Title: The Future of Web3 Publisher Transactions

Author: Arnav’s Musings

Translation: Plain Language Blockchain

Imagine this: you're scrolling through Instagram and come across a post from your favorite social media influencer wearing a hoodie from an emerging brand. You like the design and click on the photo to check the price. With another click, you're on the product description page. Within seconds, you decide to purchase the hoodie and confirm the transaction using FaceID…

In less than a minute, you've completed a social-driven purchase without leaving Instagram.

Welcome to the era of "publisher transactions," where consumers exchange value directly through content platforms. This emerging trend eliminates all friction in the purchasing process, creating a more immersive user experience that tightly links money and attention together. This is the future of e-commerce.

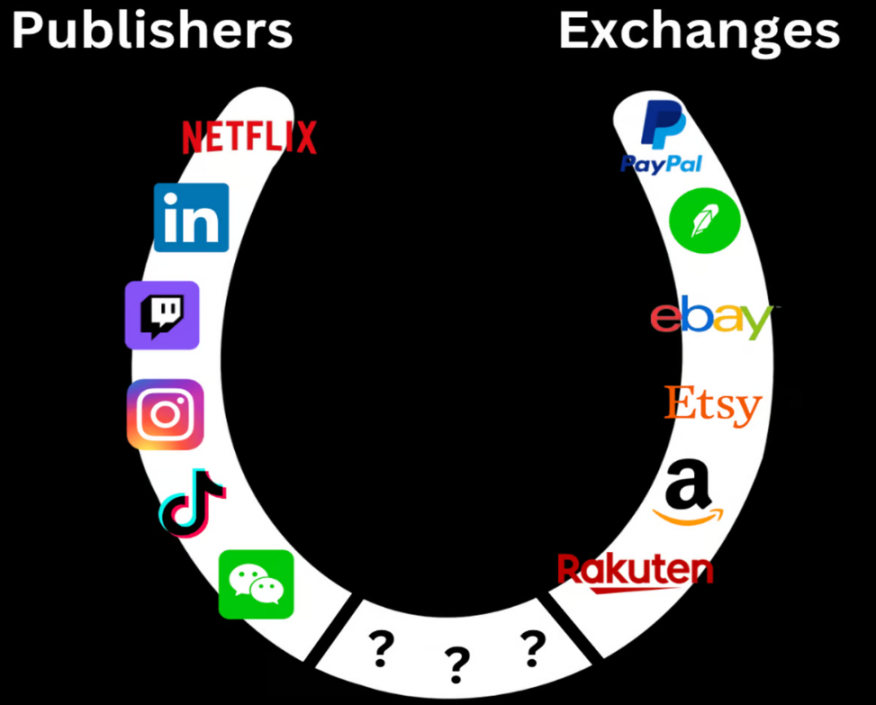

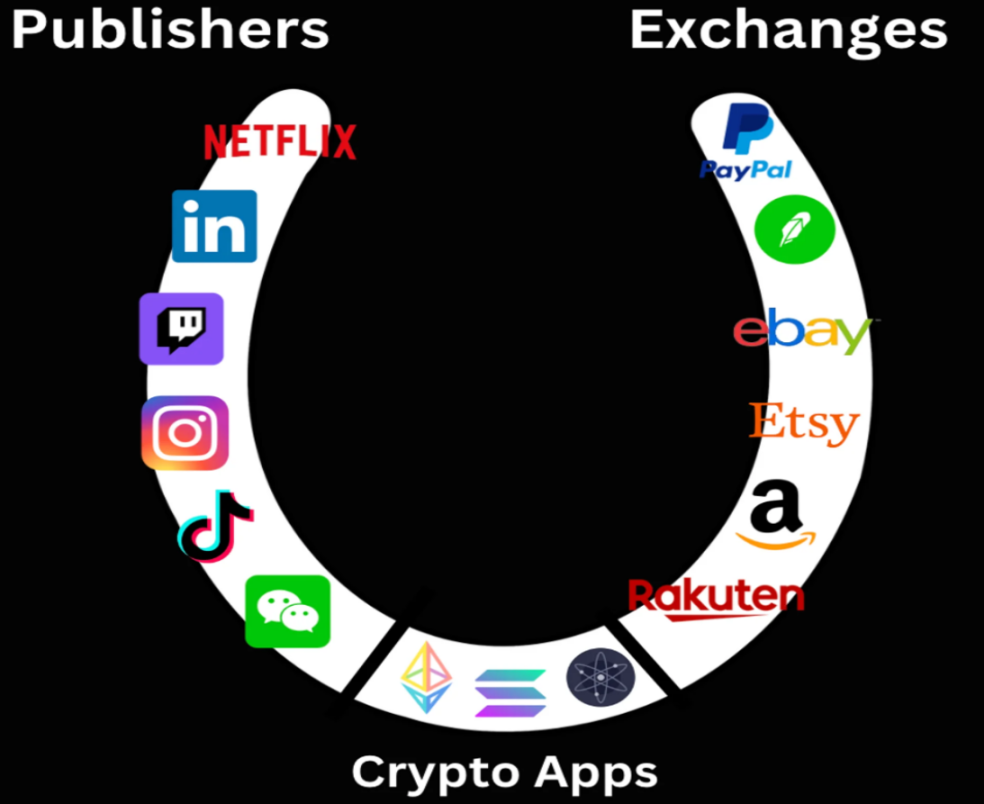

So, what is "publisher transactions"? Publishers = platforms thriving by controlling user attention

Some well-known publishers include Instagram, X, Spotify, YouTube, Netflix, etc., all competing for "regret-free user minutes."

Transaction platforms = platforms controlling the flow of funds

Some well-known transaction platforms include PayPal, eBay, Venmo, Robinhood, Coinbase, etc., all competing to control the currency system.

Therefore, the integration of publishers and transaction platforms is called publisher transactions, operating under the interaction of attention and money. Let's look at some examples of major publishers moving towards the publisher transaction model:

Spotify Merch Bar: Allows artists to directly sell merchandise and tickets through their Spotify profiles, integrating music streaming with e-commerce.

Instagram Live Shopping: Influencers can conduct live broadcasts on Instagram to sell products to fans. This is based on influencers being able to add shopping tags to their posts, allowing consumers to directly purchase products.

TikTok Shop: This digital store enables creators to locally sell products alongside their videos, often offering discounts, subscriptions, exclusives, etc. In fact, just last year, TikTok's losses in the US e-commerce market exceeded 500 million USD by subsidizing products (often offering them completely free) to familiarize users with the platform.

YouTube Shopping: Companies can sell products on YouTube through live streams, videos, or digital stores in collaboration with Shopify.

Snapchat AR Filters: Also known as "catalog-driven shopping lenses," allowing users to virtually try on glasses, makeup products, clothing, etc., and then make purchases within the app.

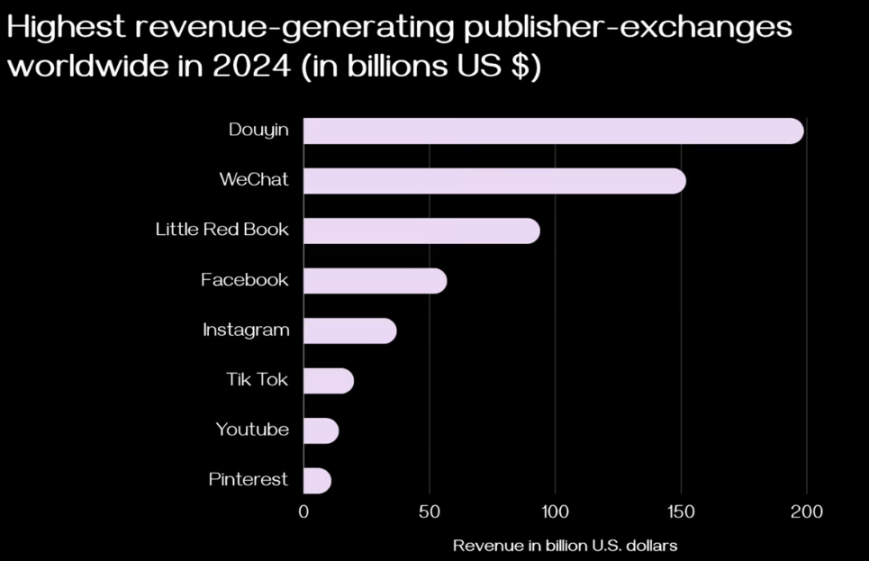

Essentially, every publisher becomes a publisher transaction by allowing value to be exchanged directly through the front end. And the data doesn't lie:

Yes, you read that right. Leading publisher transaction platforms like Douyin (Chinese version of TikTok) and WeChat have a combined annual revenue of over 350 billion USD!

Furthermore, every transaction platform is also becoming a publisher transaction platform:

Amazon Live: Combines e-commerce with live streaming, allowing influencers to showcase products for real-time purchases by the audience.

Alibaba: Alibaba has expanded into the media field through Alibaba Pictures, Youku Tudou (video streaming service), and Alibaba Music, integrating e-commerce with content streaming.

Every fintech company: For every fintech company, venturing into content creation and curation, and providing financial education and business insights has become a basic requirement (such as Robinhood, Square, Stripe, Bloomberg, Coinbase, etc.).

In summary, every publisher and every transaction platform is moving towards a hybrid publisher transaction model, as it maximizes user engagement, retention, consumption, and growth.

Okay, but what does a publisher transaction platform have to do with cryptocurrency?

Integrating Web3 publishers and transaction platforms into a unified publisher transaction platform will accelerate the creation and adoption of new applications.

Web2 publisher transaction platforms will adopt cryptocurrency payments to "attract the next billion users."

1. Web3 Publisher Transaction Platform

In Web3, we have many publishers, including block explorers, data providers, analytics tools, etc.

In Web3, we have many transaction platforms, including wallets, decentralized exchanges (DEX), NFT markets, etc.

Contrary to the technical debt of Web2, we have the opportunity to tightly integrate publishers and transaction platforms, creating experiences that were previously impossible in Web2.

In Web2, popular consumer applications like Instagram, TikTok, and Netflix are carefully designed (starting from the last detail) to provide frequent and small doses of dopamine, effectively maintaining user engagement. We have seen through applications like WeChat and Douyin that when financial products are layered on top of sticky consumer applications, they perform exceptionally well.

We live in a world where we encounter content/information at an exponential rate. Imagine if money could exchange as quickly and seamlessly as information; this is the primary advantage of cryptocurrency.

Cryptocurrency consumer applications can enable any publisher or transaction platform (whether crypto-native or non-crypto) to provide new forms of user engagement through local transactions, speculation, credit issuance, etc. If planned correctly, these new applications can foster deeper user loyalty than a single publisher. The ability to seamlessly integrate financial products into consumer applications' front ends presents a significant opportunity for new publisher transaction platforms to compete in the market against established incumbents.

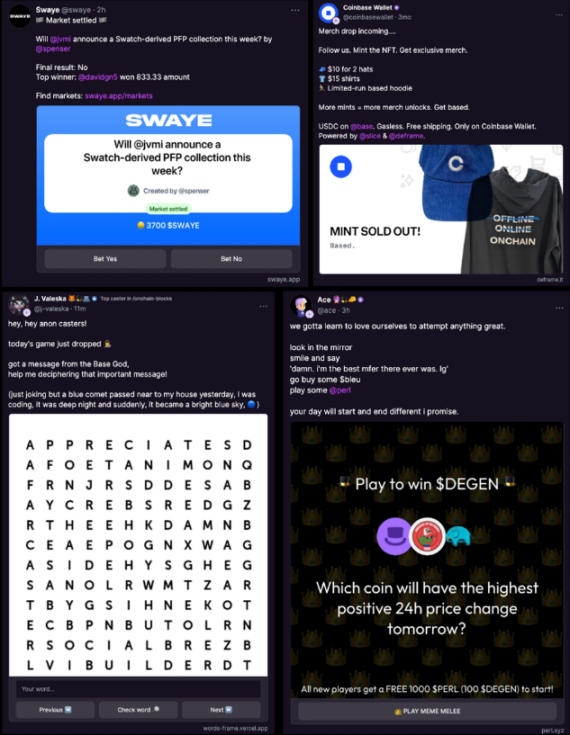

Here are some examples of consumer cryptocurrency applications:

1) Frames

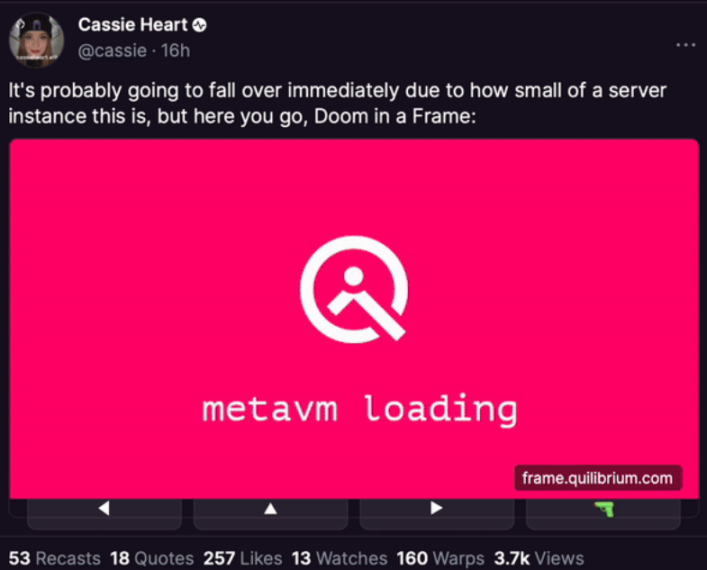

Frames extend Facebook's OpenGraph standard, converting static embeds into interactive experiences. It is a new cryptographic primitive that provides developers with a standard to run app Y within app X without any coordination between app X and Y. Here are some examples of frames:

Some have even built a playable version of "Doom" within frames:

If you can build a complete video game within a frame, then truly anything is possible.

Now imagine using Frames in wallets, block explorers, and other Web3 publishers. When combined with smart publisher infrastructure, Frames provide a powerful way for any publisher to become the next generation advertising network. For example, a block explorer sells ad space to a derivatives platform, which can achieve real-time transactions within the ad frame through issued credit. This is a typical example of a Web3 publisher becoming a publisher transaction platform due to local value issuance. Emerging infrastructure providers like Relayer offer tools for publishers to discover, curate, and reward on-chain.

Furthermore, Frames offer a whole new marketing field for advertisers, proving to be more effective than traditional access to Facebook or X's ad inventory.

The development of the Frames stack is progressing rapidly, with teams building various tools from attribution tools to smart publisher infrastructure and non-custodial social accounts. For a deeper understanding of Frames, check out the amazing Frames repository.

Have we already achieved this in Web2?

The technical debt brought by traditional infrastructure, coupled with the extremely difficult multi-team coordination required to implement elemental frameworks like Frames, has been almost impossible. Therefore, many companies (including Facebook) have attempted but none have come close.

The ability to achieve interactive advertising through Frames, even without wallets, will be a significant trend in the coming years.

2) Wallet Curation Era

The interface of wallets determines how we interact with Web3. Just as Yahoo curates news or Google curates websites, wallets have the opportunity to do both. While wallets initially were purely transaction platforms, I expect them to heavily enter the publisher space. Specifically, wallets can:

Allow access to dApps like Uniswap, dydx, Aave, etc., within the wallet. Additionally, wallets can curate leading protocols in each domain (money markets, perpetual contracts, etc.).

Curate a "recommended for you" page for a new protocol by leveraging the user's Web3 profile.

Create a "deals" page for users to discover brands for rewards and enable the wallet to earn ad revenue. It's somewhat similar to the familiar and beloved credit card rewards.

This is a prime example of "meeting the user where they are" rather than making the user click through to achieve the same result. We've only scratched the surface of the potential of wallets - from data aggregators for prediction markets to becoming news providers, from being the cryptographic event curator for X and Farcaster, there's still a lot of exploration space.

3) Applications

As we are still in the early stages of the cryptocurrency consumer lifecycle, we have seen the emergence of "v1 Web3 publisher transaction platforms" in various forms, all combining information and currency in ways that surpass Web2 frameworks.

4) Social

Farcaster - Protocol for building a new type of social network by the community

Unlonely - Live platform where users can mint coins and participate in prediction games simultaneously

JokeRace - Competition protocol for boosting and profitably implementing programming

5) Prediction Markets

Polymarket - Decentralized prediction market allowing users to speculate on anything

Swaye - Prediction market and battle royale game on Farcaster, where players can create markets, bet with friends, and earn rewards

Parcl - Prediction market for real estate, allowing liquidity participation in this asset class

6) Gaming

Parallel - Sci-fi trading card game using NFTs to allow users to own parts of the world they create

Karate Combat - Full-contact fighting league combining live action, full-contact karate, and immersive CGI environments, with token rewards for winning players

Anichess - Chess game with new mechanics that leverages NFTs and tokens

Of course, we have already made a preliminary attempt at this concept through Telegram bots (such as Banana Gun, Maestro, and BonkBot), which have collectively processed nearly 15 billion USD in transactions to date.

2. The Significance of Douyin to Media is Like the Significance of Cryptocurrency to Currency

Just as Douyin reduces the consumption unit of content and becomes the primary form of media, cryptocurrency reduces the consumption unit of currency and becomes the primary form of value.

People, especially the younger generation, are turning away from traditional media like TV and Netflix, increasingly favoring short video content. I believe that cryptocurrency is just a natural extension of the "Douyin thesis" - we have reduced the consumption unit of media, so why haven't we done the same for currency?

The above applications are the first real attempts to achieve this goal. With the maturation of infrastructure and further development of applications, I have no doubt that Web3 publisher transaction platforms will become leaders in attracting the attention of the next generation of internet users.

Okay, but does the Web3 publisher transaction platform offer something that Web2 doesn't?

There are two significant features that may make Web3 better than Web2:

1) Protocol Issued Credit

Cryptocurrency reduces the friction of currency, allowing money to flow as quickly and freely as data. As mentioned above, cryptocurrency enables publishers to seamlessly add financial channels to their applications. There are many use cases, with the most important being Protocol Issued Credit (PIC).

In the past, marketers would measure advertising campaigns through cost per click (CPC) or cost per mille (CPM). Future marketing will include interactive ads that can enable PIC. For example, a new decentralized exchange for perpetual contracts can issue 10 USDC through the ad frame for users to trade on their platform, or a game can offer 15 OP as a reward for completing a tutorial, which can be used in the game later. This is a structural shift in market spending, directly compensating users' time, and may actually increase user engagement, as early Frame statistics have shown - it can be a win-win situation.

But do I need to be a crypto-native user to participate?

In fact, you don't need to. There are now many crypto applications that can abstract away the complexity of getting started. No initial crypto is required, so there's no entry point needed to begin.

Here are some examples of crypto applications that don't require a crypto wallet:

Pudgy Penguins - The founders have presented a great demo showing users how to get started by purchasing penguins from Target and saving progress by redeeming QR codes, opening digital mystery boxes, and logging in via email.

Blackbird - Users can gain status, points, and privileges at eligible restaurants without needing to get started with crypto or pay gas fees.

Lolli - It's a browser extension that allows users to earn Bitcoin through affiliate marketing strategies while shopping, without needing a wallet or entry point.

By leveraging decentralized authentication platforms like Privy, developers can seamlessly integrate login functionality without requiring users to have a crypto wallet.

2) Eliminating Cookies

Despite the values they proclaim, platforms like Facebook, Snapchat, and Google are fundamentally designed to capture your attention. You might think these platforms are free to use, but as the saying goes, "If it's free, then you're the product." In reality, this couldn't be more true.

Yes, I'm talking about the use of cookies - they fundamentally alter the modern digital advertising era and user experience by providing personalized content and targeted ads based on individuals' browsing behavior across different websites. But… a paradigm shift is happening here.

The use of third-party cookies in traditional web browsers is gradually declining. Major browsers like Safari and Firefox have default settings to block third-party cookies, and Google Chrome also plans to phase them out by early 2025.

The gradual phasing out of third-party cookies, driven particularly by privacy concerns and regulatory changes, will have several impacts:

Enhanced privacy: Removing third-party cookies can reduce cross-site tracking, enhancing user privacy. Users will have more control over their personal data (which is already a core principle of Web3).

Advertising impact: Advertisers will need to find new ways to provide personalized ads without relying on extensive tracking.

Changes in web analytics: Without third-party cookies, businesses will need to adapt their web analytics methods to rely on proprietary data or aggregated reports.

Development of new technologies: Efforts like Google's Privacy Sandbox are aimed at creating a more private web and enabling personalization, but they may not have an effect close to that of third-party cookies.

This presents a golden opportunity for Web3.

3. Entering On-Chain Data and Digital Identity

Content curation and targeted advertising are a trillion-dollar industry, primarily built on hyper-optimized filtering algorithms using cookies and providing targeted ads. The disappearance of cookies presents an opportunity for a "seismic shift" from Web2 to Web3, where Web3 can offer more powerful solutions than Web2 alternatives.

A core belief of Web3 is to incentivize data in a meritocratic way. There are many platforms that allow users to provide various off-chain data to earn tokens: whether it's providing your eye scan data through Worldcoin, connecting your Web2 social profile through Oamo, or providing demographic data protected by zero-knowledge proofs elsewhere. Additionally, platforms like JokeRace allow you to share your projects, memes, tweets, songs, etc., for people to vote on and create a value graph. While Web3 identity verification systems are currently quite decentralized, I expect standard integrations to further increase the adoption and utility of these cornerstones.

The key here is the combination of on-chain data with incentivized off-chain data, meaning Web3 can build more complete user profiles, leading to better filtering and higher ad conversion rates.

In response, I do hope that Web2 companies start acquiring data through Web3-native venues to gain a competitive edge.

In summary, the combination of protocol-issued credit and the "seismic shift" of Web3 data may provide a viable path for long-term, widespread adoption of cryptocurrency.

So far, we have discussed the transition to publisher transaction platforms and how Web3 is the ultimate testing ground for building the next generation of publisher transaction platforms. Next, we will delve into why Web2 publisher transaction platforms are more likely to adopt cryptocurrency payment channels than you might imagine.

4. Attracting the Next Billion Users

So far, cryptocurrency payments have not seen widespread adoption by institutions, for various reasons including high transaction fees, slow settlement speeds, lack of privacy/compliance, poor user experience, and brand risk.

Fortunately, most of the major infrastructure issues have been resolved. It's now possible to naively create a sidechain and modify gas fees, block times, enable facial recognition, and almost any feature you can think of as needed.

We have reached a level of infrastructure that is good enough. Now, the benefits of adopting cryptocurrency payments may outweigh the perceived risks.

Especially for Web2 publisher transaction platforms, they have the opportunity to be early adopters of cryptocurrency.

Of course, I don't believe publisher transaction platforms will integrate cryptocurrency payments just for the sake of being cool; cryptocurrency needs to offer 10x improvements over traditional infrastructure to justify the switching costs and brand risks. Therefore, publisher transaction platforms will not adopt cryptocurrency all at once, but early adopters will fall into the following categories:

1) Demographics

2) Integrated reward systems

3) Trust neutrality

1) Demographics

One very underestimated aspect of cryptocurrency is its rapidly growing user base. By the end of 2023, the global cryptocurrency user base had surged to around 580 million, a 34% increase from the previous year. This growth trend is expected to continue, with projections showing the number could reach between 850 million and 950 million by the end of 2024. Additionally, research shows that 72% of cryptocurrency holders are under the age of 34. Essentially, global adoption of cryptocurrency is rapidly increasing, and the younger generation has a strong preference for it.

Similarly, existing publisher transaction sales are mainly driven by young people aged 10-34. As the younger generation enters the market, two trends become evident:

a. They prefer short video content and instant gratification.

b. They will make most purchases through publisher transactions.

Given the striking similarities in demographics between cryptocurrency and publisher transaction users, and the growing similarity between user bases, publisher transaction users are likely to expect or even demand the use of cryptocurrency for payments over time.

Additionally, people living in unstable government and currency countries have expressed a clear desire to transfer funds to stablecoins like USDC. Many people in developing countries are either impacted by inflation, distrust banks, and/or are unable to open bank accounts. Fortunately, the bi-directional nature of cryptocurrency is a clear answer to this problem, so Visa is exploring paying merchants with USDC. Another notable example is Stripe reintroducing cryptocurrency payments. This decision is driven by the increasing demand for cryptocurrency payments in emerging markets, rather than infrastructure improvements.

Publisher transactions are at the forefront of business, just as cryptocurrency is at the forefront of finance. Therefore, the shared user base will grow in sync until they merge into one.

2) Integrated Reward Systems

Traditional payment channels make sending value very easy, but receiving value is very difficult. The nature of sending/receiving value on-chain and the ease of creating accounts make it much easier to transact through cryptocurrency channels, essentially 10x-ing it. This brings about some unlocked opportunities:

a. You can seamlessly receive value.

b. Due to fast and low-cost settlements, smaller units of value can be exchanged.

There are many incredible use cases, a few of which are:

Interest payments: Gambling platforms or third-party custody services can incentivize users to keep funds on the platform through real-time interest payments.

Asset issuance: Specific interest communities can create and distribute virtual assets without needing to link to a bank account or undergo KYC. Preliminary signs of product market fit have already appeared with Reddit's rewards and Discord Nitro.

Protocol-issued credit: As discussed earlier, protocol-issued credit can fundamentally change the way we understand user acquisition today. Cryptocurrency payment channels can enable Web2 companies to offer protocol-issued credit as well.

These are some amazing use cases, showing the potential of integrated reward systems in cryptocurrency payments.

3) Trust Neutrality / Privacy

The beauty of smart contracts is that they represent the pinnacle of trust neutrality. Therefore, any publisher transaction platform subject to scrutiny from traditional payment processors or experiencing high chargeback rates (of which there are many) may choose to move payments onto the chain. These industries include cannabis-related products, gambling, pharmaceuticals, adult entertainment, and more.

Just look at Stripe's list of banned and restricted businesses, and you'll quickly realize the actual demand for alternative payment channels.

Typically, users of these publisher transaction platforms also have higher demands for privacy. We have many technology and infrastructure providers, such as Fhenix, Aztec, Penumbra, etc., building tools for private payments. A recent example is the Shiba Inu team adopting a privacy layer based on fully homomorphic encryption (FHE) to expand their entertainment ecosystem.

5. Looking to the Future

Publisher transaction platforms represent the future of e-commerce. Especially, Web3 publisher transaction platforms face an incredible opportunity to tightly integrate publishers and transaction platforms, establishing a closer relationship between money and attention than was possible in Web2.

Considering the striking similarities in demographics and the new functionalities and sovereignty brought about by moving payments onto the chain, Web2 publisher transaction platforms are among the most likely institutions to adopt cryptocurrency payments. Looking ahead, I expect to see a resurgence in vertical cryptocurrency payment startups, efficient privacy technologies, chain and balance abstractions, seamless non-custodial experiences, and more.

As information becomes democratized and accessible, money will become democratized and accessible. Long live cryptocurrency.

Special thanks to Anil, Dougie, David & Sean, Thomas, and Justin for their contributions and reviews of this article!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。