From a long-term perspective, comparing TON with BNB, which has a market value of 9 billion US dollars, is a reasonable and realistic goal.

Article: Potato's Thoughts

Compiled by: Deep Tide TechFlow

Compared to some old players, I have been involved in DeFi/cryptocurrency for a relatively short time, perhaps close to two years. During this time, due to the volatility of the DeFi and the broader cryptocurrency market, I feel like I have aged 50 years, but I feel that I have seen everything. Disorder, gambling, leverage, competition and dissatisfaction with opponents on the rise, as well as devastating setbacks, liquidation, malicious gloating, and ruthless rug pull/exploitation on the way down. That's why I think I am very suitable for publishing this traditional financial style memo, discussing a cryptocurrency that may interest some fund managers and also attract retail investors who just want to make a big splash. I hope to continue to create more articles like this and conduct some independent exploratory digital analysis, as long as

1) The crypto substitute market remains interesting, more importantly:

2) If I notice disproportionate coverage of a specific project/gameplay on Twitter, as it did for TON and its ecosystem.

Cryptocurrency: the wild west of the financial market. The risk is too high not to participate.

This article will focus on TON - Open Network, essentially a summary of the essence of the blockchain project from various sources, covering the project's history, current supply and demand dynamics, unique token economics, and some of my own views. This memo was written on April 29th, just a week before Pantera's headline news of purchasing locked TON tokens at an undisclosed price, marking their largest investment. Although this development does indeed mark the investment as no longer "undervalued" to some extent, all analyses have not changed due to this development.

Content Summary

TON is a proof-of-stake blockchain indirectly supported by the TON Foundation. It achieves horizontal scalability through a architecture called infinite sharding, and has achieved a performance of over 100k tps in the test environment (compared to Solana's 60k). Considering the following points, we believe that the native token on this chain is currently undervalued.

Concentrated supply and the scarcity value of being relatively less owned L1

Clear market entry strategy and excellent distribution channels

Given the current key performance indicators (KPI), there is a lot of new growth space

Specific crypto-specific catalytic factors

TON Overview

TON History

TON was initially known as the Telegram Open Network, with its origins dating back to 2018, when Telegram's founding brothers Pavel and Nikolai Durov began exploring blockchain solutions for the Telegram Messenger. In that year, they raised a total of $1.7 billion in the first public offering (ICO) of TON tokens, followed by the release of the TON white paper and the launch of the first TON test network in the spring of 2019. After a series of regulatory challenges, it was finally sued by the SEC in October 2019 for conducting an unregistered securities offering, and Telegram agreed to refund its investors' funds and paid a $18.5 million settlement fine in May 2020.

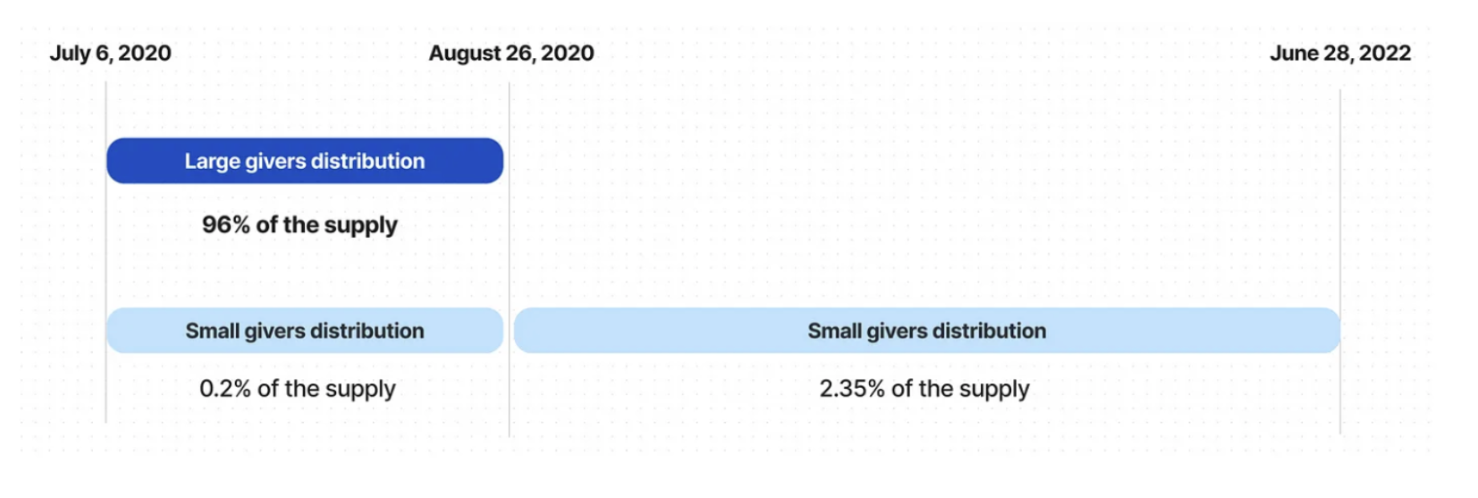

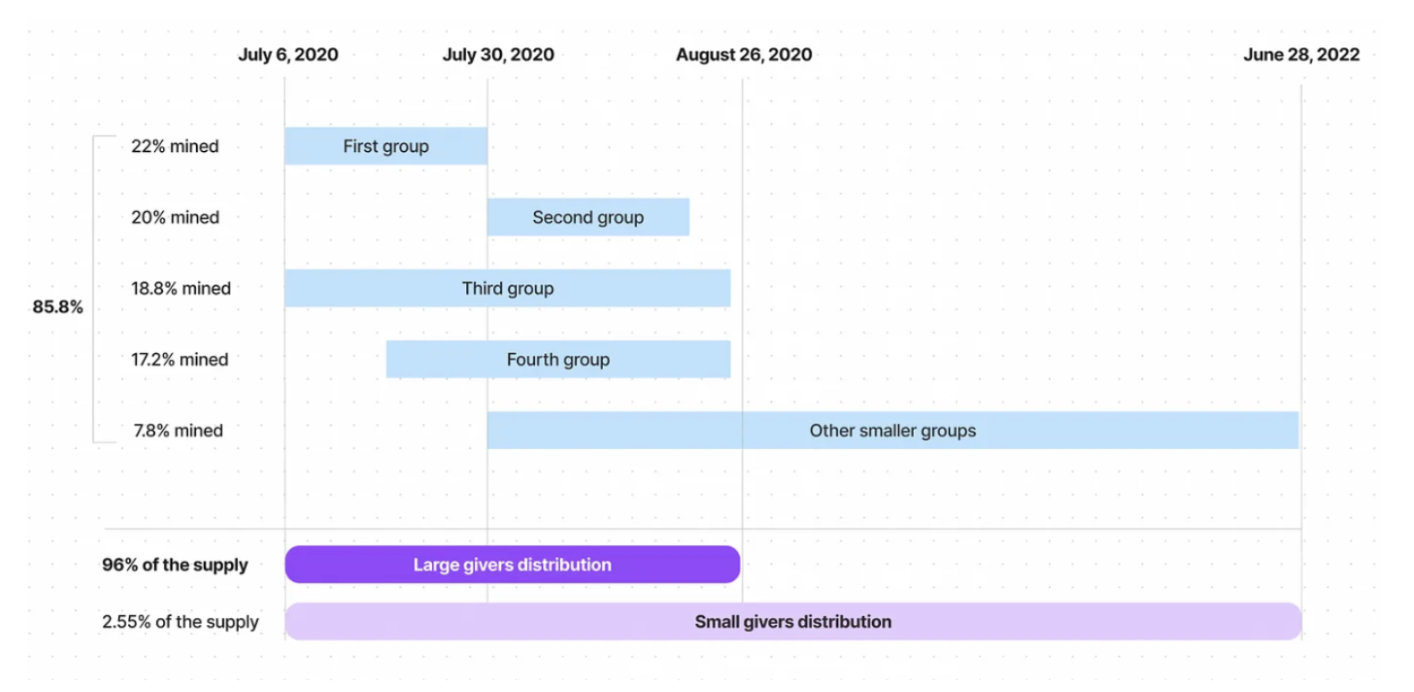

Although the Telegram team ostensibly stopped on-chain development, a new group of developers gathered around the project under the name NewTON (later renamed TON Foundation) and continued to develop seriously, focusing on being faithful to the design principles set out in the white paper, the "blockchain of blockchains" structure. At the same time, starting in 2020, all available TON coins could be mined through the "Giver" smart contract using a proof-of-work (PoW) system, and CPU mining continued from 2020 to 2022. We note that while this distribution method was intended to promote decentralization and increase fairness, research clearly shows that the majority of the supply was mined by insiders or TON Foundation-related addresses within 2 months (July to August 2020), with 248 closely related addresses mining 85% of the coins.

Token distribution by giver smart contract type

Large mining groups divided by mining duration

The TON Foundation has played a crucial role in influencing the price of TON tokens to date, which is essential for the success of the project. Since its inception, its funds have mainly come from grants obtained from the initial mining efforts and recent locked over-the-counter (OTC) sales to professional investors. To strengthen its strategic direction, the TON Foundation announced a partnership with Telegram in September 2023, led by the core team guided by Anatoliy Makosov. This collaboration marks a key step in the continued development of TON and its positioning in the broader crypto space, reinforcing the bullish case for TON, providing a coherent, central driving force that effectively influences and boosts the token price.

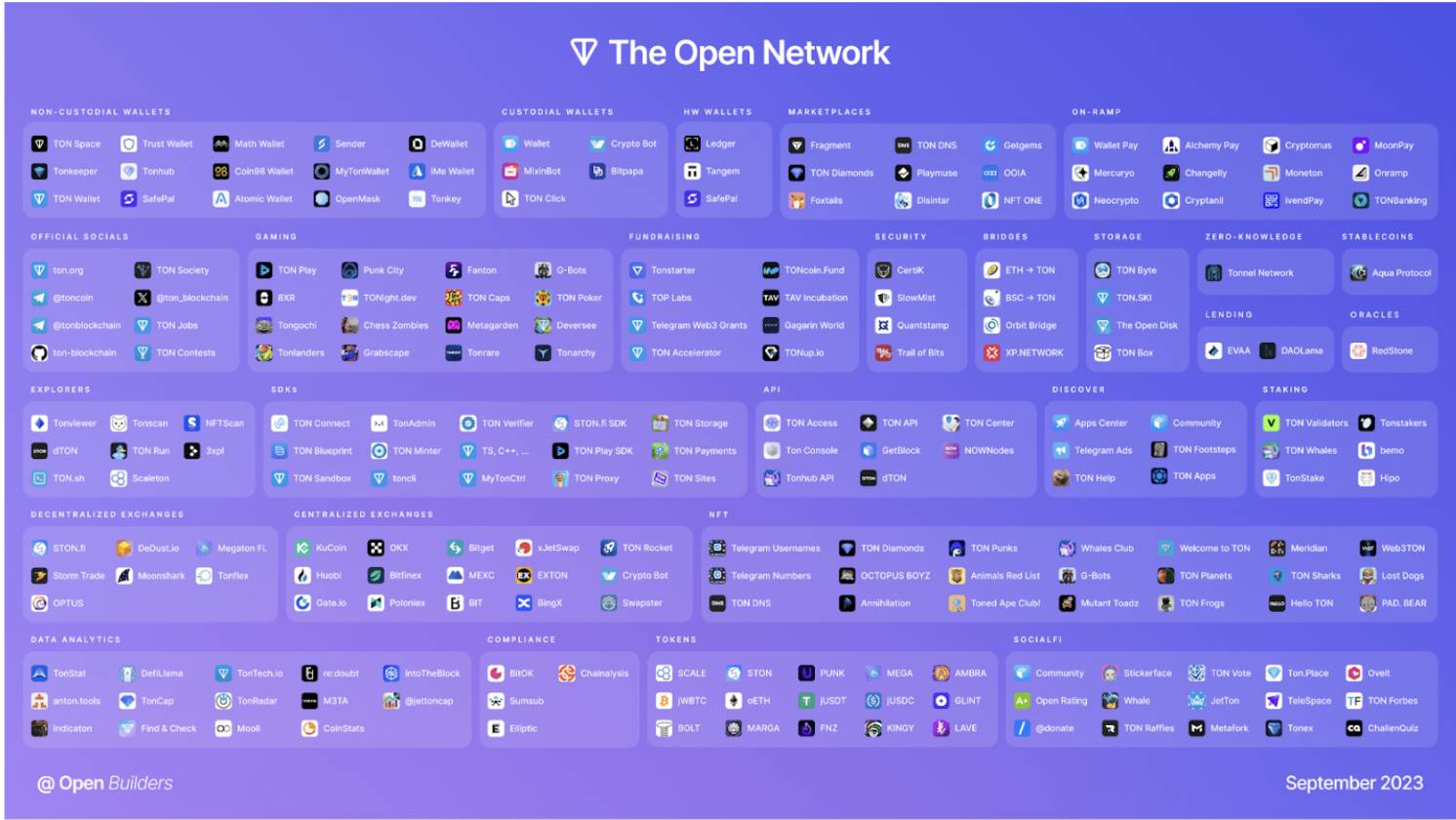

Current TON Ecosystem

TON currently consists of four main components: TON Blockchain, TON Payments, TON Proxy, and TON Storage (decentralized storage). The TON blockchain is a general-purpose blockchain containing a standard execution layer that allows permissionless transactions. TON Payments is a low-cost micro-payment platform that allows instant, fast payments between users. It is currently accessible through the @wallet bot on Telegram, benefiting from in-app convenience. TON Storage allows for the storage and distribution of files on TON, similar to a decentralized Dropbox. Finally, TON Proxy ensures censorship resistance by allowing users to run .ton websites independent of fixed IP/centralized domains. These four components have a rich roadmap to ensure future cross-compatibility and connectivity.

Due to the joint and coordinated efforts of the TON Foundation, Telegram, and their partners, the on-chain ecosystem has experienced explosive growth in recent weeks. Most notably, in April, we saw Tether announce direct integration into TON, allowing for local minting and redemption, which opens up possibilities for deep decentralized exchange (DEX) liquidity and further capital inflows. The TON Foundation is also running various liquidity mining incentives, including approximately 11 million TON (about $50 million) reserved for DeFi liquidity providers. In addition to specific incentives for DeFi, the foundation is also running a broader on-chain incentive program, totaling over 30 million TON. As a result, the total locked value (TVL) of TON in terms of pricing exploded to 30 million in April 2024, six times higher than at the beginning of the year. We note that DeFi TVL is usually quite opportunistic, and once the rewards end in June 2024, some capital may be lost.

Significant growth in DeFi TVL since the announcement of self-incentives

Significant growth in DeFi TVL since the announcement of self-incentives

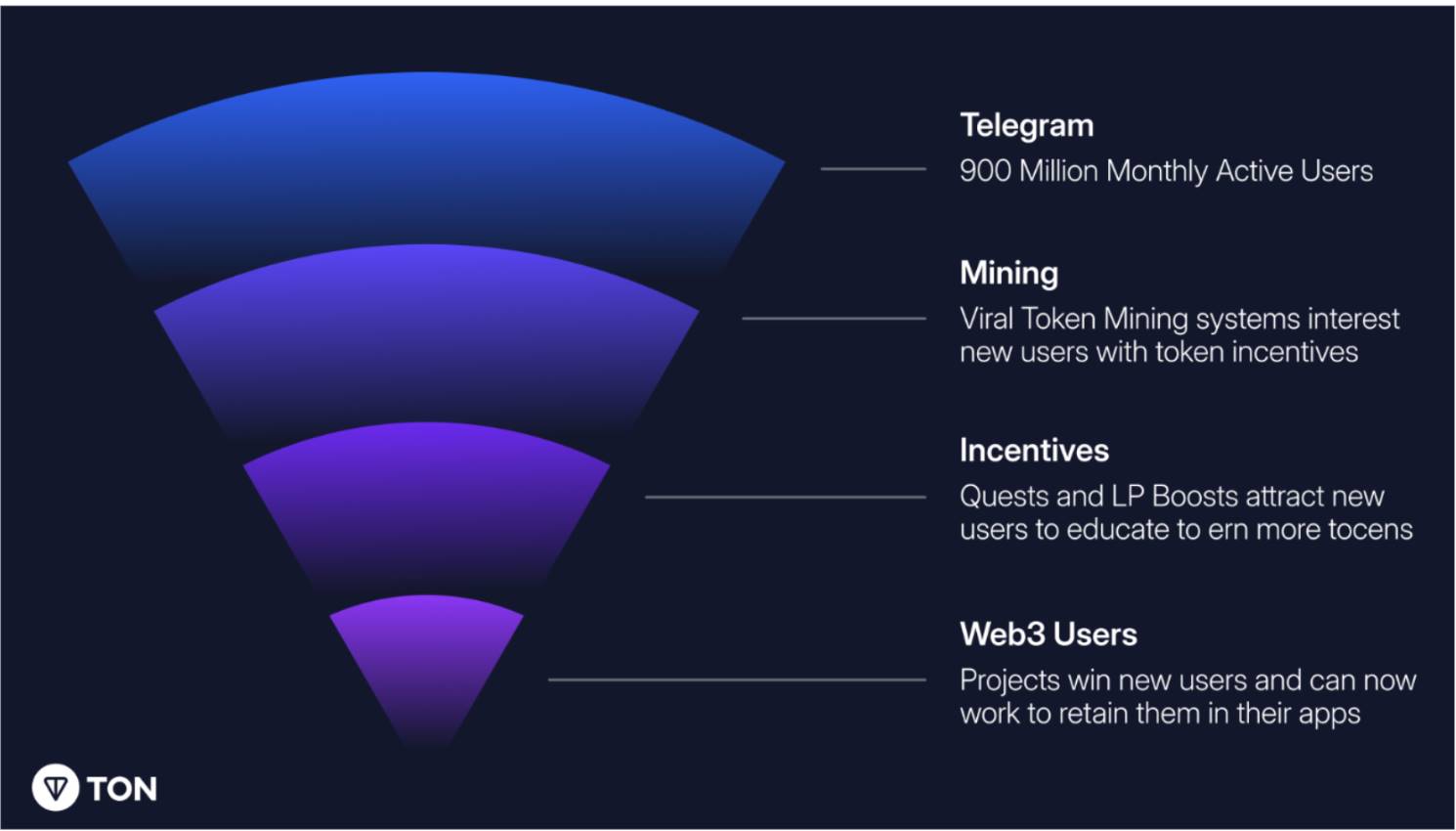

Dedust and StonFi represent the largest share of TVL on TON (>90%)

Given that DeFi liquidity mining is ultimately a solved game and has seen multiple iterations in other alt-L1s in the past, we believe the true value of these incentives lies in Telegram's ability to incentivize app users to interact with TON in other, more correct and more segmented market ways. The current incentive plan rewards projects that attract users through viral gaming mechanisms such as NotCoin (a simple but addictive click-based app with over 3.5 million daily active users). These incentives are followed by rewards for completing in-app tasks (such as minting NFTs and DNS names), and finally liquidity mining for the largest decentralized exchange (DEX) on TON. The ultimate goal here is to gradually introduce and familiarize Telegram's fixed user base with the on-chain "workflow" using TON's existing distribution channels.

The goal of the Open League Incentive program is to attract and maintain a sticky on-chain TON user base

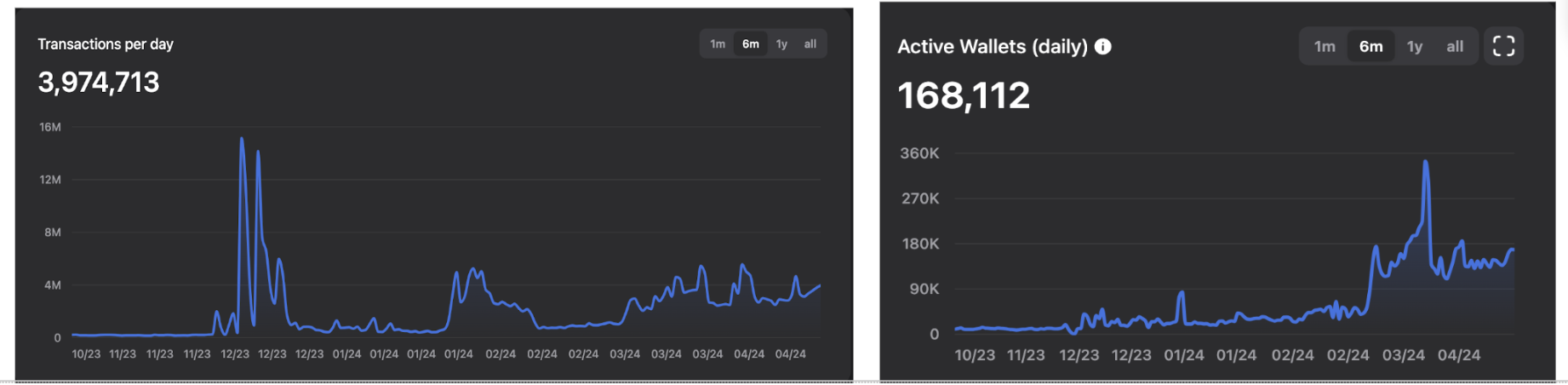

With the push of TON's incentive mechanism, blockchain activity has seen significant growth across various metrics.

10x increase in trading volume: Since March 2024, the trading volume has increased from 200,000 transactions per day to 2-4 million transactions per day.

3.6x increase in on-chain active wallets: The number of active addresses increased from 600,000 in January 2024 to 3.5 million by the end of April.

Daily Active Wallets (DAWs) grown to six figures: DAWs are now approximately 160,000, a significant increase from 30,000 at the beginning of the year.

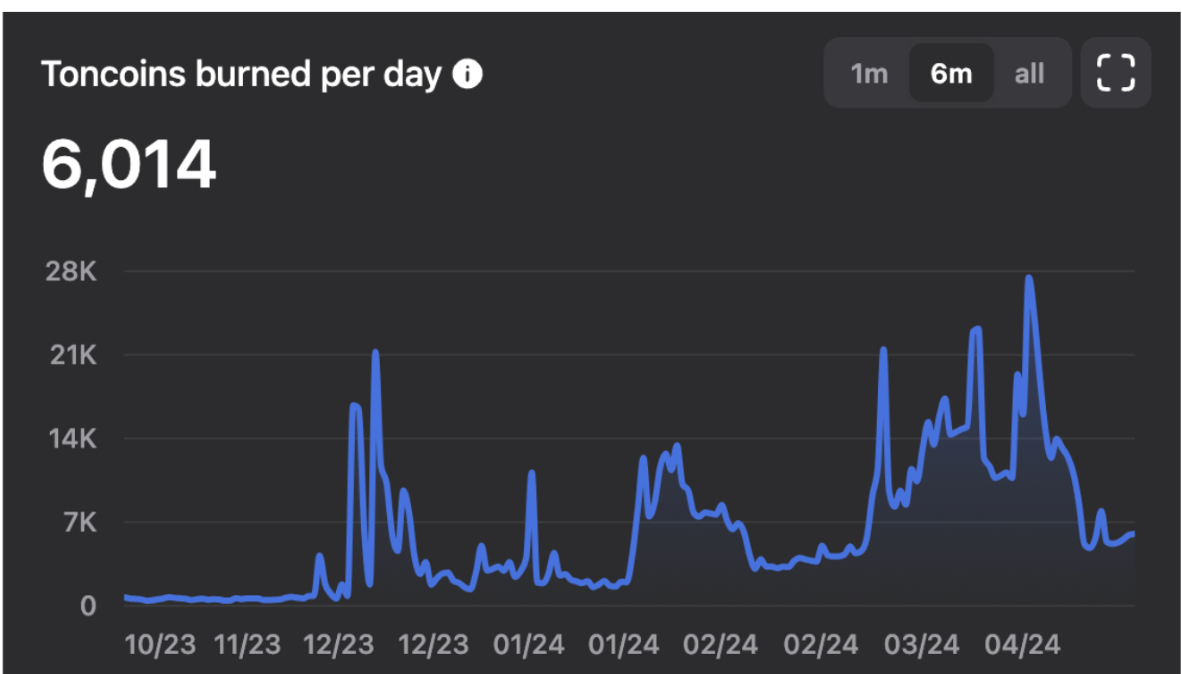

TON daily fees between $50,000 and $250,000: Half of the TON fees are burned.

Although these increased numbers may be symptoms of non-organic and non-sticky on-chain participation, the rapid growth and activity of the ecosystem are significant compared to historically smaller incentive programs (e.g., compared to the $180 million plan with Avax). Whether the ecosystem can sustain this level of activity and total locked value (TVL) after the incentive period should be continuously monitored.

Thriving TON ecosystem

Overview of TON Token Economics

The basic argument of the article is that TON has healthy token economic characteristics. Despite the relatively high valuation, with a fully diluted valuation (FDV) of $24 billion and a circulating market value of $16 billion, the TON Foundation and its affiliates tightly control a large supply, the network has a low inflation rate, and there is a systematic over-the-counter sales mechanism to allocate supply to investors, all of which are positive factors.

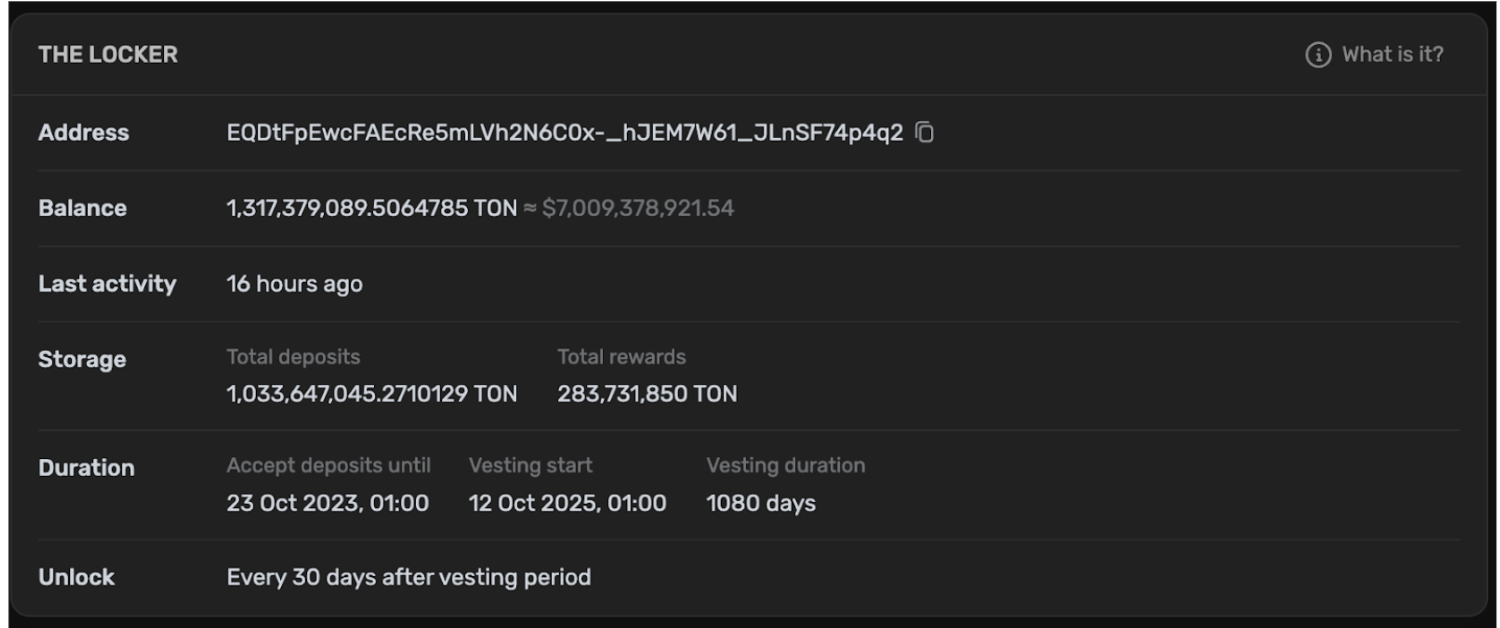

The current total supply is 5,107,343,180 tokens (50 billion at issuance), with an initial distribution ratio of 85% of tokens allocated to users and 5% to validators. The chain's inflation rate is 0.6% per year, with rewards paid to validators to maintain consensus. Looking deeper, we note that about 1.3 billion tokens are locked in a smart contract called the "Believers Fund," with over 20% of TON supply locked until October 12, 2025, with monthly unlocks thereafter for three years. The total includes about 1 billion TON locked by users and 284 million TON used for rewards.

Locker smart contract on TON

In addition to the Locker contract, the TON Foundation has also deactivated about 1.1 billion TON held in large early miner wallets that have had no outgoing transactions for 48 months. The result of these two measures is that approximately 47% (24 billion tokens) of TON supply will disappear from circulation in the foreseeable future. Therefore, the effective circulating market value is approximately $8.5 billion.

On the other hand, it is difficult to accurately assess the dollar value of the locked OTC coins sold, but according to public statements, at least $30 million worth of tokens have been sold to risk and professional investors:

MEXC Ventures made a "seven-figure" investment in TON in October 2023.

Animoca Brands became the largest validator on the TON network in November 2023.

Mirana Ventures supported TON tokens with $8 million in March 2024.

While TON is still in its early stages of adoption, the narrative of value accumulation is relatively weak. However, with the continued growth in on-chain activity and the mechanism of burning 50% of TON fees, this situation should improve. A fee burning mechanism similar to EIP-1559 on TON has already been launched.

Fee burning mechanism similar to EIP-1559 on TON

More importantly, Telegram is actively developing practical uses for the TON token to enhance its value as a "token of utility." For example, Telegram recently announced that it will exclusively use TON tokens for advertising payments. In this setup, advertisers use TON to fund their marketing campaigns, with revenue split evenly between Telegram and content creators. Additionally, Telegram has started accepting TON for payment of Telegram Premium, a service provided through Fragment Store with currently 5 million subscribers. These initiatives demonstrate deliberate efforts by the Telegram team to ensure that TON is a token with practical utility and a clear value accumulation mechanism.

Reasons to Invest in TON

Concentrated Supply and Undervalued L1

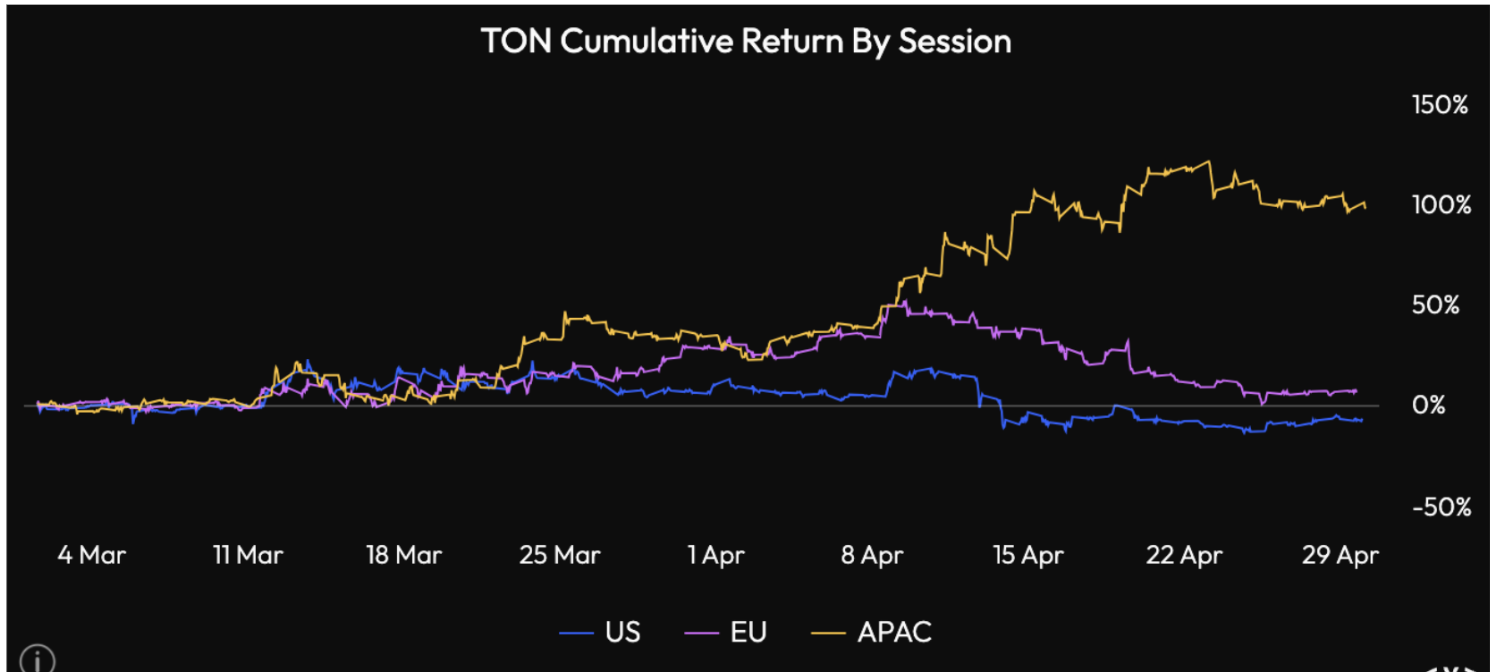

With a moderate annual inflation rate of 0.6% (lower than Bitcoin), relatively low mid-term liquidity, and approximately 50% of the supply locked in the Believers Fund and inactive miner wallets, as well as approximately 86% of mined coins controlled or at least associated with the TON Foundation, the coin is tightly controlled. Additionally, most of the attention and locked OTC coin investments have been made by Asian participants, indicating a disadvantage for EU/US participants. The significant increase in the past two months has been primarily driven by Asia.

Significant increase in the past two months primarily driven by Asia

From a technical perspective, the current trading price of the coin is 2-3 times higher than the early 2023 and 2023 low points. The increase is relatively moderate compared to similar products such as SOL, AVAX, and NEAR, making the downside risk more apparent.

Clear Market Entry Strategy and Long-Term Vision

The grand vision of building Web3 super apps directly from mobile convenience has the potential to compete with WeChat. This marks a fundamental shift from the current state of many crypto blockchains and DApps, which are essentially a smaller total addressable market (TAM) of speculators and tech elites, and should therefore receive lower valuations. Tether provides flexible support through its integration announcement, and is actually supported by Telegram through its strong roadmap on the TON blockchain, TON proxy, TON payments, and TON storage.

New Growth Opportunities

Given that there are currently about 3.5 million online active wallets, and Telegram's monthly active users are 800 million, expected to reach 1.5 billion in the next five years, this represents a substantial and natural Total Addressable Market (TAM) ceiling. The TON Foundation strategically aims to attract 30% of Telegram's monthly active users in the next 3-5 years. If Telegram can convert at least 0.2% of its 200 million daily active users, its daily active user count will exceed Ethereum's current approximately 400,000. This is clearly a huge opportunity for user base expansion.

Specific Positive Catalysts in Cryptocurrency

In the past few months, TON's daily trading volume has exceeded $170 million, and listing on the Binance spot market could significantly reduce investment risk and provide some upside potential and more downside protection as liquidity increases. As Ethereum continues to advance its sharding roadmap, TON is expected to gain further attention with its dynamic sharding architecture, although this comparison may be somewhat tenuous.

Risks and Mitigation Measures

There are questions about whether the project can maintain its current valuation. This is an ambitious project that seems to be approaching full valuation. At these levels, the chain and native Gas token should be seen as a currency rather than a tool for technical speculation. Currency premium is harder to achieve than technical premium, which is inherently more transient.

Further exploration is needed regarding the details of TON's over-the-counter trading, as it may become the funding choice for marginal price setters to purchase discounted OTC tokens, reducing buying pressure in the open market.

Due to the somewhat obscure programming language (FunC), developer engagement is lower compared to other chains. TON has 39 full-time developers and approximately 120 monthly active developers, compared to Ethereum's 2.4 thousand full-time developers and 7.8 thousand monthly active developers.

The supply unlock of the Believers Fund will begin in October 2025, to be phased in over three years.

Regulatory risk remains a factor. However, we believe that most of the risk has been mitigated given the previous experience with the SEC. Telegram is clearly working to integrate the token into the platform, and it is reasonable to expect that Telegram has conducted comprehensive legal due diligence to ensure its current and future TON operations comply with necessary regulations.

Conclusion

We believe that most of TON's growth will not come from the captured on-chain users of EVM and Rust-based blockchains. TON is paving a more conventional future for itself, carving out its niche market for consumers who prioritize ultra-fast, extremely convenient decentralized solutions that prioritize capital mobility and censorship resistance in the new blockchain. In the long run, comparing TON to the $90 billion market value of BNB is a reasonable and realistic goal, providing significant upside potential and room for excess returns compared to BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。