The "Mentougou" Mt.Gox incident, which has lasted for 10 years, is finally coming to an end.

In the early hours of May 28th, after declaring bankruptcy for 10 years and no movement in the cold wallet for 5 years, the Mt.Gox wallet showed unusual activity. It initiated 10 transactions to an unknown address, transferring 141,685 bitcoins, valued at up to $9 billion at market price. Market reports suggest that this is a preliminary preparation for Mt.Gox's debt repayment, and as a result, the price of BTC dropped by 3%, falling below $68,000.

After enduring a prolonged dispute, creditors are once again approaching a satisfactory resolution, but the market seems to be facing invisible pressure.

01. Review of the Mt.Gox Incident, a single-handedly caused the bull market to collapse

For those familiar with the history of cryptocurrency, Mt.Gox is definitely well-known. It can be said that it was one of the biggest setbacks in the history of Bitcoin and also the end of the bull market in 2013.

Mt.Gox, headquartered in Tokyo, Japan, was established by Jed McCaleb in 2010 and later acquired by French developer and Bitcoin enthusiast Mark Karpeles in 2011, becoming a leading Bitcoin exchange platform. At that time, Bitcoin was in its early stages, and there were very few trading platforms in the market. Mt.Gox, being relatively formal and large-scale, was able to develop rapidly.

In 2013, the price of Bitcoin surged from $13 to $1,100, and during this unprecedented bull market, Mt.Gox quickly became the world's largest Bitcoin trading platform, occupying 70% of the market share.

This powerful exchange, however, suddenly announced the suspension of all Bitcoin withdrawals on February 7, 2014. At that time, the platform's explanation for the suspension did not attract much attention from users, as it claimed to need to streamline the currency flow. However, just 17 days later, the exchange not only suspended all transactions but also became inaccessible. The abnormal actions quickly caused panic in the market.

A leaked internal company document revealed the grim truth: Mt.Gox was hacked, resulting in the theft of 744,408 bitcoins from Mt.Gox customers and an additional 100,000 bitcoins owned by the company itself, totaling 840,000 bitcoins, valued at approximately $450 million at the time. This large-scale attack was not the first; as early as 2011, Mt.Gox had been repeatedly hacked, and even before 2011, Mt.Gox had lost up to 80,000 bitcoins. However, due to the rapid rise in the price of Bitcoin, the company was able to cover up the losses. This three-year-long theft ultimately led to the downfall of the company.

On February 28, 2014, Mt.Gox filed for bankruptcy in Japan and two weeks later filed for bankruptcy protection in the United States. This event had a seismic impact on the cryptocurrency market, causing the price of Bitcoin to plummet from $951 to $309, a two-thirds drop. It also led to a crisis of trust in the Bitcoin market, prompting a large number of users to embark on a difficult path to seek justice.

To this day, the market still does not know the full story of the Mt.Gox hacking incident. There are theories of embezzlement, external intrusion, and collusion, but the core issue is that such a large amount of Bitcoin has not been fully recovered. The former Mt.Gox CEO, Karpeles, was charged with fraud and embezzlement in early 2015. Before being imprisoned, he voluntarily admitted to finding 200,000 missing bitcoins and storing them in a cold wallet. However, when tracking the wallet later, it was found that the bitcoins had been evenly distributed to the wallets of 100 individuals.

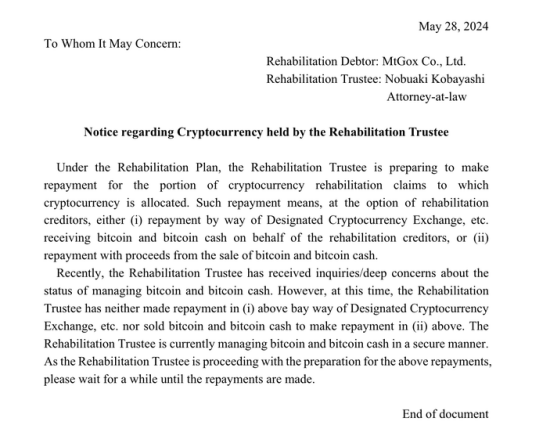

In 2019, Mt.Gox recovered a total of 141,000 bitcoins, which the court ruled to be handed over to a trustee, Nobuaki Kobayashi, for distribution to creditors. According to Mt.Gox's balance sheet in 2019, the debtor held approximately 142,000 BTC, 143,000 BCH, and 69 billion yen (approximately $510 million at the time).

By 2019, the price of Bitcoin had risen to nearly $10,000, and creditors became more sensitive to the timing and method of distribution. The compensation process was delayed for a period. In 2022, Mt.Gox announced that its Bitcoin repayment program had been accepted by the court, and the specific distribution method was disclosed in 2023.

This year, in January, creditors revealed in an email that they had registered their receiving addresses at the beginning of the year, and Mt.Gox would unlock 140,000 bitcoins for payment to creditors in the next two months.

The long-awaited compensation is finally coming to a close, which should be a good thing. However, the market has reacted with panic to this news.

02. 140,000 BTC pressure? Not quite

With 140,000 bitcoins, the compensation, valued at $9 billion at the current price, does it mean a huge selling pressure? As a result of this news, the price of Bitcoin quickly dropped to below $68,000.

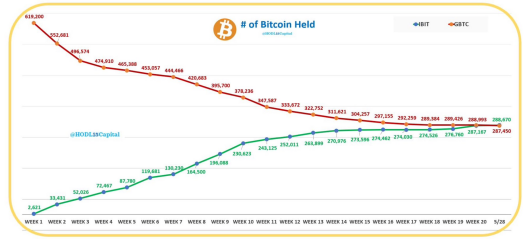

However, a massive decline is unlikely when considering the reality. Firstly, while 140,000 bitcoins may seem substantial, it is not beyond absorption in the current institutional-dominated Bitcoin market. For example, Grayscale, after the approval of the Bitcoin spot ETF, is the largest seller of Bitcoin. Before April, Grayscale's GBTC sold an average of about 7,000 bitcoins per working day, and during the intense selling in January, the daily sales volume even reached 10,000 bitcoins, lasting for two weeks. As of now, Grayscale's GBTC has sold a total of 332,000 bitcoins, with a net outflow of $17.746 billion. The result is evident: Bitcoin has continued to rise from $40,000 to $67,000.

Comparison of Grayscale GBTC and BlackRock IBI Bitcoin holdings, source: IBIT

More importantly, even if it is compensation and selling, it will not happen all at once. According to an announcement on Mt.Gox's official website in 2023, the compensation plan for creditors includes basic and proportional payments. The basic payment allows claims of up to 200,000 yen to be paid in yen, while the proportional payment provides two flexible options for creditors: "early lump sum payment" or "mid-term and final payments." The lump sum payment only allows for partial compensation, with the portion exceeding 200,000 yen allowing creditors to choose a mix of BTC, BCH, and yen or to be paid in fiat currency. Choosing mid-term and final payments will result in a higher compensation amount but may take several years. The payment options also include cash and cryptocurrency.

Overall, Mt.Gox has taken into account the danger of concentrated selling and has adopted a method of distributing compensation and proposed a coin-to-coin payment option. The former CEO of Mt.Gox also explicitly denied that Bitcoin would be sold immediately.

Furthermore, even with concentrated compensation, the amount of selling pressure is much less than the total actual amount. Due to the long-term nature of the Mt.Gox case, many creditors had already sold their claims to funds, so the majority of creditors are institutional. According to data from last year, only 226 claimants hold over 50% of Mt.Gox's claims. In the current bullish market, both institutions and retail investors are unlikely to sell their BTC easily.

But does this mean there will be no impact at all? Not necessarily. In the current illiquid market, panic sentiment can quickly cause a price drop. The deadline for compensation is set for October 31, 2024, and continuous selling pressure will still exist until the compensation date, leading to a decline in market sentiment. However, in the long run, it will not cause a significant drop as imagined.

03. Politics is the key issue compared to Mentougou

Compared to the annual "Mentougou" incident, politics may be the long-term topic of greater concern in the cryptocurrency space.

Recently, Biden and Trump have been making frequent moves regarding cryptocurrency votes. Trump first claimed to ensure that cryptocurrency is created in the United States and to release the founders of WikiLeaks and Silk Road. Later, there were reports that President Biden's re-election campaign team plans to attract the support of cryptocurrency voters by promoting innovation.

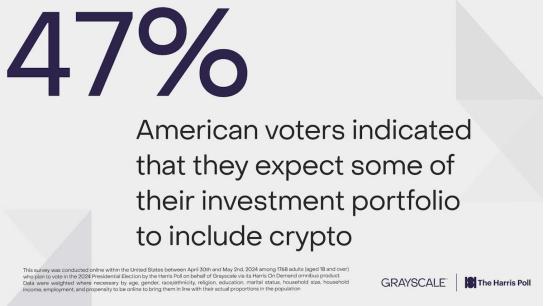

With the narrow partisan competition, cryptocurrency voters may now have a more important position than ever before. According to the latest survey of 1,768 adults planning to participate in the election by Grayscale, voter interest in Bitcoin has significantly increased (41% vs. 34% in November 2023) due to geopolitical tensions, inflation, and the risk of the US dollar. Nearly one-third of voters (32%) stated that they are more willing to learn about cryptocurrency investments or actually invest in cryptocurrency since the beginning of this year. The survey results also show that support for cryptocurrency is not significantly biased towards any political party.

In this tug-of-war, cryptocurrency has become the winner behind the scenes. Cathie Wood, the CEO of ARK Invest, explicitly stated in an interview that the approval of an Ethereum ETF application was due to cryptocurrency becoming an election issue. A rare statement from the Deputy Secretary of the US Treasury regarding mixers was also made, stating that there is no intention to ban mixers, but transparency needs to be increased to find a balance between privacy and national security.

Currently, all market institutions are closely watching the progress of the FIT21 bill. If passed, it would mean a further relaxation of the US attitude towards cryptocurrency regulation. As long as no issuer or affiliate controls 20% or more of a cryptocurrency, it will be considered a commodity, thereby lifting the securities restrictions by the SEC and opening a new era in the cryptocurrency field. Lynn Martin, President of the New York Stock Exchange, also stated at the Consensus conference that if regulations become clearer, the NYSE would consider opening cryptocurrency trading. If this is achieved, the barrier to purchasing cryptocurrency will continue to decrease.

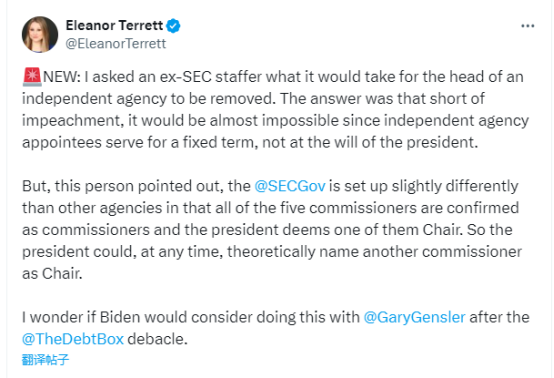

Of course, the usually tough SEC Chairman Gary Gensler is very dissatisfied with this. He has publicly stated that the bill has significant issues, but the reality is that "the small arm cannot twist the big thigh." Although, based on current information, the appointment of the head of an independent agency has a fixed term and is not determined by a single president, the SEC chairman is highly likely to serve until February 2025. However, from the current situation, regardless of which party comes to power, the relaxation of US regulation has become a foreseeable fact.

Currently, cryptocurrency lobbying organizations are still working hard. Ripple donated $25 million to the cryptocurrency super PAC Fairshake yesterday, bringing the total donations to the political action committee to nearly $100 million before the November election.

Whether $100 million can influence the situation is still unclear, but it is quite interesting that institutions had once been disdainful of and even held a condescending attitude towards fervent retail investors. However, in the end, it was the so-called retail investors who collectively made a significant impact, becoming a crucial step in determining the direction of cryptocurrency. This is perhaps another form of victory for decentralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。