The points system faces many challenges in the implementation process, but through continuous optimization and innovation, Web3 projects are expected to find more efficient and fair incentive methods.

Author: HappyBlock

In the Web3 field, adding financial attributes to various tracks (such as SocialFi, GameFi, NFTFi, ArtFi, etc.) is mainly to utilize the advantages of blockchain technology and decentralized finance to promote assetization, incentive mechanisms, financing, liquidity, and autonomy, endowing these tracks with new economic models and application scenarios.

The development of user incentives in Web3 has gone through an evolution from tokens, whitelists, Credentials to task platform points, and then to the project's own points. In the initial years, tokens were often used to incentivize participant growth or loyalty, to capture value, or to provide various types of product core utility. Common token gameplay focused on one-time retroactive airdrops to incentivize participation and reward early users (such as Uniswap, ENS); to continuous liquidity mining projects, rewarding users for performing certain actions (such as LooksRare, Compound). At the end of the NFT Summer, in order to identify "family members" willing to contribute to the community and grow with the community, whitelists became popular, but the term "whitelist" eventually became a stable low-cost arbitrage tool and a chip overhyped by the project, leaving a mess in the NFT market with the arrival of the bear market. The explosion of task platforms and the popularity of the SBT concept have led to another iteration of Web3's incentive methods, with countless on-chain and off-chain behaviors turning into vouchers that exist in the virtual space of each wallet. If these vouchers cannot be used well, they will eventually become cyber signals like snowflakes.

Point Incentives

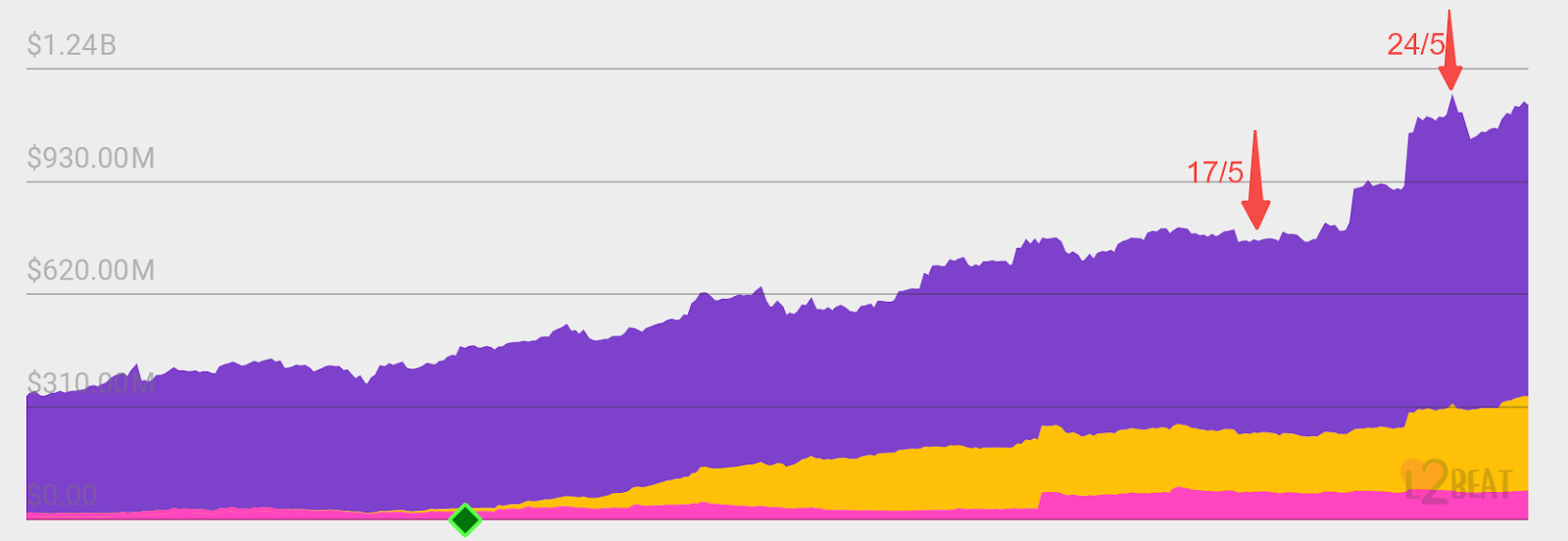

At the last bull-bear transition, the L2 public chain Blast successfully led the trend of project parties using Points for user incentives by introducing a points system and giving it real value. And recently, Linea seems to have embarked on the successful path of replicating this route. On May 17, Linea 5 launched the first phase of Volt for Linea Surge, aiming to promote the development of the ecosystem by attracting more users and increasing the TVL on the network. Linea Surge is a point-driven plan, where users can earn LXP-L tokens by holding assets on Linea and deploying them to DeFi protocols on the network. On May 24, Linea's TVL exceeded 1.1 billion USD, reaching 1.12 billion USD, setting a new historical high with a 42.58% increase in 7 days. One of the goals of the Linea Surge plan is to increase the total locked value (TVL) on the network to promote the development of the ecosystem. Data shows that Linea's TVL has grown significantly after the launch of the Surge plan, surpassing 1.1 billion USD, achieving one-third of the plan's goal (TVL reaching 3 billion USD).

Even around the incentive method of Points, a new track called PointFi has emerged, with Whales Market being a leader. Whales Market provides a new peer-to-peer primary market platform, allowing users to pre-exchange tokens before the official release. This also includes a P2P points market—Whales Market uses smart contracts to allow buyers and sellers to reach a mutually agreed upon on-chain transaction. After the token is released, Whales Market will automatically convert the points into the corresponding tokens according to the foundation's announcement, and the points order must be set in advance, but the final exchange rate for tokens will only be announced at the TGE. However, some users believe that this mechanism may lead to the points of the seller greatly exceeding the value of the tokens they receive. This may mean that the seller faces risks in the transaction because they cannot determine the value of the tokens in advance, and the quantity of points may far exceed the value of the tokens.

The prevalence of the Point incentive method reflects the urgent need of project parties to increase user retention and engagement, but as more and more points programs complete token exchanges, users and the market are beginning to voice many different opinions.

Proliferation of points systems: As more and more projects adopt points systems, some people have begun to question whether this incentive model is truly effective. They are concerned that the points system may lead to the phenomenon of "toxic TVL," attracting a large amount of funds, but not truly bringing users or builders. In addition, some people believe that the points system causes user behavior to focus more on acquiring points rather than making real contributions to the project.

Speculation and bot operations: Some voices point out that the appearance of the points system has attracted a large number of speculators and bot operations, leading to a market bubble and an unhealthy environment. Project parties use the points system to quickly gain users and trading data, but this data may not be genuine or sustainable.

Regulatory and compliance challenges: With the increasing attention of regulatory agencies to the crypto market, project parties face more compliance challenges. Some people believe that the lack of clear regulatory rules has led to the abuse and confusion of the points system, making it difficult for investors to truly understand the content and risks they are accepting.

User attention diversion: As more and more projects adopt points systems, user attention may be diverted, making it difficult for them to focus on specific projects or ecosystems. The points system becomes a means to attract user retention, but it may not necessarily bring long-term value and loyalty.

Some users question the input-output ratio: Points simplify the incentive logic of traditional airdrops, but as the data of project parties and user panels gradually increase, users may have unclear expectations of future airdrops due to the increase in points, and may ultimately face ambiguous profit calculations or be "flexibly" determined by the project party. The phrase "points do not mean profit commitment" often leads to various "noises" within and outside the community during the vacuum period from the end of the points activity to the incentive realization.

Although the points system may bring short-term attention and funds to projects, ensuring that this incentive model truly promotes the healthy development and long-term sustainability of the ecosystem still requires the joint efforts and thinking of project parties, investors, and regulatory agencies.

Solution—Long-term incentive mechanism

Phased rewards: Rewards are divided into multiple stages, and users need to complete tasks in different stages to receive the full reward. For example, many projects recently, including Ether.fi, Renzo, and UXLINK, have adopted phased airdrops. These projects generally announce the total amount of the first phase airdrop and future (vague) airdrop plans at the same time as the announcement of the airdrop eligibility to ensure continuous attention from the community users, while attracting seed users (which can be seen as the group covered by the first batch of airdrops) for the project and profit expectations.

Sharing of phased reward cases (using the Renzo project as an example):

Renzo rewards are distributed in multiple stages, and users need to complete tasks in different stages to receive the full reward.

Season 1

Method of acquisition: Users earn points by minting and holding ezETH or providing liquidity.

Reward mechanism: 1 point is earned for every hour of holding 1 ezETH; 4 points are earned for depositing 1 ezETH and 1 ETH in the DEX pool every hour.

Additional rewards: Early participants can receive additional rewards.

Season 2

Start date: April 26

Method of acquisition: Continue to hold or increase the balance of ezETH, stake REZ to earn points.

Reward mechanism: ezETH holders in the user's wallet and supported ezETH DeFi integrations provide additional point rewards. Staking 5000 REZ earns 1 point per hour.

Additional rewards: Participants from Season 1 who maintain or increase the balance of ezETH in Season 2 will receive a 10% additional point reward, and Season 1 airdrop holders who maintain a daily average REZ staking balance greater than the airdrop amount will receive a 50% additional point reward. All bonuses will take effect at the end of Season 2.

This approach not only incentivizes long-term user contributions but also increases the project's exposure by continuously introducing newsworthy points.

"Time-weighted" loyalty program: Establishing a "time-weighted" loyalty program that differs from traditional loyalty programs, where users' long-term participation and contributions can not only accumulate points but also enjoy higher redemption bonuses.

Design proposal for the time-weighted mechanism (using the SocialFi project as an example):

Due to the high cost of social migration and the strong first-mover advantage of centralized social platforms, this track has almost no successful projects. Social finance projects need to attract users and increase activity through other means. For example, in Lenster, friend.tech, and Farcaster, we see that the financial attributes such as airdrops, incentives, and financing have a much greater impact than the application itself as a social attribute. So how can we more reasonably release the financial attributes of social products? Perhaps we can imagine a plan specifically for recording user contributions to early-stage SocialFi projects, where all of the user's on-chain behaviors are recorded, including but not limited to the frequency and duration of participation in the project, as well as the specific contributions made each time, such as content creation, participation in discussions, and making suggestions. The frequency of user contributions and the duration of participation will proportionally affect the number of points they can accumulate. More frequent and long-term sustained contributions will receive more points rewards, while less frequent or shorter-term participation will receive fewer points rewards.

At the same time, a time-weighted ratio needs to be designed to determine the impact of the duration of user contributions on the points rewards. For example, the points received at the beginning of participation may only be a small fraction of the total after full participation. The time-weighted ratio can be adjusted according to specific circumstances to balance user incentives and project needs.

Example scenario:

User A has been actively participating in the project for 1 year, publishing content every month and actively participating in community discussions.

User B only participated in the project for 1 month and only published one piece of content. After learning about the airdrop snapshot time, they started to continuously publish content and actively participate in community discussions.

Let's assume that both User A and User B were actively engaged in community interactions and content creation in the months of July, August, and September of the year. The points accumulated over these three months are almost equal. However, due to A's significantly longer total contribution time compared to B, according to the time-weighted mechanism, the proportion of points that User A will receive when redeeming points will be significantly higher than that of User B, because of A's higher frequency of participation.

There are also studies suggesting that the economic model of projects, such as GameFi, can incentivize user participation and contributions through social rules (such as achievement systems, ranking systems) and economic rules (such as points rewards, NFT rewards). Specifically, it can be divided into:

Task and achievement rewards: Users can earn rewards by completing specific tasks or achieving milestones, incentivizing them to participate more in the game.

Social interaction: Encouraging players to earn rewards through social interactions (such as teamwork and competition) to enhance community stickiness.

Virtual asset trading: Allowing players to trade NFTs and other virtual assets, which will bring points and even token rewards.

Player behavior and contributions in the game will directly affect the quantity and value of rewards they can receive, which is certain. But how to allow highly active and contributing players to receive more rewards and thus occupy a more favorable position in the economic system is a topic worth researching and experimenting with.

In addition, it may also be considered to introduce a lock-up mechanism similar to VC (points can only be exchanged for tokens at specific times or after certain conditions are met) or design a gradual unlocking mechanism (users gradually unlock points within a certain period after the project goes live, which is beneficial for maintaining the value of points).

Conclusion

Although the points system faces many challenges in the implementation process, such as speculation, regulatory issues, and user attention diversion, through continuous optimization and innovation, Web3 projects are expected to find more efficient and fair incentive methods. We have proposed new incentive mechanisms such as phased rewards and time-weighted loyalty programs. The effective use of these methods can not only incentivize long-term user contributions but also increase the project's exposure by continuously introducing newsworthy points. At the same time, project parties can combine social rules and economic rules to further design incentive systems that truly promote user participation and contributions. In the future, through the joint efforts of all parties, the Web3 ecosystem will usher in a healthier and more sustainable development, bringing more value and opportunities to users and developers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。