In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

The overall cryptocurrency market is in a state of fluctuation, with some tracks already starting to collectively pull back, and the overall market trend is not very clear. Some projects have experienced counter-trend increases due to their own reasons, such as Celsius, which saw an increase due to the destruction of its own tokens. Currently, market funds lack trading enthusiasm, and funds are waiting for further signals from the macro market.

Strong wealth-creating sectors include: Celsius (CEL), AI sector (RNDR, LPT, ARKM);

User hot search tokens & topics: Jupiter Exchange, Bitlayer, TRB;

Potential airdrop opportunities: MEZO, Bitlayer;

Data statistics time: May 9, 2024, 4:00 (UTC+0)

I. Market Environment

The Federal Reserve continues to emphasize controlling inflation at the 2% level, making the release of CPI data next Wednesday a market focus. Various types of tokens in the cryptocurrency market have generally entered a "boring" market, with no clear direction of rise or fall, and trading amplitudes have also significantly decreased. It is expected that the market will decide on a new market development direction after the release of CPI data next Wednesday.

Regarding ETFs, in recent days, mainstream ETFs have shown a trend of 0 inflows or small inflows and outflows, indicating that ETF investors are also closely watching the future trend of the market, rather than rushing to buy or sell. Investors are waiting for further signals from the Federal Reserve to determine the future price movements of assets.

II. Wealth-Creating Sectors

1) Sector Movement: Celsius (CEL)

Main reasons: Celsius is a cryptocurrency lending company that was popular among US retail and institutional investors in the last bull market. However, it eventually went bankrupt due to the Luna and 3AC incidents. The CEL token recently saw a counter-trend increase after self-destructing 94% of its total token supply.

Increase situation: Over the past 9 days, the price has increased by over 550%.

Factors affecting the future market:

Celsius business aspect: The self-destructive approach of Celsius can stimulate the market relatively quickly in the short term, but for long-term development, the project team needs to make real business developments to support the sustained stable rise in token price. Investors should continue to pay attention to the development direction of Celsius at the company level and make investment decisions based on whether it can genuinely advance its business.

Progress of Celsius bankruptcy reorganization: The price surge of the CEL token reflects the market's optimistic expectations for the successful reorganization of Celsius and its future potential. This change in sentiment is an indicator of investor confidence, indicating that even after experiencing major financial and legal difficulties, cryptocurrency companies still have the potential to regain market support through strategic adjustments.

2) Sector Movement: AI Sector (RNDR, LPT, ARKM)

Main reasons: Recently, major US technology companies have held press conferences to launch new products combining AI, such as Apple's launch of a new product line with the M4 chip. RNDR, as a company with certain cooperation with Apple, has attracted market attention and speculation, and similar themes in the related sector have also seen different degrees of increase.

Increase situation: RNDR increased by 8.84% in the past 24 hours, LPT increased by 11.81% in the past 24 hours, and ARKM increased by 8.69% in the past 24 hours;

Factors affecting the future market:

The AI sector in the cryptocurrency market will continue to follow the related new products, new technologies, and new collaborations of US technology companies. The AI sector has clearly become a clear speculative track, and investors should clearly distinguish the leading projects in this track and pay attention to them as soon as there are related themes that can be speculated. However, most of these speculations are unlikely to lead to substantial cooperation opportunities, and investors also need to pay attention to the risks.

New projects in the AI sector continue to emerge, and these new projects are generally valued at a high level, which may affect the current competitive landscape in the AI field. Investors should keep an eye on the competitive landscape of the current cryptocurrency AI sector, lock in leading projects, and be aware that the heat of most projects riding on the concept dissipates quickly.

3) Sectors that need to be closely monitored in the future: TON Ecosystem

Main reasons: The TON ecosystem has seen rapid growth in TVL recently, and the current TVL of the ecosystem has reached 508 million US dollars. According to the development history of past public chains, corresponding infrastructure projects have already appeared on the TON chain, such as Liquid Staking, Swap, Lending, etc., and a head effect has gradually formed. Investors can participate in such projects, not only to harvest early high APR, but also to have the opportunity to receive potential airdrops.

Specific project list:

Tonstakers: This project is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in this protocol to earn an annualized return of 3.8%, and the project has not yet issued tokens, with expectations of airdrops;

STON.fi: This project is currently the largest DEX in the TON ecosystem, and some LP pools have received support from the TON Foundation. Users can provide liquidity in the DEX to earn returns, and the project has not yet issued tokens, with expectations of airdrops.

EVAA Protocol: This project is currently the largest lending project in the TON ecosystem. Users can deposit tokens into this protocol to enjoy lending rate returns, and the project has not yet issued tokens, with expectations of airdrops.

III. User Hot Searches

1) Popular Dapps

Jupiter Exchange: Jupiter is a decentralized DEX aggregator in the Solana ecosystem, helping users complete on-chain swaps with the lowest slippage. The project aims to do related exposure and operational activities for the top Launchpad platform in the Solana ecosystem. JUP holders can participate in VOTE to receive airdrop rewards from the project, and JUP holders can participate in subsequent Launchpad Vote activities.

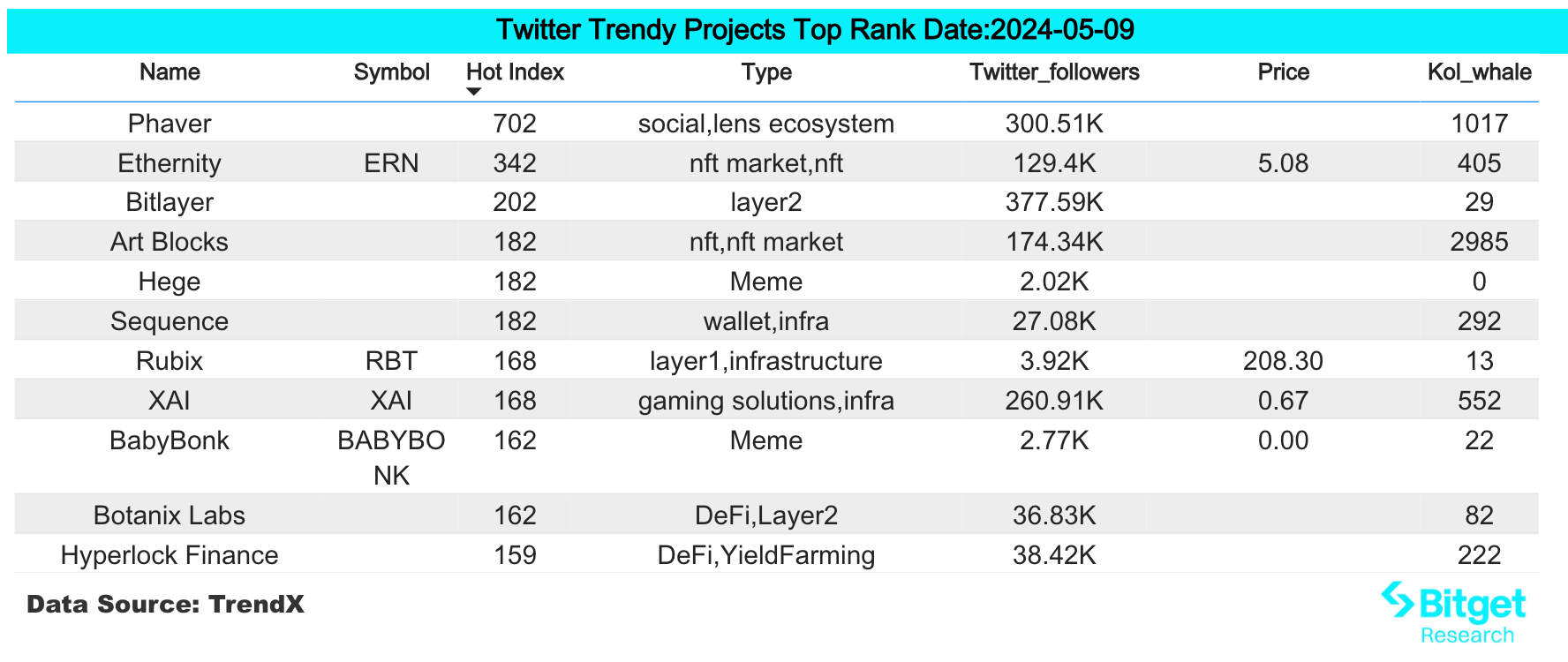

2) Twitter

Bitlayer (Dapp): The project is building a Layer2 network that is the Bitcoin equivalent of security, with tokens based on the BitRC-20 protocol standard, helping to achieve token diversification in the ecosystem. The project has received investments from ABCDE, OKX, and others, and the token has not yet been launched. The project has issued Helmet NFTs to create an "ecological golden shovel."

3) Google Search & Region

From a global perspective:

UMA (Token): The token price saw a sudden surge in the secondary market yesterday, with a sudden buy order of $6 million on the contract and oversold spot, leading to a negative funding rate. The token's short-term surge of 50% yesterday was mainly due to the entry of large funds. Currently, the token price has retraced, and users can engage in small-scale speculation, setting good psychological price levels for taking profit and stopping loss.

From the perspective of various regions:

(1) The hot search focus in various regions in Asia yesterday was mainly on TRB, CEL, FRONT.

TRB, CEL, FRONT (Token): Recently, there have been movements in the secondary market for these tokens. From the contract data, the long/short ratio is significantly lower than the balanced value of 1, indicating a strong willingness of major players to buy. The token's trend is mainly driven by the influx of large amounts of hot money from institutions/organizations. If the long/short ratio reverses and the open interest decreases, it indicates a possible trend reversal for the token. Users are advised to be cautious of risks when participating in trading and to try to engage in intraday trading.

(2) There are no significant hotspots in Africa, Asia, and English-speaking regions:

The regional heat shows a relatively scattered performance, with BTC, ETH, and Solana frequently appearing in hot searches. Some users will focus on themes such as AI and Meme narratives, and the overall market shows thematic differentiation.

IV. Potential Airdrop Opportunities

[Mezo]

Mezo is a BTC Layer 2 project that mainly focuses on the BTC ecosystem, helping BTC holders with on-chain transfers and financial management to drive the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital, and other leading institutions in the industry.

The official has publicly announced its BTC asset pledging plan and introduced a referral mechanism. There is a strong expectation for the project's airdrop, and it is currently in the early stages of operation.

Specific participation method: 1) Visit the project's official website and find the invite code on Discord; 2) Enter the invite code and link the Unisat wallet; 3) Deposit BTC.

[Bitlayer]

Bitlayer is a Layer2 network that provides Bitcoin-equivalent security. The project creatively designs tokens based on the BitRC-20 protocol standard to help achieve token diversification in the ecosystem. The project has received investments from institutions such as ABCDE and OKX, with a funding amount of $5 million.

The project's official website has opened the "Bridge & Earn" interface, where users can cross-chain BTC to the Bitlayer network to have the opportunity for future token airdrops. The airdrop expectation is quite evident, and the potential return rate is relatively objective.

Specific participation method: 1) Visit the project's official website and find the "Bridge & Earn" interface; 2) Link the wallet and deposit BTC assets into the Bitlayer network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。