"Believe that in the near future, with the further improvement of the performance of the underlying public chain, the popularization of AA wallets, and the improvement of infrastructure."

Author: SHA, SynFutures Protocol

I. Introduction

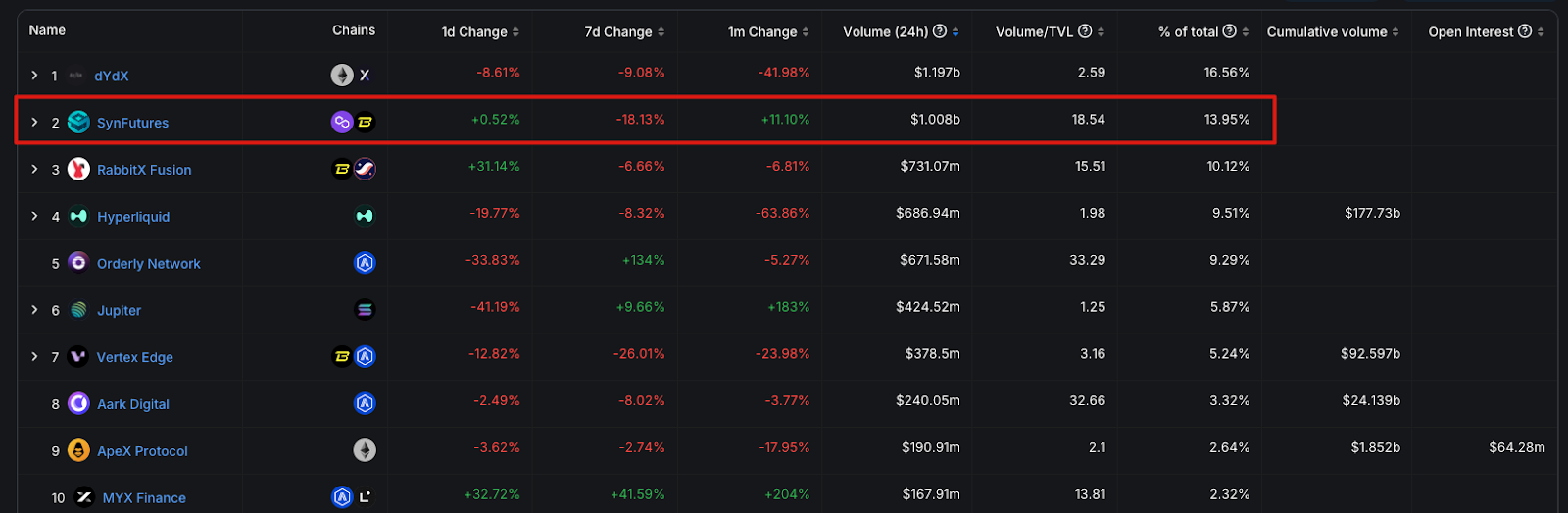

Currently, there are 2 more widely adopted solutions in the derivatives field. One is GMX's Vault mode, where LP acts as the counterparty to the trader, and the trading price is determined by the Oracle; the other is dYdX's order book mode, which matches off-chain and settles on-chain, such as AEVO, Vertex, and dYdX V3/V4. The former has counterparty risk and oracle attack risk, while the latter has opacity and exchange malpractice risks.

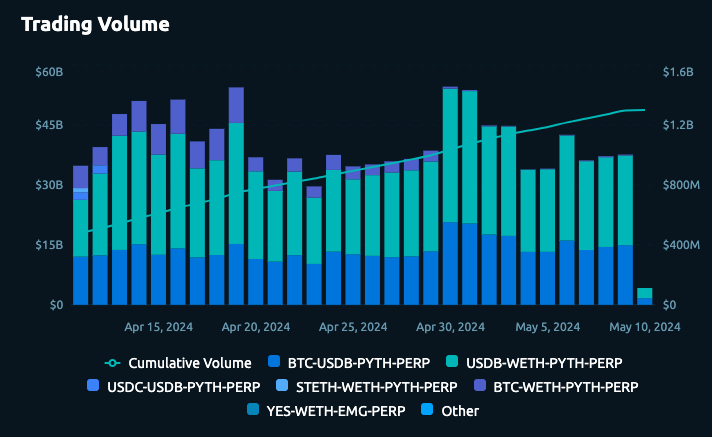

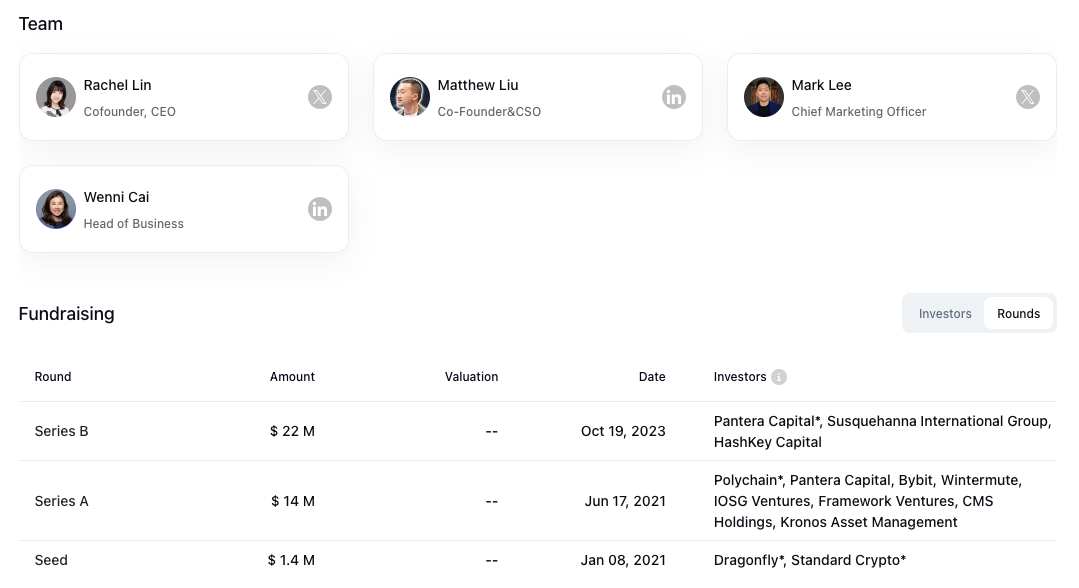

Different from semi-decentralized solutions like dYdX and AEVO, SynFutures has always insisted on and focused on creating a fully decentralized and high-performance perpetual contract exchange. SynFutures was established in 2021 and has raised a total of $38 million from well-known industry institutions such as Pantera, Polychain, Dragonfly, Standard Crypto, and Framework. According to DeFillma data, its V3 version has accumulated a trading volume of over $48 billion since the launch of Blast on 02-29 this year, with daily trading volume consistently ranking in the top 3 in the industry.

Similar to UniSwapV2, SynFutures V1 and V2 are based on the xyk AMM model, which has some issues with low capital efficiency and depth. Therefore, SynFuturesV3 introduces oAMM specifically designed for contract trading by drawing on UniSwapV3's concentrated liquidity model, allowing LPs to concentrate liquidity in specified price ranges to maximize capital efficiency and liquidity depth, while maintaining complete decentralization and providing traders with a good trading experience and minimizing trading slippage.

One of the major innovations of oAMM is the implementation of a pure on-chain order book, allowing market makers to provide liquidity through limit orders and directly receive 1/3 of the trading fee split. This may be the highest split ratio in the industry, which is conducive to SynFutures attracting market makers from centralized exchanges to participate in on-chain market making, creating order book depth comparable to centralized exchanges.

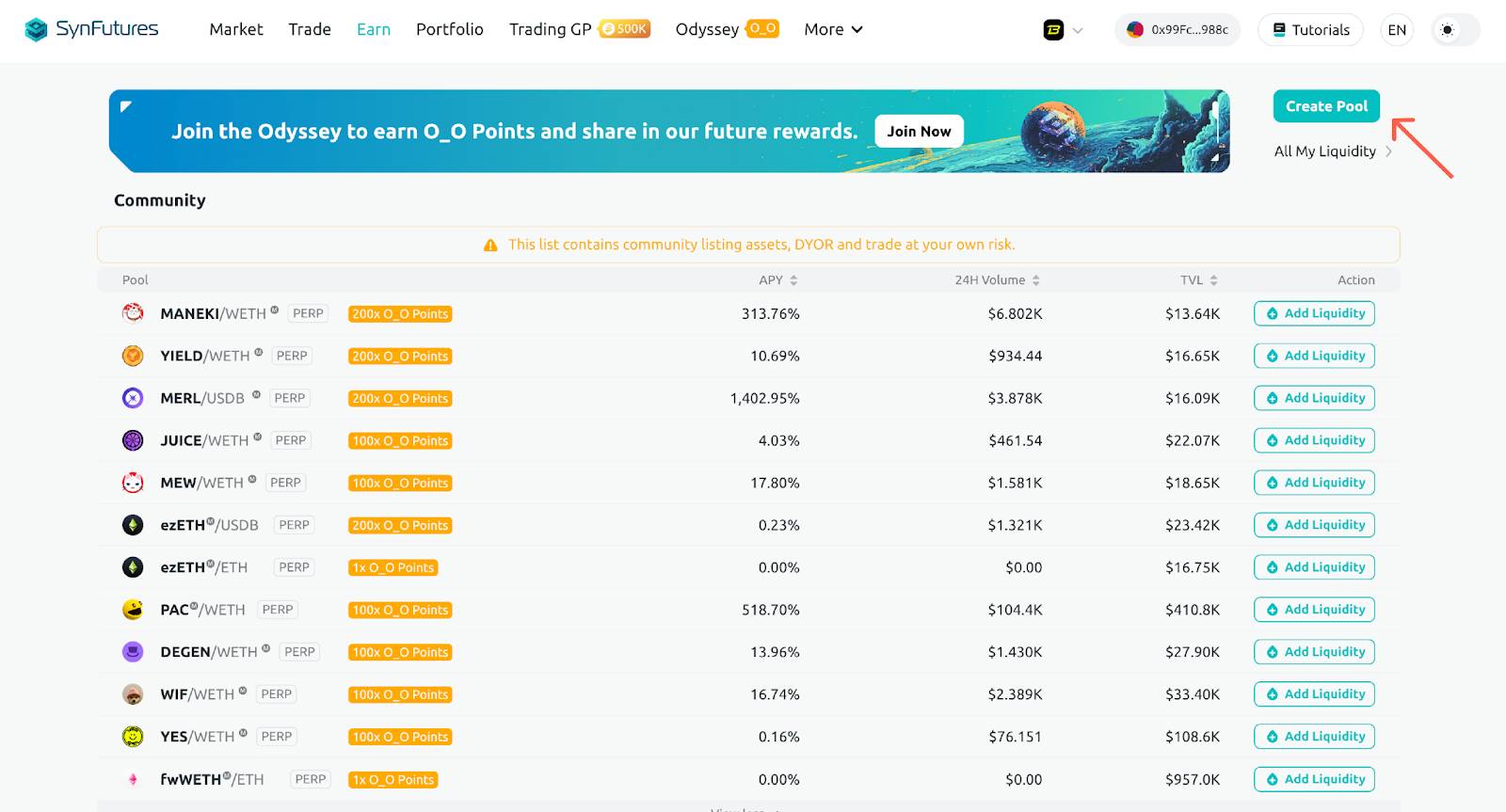

Another major innovation of oAMM is its permissionless feature, similar to UniSwapV3, and can achieve "three allows"—allowing anyone, at any time, to use any token as collateral and complete the entire listing process in just 30 seconds. This means that any project can create a contract trading pair for its token on SynFutures. Imagine if half of the projects in the future use their tokens as collateral to create a contract trading pair on SynFutures, it would be a huge market…

At the same time, as a purely on-chain contract, oAMM can naturally integrate and grow with the underlying blockchain ecosystem, which is something that many semi-decentralized exchanges currently do not have. After all, the most attractive feature of DeFi lies in its composability and layering. All its data is stored on-chain, and anyone can verify it, and traders do not need to worry about "exchange downtime, unplugging the network, or misappropriation of funds" and other centralized risks.

II. oAMM Mechanism Introduction

If UniSwapV2 is likened to a stream, then UniSwapV3 is like erecting two dams in the middle of the stream, forming a large reservoir. A small stream can only support small fish and shrimp to play, while a large reservoir can allow giant whales and sharks to swim freely, creating a more complex ecosystem. SynFuturesV3 is the same.

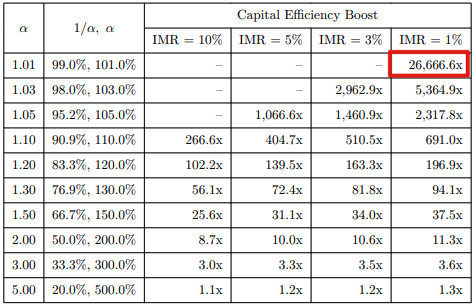

2.1 Concentrated Liquidity —— Improving Capital Efficiency

oAMM allows LPs to add liquidity to specified price ranges, greatly increasing the liquidity depth and capital utilization efficiency of AMM, supporting larger and more transactions, and creating more fee income for LPs. According to its documentation, its capital efficiency can be increased by up to 26,666.6 times.

2.2 Pure On-Chain Order Book —— Maintaining Efficiency while Being Open and Transparent

The liquidity of oAMM is distributed in specified price ranges, which are composed of several price points. For example, LPs provide liquidity in the range of [3000, 4000] for ETH-USDB-PERP, and this price range can be divided into several price points, with each price point allocated an equal amount of liquidity. You might immediately think, isn't this an order book? Exactly!

oAMM allows users to provide liquidity at specified price points to achieve on-chain limit orders, simulating the trading behavior of an order book, further improving capital efficiency.

Compared to the market-making method of traditional AMM, market makers at centralized exchanges are more familiar with and have a higher awareness of limit orders, and are more willing to participate. Therefore, oAMM, which supports limit orders, can better attract market makers to actively provide liquidity, further improving the trading efficiency and depth of oAMM, achieving a trading experience comparable to centralized exchanges.

Unlike dYdX's off-chain order book, oAMM is a smart contract deployed on the blockchain, with all data stored on-chain, which is completely decentralized, and users do not need to worry about issues such as exchange manipulation or false trading.

2.3 Limit Orders Can Receive Trading Fee Split —— Highest Industry Split Ratio

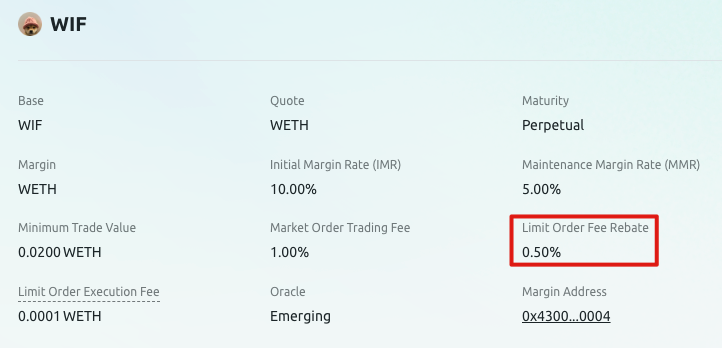

Since users placing limit orders are essentially providing liquidity for oAMM, they can receive a share of the trading fee income. In centralized exchanges, trading fee splits are usually only available to specific institutional clients and VIP users, with a certain settlement period. In oAMM, trading fee splits are returned directly to the user's margin account when the order is filled. For example, the split ratio for the BTC-USDB-PERP is currently 0.01% of the trading amount, while for the higher-risk MEME Coin WIF-WETH-PERP, it is as high as 0.5%. This may be the highest commission split ratio in the derivatives industry.

2.4 Permissionless Listing —— Quickly Seizing Trading Opportunities

Currently, all decentralized derivative exchanges are decided by the project or community on which tokens to list, making it difficult for most users to profit from "pre-coin issuance." oAMM, as a smart contract deployed on the chain, like most spot AMMs, allows for permissionless listing, allowing anyone to freely create perpetual or expiry contracts.

In other words, if you think a certain token is very popular and providing liquidity for it can be profitable, you can create the corresponding contract market on SynFutures. For example, if a new token like MEME is very popular and many people want to trade its contract but there is no exchange support yet, you can choose to list it on SynFutures, riding the popularity of MEME and SynFutures to achieve two goals with one stone.

2.5 Support for Any ERC20 Token as Collateral —— Pioneering a New Paradigm in the Derivatives Market

Each pool in oAMM is independent and does not affect each other. This design theoretically allows oAMM to support the use of all ERC20 tokens on the market as collateral without increasing the overall system's risk. This is unimaginable in systems like Hyperliquid or dYdX.

Assuming that in the future, half of the top 500 altcoins by market cap create corresponding pools on SynFutures and provide liquidity, even if each pool only has $1 million in liquidity, it would still be a significant number. Projects can also empower their tokens by allowing their token holders to use the token as collateral for trading, or by earning SynFutures points and trading fees through providing liquidity, achieving a true win-win situation.

2.6 Risk Control Mechanism —— Comprehensive Protection of User Fund Security

Derivatives are much more complex than spot trading. Spot trading is use and go, such as UniSwap, while derivatives involve holding positions, requiring higher security mechanism design for the protocol. In this regard, SynFutures protects user fund security through four methods: smoothing price curves, dynamic penalty fees, emergency response mechanisms, and large profit withdrawal checks.

2.6.1 Smoothing Price Curves

In the past, GMX and dYdX have experienced losses due to hackers manipulating prices through oracle attacks. Therefore, SynFutures does not directly use the price quotes provided by the oracle, but processes them through EMA (exponential moving average) before use. As seen in the graph below, the price curve after EMA processing is smoother compared to direct oracle price quotes, reducing the impact of oracle prices on the mark price and thereby reducing the risk of oracle attacks.

2.6.2 Dynamic Penalty Fees

What if someone tries to profit by maliciously manipulating prices? SynFutures avoids this issue by imposing dynamic penalty fees. If a user significantly deviates the price, they will be charged additional trading fees as a penalty. In this case, the attacker has no incentive as there is no profit to be gained. The fees collected will be distributed to the LPs of that market.

2.6.3 Emergency Response Mechanism

We all say that blockchain is a dark forest, and you never know what might happen. If despite the protection of the above two mechanisms, a market still experiences unforeseen circumstances that threaten user fund security, SynFutures will freeze the market triggering risk controls (such as significant deviation of market price from the mark price), then assess the reasons for the risk and determine countermeasures, making every effort to protect user fund security.

2.6.4 Large Profit Withdrawal Checks

For large profit withdrawals, SynFutures sets a withdrawal threshold, and withdrawals exceeding this threshold will have a waiting period of up to 24 hours — meaning the funds can be received within a maximum of 24 hours, and users can also accelerate the withdrawal by contacting the community. This is mainly to check whether the profits of the withdrawal initiator were obtained through legitimate means, thereby protecting user fund security.

III. Project Development Status

3.1 Data Performance

Since the launch of Blast on the mainnet on 02-29, SynFutures V3 has achieved:

- Accumulated trading volume exceeding $480 billion

- Daily trading volume approaching $10 billion

- TVL exceeding $54m

- Over 33,000 active addresses in the past 7 days

Currently the largest decentralized derivatives exchange on Blast, it is believed that with further development and expansion, its various indicators will rival projects such as GMX, dYdX V4, and Hyperliquid.

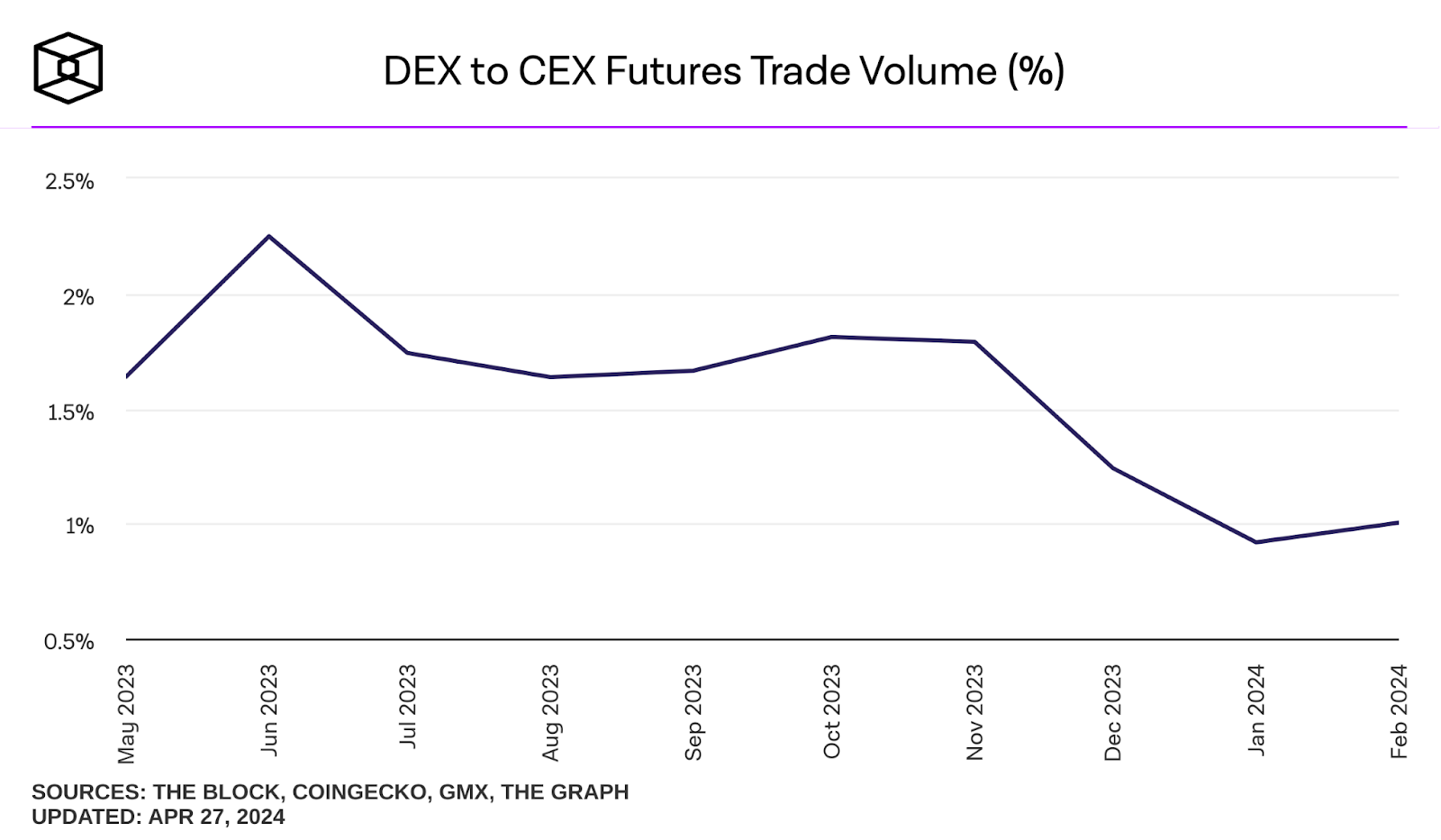

3.2 Growth Potential

According to The Block data, the trading volume of the entire decentralized derivatives market is less than 3% of centralized exchanges, indicating significant growth potential in this market. Currently, two phenomena are evident in the DeFi world: users are starting to recognize brands, with longer-standing projects being perceived as safer, and top projects are attracting more TVL. In this scenario, any project without innovation or simply copying existing projects is unlikely to surpass the original project, let alone challenge centralized exchanges.

This market needs continuous innovation and iteration to improve trading experience and capital utilization efficiency. Only projects with innovation can become challengers and disruptors, continuing to expand the market share of decentralized derivatives exchanges.

SynFuturesV3 undoubtedly possesses this innovation. Its creative use of oAMM to achieve on-chain order book functionality, allowing users to provide liquidity in specified price ranges, and enabling market makers to directly receive fee splits through limit orders, attracts market makers to provide liquidity, improving capital utilization efficiency and trading experience. This integration of active and passive market making in a single system, operating entirely on-chain, is one of the major innovations in the derivatives market.

While Vertex, BlueFin, and RabbitX also provide passive liquidity for their order books through Exilier, SynFutures directly implements passive liquidity provision through AMM, achieving native support without introducing third parties, resulting in lower risk for LPs and a better user experience.

At the same time, the permissionless and "three allows" features of SynFuturesV3 — allowing anyone, at any time, to use any token as collateral and complete the entire listing process in just 30 seconds — are pioneering a new paradigm for decentralized derivatives trading, potentially capturing a portion of the centralized exchange market in the future, similar to UniSwap.

3.3 Problem Analysis

The shortcomings of xyk AMM mainly lie in impermanent loss, which is difficult for ordinary users to hedge against and understand. SynFutures' oAMM, similar to UniSwapV3, also faces impermanent loss issues. From some public information and AMA sessions, it is understood that SynFutures is considering Strategy Vaults in the future to open effective passive market-making strategies to users, somewhat similar to copy trading, allowing more risk-averse users to participate.

IV. Team Background

### 5. Summary

The founding team of SynFutures has backgrounds in top international investment banks, internet companies, and crypto OGs, and has received favor from investors including Pantera, Polychain, Standard Crypto, Dragonfly, Framework, SIG, Hashkey, IOSG, Bybit, Wintermute, CMS, and Woo, with total funding exceeding $38 million to date.

Source: https://www.rootdata.com/Projects/detail/SynFutures?k=MzAyMA%3D%3D

DeFi seems to have entered a lull phase after experiencing the two hot periods of DeFi Summer and DeFi 2.0. There are few disruptive innovations seen in the past year, with more being minor innovations at the protocol level or innovative operational methods. However, SynFutures V3 creatively integrates the two mainstream models of AMM + Order Book and bridges the "last mile" of on-chain market making for centralized exchanges, ensuring performance and experience while also achieving security, transparency, and decentralization. Its Permissionless and "three allows" features create a new paradigm for derivative trading, becoming a breakthrough in leading innovation in the decentralized derivatives market.

Decentralization is like the elephant in the room. It seems insignificant when not important, but at critical moments, you realize how important and indispensable it is, after all, FTX is the best example. Therefore, the author strongly agrees with and understands SynFutures' firm commitment to the decentralized route. Although currently limited by the performance of the underlying blockchain and infrastructure, there is still a lack of product experience compared to centralized exchanges. However, it is believed that in the near future, with further improvement in the performance of the underlying public chain, the popularization of AA wallets, and the improvement of infrastructure, decentralized exchanges like SynFutures will also have an experience comparable to centralized exchanges, breaking the monopoly of centralized exchanges and gaining a place in the entire derivatives market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。