Author: Layergg

Translated by: TechFlow

Meme is becoming an alternative to "VC, CEX, and high FDV" in this crypto cycle. Community-driven and fair distribution have captured the hearts of retail investors and are beginning to exert influence in the actual bidding phase.

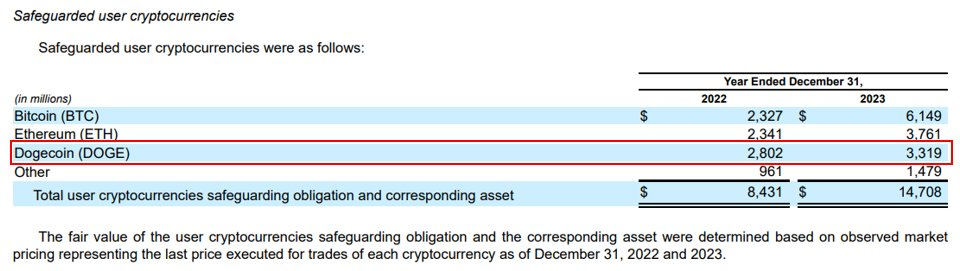

This year, high market value Memes have performed well, maintaining strong returns even during market adjustments. Now, Meme has become a mainstream asset class, as evidenced by the holdings of Robinhood users.

One thing to consider is that global asset management companies are just beginning to enter the cryptocurrency space.

I believe that senior professionals on Wall Street are unlikely to become the exit liquidity for crypto venture capital firms. They are likely to disrupt the status quo, and Meme is expected to be one of the tools they use to achieve this goal.

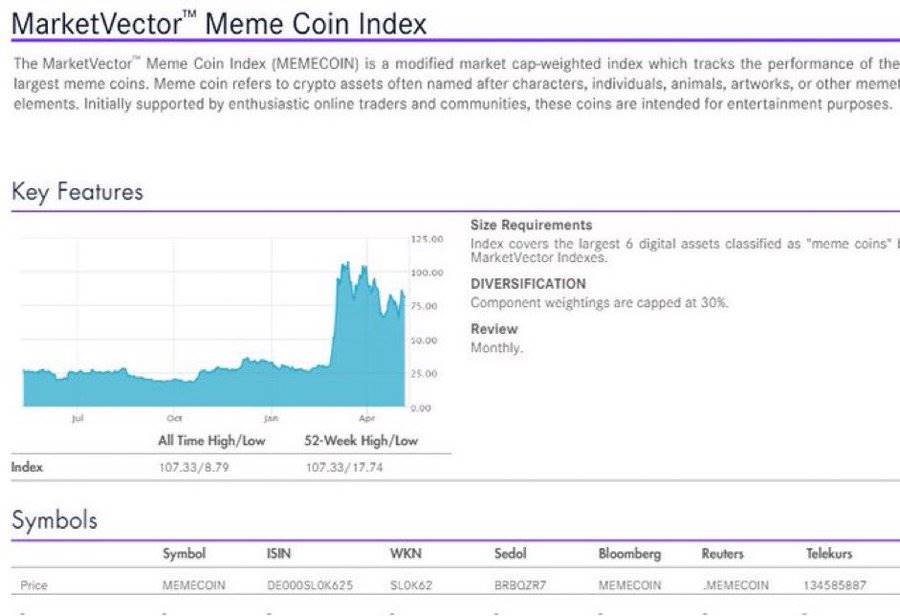

Two prominent examples are Franklin Templeton and VanEck.

a) VanEck's MarketVector recently launched the Meme index.

b) Franklin Templeton continues to publish articles about Meme. An interesting case is Franklin Templeton's promotion of $WIF.

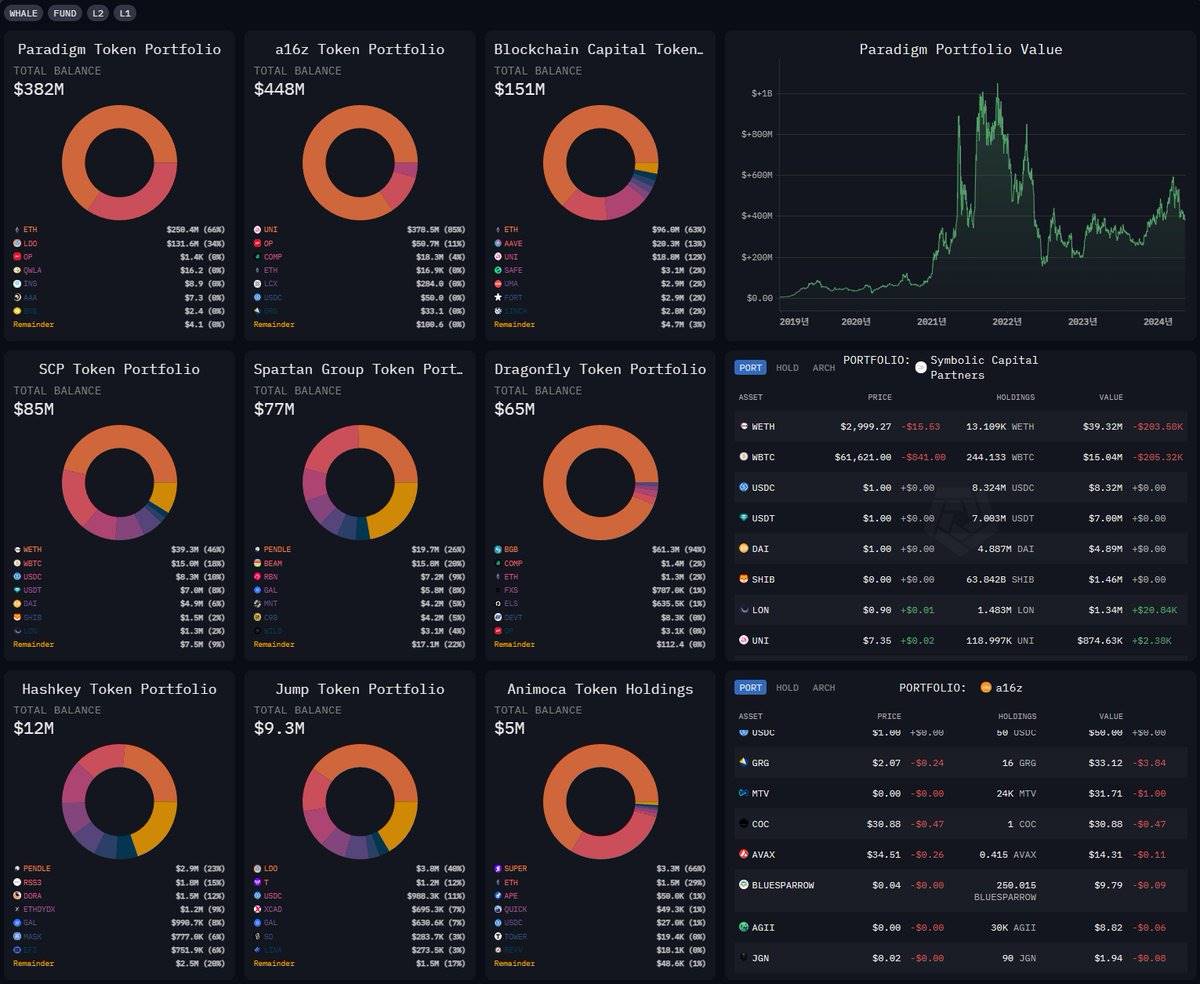

Surprisingly, traditional crypto venture capital is still slow to accept Meme. Major Memes like $WIF and $PEPE are not found in the portfolios of top venture capital firms. If they eventually succumb and decide to invest in Meme, this may mark the beginning of the second wave of the Meme cycle.

Perhaps the upcoming U.S. presidential election will force venture capitalists to make painful decisions quickly (whether to include Meme in their portfolios).

While it is still uncertain who will win, Trump or Biden, every related event seems to favor the momentum of Meme.

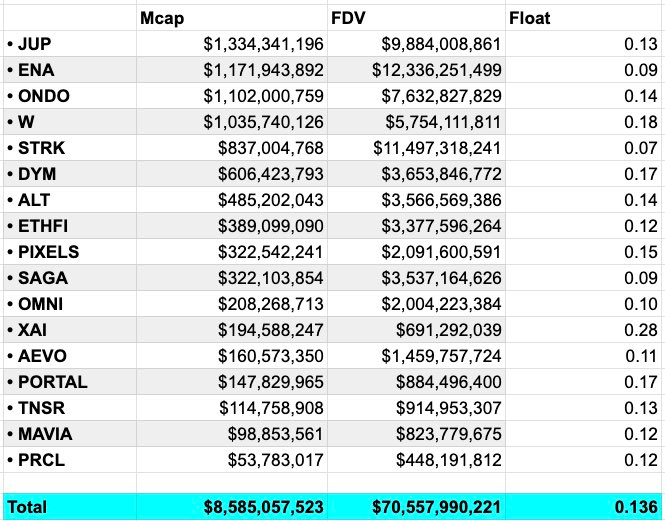

Most importantly, retail investors are disappointed with "low circulation, high market value" projects. Venture capitalists advocate "serious/fundamentals," but the market response remains tepid. In this situation, hedge funds and market makers face pressure to generate returns within a specified time frame.

"Is the Meme over?"

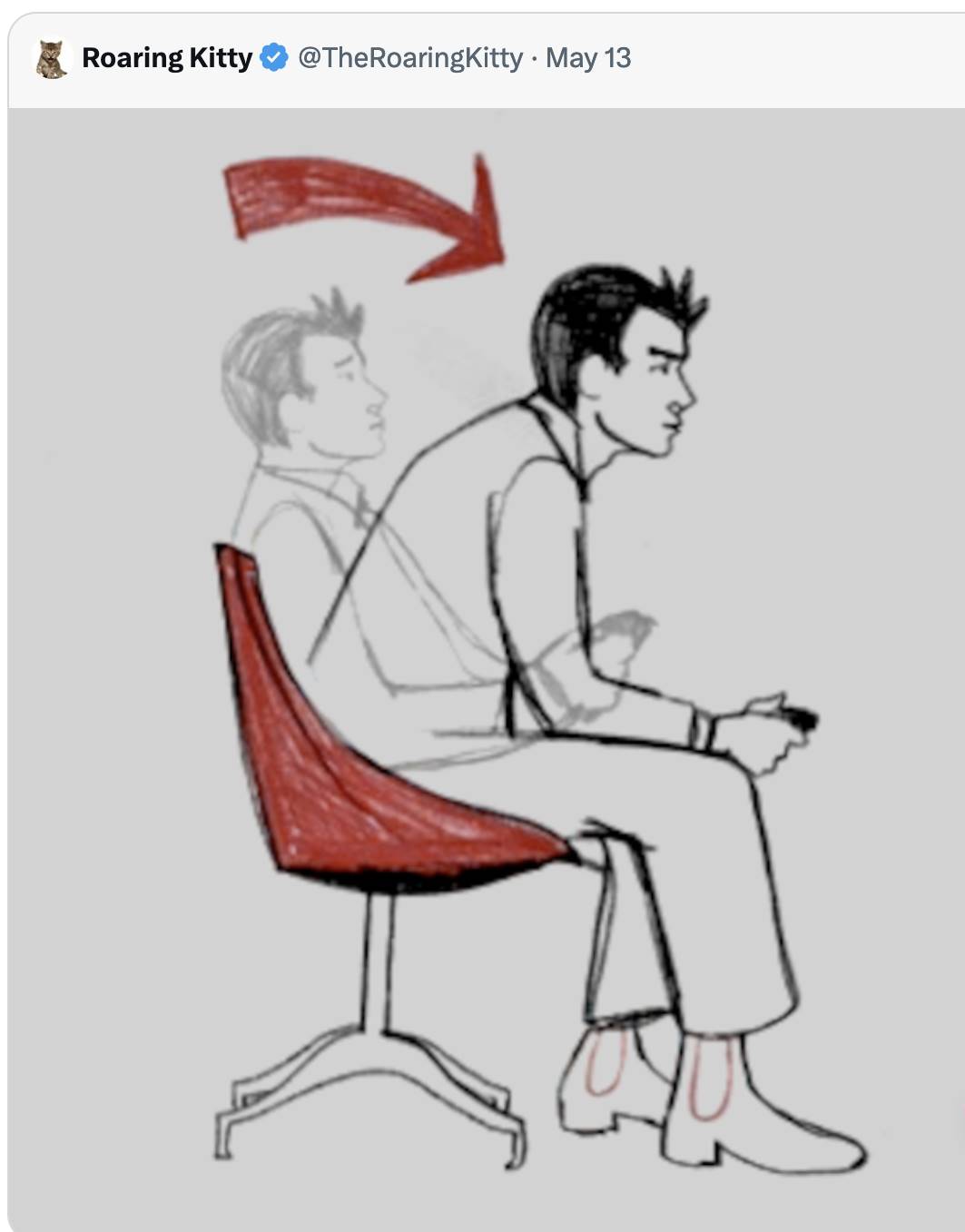

Today, Roaring Kitty, famous for $GME, made his first post in three years. His return likely heralds the beginning of the second wave of the Meme cycle.

Do not underestimate his influence.

From a technical analysis perspective, most major Memes are still in the retesting phase. Some important Memes (such as $PEPE and $WIF) are expected to enter the top 20 soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。