Author: WolfDAO

Introduction

Welcome to our special report "Comprehensive Analysis of TON Chain". In today's rapidly developing public chain field, TON Chain (The Open Network) has become a highly anticipated new star in the industry due to its unique technological innovation and extensive application prospects. This series of reports will lead you to explore the core technology, ecosystem, and future development trends of TON Chain, helping you to fully understand this ecosystem with unlimited potential.

This special report will comprehensively analyze various aspects of TON Chain through three articles.

First Article: Fundamental Analysis: "In-depth Analysis of TON Chain: Revealing the Core Strength of Future Blockchain Giants"

In this part, we will comprehensively introduce the technical architecture and fundamentals of TON Chain, including its multi-layered design concepts, multi-blockchain architecture, high throughput real-time capability, and powerful smart contract system. TON Chain's technical foundation not only gives it significant advantages but also establishes a solid foundation for its future development in the blockchain field. Through detailed technical deconstruction and market positioning analysis, we will reveal how TON Chain stands out in the competitive blockchain market.

Second Article: Exploration of TON Ecosystem and Leading Projects: "TON Ecosystem Panorama: Exploring On-chain Star Projects and Future Opportunities"

If the technical foundation is the "skeleton" of TON Chain, then its ecosystem is the "flesh and blood" of TON Chain. In this part, we will conduct an in-depth analysis of various key components of the TON ecosystem, including developer communities, node operators, users, and practical application scenarios. We will also focus on a series of leading projects on TON Chain, such as DeFi, NFT, GameFi, and DApp development tools, showcasing the contributions and future potential of these projects to the TON ecosystem through detailed data and case studies.

Third Article: Risk Analysis of TON: "Compliance and Risk Assessment of TON Chain: Coexistence of Prospects and Challenges"

The compliance and risk management of blockchain technology are crucial on a global scale. In the third report, we will interpret the regulatory dynamics of blockchain and cryptocurrencies in major global markets, assess the compliance risks of TON in different jurisdictions, and conduct in-depth analysis of potential threats from various aspects such as legal risks, market fluctuations, and technical security. In this part, we will comprehensively analyze the compliance challenges faced by TON Chain, evaluate its operational legal risks in major global markets, and delve into the market and technical risks that TON Chain may face.

We hope that through this series of reports, you will gain a comprehensive understanding of TON Chain's technical advantages, ecosystem, and future development path. In the field of blockchain, full of opportunities and challenges, TON Chain is leading the trend with its unique charm and strength. Now, please enter our detailed first report "In-depth Analysis of TON Chain: Revealing the Core Strength of Future Blockchain Giants" and embark on this journey of exploring TON Chain's knowledge.

Background

1. Birth Background of TON Chain

Ton was originally developed as a blockchain platform by Telegram founders Nikolai and Pavel Durov. However, due to strong regulation by the SEC, it was forced to be discontinued. After losing in a legal battle with the SEC, Telegram was forced to halt the active development of TON and return 72% of the investment to investors. However, the project was later taken over by the community and the TON Foundation, and continued to develop. Ton aims to make blockchain technology more user-friendly and provide stable and reliable infrastructure for easy use by everyone.

2. Leading Team and Their History

Professional background and industry experience of the project team

- Pavel Durov: CEO and founder of Telegram; previously founded VK, Russia's largest social network with over 100 million active users.

- Steve Yun: Chairman of TON Foundation. Previously worked at Koinvestor and InterCP.

- Inal Kardan: Game director of TON Foundation. Former co-founder and CTO of Meta0. Graduated from the State University of Management (SUM).

- Lisa Ferdman: Responsible for activities and production at TON Foundation.

- Julian Tan: Head of DeFi ecosystem at TON. Previously worked in business development at Binance, SEI ecosystem development partner, and graduated from the University of Queensland. Possesses strong business development and marketing capabilities.

- Jordan Dunne: Telegram DeFi lead at TON Wallet. Former product manager at FTX and technical project manager at Google.

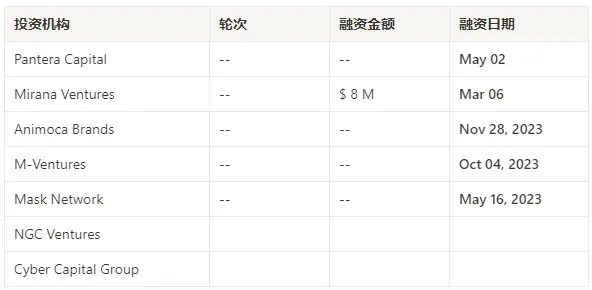

3. Investment Institutions

Project Overview

Project Introduction

Toncoin ($TON) is a Layer 1 blockchain project aimed at providing a high-speed, low-cost, and highly secure blockchain solution. Since its launch, Toncoin has rapidly developed and currently ranks 10th in the cryptocurrency market with a market value of 22.5 billion USD.

Toncoin has a circulating supply of 3.47 billion, accounting for 68% of the total supply of 5.11 billion. Despite its fully diluted valuation (FDV) reaching 33.2 billion USD, the project's maximum supply is currently set as unlimited, providing flexibility for future expansion and growth.

The project is led by an experienced team with deep expertise in blockchain technology, development, and marketing. Through its unique technology and strong ecosystem, Toncoin is gradually becoming a rising star in the global blockchain field.

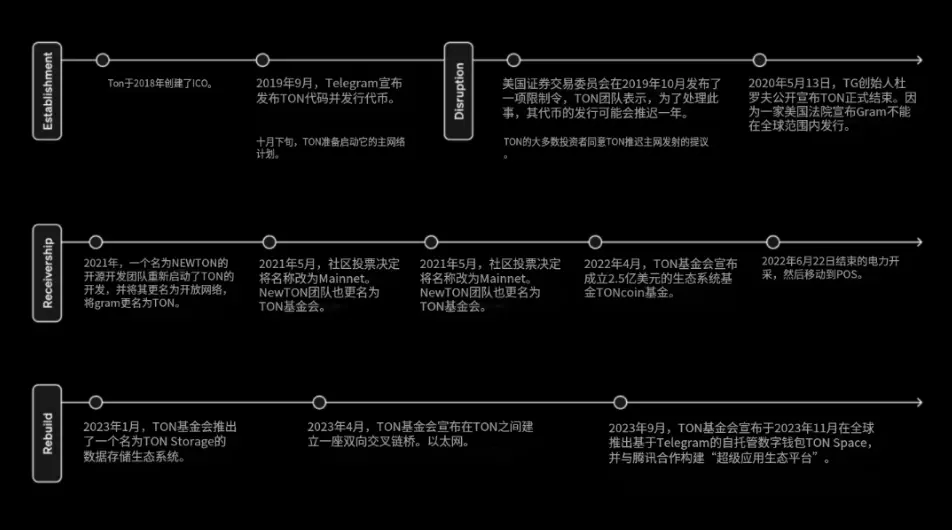

Development Milestones

1. Key Developments

Source: Ton Official Website

TON Major Events Timeline

2. Important Upgrades and Technological Iterations

RoadMap Source: Ton Official Website

Upcoming Updates and Upgrades for TON

The TON project will undergo comprehensive technical updates and feature upgrades, which can be categorized into the following aspects:

- Enhanced Functionality

- Development of stablecoin toolkit: Providing stable digital assets to reduce the impact of price fluctuations and enhance the stability of the ecosystem.

- Development and optimization of smart contract interfaces: Providing developers with more powerful and convenient development tools to drive the deployment of more innovative applications.

- Upgrade of multi-signature technology to version 2.0: Improving transaction security and reliability.

- Implementation of fast transfer and transaction functions on TON Chain: Significantly improving transaction efficiency and reducing waiting time.

- Improved Security

- Prevention of phishing attacks: Adding anti-fraud features to safeguard user asset security.

- Enhanced coordination among validator nodes: Improving the synchronization and coordination of validator nodes to reduce latency and enhance system security.

- Enhanced User Experience

- Launch of Wallet Version 5.0: New user interface and feature optimization to enhance the convenience of digital asset management.

- Implementation of Gasless Transactions: Reducing transaction costs to attract more users and developers to participate.

- User-friendly TL-B Protocol: Enhancing user experience and simplifying the development process.

- Development of TON Blockchain Explorer: Providing better data visualization tools for users to query and analyze on-chain data.

- Improvement of Governance Mechanism

- Update of the election system and configuration: Optimization of the selection and management mechanism for validators to enhance decentralization.

- Provision of voting functionality for staking pools and wallet UI: Enhancing community governance capabilities, increasing transparency, and user participation.

- Expansion of Interoperability

- Establishment of cross-chain bridges: Supporting cross-chain bridging functionality for mainstream blockchains such as ETH, BNB, BTC, etc., to enhance the flexibility and compatibility of TON.

- Introduction of additional currency support: Expanding payment and trading options to increase the attractiveness of the ecosystem.

Technical Architecture Analysis

Basic Technical Architecture

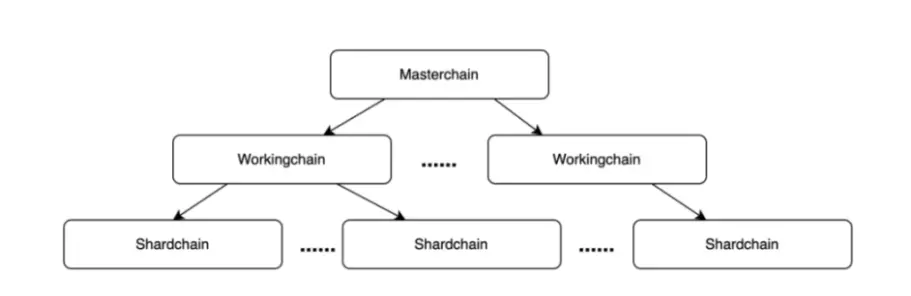

1. Core Modules of TON

Source: Ton Official Website

Source: Compiled and organized by WolfDAO

TON's technical architecture demonstrates rich innovation and depth. The main chain ensures solid coordination and state consistency; the work chain provides high customization and scalability; the shard chain achieves outstanding parallel processing capability and dynamic adaptability; TVM ensures the security and reliability of smart contracts. These modules collectively shape TON into a highly scalable, secure, and flexible blockchain platform capable of supporting various applications and large-scale user interactions.

Innovative Technologies

Within TON's ecosystem, there are three key innovative technologies: Infinite Sharding Paradigm, Instant Hypercube Routing, and Self-Healing Vertical Blockchain.

1. Infinite Sharding Paradigm

- Features: TON's Infinite Sharding Paradigm allows dynamic increase or decrease of the number of shards as needed, with a maximum of up to 2^60 work chains. This elastic sharding mechanism has the following significant characteristics:

- Dynamic adjustment: The system can automatically split or merge shards based on network load, ensuring efficient operation under high and low loads. This means that the system will automatically expand during a surge in network transactions, and shards will automatically merge after a decrease in load, saving resources.

- High scalability: Compared to fixed sharding schemes, TON's Infinite Sharding Paradigm provides a more flexible solution that can be adjusted according to different transaction loads and application requirements, thereby maintaining high performance and stability of the network.

- Adaptability: This technology can flexibly adapt to different application scenarios, efficiently supporting high-frequency trading, massive users, and large data processing.

2. Instant Hypercube Routing

- Features: TON's Instant Hypercube Routing mechanism aims to significantly improve the efficiency of cross-shard information transmission and processing:

- Efficient transmission: Using high-dimensional hypercube structures, messages can be transmitted between different shards in a very short time. By constructing multidimensional topological structures, message transmission paths become shorter, reducing the latency of cross-shard communication.

- Low-latency transaction confirmation: This mechanism ensures low-latency cross-chain interaction and transactions, helping to meet the real-time requirements of applications such as financial transactions and gaming.

- System scale independence: Regardless of how the system scales, the hypercube routing mechanism can ensure efficient information transmission, demonstrating TON's forward-looking design and flexibility.

3. Self-Healing Vertical Blockchain

- Features: The Self-Healing Vertical Blockchain mechanism is a unique design of TON that can correct invalid blocks without forking, maintaining the consistency and stability of the system:

- Consistency maintenance: When invalid blocks are detected, this mechanism can automatically make corrections without the need for complex system rollbacks or forks, reducing the complexity of network maintenance.

- High reliability: This self-healing feature enhances the overall network reliability, reduces potential security risks, and ensures the continuous stable operation of the system.

- Reduction of forks: By avoiding frequent blockchain forks, the Self-Healing Vertical Blockchain mechanism simplifies chain management, reduces the workload of miners and validator nodes, and improves the overall efficiency and security of the system.

These three technologies achieve breakthroughs in the scalability, efficiency, and security of the blockchain system. The Infinite Sharding Paradigm addresses the issue of network expansion, Instant Hypercube Routing ensures low-latency cross-chain interaction, Self-Healing Vertical Blockchain enhances the reliability and consistency of the system, and the efficient virtual machine provides solid support for the execution of smart contracts. These technologies set TON apart from many blockchain projects, demonstrating its enormous potential in future application scenarios.

Economic Model Analysis

Token Economy

1. Total Token Supply and Distribution Strategy

- Token Supply: The initial supply of TON is 5 billion, with an annual growth of approximately 0.6% (about 30 million tokens), primarily used to reward well-performing validators. In addition, by staking TON, users can earn an annualized yield of approximately 3.73%, providing stable returns for long-term holders.

- Token Utility: Through the Telegram wallet, users can directly purchase TON with a credit card and use it to buy virtual goods such as anonymous accounts. In the future, with the promotion of Telegram, the use cases of TON will further expand, increasing its practical application value.

- Token Distribution: The team holds 1.45% of the tokens, while the remaining 98.55% has been distributed through early POW mining. To optimize token concentration issues, the team has implemented measures to freeze inactive wallets and sell TON at a discounted price, effectively managing the market supply of tokens.

- Chip Distribution: The majority of users (85.53%) hold less than $1000 worth of TON, with only 0.42% of users holding over $100,000 worth of TON. Approximately 18.08% of users have held tokens for over a year, demonstrating good user loyalty and long-term investment confidence.

2. Token Value Flow

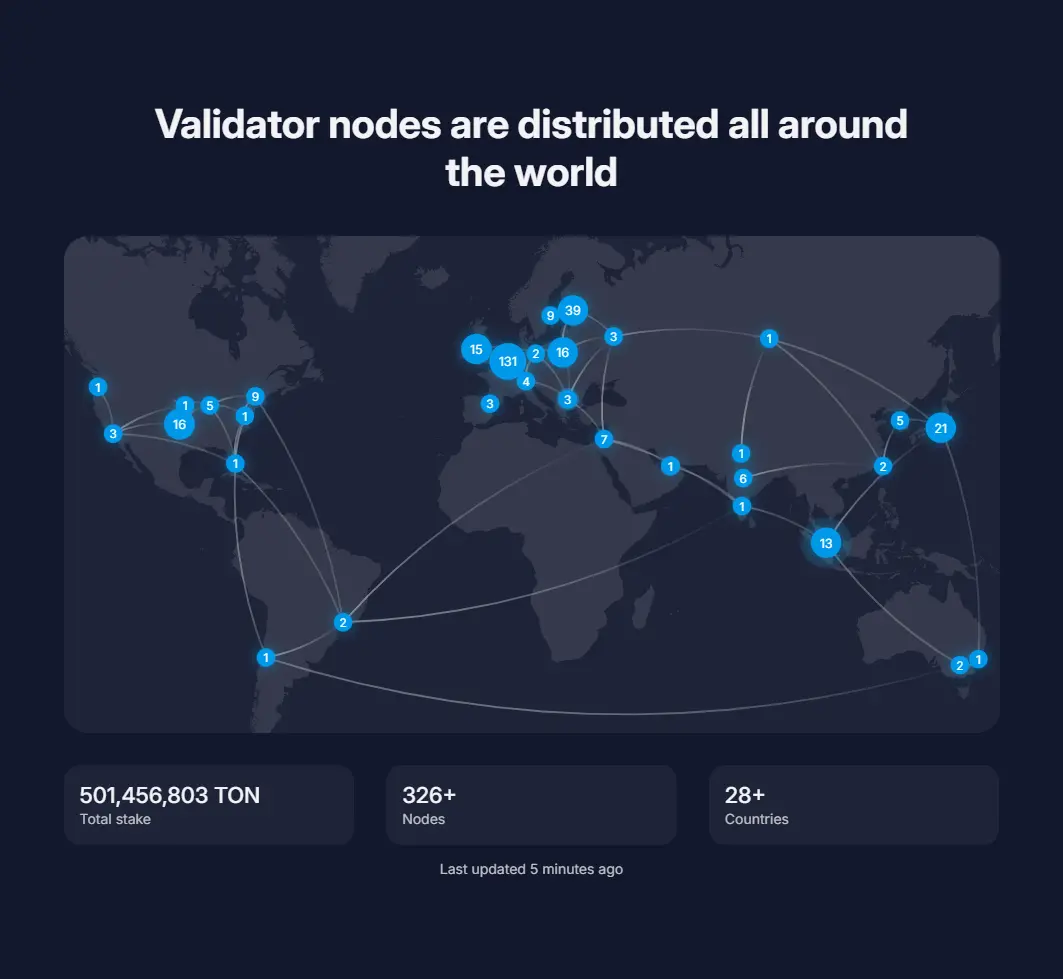

- Validator Rewards: Approximately 30 million TON are added annually to primarily reward network validators. This ensures network security and efficiency, and incentivizes validators to continue participating and contributing to the stable operation of the network.

Validator Nodes Worldwide Source: Ton Official Website

- Consumption Scenarios: One of the main uses of TON tokens on Telegram is to purchase virtual goods such as anonymous accounts. This consumption mechanism not only increases the actual demand for tokens but also promotes economic activities within the ecosystem.

- Market Strategy: By freezing inactive wallets and selling TON at a discount, the team effectively manages the market supply of tokens, avoiding excessive concentration in the market and enhancing the liquidity and stability of the tokens.

- Holding Distribution: The majority of token holders hold relatively small amounts of TON, which helps reduce market concentration, enhances token liquidity, and mitigates the risk of market manipulation.

3. Core User Groups

- Cryptocurrency traders and investors: This group is an important demand for TON tokens. They have shown great interest in purchasing, staking, and trading TON, especially investors seeking emerging crypto projects and high annualized returns. Additionally, as TON tokens gain increasing attention in the market, more investors may view it as a potential investment opportunity.

- Telegram users: Since TON tokens can be used to purchase virtual goods (such as anonymous accounts) within the Telegram platform, the large user base of Telegram naturally becomes potential users of TON tokens. With the continuous promotion and expansion of Telegram's features, the demand for TON tokens from users is expected to continue to rise.

- Cross-chain and Web3 technology developers: Developers in cross-chain interoperability and Web3 technology may utilize the technical advantages of the TON project to create new applications and cross-chain solutions, driving the application and innovation of TON tokens in these technological fields. This not only contributes to the promotion of technology but also further expands the application scenarios of TON.

Profit Models

1. User Participation Profit Models

Source: TON Official Website

TON's official website lists various profit models that users can participate in, including:

- Earn with Liquidity

- Project Competition

- Defi Grants

- Airdrops

2. Project Participation Models

Source: TON Official Website

Developers have the widest range of opportunities in the TON ecosystem. Unlike starting a business on other public chains, the TON ecosystem provides developers with greater innovation space. This means that developers can focus on various fields, not limited to financial products. They can explore games, social products, and even simple bot applications, all of which have great potential for development. The TON ecosystem provides a broad stage for innovation, allowing Web3 builders to explore new business opportunities.

Project Ecosystem

1. Ecosystem

Currently, the TON network ecosystem is led by the TON Foundation, which is 100% community-led. This means that the direction and development of the entire ecosystem depend more on the community's needs and innovation. This community-led model can respond more quickly to market demands and technological advancements compared to many centralized foundations.

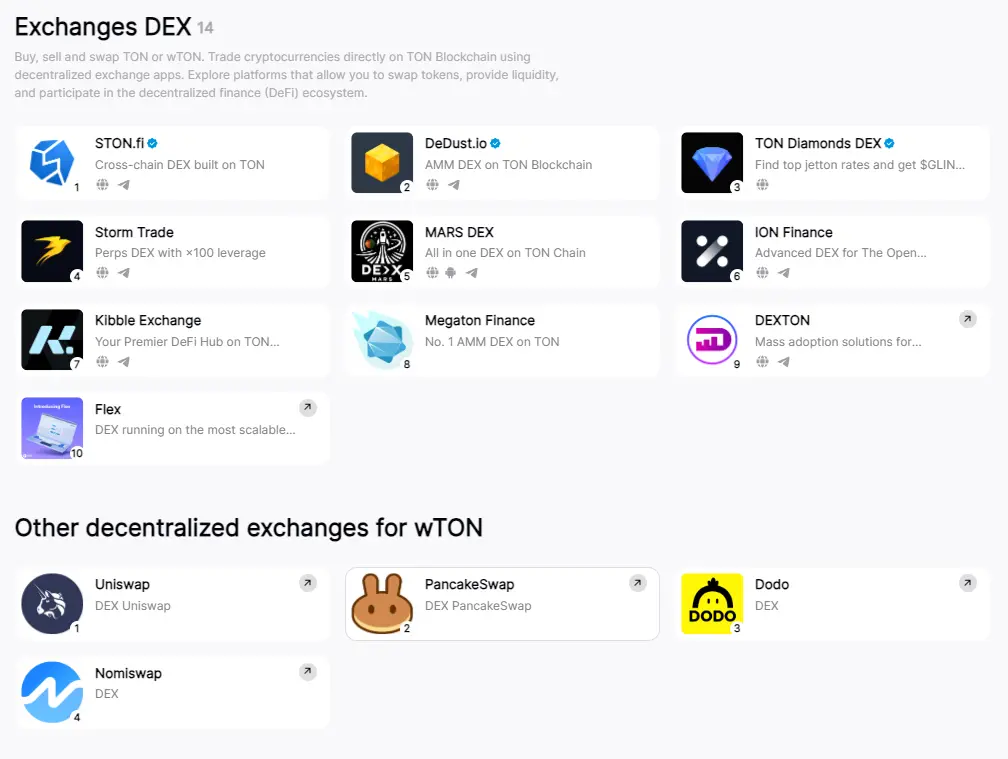

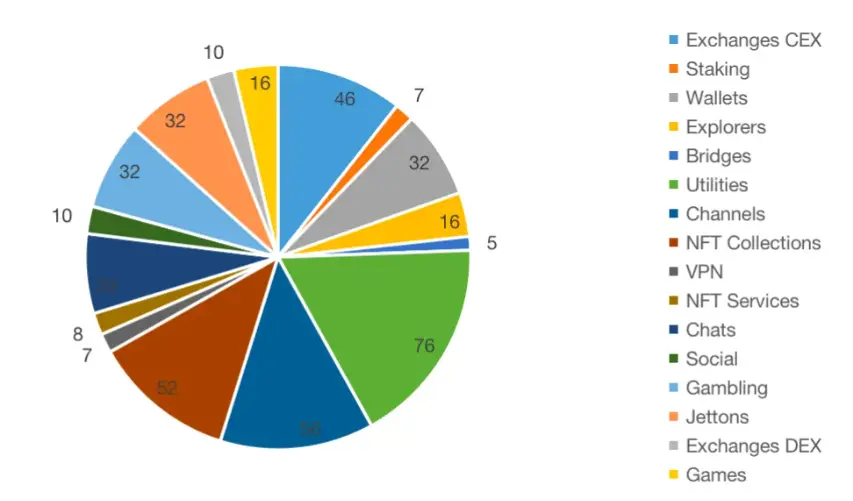

According to statistics from ton.app (as of May 28, 2024), the TON ecosystem currently has 792 apps, which is not a small number for a public chain that has not yet exploded. However, the number of apps included by DefiLlama is 14, covering liquidity staking, DEX, DeFi, privacy, SocialFi, and gaming, with a significant increase in the proportion of financial projects. With the influx of more capital and users, these projects are expected to create more innovative financial products and services.

Source: TON Official Website

Although only a few apps are currently included by DefiLlama, this does not mean that other apps lack value. In fact, over time and as technology matures, more apps may be widely recognized and gain more users and investments.

Source: TON Foundation

The TON ecosystem features diversification and comprehensiveness, providing users with opportunities for comprehensive encrypted asset management, trading, social interaction, and innovative experiences, including:

Encrypted Asset Management:

- Wallet Services: Users can store and manage various encrypted assets in TON applications.

- Trading Platforms: Users can buy, sell, and exchange TON and wTON through the application's DEX and CEX functions.

Developer Tools:

- Dev Tools: Applications provide developers with the tools they need to develop applications and smart contracts on the TON blockchain.

Social and Communication:

- Telegram Interaction: Users can stay up to date and participate in the community by tracking TON's Telegram channels and group chats.

- Social Network: The TON ecosystem supports blockchain-based social networks, providing a new social experience.

Gaming and NFT:

- Blockchain Games: Users can play blockchain games, experience innovative gameplay, and engage in digital asset trading.

- NFT Ecosystem: Explore NFT collections, markets, and related tools on the TON blockchain, participating in digital art transactions.

Other Features:

- Shopping Experience: Support for shopping using Toncoin.

- Privacy Protection: Enhance online security and privacy protection through TON blockchain-based VPN services.

- Staking Applications: Maximize the utilization of Toncoin and participate in staking for rewards.

Market Performance

Market Data

1. Token Price Trends

Source: DEXScreener

Market Trading Volume Ranking

According to the exchange trading volume data displayed by CoinMarketCap, the ranking of trading volume from high to low is: Bybit, OKX, Bitget. The high trading volume on these exchanges indicates that TON is receiving significant attention and participation in the market. In particular, the leading trading volume on Bybit demonstrates its dominant position in TON trading.

Price Trend Analysis

Since its launch on October 21, 2021, the price of TON has experienced significant fluctuations:

Highest point: $7.2, Lowest point: $0.85, Recent one-year range: $1.2 - $7.2

This price information reveals that TON has experienced significant volatility in the market, with noticeable changes in market sentiment and fund flows at different times. The high trading volume and high prices after February 2024 indicate significant capital intervention, implying positive market expectations for TON's future.

Chip Distribution and Trading Volume Analysis

- Fluctuation in the range of 0.9-2.6: TON has mainly fluctuated in this range over the past two years, indicating the accumulation of a significant amount of chips in this range in the market.

- Volume expansion range: When the price is near 2.6, the trading volume significantly increases, indicating significant market attention. This situation is consistent with the rapid growth in prices and trading volume later, indicating signs of significant capital intervention, possibly from institutional or large investors.

Circulating Supply and Market Cap Analysis

TON's circulating supply is relatively concentrated, especially on the top exchanges:

- Bybit: 16.71 million

- OKX: 6.83 million

- Bitget: 4.5 million

The total circulating market value of the exchange is 236 million USD, and the number of non-zero TON addresses on the chain has reached 3.6 million, indicating a broad user base for TON. However, due to the token's concentration in a few addresses (the top 20 addresses hold 71.34% of the market value, and the top 100 addresses hold 93.01% of the market value), there is a certain degree of token supply concentration.

Market Outlook

- In summary, TON has shown high recent ecosystem activity, rapid growth in Total Value Locked (TVL), a significant increase in the number of participants, and the listing of its representative project Notcoin on Binance, all reflecting its significant potential in the market.

- However, at present, TON's capital volume (TVL is 220 million USD) is still relatively low compared to other public chains, indicating that it is still in the early stages of development. However, considering the large active user base of Telegram, TON's future growth potential should not be overlooked.

Risk Factors:

- Selling Pressure: If tokens do not continue to flow into exchanges, the price may remain relatively strong. However, once selling pressure increases, the price may face significant fluctuations.

- Concentration Risk: TON tokens are highly concentrated, with a few addresses holding a large number of tokens. Once these addresses start selling, it will significantly impact the market.

2. Trading Volume and Market Depth

Current project TVL performance: 228M, ranking 28th in the same track of public chains, with TVL starting to grow significantly in March 2024.

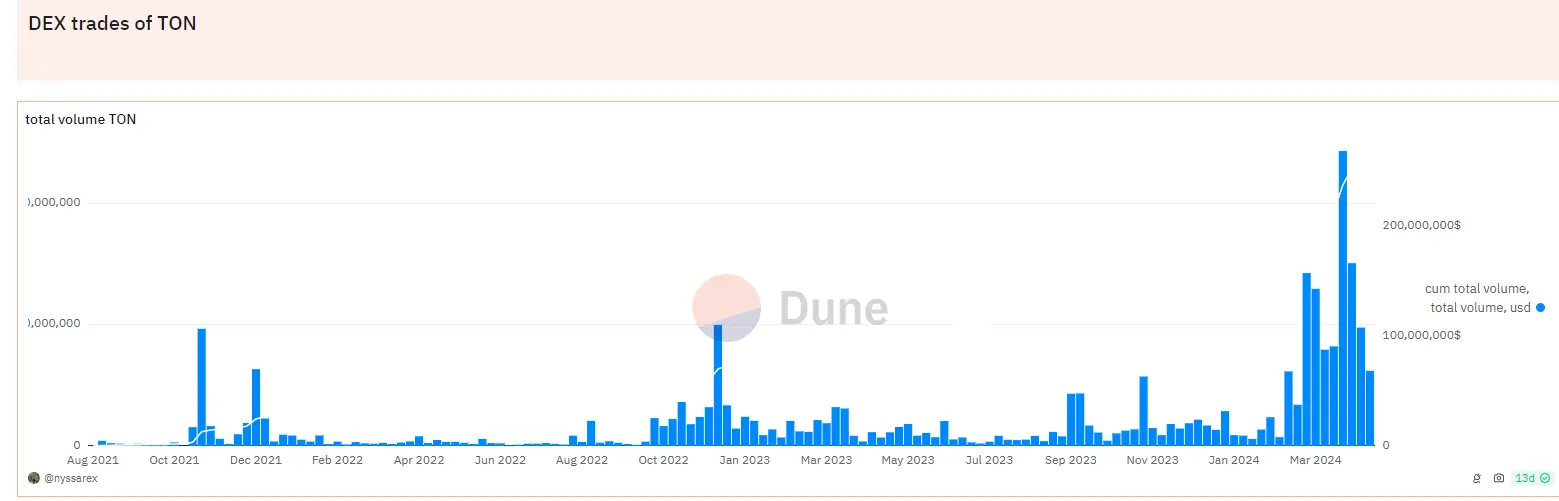

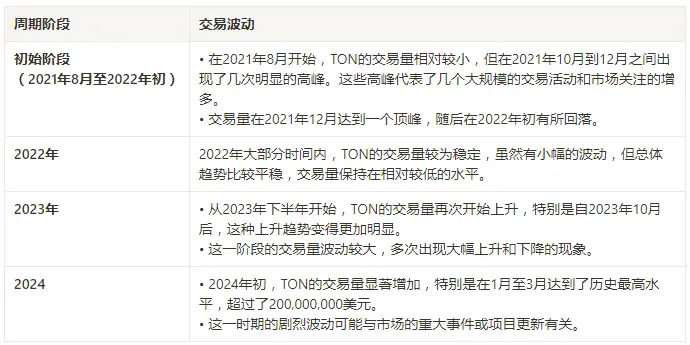

Trend of TON trading volume on DEX

From the chart, it can be seen that since August 2021, decentralized exchange (DEX) trading volume of TON (The Open Network) has experienced significant fluctuations:

TON's DEX trading volume has experienced gradual growth from the initial low to recent significant growth. This indicates an increasing popularity and participation of TON in the market, especially in recent months. However, the volatility of trading volume also suggests market uncertainty and potential risks.

Competitive Environment

TON Chain, as an emerging blockchain project, faces a dynamic and highly competitive market environment. The rapid development of blockchain technology has attracted various innovative projects, which not only compete fiercely on the technical level but also demonstrate their capabilities in community building and application promotion. In such a context, TON Chain needs to accurately grasp market dynamics, identify key competitors, and find its own positioning in order to stand out in the market.

High-Performance Blockchain Track

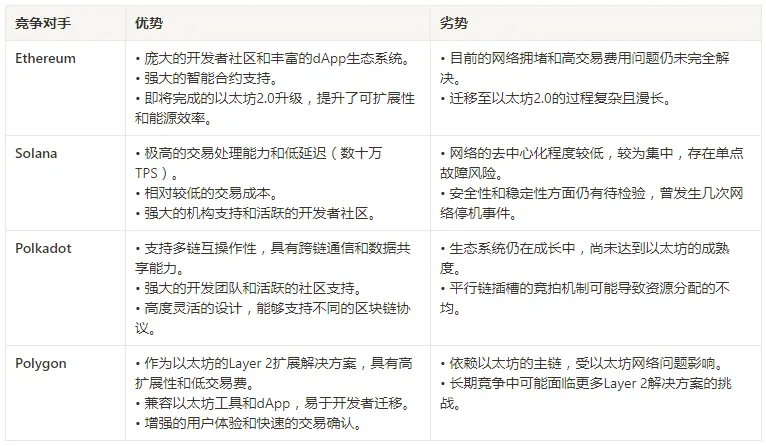

High-performance blockchain is an important development direction in the current blockchain industry, aiming to solve the scalability and efficiency issues of traditional blockchains. TON Chain is positioned in the high-performance blockchain field, striving to achieve efficient transaction processing and resource utilization through innovative architecture design and advanced consensus mechanisms. In this field, several well-known projects have already occupied important market positions, including Ethereum, Solana, Polkadot, and Polygon.

These projects each have significant technical advantages and market influence. Ethereum further solidifies its industry leadership position through its widespread applications and the upcoming 2.0 upgrade. Solana has attracted a large number of users and developers with its outstanding processing capabilities and low transaction costs. Polkadot has successfully created a multi-chain ecosystem through its unique cross-chain interoperability design. Meanwhile, Polygon, as Ethereum's Layer 2 scaling solution, has performed well in improving transaction efficiency and reducing costs.

Decentralized Application (dApp) Platforms

Decentralized application platforms are important application scenarios for blockchain technology. TON Chain is committed to providing an efficient, scalable, and secure environment for dApp development, placing it in direct competition with platforms such as Ethereum, EOS, and Binance Smart Chain (BSC). While Ethereum still holds the largest market share, its mature dApp ecosystem and extensive developer support are undoubtedly the targets that TON Chain needs to face and surpass. However, at the same time, EOS and BSC have achieved significant success in their respective niche markets through high performance and low costs.

Blockchain Infrastructure

In addition to specific competing projects, the rapid evolution of blockchain infrastructure poses a potential competitive threat to TON Chain. For example, Layer 2 solutions (such as Rollups and Plasma) and cross-chain bridge technologies (such as Cosmos' IBC and Polkadot's XCMP) continue to mature. These technologies can significantly improve the scalability and interoperability of existing blockchain networks, potentially challenging TON Chain's technological leadership position.

Market Demand and User Preferences

Market demand and user preferences are key factors that affect the success of blockchain projects. Users are increasingly focused on the practical application value and usability of blockchain projects, rather than just comparing them at the technical level. TON Chain needs to meet market demand by providing simple and user-friendly development tools, efficient and secure trading experiences, and a diverse dApp ecosystem to attract more users and developers.

Regulatory Environment

Finally, the regulatory environment of the blockchain industry is also an important factor that cannot be ignored. Regulatory policies around the world are becoming increasingly strict, placing higher demands on the compliance of blockchain projects. TON Chain must actively address regulatory challenges in different regions around the world while ensuring its technological and market advantages.

1. Major Competitors and Alternatives

2. Comparison of TON Chain with Major Competitors

TON Chain's main competitive advantage lies in its innovative architecture design, providing efficient transaction processing capabilities and support for decentralized applications. Additionally, TON Chain's native sharding technology and flexible smart contract platform also contribute to its performance and scalability.

However, TON Chain also faces some challenges, including how to quickly build and expand its ecosystem, attract more developers and users, and stand out in a highly competitive market. The competitive environment in which TON Chain operates is complex and ever-changing, involving intense competition in technology, market demand, and regulatory environment. Only by fully understanding the competitive environment, leveraging strengths, and avoiding weaknesses, can TON Chain find its own blue ocean in this red sea.

Conclusion

Overall Evaluation of TON's Fundamentals:

TON, as a blockchain project based on the Telegram platform, demonstrates significant market advantages and future development potential.

Advantages

- Large User Base: Telegram has over 900 million active users, providing a huge potential market for TON, and the expected growth of user base is quite optimistic.

- Efficient Technical Architecture: TON supports tens of thousands of transactions per second, with significant technical advantages in high throughput and low latency, meeting the needs of high-frequency trading. Rooted in the Telegram ecosystem, it has a natural advantage in the user market.

- Robust Token Economic Model: Through a scientific distribution strategy, clear application scenarios, and a wide range of user groups, the TON token has formed a stable and growth potential economic system. Moderate token supply growth and reasonable distribution of holdings ensure market liquidity and value stability.

- Diverse Application Scenarios: The TON ecosystem currently includes multiple areas such as payments, decentralized storage, and more. The rich number of on-chain applications, especially in the financial sector, shows significant growth potential. The TON ecosystem demonstrates great vitality and development potential.

- Continuous Ecosystem Development: With the increase of developers and users, the TON ecosystem continues to expand. The official platform has already included nearly 750 applications, covering staking, wallets, NFTs, social, games, and more, forming a thriving ecosystem. The continuous introduction of developer-friendly activities and support strategies by the official platform helps developers better serve the ecosystem, strengthening ecosystem prosperity and optimization.

- Continuous Innovation: The TON team continues to improve technology, continuously optimizing on-chain performance and user experience, ensuring that TON maintains a leading technological position. The project roadmap is clear, and the team's technological advantages are evident.

Disadvantages and Risks

- Centralization Controversy: Despite the use of advanced technology, the decentralization level of the TON chain is still questionable, with initial token distribution methods and a high team holding ratio.

- Immature Ecosystem: Compared to mature platforms like Ethereum and Polkadot, the TON ecosystem is still in the early stages of development and needs more time to attract developers and DApp projects.

- Security and Stability Risks: As an emerging blockchain platform, TON needs to prove its security and stability under large-scale applications, otherwise it may face significant impacts from technical vulnerabilities or security events.

- Regulatory Risks: The global regulatory environment in the blockchain and cryptocurrency field is still uncertain, and TON may face compliance pressure from various governments and regulatory agencies.

- User Education and Adoption: Despite the support of Telegram, the general understanding of blockchain and cryptocurrency among ordinary users is still limited, and driving widespread adoption still faces challenges.

- Limited Market Liquidity and Exposure: Although ranked 8th in market value, TON has not yet been listed on larger exchanges, which may limit its liquidity and market exposure. If it can overcome these bottlenecks, TON may encounter greater development opportunities.

Future Outlook

TON demonstrates significant development potential and market vitality. With the continuous development of Telegram's application scenarios and the participation of more developers, the user base and ecosystem of TON are expected to further expand. In the future, the token economic system of TON will become more robust, attracting more users and developers to participate, forming a thriving ecosystem.

Although facing many challenges, through continuous technological and ecological progress, TON is expected to achieve leapfrog development in the blockchain field and become an important participant in the ecosystem. Investors should carefully consider market risks and potential technological and regulatory obstacles while evaluating its long-term development potential.

Upcoming Content

Through this detailed fundamental analysis, we hope to provide you with a comprehensive understanding of TON Chain's core technology and architecture, as well as its potential and advantages as a future blockchain giant. Thank you for reading our report!

Next, we will release the second report in this series, "TON Ecosystem Panorama: Exploring Leading Projects and Future Opportunities on the Chain". In this report, we will:

- In-depth analysis of various components of the TON ecosystem, exploring developer communities, node operators, users, and application scenarios.

- Focus on leading projects within the TON ecosystem, especially in DeFi, NFT, GameFi, and DApp development tools, providing detailed data and case analysis to explore their future development potential.

In the final report, "Compliance and Risk Assessment of TON Chain: Coexistence of Prospects and Challenges", we will:

- Comprehensive evaluation of the compliance of TON Chain in different legal jurisdictions.

- Analysis of legal, market, and technological risks.

Stay tuned for the next two reports, which will bring you richer and more in-depth insights and analysis, helping you find more opportunities and value in the TON Chain ecosystem!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。