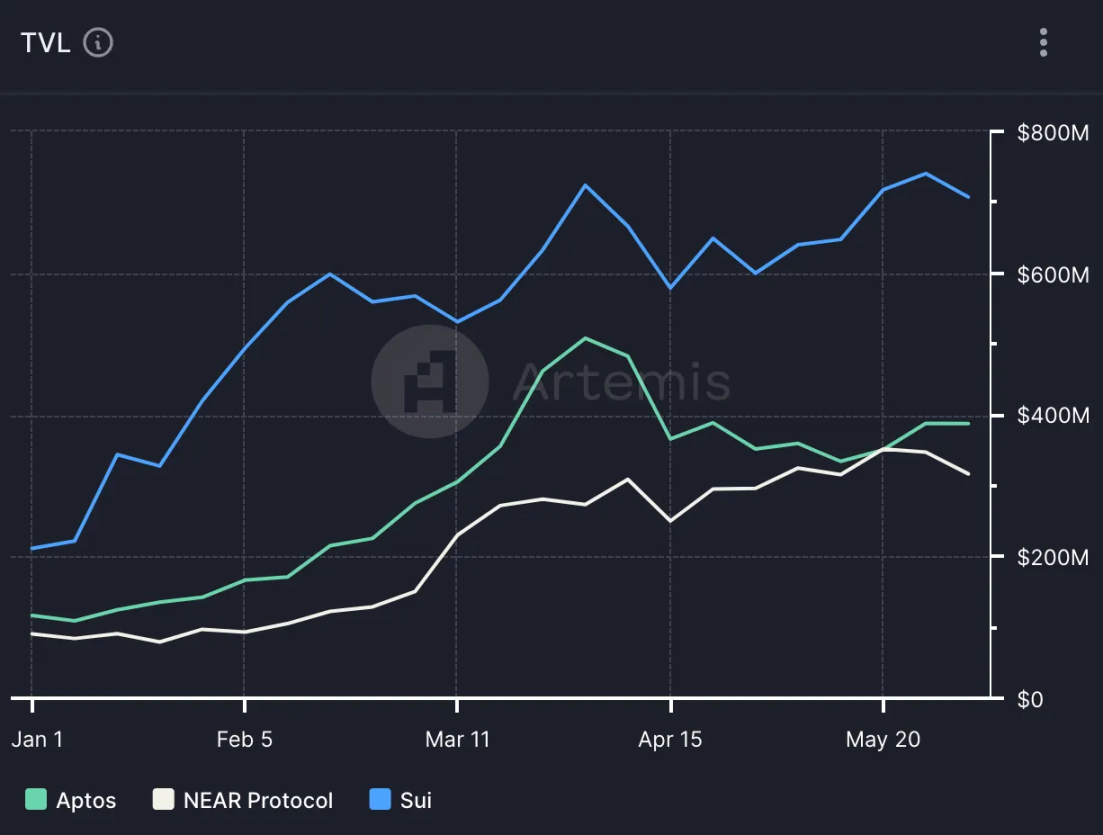

- In the previous quarter, the Sui ecosystem saw significant adoption, with TVL (Total Value Locked) increasing by 240% and DEX trading volume increasing by 407%.

- The Sui Foundation is heavily investing in community development activities, such as Sui Overflow, a global hackathon with a prize pool of over $1 million, and Sui Basecamp, a conference attended by members from top industry participants such as Binance, Messari, and a16z.

- The Sui application activity has just been launched on Artemis and can be used to analyze real-time metrics, on-chain activities, and performance.

Sui Ecosystem

Exploring Sui and its user behavior trends often requires extensive research and often involves a lot of directionless exploration. The good news is that Sui application activity can make exploring on-chain activities more efficient and organized, allowing investors to analyze real-time trends and explore user activities. Let's take a look at user activity on Sui.

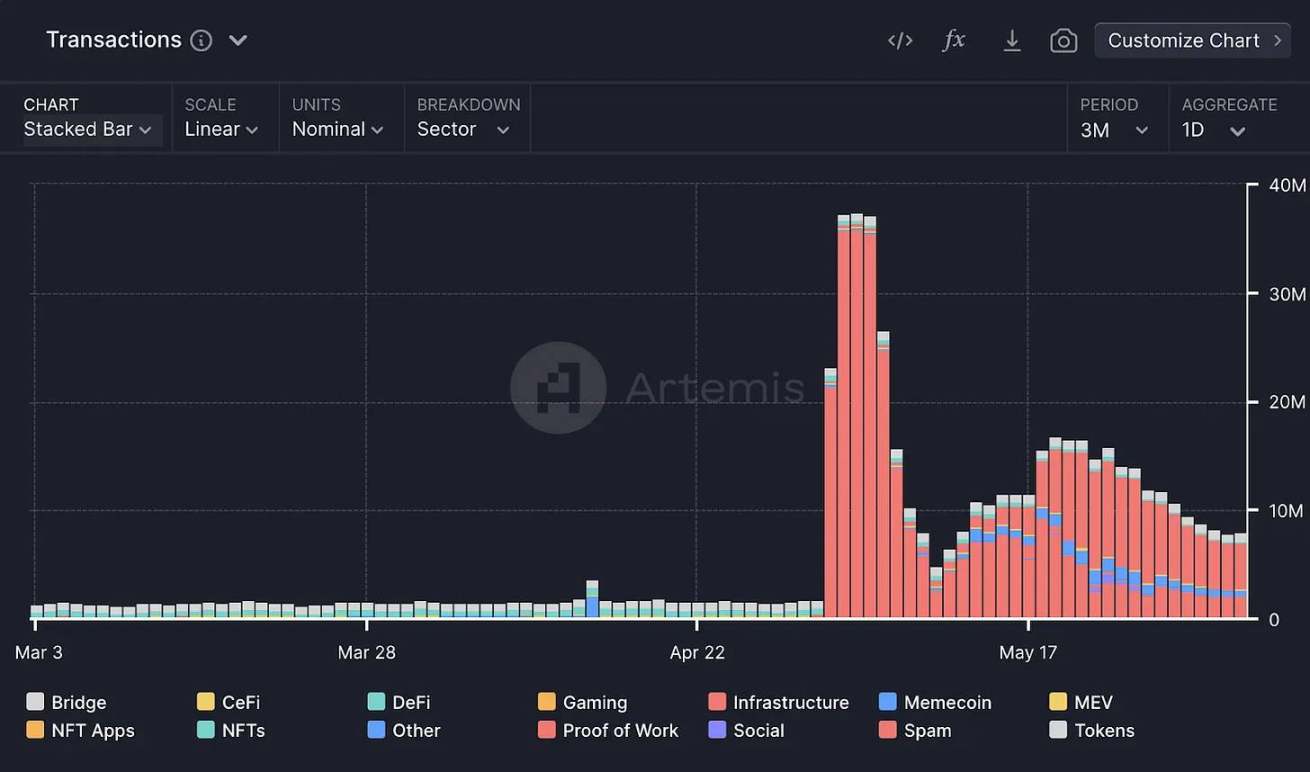

By analyzing the distribution of transactions over the past three months, we noticed a surge in user transaction volume in early May 2024, led by Spam, reaching a peak of 37.5 million transactions on May 4, 2024, accounting for 96.04% of the day's transactions. To understand which dApps within Spam are responsible for the high activity on Sui, we explored the segmentation table.

Spam is dominated by a single dApp: Spam Sui.

Spam Sui is a community-driven stress test developed by Polymedia, where users earn SPAM tokens by sending transactions on the Sui network. Spam Sui successfully achieved its goal, with a total transaction volume increasing by 1134% in the week before and after its release.

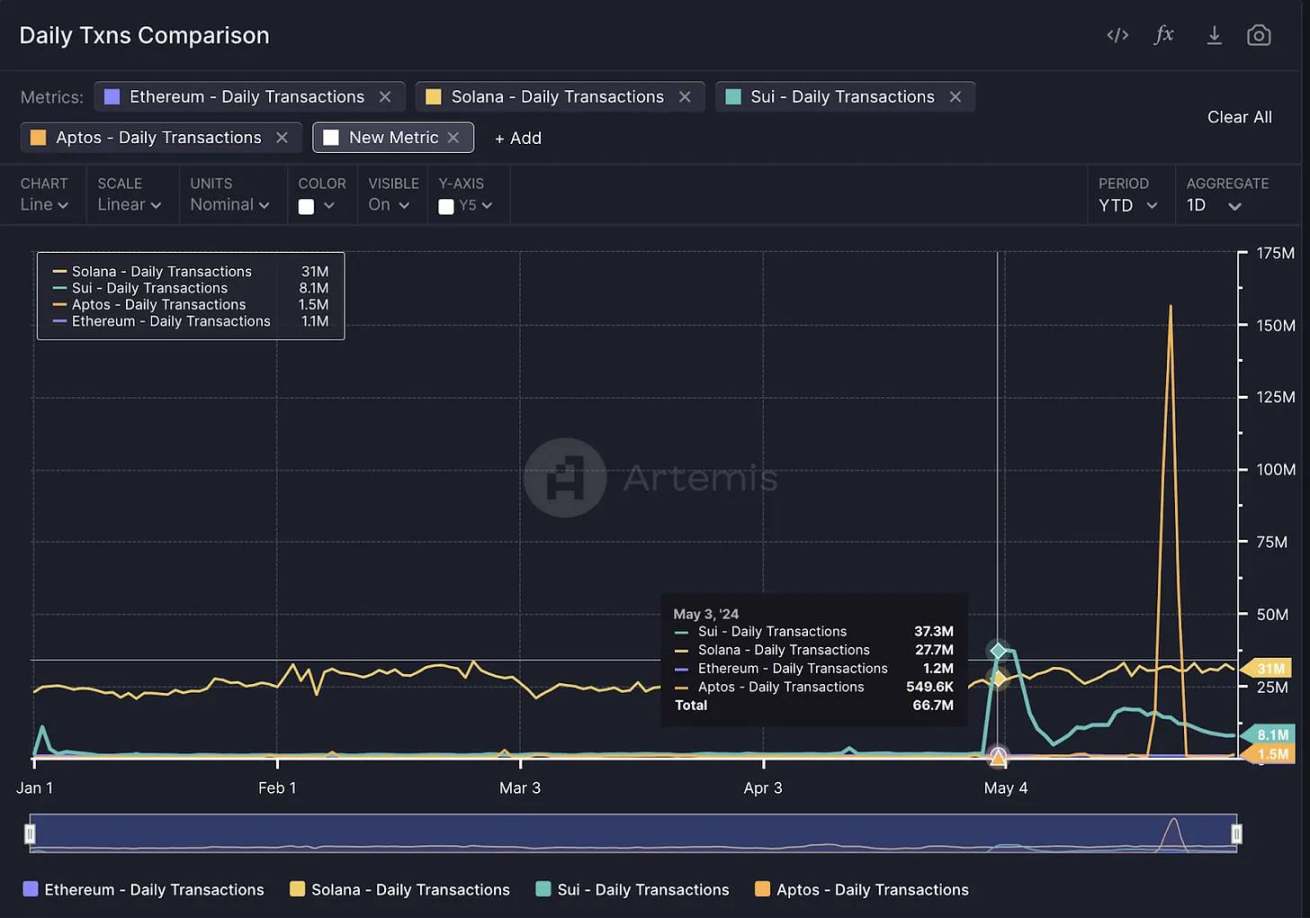

Due to the presence of Spam Sui, Sui's daily transaction volume even temporarily exceeded that of Solana for 3 days, demonstrating its ability to handle traffic far beyond that experienced by its L1 competitors. In early June, Sui processed approximately 8 million transactions per day.

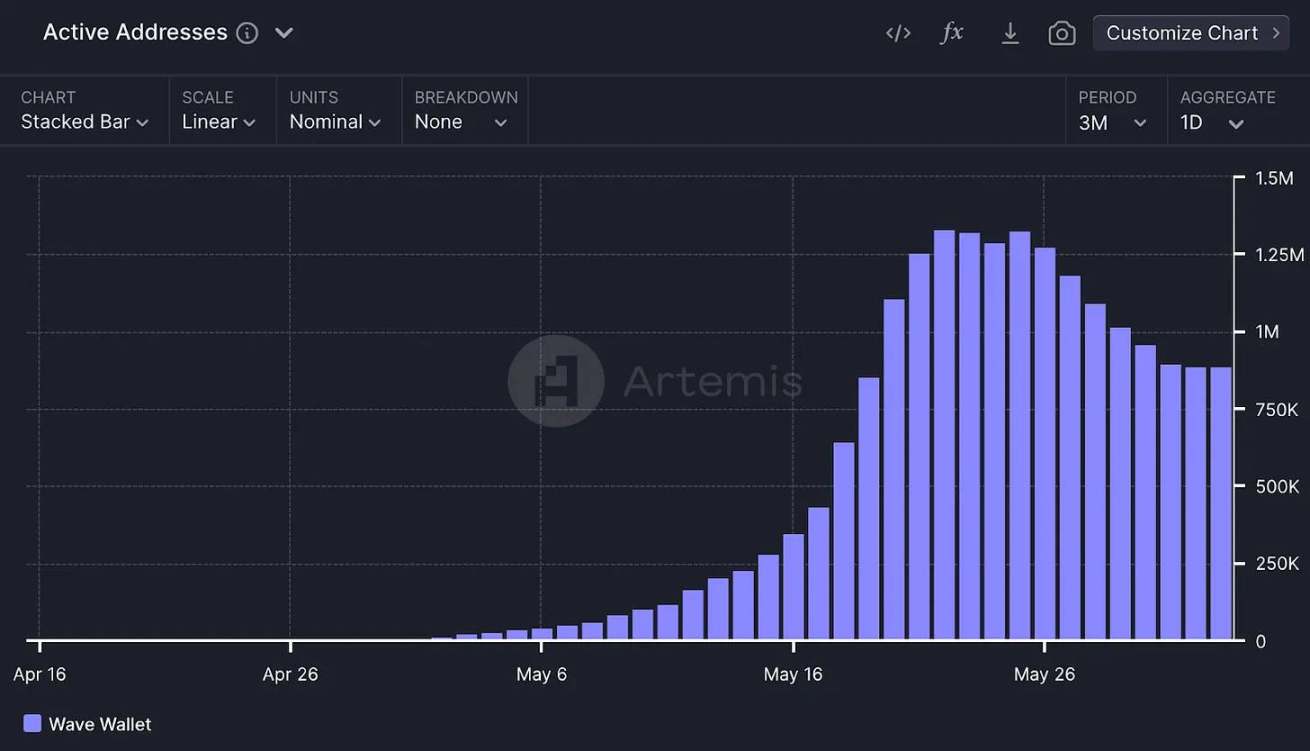

Another dApp that has recently attracted interest from Sui users is Wave Wallet, a Sui wallet based on Telegram with its own native token $OCEAN. The number of active addresses and the volume of transactions submitted by Wave Wallet have shown rapid growth. We observed a rapid increase in active addresses, with 163,600 active addresses recorded on May 12, representing a 265% increase from a week ago and a 3,618% increase from two weeks ago. Transactions submitted using Wave Wallet also showed similar growth, with a week-on-week increase of 258%, reaching 3.5 million transactions. These transactions mainly involve users mining $OCEAN by playing the OCEAN game in the Telegram wallet.

From recent trends, it is evident that whether it is Spam Sui or Wave Wallet, the majority of Sui transactions in the past three months have come from users bridging to Sui through Wormhole. Wormhole is an interoperability protocol compatible with over 17 blockchains. In the first quarter of 2024, the net flow of bridged assets on Sui through 1,100 active addresses reached $423.7 million, involving 59.9 million transactions, representing a 432% increase in asset transfer value compared to the fourth quarter of 2023.

By examining the ecosystem traffic on the Artemis platform, we can discover another impressive metric: in the past three months, the number of assets bridged to Sui from Ethereum exceeded that from any other blockchain.

DeFi

Users are transferring a significant amount of liquidity to Sui, leading to increased DeFi usage.

In the first quarter of 2024, Sui's DEX trading volume reached $7.1 billion, a 407% increase compared to the previous period. TVL reached $724 million, a 240% increase.

If we look at the segmentation data in the DeFi field within Sui Application Activity, we can sort by Gas (USD) to better understand the specific transaction situation of DeFi users. The data shows that Gas fees have increased by 122% year-to-date, reaching $81,975.80, with most of it spent on DeepBook.

DeepBook is one of Sui's native standards, providing basic functionality and frameworks on the Sui blockchain that dApps can leverage or extend. It is a native liquidity layer on Sui, existing in the form of a Central Limit Order Book (CLOB). Although it does not have a built-in user interface, Cetus recently released an interface on its decentralized trading platform. Gas fees on DeepBook have increased by 78% this year, as more independent DeFi protocols and MEV bots utilize its CLOB to access liquidity.

As shown in the table, the gas expenses of the DeFi protocols Scallop and NAVI are an order of magnitude higher than other protocols on Sui. Let's delve deeper into this.

Scallop is a lending protocol built on Sui. They are the first project to receive a grant from the Sui Foundation, known for their reliable security, and recently launched their native governance token $SCA. With more liquidity flowing into the Sui platform, most of it into Scallop, the Total Value Locked (TVL) has reached $1.21 billion, a 256% increase since the beginning of the year. Scallop is currently running bi-weekly incentive programs, rewarding lenders and borrowers with Sui to attract users and their liquidity. The bi-weekly incentive program starting from May 13th provided 251,000 Sui to suppliers and borrowers for higher yields. The incentive program varies between each bi-weekly period.

NAVI is also a DeFi platform built on Sui, offering lending and liquidity staking services. They recently launched the governance token $NAVX. Unlike Scallop, NAVI has laid out a roadmap for 2024, planning to expand operations to more chains. The TVL of the NAVI protocol has reached $1.49 billion, a 366% increase since the beginning of the year. They also run bi-weekly incentive programs. For example, the program starting from May 13th offered a supply APY of up to 23.99%.

Where there's DeFi, there's also MEV. Sui is no exception, with MEV bot gas expenses growing by 1,905% year-to-date, surpassing the DeFi industry's 22% during this period. As MEV smart contracts call DeFi protocol contracts, there is some double counting, but this also indicates that a significant portion of DeFi activity actually originates from MEV bots.

Given the prevalence of DeFi on Sui, it is worth noting that smart contracts on Sui are written in Move. Move is a programming language developed by Meta and extended by Mysten Labs, based on Rust, and is more secure and reliable than Solidity. Recent hacking incidents, such as the theft of $197 million from Euler Finance or $54.7 million from KyberSwap, may prompt founders and users of DeFi protocols to seek more secure and reliable smart contracts, such as those written in Move on Sui.

Gaming

Sui's low gas fees and efficient transaction capabilities provide a favorable ecosystem for the development of games. Sponsorship transactions, where one Sui address pays gas fees for another transaction address, enable users to interact with games on-chain without pre-funding. However, the gaming industry is still in its early stages, accounting for only 3% of the Sui ecosystem in the fourth quarter of 2023, dropping to below 0.1% in each subsequent quarter.

Although activity is relatively low, two platforms have dominated this area so far this year.

The first is Arcade Champion developed by Blue Jay Games, a mobile arcade-style game using a "play to earn" model, where players can earn "heroes" – NFTs that can be traded or sold directly on Sui – within the game. The game has a 4.8-star rating on the App Store with over 170 reviews. While it spent approximately $10,300 on gas fees in the fourth quarter of 2023, its activity seems to have slowed with the rapid development of DeFi, with a quarterly decrease of 96%.

The second platform is the on-chain betting game from DeSuiLabs, such as Sui Coin Flip, with a transaction volume exceeding $20 million. In the fourth quarter of 2023, users spent $1,200 on gas fees for DeSuiLabs games, with a quarterly decrease of 93%. DeSuiLabs does not offer sponsorship transactions.

It is expected that the gaming sector of Sui will release more games in the second half of 2024. Notable announcements on Sui Basecamp include Ambrus Studio's E4C: Final Salvation and NDUS Interactive's Xociety. The mobile gaming device based on Sui, SuiPlay0X1, has also announced an expected release date in 2025.

Community

Sui has also announced Sui Overflow, its first global hackathon with a prize pool of over $1,000,000. This is sure to attract students, developers, and founders from around the world to join the Sui chain, including those who may not have had experience or interest in building on Sui before.

Finally, the recent Sui Basecamp conference showed that Sui is making highly coordinated efforts to attract more newcomers to its ecosystem and promote the development of the existing community. According to the conference website, over 1200 people attended the conference, including speakers from Messari, Binance, a16z, Aftermath Finance, and Mysten Labs executives.

Sui is heavily investing in its community development and gaining recognition from top industry participants.

Conclusion

To reiterate, Sui is a PoS L1 blockchain with a novel architecture designed to onboard the next 1 billion users into Web3. Its object-centric model achieves transaction parallelization through the horizontal scalability of validators. The Sui ecosystem is evolving towards DeFi, but given its low gas fees, sponsorship transactions, high transaction capacity, and zkLogin, it also has great potential in gaming and social areas. The fixed supply of Sui tokens is 10 billion, released in the form of staking rewards and pre-mining unlocks for private investors, the Mysten Labs team, and community projects. The Sui Foundation is strengthening its community development plans, including DeFi incentives, the Sui Overflow hackathon, and the Sui Basecamp conference. Of course, using Artemis's Sui Application Activity is a good way to monitor and analyze real-time Sui chain activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。