Author: Karen, Foresight News

On May 17th, the Linea Surge event officially kicked off. Linea launched the first phase of the Linea Surge points program (Volt 1), aiming to drive the prosperity and development of the ecosystem by attracting more users and increasing the Total Value Locked (TVL) on the network, potentially opening a new chapter in Linea's growth flywheel.

Despite sparking controversy and complaints among some community users, Linea previously stated that Linea Surge is the final piece of the puzzle before embarking on its journey to decentralization, creating a network truly owned and operated by the community.

As part of this program, Linea will reward participating users who hold assets on Linea and deploy them to DeFi protocols with LXP-L points. Linea Surge will run for 6 months (6 Volts), or until its TVL reaches 3 billion USD. As the event progresses, the allocation of LXP-L in each phase will decrease by 10%, meaning that the earlier participants will earn more rewards. Linea stated that users only need to cross-chain their assets to Linea, keep them in their on-chain state, and deploy them to specified protocols to earn LXP-L points every hour.

For users with existing liquidity exceeding 0.1 ETH before the last block at 07:59 on May 16th, they will receive a multiplier for early adopters of Volt 1's LXP-L as an additional reward. Additionally, in the Linea Surge event, liquidity deployed in a single protocol must be greater than or equal to 24 USD for the points to be counted. It is worth mentioning that Linea stated that there is no need to "witch hunt" in this event, and regardless of whether users concentrate all liquidity in one wallet or disperse it among thousands of addresses, they will receive the same amount of points.

There are three main ways to earn LXP-L points: ecosystem points, referral points, and Veteran points. Ecosystem points are mainly used to incentivize users to cross-chain assets or deposit them into Linea and engage in interactions across various ecosystem protocols. Referral points are distributed through Linea Surge's referral mechanism, while Veteran points are additional rewards for users with significant historical activity and contributions on the Linea platform.

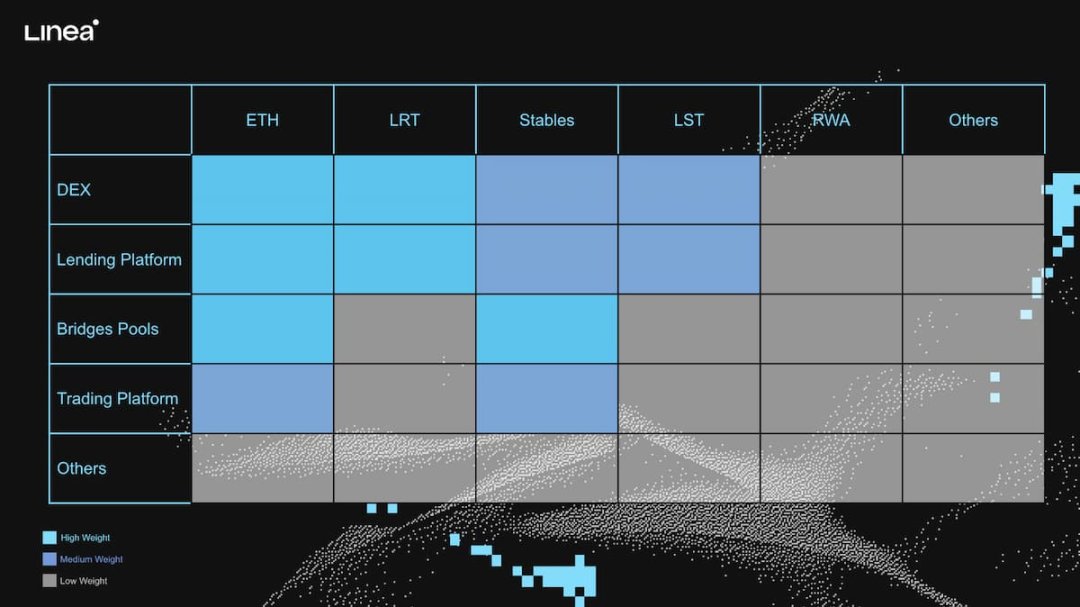

The following image shows the weight of ecosystem points rewards, with the highest reward weight for points related to ETH and LRT liquidity on DEX and lending platforms, as well as rewards for ETH cross-chain activities, and smaller reward weights for stablecoins, LST, and RWA.

Which tokens are included in the Linea Surge whitelist?

The Linea Surge event has included the following tokens in the whitelist:

- ETH, wETH, WBTC, nextwETH, mBTC, SolvBTC;

- LRT/LST: weETH, wrsETH, uniETH, ezETH, inETH, ankrETH, wstETH, mpETH, STONE, frxETH;

- RWA: sUSDE, wDAI, EURO3, LUSDC, agEUR, USD+, USDT+;

- Stablecoins: USDC, USDT, DAI, alxUSDC, nextUSDC, nextUSDT, nextDAl, USDE, GRAI, Added, LYU.

21 protocols participating in the Linea Surge event

Teahouse Finance: A multi-chain DeFi asset flexible management platform, focusing on centralized liquidity provision on Uniswap V3;

PancakeSwap: A multi-chain DEX protocol;

Secta: Linea's ecosystem DEX and Launchpad, which has not issued a platform token or launched a Launchpad yet. However, Secta's first Launchpad will issue its own platform token SECTA. The main use case of Secta's token is to ensure distribution in projects incubated and launched on its platform.

Token economic model: 57% allocated to the community, 5% for public sale, 15% allocated to investors (fully locked for 6 months, then linear release over 24 months), 3% allocated to advisors (fully locked for 12 months, then linear release over 24 months), 20% allocated to the team (fully locked for 12 months, then linear release over 24 months).

Mendi Finance: A lending protocol in Linea's ecosystem, which has introduced the Mendi Loyalty Points (MLP) program. MLP is an ERC-20 token bound to the soul, which will be proportionally distributed to users of lending and staking protocols. Mendi Finance stated that if there are potential airdrops for Mendi in the future, MLP will be used as the accounting system for fair distribution to holders. To gain liquidity, Mendi Finance will bribe Lynex weekly, and the earned oLYNX will be distributed to MENDI stakers. Mendi Finance issued tokens at the end of last year, and the token economic and distribution model can be found here.

Connext: A Layer2 interoperability protocol;

Overnight: An asset management protocol that provides passive income products based on Delta-neutral strategies for conservative stablecoin investors.

Sushi: A multi-chain DEX protocol;

Lynex: Linea's ecosystem liquidity engine, aggregating Automated Liquidity Managers (ALM). Each transaction on Lynex generates transaction token fees, which are used to reward active voters and strengthen the Lynex treasury. Lynex has issued tokens.

SyncSwap: zkSync Era, Linea, and Scroll ecosystem DEX protocol, with no issued token.

Deri Protocol: A decentralized derivatives protocol, with an issued token.

Velocore: A veDEX protocol based on Velodrome in the zkSync Era and Linea ecosystem, with an issued token.

SpartaDEX: A gamified DEX in the Arbitrum One and Linea ecosystem, with an issued token.

iZUMi Swap: A multi-chain DeFi protocol that provides Liquidity as a Service (LaaS), with an issued token.

Stargate: A cross-chain bridge, with an issued token.

Celer Network: A cross-chain bridge, with an issued token.

NILE: A DEX protocol, with an issued token.

Gravita Protocol: A multi-chain LST lending protocol centered around ETH, yet to launch a governance token for the protocol.

Lyve Finance: A stablecoin project in Linea's ecosystem, supporting the minting of stablecoin LYU with ETH or LST, and enabling circular lending. It has issued a governance token.

ZeroLend: A decentralized lending protocol on zkSync, Manta Network, Blast, and Linea, with an issued token.

Renzo: A re-staking protocol, with an issued token.

Clip Finance: An automated yield solution that will unlock the CLIP token when the TVL reaches 1 million USD, and is about to release a points system. CLIP token holders can enhance liquidity mining by staking tokens and also have governance rights. The token economics can be found here.

How to efficiently participate in Linea Surge?

So how can you earn the most LXP and potentially receive airdrops with the highest capital efficiency? Some paths include:

Path 1: Cross-chain ETH to Linea using a cross-chain bridge, stake ETH in a staking protocol, and deposit LRT or LST tokens in a lending protocol. For example, providing wrsETH (LRT token issued by Kelp DAO) on ZeroLend can earn double Kelp Miles, Linea LXP-L points, 5% Turtle (virtual liquidity protocol) LXP-L points, and TurtleDAO points. Alternatively, use ether.fi weETH on Gravita Protocol to borrow stablecoin GRAI (over-collateralized debt token issued by Gravita Protocol), then provide liquidity on NILE to earn the maximum LXP with the highest capital efficiency.

Path 2: Cross-chain ETH to Linea using a cross-chain bridge, deposit liquidity and LP tokens in DEX protocols, such as cross-chain ETH on Connex, and provide liquidity and stake LP tokens on Velocore to earn LXP-L points, pre-mining rewards LVC from Velocore, and Carrot points from Router Nitro.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。