ENA (Ethena) makes it possible for the Web3 world to have independent currency (stablecoin) issuance and valuation rights.

By: Dapengtongfengqi

ENA (Ethena) makes it possible for the Web3 world to have independent currency (stablecoin) issuance and valuation rights, with huge potential for future growth and imagination space. Based on the chip distribution and on-chain data of MVRV from Teacher Lin, now is a good time for phased fixed investment and building positions, with relatively low risk.

For specific information about ENA's project research and investment research, you can read this article in detail, and we welcome everyone to communicate more.

Chapter 1 Project Overview

1.1 Project Introduction

When it comes to ENA (Ethena), many people's understanding of ENA still remains at the level of it being a decentralized stablecoin USDe project, a synthetic dollar protocol based on Ethereum. It provides a crypto-native currency solution that does not rely on traditional banking system infrastructure, as well as a globally accessible dollar valuation tool - "Internet Bonds." Compared to centralized stablecoins, Ethena has many advantages and some disadvantages. However, in my opinion, the ENA project actually has a deeper meaning - to solve the independent currency issuance and basic valuation of the Web3 world, returning the currency issuance rights to the Web3 world.

To understand the deeper meaning of ENA, we first need to understand the development of currency. The first division of labor in human history brought about the exchange of goods, but the inconvenience of carrying and trading partners led to the emergence of true currency.

The earliest forms of currency were mainly shells, which later evolved into bronze (later becoming copper), silver, gold, iron, and so on. Because copper and iron are more prone to oxidation and difficult to cut, silver and gold gradually became the accepted forms of currency. However, with the rapid development of the handicraft economy and the rapid accumulation of wealth, traditional silver and gold could no longer meet people's needs, leading to the invention of paper money (earliest in China, silver notes). The invention of paper money greatly promoted economic development, but paper money cannot be printed arbitrarily. Behind each banknote, there is a corresponding reserve of silver or gold, which is what people often refer to as the silver or gold standard. The development of the US dollar benefited from the typical gold standard system (the Bretton Woods system), which ensured the US dollar's hard currency attributes and internationalization. In other words, how much gold is mined/reserved each year determines how much banknotes can be printed (e.g., the initial US dollar).

However, when the economy reached a new stage and the gold reserves could not keep up, the fixed ratio currency system of the Bretton Woods system quickly faced challenges and had to be declared dissolved in the "Smith Agreement." Since then, the currency issuance of major countries in the world, represented by the United States, has gradually transitioned from the gold standard to the national debt standard. Recently, another major country has also adopted a currency issuance mechanism similar to that of the United States. Specifically, when a country issues ultra-long-term government bonds (e.g., 10 years, 20 years, 30 years, 50 years, etc.), the central bank prints an equivalent amount of banknotes to purchase the ultra-long-term government bonds issued by the country to achieve currency issuance. The benefit is that it can bring a large amount of cash for the government to invest and inject more currency liquidity into the market, commonly known as "flooding." The purpose of flooding is actually to stimulate the economy, but it can easily lead to a trap of currency overissuance.

Returning to the Web3 world, let's take another look at the ENA project and see if the concept of "Internet Bonds" is particularly familiar. What is the specific investment logic?

1.2 Investment Logic

BTC, ETH, etc., are first-rate assets, similar to gold in the real world. Although they can be used for payment and purchase, fundamentally, they are assets, not valuation and issuance currencies. However, with the vigorous development of Web3, the market needs more liquidity, which is currently mainly achieved by using centralized stablecoins such as USDT and SUDC that rely on traditional financial infrastructure. However, centralized stablecoins face three major challenges:

(1) Regulated bank accounts need to hold continuous bond collateral (such as US Treasury bonds), which poses un-hedgable custody risks and is easily subject to regulatory scrutiny; (2) Heavily reliant on existing banking infrastructure and evolving regulations in specific countries (including the United States); (3) Since the issuer internalizes the risk transfer while using the income generated by the supported assets, users face the risk of "no return."

Therefore, a decentralized and reasonable stable asset that does not rely on traditional financial infrastructure is a necessary path for the development of Web3, which can serve as both a trading currency and a core underlying asset for financing. Without independently and reasonably stable reserve assets, both centralized and decentralized order books are fundamentally very fragile.

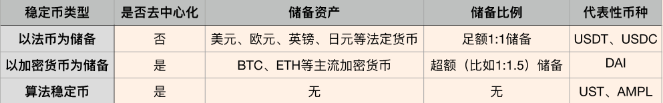

Before ENA, there were pioneers who attempted decentralized stablecoins, with MakerDAO (DAI), UST, and others being typical representatives. However, these pioneers encountered many problems related to scalability, mechanism design, and lack of user incentives.

(1) "Over-collateralized stablecoins" (typified by MakerDAO's DAI, with a 1.5x collateralization ratio) historically encountered scalability issues because their growth is closely tied to the leverage demand on the Ethereum chain and the rapid price fluctuations of Ether. For example, DAO, with a 1.5x collateralization ratio and a 1.4x liquidation collateralization ratio, is inefficient and lacks collateral desire. Recently, some stablecoins have begun to introduce government bonds to improve scalability, but at the cost of sacrificing anti-censorship capabilities.

(2) The mechanism design of "algorithmic stablecoins" (typified by UST) faces challenges and is inherently fragile and unstable. Such designs are unlikely to have sustainable scalability.

(3) Previous "Delta Neutral Synthetic Dollars" were difficult to scale due to their heavy reliance on decentralized trading venues with insufficient liquidity and susceptibility to smart contract attacks.

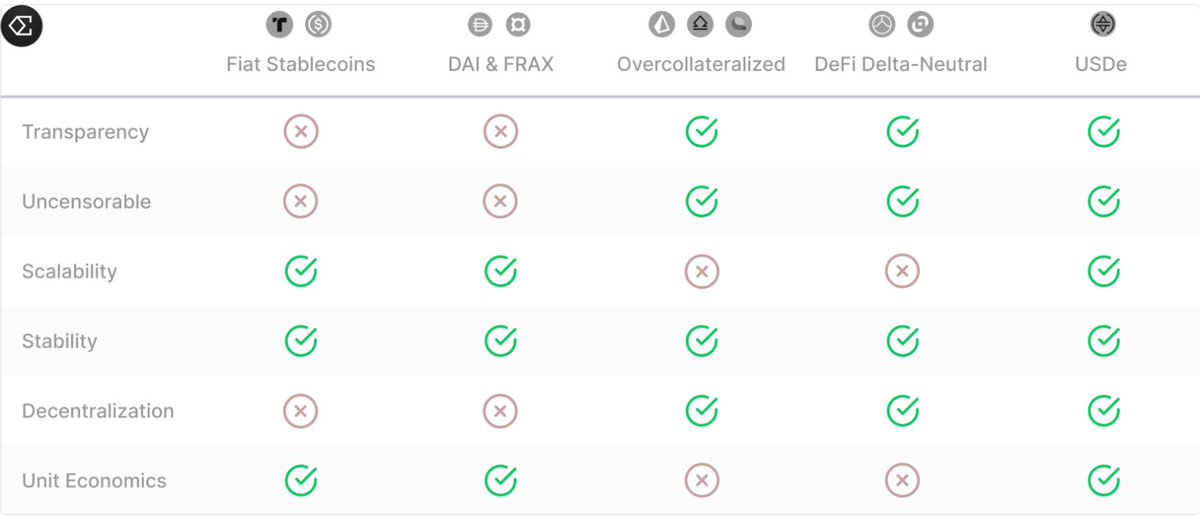

ENA has learned from historical lessons and provided a relatively perfect solution, with corresponding measures in scalability, stability, and resistance to censorship, which will be detailed in the technical section. ENA enables the Web3 world to have independent currency (stablecoin) issuance rights, and its economic model will also promote more participants to provide more liquidity for USDe.

In 2023, the settlement of stablecoins on the chain alone exceeded $12 trillion. Once stablecoins gain market acceptance, their value potential is immeasurable. AllianceBernstein, a globally leading asset management company with $725 billion in assets under management (AUM), predicts that the stablecoin market size could reach $28 trillion by 2028. This forecast indicates that the current $140 billion market value (previously reaching a peak of $187 billion) will have tremendous growth opportunities.

1.3 Investment Risks

Although Ethena has its unique advantages, there are also potential risks that need to be taken seriously, including:

(1) Financing Risk

"Financing risk" is related to the possibility of sustained negative financing rates. Ethena can earn income from financing but may also incur financing costs. First, negative returns often do not last long and quickly return to a positive mean; second, the establishment of the reserve fund is to ensure that negative returns do not transmit to users.

(2) Liquidation Risk

Liquidation risk refers to the forced liquidation risk that occurs in centralized exchanges due to insufficient margin during delta-neutral hedging. For Ethena, derivative trading is only for delta-neutral hedging, with low leverage and a small probability of liquidation risk. At the same time, Ethena ensures that liquidation risk does not occur or has minimal impact through additional collateral, temporary circular delegation between exchanges, reserve funds, and other means.

(3) Custody Risk

Ethena relies on Over-the-Counter Settlement (OES) providers to hold protocol-supported assets, thus there is "custody risk." To address this issue, Ethena uses bankruptcy-isolated trusts for holding and cooperates with multiple OES providers, such as Copper, Ceffu, and Fireblocks.

(4) Exchange Bankruptcy Risk

First, Ethena diversifies risk and mitigates the potential impact of exchange bankruptcy by collaborating with multiple exchanges. Second, Ethena retains complete control and ownership of assets through OTC Settlement (OES) providers, without the need to deposit any collateral with any exchange. This ensures that the impact of any special events at an exchange can be limited within the unrealized profit and loss range between settlement periods of OES providers.

(5) Collateral Risk

"Collateral risk" refers to the difference between the support assets of USDe (stETH) and the underlying assets of perpetual futures positions (ETH). However, due to low leverage and minimal collateral discounts, the decoupling of stETH has minimal impact on hedging positions.

Chapter 2 Technical, Risk Management, Business Development, and Competitive Analysis

2.1 Technical

From a technical standpoint, Ethena is a synthetic dollar protocol based on Ethereum, providing a crypto-native currency solution that does not rely on traditional banking system infrastructure, as well as a globally accessible dollar valuation tool - "Internet Bonds." The synthetic dollar USDe provided by Ethena offers a crypto-native, scalable currency solution achieved through delta hedging of collateral assets such as Ethereum and Bitcoin, supporting USDe-pegged stability.

The "Internet Bonds" combine the income generated from collateral assets (such as collateralized Ethereum) as the degree of support for assets, as well as the financing and basis spreads in the perpetual and futures markets to create the first on-chain crypto-native currency solution.

So how does USDe achieve stability, resistance to censorship, economic returns, and address the shortcomings and risks of other projects?

(1) Stability

Users can obtain USDe from permissionless external liquidity pools (USDT, USDC, DAI, etc.), or by directly using the Ethena contract to mint and redeem USDe with held assets such as stETH, stBTC, etc.

At the same time as minting USDe, delta-neutral hedging is conducted through multiple centralized exchanges (derivatives) externally, ensuring that its dollar value remains unchanged regardless of market fluctuations. The price of ETH may triple in a second and then drop by 90%, but the dollar value of the portfolio will not be affected (except for brief discrepancies between the spot market and the derivatives market). This is because the profit from a 3x increase in the price of 1 ETH is completely offset by the loss from an equal-sized short perpetual position.

(2) Scalability

The delta-neutral strategy with a 1:1 ratio, combined with liquidity guarantees from multiple centralized exchanges and high-value and highly scalable collateral assets such as ETH and BTC, provides USDe with significant scalability. Currently, ETH has a collateralization ratio of up to 27% (as of April 2024), with a total collateral amount of approximately $160 billion. The consensus among Ethereum researchers and ecosystem workers is that the collateral amount of ETH will soon exceed 40%. This also provides a lot of room for imagination for the growth of USDe.

(3) Resistance to Censorship

Ethena uses Over-the-Counter Settlement (OES) providers to hold supported assets. This allows Ethena to delegate/cancel collateral to centralized exchanges without facing exchange-specific risks.

While using OES providers requires technical dependence on them, it does not mean that counterparty risk has been transferred from exchanges to OES providers. OES providers typically custody funds in bankruptcy-isolated trusts without using MPC solutions, ensuring that the creditors of OES providers have no claim to the assets. If the custodian provider fails, these assets are expected to be outside the provider's estate and not affected by custodian credit risk.

These OES providers are all located outside the United States, so there is no need to worry about U.S. censorship. Traditional custody of funds through exchanges or holding fiat currency, government bonds, or stablecoins in U.S. bank accounts or with U.S. custodians carries significant censorship risks due to the current regulatory environment in the United States and the high level of global regulatory compliance scrutiny.

(4) Economic Returns

The income generated by the ENA protocol comes from two sources:

- Consensus and execution layer rewards for collateral assets (mainly ETH staking rewards)

- Financing and basis spreads obtained from delta hedging derivative positions

In history, due to the mismatch of supply and demand for digital assets, participants who shorted this delta (when delta is 0) received positive financing rates and basis spreads.

In addition, USDe holders, if not trading, can also stake USDe to obtain sUSDE. When unstaking USDe and destroying sUSDE, they can receive the original USDe and staking rewards. This design can attract more ETH holders to participate, not just participants who need leverage, thereby providing more liquidity for the entire Web3.

2.2 Risk Management

Although decentralized stablecoins are good, there are also some risks that need to be taken seriously and considered. The advantage of ENA is that these risks were taken into account in the overall technical solution design from the beginning, and efforts were made to address or reduce the likelihood of these risks occurring. Let's take a closer look.

- Financing Risk

"Financing risk" is related to the possibility of sustained negative financing rates. Ethena can earn income from financing but may also incur financing costs. Although this poses a direct risk to protocol income, data shows that negative returns often do not last long and quickly return to a positive mean.

Negative financing rates are a characteristic of the system, not a flaw. This was considered in the establishment of USDe. Therefore, Ethena has established a reserve fund that intervenes when the comprehensive yield between LST assets (such as stETH) and short-term perpetual position financing rates is negative. This is intended to protect the spot support of USDe. Ethena does not transfer any "negative yield" to users who stake USDe for sUSDe.

Using LST collateral (such as stETH) as collateral for USDe can provide additional safety margins for negative financing (stETH can achieve an annualized yield of 3-5%). In other words, the protocol yield rate will only be negative when the combined yield of LST and funding rates is negative.

- Liquidation Risk

The liquidation risk mentioned here refers to the forced liquidation risk that occurs in centralized exchanges due to insufficient margin during delta-neutral hedging. For Ethena, derivative trading is only for delta-neutral hedging, with low leverage and a low probability of liquidation risk. Although Ethena's margin on exchanges is composed of ETH spot and stETH assets (with stETH accounting for no more than 50%), since the Shapella upgrade on the Ethereum network, the stETH/ETH discount has never exceeded 0.3%. In other words, the value of stETH is almost identical to the value of ETH spot.

In addition, to ensure that liquidation risk can be well managed in extreme cases, Ethena has made the following arrangements:

(1) Whenever any risk situation arises, Ethena systematically delegates additional collateral to improve the margin status of hedging positions.

(2) Ethena can temporarily cycle collateral between exchanges to support specific situations.

(3) Ethena can use the reserve fund, which can be quickly deployed to support exchange hedging positions.

(4) In the event of extreme circumstances, such as a serious smart contract flaw in the collateralized Ethereum assets, Ethena will immediately reduce risk to protect the value of supported assets. This includes closing hedging derivatives to avoid liquidation risk becoming a problem, and disposing of affected assets for another asset.

- Custody Risk

Because Ethena relies on Over-the-Counter Settlement (OES) providers to hold protocol-supported assets, there is a certain level of dependence on their operational capabilities, which is what we refer to as "custody risk." The business model of custodians is based on asset protection, not leaving collateral on centralized exchanges.

Custody by OES providers carries three main risks:

Chapter 2 Technical, Risk Management, Business Development, and Competitive Analysis

2.1 Technical

From a technical standpoint, Ethena is a synthetic dollar protocol based on Ethereum, providing a crypto-native currency solution that does not rely on traditional banking system infrastructure, as well as a globally accessible dollar valuation tool - "Internet Bonds." The synthetic dollar USDe provided by Ethena offers a crypto-native, scalable currency solution achieved through delta hedging of collateral assets such as Ethereum and Bitcoin, supporting USDe-pegged stability.

The "Internet Bonds" combine the income generated from collateral assets (such as collateralized Ethereum) as the degree of support for assets, as well as the financing and basis spreads in the perpetual and futures markets to create the first on-chain crypto-native currency solution.

So how does USDe achieve stability, resistance to censorship, economic returns, and address the shortcomings and risks of other projects?

(1) Stability

Users can obtain USDe from permissionless external liquidity pools (USDT, USDC, DAI, etc.), or by directly using the Ethena contract to mint and redeem USDe with held assets such as stETH, stBTC, etc.

At the same time as minting USDe, delta-neutral hedging is conducted through multiple centralized exchanges (derivatives) externally, ensuring that its dollar value remains unchanged regardless of market fluctuations. The price of ETH may triple in a second and then drop by 90%, but the dollar value of the portfolio will not be affected (except for brief discrepancies between the spot market and the derivatives market). This is because the profit from a 3x increase in the price of 1 ETH is completely offset by the loss from an equal-sized short perpetual position.

(2) Scalability

The delta-neutral strategy with a 1:1 ratio, combined with liquidity guarantees from multiple centralized exchanges and high-value and highly scalable collateral assets such as ETH and BTC, provides USDe with significant scalability. Currently, ETH has a collateralization ratio of up to 27% (as of April 2024), with a total collateral amount of approximately $160 billion. The consensus among Ethereum researchers and ecosystem workers is that the collateral amount of ETH will soon exceed 40%. This also provides a lot of room for imagination for the growth of USDe.

(3) Resistance to Censorship

Ethena uses Over-the-Counter Settlement (OES) providers to hold supported assets. This allows Ethena to delegate/cancel collateral to centralized exchanges without facing exchange-specific risks.

While using OES providers requires technical dependence on them, it does not mean that counterparty risk has been transferred from exchanges to OES providers. OES providers typically custody funds in bankruptcy-isolated trusts without using MPC solutions, ensuring that the creditors of OES providers have no claim to the assets. If the custodian provider fails, these assets are expected to be outside the provider's estate and not affected by custodian credit risk.

These OES providers are all located outside the United States, so there is no need to worry about U.S. censorship. Traditional custody of funds through exchanges or holding fiat currency, government bonds, or stablecoins in U.S. bank accounts or with U.S. custodians carries significant censorship risks due to the current regulatory environment in the United States and the high level of global regulatory compliance scrutiny.

(4) Economic Returns

The income generated by the ENA protocol comes from two sources:

- Consensus and execution layer rewards for collateral assets (mainly ETH staking rewards)

- Financing and basis spreads obtained from delta hedging derivative positions

In history, due to the mismatch of supply and demand for digital assets, participants who shorted this delta (when delta is 0) received positive financing rates and basis spreads.

In addition, USDe holders, if not trading, can also stake USDe to obtain sUSDE. When unstaking USDe and destroying sUSDE, they can receive the original USDe and staking rewards. This design can attract more ETH holders to participate, not just participants who need leverage, thereby providing more liquidity for the entire Web3.

2.2 Risk Management

Although decentralized stablecoins are good, there are also some risks that need to be taken seriously and considered. The advantage of ENA is that these risks were taken into account in the overall technical solution design from the beginning, and efforts were made to address or reduce the likelihood of these risks occurring. Let's take a closer look.

- Financing Risk

"Financing risk" is related to the possibility of sustained negative financing rates. Ethena can earn income from financing but may also incur financing costs. Although this poses a direct risk to protocol income, data shows that negative returns often do not last long and quickly return to a positive mean.

Negative financing rates are a characteristic of the system, not a flaw. This was considered in the establishment of USDe. Therefore, Ethena has established a reserve fund that intervenes when the comprehensive yield between LST assets (such as stETH) and short-term perpetual position financing rates is negative. This is intended to protect the spot support of USDe. Ethena does not transfer any "negative yield" to users who stake USDe for sUSDe.

Using LST collateral (such as stETH) as collateral for USDe can provide additional safety margins for negative financing (stETH can achieve an annualized yield of 3-5%). In other words, the protocol yield rate will only be negative when the combined yield of LST and funding rates is negative.

- Liquidation Risk

The liquidation risk mentioned here refers to the forced liquidation risk that occurs in centralized exchanges due to insufficient margin during delta-neutral hedging. For Ethena, derivative trading is only for delta-neutral hedging, with low leverage and a low probability of liquidation risk. Although Ethena's margin on exchanges is composed of ETH spot and stETH assets (with stETH accounting for no more than 50%), since the Shapella upgrade on the Ethereum network, the stETH/ETH discount has never exceeded 0.3%. In other words, the value of stETH is almost identical to the value of ETH spot.

In addition, to ensure that liquidation risk can be well managed in extreme cases, Ethena has made the following arrangements:

- Whenever any risk situation arises, Ethena systematically delegates additional collateral to improve the margin status of hedging positions.

- Ethena can temporarily cycle collateral between exchanges to support specific situations.

- Ethena can use the reserve fund, which can be quickly deployed to support exchange hedging positions.

- In the event of extreme circumstances, such as a serious smart contract flaw in the collateralized Ethereum assets, Ethena will immediately reduce risk to protect the value of supported assets. This includes closing hedging derivatives to avoid liquidation risk becoming a problem, and disposing of affected assets for another asset.

- Custody Risk

Because Ethena relies on Over-the-Counter Settlement (OES) providers to hold protocol-supported assets, there is a certain level of dependence on their operational capabilities, which is what we refer to as "custody risk." The business model of custodians is based on asset protection, not leaving collateral on centralized exchanges.

Custody by OES providers carries three main risks:

- Accessibility and availability. Ethena's ability to deposit, withdraw, and delegate to exchanges is crucial for the availability of trading workflows and the minting/redeeming of USDe. It's worth noting that this does not affect the value supporting USDe.

- Fulfilling operational responsibilities. If an exchange fails, OES will transfer any unrealized PnL risk to another exchange quickly. Ethena reduces this risk by settling PnL with exchanges frequently. For example, Copper's Clearloop settles PnL between exchange partners and Ethena daily.

- Custodian operational failure. Although there have been no major operational failures or bankruptcies of large cryptocurrency custodians, there is a possibility. While assets are held in separate accounts, custodian bankruptcy would cause operational issues for creating and redeeming USDe, as Ethena is responsible for transferring assets to other providers. Fortunately, supported assets do not belong to the custodian, and the custodian or its creditors should not have legal claims to these assets, as OES providers either use bankruptcy-isolated trusts or MPC wallet solutions.

Ethena does not provide excessive collateral to a single OES provider and ensures that concentration risk is managed, thereby mitigating these three risks. Even when facing the same exchange, multiple OES providers are used to mitigate the above two risks.

- Exchange Bankruptcy Risk

First, Ethena diversifies risk and mitigates the potential impact of exchange bankruptcy by collaborating with multiple exchanges. Second, Ethena retains complete control and ownership of assets through OTC Settlement (OES) providers, without the need to deposit any collateral with any exchange. This ensures that the impact of any special events at an exchange can be limited within the unrealized profit and loss range between settlement periods of OES providers.

Therefore, if an exchange goes bankrupt, Ethena will delegate collateral to another exchange and hedge the unrealized delta previously covered by the bankrupt exchange. If an exchange goes bankrupt, derivative positions will be considered closed. Capital preservation is Ethena's top priority. In extreme cases, Ethena will always strive to protect the value of collateral and maintain the stability peg of USDe (using reserve funds).

- Collateral Risk

The "collateral risk" here refers to the difference between the support assets of USDe (stETH) and the underlying assets of perpetual futures positions (ETH). The support assets ETH LSTs are different from the underlying assets ETH of the hedging contracts, so Ethena needs to ensure that the price difference between these two assets is as small as possible. As discussed in the liquidation risk section, due to low leverage and minimal collateral discounts, the decoupling of stETH has minimal impact on hedging positions, and the likelihood of liquidation is extremely low.

2.3 Business Development and Competitive Analysis

Since its establishment, ENA has experienced rapid growth, with a significant increase in value in the short term. This surge is attributed not only to its strong technology and institutional support but also to the high returns it offers, making it attractive to both retail and institutional investors. On March 29, 2024, Binance announced that Binance Launchpool would launch the 50th project, Ethena (ENA). Users could start mining by depositing BNB and FDUSD into the ENA mining pool after 08:00 on March 30, Beijing time, for a period of 3 days. In addition, Binance would list Ethena (ENA) and open trading pairs such as ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD, and ENA/TRY at 16:00 on April 2, Beijing time. Binance's mining activities and listing on the exchange also demonstrate the rapid development of ENA.

ENA's advantages have made it stand out and truly represent decentralized stablecoins, competing with traditional major competitors USDT and USDC, two centralized stablecoin projects. Although there may be many difficulties in the early stages, the development momentum is very rapid, which has raised high expectations from many in the industry.

Chapter 3 Team and Financing Situation

3.1 Team Situation

Ethena was founded by Guy Yang, inspired by a blog post by Arthur Hayes. The core team consists of 5 members.

- Guy Young is the founder and CEO of Ethena.

- Conor Ryder is the Research Director of Ethena Labs, previously serving as a research analyst at Kaiko. He graduated from University College Dublin and Gonzaga College.

- Elliot Parker is the Product Management Director of Ethena Labs, previously serving as a product manager at Paradigm. He graduated from the Australian National University.

- Seraphim Czecker is the Business Development Director of Ethena, previously serving as the Risk Director at Euler Labs and an emerging market forex trader at Goldman Sachs.

- Zach Rosenberg is the Chief Legal Counsel of Ethena Labs, previously working at PwC. He graduated from Georgetown University, American University Washington College of Law, Kogod School of Business at American University, and the University of Rochester.

3.2 Financing Situation

In July 2023, Ethena completed a $6.5 million seed round of financing, led by Dragonfly, with participation from Deribit, Bybit, OKX Ventures, BitMEX, and others.

In February 2024, Ethena received a $14 million strategic investment led by Dragonfly, with participation from PayPal Ventures, Binance Labs, Deribit, Gemini Frontier Fund, Kraken Ventures, valuing the company at $3 billion.

Chapter 4 Token Economy

4.1 Token Distribution

- Total supply: 15 billion

- Initial circulation: 1.425 billion

- Foundation: 15%, for further promoting the adoption of USDe, reducing the crypto world's reliance on traditional banking systems and centralized stablecoins, and for future development, risk assessment, audits, and more.

- Investors: 25% (25% in the first year, linear unlock thereafter)

- Ecosystem development: 30%, with 5% of these tokens distributed as the first round airdrop to users, and the remaining portion supporting various future Ethena initiatives and incentive activities. Binance's lanuchpool token activity is one of them, accounting for 2% of the total scale.

- Core contributors: 30% (Ethena Labs team and advisors, 25% unlock in 1 year)

After the launch of Ethena's governance token, it will immediately launch the "Second Quarter Activity" to further expand its token economic model. This activity will focus on the development of new products using Bitcoin (BTC) as the supporting asset, expanding the growth potential of USDe and bringing Ethena to a wider market acceptance and application scenarios.

Sats Rewards, as the core of the second quarter activity, aims to reward users participating in the construction of the Ethena ecosystem. By increasing rewards for early users, Ethena further strengthens community participation and a sense of belonging, while also encouraging new users to join. The design of this incentive mechanism demonstrates Ethena's understanding of the importance of building a sustainable and active community.

Through a carefully designed token economic model and incentive mechanism, Ethena is committed to building an inclusive and sustainable DeFi platform, exploring new paths for the future of decentralized finance.

4.2 Token Unlocking

- 0.36% unlocked on 2024.6.2

- 0.36% unlocked on 2024.7.2

- 0.36% unlocked on 2024.8.2

- 0.36% unlocked on 2024.9.2

- 0.36% unlocked on 2024.10.2

- 13.75% unlocked on 2025.4.2, a very high proportion that requires special attention.

Chapter 5 Target Valuation

Chapter 5 Target Valuation

Currently, ENA's circulating market value is $1.4 billion, and its fully diluted valuation (FDV) market value is $14 billion. The valuation of stablecoins is generally not low. In 2023, the settlement of stablecoins traded on-chain alone exceeded $12 trillion. Once stablecoins gain market acceptance, their value potential is immeasurable. AllianceBernstein, a globally leading asset management company with $725 billion in assets under management (AUM), predicts that the stablecoin market size could reach $28 trillion by 2028. This forecast indicates that from the current $140 billion market value (previously reaching a peak of $187 billion), there will be tremendous growth opportunities.

So how should ENA be valued?

First, there is no completely comparable valuation object for it. Second, the stablecoin market size is huge, with significant room for future growth. In such a large context, it is difficult to provide a definite valuation. What we should consider more is whether Ethena's solution can meet the development needs of decentralized stablecoins in Web3 and address potential risks.

However, Arthur Hayes, the founder of BitMEX, attempted to use a valuation similar to Ondo's to value ENA. His valuation model is based on the following:

Ethena's annual income = Total income * (1 - 80% * (1 - sUSDe supply / USDe supply));

If 100% of USDe is staked, i.e., sUSDe supply = USDe supply: Ethena's annual income = Total income * 20%;

Total yield = USDe supply * (ETH staking yield + ETH Perp Swap funding);

ETH staking yield and ETH Perp Swap funding are both variable interest rates.

ETH staking yield - assuming a yield rate of 4%.

ETH Perp Swap funding - assuming a rate of 20%.

The key part of this model is that the fully diluted valuation (FDV) should use the income multiple. Using these multiples as a guide, the potential FDV of Ethena was estimated.

In early March, Ethena's $820 million in assets generated a 67% yield. Assuming a 50% supply ratio of sUSDe to USDe, it is inferred that Ethena's annualized income will be approximately $300 million in a year. The FDV derived from a valuation similar to Ondo's is $189 billion.

Therefore, ENA's growth potential = 189/14 = 13.5, which translates to a price of 12.6.

Whether from the market size or income structure, ENA's growth potential is still very significant and worth paying close attention to and investing in. In terms of investment operations, how should one proceed? Let's look at the next chapter.

Chapter 6 ENA Investment Analysis and Recommendations

Since ENA is a coin worth long-term investment, one approach is to buy now and hold for the long term. Another approach is to buy at the right time and sell at the right time, continuously trading in waves while also making long-term investments. This chapter will focus on studying and analyzing the second investment approach and provide investment recommendations for the current situation, using chip distribution and MVRV research methods.

6.1 Chip Distribution Study

According to the URPD chip distribution chart shared by Lin in the VIP group, it is easy to see:

From May 15th, the chips above a price of 1 are gradually decreasing, and a very large chip consensus area has formed around 0.85, especially reaching its peak on May 22nd.

Secondly, from May 22nd to the present, between 0.7 and 1.2, especially around 0.85, nearly one-third of the chips have been removed, but the consensus area is still concentrated around 0.85, forming a very strong support level. Building a position near this level would be very advantageous.

There is no significant concentration of chips above 1, and it can even be said to be a clear path. Once the bull market arrives, the resistance to an increase will be very low, and once it rises, the speed and magnitude of the increase will be very fast.

6.2 MVRV Indicator Analysis

Let's take a look at the MVRV (Market Value to Realized Value) Z-score indicator.

MVRV-Z Score = Circulating market value / Realized market value, where "realized market value" is based on the value of the coin transferred on-chain, calculated as the sum of the "last moved value" of all the coins on-chain. Therefore, when this indicator is too high, it indicates that the market value of the coin is relatively overvalued, which is not conducive to further price increases; conversely, it indicates undervaluation. Based on past historical experience, when this indicator is at a historical high, the probability of the coin's price showing a downward trend increases, and attention should be paid to the risk of chasing highs. When this indicator is below 1, it means that the average holding cost of the entire network is at a loss, and building a position in this range will give an advantage over all holders.

When this indicator is above 3, it means that the entire network's profit is over 3 times, entering a risky area, and it may be considered to take profits in stages.

Looking at ENA's MVRV indicator, from the above chart, it can be seen that since April 14th, ENA's MVRV indicator has been concentrated around 1, reaching a low of 0.71. The current Z-score is 1, which is a good time for phased investment and building a position.

Therefore, the current area is suitable for building a position. It would be even better to build a position near 0.85 or even lower.

Chapter 7 Market Heat

The market's attention to ENA has been very positive. Through the following three images, it is easy to see:

Although the overall market correction has led to a pullback in ENA's price, the market and KOL's attention to ENA has always been very positive. The attention from KOLs to ENA has shown a clear increase in May compared to April, which also indirectly indicates the technical advantages and future development prospects of ENA.

Chapter 8 Conclusion

ENA (Ethena) makes it possible for the Web3 world to have independent currency (stablecoin) issuance and valuation rights. Its future growth potential and imagination space are huge. From Lin's chip distribution and on-chain MVRV data, it is currently a good time for phased investment and building a position, with low risk.

ENA (Ethena) is currently the relatively most perfect decentralized stablecoin project. It is hoped that the ENA project team will continue to update and iterate, using more appropriate technology and methods to resolve potential risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。