Translation:

Catherine, Onchain

Partners

DIMO - A driver network that powers the future of mobility by helping drivers fully utilize their cars for on-the-go mobility.

ICP - A universal blockchain designed to provide a world computer that can replace traditional IT.

Natix Network - The first AI-driven dynamic map supported by the DePIN and Drive-to-earn community.

Key Points

- DePIN stands out as a niche market in the Web3 field, with extremely diverse business operation methods.

- Compared to other Web3 branches, DePIN's business utilizes more innovative revenue streams and incentive mechanisms, which vary based on business sectors (storage, computing, wireless networks, etc.) and project characteristics. Unique examples include activity-based rewards and green incentive measures, while other projects draw from popular online payment models such as prepayment and subscription models.

- DePIN currently seems to have a realistic opportunity to participate in Web2 competition and conquer a portion of the market controlled by internet giants like Google, Amazon, and Nvidia. However, to achieve this goal, DePIN's business model needs to become more sustainable and improve the efficiency of its revenue streams and incentive mechanisms. The competition is fierce, and it's relentless (we're now talking about competition among the S&P 500, not CMC's TOP100).

- The future of DePIN projects depends on their incentives for business demand. Decentralized physical infrastructure networks are very encouraging for supply-side participants, but they still lack the ability to attract customers outside of Web3. The main challenge is to bridge the gap and enter the general non-Web3 market.

- The DePIN project is creative in both methodology and practice. We have discovered many ready-to-use methods, which we outline and explain in the report.

Why Study DePIN Business? Why Should You Care?

Building a sustainable enterprise is by no means easy, and doing so on Web3 infrastructure feels more like an obstacle course.

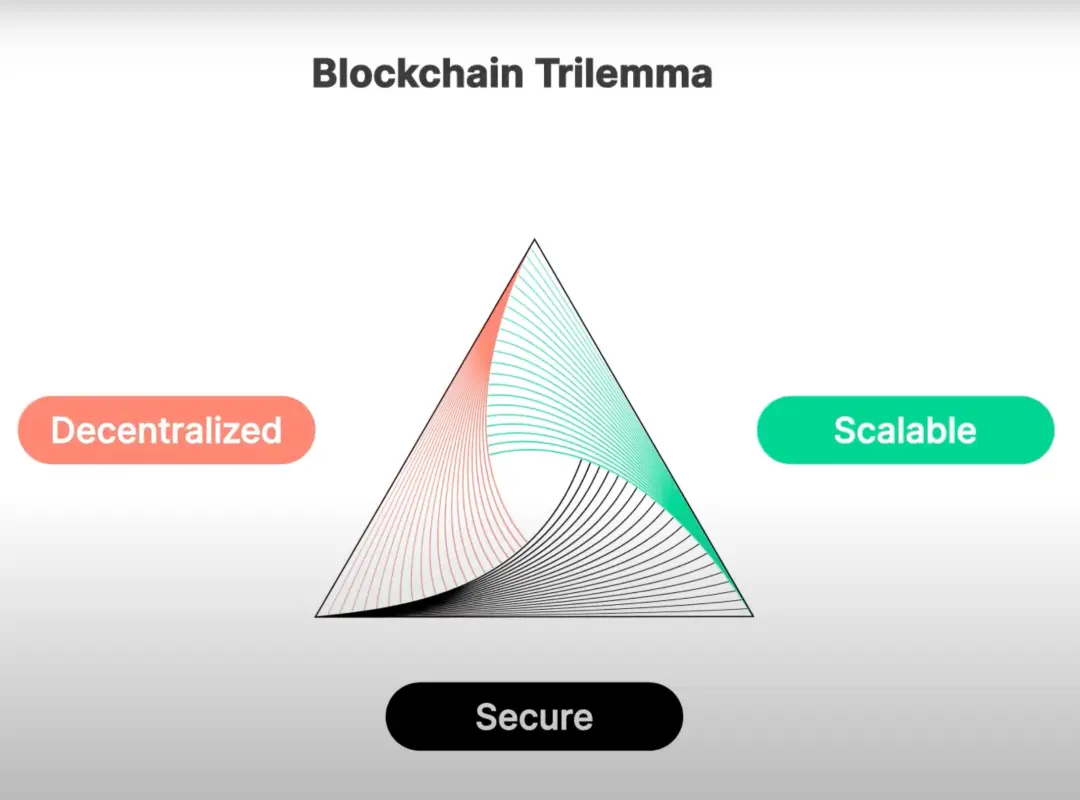

If you read our first report on modular blockchain architecture, you will understand the blockchain-specific challenges related to the four dilemmas we mentioned:

When you try to increase profitability for issues typically focused on (decentralization, security, and scalability), this happens. But what can you do? Profitability is what businesses need, right?

Therefore, DePIN (decentralized physical infrastructure network) was born, a new narrative that, if implemented properly, can compete with some of the world's most profitable companies. The DePIN project may eventually challenge Google, Amazon, or Nvidia.

In this report, you will learn how DePIN combines its revolutionary technology and incentive model with the business aspects of its projects. Our goal is to show you different methods, challenges, and solutions to transform DePIN into a sustainable business.

We have studied some of the most successful existing DePIN projects, analyzed their business models, and investigated the competitive Web3 landscape and other areas. We provide you with a comprehensive understanding of the possibilities and risks of various DePIN niches and concepts.

This will help make your participation more beneficial. Who knows, maybe DePIN will become the killer use case that the blockchain community has been waiting for for over 15 years, and you will be a part of it.

Source: Messari

The Web3 world loves new narratives, and if it involves explicit investment opportunities and token incentives, speculation will surely follow.

Decentralized physical infrastructure meets all these requirements:

- It is a relatively new trend, although its first major representative - Filecoin - was launched in 2017.

- It provides a wealth of new investable projects, all of which issue tokens as incentives.

- It allows users to earn tokens by performing operations without having to purchase tokens.

The best way to understand the practicality of DePIN and how it works is to look at examples.

Three Representative Examples You Might Know

1. Computing Network - Akash

What Problems Does Akash Solve?

Computing seems destined to become the currency of the AI era. It has quietly permeated and gradually taken over our daily activities since before 2010. When ChatGPT triggered an incredible AI innovation explosion in early 2023, it finally made headlines.

AI makes our lives more efficient, saving us time on automated activities, not just repetitive tasks. However, putting a large number of tasks and activities online has led to a significant increase in the demand for computing to support increasingly complex AI algorithms.

As a result, companies providing AI solutions are now at the mercy of large suppliers like Nvidia or Amazon Web Services (AWS). The former struggles to meet demand, and the latter's software is centralized and expensive, not everyone can (or wants to) afford it.

What is Akash's Solution?

Akash Network addresses these two issues. First, they provide a decentralized computing power provider network, making AI algorithms more secure and reliable. Second, Akash has created a data center similar to Airbnb, allowing people to lend unused computing power to companies and individuals in need in exchange for lucrative returns.

What Notable Results Are There?

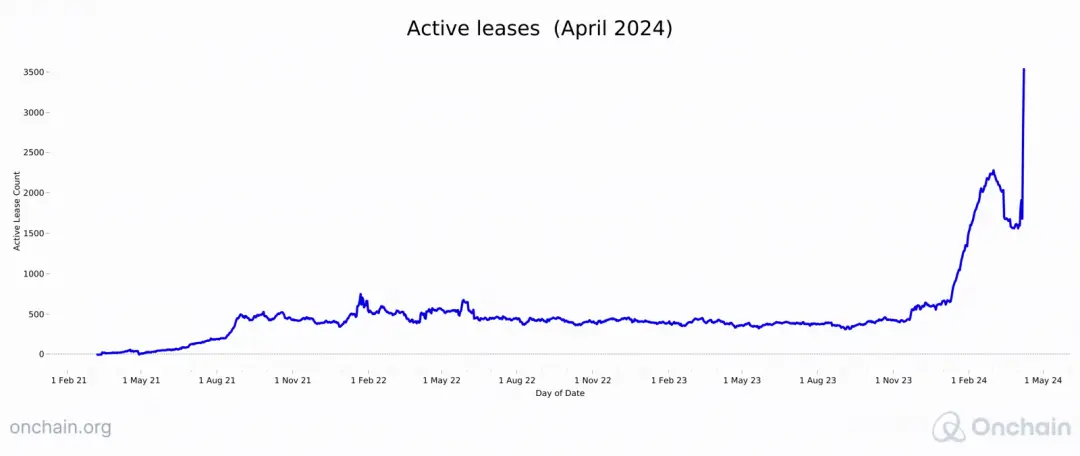

In early 2024, activity on the Akash Network surged significantly. Active computing leases increased from 600 to over 2,200 in just a few weeks. This total is still negligible compared to AWS, which supports nearly 1.5 million global businesses.

However, Akash offers highly competitive prices: $5.83 per CPU on Akash compared to $32.82 per CPU on AWS. Combined with a unique incentive model for providers, this could be enough to stimulate significant changes in the computing market share.

2. Wireless Network - Helium

What Problems Does Helium Solve?

Helium focuses on key challenges in the wireless network industry, including the need to reduce data transmission costs, improve security and privacy, enhance scalability, and increase innovation potential. The company also aims to mitigate economic risks such as token price volatility, network saturation, and competition from established telecom companies and other Web3 projects.

Solutions to Industry Problems by Helium:

- Reducing Data Transmission Costs: Helium uses a coverage proof consensus mechanism and existing infrastructure (hotspots) to avoid the cost of building new infrastructure.

- Improving Security and Privacy: Helium's decentralized architecture eliminates the possibility of single points of failure and reduces the likelihood of hacking attacks. The network relies on pseudonymous device identifiers to enhance privacy.

- Enhancing Scalability: Unlike traditional cellular networks with limited infrastructure capacity, the Helium network can easily grow with the addition of more hotspots.

- Increasing Innovation Potential: Helium's open-source design and the use of HNT tokens encourage developers to create new devices and applications for the network, promoting innovation.

How Does Helium Address Specific Issues of Decentralized Networks?

- Token Price Volatility: Helium explores alternative monetization models, such as data credits for specific data transmissions, to reduce reliance on token value and minimize volatility.

- Network Saturation: Helium implements mechanisms to prevent excessive hotspot deployment in concentrated areas, aiming to maintain a balanced network distribution. Additionally, coverage proof verification helps ensure actual hotspot coverage.

- Competition: Helium targets the niche market of low-power, long-range IoT connectivity, which can coexist with other high-bandwidth application solutions. It also encourages integration with other networks by providing open APIs.

Notable Results:

In less than 30 days after its launch, Helium gained significant traction, with over 404,083 active hotspots. Helium raised a substantial amount of funding in its last financing round, with a post-investment valuation ranging from $1 billion to $10 billion. The company has established partnerships with the city governments of San Jose, California, Valencia, Spain, and Dish Network for various use cases such as environmental monitoring, smart city sensors, and 5G coverage expansion.

3. Sensor Network - Hivemapper

What Problems Does Hivemapper Solve?

Hivemapper addresses several key challenges in global and local traffic and mobility management and operations:

- Increasing operational costs for road planning and construction, primarily due to the introduction of autonomous vehicles.

- Providing reliable sources of road maintenance information for governments.

- Lack of real-time data to help insurance companies resolve accident-related disputes and issues.

What is Hivemapper's Solution?

Hivemapper's API and imagery provide essential real-time traffic and map data. The DePIN solution supports efficient fleet management, route planning, and package tracking through location sharing. Other industries, such as real estate, can also benefit from the network. Hivemapper assists in property assessment and planning, ensuring effective land use and compliance with regulations.

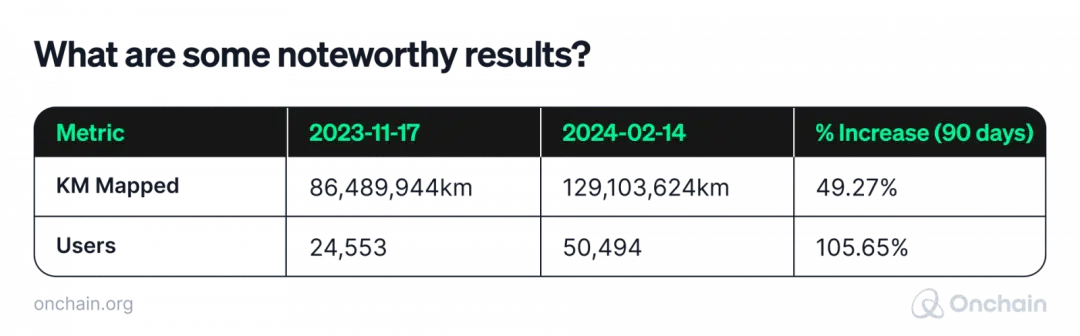

Source: hivemapper.com

Source: hivemapper.com

DePIN - Cryptocurrency Trend or Real-World Opportunity?

The Web3 world loves new narratives, and if it involves explicit investment opportunities and token incentives, the frenzy of Crypto Twitter (or Crypto X) is inevitable.

For speculators, this is what they need. But for those with long-term vision, wanting to build thriving businesses or change the world, if it turns out to be just a passing fad, it could be a trap. You must see the big picture to grasp the odds correctly.

Why DePIN is Such a Hot Topic Today

1. Financial Growth

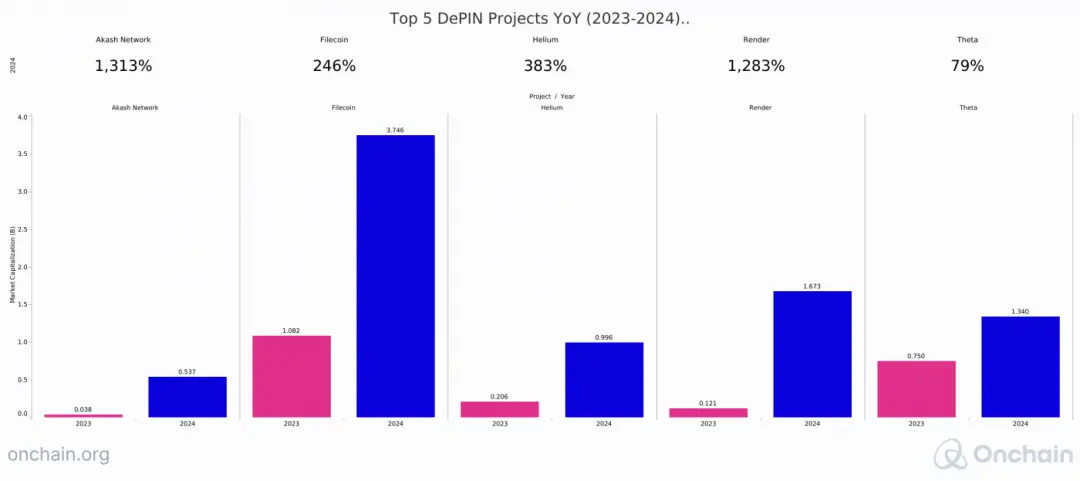

Anyone following the cryptocurrency space knows that DePIN's market value has seen significant growth in recent months, with a large amount of funds being poured into this blockchain use case.

When comparing the valuations of DePIN projects in early 2023 and early 2024, the numbers speak for themselves. Akash broke through the peak, growing by 1313%, and the growth of several other protocols exceeded 200%.

The table below lists the top 5 DePIN projects (projects with high market value):

2. Speculative Factors

Speculation is not only created through financial opportunities and is not only related to cryptocurrency prices. DePIN is a topic of community discussion.

Web3 media is filled with this topic. We looked at the predictions for Web3 in 2024 from several experts and researchers and found that DePIN is present in almost all predictions.

Trends like this have spread to Web2, and interest from the retail industry has followed. Google Trends shows a significant increase in searches for DePIN, indicating growing interest over the past year. More importantly, although most Web3 narratives are short-lived, it seems relatively sustainable.

3. Technological Uniqueness

Imagine a world where the construction and maintenance of critical infrastructure such as roads, power grids, and communication networks are not controlled by central authorities but by a global community. This is the vision behind DePIN, offering an innovative way to integrate blockchain, the Internet of Things (IoT), and the physical world.

DePIN leverages blockchain technology to create a transparent and tamper-proof ledger recording network activities, ensuring secure and verifiable proof of contribution, eliminating trust issues and central control.

What makes DePIN as a technology so interesting is that it goes beyond the digital realm, using the Internet of Things as a bridge to connect physical infrastructure components to the network, closing the loop back to the real world.

Hardware equipped with sensors, such as routers, towers, and renewable energy generators, collects data and interacts with the blockchain. This real-time data flow enables efficient monitoring, maintenance, and optimization of physical infrastructure.

Source: blog.entangle.fi/entangling-depin

DePIN's Success Factors

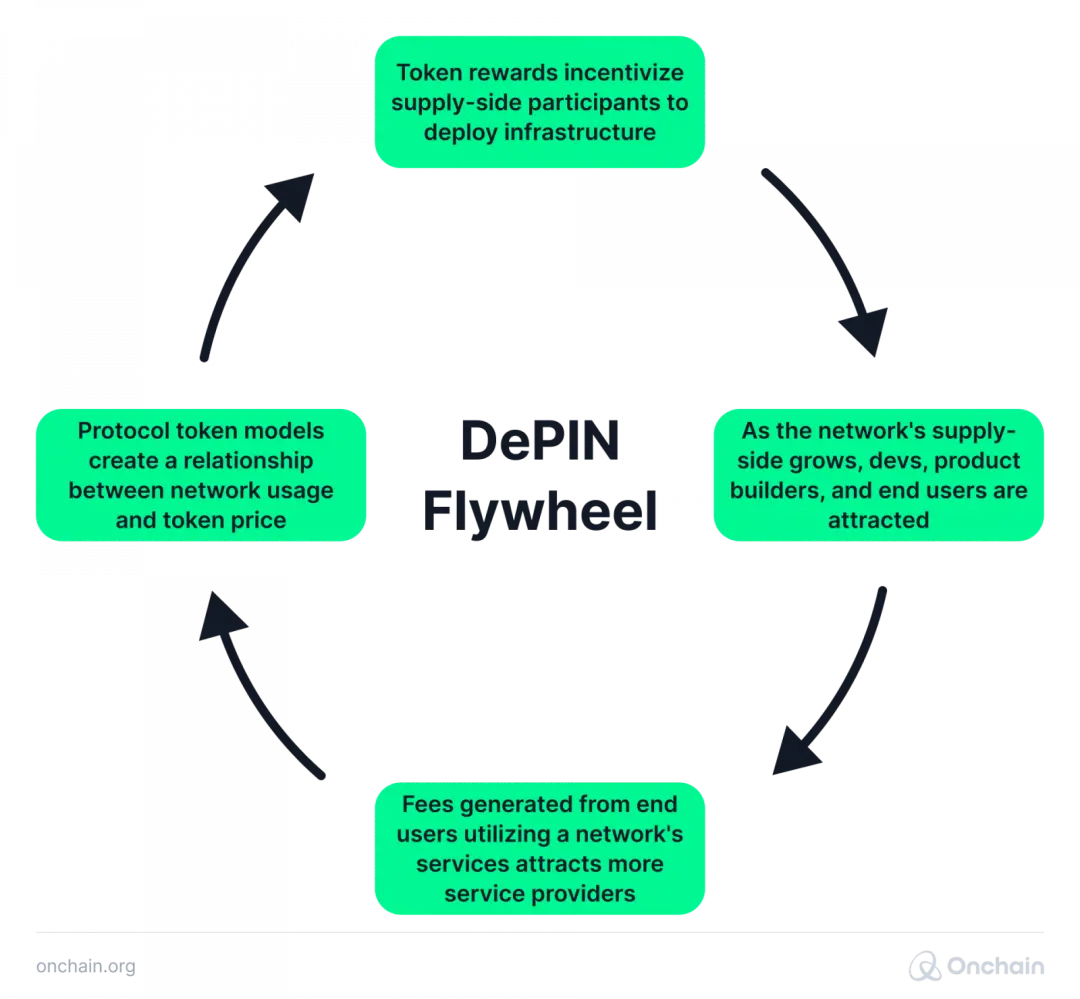

The key to DePIN's success lies in its token-based incentive system. Participants who contribute physical hardware or provide valuable services will receive token rewards, which have economic value and can be used within the network for service fees and governance participation.

It has created a self-sustaining economic model that incentivizes continuous growth and maintenance. Additionally, this clever incentive system addresses a major hurdle for startups - the cold start problem. Even when the network is young and small in scale, it encourages people to join and contribute, thereby forming a strong network effect early on.

Other Factors

Environmental and Economic Efficiency: DePIN projects often emphasize their potential to improve environmental and economic efficiency by utilizing crowdsourced infrastructure and renewable energy, reducing costs and carbon footprint. This makes them attractive in an era increasingly focused on sustainability. Some projects, such as Power Ledger, directly promote increased use of clean energy.

Regulatory Evolution: As governments and regulatory bodies worldwide begin to understand and adapt to blockchain technology, DePIN projects have increasing opportunities to integrate with traditional systems and markets. This regulatory evolution can open new pathways for growth and mainstream adoption.

Global Connectivity Goals: Since a significant portion of the world's population still lacks reliable internet access, DePIN projects aimed at expanding connectivity can enter vast markets. This aligns with global initiatives to bridge the digital divide and provides a strong use case for investment and development in the industry.

Tug of War Between Supply and Demand in DePIN

Building the Supply Side of DePIN

The foundation of each DePIN project is the physical assets that make up the physical infrastructure. Storage providers, computing power lenders, or some form of physical asset providers are the cornerstones of decentralized network structures.

Attracting suppliers who own or can deploy these assets is the first step in building DePIN. This is the supply side.

Early DePIN projects primarily used token-based rewards to incentivize suppliers (other incentive measures are also being explored in the DePIN business). This approach helps guide the network by creating a clear value proposition for potential participants - they can earn rewards by contributing resources.

For example, Helium initially focused on incentivizing the deployment of physical network hotspots to create a geographically widespread foundation for its decentralized wireless service.

This approach helps attract individuals or companies to contribute time and resources if certain key criteria are met. Below, you will find a series of initial considerations that each new DePIN project should take into account.

Openness of Hardware Systems

Closed systems can tightly control device quality, ensure network performance, and simplify technical support. However, they limit the types of hardware that can be used, which may stifle innovation and potentially raise costs.

Open systems allow participants to use compatible off-the-shelf or repurposed devices, providing greater flexibility and faster scalability. However, they bring challenges in ensuring consistency and quality of service and may increase management complexity.

Device Placement Requirements

The physical coverage range of DePIN systems is a concern and often requires careful spacing. In wireless networks (Helium) or positioning systems (Geodnet), extreme local device density can lead to interference and poor service.

In contrast, projects like Render Network focus on maximizing total available computing power (GPU) without geographical space restrictions. Here, systems with distance requirements can incentivize deployment in underserved areas or penalize over-saturation.

Affordability

Lower device costs reduce the barrier to entry for contributors, which is crucial for DePIN projects that leverage crowdsourced infrastructure and aim to attract a broad base of participants. Highly accessible DePIN systems benefit from crowdsourced deployment, while projects relying on expensive specialized hardware may find it challenging to attract a large distributed contributor base.

Scalability through Network Expansion

For DePIN projects looking to expand coverage and influence, scalability is a key consideration. By attracting more asset providers and expanding infrastructure deployment, projects can meet growing demand, enhance network coverage, and support a larger user base.

In addition to scalability, careful planning of supply-side distribution should be considered to avoid overexposure to specific regions. For example, Filecoin's network has over 80% of its testnet storage mining power in China, leading to concerns and criticism about centralization, posing a challenge to its development.

Considerations for the Demand Side of DePIN

"Supply first, but demand cannot be ignored."

Many DePIN projects initially prioritize building a strong supply base, which is not a bad approach. However, prematurely neglecting the demand side can be harmful. If there is insufficient demand, the transmission of data within the network will bring limited returns for the supply side. Unless demand is generated, the available market needs to be reached.

Unlike other Web3 vertical industries, DePIN systems can generate early revenue by meeting existing market demands and providing solutions beyond existing ones. This can be said to be the biggest advantage of DePIN compared to other Web3 areas.

This also means that DePIN can offer solutions beyond the Web3 ecosystem and enter Web2-dominated markets. However, attracting users beyond Web3 is challenging for almost all DePIN projects. We will further explore the competitive landscape in the report.

Even though the advantages are very clear and can save up to 80% or more in costs (as in the case of Akash), convincing users is very difficult. Below, you can see a direct cost comparison between Akash and its top Web3 competitors.

Source: Cloudmos

There are various reasons for this. Due to the dominance of Google and AWS, the barriers to entry in many mainstream markets are high. They have established credibility and gained the trust of users. The convenience of sticking to more or less satisfactory solutions and the fear of change pose significant obstacles.

In addition, lack of familiarity with market dynamics leads to inconsistent communication and a lack of clear value propositions for non-Web3 clients.

Each DePIN has its own challenges. If you are a hardware-based DePIN, your supply chain issues will hinder your network growth. If you are a software-based DePIN, you may encounter retention issues based on active and passive contributions. - Alireza Ghods, Co-founder of NATIX Network

However, Web3 participants are gaining experience, and DePIN projects targeting Web2-dominated markets are already considering creative solutions to help them bridge the gap (which will be detailed later).

How Individuals Can Utilize DePIN

DePIN provides perceptual data for its network. Let's further break down the supply and demand sides of DePIN and explore how individuals can utilize the project through social welfare and reward income.

1. Making Social or Environmental Contributions

We will illustrate this point through an example: Airly provides a solution to maintain air quality through a sensor network and data platform. This service is particularly beneficial for users within the Helium network, as it enables ultra-local, real-time air quality data collection and analysis. Governments, businesses, and communities can use Airly's insights to make informed decisions on environmental policies and actions to reduce emissions and protect public health.

The case study of Qualitair Corse by Airly examined the efficiency of 12 Airly sensors deployed across Corsica to monitor particulate matter and nitrogen dioxide levels. The project aimed to identify sources of pollution, particularly from ports, assess air quality improvement measures, advocate for environmental policy changes, and track particulate matter from Saharan dust to support government actions and raise public awareness.

Everyone on the supply side contributes to society.

Whether you are expanding cellular networks in your community or monetizing vehicle data, these are opportunities that consumers could not previously seize. People couldn't say, "Hey, I want to support infrastructure, it's not cheap, and building that infrastructure is not easy." - Alex Rawitz, Co-founder of DIMO

2. Earning Rewards from DePIN

Individual contributions to the network often receive token rewards. While this is a powerful incentive, the stories we hear from users supporting DePIN networks are diverse.

We interviewed two users who spent about $600-800 installing equipment in busy metropolitan areas but did not see the expected returns from projects like Helium.

They both shared their initial enthusiasm for the project, with exciting and innovative use cases, including one involving locating lost fishing nets in the ocean by embedding fragments in the nets. Even authorities praised the practicality of this unique application in using the network to accomplish impossible tasks.

However, as the story unfolded, users expressed disappointment with the actual results of their technical investment. They spent about $400 on mining kits, $250-300 on antennas and cables, but then faced 7-9 months of delivery delays.

When they finally completed the setup, they encountered network saturation issues as more devices were activated nearby, intensifying competition and decreasing returns. Despite trying to optimize the setup by experimenting with different antennas and locations, the results were unsatisfactory. Both of our interviewees criticized the lack of guidance on optimizing equipment performance and shared their frustration with inconsistent and often poor data mining yields.

This is a disappointing story, but there are also many positive and inspiring ones. In other cases, rewards for individual suppliers may be genuinely beneficial. For example, Hivemapper users often share their income on social media and are satisfied with the bounties for contributing to network expansion.

The core of DePIN projects varies, and different user experiences should not be surprising. We will explore the reasons in detail in the DePIN business section.

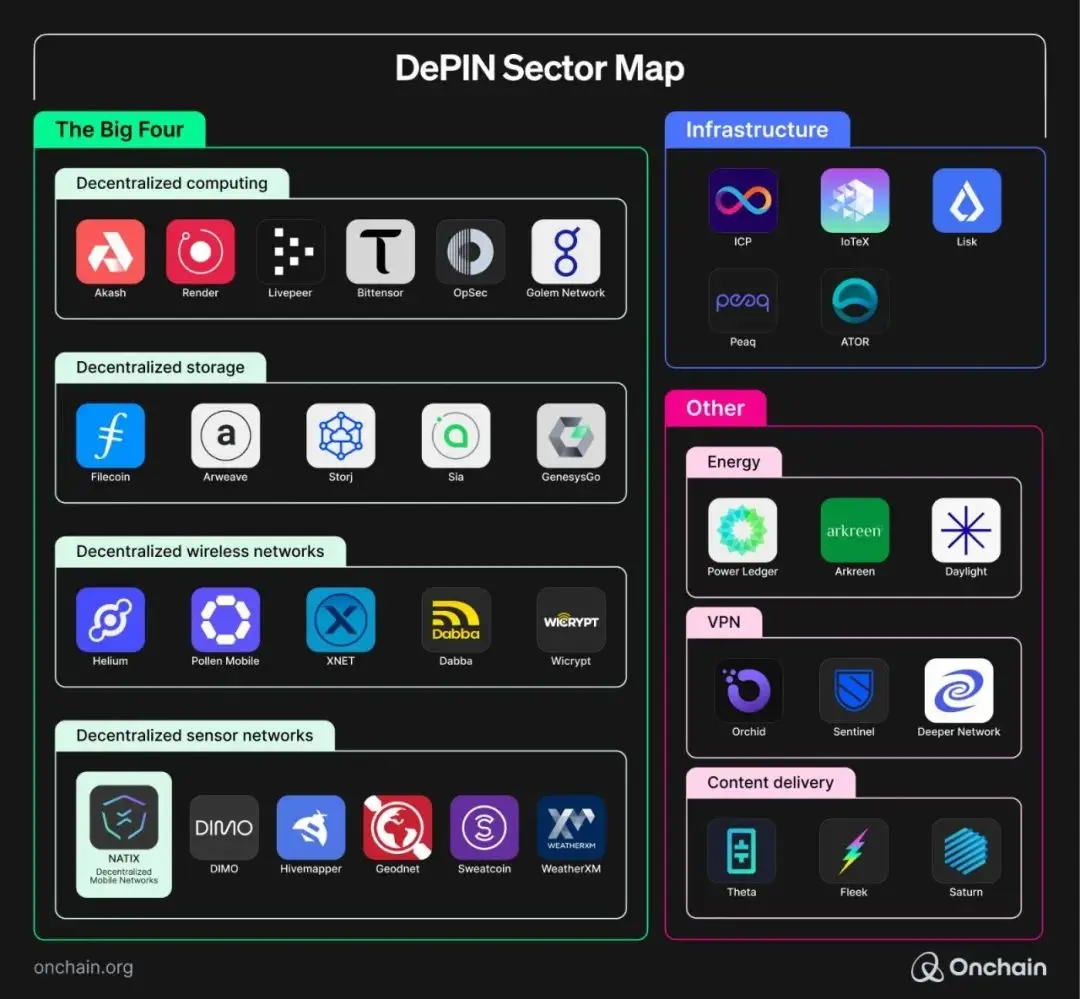

DePIN Niche Markets and Related Projects

Before we dive into the discussion, we want to ensure that you are aligned with our views. Below, you will find a brief overview containing descriptions of the projects and DePIN niches (a glossary) that we will unpack in the main sections of the report. If you are familiar with these projects, feel free to skip ahead.

Decentralized Computing

Encourages individuals to share their unused computing power and allocate these resources to a decentralized cloud network in exchange for tokens.

Key Projects:

- Akash - A decentralized computing marketplace aimed at seamlessly connecting GPU computing lenders with companies and individuals in need.

- Render - A decentralized GPU network similar to Akash but primarily focused on artists and studios in need of rendering capabilities.

- Livepeer - A decentralized video infrastructure focused on providing market suppliers' unused computing resources to filmmakers and live streamers.

Decentralized Storage

Utilizes a distributed node network to store data instead of relying on centralized servers or service providers. These files are often encrypted, fragmented, and distributed across multiple independent computers, making the data resilient to interruptions.

Key Projects:

- Filecoin - A decentralized data storage marketplace that connects users with providers in a peer-to-peer network. It uses economic incentives and robust encryption technology to ensure the reliability and security of files.

- Arweave - A decentralized storage protocol designed to ensure the permanent and immutable preservation of data. It achieves this goal through a novel payment structure where users provide a one-time upfront payment to store data indefinitely.

Decentralized Wireless Networks

DePIN leverages blockchain technology and token incentives to create and maintain wireless communication networks in a decentralized manner. These networks encourage individuals to contribute hardware (such as hotspots, routers, and other wireless devices) to establish connectivity services, such as WiFi hotspots and other wireless communication services.

Key Projects:

- Helium - A decentralized telecommunications network that uses LoRaWAN technology to connect IoT devices to the internet. Helium is also known as the "People's Network" and has achieved the milestone of deploying over 150,000 hotspots globally in just over two years.

- Pollen Mobile - A decentralized, user-owned and operated mobile network that utilizes blockchain technology and token incentives to create a privacy-focused, affordable wireless communication ecosystem.

Decentralized Sensor Networks

Thanks to DePIN, users can also earn rewards by simply providing valuable data. Projects building decentralized sensor networks collect information from individual users and resell it to third parties or institutions, and they can also turn it into actionable insights and recommendations.

Key Projects:

- Hivemapper - A project that incentivizes individuals to generate and share vehicle map data using plug-and-play sensors. Its functionality is similar to a decentralized, community-owned version of Google Maps.

- DIMO - A project similar to Hivemapper, with a greater focus on vehicle-related data. It rewards users' contributions through token incentives and additional features such as private location tracking, vehicle health diagnostics, virtual glove boxes, and privacy-protected GPS.

- Sweatcoin - The concept of earning money through exercise, incentivizing individuals to improve physical activity. This example is particularly interesting because it was originally a Web2 application that migrated to Web3 after testing its model with over 100 million users.

- Geodnet - A decentralized network utilizing real-time motion data. It incentivizes users to share their personal location data, significantly improving location accuracy compared to independent GPS devices.

Other Decentralized Networks

DePIN is clearly not limited to these four use cases, and as the industry evolves, more examples are expanding beyond the initial DePIN classifications.

Key Examples:

Theta (Content Delivery) - A decentralized video delivery network aimed at improving the quality of video streaming by effectively delivering content through the use of a peer-to-peer node network. Theta Network incentivizes users to share bandwidth through token rewards.

IoTeX (General DePIN Infrastructure) - A project providing comprehensive blockchain-based infrastructure aimed at enhancing the development and operational capabilities of DePIN. It specifically focuses on building blockchain-driven network interconnectivity and managing physical assets.

Lisk (General L2 DePIN Infrastructure) - An L2 infrastructure that allows the seamless transfer of tokenized real-world assets (RWA) into the Ethereum DeFi ecosystem.

Power Ledger (Energy Trading) - A blockchain network focused on decentralized energy trading to accelerate the adoption of clean energy. It enables individuals to transfer surplus energy from sustainable sources and earn additional income in exchange, often referred to as the "Airbnb of green energy."

Orchid (Decentralized VPN) - A VPN provider network where users can establish custom multi-hop connections and make payments using cryptocurrencies. It serves as a marketplace for individuals to sell their own servers as VPN nodes - a unique approach to such services compared to non-Web3 products.

EdgeMatrix Computing / EMC (Decentralized Edge Computing Infrastructure) - EMC is a leading AI DePIN in the AI + Web3 field, bridging the gap between computational networks and AI(d)apps. EMC jointly released the world's first GPU RWA.

Explanation from ICP for Contributing to this Report

ICP is one of the leading DePIN networks, hosted by specialized node machines dedicated to creating sovereign networks, managed by advanced DAO. Container smart contracts can rent out computing power and storage space on the network.

Potential DePIN Use Cases

You create a DePIN network consisting of physical sensors to monitor soil moisture. The signature outputs of these sensors can be easily and directly verified on internet computers to ensure they have not been tampered with. This evidence can also be shared to other chains, such as Bitcoin or Ethereum, through ICP's Chain Fusion technology, and even the ability to make HTTP calls through ICP to traditional Web2 systems.

ICP smart contracts come with bundled storage, allowing for the tagging of other related data alongside data from DePIN infrastructure, such as images or videos. For example, a decentralized solar panel network can be directly mapped to the blockchain with additional data sources (e.g., weather patterns, time-lapse videos captured by cameras).

What Entrepreneurs Need to Know

ICP offers a pay-as-you-go model for:

- Computing

- Storage

- Communication fees

- All other functionalities (e.g., threshold signatures, reading and writing to the Bitcoin blockchain, calling smart contracts on EVM chains, etc.)

Potential Revenue Sources:

- Standard Web3 model where user payments are a natural feature of the platform

- Flexibly using a traditional Web2-like revenue model through a reverse Gas model

- Infrastructure components - as containers are composable services, those providing functionality to other containers/dApps (backend services) can charge for it

Potential Business Models:

- AI - monetizing training data and trained models

- Leveraging ICP's capabilities (integrations with Web2 and other chains, computing and storage) to provide services for dApps on other blockchain platforms (automation, governance, oracles, etc.)

- Building DePIN networks on top of ICP, for example, using HTTP calls to enable smart contracts to interact with external infrastructure, referencing Loka Mining.

DePIN dApp Examples

- Loka Mining: Loka is a platform where retail investors can purchase BTC at below-market prices without exposure to any centralized counterparty risk, by providing liquidity to Bitcoin miners. It uses non-custodial escrow and fully decentralized mining pools.

- RentSpace: RentSpace is leading the future of real estate leasing by harnessing the power of blockchain technology and Web3 innovation. Their mission is to revolutionize the real estate industry by providing features such as TikTok-style video marketing, integration of cryptocurrency and fiat payments, collaborative bookings, and action-based reward programs.

DePIN as a Business Concept

It's time to get down to business.

Our report findings will provide you with a comprehensive overview of how DePIN companies can (or cannot) make money and sustain operations. To achieve this goal, we analyzed the most prominent projects, examined the DePIN categories listed above, and assessed the business models adopted by related projects.

Our research team analyzed their revenue streams and cost drivers, mapped out the competitive landscape, and defined how each project positions itself compared to Web3 and Web2 competitors. The report also defines their typical DePINish mechanisms, such as incentive measures for their business demand and supply sides.

Finally, we evaluated their adoption and proposed how they can bridge the gap and reach mainstream (though often B2B) audiences.

Below, you will see our analysis summary and an overall overview of the DePIN business model sections.

We recommend not skipping the last part of this section, as it provides the foundation for the following ready-made business models, which are evaluated based on three values:

- Most popular approach

- Most effective approach

- Most promising approach

We hope it will make your entrepreneurial decisions for DePIN projects more data-driven!

Eight Major Revenue Sources

Let's start with the most intuitive part of the business model, where we found eight ways DePIN projects make money.

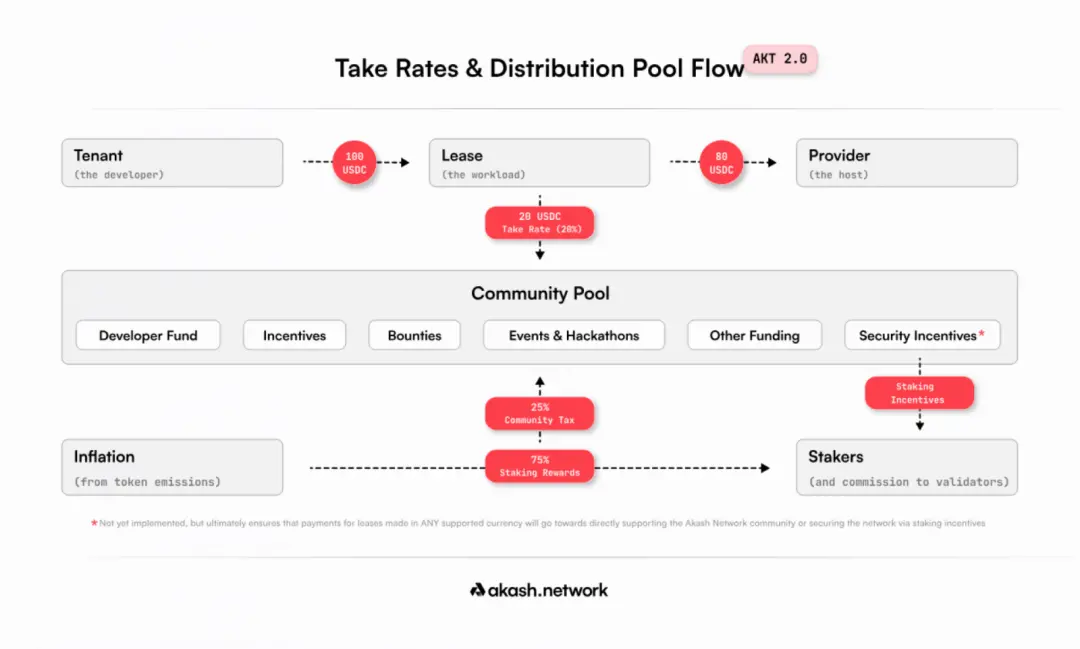

1. Transaction Fees/Commissions

This is currently the most popular way, also typical for non-DePIN Web3 projects. It typically involves deducting a small fee from transactions on the platform (e.g., used by Akash in the computing power market) or other activities related to running the project. In some cases (i.e., Livepeer), applications built on the protocol also generate fees.

Future commission-based revenue model developed by Akash:

Source: akash.network

2. Token Value Appreciation

This similar method ranks second in popularity and is typical for other Web3 projects. A portion of the tokens issued by DePIN projects is held in the project's treasury and can generate revenue based on the appreciation of token value. Since this model is typically unsustainable in the long run, as it relies on positive price behavior, it should be viewed as a short-term booster.

Example: DIMO and its revenue generated through the allocation of $224 million worth of DIMO tokens to the initial team, resulting in a 500% growth for the full year of 2023.

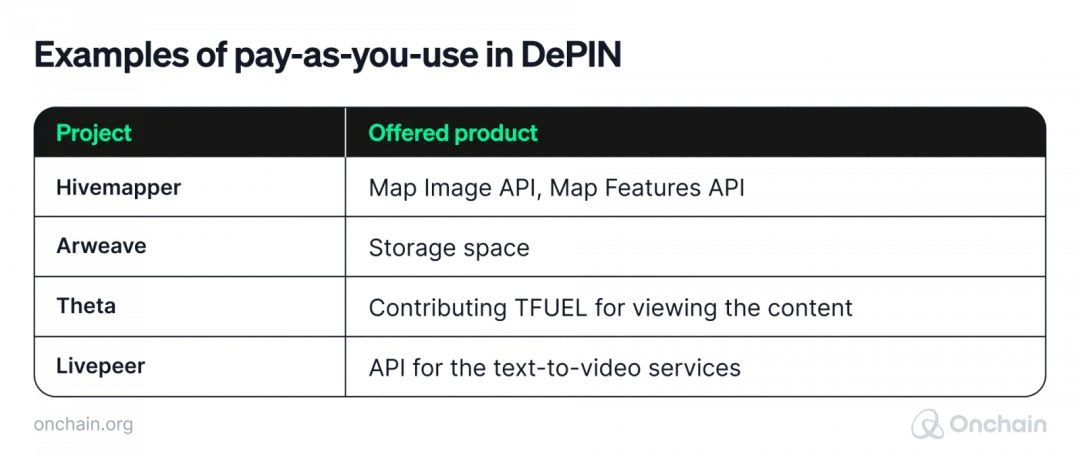

3. API Access/On-Chain Data Sales

Some DePIN categories, such as sensor networks, are all about data. Projects can sell this data to businesses in need, for example, Hivemapper sells map image APIs and allows access to street-level images globally for insurance companies and similar clients (starting at $0.85 per kilometer per week).

4. Pay-As-You-Go

Pay-as-you-go pricing is becoming increasingly common in the DePIN field and can be considered as a separate category of revenue stream, given the diversity of industries where DePIN projects operate, this approach provides customers with access to a wide range of products.

5. Prepayment/Hardware

This revenue model is native to DePIN, allowing projects to allocate specific margins on hardware required for application usage, such as sensors collecting data for the DIMO network.

Projects may also require on-chain prepayments, with Helium users paying one-time fees in HNT and Solana tokens for access to devices for hotspots, and may incur additional activation or data plan fees.

So far, we have discussed the general models for Web3 projects (transaction fees), particularly for DePIN (prepayment, API access), as you will further see throughout the report, DePIN enterprises must be creative to capture and maintain their market share.

Therefore, be open-minded and ready to embrace more plug-and-play models, which may prove to be more advantageous in the long run.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。