Author: Teahouse Waiter

1. Project Introduction

Lista DAO is a liquidity staking and decentralized stablecoin (LSDFi) project based on the BNB chain, aiming to provide income for collateralized crypto assets (such as BNB, ETH, stablecoins, etc.) and support decentralized stablecoin borrowing and lending LISUSD (also known as decentralized stablecoin).

Formerly known as Helio Protocol, in August 2023, Binance Labs invested $10 million in Helio Protocol. Subsequently, Helio Protocol merged with the collateral infrastructure and liquidity staking provider Synclub on the BNB chain to establish Lista DAO.

Lista DAO aims to create a low-threshold DeFi protocol using innovative liquidity staking solutions. Its core vision is to explore various applications such as stablecoin re-collateralization based on liquidity staking, starting with BNB, and ultimately establish a low-threshold LSDFi protocol across multiple chains.

The protocol is based on and extends the MakerDAO model, including the dual-token model LISUSD and LISTA, as well as a range of mechanisms supporting instant conversion, asset collateralization, borrowing, yield farming, and other functions.

2. Core Mechanisms

2.1 Stablecoin Borrowing and Lending Mechanism

One of the core products of Lista DAO is the stablecoin borrowing and lending service, primarily achieved through over-collateralization.

2.1.1 Operation Mechanism

- Over-collateralization Model

Lista DAO uses an over-collateralization model to ensure the stability and security of the system. Users can collateralize assets such as ETH, BNB, sLISBNB, etc., to borrow decentralized stablecoin LISUSD. The value of the collateral must exceed the value of the borrowed stablecoin, effectively reducing the risk of loan default.

For example, a user collateralizing $100 worth of BNB may only be able to borrow $70 worth of LISUSD to ensure the system has sufficient buffer to withstand market fluctuations.

- Decentralized Stablecoin LISUSD

LISUSD is the decentralized stablecoin of Lista DAO, using decentralized liquidity staking of crypto assets as collateral. Unlike traditional stablecoins, LISUSD is not entirely pegged to fiat currency's absolute price, but allows for a certain degree of price fluctuation to better reflect the actual market conditions.

The design purpose of LISUSD is to provide a relatively stable value store and medium of exchange while maintaining decentralization.

- Types and Innovation of Collateral Assets

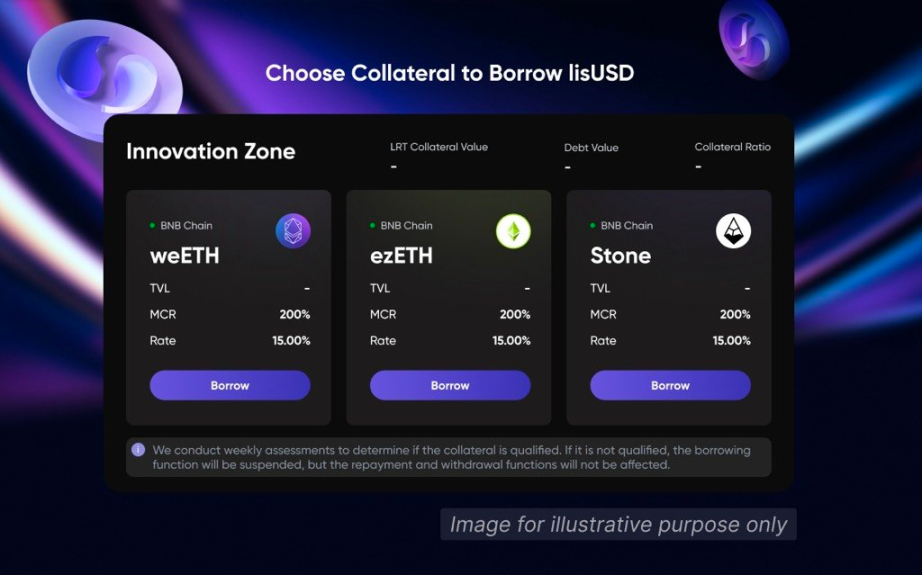

Lista DAO not only supports traditional crypto assets such as ETH and BNB but also introduces an Innovation Zone, allowing users to collateralize innovative liquidity staking assets such as WEETH from Etherfi and STONE from Stakestone. This provides users with more collateral options, enhancing the system's flexibility and capital efficiency.

2.2 Liquidity Staking

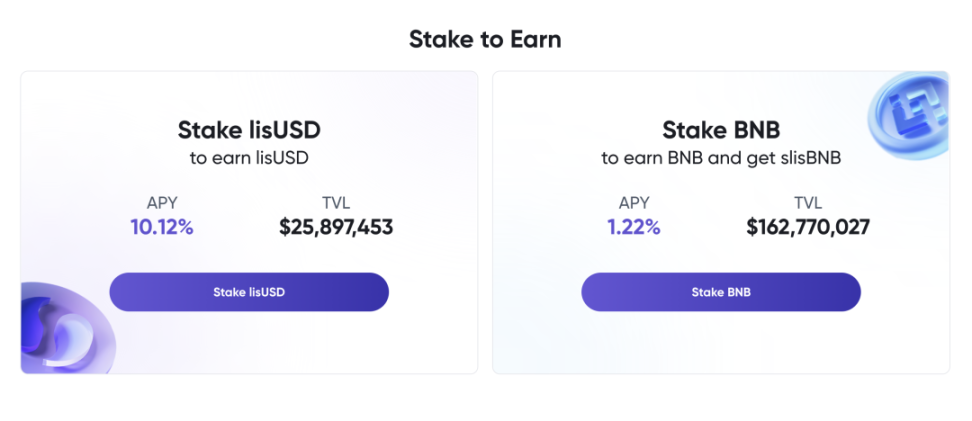

Another core product of Lista DAO is liquidity staking, through which users can collateralize crypto assets and receive corresponding liquidity tokens to improve capital utilization.

2.2.1 Operation Mechanism

- Liquidity Staking (Liquid Staking)

Users can collateralize assets such as BNB to obtain liquidity staking certificates (e.g., sLISBNB) on the Lista DAO platform, which can be used for lending, providing liquidity, and other operations on various DeFi platforms while still earning staking rewards.

Liquidity staking separates the earnings and liquidity of staked assets, allowing users to flexibly engage in other DeFi activities while enjoying staking rewards.

- Generation and Use of sLISBNB

Generation of sLISBNB from BNB collateral: Users collateralize BNB in the liquidity staking contract of Lista DAO, generating sLISBNB corresponding to the amount of collateralized BNB.

Use of sLISBNB: Users can use sLISBNB for lending, providing liquidity, and other operations on various DeFi platforms while still earning staking rewards. The applications of sLISBNB on different platforms include providing liquidity, lending, yield farming, etc.

- Earnings and Fees

Staking rewards: Users staking BNB will receive staking rewards from the BNB network, which will be proportionally distributed to holders of sLISBNB.

Fee structure: Lista DAO may charge certain management fees or transaction fees for platform maintenance and development. The specific fee structure will be detailed in the protocol's documentation.

- Collateralization and Borrowing

Over-collateralized borrowing: Users can use sLISBNB as collateral to borrow decentralized stablecoin LISUSD. This not only increases the liquidity of user assets but also allows users to borrow more funds for investment or other operations.

Borrowing interest: Users borrowing LISUSD need to pay a certain borrowing interest, which is currently 0%. Users can repay the loan and retrieve the collateralized sLISBNB at any time.

2.3 Innovative Collateral Assets

To provide more flexible and diverse collateral options, Lista DAO introduces innovative collateral assets (Innovation Zone), allowing users to use various new liquidity staking assets as collateral to enhance system flexibility and capital efficiency.

2.3.1 Operation Mechanism

- Innovation Zone

Purpose: The establishment of the Innovation Zone aims to include eligible liquidity staking tokens (LST) and liquidity re-staking tokens (LRT) as collateral options, providing users with more choices and improving liquidity and capital utilization efficiency.

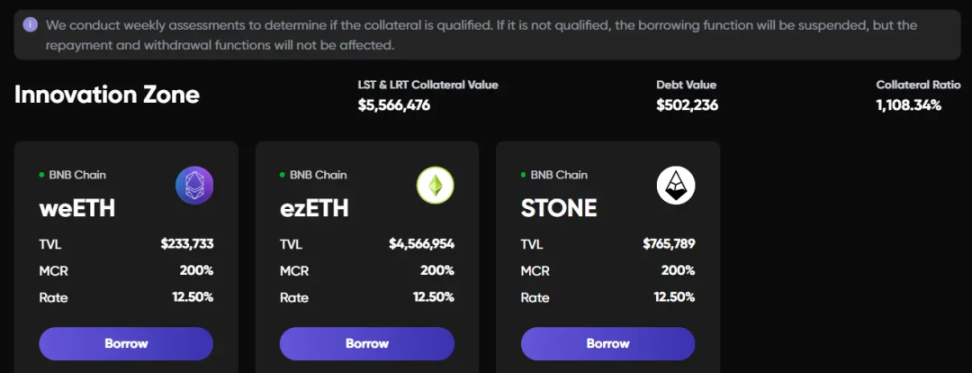

Types of collateral: In addition to traditional crypto assets such as ETH and BNB, the Innovation Zone also supports innovative liquidity staking assets such as WEETH from Etherfi, STONE from Stakestone, and EZETH from Renzo.

Collateral risks and ratios: The collateral assets in the Innovation Zone have higher risk coefficients and corresponding higher collateral ratios compared to traditional collateral assets. The project team of Lista DAO will evaluate these collateral assets weekly to determine their eligibility for collateralization.

- Specific Collateral Asset Types

WEETH from Etherfi: WEETH is a liquidity staking token based on Ethereum, allowing users to collateralize ETH and obtain WEETH. WEETH can be used as collateral on Lista DAO to borrow LISUSD.

STONE from Stakestone: STONE is an innovative liquidity staking token, allowing users to collateralize specific crypto assets and obtain STONE, which can be used for collateralization and borrowing operations on Lista DAO.

Renzo's EZETH: EZETH is another innovative liquidity staking token that supports the collateralization and liquidity management of various crypto assets. EZETH can be used as collateral on Lista DAO, increasing the flexibility of user assets.

- Borrowing and Liquidity Management

Users can use these innovative collateral assets to borrow decentralized stablecoin LISUSD. By using these liquidity staking tokens as collateral, users can not only obtain liquidity but also participate in other DeFi activities such as yield farming and providing liquidity.

This mechanism effectively improves the capital utilization efficiency of users, allowing them to manage and use their crypto assets more flexibly.

- Earnings and Fee Structure

Staking Rewards: Users can earn staking rewards by staking innovative collateral assets. These rewards will be distributed based on the type of collateral assets and market conditions.

Borrowing Fees: Users need to pay a certain borrowing interest and fees when borrowing LISUSD, which are used to maintain the platform's operations and development. The specific fee structure is detailed in the protocol's documentation.

3. Token Economics

3.1 LISUSD

Definition: LISUSD is a decentralized, unbiased collateral-backed stablecoin, softly pegged to the US dollar. Users can borrow LISUSD by collateralizing assets on the Lista platform. LISUSD is generated and maintained by depositing collateral assets into the Lista Collateralized Vault (CEVault).

Liquidity: Users can borrow LISUSD by depositing collateral assets into Lista's CEVault, which is the primary way LISUSD enters circulation. Others can acquire LISUSD through brokers or exchanges, or by providing liquidity on decentralized exchanges (DEX) to obtain LISUSD. LISUSD can be used like any other cryptocurrency for payments, transfers, and purchasing goods and services.

3.2 LISTA

Definition: LISTA is the native cryptographic protocol token of Lista DAO, with transferability and multifunctionality. The LISTA token is designed as an interoperable utility token primarily used for decentralized payments and settlements among participants within Lista DAO.

Functions:

- Governance: LISTA token holders can propose governance proposals and vote to determine the future features, upgrades, and parameters of Lista DAO (such as ecosystem development and allocation of revenue pools, addition of new treasuries, protocol parameters, and fee levels).

- Incentive Mechanism: LISTA tokens are used to incentivize user participation and contribution within the Lista DAO ecosystem, rewarding activities such as deposits, collateralization, trading, and governance.

- Liquidity: LISTA tokens can be exchanged on decentralized exchanges or placed in yield farming pools, allowing users to maximize their capital efficiency, obtain loans, and compound returns.

Supply and Circulation:

- Maximum token supply: 1,000,000,000 LISTA;

- Initial circulation: 230,000,000 LISTA (23% of the maximum token supply);

- Megadrop total: 100,000,000 LISTA (10% of the maximum token supply)

Currently, the OTC price of the LISTA token is 0.8 USDT.

Specific Allocation Ratios

- Binance Megadrop: 100 million tokens, accounting for 10% of the total supply.

- Airdrop: accounting for 10% of the total supply.

- Investors and advisors: accounting for 19% of the total supply.

- Team: accounting for 35% of the total supply.

- Community: accounting for 40% of the total supply.

- DAO Treasury: accounting for 8% of the total supply.

- Ecosystem: accounting for 9.5% of the total supply.

3.3 Token Issuance and Use

- Issuance

The issuance of LISUSD and LISTA tokens primarily occurs through user collateralization and borrowing operations, as well as through activities and contributions within the ecosystem. The purpose of token issuance is to raise funds for project development, increase market brand awareness, and support community building and social engagement.

- Use

LISUSD: As a decentralized stablecoin, LISUSD can be used for various payments, transfers, and purchasing goods and services, as well as providing liquidity and borrowing in DeFi operations.

LISTA: Primarily used for payments and settlements, governance voting, and incentivizing user participation and contribution within the ecosystem. LISTA does not represent any shares, ownership, or participation rights, nor does it promise any fees, dividends, income, profits, or investment returns.

3.4 Economic Incentives and Liquidity Management

- Economic Incentives

Participation Incentives: Users can earn LISTA token rewards by engaging in activities such as deposits, collateralization, trading, and governance within the Lista DAO ecosystem. This mechanism ensures that users receive fair compensation for participating in the ecosystem.

Governance Participation: LISTA token holders can participate in protocol management and decision-making by proposing and voting on governance proposals. This decentralized governance mechanism enhances the transparency and participation of the ecosystem.

- Liquidity Management

Market Pricing: The secondary market pricing of LISTA tokens is not controlled by Lista DAO, and there are no mechanisms or schemes designed to control or manipulate secondary market prices. Users are free to exchange LISTA tokens on decentralized exchanges to maximize their capital efficiency.

Capital Management: Through decentralized exchange liquidity pools, users can provide liquidity and earn trading fees and rewards. This mechanism not only enhances the liquidity of LISTA tokens but also improves the capital utilization efficiency of the entire ecosystem.

Lending Process

Provide Collateral

Users need to provide collateral, such as BNB, ETH, sLISBNB, and other crypto assets on the Lista DAO platform. The type and value of the collateral will affect the amount of LISUSD that users can borrow.

For example, if a user collateralizes $100 worth of BNB on the platform, the system will determine the maximum amount of LISUSD the user can borrow based on the collateral ratio (e.g., 70%).

- Generate LISUSD

After providing collateral, users can borrow a corresponding amount of LISUSD based on the value of the collateral. LISUSD is the stablecoin of the Lista DAO platform, softly pegged to the US dollar.

The generation of LISUSD is based on the collateral provided by users, ensuring the safety and stability of borrowing.

- Borrow LISUSD

Once users provide sufficient collateral, they can borrow LISUSD on the platform. Borrowed LISUSD can be used for various DeFi activities such as payments, transfers, purchasing goods and services, or for investment and yield farming on other DeFi platforms.

There is a certain borrowing interest during the lending process, which is currently 0%. This low interest rate helps attract more users to participate in the platform's lending operations.

- Repay the Loan

Users can repay the borrowed LISUSD and the corresponding borrowing interest at any time. Once the loan is fully repaid, users can retrieve their collateralized assets.

The loan repayment process is straightforward, as users only need to return the borrowed LISUSD and interest to the platform.

- Retrieve Collateral

After fully repaying the loan, users can retrieve their collateralized assets. These assets can be used for other DeFi activities or re-collateralized to borrow more LISUSD.

- Liquidation Mechanism

If the user fails to repay the loan on time and the value of the collateral falls to a certain level, the system will trigger the liquidation mechanism. Part or all of the collateral will be sold to repay the loan, ensuring the stability and security of the system.

The liquidation price and ratio will be adjusted based on market conditions and protocol parameters. This mechanism effectively reduces the risk of loan default and protects the interests of the platform and other users.

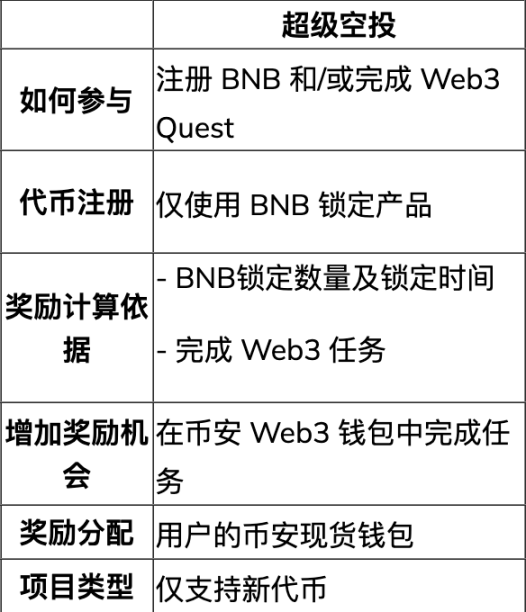

5. Binance Megadrop Guide

On May 23, Binance announced the deployment of Lista (LISTA token) on Binance Megadrop, where users can stake BNB and complete Web3 tasks to receive rewards.

Megadrop is a new token issuance platform launched by Binance, allowing users to access and receive airdrops from promising projects early. Projects launched on Megadrop are guaranteed to be listed on the Binance exchange.

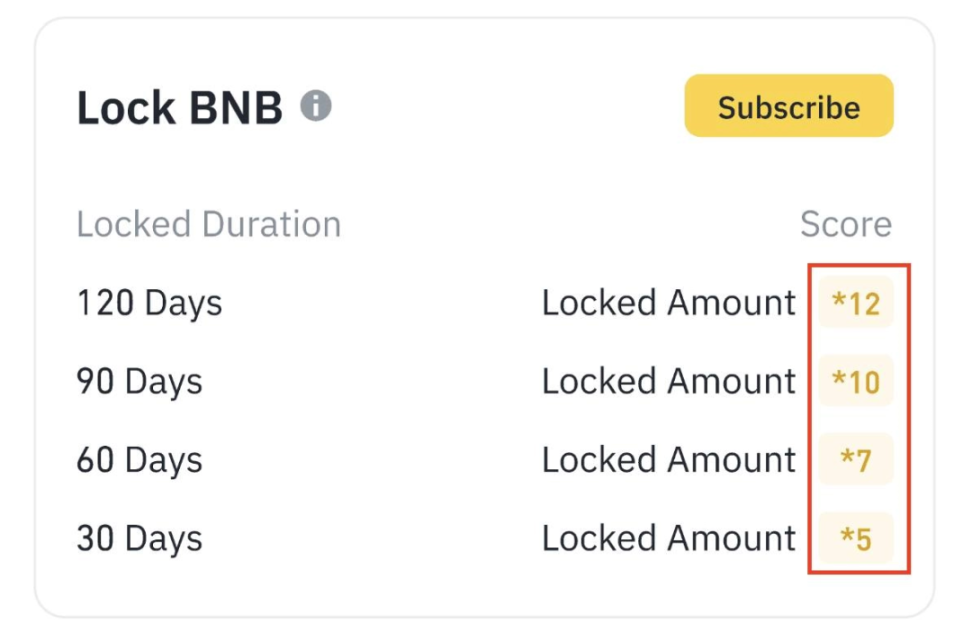

Token rewards are distributed based on the total points obtained by the user. The total points depend on the locked BNB points, Web3 Quest coefficient, and Web3 Quest rewards. The formula is as follows:

Total Points = (BNB Locked Points x Web3 Quest Coefficient) + Web3 Quest Rewards

BNB Locked Points

Points are calculated based on the amount of locked BNB and the lock-up period, with higher points for longer lock-up periods. Binance calculates points based on daily average lock-up snapshots (points may fluctuate due to lock-up fluctuations).

- There are four fixed coefficients for BNB lock-up periods: 30 days, 60 days, 90 days, 120 days:

- Points increase by a multiple of 30 days if the lock-up period is less than 59 days

- Points increase by a multiple of 60 days if the lock-up period is less than 90 days

- Points increase by a multiple of 90 days if the lock-up period is between 90 and 120 days

- Points increase by a multiple of "120 days" if the lock-up period is 120 days or more

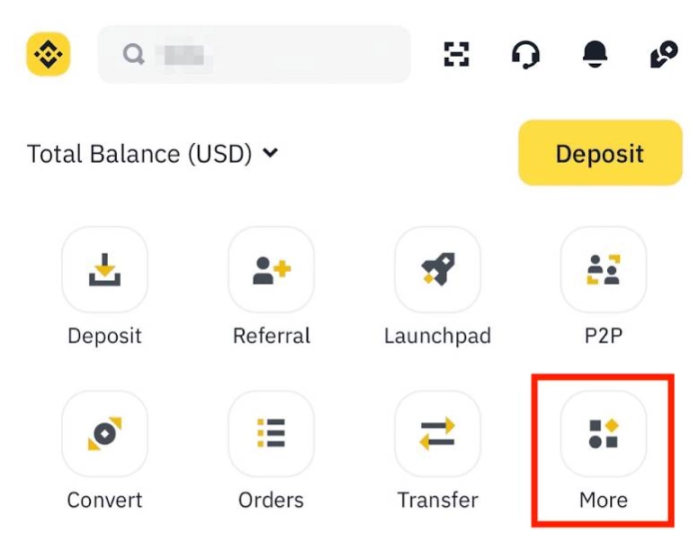

Megadrop Participation Guide

To participate in Megadrop, users need to lock BNB tokens in Binance Simple Earn and/or complete Web3 Quest tasks in the Binance Web3 wallet. The rewards for eligible users are calculated based on their individual points ratio divided by the total points of all users.

Access the Binance app on your mobile, select "More," and then choose Megadrop.

Browse the list of launched Web3 projects and select the project you want to participate in.

After entering the detailed information page, carefully read the project requirements and rules.

Register the appropriate lock-up period for BNB.

Complete the tasks in the task section.

6. Team / Financing Situation

The success of Lista DAO is attributed to a strong and experienced team with a deep background. The core team members have rich experience and achievements in blockchain technology, fintech, and operational management, providing a solid foundation and guarantee for the project's development.

Toru Watanabe is the founder and CEO of Lista DAO, responsible for the overall strategic planning and execution of the project. As the founder, he has extensive experience in blockchain technology and project management, leading the team to drive the development of Lista DAO.

Co-founder and Chief Operating Officer (COO) Terry Huang previously served as the regional manager at Binance and the strategic director at ChainNews. He has extensive experience in the blockchain field, specializing in operational management and marketing.

Both Toru Watanabe and Terry Huang have experience working at Binance, providing them with a deep understanding and practical experience in the cryptocurrency market and blockchain technology. As a leading global cryptocurrency exchange, Binance has provided them with abundant industry resources and connections.

Binance Labs invested $10 million in Lista DAO (formerly known as Helio Protocol) to help it transition into a liquidity staking platform. The funds will be used to establish infrastructure on the BNB chain and expand to other networks such as Ethereum, Arbitrum, and zkSync. Helio Protocol is the issuer of the overcollateralized stablecoin HAY and merged with collateral provider Synclub in July 2023 to establish a new foundation to manage the income streams of Synclub and Helio. This funding will accelerate technological development and platform upgrades, especially in the field of liquidity staking and decentralized finance. The investment will also be used for marketing and user education to enhance the global visibility of Lista DAO. Through the collaboration with Synclub, Lista DAO will further enhance its technological capabilities and market position, aiming to become a significant participant in the decentralized finance field.

7. Project Evaluation

7.1 Track Analysis

Lista DAO belongs to the decentralized finance (DeFi) track, specifically involving the following sub-areas:

- Liquid Staking

Liquid staking allows users to stake crypto assets (such as BNB, ETH) and receive liquidity tokens (such as sLISBNB), which can be used for lending, providing liquidity, and other operations within the DeFi ecosystem, while still earning staking rewards.

This technology enhances the liquidity of user assets and capital utilization efficiency, representing an important innovation in the DeFi field.

- Decentralized Stablecoin

Lista DAO provides a decentralized stablecoin LISUSD, which users can borrow by collateralizing crypto assets. LISUSD is designed to maintain price stability, similar to MakerDAO's DAI.

Decentralized stablecoins provide users with a more secure and transparent financial tool, reducing reliance on traditional financial systems.

- Overcollateralized Borrowing

Users can borrow the stablecoin LISUSD by collateralizing a certain amount of crypto assets. This overcollateralized model ensures the stability and security of the system, mitigating the risk of loan default.

This mechanism is widely used in the DeFi ecosystem and is a core feature of many decentralized lending platforms.

In the DeFi track, there are several projects similar to Lista DAO in the areas of liquid staking, decentralized stablecoin, and overcollateralized borrowing:

- Lido Finance

Area: Liquid Staking

7. Project Evaluation

7.1 Track Analysis

Lista DAO belongs to the decentralized finance (DeFi) track, specifically involving the following sub-areas:

- Liquid Staking

Lido is the largest liquid staking platform on Ethereum, where users can stake ETH and receive stETH, which can be used on DeFi platforms while still earning ETH staking rewards.

Similarities: Both Lido and Lista DAO offer liquid staking services, enhancing the liquidity and utilization of user assets.

- MakerDAO

Area: Decentralized Stablecoin

MakerDAO is the issuer of the decentralized stablecoin DAI, allowing users to generate DAI by collateralizing assets like ETH, with the price of DAI soft-pegged to the US dollar.

Similarities: Lista DAO's LISUSD is similar to DAI, both being decentralized stablecoins generated through overcollateralization, aiming to provide price-stable crypto assets.

- Aave

Area: Lending

Aave is a decentralized lending platform where users can lend or borrow various crypto assets. Aave offers overcollateralized borrowing services to ensure system security and stability.

Similarities: Lista DAO offers overcollateralized borrowing services similar to Aave, allowing users to borrow stablecoins by collateralizing crypto assets, providing flexible fund utilization.

7.2 Project Performance

As of May 24, the total locked value of Lista DAO is $463,853,482, with collateral value at $301,170,727, liquid staking at $162,682,754, and total borrowed amount at $60,274,786.

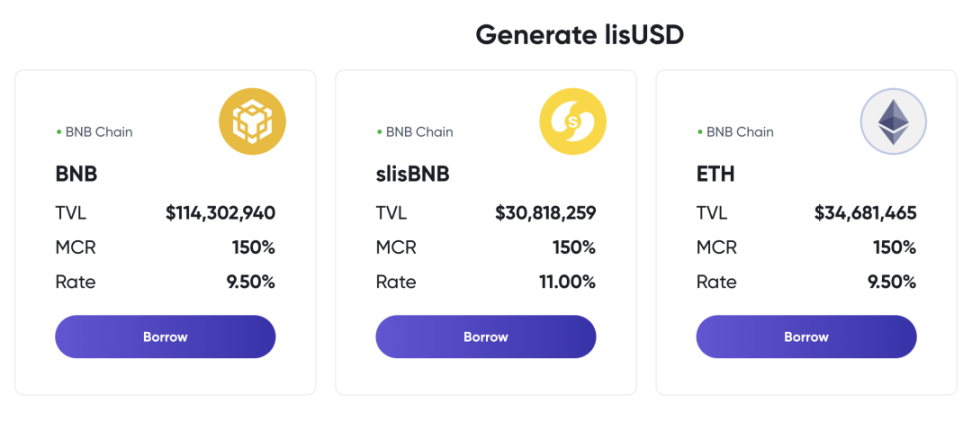

The Lista DAO project has performed well in liquidity staking and decentralized lending. The total locked value (TVL) of BNB, sLISBNB, and ETH is $114,302,940, $30,818,259, and $34,681,465, respectively, indicating high demand for these assets as collateral. The minimum collateral ratio (MCR) for all is 150%, ensuring system stability and security. The lending rates are 9.50% and 11.00%, providing flexible fund utilization.

ListaDAO's Innovation Zone supports collateralizing weETH from Ether.fi, STONE from StakeStone, and ezETH from Renzo to borrow the stablecoin LISUSD. As of May 23, the collateral value in the ListaDAO Innovation Zone is approximately $5.56 million.

7.3 Project Advantages

- Decentralization and Security

Lista DAO's lending mechanism is fully decentralized, allowing users to have full control over their assets, ensuring system security and transparency.

The overcollateralization model further ensures system stability and security, effectively mitigating the risk of loan defaults.

- Flexibility and Efficiency

Users can flexibly choose the type and quantity of collateral based on their needs and market conditions. The lending process is simple and efficient, allowing users to borrow and repay LISUSD at any time.

Through liquidity staking, users can enjoy staking rewards while flexibly using these assets for other DeFi operations, improving fund utilization efficiency.

- Low Rates and Diversified Returns

Low lending rates help attract more users to participate in platform lending operations. Users can obtain more funds for investment or other operations through lending, enhancing overall returns.

Diversified revenue channels enable users to achieve stable returns under different market conditions.

- Reduced Collateral Risk

By separating staking rewards from liquidity, users do not need to release their collateral when they need funds, reducing the risk associated with market fluctuations.

The liquidity staking mechanism ensures that users can flexibly use their assets at any time while still enjoying staking rewards.

7.4 Challenges and Future Outlook

- Market Volatility Risk

Despite overcollateralization and liquidation mechanisms, the high volatility of the crypto market may still pose risks to user assets and platform stability. Users need to closely monitor market dynamics and manage risks.

Lista DAO needs to continuously optimize its risk management mechanisms to ensure system stability and security.

- User Education and Adoption

The lending mechanism is relatively complex and requires users to have a certain level of DeFi knowledge and experience. Lista DAO needs to enhance user education to help users understand and use the platform's lending functionality.

Increasing user adoption is crucial for the project's success, requiring promotion and publicity through various channels and activities.

- Multi-Chain Expansion Plan

Lista DAO plans to expand its lending functionality to multiple blockchains, including Ethereum, to provide users with more diversified choices and broader application scenarios.

Multi-chain expansion will further enhance the Lista DAO ecosystem, allowing it to occupy a more prominent position in the decentralized finance field.

8. Conclusion

In conclusion, the Lista DAO project has demonstrated strong potential and robust growth in the decentralized finance (DeFi) field. By offering a variety of staking and lending options, including BNB, sLISBNB, and ETH, Lista DAO provides users with high liquidity and flexible fund utilization solutions, with a total locked value (TVL) exceeding $179 million, indicating a high level of user trust in the platform. Stable minimum collateral ratios (MCR) and competitive lending rates further enhance system security and attractiveness. The introduction of new assets such as weETH, ezETH, and STONE demonstrates its innovative capabilities and market adaptability. In summary, through high-quality services and continuous innovation, Lista DAO is gradually establishing its leadership position in the DeFi market, with a promising future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。