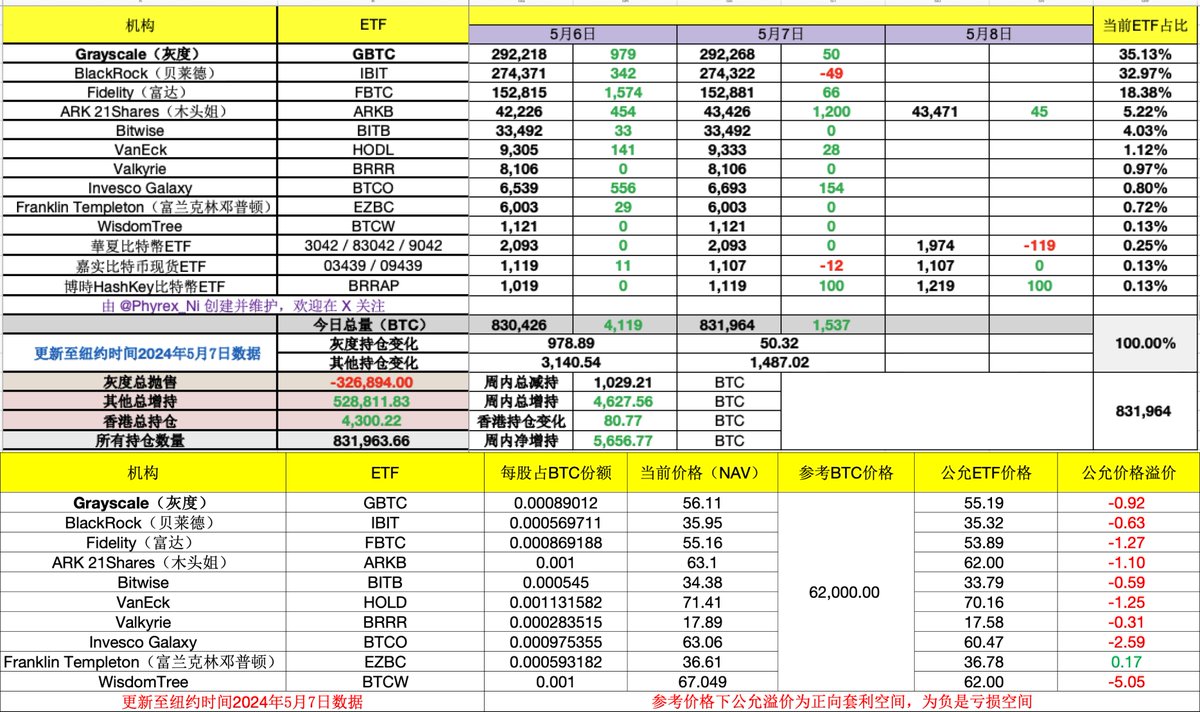

On Tuesday, there was a bit of a difference in the data compared to Monday. At least, on Monday, none of the 14 spot ETFs had continued to flow out. On Tuesday, GBTC still stubbornly achieved a net inflow, marking the second consecutive working day of net inflow for GBTC. However, the net inflow on Tuesday was only 50 BTC, so today might be dangerous.

Only two institutions had outflow data this time. One was BlackRock, the head of US spot ETFs, which saw an outflow of 49 BTC, not a large amount. The other was the Huaxia Bitcoin ETF from Hong Kong, which saw an outflow of 119 BTC. Purely based on Hong Kong's data, three Hong Kong ETFs also experienced net outflows today, although it was only 19 BTC. This also indicates the awkward position of Hong Kong at the moment. It's worth noting that apart from GBTC, there had been no institutional net outflows from US spot ETFs after a month of operation.

In contrast, Hong Kong has only just started for ten working days and has already seen net outflow data. The purchasing power in Hong Kong is quite different from that in the US.

Some friends asked why spot ETFs had seen net inflows for two consecutive days on Monday and Tuesday, but the price of BTC had been declining. Shouldn't it be rising?

In fact, we have emphasized this issue for a long time. Spot ETF data cannot be used to judge the price trend of BTC because even at the peak trading volume of spot ETFs, which is about $1 billion a day, it only accounts for a fraction of the total market turnover. Not to mention in the current low liquidity situation, so the impact of spot BTC prices by spot ETFs can be said to be minimal, and this trading volume is not enough even on Coinbase.

The highlight of yesterday's data was Fidelity, which increased its holdings by over 1,500 BTC. Today's highlight is ARK, which increased its holdings by 1,200 BTC. However, while the net inflow was 4,119 BTC yesterday, it was only 1,537 BTC today. Although this data cannot represent the price trend, it does indicate that the sentiment of US investors has gradually shifted from optimism to a downturn.

After all, there has been no new information or emotion-driven events in the past two days.

This indicates that the sentiment from last Friday has not continued to the present. Although a Fed official hinted that there might be a maximum of two rate cuts by 2024, this data itself was within market expectations. However, the market is not very enthusiastic about two cuts now and is starting to fantasize about three or more. With the earnings season almost over, all that's left is to rely on sentiment.

The data has been updated, and the link is: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。