In the currency circle, it has become increasingly difficult to be a KOL. In the past few bull markets, due to reasons such as the industry crowd and track not being finely divided, limited channels for industry knowledge dissemination, and the average cognitive level of industry participants not being high, "crypto internet celebrities" such as Irene Zhao and Liang Xi could secure a ticket to become opinion leaders and enjoy the strong monetization effect of traffic in the crypto field solely based on their looks and drama. However, with the development of the industry and the entry of more professional players, the days of crypto KOLs are not easy anymore.

Now, any misinterpretation of project mechanisms or improper selection of data sources by KOLs will be magnified and publicly scrutinized by various crypto researchers. After the migration from the Chinese crypto community to Twitter, the market and ordinary investors demand KOLs who have cognition, are professional, and can discover alpha opportunities early. Under increasingly stringent market standards, crypto KOLs are experiencing a new round of survival of the fittest. The older generation of KOLs is gradually fading from the center stage, while also giving rise to the opportunity for a new generation of influential KOLs.

Among the new generation of influential KOLs, Fiona is highly regarded by the community. She first gained attention during the "Arbitrum craze" at the beginning of last year, then seized the Ordinals inscriptions and PEPE market from March to May, and shone brightly at the beginning of the bull market at the end of the year, leading her community members to discover many opportunities such as Ronin, TurtSat, and Auction, which multiplied tenfold or even a hundredfold. While Bitcoin broke through the $70,000 mark and market bullish sentiment continued to rise, she chose to strategically "lie low" and successfully avoided the major market bloodbath last weekend.

Many of her followers are curious about the background of this seed player who combines looks and strength. What is her philosophy of speculation? Recently, we had an in-depth conversation with Fiona about these questions.

"After joining VC and the project party, I chose to be a retail investor"

In fact, compared to most old hands in the currency circle, Fiona did not have a first-mover advantage when she entered the industry; it was already 2021.

Unlike most people who sought development in the crypto industry early on, Fiona's career trajectory in the currency circle seems somewhat "counterintuitive." Her journey in the crypto world started with a professional VC, then joining a popular project, and finally actively transitioning to become a "full-time retail investor." The accumulation of experience in a different order from other speculators also gave her some different cognition and methodology when seeking and seizing opportunities. In Fiona's view, retail investors in the crypto market are the most clear-headed and comprehensive group in terms of industry cognition.

Impressive Start

Before entering the currency circle, Fiona was a financial media journalist. During the interview process, she met Yi, a well-known partner at LD Capital.

In mid-2021, Fiona planned to study abroad in Singapore. Upon hearing the news, Yi extended an olive branch to Fiona. He told Fiona that Singapore has many crypto industry resources, and "the most important thing in this circle is the industrial chain, and VC is a particularly important part of this industrial chain." Not long after, Fiona joined LD, and she still recalls that period with gratitude, "Most of what I learned was completed at LD, which was like the first school for me in the crypto industry."

Fiona joined LD in mid-2021, during the period of the "narrative explosion" in the crypto industry, when DeFi was thriving, and emerging concepts such as GameFi and NFT were also gaining momentum. However, apart from Bitcoin and Ethereum, Fiona knew almost nothing about the crypto industry. She recalled that at the time, she didn't even know how to use MetaMask, let alone Twitter, Telegram, and Discord. She had to start from scratch to learn everything.

"At that time, the atmosphere of speculating in the office was quite strong, but everything was so unfamiliar because there was too much catching up to do, so I didn't have the energy to speculate. When I first joined LD, I could only listen and learn from my colleagues, and then do some research on my own. However, her professional role in primary investment allowed her skills to improve rapidly.

BlockBeats: What was the overall feeling in VC at that time? What was your learning process and channels?

Fiona: At that time, I would attend (project party) meetings, chat with people, and so on. I think the growth rate in VC is doubled because you have pressure, a lot of deals are sent to you every day, and the process of chatting with others is a crazy absorption of knowledge. At first, I didn't have my own opinions, I just listened to others, but I think half a year was a big turning point. That's when I started to have some of my own judgments.

BlockBeats: So the more people you talk to, the faster your cognition progresses.

Fiona: There will be progress, but it depends on whether the people are right or wrong. However, no matter which kind, it's a perspective, and you are absorbing experience.

BlockBeats: How do you find and judge the "right people"?

Fiona: At first, I used some very conventional standards, for example, for a first-tier project founder, you can see who their other investors are. If they have been invested in by some top VCs, we usually consider it a good project, or who their team members are, who introduced them, and so on. I can only believe in this known information, and at that time, I lacked judgment about the project itself.

BlockBeats: Did this judgment standard change later?

Fiona: First, I think the founder is very important. After talking to the founder, you can clearly feel some qualities, or whether their logic can impress you.

Second, I think cryptocurrencies are very different from ordinary listed companies; they are actually directly to C, regardless of whether the product logic is to B, because they have to sell tokens, so it must be to C. You should look at the image they present to the public, and their community atmosphere is very important, so all social media channels are also important.

The third point is the product logic, and all the underlying logic of the product should be looked at more carefully. For example, how StepN rose and how it was destroyed are actually related to its underlying logic. The original script is everything, and it determines the outcome of the project. When you analyze the entire logic, you can actually feel it.

BlockBeats: Do you think VC's approach to analyzing project logic and investment logic is helpful for your speculation?

Fiona: I think speculators are the most objective group in the currency circle. If there is any shortcoming, I think it's just information asymmetry. Besides that, I think they sometimes perceive things even more than VCs, because they can continue to deeply follow a project, and delve into the community. VCs usually don't have this time because your portfolio is too large, and there are too many projects to follow up on, so your time is divided, and you can't use it efficiently.

I also received offers from VCs later, but I didn't have a strong motivation to go back. Because I think every position, every identity, actually limits your way of thinking; it is both a gift and a shackle. It will make you think about issues under specific interests, and I think it's not that objective and comprehensive.

BlockBeats: Why can't VCs follow a project in depth?

Fiona: For example, if I want to invest in a project, I will look at all their social media accounts. But imagine a VC in a bull market, they might conservatively estimate that they can receive 10 project decks in a day, and the time allocated to each project is very limited. But if a retail investor buys a lot of tokens, they will definitely keep a close eye on the project's dynamics. I think this level of attention is completely different.

And I think every project is dynamically developing, and speculators sometimes can continue to dynamically observe changes in a community. VCs don't have that much time, and their due diligence with the project may end at the moment of payment, and the post-investment team is another group of people, who may be under even greater pressure.

It's difficult for a VC to deeply focus on the community aspect of a general project. So if someone is really paying attention to a project's community, that's usually not a VC behavior, at least not behavior that maximizes VC interests; it should be their personal behavior. Of course, there are some exceptions, such as Delphi Digital designing the token economic model for Axie Infinity, but I feel this is more of a "familiar with each other" situation, or it's a case of being heavily invested. But generally, I think it's difficult for broad-spectrum investments to deeply engage with the community.

Running Shoe Faith

During her more than half a year in VC, Fiona came into contact with many excellent crypto projects, but none of them had as much impact on her development trajectory as StepN.

The name StepN is familiar to old hands in the currency circle. StepN, which promotes "earning money by running" under the banner of Move To Earn, is one of the few phenomenon-level applications to break into the crypto industry. At that time, simply owning a pair of StepN running shoes felt like holding the golden key to an ideal life, not only exercising the body but also "earning money" with every step. And the astonishing DAU data of hundreds of thousands at its peak gave countless practitioners hope for mass adoption.

For Fiona, StepN was a very "personal" project. She saw the project at a very early stage, but the feedback she received from the reporting team was not positive, so she decided to buy shoes and try running herself. Around the Chinese New Year in January 2022, Fiona discovered that some Degen players were very interested in this running shoe app during a chat with friends. After "exchanging information," she decided to make a big move.

Before long, StepN spread like a virus and became a hot star in GameFi and even the entire crypto world. Many people's impressions of StepN during that period, in addition to Bloomberg's extensive coverage, included news of various VCs, institutional executives, or researchers leaving their jobs to join the StepN team. Fiona was one of them.

Upon joining StepN, Fiona was mainly responsible for PR work, helping the team manage and connect with the community Mod team, as well as contacting and arranging interviews and reports with mainstream media. However, this career experience was not smooth, and soon Fiona felt the gap between idealism and reality. Eventually, her experience working at "Web3 Village of Hope" turned into "living through the days."

In the end, she chose to leave. Shortly after, StepN's governance token GMT price collapsed, and the product and community fell into a death spiral, temporarily extinguishing the great journey of mass adoption. After experiencing StepN for over half a year, the painful lesson Fiona learned was: don't aim too high.

BlockBeats: Why were you so optimistic about StepN at the time?

Fiona: At that time, StepN was so popular in Taiwan that even people of my parents' generation were playing it, and they learned about decentralized wallets and the congestion of the Solana network through this project. Another time, I attended a very non-industry dinner, where there were some news anchors and TV program producers, and they were all using the running shoes to walk and even participating in offline events at Daan Park.

Usually, it's difficult for Web3 projects to reach non-industry groups, but StepN did. Although I was already involved at the time, it made me more convinced that it was a real bridge, connecting Web2 and Web3. I was very excited at the time, so its failure was a big blow to me. I really hoped they could make a difference.

BlockBeats: Does this blow refer to a blow to your optimism about the industry's future prospects?

Fiona: It's not that serious, but I think it could have brought more to the industry, allowing more people to learn about blockchain basics in a subtle way, such as wallets and some network choices, and so on. I think the projects that have done well in this regard, at least for now, are only StepN and Luna (the latter eventually collapsed due to a Ponzi scheme model).

The reason I mentioned Luna is that at the time, many investors and institutions were using their pension funds and mortgaging their houses to invest in Luna (its ecosystem lending protocol Anchor provides a 20% stable coin fixed annual return). At that time, this process actually required some technical barriers, but everyone was willing to learn.

BlockBeats: What were the main problems you encountered in your work at the time?

Fiona: I didn't have much contact at the product level, but as a user, there were constant feedback on product issues. I could clearly feel that the team's focus in the later stages was not on StepN, but on constantly trying new products.

Because I was in charge of Mod, directly interacting with users, there were probably hundreds of shoe-related issues every day. There were many issues with the product updates not being effective, and you know you can hardly solve them, but new issues keep arising, so it's a state of constantly adding without subtracting. At the time, I was very determined to solve the problems, but the decision-making power was completely out of my hands, so I became the "punching bag" in the middle.

BlockBeats: When did you start to feel that StepN was difficult to succeed?

Fiona: I knew it from the beginning. The fundamental problem is actually a death spiral, and xx To Earn does not solve the death spiral. Later, to maintain the stability of the in-game token GST, there needed to be an exponential increase in users, and new users coming in had to To Earn. So I think xx To Earn is a death proposition, or it can't be that everyone is there just to To Earn; the end of this track for all projects will be like this. In the later stages, StepN also made some moves or had some intentions to solve this death spiral, but it was not successful. I think the founder himself was very clear, so by the end, they strategically abandoned the project at a certain point and moved on to the next project.

BlockBeats: Did you eventually sell your shoes and tokens?

Fiona: I did eventually sell them. When you see the situation internally, you know when to cut your losses, but if I hadn't been on the team, I might have held on until the end. It's usually like this because there's too much faith. So after leaving StepN, I told my friends that it was like having a long relationship with a scumbag, not only losing money but also feeling very sad.

I left some shoes for my parents. At first, they would go out walking rain or shine every day because they could earn a few hundred or even a few thousand dollars a day at that time. Later, I asked them if they would still walk if the price dropped, and they said they definitely would. But everyone has a breaking point, and when they couldn't earn a dollar a day, they gave up altogether.

BlockBeast: How do you view this experience with StepN? What experience did you gain?

Fiona: I think it was a very good growth experience with StepN. Because before, as a VC, you invest in projects, and your understanding of the project is just what's on paper, but once you're in the project, you know what's really happening inside the project, what it's really like, including the progress of the product and departmental differentiation, and you can feel the problems that arise. That's when I felt like I was really someone who understood the project.

Also, I think this has been a very useful lesson for me in my life so far, which is never aim too high. This is true for all projects because usually your scope is even larger than that of the project.

This lesson really saved me a lot of money.

"Calendar Book" and "Buying Lottery Tickets," Fiona's Philosophy of Speculation

From entering the circle in 2021 to now, it's been almost three years, and Fiona seems to have had a fulfilling year every year: the first year learning cognition in VC, the second year gaining experience in the project party, and the third year speculating on her own.

After leaving StepN, Fiona planned to take a break, but she couldn't stay idle for more than two months. During this time, despite receiving offers from VCs, she was no longer willing to return to her old job and ultimately decided to speculate full-time on her own. "I've done VC, I understand investments, I've been in the project party, and I know all the good and bad things about it, so I think I can go solo for a while." This move turned her into a powerful KOL with over ten thousand fans.

Choosing Time Over Choosing Tracks

Fiona's first practical operation after leaving StepN at the end of 2022 probably began to emerge in February of the following year. At that time, the massive airdrop of Arbitrum injected a strong liquidity into the market, and the crypto industry experienced a small bull market in the midst of a deep bear market. During this period, the Arbitrum ecosystem showed a trend of explosive growth, with Camelot being the most eye-catching. In the bear market background, it gained a 20-fold increase in less than two months, and Fiona was among the first to discover this opportunity.

In March, Fiona promptly followed up on the inscription opportunity of Ordinals, and in May, as a fan of PEPE memes, she captured the several-fold increase of PEPE. Towards the end of the year, she also seized multiple high-yield trading opportunities such as Atomicals, Ronin, and Multibit. In the eyes of the community, Fiona always seemed to appear at the right time and in the right position. During the early meme trend this year, Fiona was constantly present in her Telegram group, staying up late with her group members to speculate on Dogecoin.

However, recently, Fiona has chosen to "passively lie flat," no longer engaging in high-intensity speculation. In her own words, she "sleeps until naturally waking up, cooks breakfast, checks the market in the afternoon, and sends out tweets." However, this forced lying flat helped Fiona protect her positions to the greatest extent over the past weekend.

BlockBeats: When you first started speculating, did you go through a process of finding your style and logical framework that suits you?

Fiona: Yes, I think this process is particularly important because, except for some genius players, not everyone is suitable for speculating on coins at all times. I am a typical example. I don't actually speculate on coins as frequently as people imagine. I usually only do it during specific time periods when my success rate is very high, and I only make money during that time period, doing other things during the rest of the time.

BlockBeats: When you say "at all times," are you referring to trend points or daily time periods?

Fiona: I'm referring to trend points. For example, a one-sided market, a one-sided rise, a one-sided fall, and a period of oscillation, roughly divided into these three types. This may not be very accurate, and each person may have a different suitable state.

BlockBeats: Was catching the Arbitrum trend at the beginning of last year a good example of how you judge trend points?

Fiona: I have a calendar book where I tell myself which important points are coming up this year and what is expected to happen at those points. So my calendar tells me which projects I am most interested in for the year, along with their approximate timing, and then I might study or position myself two months in advance. I think this is quite helpful for beginners.

I remember hearing news at that time that there would be a coin release on Arbitrum in the first half of the year, and Blur was going to go live, probably in February. So at that time, I only speculated on two tracks. In December, I started to focus on the NFTfi track, and then the Arbitrum ecosystem. So I think I should have benefited from two tracks during that period, one being NFTfi, where everything I bought took off, with BendDAO gaining fourfold, among others, because the bear market had limited hotspots. The other was Arbitrum, where everything I bought had very high multiples, and Camelot was even more exaggerated.

BlockBeats: Did you use this method to judge the initial trend at the beginning of last year? At that stage, many people were still denying the arrival of a bull market, but you seized the opportunity with Ronin.

Fiona: I think the trading volume is different, and you can clearly feel the change in Bitcoin's trading volume from $25,000 to $32,000. I think it's completely different, so at that time, I was very sure there was a new market. Because if there is a phenomenal market in this industry, there must be a large influx of funds. So what made me very confident at that time was the trading volume. I only rushed in with half of my position at the time, and then added more as it rose, eventually going all in.

I had actually been paying attention to Ronin for a long time because I had been involved with Axie Infinity for a long time, so I was very attentive to all their developments. I think there was a point when I decided to buy Ronin. At that time, the market value of IMX exceeded that of RON, and I thought RON was really cost-effective, and they were doing so well. Because I had been playing Pixel for a long time, I felt I had to go all in on Ronin. At that time, I had a good friend named Mori, who was also in the gaming track, and we both agreed that RON was really cheap, so I thought it was a good secondary position to buy RON, and I bought a relatively large amount.

BlockBeats: In addition to the calendar book, do you have your own judgment on different tracks? What methodology do you use to find projects within the track?

Fiona: I still guess at the big ecosystem level, but I actually think the accuracy of blind guessing is not as high as the feedback from the calendar book.

When it comes to finding projects, there are some basic but very useful ranking and data websites that I think everyone should consider. For example, DefiLlama, where you can see changes in certain values, such as the TVL and trading volume of a certain ecosystem or project in the last 7 days, which can help you sort through projects.

Also, I think you should always try new things. I remember in March last year, I saw that NFTs were being minted on Bitcoin at the time, and although Ordinals didn't take off, I bought in early, and even though I later sold for a profit, I felt I had already done well in that wave.

BlockBeats: So, when speculating on coins, it's important not to have biases.

Fiona: Yes. I'm a person who doesn't have biases, I play everything, I don't have the biases of an old hand, and I think you should never become an old hand, as the industry will lose its appeal to you.

So I think you should keep a very open mind about very new things, such as minting NFTs on Bitcoin, which sounds pretty cool. This kind of early-stage inclination, especially in a completely new track, you actually risk very little money. You just use the money you would spend on a lottery ticket, but the return on investment is beyond expectations.

BlockBeats: Sometimes people may confuse experience with bias, saying it's experience, but sometimes it's actually bias.

Fiona: Yes, but I think experience and bias should be used in different places, and the most important thing is the timing of your sales.

I have an indicator because I'm suitable for a one-sided market, whether it's a one-sided rise or a one-sided fall. If I lose money twice in a row during my aggressive buying process, I stop. I would think that either there's a problem at this stage, or I have a problem, but in any case, it's not a market where I make money. So I've been resting recently because I lost money twice in a row during the meme rush, which for me is a signal, and then I stop.

The other day, I said the market was "dehydrated" on Twitter because I could clearly feel that the liquidity of altcoins was very poor. So my "dehydration" means that if you're not good at trading, you should choose to return to your defensive positions, such as Bitcoin and Solana. So I sold some altcoins and added more to these main positions.

BlockBeats: How do you judge the quality of liquidity? What are the indicators?

Fiona: You can try selling and see for yourself, it's quite obvious. Sometimes you can drop a few points even if you sell $50,000, which means it's quite poor, indicating that market makers are fighting each other. Or you can look at the order book, these are quite obvious, you'll get a feel after trading more. Another thing is, I think when it can't go up, you have to come down. I think it's very difficult to maintain a relatively high price curve, but I think the bull market definitely hasn't ended, it's just that the money in the future may not be as easy to make as it was in the past.

"Fading Bag" and "Buying Lottery Tickets"

In addition to judging and choosing the right timing, Fiona also has some interesting "jungle tactics."

Last November, Fiona tweeted that she was preparing to use an initial capital of $50,000 to explore some non-mainstream ecological projects in the market. She referred to this capital as the "Fading Bag," meaning the "disappearing position." With a mindset of potentially losing it all, Fiona bought tokens of projects such as RON, KUJI, and ZEN, occasionally disclosing updates on her positions. In the most recent update, the Fading Bag's position had exceeded $200,000.

Another tactic that Fiona and her community enjoy is the "buying lottery tickets" strategy. Although it's difficult to integrate into her overall position management, Fiona still joins the community in speculating on meme coins or Dogecoin late at night and early in the morning. Her Twitter feed often features various tweets about "10x" or "20x" gains, but with token names that are unfamiliar to those who have just started following Fiona, which can easily cause some anxiety.

BlockBeats: Where did the idea for the Fading Bag come from?

Fiona: My friend Woody from Taiwan (a well-known crypto KOL in Taiwan) told me that during the bear-to-bull transition, someone managed a "small fund" of tens of thousands of dollars, which later grew to $2 million during the bull market. At that time, I was watching the live trading of Chu Mu (a well-known KOL), and I thought that kind of live trading doesn't have much relevance for ordinary people because the pace is too fast, and some people can't keep up, or can't handle that volatility. So at that time, I thought, why don't I do something similar, like live trading, but maybe with a longer cycle, and that's how I came up with this idea.

BlockBeats: What is the logic behind managing this Fading Bag?

Fiona: I think it's about buying some early-stage projects that don't have the certainty of projects like Solana or Ethereum, but in my opinion, they have a lot of potential, perhaps finding projects like Camelot. The most successful projects I've found so far are probably RON and MUBI. They actually had quite a high multiple, but I didn't sell them very well.

BlockBeats: You also have an interesting strategy of "lottery ticket positions." But for you, are these positions too small, and why spend time speculating on lottery tickets?

Fiona: I think it's a good way to diversify my focus because I don't want to adjust my large positions frequently. By that time, I had basically finished buying my large positions, and I never touched my Solana position from start to finish, so the small positions should be used for "jungle" play, meaning you should feel like you're doing something.

Because I was in a state of excessive excitement at that time, I couldn't stop, but I didn't want to move my Solana position every day, which didn't make sense either. I actually like speculating on Dogecoin because I think it's a part of the community culture, a part of the crypto culture. It's not about the money anymore, it's about participation, and the adrenaline rush from the feeling of doubling a small multiple is actually very high.

BlockBeats: What was your daily routine during that time?

Fiona: I used to wake up at four or five in the morning to speculate on Dogecoin, then sell, and maybe go back to sleep around eight or nine, then wake up at noon for lunch. In the afternoon, I would go to a café to speculate on coins until the evening, and if I didn't feel like sleeping at night, I would speculate on Dogecoin again, maybe until one or two in the morning, and then wake up at five the next morning to speculate on Dogecoin again. Now I sleep for nine to ten hours a day, but during that time, I only slept for three to four hours a day, and the state of mind and the amount of sleep needed were completely different.

BlockBeats: During that time, your reaction to news was also very quick, especially the concept of "Musk AI" with GROK.

Fiona: I actually wanted to buy more (GROK), but because I saw that Musk had tweeted and the price hadn't gone up all day, I was a bit surprised. At that time, because I was speculating on memes around the clock, I was constantly checking the Dexscreener rankings, and that's when I saw GROK come out. I thought Musk's theme was very effective, and since Musk had just promoted this AI, he would definitely keep tweeting about it, which would bring continuous traffic, so I couldn't understand why people hadn't noticed or bought it, so I actually bought too little.

BlockBeats: In the recent meme frenzy, did you seize any opportunities?

Fiona: I caught my favorite, PEPE, and made a secondary gain. Actually, I bought many of the meme coins that are now listed on Binance in this round, but I sold them, so I've been quite upset recently. For example, Myro, I posted in the group when it had a market value of $1 million, and happily left when it reached $10 million, so I've been quite frustrated recently. There's also WIF, which seems to have been sold too early from today's perspective, but at that time, it didn't seem much different.

KOL Dividend

For Fiona, becoming a KOL was actually accidental. When she first left StepN, her Twitter had only about a hundred followers, half of whom were friends she knew, and she had no idea how to become a KOL. Later, Fiona posted a tweet related to Korean crypto regulation, which was retweeted by her friend Jeromeloo (a well-known KOL in the Chinese community), and she gained over 300 followers in one go, which led her to give it a try. Eventually, Fiona discovered that being a KOL not only monetizes traffic but also helps her find and seize early opportunities.

BlockBeats: How did you catch the trend of Metis at that time?

Fiona: At that time, they started doing a lot of marketing. Because I have a friend doing PR and marketing in Korea, she had a deal with Metis, and at that time, METIS was around $20. She shared this information with me. I actually think that being a KOL now has a good point, which is that if there is a large-scale marketing campaign, you can know about those news, which means the team really has something to launch, either to pump the price or to launch a new product, usually a combination of both.

Another thing I think is important to pay attention to in the Metis ecosystem is that they launched a very large ecological fund, which made me think it's very similar to the ecological fund before the explosive rise of Avalanche. So at that time, I bought METIS and tokens from the Metis ecosystem, but in the end, METIS did well, but its ecosystem tokens lagged behind a bit.

BlockBeats: There has been a lot of discussion in the community about the "KOL cycle" recently, and it seems that being a KOL does have many dividends.

Fiona: That's true, but recently I also feel a bit lacking because being in the KOL cycle still requires work. You have to help the team release things, which is actually like having some work-related involvement, so I can't fully immerse myself in it like before.

BlockBeats: How many KOLs does your PR company currently work with?

Fiona: There are about 37 KOLs in the Chinese community because I don't want to work with a large number, I want to provide real value. There are more in the Korean community, probably over 200. Currently, these two languages are the main focus, and there may be some other languages in the future, but it's still too early.

BlockBeats: How do you expand the market for overseas KOLs?

Fiona: I always find local friends, and this is something that is very easy to make mistakes in. Sometimes you don't even understand the language, and you don't have that much time. So I have a good friend who is a top KOL in Korea, and he introduces reliable agencies and his own PR company, so these two parts make up the composition of our Korean market.

More Than All In

If you have been following Fiona's Twitter, you will find that her trading and life are not separate, but rather integrated in a somewhat excessively perfect way. In addition to sharing the logic and opportunities of trading, most of Fiona's highest traffic tweets are actually her delicate sharing of her life as a trader: if she burns the food while trading, she will take a picture and tweet about it; if she has a meal with KOL friends, she will take a photo and tweet about it; if she faints from staying up late to trade and wakes up in the hospital, she still wants to tweet about it. Whether it's trading stocks, buying a house, or any other opportunity or insight shared on Twitter, it's almost always an experience she has summarized from her actual life. In her past tweets, there is often a traceable path, and if summarized in one word, it's down-to-earth.

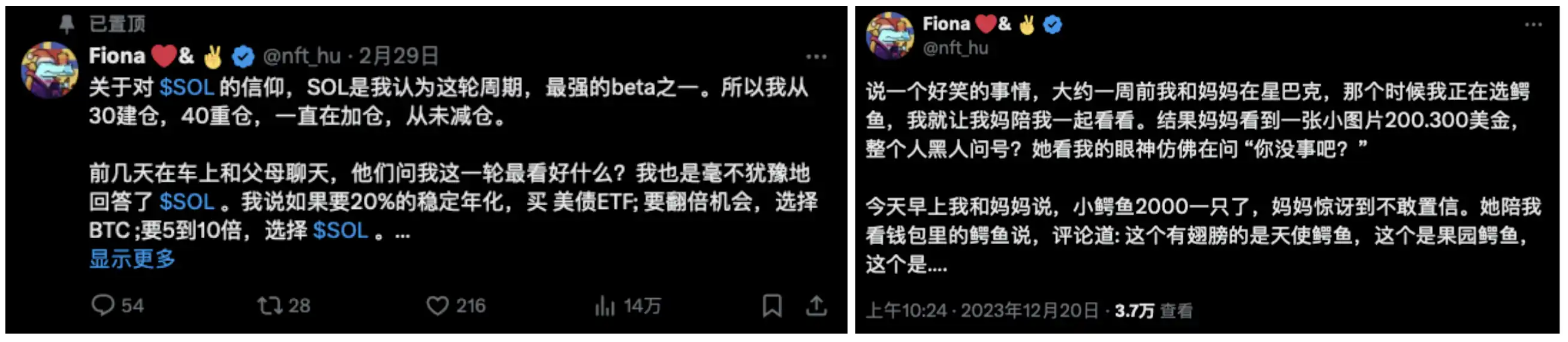

Of course, what fans are most excited about is her process of "preaching" to her parents, especially the tweet about how Fiona convinced her parents to buy SOL, which has now reached 140,000 views.

Fiona's parents have known for a long time that she trades cryptocurrencies, but their perspective on the matter was completely different at the time. In the early years, the news media had mostly negative reports about the blockchain industry, but after Fiona started working in the crypto industry and making money, they may have had a different view of the industry. Fiona's parents had some basic knowledge of cryptocurrencies since the StepN era, "because they were making money every day in the early days, so I think they have a relatively open attitude towards crypto." Later, whether it's position management, investment logic, or the selection of NFT images, Fiona can talk to her parents about these topics, which is quite "rare" among traders.

At the end of last year, Fiona persuaded her parents to "casually buy" Ethereum near $1,000 and Bitcoin near $25,000, making them some of the best buyers in this bull market. She herself feels that there are too many irresponsible bank wealth management products nowadays, and her parents don't have the energy to manage their money, so someone should help them buy and hold. "They are quite happy now, just watching the price movements of Bitcoin and Solana every day," Fiona said. "Compared to being scammed, it's better for my parents' money to be in Bitcoin."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。