Author: Ian, Xinwei, Severin, MT Capital

TL;DR

1. Overview of DePIN: The Decentralized Physical Infrastructure Network (DePIN) integrates the physical world with Web3, reducing costs and improving efficiency through decentralized technology. It is widely used in computing, storage, wireless networks, and more, with broad market prospects from traditional fixed devices to new-generation portable and wearable devices.

2. Investment Trends and Projects: DePIN projects have shown significant growth in both bull and bear market cycles, covering various areas such as wireless networks, mapping, connected vehicles, agriculture, drones, weather, and energy. Investment institutions have expanded from Europe and America to Asia, with increasing participation and interest in the DePIN field.

3. Market Demand and Potential: The emerging DePIN market includes diverse categories such as health data, weather, energy, bandwidth, AI, and mobile phones, with enormous market space and high growth rates. The energy and mobile phone markets have tremendous potential, while the growth rates of health data and AI markets are also considerable.

4. Project Ecosystem and Blockchain Selection: Ethereum and Solana have become the primary choices for existing and emerging DePIN projects. Solana, with its high performance, low cost, and strong community support, has attracted numerous new projects and gradually become the preferred platform for DePIN projects. Representative projects such as Render, Helium, and Hivemapper demonstrate the diverse applications of DePIN. Core players like Solana and IoTeX provide strong technical support and ecosystem for DePIN projects, driving rapid development.

5. Modular Blockchain Trend: Modular design significantly enhances the scalability and adaptability of DePIN. Through standardized interfaces and interchangeable components, DePIN can flexibly adapt to different application scenarios and technological requirements, promoting rapid deployment and maintenance of the network.

6. Evolution of Token Economics: From early fixed incentive models to the current dynamic incentive mechanisms, DePIN projects like Helium ensure the network's sustained growth and healthy development through measures such as adjusting incentives for new and old devices, regional incentives, and incentive period adjustments.

Definition of DePIN

DePIN, short for Decentralized Physical Infrastructure Network, literally means "decentralized physical infrastructure network." "De" represents decentralized, "P" stands for physical, "I" refers to infrastructure, and "N" is for network.

The core definition of DePIN is to bring real-world users into Web3 through decentralized networks to achieve cost reduction and socialization. In the current world, especially in the physical business field, DePIN achieves the goal of cost reduction and efficiency improvement through decentralized technology.

In previous research and reports, DePIN has often focused more on infrastructure, while this report (for the complete PDF version, please download from the official website) focuses more on the decentralized aspect, aiming to showcase the diverse future DePIN markets and investment opportunities.

Types of DePIN Projects

Classic DePIN Devices:

Characteristics: These devices are typically stationary and cannot be moved.

Main businesses: Including computation, bandwidth, and storage.

Market characteristics: The market for classic DePIN projects tends to be in the technology sector, especially in areas such as AI computing power, attracting significant funding and traffic. This market has a large scale but is highly competitive, akin to a red ocean.

Representative projects: Filecoin, RNDR, etc.

Next-Generation DePIN Devices:

Characteristics: These devices are small, flexible, portable, and even wearable.

Main businesses: Services related to daily life, such as health monitoring, weather forecasting, and mobile phone functions.

Market characteristics: The market for next-generation DePIN projects leans more towards daily life, with low costs and suitability for everyday applications. This market has diverse categories and wide-ranging applications, with significant untapped potential, akin to a blue ocean.

By comparing these two generations of DePIN projects, it is evident that DePIN technology is continuously evolving, and application scenarios are expanding. From traditional fixed devices to more flexible and portable devices today, the market prospects for DePIN are increasingly broad, covering various needs from high-tech fields to daily life. The traditional DePIN market has a large scale but is highly competitive, akin to a red ocean; while the innovative DePIN market has diverse categories and wide-ranging applications, with significant untapped potential, akin to a blue ocean.

New Ecological Map of DePIN Investment

During this bull market cycle, the number and variety of DePIN projects have significantly increased. New lightweight DePIN projects of the next generation have emerged, including AI, health data-collecting wearables such as wristbands and watches, and a large number of portable lightweight physical DePIN devices.

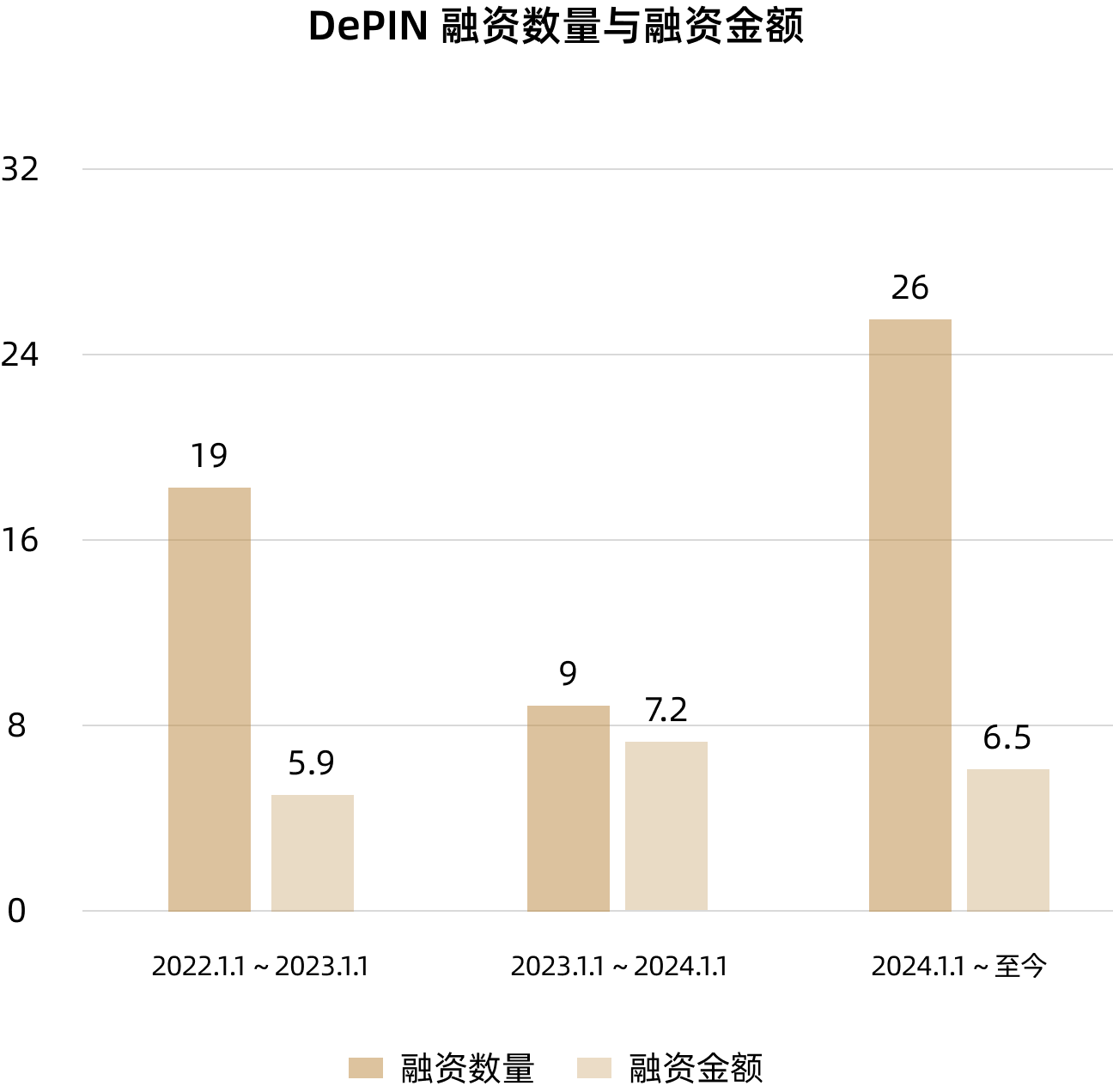

2022.1.1 - 2023.1.1

A total of 19 DePIN projects were funded, with an average funding amount of 18M, excluding the large 200M funding round for Helium D, the average funding amount is 5.9M.

The project categories include wireless networks, mapping, connected vehicle data, agriculture, drone imagery, weather, electricity markets, DePIN infrastructure, with the largest number of projects in the wireless network category, reaching 7.

2023.1.1 - 2024.1.1

A total of 9 DePIN projects were funded, with an average funding amount of 7.2M, significantly lower in quantity compared to the year 2022 (bear market), but a 22% increase in funding amount compared to 2022.

The project categories include wireless networks, decentralized computing power, mapping/geospatial data, weather, DePIN infrastructure, with a significant decrease in both funding quantity and categories (bear market requires more reasonable business scenarios and models).

2024.1.1 - 2024.5.20

A total of 26 DePIN projects were funded, with an average funding amount of 6.5M. The number of funded projects has significantly increased, while the funding amount has slightly decreased.

The project categories include decentralized computing power, connected vehicles, Internet of Things (IoT), wireless networks, FHE, mapping, weather & environment, bandwidth, DePIN infrastructure, mobile phones, energy, storage, mixed reality.

New first-level funding categories have been added: AI, VPN, wearables such as wristbands/watches, and portable device type projects (health data) that have not been disclosed.

source: MT Capital

Number of DePIN Projects and Institutions

In the previous cycle, DePIN participating institutions were mainly from Europe and America. In the current DePIN cycle, more Asian institutions have emerged, demonstrating strong interest in DePIN from Asian institutions. The number of DePIN projects has also significantly increased, with over 135 secondary DePIN projects and over 130 primary DePIN projects.

Projects:

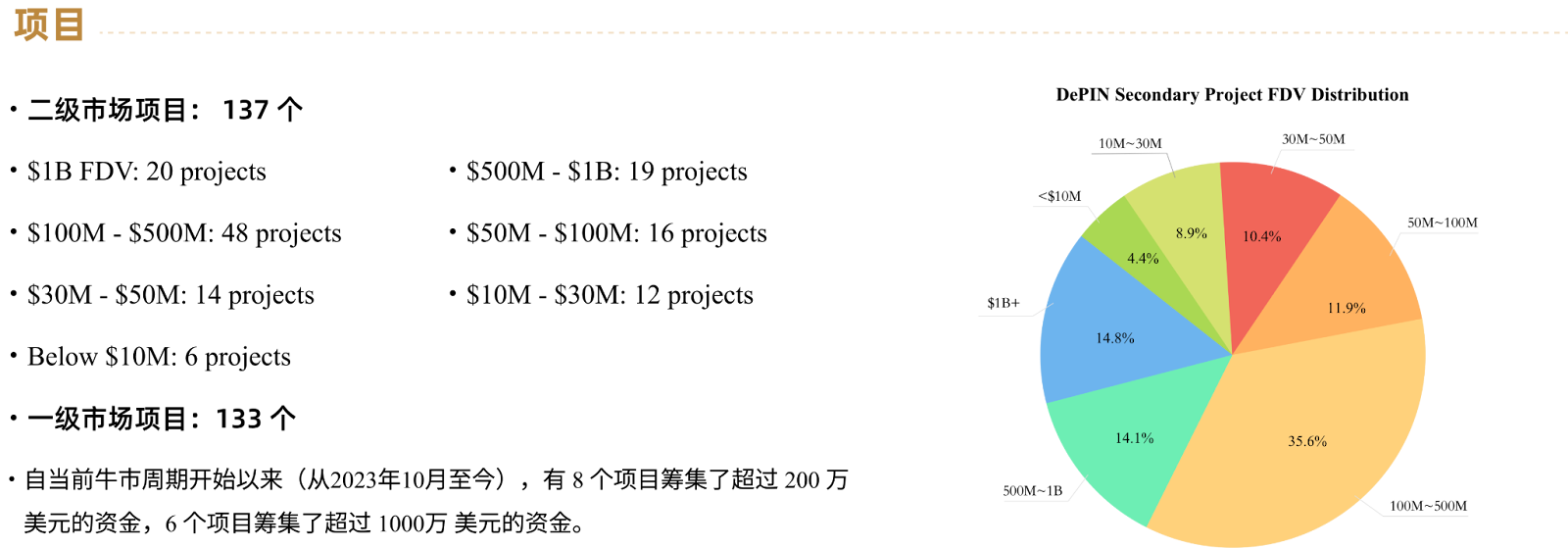

•Secondary market projects: 137

•>$1B FDV: 20

•$500M - $1B: 19

•$100M - $500M: 48

•$50M - $100M: 16

•$30M - $50M: 14

•$10M - $30M: 12

•$10M: 6

•Primary market projects: 133

•Since the current bull market cycle began (from October 2023 to present), a total of 8 projects have raised over 2 million USD, and 6 projects have raised over 10 million USD.

source: MT Capital

Institutions:

Previous cycle:

•Andreessen Horowitz (A16z)

•Multicoin Capital

•HashKey Capital

•IOSG Ventures

•Spartan Group

•Borderless Capital

•Lattice Ventures

•Variant Fund

•Delphi Digital

•Big Brain Holdings

•Cogitent Ventures

Current cycle:

•OKX

•Animoca Brands

•JDI

•IoTeX

•FMG

•Waterdrip Capital

•MH

DePIN Market Demand

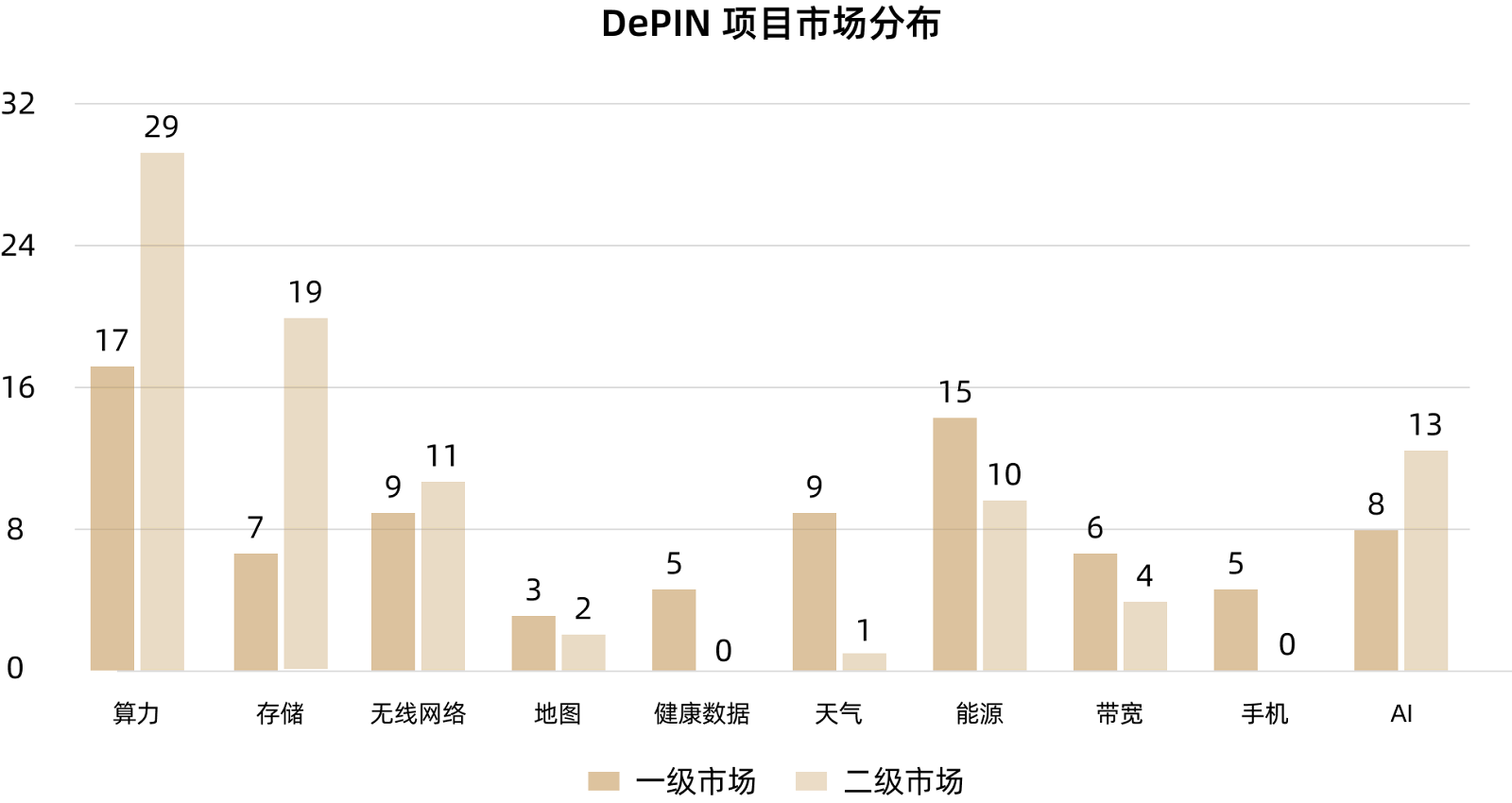

In the previous cycle, emerging projects in sub-sectors of DePIN, represented by computing power, storage, wireless networks, and mapping, continued to emerge. In the current cycle, new emerging sub-sectors such as wearable devices focused on health data, weather, energy, bandwidth, AI, and mobile phones have been added.

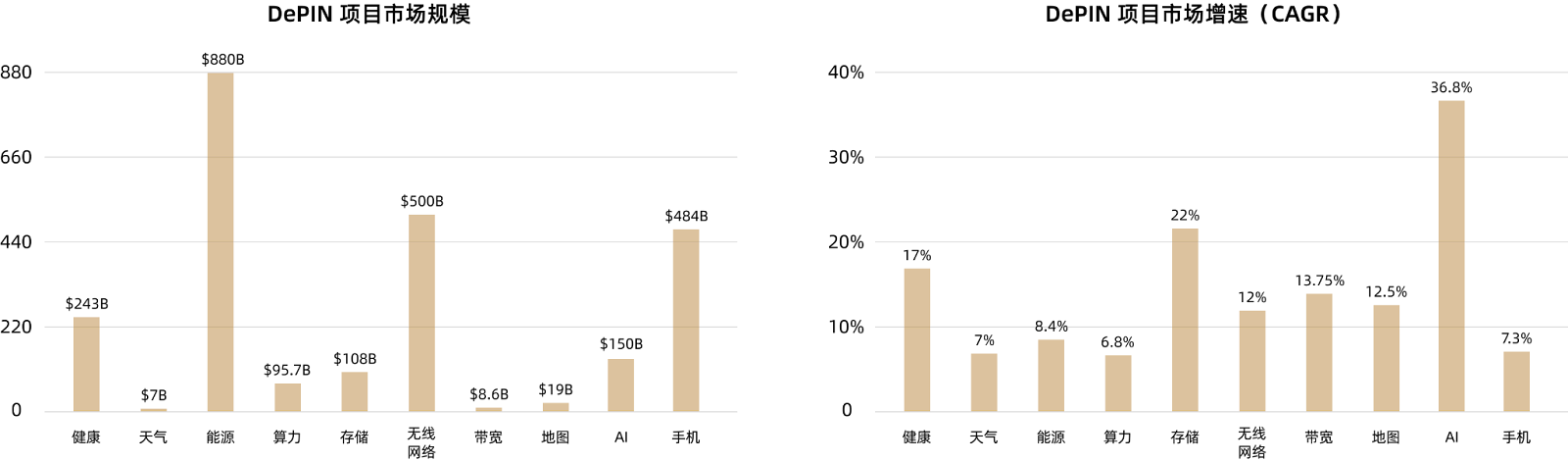

From the perspective of market demand, the energy and mobile phone markets have significant market space. The health data market and AI market not only have a large market space but also have very high year-on-year growth rates, indicating a substantial market size.

Market: (Number of primary market projects + Number of secondary market projects)

Health (5+), Weather (9+1), Energy (15+10), Computing Power (17+29), Storage (7+19), Wireless Networks (9+11), Bandwidth (6+4), Mapping (3+2), AI (8+13), Mobile Phones (5+)

Number of market projects in the previous cycle

•Computing Power: 17+29

•Storage: 7+19

•Wireless Networks: 9+11

New emerging market projects

•Health Data (Wearable Devices): 5+ /

•Weather: 9+1

•Energy: 15+10

•Bandwidth: 6+4

•Mobile Phones: 5+

•AI: 8+13

source: MT Capital

Market Size and Growth Rate

•Health Market: $243B, CAGR 17%

•Weather Market: $7B, CAGR 7%

•Energy Market: $880B, CAGR 8.4%

•Computing Power Market: $95.7B, CAGR 6.8%

•Storage Market: $108B, CAGR 22%

•Wireless Networks Market: $500B, CAGR 12%

•Bandwidth Market: $8.6B, CAGR 13.75%

•Mapping Market: $19B, CAGR 12.5%

•AI Market: $150B, CAGR 36.8%

•Mobile Phone Market: $484B, CAGR 7.3%

source: MT Capital

Blockchain Selection and Device Types

source: MT Capital

Currently, the highest number of DePIN projects in the secondary market are on the Ethereum chain, with a total of 70 DePIN projects choosing to build on Ethereum, accounting for 81% overall.

Among the collected primary market projects, the number of Solana ecosystem projects is 28, accounting for 62% overall. Solana is gradually becoming the preferred public chain for DePIN projects in the new cycle.

source: MT Capital

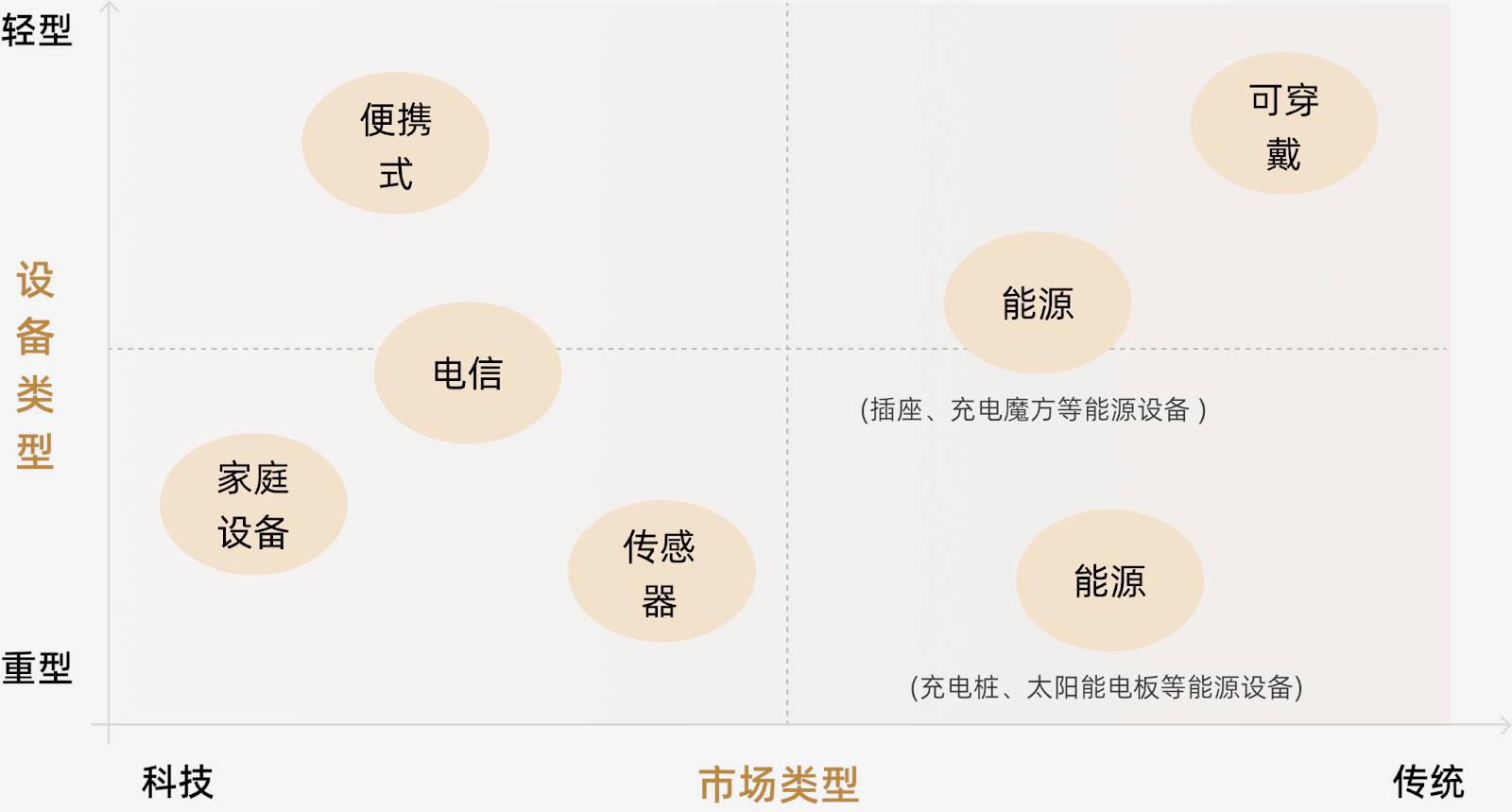

From the perspective of device types, there are more new projects in the energy and sensor device categories. There are also more projects in the primary market that use wearable, portable, and home devices as physical hardware.

DePIN Full Industry Chain

Upstream Supply Chain

- Hardware Manufacturing and Supply

Hardware suppliers: Produce various devices and sensors for the DePIN network, such as GPUs, servers, IoT devices, and wireless devices. For example, providing LoRaWAN hotspots for the Helium network and dashcams for Hivemapper.

Specialized hardware manufacturers: Some specialized hardware manufacturers provide custom hardware for specific DePIN projects, such as storage miners for Filecoin and GPUs for the Render network.

- Chips and Semiconductors

Chip manufacturers: Companies like NVIDIA and AMD provide high-performance GPUs for computing networks such as Render and Akash, which are core for processing AI workloads and complex computing tasks.

- Internet of Things (IoT) Devices

Sensor manufacturers: Provide sensors for environmental monitoring, traffic data collection, and other needs. For example, Bluetooth sensors in the Nodle network and noise pollution detectors for Silencio.

Smart devices: Such as smartphones and other mobile devices, which can be part of sensor networks for data collection and transmission.

- Power and Energy Devices

Energy equipment suppliers: Provide solar panels, wind turbines, energy storage batteries, and other devices for decentralized energy networks. For example, solar panels and battery systems for the Daylight Energy network.

Midstream Industry Chain

- Network Operations and Maintenance

Network operators: Manage and maintain the normal operation of decentralized networks, including node management, data transmission, and storage.

Service providers: Offer infrastructure services for the network, such as cloud computing and storage services.

- Software and Platform Development

Blockchain platforms: Such as Solana and IoTeX, provide fundamental blockchain technology support for DePIN projects, including smart contract execution, data storage, and verification.

Software developers: Develop software platforms and tools for managing and operating DePIN networks, such as distributed storage management platforms from Filebase and video streaming management tools from Livepeer Studio.

- Data Processing and Analysis

Data analysis companies: Process and analyze data collected from sensor networks to provide valuable insights and services to users.

AI and machine learning services: Such as Beam, provide cloud-based AI computing services, distributing model training and inference workloads to decentralized GPU networks.

Downstream Industry Chain

- Applications and Services

Enterprise clients: Utilize services provided by DePIN networks to enhance their business efficiency, such as logistics companies using map data from Hivemapper and agricultural companies using high-precision location data from Geodnet.

Consumer applications: Such as shared mobility applications from Teleport and vehicle data platforms from DIMO, providing convenient services to consumers and rewarding them for contributing data.

Smart Cities and Public Infrastructure: Utilizing decentralized network data and services to optimize city management and public services, such as energy management and traffic control.

Modular/Data Layer/Middleware

Modular blockchains optimize scalability, security, and flexibility by dividing core functions (such as execution, consensus, data availability, and settlement) into different layers. For example, Ethereum improves data availability and processing capacity through sharding and rollups, while Cosmos achieves cross-chain interoperability and high customization through the IBC protocol and Tendermint consensus mechanism. The advantages of modular blockchains include higher transaction processing capacity, enhanced security, and greater development flexibility, which will further drive the development of blockchain technology in the future.

The modular trend of DePIN significantly enhances its scalability. Modular design allows DePIN to adapt flexibly to different application scenarios and technological requirements, simplifying network deployment and maintenance through standardized interfaces and interchangeable components. For example, the Render network expands its services and market potential from image rendering to AI model training through modular structure. Additionally, Filecoin's modular design allows it to expand storage services and add hot storage and data computation functions, further enhancing its network's practicality and attractiveness. The modular trend not only enhances the technical compatibility and upgradeability of the DePIN network but also allows independent modules to develop and optimize independently, accelerating innovation and progress in the entire network ecosystem. This flexible and efficient architecture greatly enhances the scalability of DePIN, enabling it to respond more quickly to market demands and technological changes, driving the widespread application and development of decentralized infrastructure.

Representative Projects

DePHY

DePHY is a development framework designed for DePIN, significantly reducing development costs and time, supporting any standard interface hardware, and enabling rapid, efficient, and secure deployment of decentralized infrastructure projects.

PINGPONG

PINGPONG is a DePIN liquidity and service aggregator that optimizes and maximizes mining rewards across multiple networks through innovative tools and solutions.

DePIN Track Platforms and Players

Solana

Solana is becoming the new super infrastructure for DePIN. Its high performance, low network fees, strong developer and user community, and high purchasing power make it the preferred launch network for many DePIN projects. Established DePIN star projects such as Render and Helium have achieved better development after migrating to Solana, demonstrating the vitality that Solana's strong infrastructure and extensive community user base bring to DePIN projects. Solana is gradually attracting emerging and cutting-edge DePIN projects from different categories, including Grass, Natix, and Exabits, and is gradually improving its DePIN ecosystem.

Representative Projects

Render

Render Network is a decentralized GPU rendering platform that connects artists with GPU providers using blockchain technology to provide scalable, cost-effective rendering solutions.

Hivemapper

Hivemapper is a decentralized mapping network that creates detailed real-time maps using blockchain technology and crowdsourced dashcam data.

Helium

Helium is a pioneering DePIN project that creates a decentralized wireless network, allowing IoT devices to connect globally through a distributed hotspot network.

Natix:

Natix Network is a blockchain-based crowdsourced camera network for creating real-time world maps.

Exabits:

Exabits is a decentralized infrastructure for AI and compute-intensive applications, allowing users to provide distributed GPU services, data storage, or expertise to the AI community without central authority or intermediaries.

Grass:

Grass is a DePIN project developed by Wynd Network, allowing users to monetize their unused network resources by adding their connected devices to a decentralized network designed to provide data for AI training.

EV3

EV3 is an investment-driven investment firm that supports entrepreneurs building DePIN. By investing up to $1 million in early-stage projects, EV3 aims to unlock the next $100 trillion of global GDP through next-generation open infrastructure networks such as telecom, logistics, energy, cloud computing, and artificial intelligence. Founded by institutionally trained investors Mahesh Ramakrishnan and Salvador Gala, EV3 combines deep industry expertise and long-term partnerships to gain support from leading investors.

Representative Projects

3DOS

3DOS is the world's largest decentralized on-demand manufacturing network, aiming to revolutionize manufacturing through blockchain technology and 3D printing. The platform allows anyone to upload designs, receive royalties, and engage in on-demand manufacturing globally.

Zonal

Zonal is developing a decentralized network based on a micro-location protocol, using wireless communication technologies such as ultra-wideband (UWB) and Bluetooth Low Energy (BLE) to provide highly reliable global and indoor positioning services, verifying real-world interactions. Its goal is to create a unified protocol to provide location verification tools for various services and businesses.

XNET

XNET is a next-generation mobile operator that establishes a decentralized network using blockchain technology. By using CBRS spectrum, XNET aims to establish a reliable industry-grade neutral host network. The project aims to solve the inefficiency and capital-intensive issues in the telecom industry through its distributed radio access network (RAN).

IoTeX

IoTeX is an open platform for modular AI+DePIN infrastructure, aiming to bridge the connection between smart devices, real-world data, and Web3, allowing Web2 to efficiently access the blockchain and create a decentralized real-world open ecosystem for multi-dimensional data and scenarios. Through modular construction, developers can innovate applications across various scenarios from smart living to intelligent industry in Web3.

As of the first quarter of 2024, the IoTeX network has 108 active nodes, with a total staked value of $29 million, a 73% increase compared to the previous period. The average staking participation rate reached a historical high of 40.6%. In addition, node rewards increased by 71% compared to the previous period, reaching $3.3 million.

IoTeX offers complete "plug-and-play" products and tools to efficiently build and deploy blockchain-driven IoT applications. The platform is divided into four layers: hardware layer, middleware, tool layer, and blockchain layer. Since its inception, IoTeX has raised over $90 million to support its research and market expansion. IoTeX's solutions support various IoT ecosystems, such as the sharing economy, smart homes, autonomous driving, and supply chain management.

Representative Projects

Network3

Network3 is a Layer2 blockchain platform integrated with AIoT technology, aiming to provide efficient model training and validation tools for AI developers, while empowering users to earn cryptocurrency by running nodes.

Inferix

Inferix is a decentralized GPU visual computing platform dedicated to 3D/AR/VR rendering and AI inference.

Wayru

Wayru Network is a decentralized wireless network that provides various intelligent functions through WayruOS and Wayru Connectivity Superapp, using UWB and BLE wireless communication technologies.

DePIN Sub-Track Based on Physical Hardware Devices

Source: MT Capital

Source: MT Capital

Track Mapping

Sensor Track

We define "sensors" as outdoor sensors that can help users collect various types of data, such as maps, weather, and vehicle information. After collecting data, users can contribute their data to create a data value network and receive corresponding token rewards. DePIN projects can aggregate this user-shared data to provide B-side customers with more diverse data samples and capture commercial revenue from Web2.

Representative Projects

Mapping Network

Hivemapper

Hivemapper is a decentralized mapping network that uses blockchain technology and crowdsourced dashcam data to create detailed real-time maps.

Connected Vehicle Data Network

DIMO

DIMO is a decentralized IoT vehicle data DePIN network that enables vehicle owners to collect, use, and monetize their vehicle data.

Positioning Network

Geodnet

GEODNET is a blockchain-based global earth observation decentralized network that significantly improves GPS accuracy using real-time kinematic (RTK) technology.

Wireless Network Track

Mobile Wireless Networks:

- Market Size and Growth: Occupying over 76% of the market share in the telecom industry in 2022, driven mainly by 5G and IoT technologies. The compound annual growth rate is expected to be 6.2% from 2023 to 2030.

- Role: Providing widespread personal and business connectivity through cellular technology. Supporting various devices and applications for mobile communication and data services.

- Future Outlook: The demand for mobile wireless networks is expected to increase due to the growing need for higher bandwidth, advancements in 5G technology, and integration of IoT devices.

Helium

Helium is a pioneering DePIN project that creates a decentralized wireless network, allowing IoT devices to connect globally through a distributed hotspot network.

Fixed Wireless Access (FWA):

- Market Size and Growth: Rapidly growing as an alternative to wired broadband, especially in areas where laying cables is impractical. The market size is expected to grow from 130 million connections at the end of 2023 to 330 million by 2029.

- Role: Providing internet services using radio waves between fixed points. Typically deployed in areas with insufficient mobile wireless network coverage, with lower deployment costs and greater simplicity compared to wireless mobile networks.

- Future Outlook: With advancements in 5G technology, FWA is expected to become a more common form of internet access, especially in underserved areas such as remote and rural regions.

Andrena

Andrena is a high-speed fixed wireless access network service provider, creating high-speed, low-cost wireless networks in cities and regions with insufficient mobile wireless network services using cutting-edge radio technology.

Wi-Fi Networks:

- Market Size and Growth: Valued at approximately $14.5 billion in 2023, expected to reach $39.4 billion by 2028, with a compound annual growth rate of 22.2%.

- Role: Providing local area network connectivity to devices using radio waves, supporting a wide range of consumer electronics products from smartphones to home appliances in limited private spaces such as homes, businesses, and public hotspots.

- Future Outlook: Market growth driven by the increasing demand for reliable internet connectivity for smart devices and the growing implementation of IoT in public and private sectors.

Roam

Roam is a decentralized global WiFi network, providing enterprise-grade OpenRoaming WiFi roaming services to the public globally.

Energy Track

The traditional energy market faces challenges such as mismatched supply and demand in regional energy networks, lack of transparent and tradable energy markets, untapped large clean energy markets, slow and costly expansion of energy networks. However, DePIN can help shape a new generation of decentralized energy networks.

From a market perspective, the clean energy market is experiencing significant growth, with a current market value of approximately $1.4 trillion and an expected compound annual growth rate of 9.1% from 2022 to 2032. The renewable energy market is expected to grow from a market size of $881.7 billion to approximately $1.9 trillion by 2030, with a compound annual growth rate of about 8.4%. Energy-related DePIN projects have enormous market potential.

Power Plants:

Starpower

Starpower is a pioneering DePIN project that aims to revolutionize energy management and distribution by creating virtual power plants (VPP) using decentralized networks powered by blockchain technology.

Energy Trading

Daylight

Daylight is an open-source blockchain network focused on creating a decentralized market for renewable energy and carbon credits, aiming to promote more sustainable global energy trading and usage.

Energy Storage

PowerPod

Powerpod aims to revolutionize the charging of electric vehicles (EV) by creating a shared, blockchain-driven community-owned charging station network.

Home Devices Track

The home devices domain focuses on enhancing and optimizing various aspects of daily life using decentralized technology. It addresses key issues such as high costs, privacy concerns, and uneven resource allocation by transforming standard home devices into decentralized network nodes to provide solutions. By using blockchain and other decentralized protocols, these devices offer low-cost, secure, and efficient alternatives to traditional cloud services and computing capabilities. This approach not only reduces reliance on centralized infrastructure but also gives users greater control over data and resources. Additionally, the integration of these devices enhances smart home ecosystems and gaming experiences, aiming to improve daily interactions and create a globally connected community.

FX Land

FX Land provides a distributed cloud storage solution that addresses high storage costs and privacy concerns through Crowd Storage nodes and the Fula protocol.

Hajime AI

The Hajime AI project aims to create a global edge computing power supply network, providing economically efficient computing services for AI startups and seamlessly integrating with smart home and IoT ecosystems through a decentralized platform to address uneven resource allocation.

FrodoBots

The FrodoBots project addresses embodied AI issues using real-world robots in a gamified manner.

Wearable Devices Track

In the wearable devices domain, the focus is on integrating smart wearable devices with blockchain technology. They utilize advanced AI and data privacy protection technologies to provide personalized health monitoring and data management services. By enabling users to monetize their data and providing reward mechanisms, these devices incentivize active participation in health management. Typically made of high-quality materials, these devices have long battery life and strong waterproof capabilities to ensure user convenience and safety. Additionally, these smart wearable devices are compatible with mainstream mobile devices and the cryptocurrency ecosystem, promoting widespread adoption of decentralized applications and the Web3 ecosystem while improving user health and quality of life.

CUDIS

CUDIS is a stylish, pioneering AI smart ring that motivates users by rewarding their health journey. It features core functions such as immutable data collection and control, personalized AI coaching, health incentive tasks, and social activities.

WatchX

The WatchX project aims to integrate millions of smartwatch users into the Web3 ecosystem and provide extensive opportunities for partners within the ecosystem.

Dogewalk

A DePIN platform that integrates innovative software and hardware through GameFi and SocialFi elements to enhance interaction between pet owners and Web3 users.

Portable Device Track

Portable devices share common features such as providing convenient mobile devices and applications to enhance the Web3 experience. They focus on simplifying user interactions, improving security, and implementing data ownership and reward mechanisms. These projects integrate hardware and software solutions to facilitate the development and use of decentralized applications, especially in mobile environments. The goal of this section is to drive the adoption and application of Web3 technology by lowering barriers to entry, optimizing user experience, and providing practical use cases.

Solana Mobile Saga

The Solana Mobile Saga project aims to lead the Web3 mobile revolution by providing top-tier hardware and powerful developer resources, offering a secure and user-friendly decentralized application experience.

Universal Phone Oyster Labs

The Universal Phone project launched by Oyster Labs targets 800 million Telegram users, focusing on emerging markets such as India, Indonesia, and Nigeria.

Puffpaw

Puffpaw is a "quit smoking and earn" project incubated by Arweave and OrangeDAO. It helps users quit smoking and earn economic rewards through e-cigarette devices and blockchain technology.

Token Economy of DePIN Projects: Evolution from Fixed Incentive Model to Dynamic Incentive

Internal Logic Analysis: Using Helium as an Example

Early Incentive Mechanism and Its Impact

In the early stages of the Helium project, early participants were able to earn very high token rewards by purchasing and deploying mining rigs. This high profitability attracted a large number of early users and rapidly drove network expansion. However, this incentive mechanism also brought some problems:

Excessive profit share for early participants: Early users rapidly achieved high returns due to receiving a large number of tokens. While this phenomenon initially drove rapid network growth, it also led to a rapid increase in token supply in the market.

Token economy fluctuations: Due to the large number of tokens held by early participants, they began selling tokens in the market, leading to token price fluctuations and declines. When new users entered the market, they found the returns to be much lower than those for early users, resulting in slower new user growth.

Stagnation in network growth: As the early high returns gradually disappeared, the willingness of new users to enter the network decreased, slowing down the network expansion and leading to slower project growth.

Introduction of Dynamic Incentive Mechanism

To address the above issues, the Helium project introduced a dynamic incentive mechanism to ensure the network's continued growth and healthy development.

Adjustment of incentives for new and old devices: Helium adjusted the incentive mechanism for new and old devices, allowing new device users to receive attractive rewards. For example, increasing the initial reward for new devices while gradually reducing the reward share for outdated devices, encouraging users to purchase and deploy new devices while maintaining network robustness.

Regional incentive policies: To promote balanced network development globally, Helium established differentiated incentive policies based on the deployment of devices in different regions. In areas with fewer devices, higher token rewards are provided to attract users to deploy devices in these regions.

Incentive adjustments by time period: Helium balances network load and improves device utilization by offering different rewards during different time periods. For example, users operating devices during off-peak periods can receive additional rewards, ensuring stable network operation around the clock.

Density-based incentives: In areas with low device density, Helium provides additional incentives to promote stable device operation and efficient data transmission. This not only increases user earnings but also enhances overall network performance.

Implementation of Dynamic Incentives

The Helium project uses smart contracts and algorithms to implement dynamic incentive mechanisms, ensuring real-time adjustment of incentives and fair distribution. These measures not only increase the participation of new users but also stabilize market expectations, preventing market fluctuations caused by early high returns.

Smart contract-based incentive adjustments: Through smart contracts, incentives for different devices are dynamically adjusted based on device usage and market demand. This mechanism ensures the flexibility and real-time nature of incentives.

Real-time data feedback: By collecting and analyzing device operation data, the Helium project can promptly adjust incentives for different regions and time periods, ensuring optimal network resource allocation and utilization.

Transparent incentive mechanism: The transparency and openness of the dynamic incentive mechanism enhance user trust and encourage more users to participate in network construction.

Changes in Incentives for New and Old Devices

Incentives for new devices: To lower the barrier to entry for users, new devices typically receive higher initial incentives to attract early adopters. Project teams may incentivize users to purchase and deploy new devices by offering high token rewards and lower initial costs, making it easier for new users to participate.

Maintenance incentives for old devices: To prevent users from abandoning old devices, project teams provide ongoing incentives, which may gradually decrease over time. By offering device upgrade rewards and maintenance cost subsidies, project teams can adjust the operating costs of old devices to ensure their continued effective operation.

Physical Market Changes

Device price adjustments: Project teams adjust the prices of different types of devices based on market demand and device lifespan. Due to reasons such as capacity, supply, and orders, the cost of new devices is usually higher, but so are the incentives. The prices of old devices are lower, but they still yield stable returns, attracting users at different levels.

Secondary market trading: Devices can be traded on the secondary market, and project teams may charge transaction fees, using part of the proceeds for token buybacks and burns to support token prices. This not only increases device liquidity but also stabilizes token value.

Regional Markets

Regional incentive policies: To promote balanced device deployment globally, project teams establish differentiated incentive policies based on market demand and development in different regions. For example, higher rewards are provided in areas with lower device density to attract more device deployments and achieve global network coverage.

Localized support: Project teams provide localized technical support and training in different regions to help users better install and maintain devices, improving device operational efficiency and user participation. This localized support effectively promotes project promotion and development in various regions.

Device Density

Density-based rewards: In areas with low device density, project teams may provide additional rewards to promote growth in less dense areas, encouraging stable device operation and efficient data transmission. These rewards may include higher token incentives and device upgrade subsidies, incentivizing users to maintain good device operation.

Dynamic adjustments: Project teams can dynamically adjust device density based on real-time data to ensure balanced network development and optimal resource allocation. Through such dynamic adjustments, project teams can flexibly respond to market changes and optimize network performance.

Device Operation Time Periods

Time-based rewards: To balance network load and improve device utilization, project teams may set different rewards for different time periods. For example, devices operated during off-peak periods may receive additional incentives to ensure stable network operation around the clock.

Load balancing mechanism: Project teams can dynamically adjust incentives for different time periods through smart contracts and algorithms to achieve balanced network load distribution and optimal resource utilization. Through this mechanism, project teams can effectively manage network resources and improve overall operational efficiency.

Conclusion and Outlook

We believe that in the DePIN track, both classic DePIN and next-generation DePIN have sufficient categories and broad markets, with the potential to give rise to great projects with large-scale user adoption. In the future, it is highly likely that a Web3 project entering the Top 20 will emerge in this field.

The core logic of DePIN lies in the cost reduction and efficiency improvement of existing world business by Web3. By bringing real-world users into Web3, DePIN not only achieves cost reduction and socialization but also significantly increases the quantity and accuracy of data sources. In the three generations of DePIN devices, from fixed devices to flexible portable devices, the market prospects continue to expand, covering various needs in high technology and daily life.

In recent years, the variety and number of investments in the DePIN market have significantly increased, and the number of institutions and projects continues to grow. From the demand side, DePIN has shown tremendous potential in multiple markets (such as weather, air quality, health, AI, etc.) and device types (such as wearable devices, mobile phones, etc.). The upstream and downstream industry chains are also gradually improving, including on-chain interactive data, device middleware, data, and hardware.

Of particular note is that the lifecycle of DePIN, due to the combination of physical devices and token design, is theoretically longer than non-DePIN projects. This makes the DePIN track have tremendous potential and is worthy of high attention and investment from investors.

Looking ahead, with the development of DePIN projects and technological advancements, we have reason to believe that this track will give rise to more innovative and influential projects, injecting new vitality and possibilities into the Web3 ecosystem.

Acknowledgments:

Salvador @DAnconia_Crypto from EV3

Anna @gizmothegizzer from Solana

Raullen @raullen from IoTeX

Peter from Hashkey

EO @ Future money group

Reference:

https://messari.io/report/infrastructure-sector-brief-gpu-networks

https://public.bnbstatic.com/static/files/research/depin-an-emerging-narrative.pdf

https://htxresearch.medium.com/depin-current-state-and-prospects-ad6b1a59b3d4

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。