In Singapore, regulatory oversight in the payment industry is crucial to ensure compliance and prevent illegal activities.

By Aiying

In Singapore, regulatory oversight in the payment industry is crucial to ensure compliance and prevent illegal activities. The main regulatory authorities include:

MAS is the primary regulatory authority, equivalent to China's "One Bank, Three Commissions," responsible for regulating financial institutions and companies holding fund service licenses, as well as managing non-financial institutions such as wealth management and credit rating. In addition to MAS, the Singapore Clearing House Association and the Association of Banks in Singapore also participate in the regulation of the payment industry.

I. Evolution of Payment Regulatory Framework

1. Early Regulatory Framework

Before 2006, Singapore's payment system regulatory provisions were scattered in the "Banking Act," "Bill of Exchange Act," and some informal documents.

2. "Money-Changing and Remittance Businesses Act" (MCRBA)

The 1979 MCRBA established regulatory requirements for enterprises engaged in remittance businesses.

3. "Payment Systems (Oversight) Act" (PS(O)A)

In 2006, MAS issued the PS(O)A, providing a unified legal basis for payment system regulation.

4. Legal Consolidation and Update - "2019 Payment Services Act"

With the innovation of payment technology, the existing legal framework gradually became inadequate to adapt to emerging payment tools and business models. Therefore, Singapore underwent legal updates: Singapore abolished the PS(O)A and MCRBA, and the new "2019 Payment Services Act" came into effect in 2020, consolidating the previous laws and incorporating new types of digital payment services revised in early 2020. This includes regulatory provisions related to virtual assets, mainly concerning electronic money (E-money) and digital payment tokens (DPT).

II. Regulatory Framework of the New Act

1. Classification of Payment Services

Under the new legal framework, payment services are divided into two major categories:

- Payment Service Providers

Providers offering acquiring, remittance, account issuance, and other services are the focus of our discussion.

- Payment Systems

Similar to China's clearing systems (such as UnionPay and Wanglian), payment systems serve as the underlying financial infrastructure to facilitate fund transfers among participants.

2. Key Regulatory Focus: Payment Service Providers

As payment systems mainly involve financial infrastructure and have little direct relationship with consumers and merchants, the following discussion will focus on the regulatory situation of payment service providers.

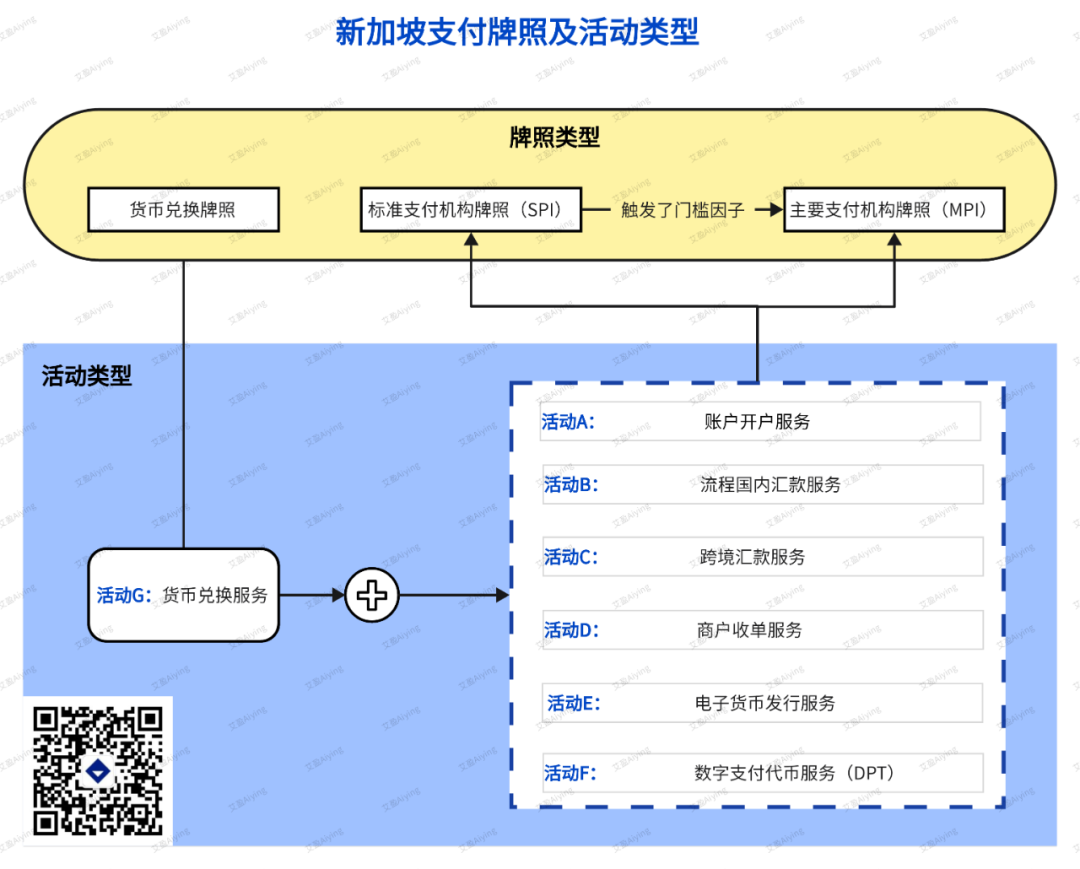

There are a total of 3 types of licenses related to payment service providers:

Money-Changing Licence

Standard Payment Institution Licence (SPI)

Major Payment Institution Licence (MPI)

Singapore has further divided these 3 types of licenses into 7 activities, as shown in the following figure:

(Description of activities)

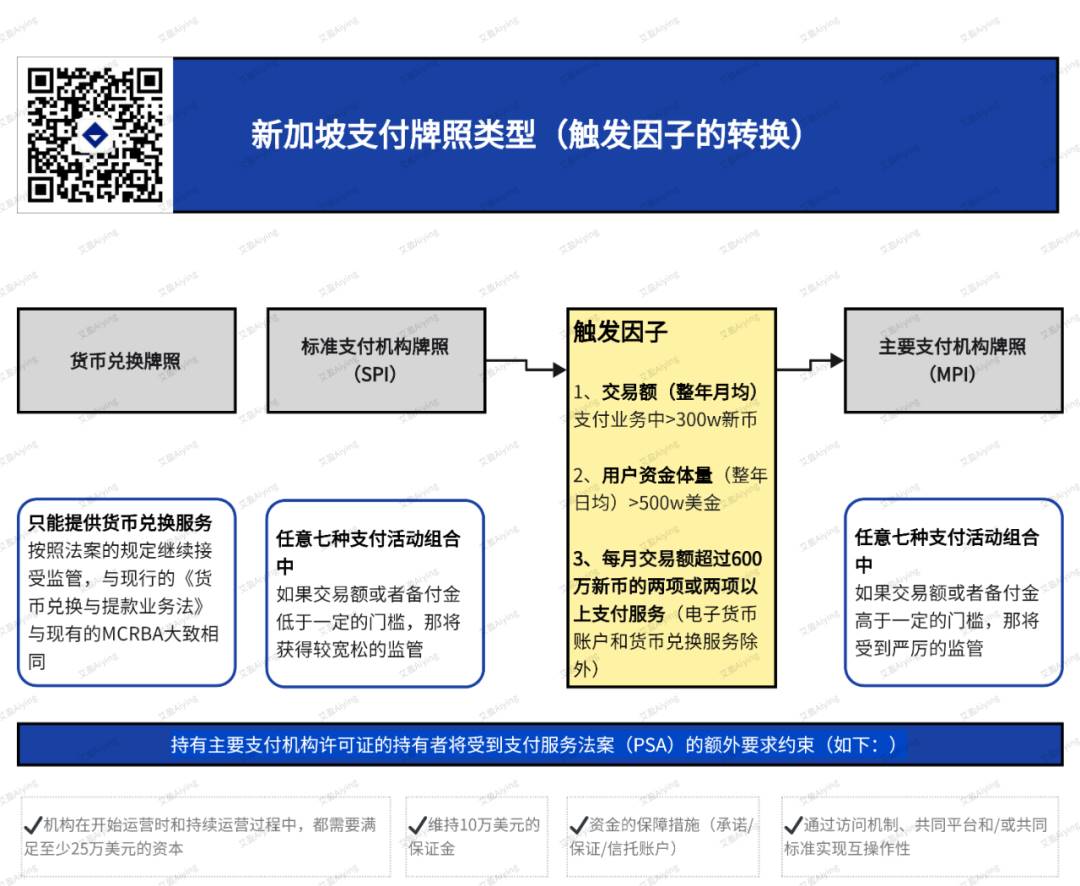

To illustrate, if you apply for a Standard Payment Institution (SPI) or Major Payment Institution (MPI) license, you can declare multiple activities when applying for the license, indicating the business you intend to conduct with the license, such as acquiring, wallet services, money exchange, digital currency, etc. You can declare all activities, but not all may be approved by the regulator. The regulator also considers the reasonableness, necessity, and whether you meet the conditions. The following figure shows MAS's requirements for triggering factors for license types:

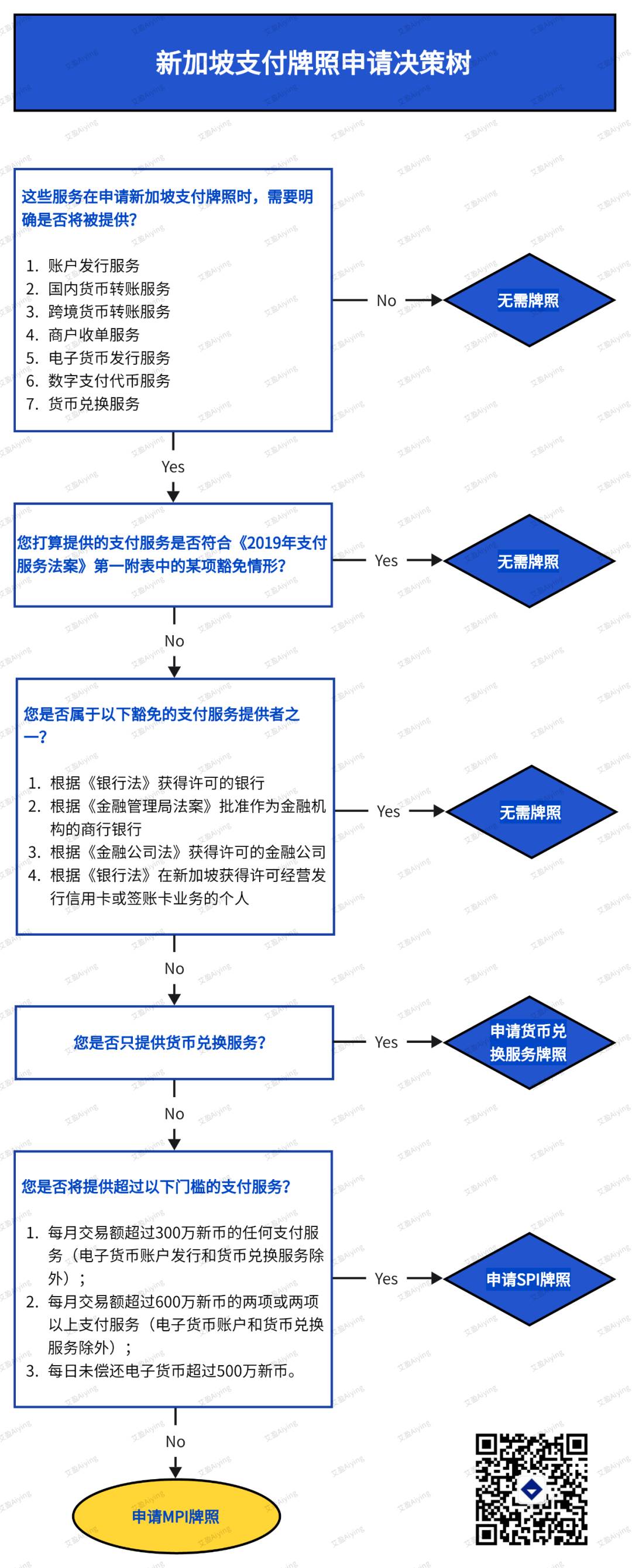

When deciding which type of license to apply for and providing payment business services, you can refer to this decision tree for guidance:

3. DPT Digital Payment Token Services

Among the seven types of activities, we will focus on activity F, digital payment token services.

(1) Definition of DPT Services

(2) Electronic Money (E-money) and Digital Payment Tokens (DPT)

For virtual assets with payment functions, it is necessary to first determine whether they belong to electronic money or DPT, in order to further establish the applicable regulatory provisions.

PSA clearly distinguishes between electronic money and DPT:

Electronic Money: Currency value stored electronically, characterized by:

Priced or pegged to a legal tender;

Prepaid for payment transactions;

Accepted by parties other than the issuer;

Represents a claim against the issuer.

Digital Payment Token (DPT): Digital form of value, characterized by:

Represented in units;

Not priced in or pegged to a legal tender;

Recognized by the public as a medium of exchange;

Used as consideration for goods or services or for the discharge of a debt;

Capable of being electronically transferred, stored, or traded.

(3) Distinction between Electronic Money and DPT

MAS points out the main differences between electronic money and DPT:

Whether priced or pegged to a legal tender;

Whether representing a claim against the issuer;

Whether the value is determined by market mechanisms.

Payment-type tokens such as Bitcoin and Ethereum are usually classified as DPT.

(4) Stablecoins also Fall under DPT

There has been ongoing debate about whether stablecoins, due to their peg to a legal tender, should be classified as electronic money or DPT. MAS believes that stablecoins usually do not meet the definition of electronic money because:

Electronic money is the electronic form of legal tender, while stablecoin exchange rates are not fixed;

There may be no direct contractual relationship between stablecoin holders and issuers.

Stablecoins such as USDC and Tether are considered DPT based on their characteristics.

MAS will determine the applicable regulatory framework based on the specific characteristics of stablecoins and has proposed draft regulatory policies for stablecoins in 2022. Currently, companies like Paxos have received provisional approval from the Monetary Authority of Singapore, and its Singapore subsidiary can issue a new US dollar stablecoin in Singapore.

(5) Regulatory Exemption for Non-Monetary Tokens

PSA stipulates that certain non-monetary tokens (such as customer loyalty points, in-game assets) are not subject to regulation, provided that:

They cannot be redeemed for cash, transferred, or sold for money;

They are only used to redeem goods or services from the issuer or designated merchants;

They are only used for virtual items or services within online games.

III. License Application

Checklist and Requirements for Payment License Application:

1. Company Entity and Management Requirements

Company registration: Applicants must be a company registered in Singapore or a Singapore branch of a foreign company.

Composition of management:

At least one executive director must be a Singapore citizen or permanent resident.

Or at least one executive director holds a Singapore employment pass, and at least one non-executive director is a Singapore citizen or permanent resident.

2. Fit and Proper Criteria

Applicants and their directors, chief executive officers, shareholders, and employees must meet the "Fit and Proper" criteria.

The applying company/group must not have a financial crime record or a bad reputation.

3. Industry Experience and Educational Qualifications

Executive directors and CEOs must have operational experience in the payment services or financial services industry.

The educational background and professional qualifications of key personnel are important considerations.

4. Permanent Local Business Office

Applicants must have a fixed place of business or registered office, and it must be a long-term lease.

The office should ensure privacy, securely store business records, and have dedicated personnel for customer consultation.

5. Capital and Security Deposit

Capital requirements:

Standard Payment Institution License: SGD 100,000.

Major Payment Institution License: SGD 250,000.

Security deposit:

Monthly average transaction volume less than SGD 6 million: SGD 100,000.

Other situations: SGD 200,000.

6. Compliance and Risk Management

Establish an independent compliance department or obtain compliance support, develop AML/CFT policies, and conduct risk assessments.

Conduct comprehensive technical testing for online financial services, including penetration testing and independent verification.

7. Audit Arrangements

Implement internal audit arrangements commensurate with the business scale.

Conduct annual external audits to ensure compliance with regulatory requirements.

8. Undertaking Letter

MAS will assess the applicant's financial condition, compliance risks, and public interest factors.

9. Funds Safeguarding Arrangements

Provide details of safeguarding arrangements, including the name of the safeguarding institution, draft contracts, and the coverage scope of the safeguarding measures.

If using insurance or bank guarantees, provide legal opinions to demonstrate compliance.

10. Documentary Evidence

Upon approval, provide ready-made documentary evidence of safeguarding arrangements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。