In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

The US PMI data weakened, indicating a potential early recession in the US economy, leading to a decline in the US dollar index and a short-term breakthrough of BTC above $70,000. The overall wealth creation effect in the market is good, including:

Sectors with strong wealth creation effects: blockchain gaming, meme sector, and Rune track

User hot search tokens & topics: UXLink, GME, ALICE

Potential airdrop opportunities: Bedrock, Nile Exchange

Data statistics time: June 4, 2024, 4:00 (UTC+0)

I. Market Environment

Yesterday, the price of BTC broke out of a low volatility range, forming an upward trend, with the price of BTC briefly breaking through $70,000 and then pulling back to around $69,000. The ETH/BTC exchange rate retreated to the support level of 0.054, with implied volatility of 52 for BTC and 65 for ETH. Generally, in a bull market environment, when tokens form an upward trend, each pullback is an entry opportunity. It is advisable to pay attention to the timing of investing in hot tokens when they pull back to the bottom line of the Bollinger Bands, and to sell after the tokens break through the top line of the Bollinger Bands. This strategy generally carries lower risk and higher returns than holding spot positions.

At the macro level, due to the weakening of US PMI data, there is a risk of recession in the US economy. The yield on the US 10-year Treasury bond has dropped from 4.5% to around 4.4%, and the US dollar index has declined, which is short-term positive for the crypto market. The New York Stock Exchange experienced trading failures, with stocks such as Berkshire Hathaway showing a decline of over 99%, leading to short-term risk aversion among crypto traders, which is an important reason for the market's peak and subsequent decline.

II. Wealth Creation Sectors

1) Sector Movement: Blockchain Gaming (NOT, ALICE, PORTAL)

Main reasons:

NOT experienced a surge in prices, rising 5 times from the bottom price of 0.005 within a week, attracting capital inflows and attention from the market;

The sector rotation effect is evident, with significant inflows of hot money into ALICE contract data, with a large amount of main funds buying in;

Rise situation: NOT rose by over 80% in 3 days, ALICE rose by over 60% in 3 days, PORTAL rose by over 20% in 3 days;

Factors affecting the future:

Technical indicators: In a bull market environment, after tokens form an upward trend, each pullback is an entry opportunity. It is advisable to pay attention to the timing of investing in hot tokens when they pull back to the bottom line of the Bollinger Bands, and to sell after the tokens break through the top line of the Bollinger Bands. This strategy generally carries lower risk and higher returns than holding spot positions;

Changes in open interest: ALICE's contract data showed significant changes yesterday, with a substantial increase in open interest, a net purchase of $5 million worth of tokens, equivalent to a net purchase of about $10 million by main funds, driving the price upward. The long/short ratio of contract trading accounts is less than 1, confirming the entry of main funds. Subsequent attention should be paid to changes in open interest, to see if a net increase in long positions is formed;

2) Sector Movement: Meme Sector (PEOPLE, LADYS)

Main reasons:

The US presidential election, held once every 4 years, is approaching, and PEOPLE and LADYS are currently the mainstream tokens supported by CEX most relevant to the election, attracting high community attention recently;

Institutional entry: DWF announced a $5 million investment in LADYS, driving the hot spot of related assets;

Rise situation: PEOPLE rose by over 40% in 7 days, LADYS rose by 11% in 7 days;

Factors affecting the future:

US election process: Pay attention to the impact of the US election process on this sector. If positive news emerges, PEOPLE and LADYS may rise first;

Dynamics of main funds: Understand whether main funds continue to flow in through contract data and the news of the primary market. Generally, a sudden substantial increase in open interest in contracts indicates the core standard of main funds' entry, and the dynamics of contract indicators should be continuously monitored;

3) Sectors to Focus on in the Future: Rune Track

Main reasons: BTC briefly broke through $70,000, the BTC ecosystem is warming up, and BTC runes are a new type of asset with speculative space;

Specific coin list:

DOG: A project created by the well-known KOL and builder Leonidas of ord.io, with a well-operated community and strong community purchasing power;

RUNECOIN: Just launched, it airdropped to players facing high transaction fees, with ample project funds, and previously conducted stake activities in cooperation with 9GAG & MEMELand, demonstrating an understanding of token operation;

SATOSHI•NAKAMOTO: The project's on-chain popularity is rising, with yesterday's trading volume reaching $10 million and the number of holders reaching 18,000, with a strong community base and high popularity;

III. User Hot Searches

1) Popular Dapps

UXLink:

UXLINK announced the completion of the first season community airdrop certificate NFT snapshot on the X platform, covering over 1.5 million independent community addresses. According to DappRadar and TON chain data, the number of independent addresses holding UXLINK on-chain NFT ($UXLINK token airdrop certificate) is 1.5 million, equivalent to the current number of independent addresses holding NOTCOIN tokens, exceeding the 220,000 independent address count before NOTCOIN tokens were listed. UXLINK's Dapp Unique Active Users data on the Arbitrum chain has also ranked first for several days.

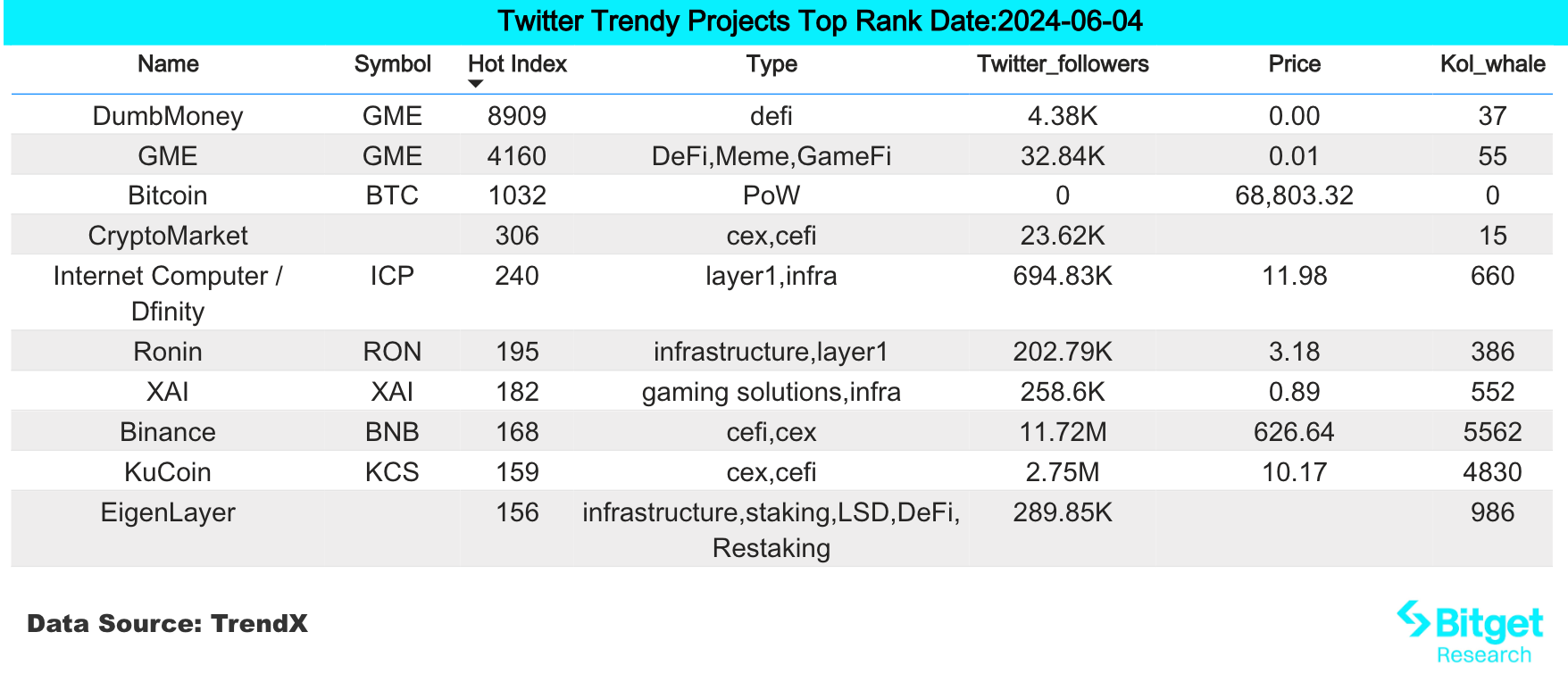

2) Twitter

GME:

Retail investor king Roaring Kitty posted a position screenshot on Reddit, showing that Roaring Kitty holds GME stocks and GME call options, with the call options expiring on June 21, 2024. Roaring Kitty posted a "flip card" from the UNO card game on Twitter, sparking market discussions. GME, KITTY, and other GameStop-related tokens experienced a short-term surge.

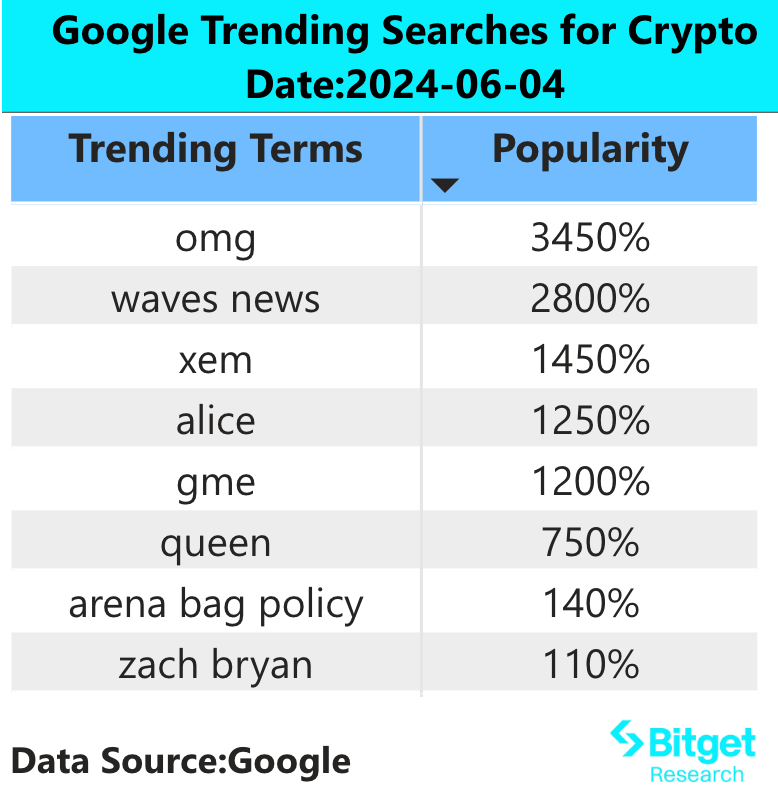

3) Google Search & Regions

From a global perspective:

ALICE: GameFi project MyNeighborAlice (ALICE) saw a significant rise yesterday, driving up several low- to mid-market value old GameFi tokens.

OMG, WAVES, XEM: Binance decided to cease trading and delist the following tokens on June 17, 2024: OmiseGO (OMG), Waves (WAVES), Wrapped NXM (WNXM), NEM (XEM).

From regional hot searches:

(1) In the Asian region, Notcoin (NOT) stands out in hot searches, and the previously highly popular "CeDeFi concept" hybrid exchange Blum in the CIS region has also begun to appear in some Asian countries' hot searches.

(2) In the European and American regions, attention is focused on the TON ecosystem. In addition to TON and NOT, the unreleased Hamster Kombat also appeared in the hot search rankings; in addition, new memes such as ZACK, CWIF, and PEW also appeared in hot searches in several European and American countries.

(3) In the CIS region, the Bitcoin ecosystem project Babylon made it to the top of the Russian hot search list yesterday.

IV. Potential Airdrop Opportunities

Bedrock

Bedrock is a multi-asset liquidity re-staking protocol, starting with the institutional-grade liquidity re-staking token uniETH on EigenLayer, and later expanding to become the first and largest liquidity re-staking protocol on the IoTeX network. It will introduce the protocol before the launch of the Babylon mainnet, supporting liquidity staking of Bitcoin uniBTC.

Bedrock's TVL has exceeded $200 million, with a strong lineup of backers: OKX Ventures, LongHash Ventures, and Comma3 Ventures leading the investment, with additional participation from Droplet Capital, Lbank Labs, Amber Group, ArcheFund, Whale Ground, and Babylon co-founder Fisher Yu, among other angel investors.

Specific operations: If you hold ETH or IOTX, you can stake them in Bedrock as uniETH or uniIOTX to earn staking rewards and future Bedrock airdrops. If you hold wBTC, you can stake it in Bedrock as uniBTC to receive staking rewards, Babylon airdrops, and Bedrock airdrops in the future.

Nile Exchange

Nile is a centralized liquidity DEX on Linea, combining incentive measures with centralized liquidity to achieve higher levels of capital efficiency. As a sister branch of RAMSES on Arbitrum, NILE inherits the proprietary centralized liquidity ve(3,3) implementation mechanism. Nile Exchange is one of the Eligible Protocols in Linea's The Surge event, and providing liquidity to the Nile protocol can earn LXP-L points from Linea.

Specific operations: On the Linea mainnet, deposit LP positions of weETH/ETH, wrsETH/ETH, ezETH/ETH, and USDC/USDT into Nile to earn a higher APY and multiple points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。