2024 is undoubtedly a big year for airdrops, with various airdrop activities being intensively released. In our airdrop circle, there is a saying, "Low-cost gains, still need public chains." However, due to the long-term PUA of users by public chain projects such as Layerzero and zkSync, many studios, professional airdrop enthusiasts, and airdrop hunters have started to feel lost, and even many airdrop hunters have lost confidence in the industry.

It seems that the market has forgotten that in the previous round of big gains like Aptos, only 3% of the tokens were airdropped. With just this 3% token allocation, individual wallets could receive airdrops of 1000–3000u. It's important to note that these wallets had only completed a few tasks on Galxe, voted on Gitcoin, and minted a few NFTs.

Aptos has prepared 51% of the token allocation for the community, with 48% yet to be distributed. Therefore, there is over $4 billion worth of wealth available for us to explore. With such a large total wealth, why should we be swayed by those projects with no vision? What reason do we have not to take advantage of these projects that already have methods and results?

I. Where Should We Focus Our Efforts on Aptos?

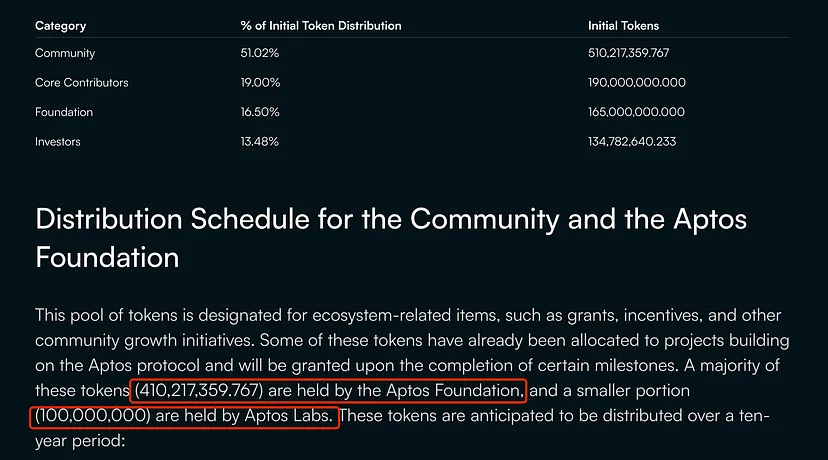

Aptos will definitely have several rounds of airdrops. As professional airdrop enthusiasts, we need to know where to focus our efforts and how to do so. Let's take a look at the official token allocation:

51% of the community token allocation, 410,217,359.767 APT, is held by the Aptos Foundation, and 100,000,000 is held by Aptos Labs. The official statement indicates that these tokens will be used to drive the growth of Aptos ecosystem projects, so many people refer to the "community allocation" as the "ecosystem fund."

Aptos Tokenomics: https://aptosfoundation.org/currents/aptos-tokenomics-overview

From these statements, we already have a rough idea that a large portion of the remaining 48% of tokens will be allocated to ecosystem users based on Aptos. Only users actively participating in ecosystem projects will receive airdrops. Therefore, our next focus should be on the Aptos ecosystem.

This is somewhat better. Nowadays, most Web3 development teams will issue their own tokens, allowing users to benefit from multiple sources. If it's a DeFi project, users can benefit even more.

So, in today's article, let's focus on what we should be taking advantage of.

First, let's see if Aptos is really preparing for the second round of airdrops.

II. Is Aptos Really Preparing for the Second Round of Airdrops?

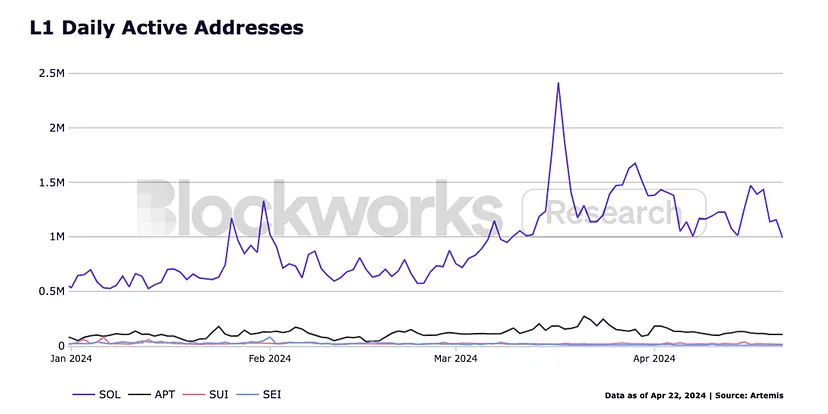

Aptos' technology surpasses Solana's, but in terms of both tokens and community, Aptos has not developed as vigorously as Solana. Not only Solana, but also Aptos' valuation is almost the same as Celestia's (30 billion USD), which has about 400,000 active stakers, nearly four times that of Aptos.

The largest staking platform in the Aptos ecosystem, Amnis, has less than 100,000 users, with a TVL of only 45 million USD, accounting for over 25% of the total locked value of Aptos.

For an L1, for a public chain, these shortcomings are significant, and a lack of active users can easily lead the system into a vicious cycle. Can the project team afford not to be anxious?

So, what's the point of all this talk? How has the market reacted? What actions has the project team taken?

Inference 1: Aries Incentive Program, Rewarding APT

In mid-January, Aries launched an incentive program, distributing APT rewards.

https://x.com/AriesMarkets/status/1745668145015410850

When the project was launched, its TVL was approximately 29 million USD. Near the end of March, Aries introduced the ARIES point system, incentivizing lending/borrowing activities and referrals. When this announcement was made, Aries' TVL was 155 million USD.

Benefit from multiple sources: https://x.com/AriesMarkets/status/1770753114800284005

Inference 2: Aptos Released Four Tasks on Galxe

In addition, Aptos released four tasks on Galxe in the first and second quarters (ending in April). The tasks were simple, requiring only OAT to be obtained, which may have been a market test.

But this indicates that the second round of airdrops will be coming soon, especially targeting active contributors and investors in the Aptos DeFi and NFT ecosystems.

https://x.com/Aptos/status/1767594987594944587

It's quite obvious at this point that Aptos' data is not very good and has been surpassed by too many others. The Aptos Foundation has also started to feel anxious, testing the waters several times, possibly in preparation for a comprehensive rollout in the future.

So, let's now see if Aptos is worth taking advantage of.

III. About Aptos — High-Performance Public Chain

Many people entered the market in 2024 because of $STRK, so many people may not be aware of how powerful Aptos is. Let's start by introducing Aptos' background and see if the project is worth taking advantage of based on these objective facts.

About Aptos

According to a Messari research report, Aptos is a newly established independent public chain project in 2021, focusing on security and scalability as a first-layer public chain. Its consensus mechanism adopts Proof of Stake and has attracted attention due to its Meta background, Move language, and high TPS. The core developer, Aptos Labs, raised approximately 400 million USD in two rounds of private investment in 2022.

Aptos' founder worked at Novi (Facebook) for two years, responsible for the Diem (formerly known as Libra) project. Libra was a digital currency project for payment transactions that started in 2019. Due to regulatory reasons, Libra was rebranded as Diem and transitioned to stablecoins.

After several setbacks, Diem also did not launch successfully. As a result, a team of 17 former Novi/Diem engineers and researchers founded Aptos with the goal of building the most secure and scalable Layer1 blockchain.

For Aptos, the team's background in Diem is one of the reasons it has received attention.

Technology

Aptos' technology stack has many novel aspects, including the AptosBFTv4 consensus mechanism, Quorum Store mempool protocol, Block-STM parallel execution engine, and Move programming language. Move on Aptos is based on the original Move language created by the Diem and Novi teams, providing enhanced flexibility and security compared to other Web3 programming languages. Move on Aptos is developed by multiple protocols.

Other key features aimed at improving user experience and security include accounts with decoupled private and public keys, transaction pre-execution to interpret transaction results before user signature, and transaction expiration time and sequence number. The development of the Aptos network and the growth of the Aptos ecosystem are primarily led by Aptos Labs and the Aptos Foundation.

Aptos' architecture makes it well-suited to support a new generation of high-performance dApps, surpassing fork derivatives of existing EVM products on other chains. This architecture provides Aptos with three main advantages compared to other networks: high throughput, low transaction fees, and security.

Background

Since its official exposure in February 2022, Aptos has continued to receive market attention due to its Facebook team background, and with the "halo effect of a star-studded team," capital has offered high olive branches. In March 2022, it completed a $200 million seed round of financing, and in July of the same year, it received a $150 million Series A round of financing, with participation from well-known industry investment institutions including a16z, Coinbase Ventures, Paypal, and Binance Labs.

MOVE Language

Move is a bytecode language inspired by Rust, created by the Diem and Novi teams to provide a more flexible and secure solution than Solidity and other Web3 programming languages. It eliminates attack vectors present in Solidity and EVM, such as reentrancy attacks and asset duplication issues, through enforced data abstraction and built-in protection features.

Market Performance

The first quarter brought new momentum to the Aptos ecosystem, with TVL increasing from $130 million to $493 million in just four months, nearly 500% growth, and average daily active addresses (DAA) stabilizing at around 120,000. Although Solana leads in TVL and DAA among Alt L1 networks, interestingly, Aptos has the second-highest DAA in the Alt L1 field.

Aptos Ecosystem Turning Point

For every L1 public chain, a complete DeFi ecosystem is crucial for sustainable development. Currently, Aptos has high-quality projects in various sectors that are ready for the next stage. The network data indicates that Aptos is at a turning point, with a thriving dApp ecosystem ready to welcome new users. Aptos Ascend positions the network as a competitive TradFi entity and RWA with built-in compliance and customizability. DeFi on Aptos has grown significantly in the past quarter.

So, What Should We Take Advantage Of?

When taking advantage of public chains, it's important to focus on leading projects such as Aries Finance, Aptin Finance, Liquidswap, as well as NFT markets like Wapal, Mercato, and Topaz.

The more participation, the more likely to earn APT tokens and obtain other new tokens. However, participation comes with costs, and the goal is to find ways to benefit from multiple sources and reduce costs.

Therefore, this tutorial starts with the largest application of APTOS, Pontem Network, to explore strategies for benefiting from multiple sources.

IV. About Pontem Network

Pontem Network was founded in 2020, more than a year before Aptos was launched. At that time, Meta was still researching the Diem blockchain project, and the Move language was part of it. The initial goal of Pontem Network was to bridge the highly regulated Diem ecosystem with other parts of the blockchain world, using Polkadot's infrastructure to achieve this.

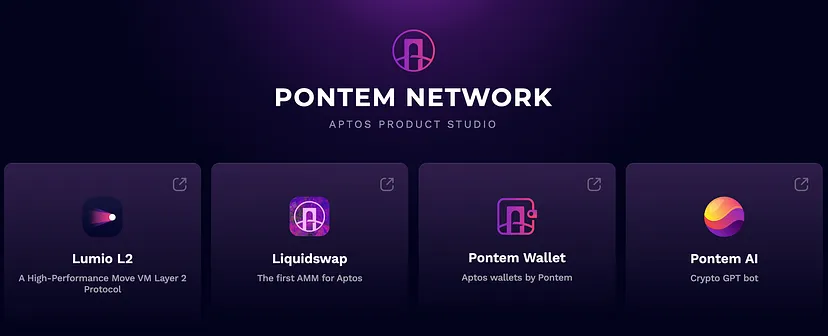

What is Pontem Network's Product Studio?

Pontem Network is a product development studio, often referred to as "developers" in many public chains. Pontem's strategic collaboration with Aptos involves creating dApps and infrastructure for Aptos, including development tools, EVM, AMM, to promote the widespread use of its L1 blockchain.

Key Products of Pontem Network

Pontem Network has created Pontem Wallet, Liquidswap DEX, NFT, and also supports NFT.

Lumio L2

Lumio is a groundbreaking Optimistic Rollup developed by Pontem Network, aiming to redefine the field of Layer 2 solutions.

What sets Lumio apart from similar products like Optimism and Arbitrum is its support for both the Ethereum Virtual Machine (EVM) and Move VM. Lumio's goal is to leverage Aptos to process transactions settled on the Ethereum network.

Developed based on the open-source OP Stack (Optimism Collective's toolkit), Lumio inherits the strong capabilities of the Optimism mainnet, effectively ensuring transaction speed and scalability.

Technically, Lumio benefits from the solid foundation provided by the Paradigm execution layer, utilizing OP Stack's Rust implementation and the Magi client developed by a16z and Reth (Rust Ethereum) to achieve various scalability.

SuperLumio, on the other hand, is the EVM iteration of Lumio L2 Pontem Network (already on the mainnet), supporting both the Ethereum Virtual Machine (EVM) and Move VM (part of Aptos).

As research on merging alternative virtual machines progresses, SuperLumio may potentially integrate into other networks such as Solana, Avalanche, and Cosmos in the future.

Can You Benefit from Pontem Network?

So much talk, but has Pontem Network launched its token?

Pontem Network has not launched its token yet. It is one of the few projects on Aptos that has not launched a token and is the first cross-chain solution between APT and EVM.

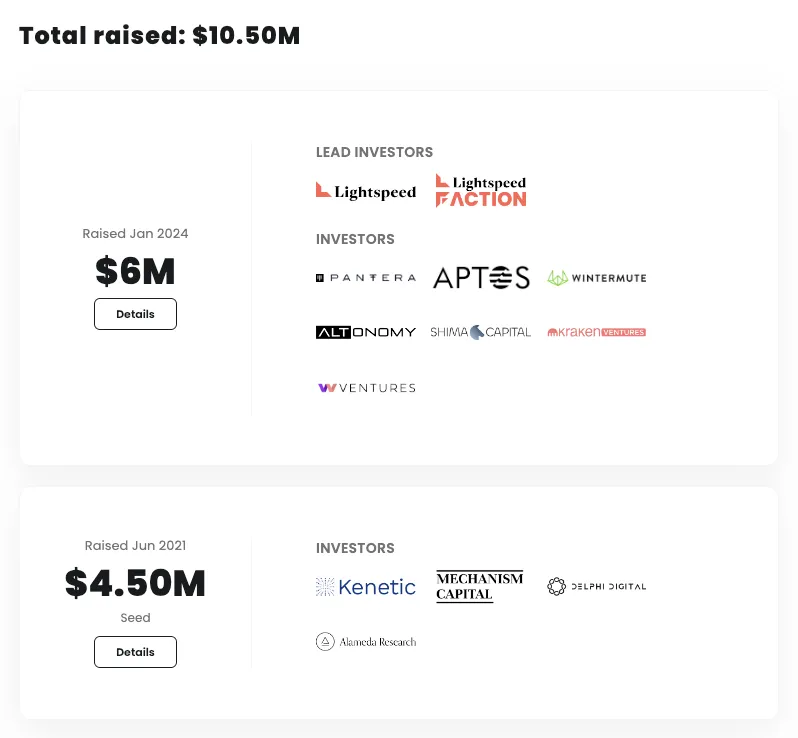

Pontem Network raised $10.5 million from primary markets such as Animocabrands, with a TVL of $42 million.

So, Pontem Network is a project you can benefit from. As a strategic partner of Aptos since its inception, we should seize the opportunity and strive to receive the maximum airdrop allocation.

So, how can you benefit from Pontem Network?

IV. Preparation Before the Airdrop Tutorial

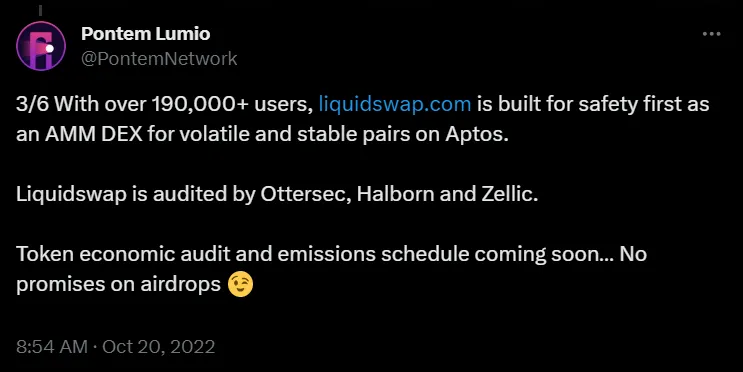

Pontem hinted at a possible token launch in 2022.

What Preparation is Needed to Benefit from Pontem?

(1) Financial Preparation

- Funds 1: +10.1 APT (currently valued at 80u+)

- Funds 2: +100u

These funds will be used for:

- Trading volume: +$5,000

- Interactions: +30 times

- Adding liquidity: +$100, with at least 3 pairs added

- Staking: +10 APT

These are just basic estimates; the more interactions, the better.

(2) Wallet Preparation

- Phantom Wallet

- Metamask or OK Wallet

- Pontem Wallet (if previously had APT fees on OK Wallet, can directly import using the original mnemonic)

Since this tutorial is about the Pontem Network airdrop, we will start with the Pontem Wallet. I will import the original OK Wallet mnemonic.

(3) Pontem Wallet Tutorial

- Log in to the Pontem airdrop page

https://airdrop.liquidswap.com/?ref=01HYAQ97X8M52ZCEJWEJBFVG7R

- Click on the Pontem section and install the Pontem Wallet

After creating the wallet, recharge APT, and then continue with the first step above, linking the Pontem Wallet, Phantom Wallet, and Metamask or OK Wallet. Once linked, it should display as shown in the image below:

V. Airdrop Tutorial

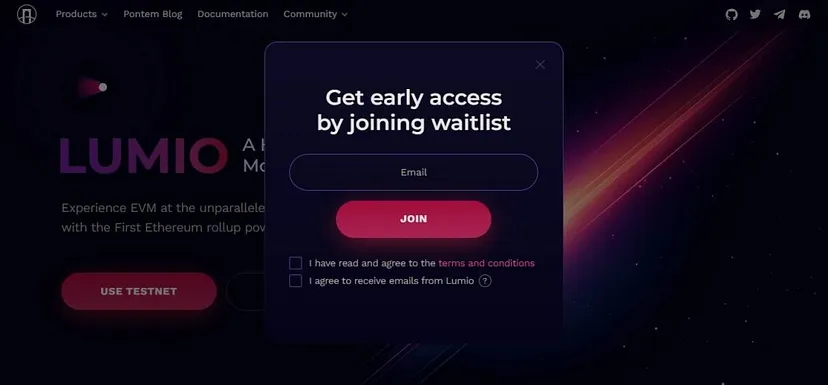

(1) L2 Lumio Whitelist

Step 1: Visit https://lumio.io/#join-whitelist

Step 2: Fill in your email, check "I have read and agree to the terms and conditions" and "I agree to receive emails from Lumio" -> "Join"

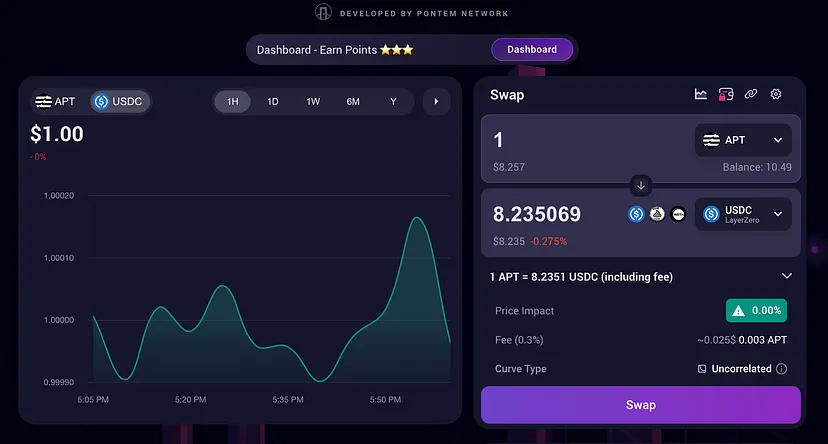

(2) Exchange on Liquidswap

Step 1: Log in to Liquidswap and link your wallet

Step 2: Choose a trading pair to trade

To qualify, it is recommended to increase the trading volume to over $5,000 and have at least 30 interactions.

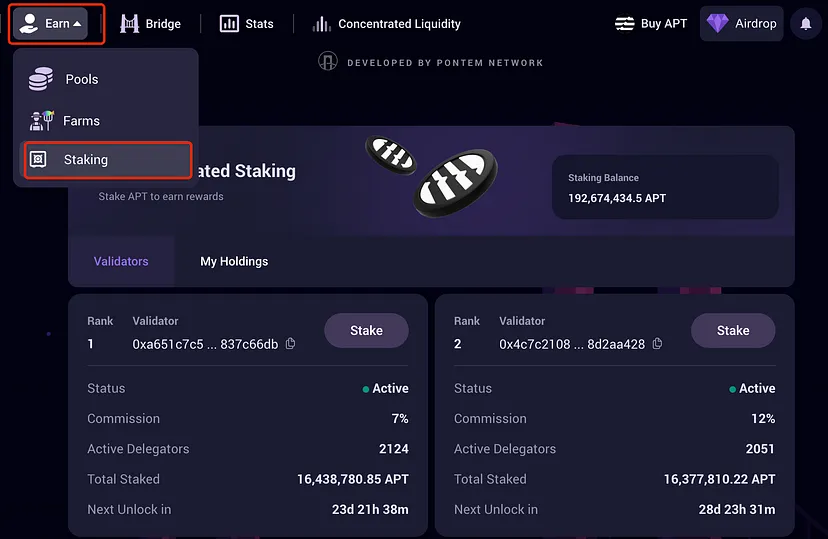

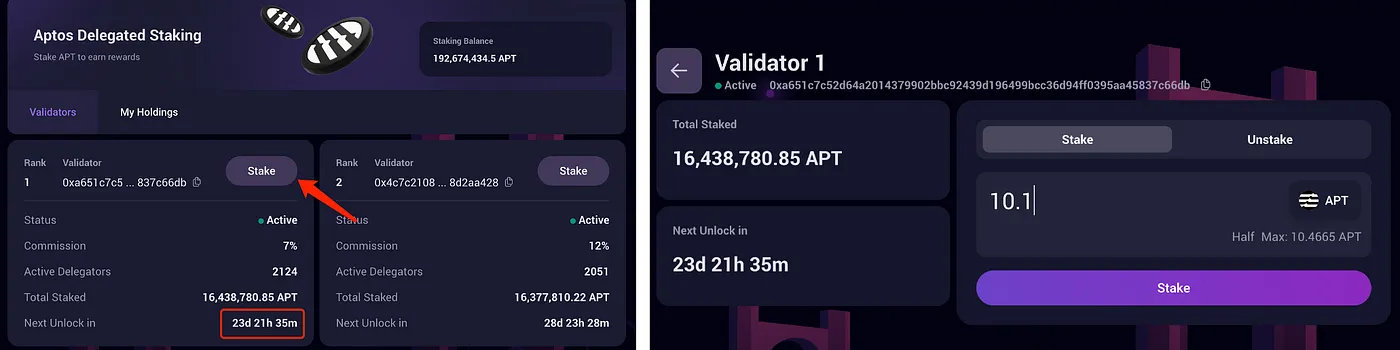

(3) Staking

- On the Liquidswap website, click on Earn

- Select Staking

- Select any "Validators" section

- Click stake

- Stake at least 10.1 APT (it is recommended to choose a longer time validator)

(Four) Adding Liquidity (One Fish, Three Meals)

Here we choose the Amnis Finance platform. The Amnis Finance platform is a liquidity staking protocol. Amnis has a point system, and creating an Amnis Finance account allows simultaneous use of the systems of Amnis and Aries Markets, which can enable us to receive at least 3 airdrops.

Step 1: Log in to Amnis Finance and link your wallet

https://stake.amnis.finance/mint

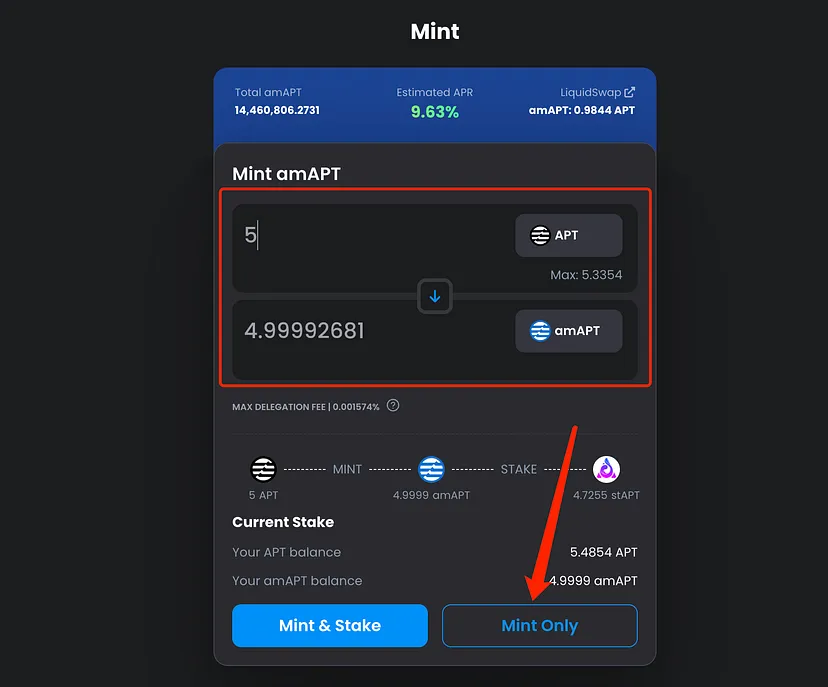

Step 2: Enter the amount of amAPT you want to mint and click Mint Only (if you want to benefit more from Amnis Finance, you can choose Mint&Stake later, but for now, let's skip this step)

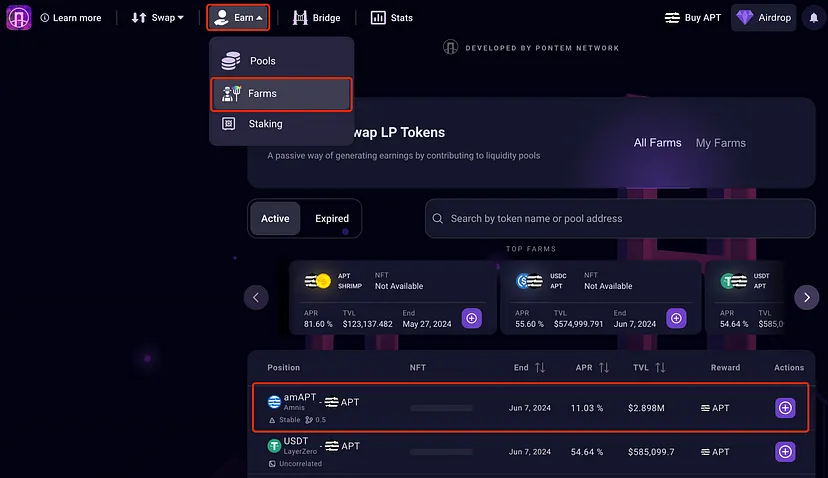

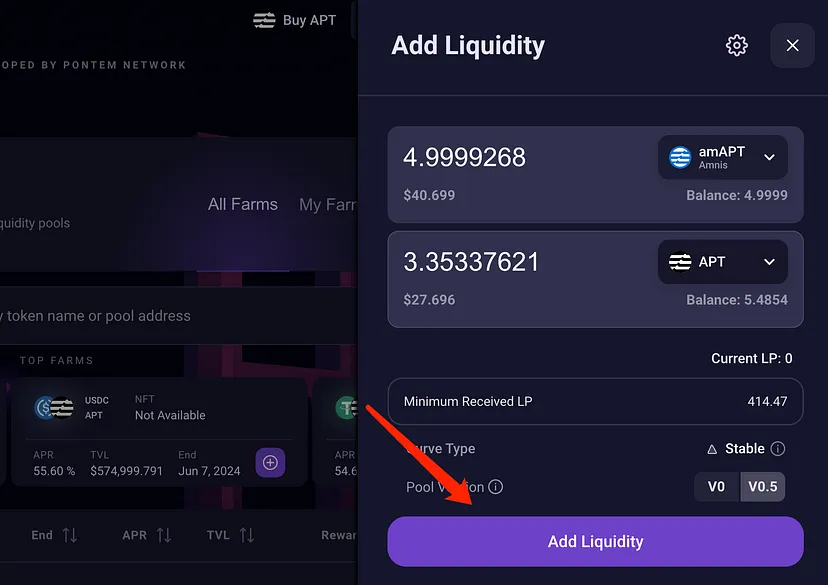

Step 3: Add liquidity on Liquidswap

- Return to the Liquidswap platform

- Click Earn

- Select Farms

- Add amAPT/APT

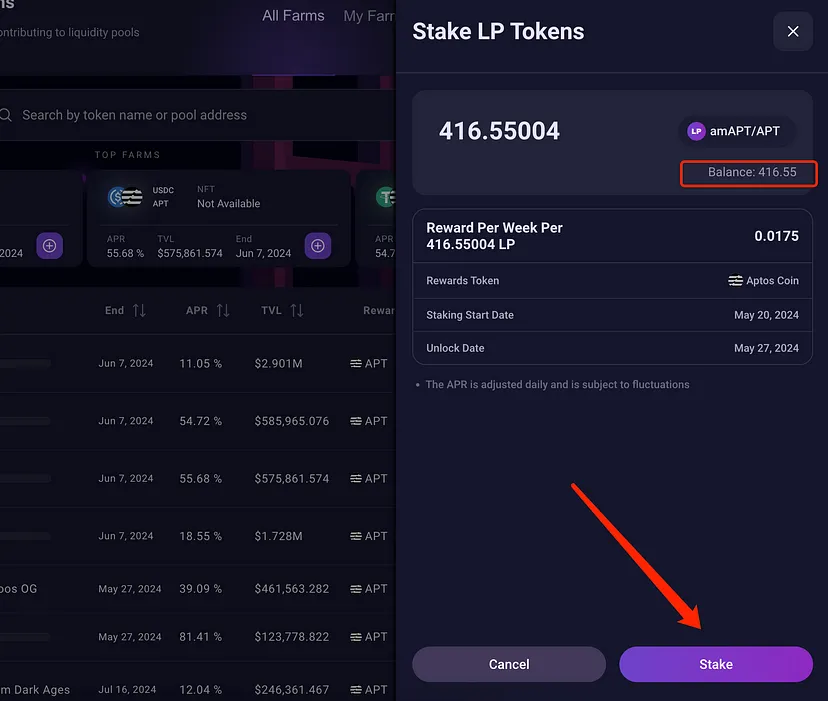

Step 4: Stake LP

- Click the "fish icon"

- Click Balance

- Click Stake, stake LP, with an annualized rate of 30%

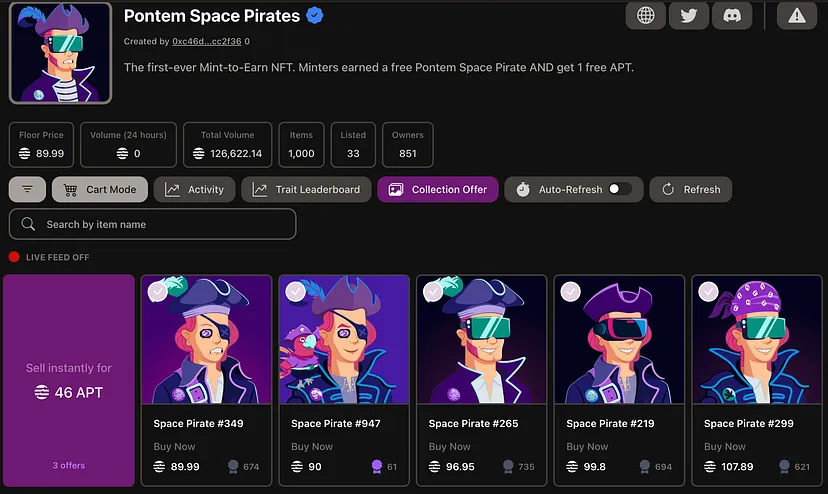

(Five) Purchase NFT (For Reference Only)

NFT 1: Log in to the NFT trading platform and link your wallet

https://www.topaz.so/collection/Pontem-Space-Pirates-c46dd298b8

Choose an NFT for trading

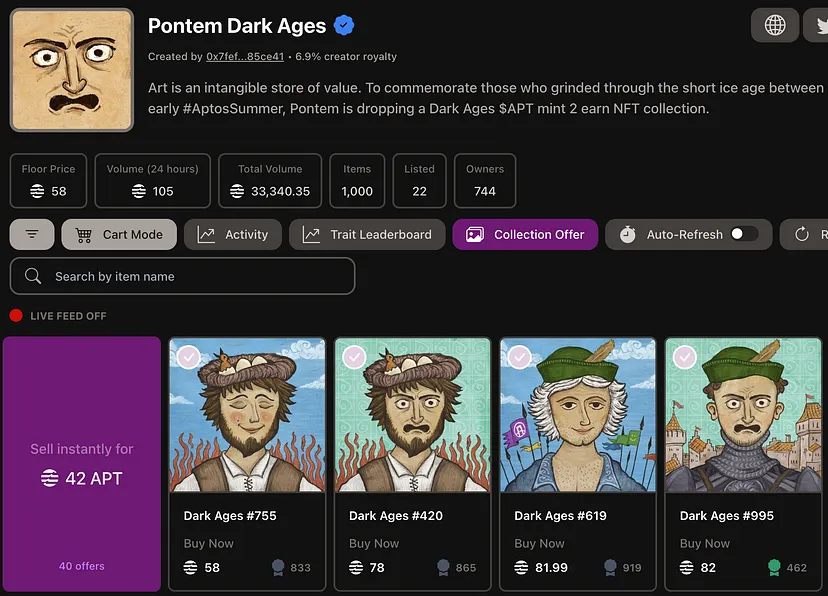

NFT 2: Log in to the NFT trading platform and link your wallet

https://www.topaz.so/collection/Pontem-Dark-Ages-7fef9d50cd

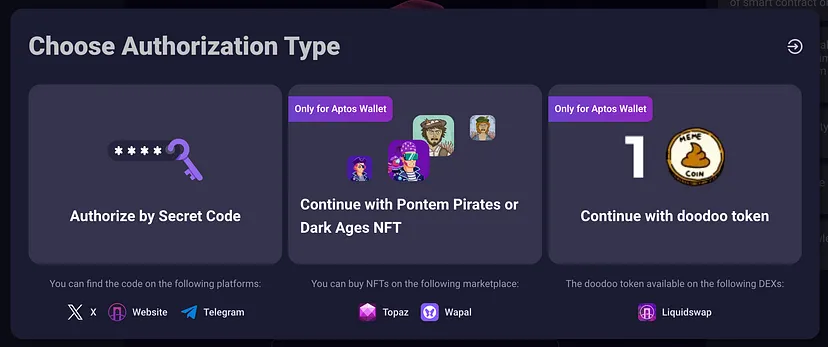

(Six) Use PontemAi

PontemAi is a Web3 native chatbot. To register, you need a verification code, NFT, or doodoo token.

Summary

Pontem is a very powerful project collection on APTOS, including many products. It has not yet launched its token and may do so during the second APTOS airdrop.

This article introduces the interaction tutorials for various products on Pontem. If you want to benefit, focus on the DeFi section, increase trading volume and frequency, and benefit from multiple sources.

You can use multiple accounts for any airdrop. Currently, the multi-account tool I use is: MorLogin fingerprint browser

https://www.morelogin.com/?from=AANvwSB8onX4

This is the Web3 fingerprint browser that I consider relatively secure among the tools I have used, and it has been approved by the OK Wallet official browser:

The multi-account tutorial is as follows:

https://medium.com/@jiamigou/加密狗整编空投第263篇-使用指纹浏览器开启撸毛暴富历程-撸毛小白超级教程-8240e4c8d51f

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。