Lorenzo's Plan to Maximize Bitcoin Liquidity and Recreate the Financial Empire of the Medici Family

By Peng Sun, Foresight News

* Preface: The metaphor "Prisoner of Babylon" refers only to the current BTC pledged through Babylon, which has liquidity restrictions. The author has high expectations for Babylon. Its native BTC pledge provides shared security for PoS chains, truly opening the door to Bitcoin's financial ecosystem. Maximizing BTC liquidity and providing users with more sources of income based on Babylon is currently an active exploration direction for Lorenzo.

We often talk about the Bitcoin Renaissance, but few people know what lies behind it. In fact, the Medici family is the "godfather of the Renaissance," and the Medici Bank is the "financial force" behind the Renaissance.

If we liken the noble families of medieval Europe to a dazzling starry sky on a summer night, then the Medici family is the most dazzling star. They not only ruled Florence in practice but also produced three popes and two French queens. They gathered and funded artists, including Botticelli, da Vinci, Michelangelo, and Raphael. Such grand gestures mostly came from the hands of Lorenzo di Piero de' Medici, the fourth-generation heir of the Medici family, known as "Lorenzo the Magnificent."

The liquidity finance of the Medici Bank was behind the Italian Renaissance, and similarly, the Bitcoin Renaissance is also about inspiring and releasing the liquidity of BTC, constructing a more complex BTC asset financialization scene. Babylon has achieved native BTC pledging on the Bitcoin mainnet, providing shared security for any PoS chain, opening the door to Bitcoin's financial ecosystem. However, the liquidity of BTC has not been fully released. The current liquidity restrictions of Babylon are like being "imprisoned in Babylon." There are many projects hoping to solve this issue, but they are far from delving as deeply as Lorenzo, and the release of liquidity finance is not thorough enough.

Today, Lorenzo is strategically positioned to create a Bitcoin liquidity finance layer that integrates Lido, Renzo, and Pendle, providing income based on native BTC through Babylon, bridging liquidity pledging, re-pledging, principal and interest separation, StakingFi, and more. In other words, Lorenzo will become the capital entrance for users to access various BTC financial products. Currently, Lorenzo has received investment from Binance Labs and has launched the mainnet test version, with the V2 mainnet set to be released in June. Additionally, Lorenzo has recently initiated a Bitcoin pre-pledge Babylon and Bitlayer joint mining event. To thank early supporters, Lorenzo has set up incentive pools and launched multiple incentive schemes for users to participate in pre-pledging Babylon, bridging stBTC to Bitlayer for participation in ecological projects, and other collaborative projects with Lorenzo.

So, how will Lorenzo maximize the release of Bitcoin liquidity and recreate the financial empire of the Medici Bank, and where will it lead Bitcoin in its Renaissance?

Lorenzo: The Wealth Manager of the Pope

In the Middle Ages, the Pope was the patron of Italian banks and trading companies. He was the only ruler with the right to levy taxes in every corner of Europe, and the bank was a financial institution dedicated to managing his finances, including tax collection, receipt and transfer of taxes, currency exchange, and providing loans. The Medici Bank became the manager of the Pope's wealth early on. In the confidential account books, the accounts of the Papal Treasury were under the name of the Roman branch, equivalent to the U.S. Treasury having an account at a Federal Reserve Bank today.

During Lorenzo's time, the Vatican, nobles, and aristocrats once believed that the Medici Bank had the ability to lend unlimited amounts. In reality, the Medici Bank was overborrowing, and the Vatican was unable to repay. In 1494, the Medici Bank was on the verge of bankruptcy, and the main branch in Rome was entangled in loans granted to the Papal Treasury. As the manager of the Pope's wealth, the Medici Bank was deeply involved in politics. With the shortage of English wool supply and the fall in silver prices, the Medici Bank's reinvestment opportunities sharply decreased, and its sources of income were severely lacking. Its cash reserves were also far below 10% of its total assets, ultimately leading to a liquidity crisis.

Today, Lorenzo is also a "religious wealth" manager. Bloomberg has called Bitcoin the "first true religion of the 21st century," and Bitcoin maximalists and holders are its believers. From a financial perspective, today's public chains are like banks, spawning various financial products such as deposits, loans, collateral, exchange, structured products, and insurance products. However, due to the limitations of Bitcoin's script language and technology, it has been unable to build its own liquidity finance. This has led to a common phenomenon where the number of addresses holding over 100 BTC has remained stable at around 16,000 for the past four years. Although the current largest wrapped token WBTC has a market value of about $10.5 billion, the total market value of BTC is a whopping $1.3 trillion, accounting for only 0.8%. Coupled with the deep belief of the Bitcoin cult in "Not your keys, not your coins," few are willing to take the risk of participating in cross-chain and other on-chain DeFi protocols.

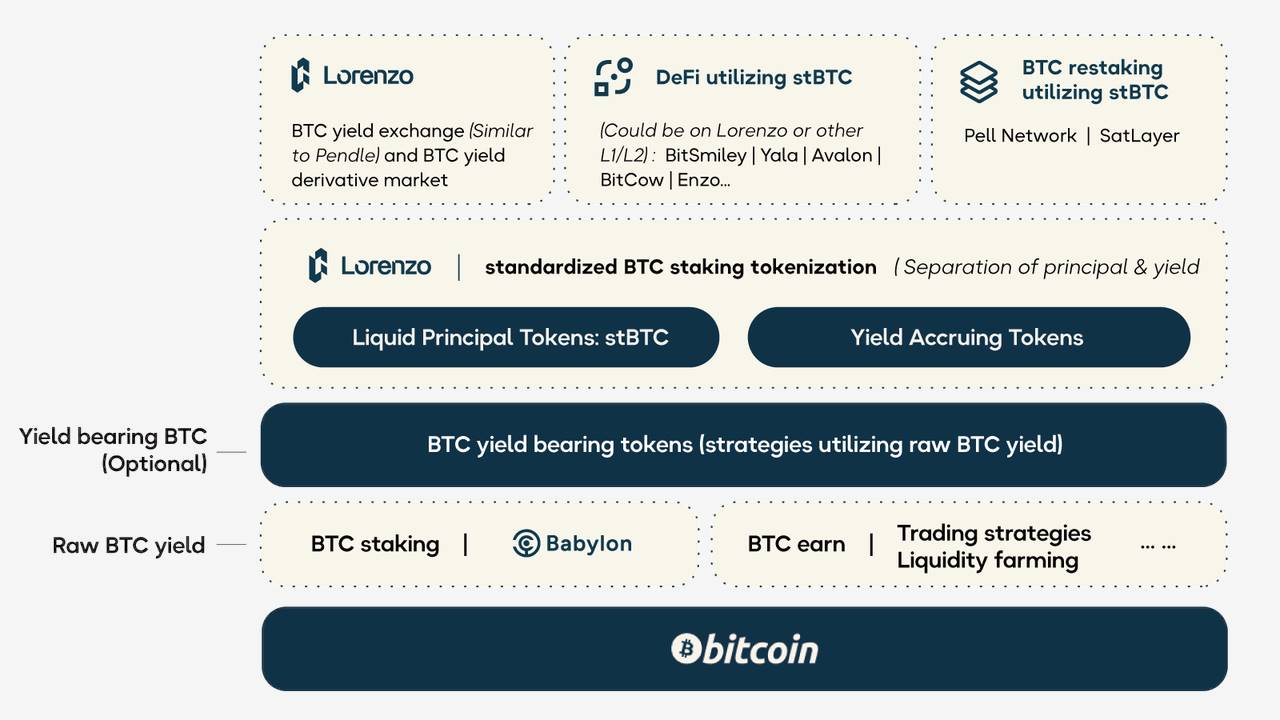

Lorenzo is targeting these long-dormant BTC holdings. It is the first Bitcoin liquidity finance layer based on Babylon and the issuance trading and settlement platform for BTC liquidity pledging tokens, providing truly secure native income for Bitcoin users and issuing principal and interest separation LST for different Bitcoin pledging projects. Lorenzo can be understood as a combination of Lido, Renzo, and Pendle, thereby building a super-large bond market, providing integrated products for matching, issuance, settlement, and structured finance, thoroughly releasing pledged BTC liquidity, activating BTC asset financialization scenes, and supporting the construction of downstream DeFi ecosystems.

The LRT Competitive Market Based on Babylon

2024 can be described as the first year of the Bitcoin ecosystem. After the narrative of asset issuance such as inscriptions and runes, the Bitcoin ecosystem has also entered the narrative of living assets. In the past, due to the use of the Nakamoto consensus, Bitcoin could not stake and generate income like PoS. However, today, users only need to deposit BTC into their self-managed deposit address on the Bitcoin mainnet through Babylon and include PoS verification information in Bitcoin blocks through a timestamp protocol to provide shared security for existing PoS chains and earn staking rewards, without any third-party custody/cross-chain/wrapping. At the same time, the Schnorr signature and Extractable One-Time Signature (EOTS) mechanism also make BTC a confiscatable asset, effectively avoiding double-spending attacks.

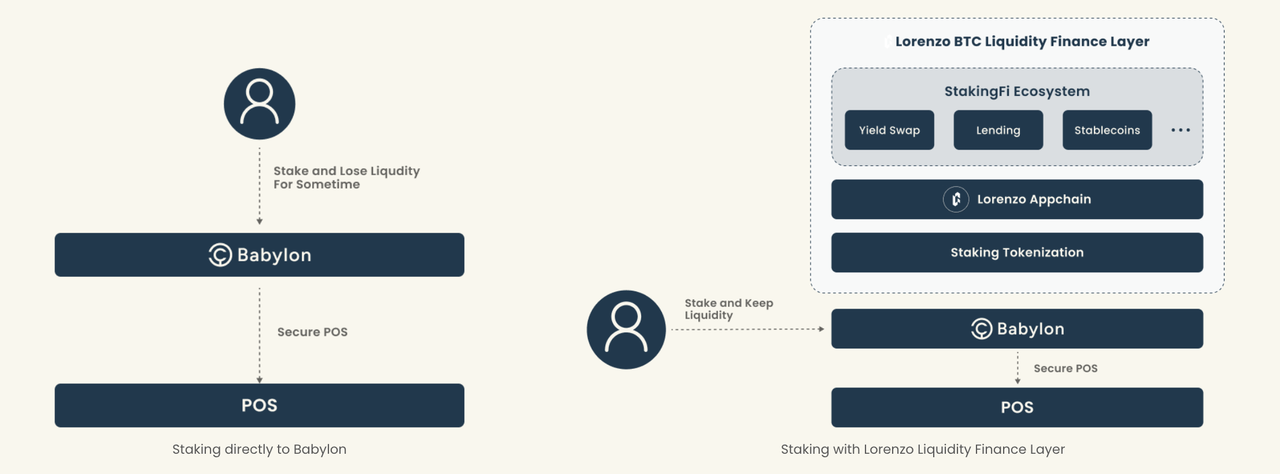

Babylon's shared security mechanism provides unlimited potential for Bitcoin's financial ecosystem. However, the current issue is that the BTC provided for PoS chain staking through Babylon also loses liquidity and becomes a "prisoner of Babylon," affecting capital utilization efficiency and income sources. So, how can BTC liquidity be fully released based on Babylon, and how can more income sources be provided to users?

Considering this, there are now protocols such as Uniport, Chakra, BounceBit, Bedrock, Solv Protocol, and StakeStone aiming to further release BTC liquidity. Let's take a look at each of them:

Chakra is a ZK-based Bitcoin re-staking protocol that cross-chains BTC and ETH from the Bitcoin and Ethereum mainnets to the Chakra chain, forming an asset settlement center for BTC L2, and deploys ChakraBTC and ChakraETH to other BTC L2 through lightweight client cross-chain technology. Chakra provides re-staking services for PoS chains based on SCS (Settlement Consumption Service), similar to what Babylon aims to do, but BTC is not native staked on the Bitcoin mainnet. To address this issue, Chakra has now integrated with Babylon, allowing Chakra to map BTC pledged through Babylon to any ecosystem via Chakra network's trustless settlement service/layer. Babylon uses BTC pledged through Chakra to ensure the security of its PoS system within the protocol, allowing stakers to share validation rewards. The ZK-STARK staking proof generated by Chakra enables users to obtain liquid assets on Chakra Chain, Starknet, and various other blockchains.

BounceBit is a Bitcoin re-staking infrastructure that uses a dual-token PoS structure based on the wrapped token BTCB instead of native BTC, and converts BTCB into BBTC. The shared security mechanism is based on staking BBTC. BBTC is designed to address the low liquidity and limited use cases of Bitcoin on the native chain, but compared to the Babylon solution, its native BTC nature is relatively weaker. Although its BTC Bridge will allow native BTC to be directly cross-chained into BBTC, cross-chain bridges and oracles always carry risks.

Uniport is a Bitcoin re-staking chain that uses the UniPort zk-Rollup Chain built on the Cosmos SDK to achieve multi-chain interoperability of BTC ecosystem assets. Its cross-chain solution converts native BTC into UBTC and manages it using a centralized multi-signature cold wallet (which will use multi-signature contracts in the future). UBTC will be deeply integrated with Babylon.

Bedrock is a multi-asset liquidity re-staking project that has collaborated with Babylon to launch the LRT token uniBTC. Users can pledge WBTC on Ethereum and receive uniBTC. Bedrock establishes a connection with Babylon through proxy staking and direct conversion. The proxy mechanism involves staking the corresponding amount of native BTC on Babylon while staking wBTC on Ethereum. Direct conversion involves exchanging WBTC directly for BTC and staking it on Babylon. Holding uniBTC allows users to earn BTC income and use it in other DeFi protocols.

Solv Protocol is a full-chain income and liquidity protocol that converts WBTC on Arbitrum, M-BTC on Merlin, and BTCB on BNB Chain into interest-bearing asset solvBTC, not native BTC.

StakeStone is a full-chain liquidity infrastructure that pledges native BTC into Babylon and issues full-chain interest-bearing BTC STONEBTC.

SataBTC is a Bitcoin re-staking layer that has not yet been launched.

When comparing these projects, it can be observed that LRT projects in the same field are actively exploring their own approaches. BounceBit, Bedrock, and Solv Protocol prioritize absorbing existing market share, using wrapped BTC as the underlying asset to provide interest-bearing capabilities for BTC, but they carry the same inherent risks as WBTC and other wrapped tokens. Other projects are targeting the incremental market brought by Babylon's LRT, with Chakra, Uniport, and StakeStone focusing on using Babylon as the underlying income source and issuing LRT tokens to release pledged BTC liquidity, but they all stop at Restaking and LRT.

In fact, income-bearing LRT also faces high volatility issues and cannot meet the needs of users with different risk preferences. Just think about Ethereum, where any income-bearing asset ultimately flows to Pendle, which is the missing part in Bitcoin DeFi. This is exactly what Lorenzo aims to do, but they are not in a competitive relationship, but rather will lead to more collaboration.

Lido + Renzo + Pendle: How will Lorenzo build Bitcoin liquidity finance?

Some say that Ethereum took 9 years to walk the path of income-bearing assets, while Bitcoin did it in 9 months. So, the path of income-bearing assets that Ethereum walked through in 4 years and 3 generations of products can be completed by Lorenzo in just one protocol.

Communication Path between Bitcoin Mainnet and Lorenzo

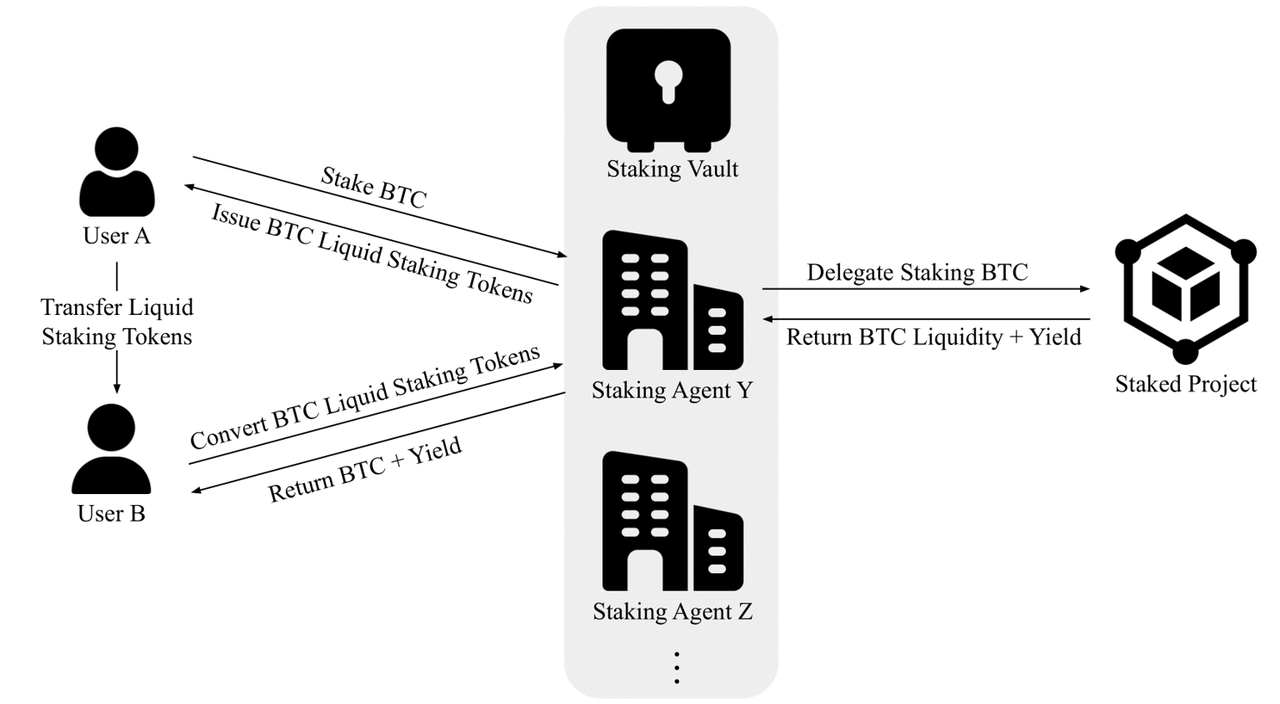

Let's first take a look at the architecture of the Lorenzo protocol, as shown in the following diagram. It consists of the Lorenzo Chain, the Bitcoin relayer, and a set of smart contracts for verifying off-chain information, managing the issuance and settlement of liquidity staking tokens.

- The Lorenzo Chain (corresponding to the EVM-compatible layer) is a Cosmos application chain built using Cosmos Ethermint, compatible with EVM, and mainly provides the underlying infrastructure for liquidity staking tokens.

- The Bitcoin relayer can relay Bitcoin mainnet information to the Lorenzo application chain.

- A set of smart contracts for verifying off-chain information, managing the issuance and settlement of liquidity staking tokens.

The initial logic is that when a user deposits BTC into the Lorenzo cold and hot wallet multi-signature addresses on the Bitcoin mainnet through the Lorenzo website to obtain Lorenzo liquidity tokens stBTC, the Bitcoin relayer of Lorenzo will monitor the deposit address for incoming transactions. Once a transaction is confirmed, the relayer will obtain the transaction's Merkle proof and submit it to the Lorenzo Chain, and call the mint function of the "Lorenzo YATControlModule" module to internally verify the transaction proof's legitimacy. Upon successful verification, Lorenzo will mint an equivalent amount of stBTC for the user's EVM account.

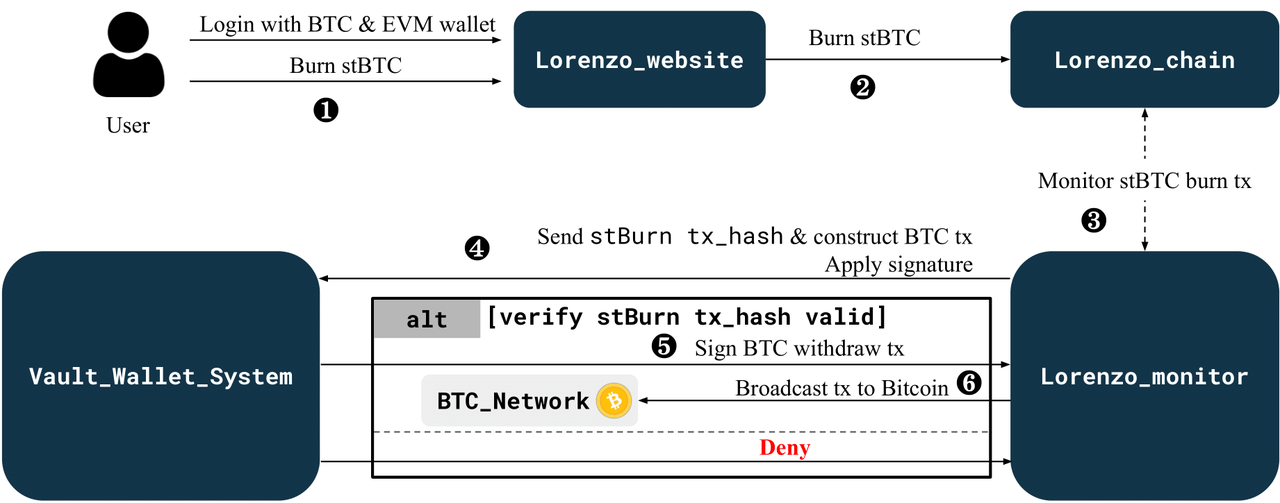

If a user needs to exchange stBTC back to BTC, they can initiate a request to destroy stBTC on the Lorenzo website. The Lorenzo Monitor will monitor the destruction of stBTC on the Lorenzo chain, send the transaction hash for the destruction of stBTC and the constructed BTC withdrawal transaction to the multi-signature service Vault Wallet System, and request a signature. After verifying the legitimacy of the destruction transaction, the final signature is generated and sent back to the Lorenzo Monitor. Upon receiving the BTC signature, the Lorenzo Monitor will broadcast the signed transaction to the Bitcoin mainnet, completing the user's withdrawal operation.

Unleashing Liquidity, Unleashing "Babylon's Captive"

Lorenzo uses Babylon as the underlying income layer, providing users with naturally secure native income and almost no staking risk. In addition, similar to early EigenLayer, Babylon's mainnet will also set a deposit limit. As mentioned earlier, Babylon currently has liquidity restrictions similar to "Babylon's Captive" and also has entry barriers.

However, this is not the end of Babylon's narrative. It is the financial foundation of the Bitcoin ecosystem, providing possibilities for Lorenzo. The first step for Lorenzo is to complete the construction of Bitcoin Lido, unleashing the liquidity of pledged BTC, and solving the deposit limit issue of Babylon. Users can directly deposit BTC into Babylon through Lorenzo, which acts as an asset issuance and settlement platform, tokenizing the pledged BTC to provide users with liquidity staking tokens. This is similar to Lido's stETH, but also different, as we will explain in the next section.

Of course, as a Bitcoin liquidity finance layer, similar to Ethena, in addition to BTC staking income, users can also use their deposited BTC for other trading strategies, liquidity mining, and other sources of income. Currently, Lorenzo has partnered with Bitlayer to integrate 7 to 8 downstream DeFi projects through Bitlayer Mining Gala, allowing participation in staking, borrowing, and other on-chain activities.

Principal-Interest Separation Bonds and Re-staking Plans: Attempting Unified Liquidity

Similar to stETH, Lorenzo's LST is also an income-bearing asset for BTC, essentially a type of interest-bearing Bitcoin bond. However, since the pledging to Babylon is actually pledging to different PoS chains, rather than anchoring to ETH like Lido's stETH, different liquidity staking tokens may be generated for different staking projects. Issuing different LST for different staking projects would obviously lead to fragmented liquidity.

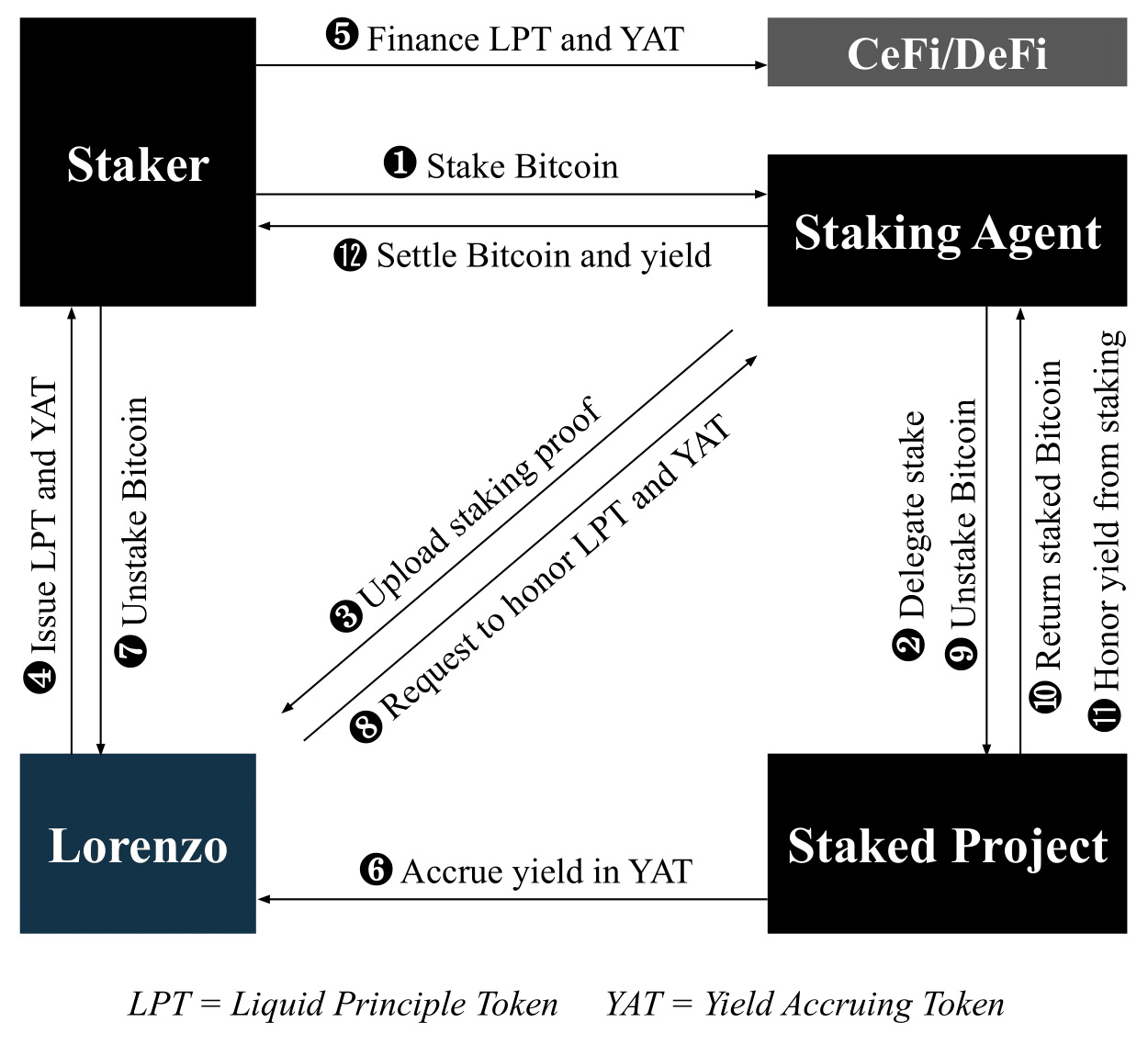

How to more effectively address the issue of fragmented liquidity? Lorenzo has come up with a principal-interest separation model similar to Pendle, and has adopted a Bitcoin liquidity re-staking plan (BLRP) based on Babylon's staking to avoid the dispersion of income-bearing tokens due to different projects and staking periods. Lorenzo will predefine BLRP staking plans, including the staking project (PoS chain) and the start and end times of the staking. Users can only select the plan they wish to stake in before the staking plan begins.

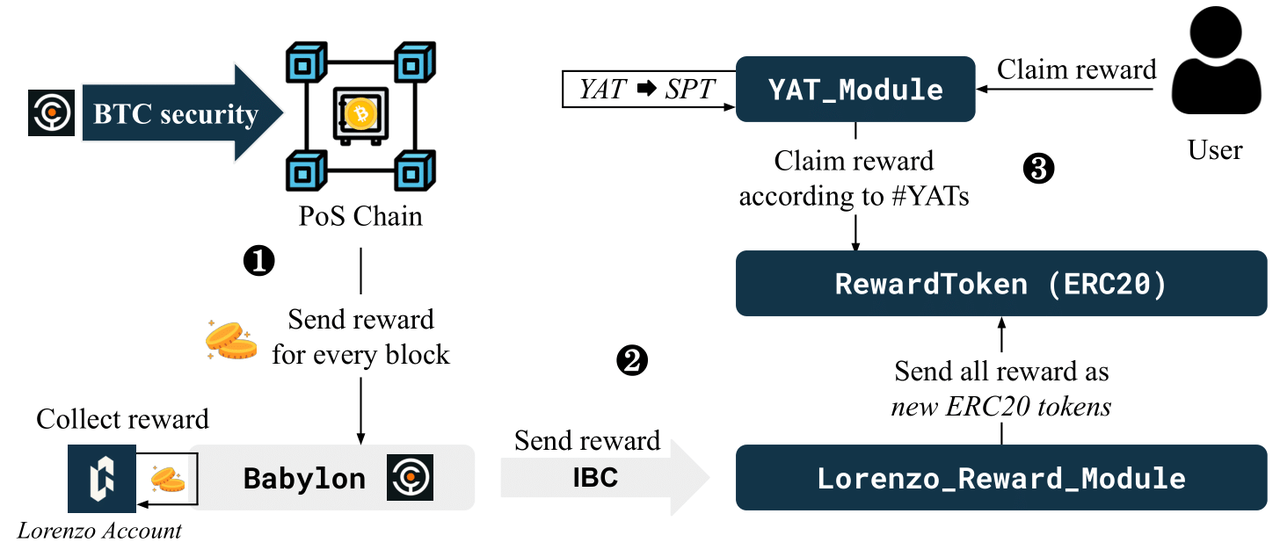

In other words, if a user selects the "Babylon-Lorenzo-01" staking plan on Lorenzo, they will receive two types of tokens after depositing BTC into Babylon: Liquid Principal Tokens (LPT) and Yield Accruing Tokens (YAT). Lorenzo issues the same LPT for all low-risk staking projects, which is stBTC, anchored 1:1 to the pledged BTC, unifying the liquidity of BTC from different ecosystems. Holders of stBTC can redeem the pledged BTC principal after the staking period ends. YAT is an ERC-20 token issued through BLRP, representing a bond with future income from the staking. YAT has its own re-staking plan, start and end times. YAT can be traded and transferred before maturity, and holders can also claim PoS chain rewards. YAT tokens issued under the same BLRP can also be exchanged.

{ name: YAT token name symbol: YAT token ticker planDescUri: project description planId: stakePlanId, incremental ID for restaking plan agentId: stakeAgentId, Staking Agent ID subscriptionStartTime: Subscription starts subscriptionEndTime: Subscription ends endTime: YAT maturity time}

After YAT matures, holders can receive the income from Babylon, PoS chains, and Lorenzo in one lump sum.

Staking Agent: CeDeFi-based Asset Issuance and Settlement System

Both stBTC and YAT belong to Lorenzo's asset issuance side, but it also serves as an asset settlement platform. As mentioned in the previous article, due to the paradigm shift in the asset issuance layer, DeFi has entered the active asset management stage, and Lorenzo embodies this generational characteristic. As the issuance and settlement layer of stBTC, it also manages native BTC assets and can determine the destination of stakers' BTC.

Lorenzo acknowledges that it does not provide inherent guarantees to stakers that it will not misuse the BTC it manages. However, due to the limited programmability of the Bitcoin network, it is currently unable to build a fully decentralized settlement system. Therefore, Lorenzo has chosen the "middle path" of CeDeFi, introducing the Staking Agent mechanism, with top-tier Bitcoin institutions and TradFi institutions jointly acting as the asset issuance and settlement layer, with Lorenzo also being one of the staking agents. If a staking agent engages in improper behavior, its agent qualification will be revoked.

The staking agent is responsible for the entire asset issuance and settlement of Lorenzo, which means creating staking plans for users, accepting their BTC and depositing it into Babylon and PoS chains, then sending the Restaking proof to the Lorenzo protocol and issuing stBTC and YAT to users. When the staking plan matures, the staking agent safeguards the project's return of BTC to users and cashes out the matured stBTC and YAT, converting them into BTC principal and income.

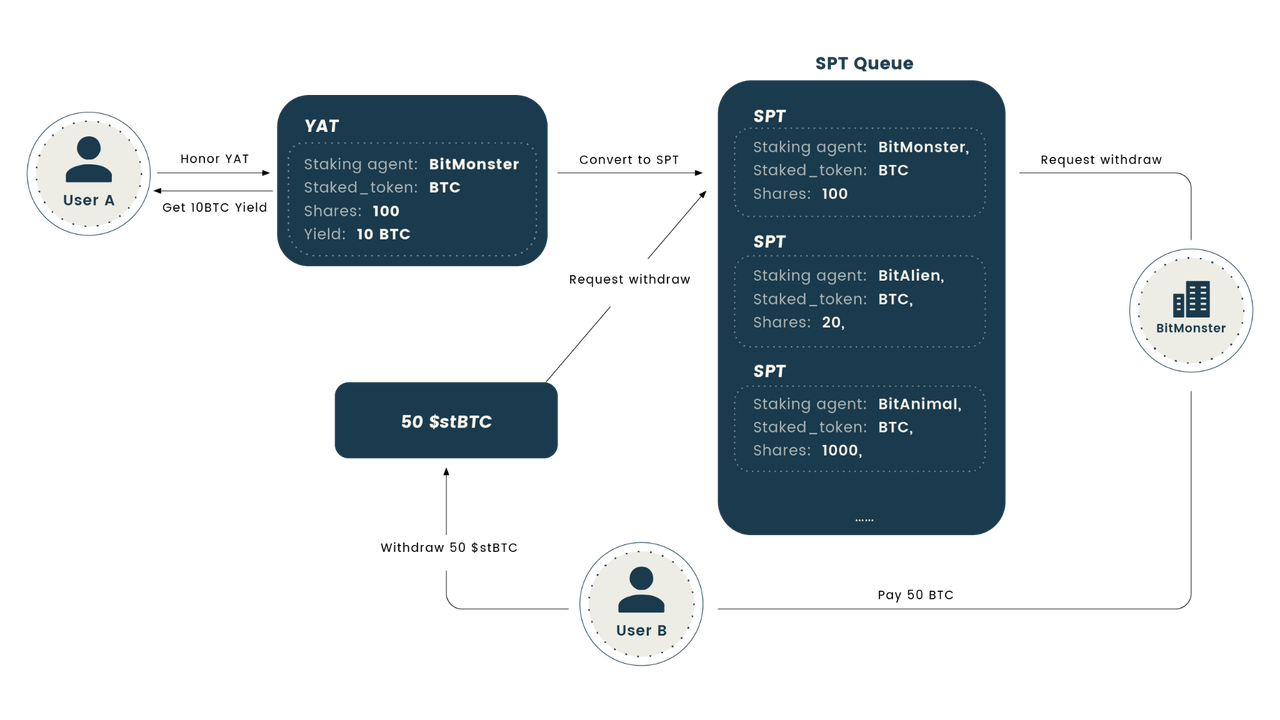

In terms of fund settlement, Lorenzo has also implemented a sorting mechanism. In the first phase, Lorenzo did not introduce YAT, and users only needed to destroy stBTC to redeem the native BTC. However, after the issuance of YAT in the second phase, if users want to redeem BTC, they not only need to destroy the corresponding stBTC but also an equivalent amount of Staking Proof Token (SPT). Only then will Lorenzo return the BTC to the user.

SPT plays a role in sorting, destroying stBTC, and redeeming BTC vouchers. When YAT matures, the profit distribution contract of Lorenzo will distribute income to YAT holders and convert YAT into an equivalent and non-tradable SPT. These SPT will enter a unified queue and be placed at the end of the queue, determining the order of stBTC destruction. The associated agent ID of the destroyed SPT will determine which staking agent will redeem the BTC. Users who generate SPT by claiming YAT can use their generated SPT to destroy stBTC up to the amount of generated SPT, or they can claim YAT income by generating SPT without destroying stBTC. If a user does not hold YAT but needs to redeem BTC and there are no SPT in the queue, they must wait for new SPT to enter.

In the example below, User A pledges 100 BTC and earns 10 BTC in income. When A redeems 10 BTC from BitMonster staking agent by cashing out YAT, an equivalent amount of SPT is generated but stBTC is not destroyed. User B buys 50 stBTC in the market and wants to exchange it for BTC, but without YAT. In this case, BitMonster must hold an equivalent amount of SPT to redeem 50 BTC, otherwise, B will have to wait in line for other users to generate SPT. Once all the BTC in the "Staked_token" is redeemed, the SPT will be removed from the queue.

Based on the issuance and settlement system of the staking agent, Lorenzo effectively unleashes the liquidity of BTC and expected income, allowing users to obtain and trade income-bearing tokens in advance. Lorenzo's SPT settlement method determines that users must have sufficient income to extract BTC, which is why there are staking plans. Without the income from the maturing staking, there is no BTC to withdraw. In other words, we can imagine the staking agent structure as a large pool of funds. The more abundant and stable the underlying BTC income source of Babylon, and the more funds users deposit, the better the liquidity of Lorenzo's dual currency.

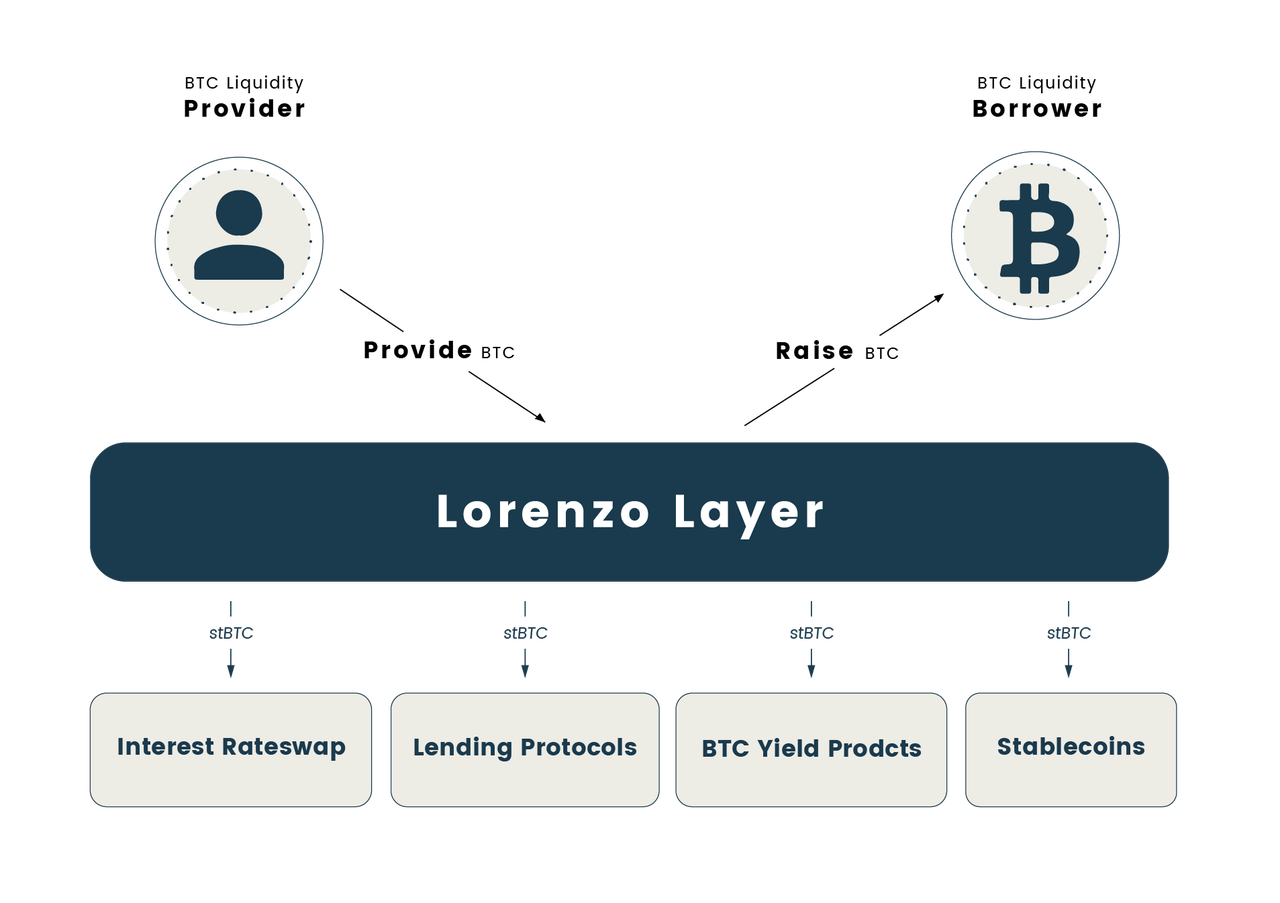

StakingFi: Financialization Scenarios for BTC Assets

Of course, Lorenzo not only aims to unleash the liquidity of pledged BTC but also hopes to provide a good token structure for this pledged liquidity. Due to the uncertainty of interest rates, principal-interest separation fundamentally reduces reinvestment risk. For users who want to avoid volatility, they can purchase stBTC anchored to BTC and short the income. For risk-seeking users, they can purchase YAT to go long on the yield. Compared to other BTC LRT projects, this principal-interest separation mechanism also supports the construction of more complex downstream DeFi products, not just simple income generation.

Currently, Lorenzo's stBTC can be cross-chained to Bitlayer. In the future, stBTC and YAT will be used in the following financial scenarios:

Interest rate swaps: Refers to the exchange of fixed and floating interest rates for two currencies with the same amount of debt (principal) and the same term. stBTC can be seen as another form of wrapped BTC and can ultimately replace WBTC in almost all scenarios. The value of YAT comes from accumulated income and speculation on future income. There will be a basic trading pair between stBTC and all YAT, and YAT from the same staking plan can be exchanged. There may also be trading pairs between stBTC, YAT, and other mainstream assets.

Lending protocols: stBTC and YAT can be used as collateral to borrow any needed assets, ensuring that stakers have greater control over their investments and liquidity.

Structured BTC income products: For example, it is possible to build Bitcoin fixed income products that protect the principal based on stBTC and YAT, as well as options-based financial derivatives to enhance income.

Bitcoin-backed stablecoins: stBTC can support stablecoins.

Insurance products: Used to reduce the risk of native BTC being confiscated by Babylon.

Roadmap and Future Plans

Lorenzo will launch testnets and mainnets in phases, with the mainnet test version already launched at the end of May, and mainnet V2 expected in June. At that time, Lorenzo will introduce the principal-interest separation mechanism. In addition to stBTC, Lorenzo will support more income-bearing tokens (Yield Accruing Tokens, YAT). The staking agent model and SPT will also be launched in V2, making Lorenzo's asset issuance and settlement more decentralized. Furthermore, Lorenzo plans to support more PoS projects in the Babylon ecosystem, providing users with more income scenarios.

Conclusion

Like any current BTC LRT project, Lorenzo is also attempting to activate the liquidity of the $1.3 trillion market value of BTC. This is a blue ocean market worth over a hundred billion dollars, and building DeFi around BTC LRT will have unlimited potential. "Babylon's Captive" is temporary, and what's important is that Babylon lays the foundation for the entire Bitcoin liquidity finance, providing the basis for Lorenzo to build income-bearing assets. Unlike other BTC LRT projects, Lorenzo is the first Bitcoin liquidity hub based on the Babylon ecosystem and introduces a principal-interest separation mechanism similar to Pendle, which can provide more complex liquidity financial scenarios for principal tokens and interest tokens, meeting the risk investment needs of different users and fully unleashing the liquidity of BTC.

However, in the author's opinion, the staking agent model still carries centralization risks. The underlying Bitcoin UTXO opcode can impose an output limit on BTC spending conditions, but cannot set secure restrictions on staking agents. The Solv team has specifically developed Solv Guard to provide an additional security layer for third-party fund managers, which may set restrictions on BLRP investment strategies, specifying investment targets, smart contracts, etc., separating fund usage rights from governance rights. In the future, Lorenzo may adopt a similar solution to address this issue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。