By introducing innovative heavy staking options and promoting a competitive environment, Sanctum can provide Solana stakers with more flexibility, increased liquidity, and additional profit opportunities.

Authored by: Greythorn

Market Opportunity

Liquid staking has fundamentally changed the way asset management works in PoS networks by transforming traditionally illiquid staked assets into liquid assets. Staking typically involves locking up a certain amount of cryptocurrency to support the security and operation of a blockchain, rendering these assets inaccessible during the staking period. However, liquid staking issues liquid staking tokens (LST) in exchange for the staked assets. These LST tokens represent the staked amount and accumulated rewards, allowing users to trade, use in DeFi applications, or leverage as collateral without having to wait for the staking period to end.

EigenLayer is a decentralized heavy staking protocol on the Ethereum network that takes this concept further. It allows users to heavy stake by depositing LST into EigenLayer's smart contracts, earning liquidity heavy staking tokens (LRT). These LRT tokens encapsulate the value of staked tokens, staking rewards, and additional rewards from EigenLayer operations, providing users with greater flexibility and higher profit potential.

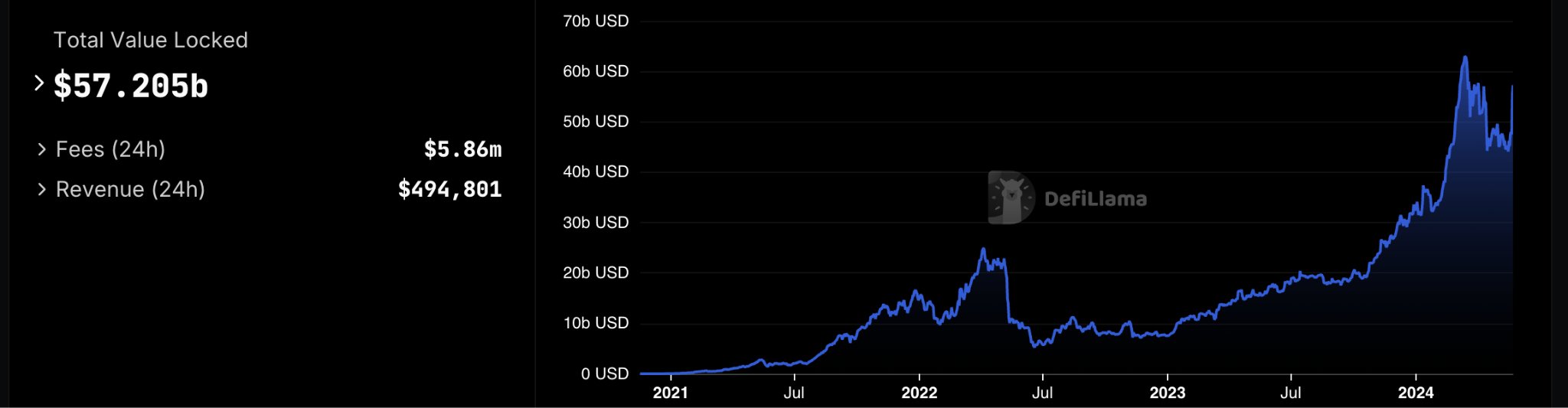

The total value locked (TVL) of liquid staking has surged from $30 million to over $57 billion in less than four years. Lido is one of the major participants in the liquid staking space, with staked assets totaling around 35 billion USD.

Source: DeFiLlama

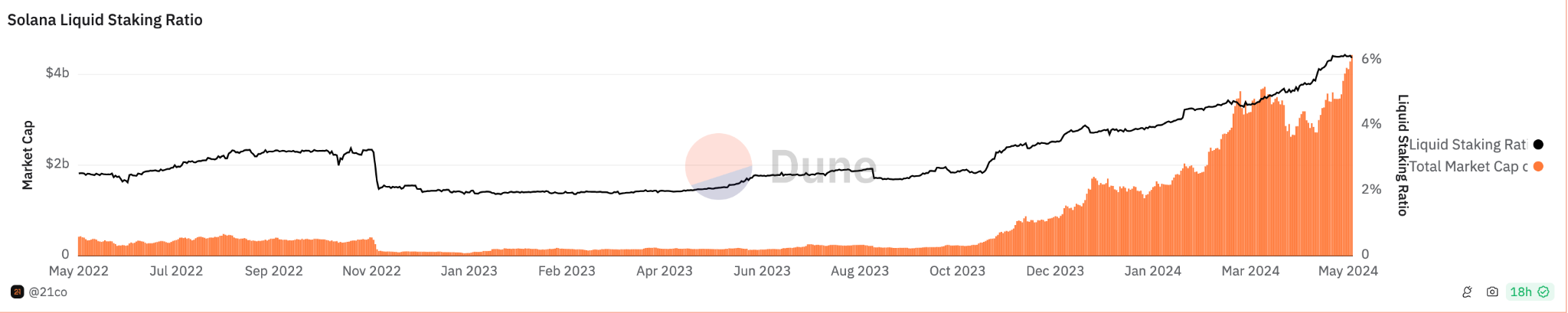

Despite such growth, there are still differences in staking ratios across different networks. For example, Solana's staking ratio exceeds 70%, significantly higher than Ethereum's 27%. However, according to data from Dune Analytics, LST accounts for only 6% of the staked supply on Solana, while it exceeds 40% on Ethereum.

Source: Dune Analytics

This presents a huge market opportunity for Sanctum within the Solana ecosystem. By introducing innovative heavy staking options and promoting a competitive environment, Sanctum can provide Solana stakers with more flexibility, increased liquidity, and additional profit opportunities. This not only meets the growing demand of the DeFi movement but also caters to the need for more efficient and diverse staking solutions, ensuring that Solana will not be dominated by a single dominant staking protocol (such as Lido) like Ethereum.

Protocol

Sanctum's Infinite Pool

Sanctum Infinity is an innovative liquidity pool designed to make trading and staking liquid staking tokens (LST) on Solana easier and more efficient. It can be seen as a large flexible pool that seamlessly exchanges various LSTs.

When you purchase LST with SOL, you may notice that the amount of LST received is slightly less than one. This is because LST accrues staking rewards over time, making them more valuable. For example, JitoSOL is priced higher than SOL because it has been collecting rewards since its launch, showing a return of about 11%.

Sanctum Infinity uses Solana's staking pool data to accurately price LST. Traditional AMMs may be inefficient with low liquidity or large trades, but Infinity's approach ensures accurate pricing regardless of liquidity, as it utilizes reliable on-chain data.

When you deposit LST into the Infinity pool, you receive INF tokens as a reward. These tokens are special because they not only earn staking rewards from all LST in the pool but also collect trading fees, providing you with an additional source of income.

Infinity also maintains balance by dynamically adjusting exchange fees. This means it encourages trades that help maintain a good mix of different LSTs in the pool, ensuring growth for both new and old tokens and providing good returns.

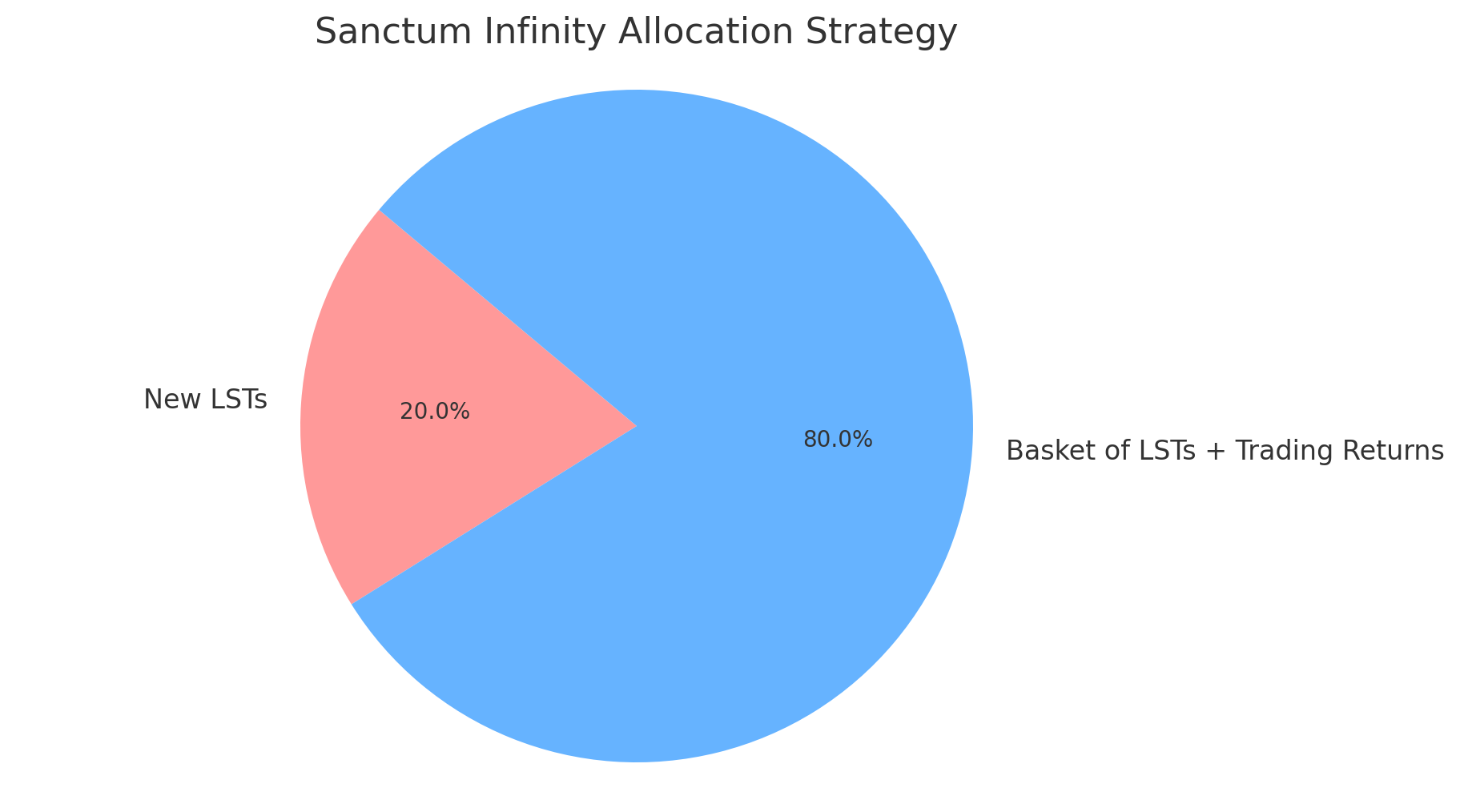

The pool allocation strategy of Infinity encourages the creation of new LSTs, reserving 20% of the pool for new approved LSTs. Each new LST requires at least 1000 SOL and is adjusted based on its holding value and recent earnings. The remaining 80% of the pool is dedicated to a mix of existing LSTs and trading returns, aiming to achieve diversified returns and high trading volume, with allocation based on the holding value of each LST, and future adjustments will consider earnings and support for smaller LSTs.

Source: Greythorn Internal

With this approach, Sanctum Infinity is a cutting-edge solution for trading and staking a wide variety of LSTs, designed to support an endless number of tokens efficiently.

Validator LST

Validator LST is a token representing your staking with a specific validator. These tokens appreciate as staking rewards accumulate, providing a flexible and efficient staking method.

When you traditionally stake SOL, you create a staking account and delegate it to a validator. To unstake, you need to deactivate this account, which takes some time. In the liquid version, when you deposit SOL into the validator LST pool, a staking account is created and delegated to a validator for you. In return, you receive a token representing your staking with the validator.

Benefits of Validator LST

● The native staking APY is similar among validators, making it difficult for them to stand out.

● Validator LSTs help validators differentiate themselves by issuing their own tokens and providing unique rewards.

● LSTs allow stakers to participate in a wider range of DeFi activities, providing more opportunities for rewards.

LST reduces the need to create liquidity pools, allowing smaller and newer validators to compete with larger validators, making the validator set more decentralized and competitive.

LST simplifies the staking process, providing instant exchanges and avoiding the long waiting period associated with unstaking in traditional methods.

The Reserve

Sanctum's Reserve Pool provides deep liquidity for all LSTs on Solana, offering unique advantages and addressing key challenges in the staking ecosystem.

Users typically have two ways to redeem LST:

Deactivate and Wait: Deactivate the staking account and wait 2-4 days to receive SOL.

Instant Trade: Trade LST on a DEX for immediate liquidity.

The Sanctum Reserve Pool simplifies the process of redeeming LST by allowing users to exchange LST for SOL immediately. The Reserve Pool then deactivates the staking account and retrieves SOL after the cooldown period. It operates by accepting staked SOL and returning SOL, then unstaking the SOL at the end of each epoch to replenish its reserve.

The Reserve Pool also supports various DeFi protocols, allowing them to accept any LST as collateral. This broad compatibility enhances the utility and adoption of LST.

More importantly, the Reserve Pool helps smaller validators compete with larger validators by providing a shared source of liquidity, promoting a more decentralized network. This democratizes staking, providing users with more choices and higher returns.

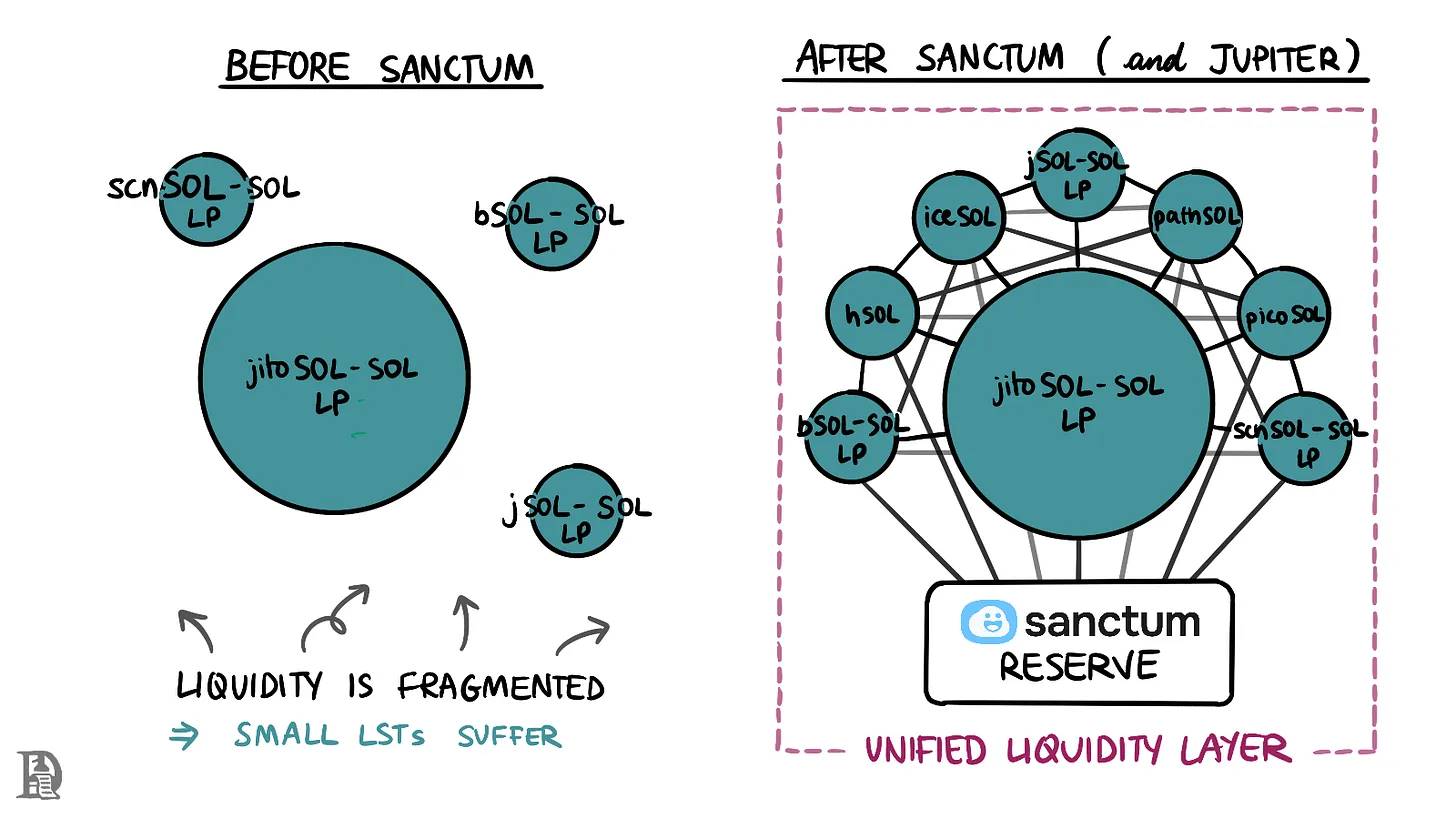

Source: Desentralised.co

The Router

Sanctum's Router is a tool that makes it easy to exchange different LSTs on the Solana blockchain. Here's a simplified explanation:

A staking account is a locked SOL account that you delegate to a validator. When you stake SOL or deposit it into LST, a staking account is created and managed by the pool. Previously, the liquidity of LST was limited by its specific pool. Shallow pools made it difficult to quickly convert LST to SOL, reducing its effectiveness and attractiveness in DeFi.

Sanctum's Router solution achieves seamless exchange of any LST by moving staking accounts between pools. This process unifies the liquidity of all LSTs. Sanctum charges a fixed fee of 0.01% for each LST to SOL exchange through the Router.

Essentially, Sanctum's Router unlocks the full potential of liquid staking on Solana by facilitating easy and efficient exchange of LSTs, enhancing liquidity and availability in the DeFi ecosystem. Lido has become a dominant force in the Ethereum staking ecosystem. Currently, 27% of ETH is staked, with nearly 30% deposited in Lido. This accounts for approximately 35.5 billion USD in total value locked (TVL), surpassing the second-largest staking protocol, RocketPool, with 4.6 billion USD. Lido's TVL represents over half of the total staked value on Ethereum and nearly one-third of the total TVL in all on-chain DeFi.

Sanctum vs Lido

Lido's liquid staking token, stETH, has become a key element in the Ethereum ecosystem. Its liquidity and widespread adoption have made it the "dollar of staked assets." The high liquidity of stETH has attracted many users, enhancing its dominant position. However, this concentration of power has also raised concerns. Lido DAO controls approximately 30% of staked Ethereum, potentially impacting the network significantly and affecting its decentralization.

In contrast, Sanctum has taken a different approach on Solana. Their journey has led to a key realization: LSTs are essentially interchangeable, just packaged staking accounts. This insight has shifted their strategy towards nurturing a multi-LST environment rather than directly competing with other staking pools.

Sanctum's philosophy is about collaboration rather than competition. Their goal is to create infrastructure that supports various LSTs. By focusing on expanding the overall staking market rather than dominating it, Sanctum aims to achieve greater success.

Lido's success on Ethereum is built on its dominant position and the widespread adoption of the stETH token. This model has proven to be very effective but also carries risks associated with centralization. In contrast, Sanctum aims to establish a more decentralized and collaborative ecosystem on Solana. By supporting multiple LSTs and promoting collaboration, Sanctum hopes to create a healthier and more inclusive staking environment and potentially surpass Ethereum's staking landscape in innovation and participation.

Sanctum vs Jito

Jito is a native protocol on Solana that gained significant attention through airdrops in 2023. Since then, it has leveraged its governance token, JTO, to incentivize liquidity and integration with other major Solana protocols, dominating the LST market on Solana.

Key Features

JitoSOL is the leading LST on Solana, with the highest APY, TVL, and trading volume in the Kamino liquidity treasury.

Collaborations with top protocols like Solend, Drift, Jupiter, and marginfi have strengthened its ecosystem presence. Through Wormhole, Jito is expanding its influence to Arbitrum, increasing the utility of JitoSOL.

Jito excels in maximizing extractable value (MEV) through its innovative Solana client and blockchain engine. This technological advantage enables it to offer higher staking rewards and optimize trade sequencing.

While Jito's growth is similar to Lido's growth on Ethereum, it has also raised similar concerns about whether this dominance could pose risks to the health of Solana's ecosystem.

Sanctum focuses on providing robust infrastructure support to ensure the stability and security of the Solana ecosystem. Key features of Sanctum include:

The Infinity multi-LST liquidity pool consolidates liquidity for various trading pairs, enhancing liquidity and reducing slippage risk.

The Reserve Pool and Router facilitate instant unstaking services and efficient LST token exchanges, supporting liquidity and stability.

Source: Greythorn Internal

Bullish Factors for Sanctum

Sanctum's unique Reserve and Router approach provides users with capital-efficient ways to redeem and exchange LST, enhancing liquidity and user appeal.

Sanctum's Reserve Pool has over 200,000 SOL (approximately 30 million USD) in liquidity, ensuring instant redemption for LST holders and reducing slippage, making it an attractive option for users.

By lowering the barrier to creating LST, Sanctum enables smaller validators to issue their own tokens, promoting decentralization and increasing validator competition within the Solana network.

Sanctum's TVL has grown to over 700 million USD, making it the fourth-largest protocol on Solana, indicating strong market acceptance and trust.

Bearish Factors for Sanctum

Despite its innovation, Sanctum faces fierce competition from established players like Jito, which has already established dominance in Solana's LST market.

Sanctum's success is closely tied to the growth and stability of the Solana ecosystem, which has experienced volatility and infrastructure challenges.

While Solana currently does not implement slashing, its potential introduction in the future could pose risks to validators and stakers, affecting the attractiveness of staking and LST. While Sanctum's unique mechanisms of the Reserve and Router are innovative, they may face challenges in user understanding and adoption compared to simpler staking solutions.

Like all crypto protocols, Sanctum also faces regulatory scrutiny and potential legislative changes that could impact its operations and the broader liquid staking environment.

Deep Dive into the Sanctum Ecosystem: Part 2

In the upcoming second part of the Sanctum research report, we will delve into all the liquid staking tokens within the Sanctum ecosystem. Our goal is to provide a concise comparison, analyzing the risks and potential staking advantages of each LST. Additionally, we will share insights and opinions on the future of this innovative project.

We recommend staying connected and following our social media for the latest updates and insights. Your engagement will ensure you don't miss any key developments, including our in-depth exploration of how innovative features like the Sanctum Router operate within the broader blockchain environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。