First, understand the concept of node sale. Node sale is actually a new way of token issuance. It is a mutually beneficial method. For a project, a decentralized network itself needs a large number of nodes. For the project party, node sale has also become a new financing method. And for us retail investors, current projects are all institutionally overvalued when they go online, making it difficult to find good profit opportunities in the secondary market. Participating in node sales means investing in the project before it goes live.

Overall, in terms of node token rewards, CARV is the most generous, with 25% of the total token rewards allocated to nodes, which is the highest among the three, and it releases 12.5% of the tokens during the first year of the bull market, more than twice as much as the other two projects.

In terms of sales, Sophon sold 30,000 ETH, Aethir sold 40,000 ETH. CARV is about to start, and it is not expected to be too bad. Everyone can use this as a reference.

1 Project Introduction

Aethir is a decentralized computing power platform. Aethir aims to build a scalable, decentralized cloud infrastructure (DCI) network to help game and artificial intelligence companies deliver products directly to consumers of all sizes, regardless of their location or hardware. Aethir solves the problem of market fragmentation in a decentralized cloud manner.

Sophon is an entertainment-centered ecosystem, built as a modular aggregation using zkSync's superchain technology. As a zkSync superchain utilizing ZK Stack, Sophon aims to customize for any high-throughput applications (such as artificial intelligence and gaming applications).

CARV aims to build the largest modular data layer, providing data services for GameFi and AI. It fundamentally changes the way data is used and shared by ensuring privacy, ownership, and control firmly in the hands of individuals, creating a future where data creates value for everyone. CARV already has 2.5 million registered users, 1.2 million monthly active users, and over 750 gaming and artificial intelligence companies integrated into the CARV ecosystem.

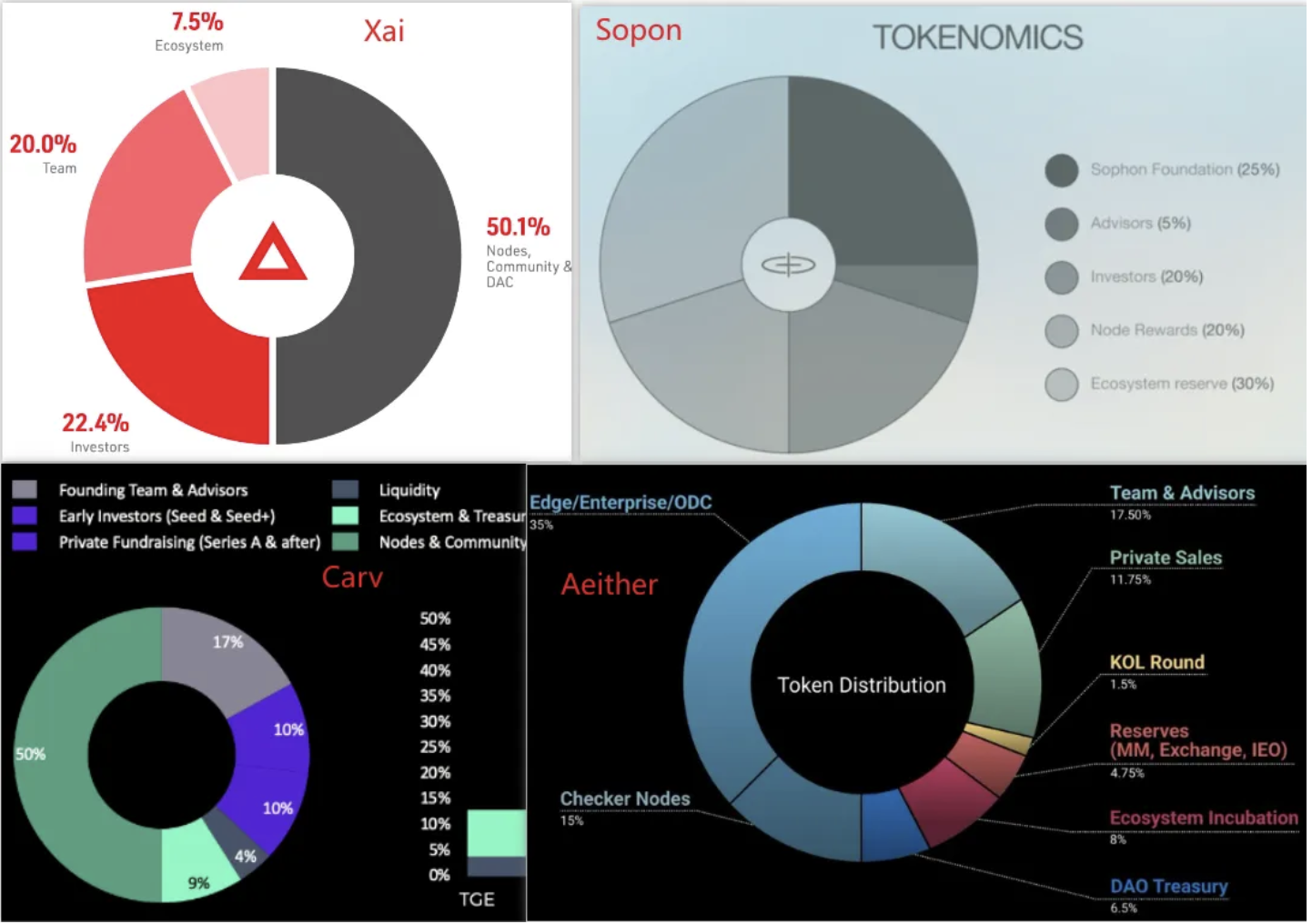

2 Node Token Total Supply

CARV has a total token supply of 1 billion, with 25% allocated for node rewards.

Aethir has a total token supply of 42 billion, with 15% allocated for node rewards.

The total token supply for Sopon has not been disclosed, with 20% allocated for node rewards.

Xai has a total token supply of 2.5 billion, with 42.09% allocated for DAC and nodes.

So Xai's 42.09% is for nodes and DAC, but the overall reward for nodes is also relatively high. Among the recent node sale projects, CARV has the highest total token reward for nodes.

3 First Year Node Token Release

The release of node tokens is crucial in the first year because it is highly likely to be a bull market in the future. The token price will be relatively good. However, it may enter a bear market later, and with the continuous accumulation of token releases, coupled with institutions and teams starting to unlock, a 10x drop in token price is normal. So for node releases, the focus is on how many tokens can be mined within the first year.

Xai's 42.09% is composed of two parts. Based on the official node release chart, Xai initially releases 1.712 million tokens daily, and when the circulation reaches 1.25 billion (expected to be in 5-6 months after TGE), 856,000 tokens will be released daily. Based on calculations, Xai's first-year release is approximately 440 million tokens, with 85% allocated for node rewards, about 3.74 billion tokens, accounting for approximately 14.98% of the total supply.

CARV's node reward is 25%, but its token release is relatively fast. According to the official whitepaper, CARV's token release in the first year is 50%, which is 12.5% of the total supply, similar to Xai.

Aethir's release rules are not clear, only stating a 4-year release period. The node reward accounts for only 15% of the total supply, expected to be around 5-7% in the first year. This is mainly because Aethir has reserved a large portion of the reward for computing power providers for mining.

Sopon's node reward has a linear release over three years, with 27.78% released in the first year, which is 5.56% of the total token supply.

In terms of node token rewards, CARV's 12.5% release in the first year is the highest among the three projects. Aethir and Sopon's share for nodes is only 5% of the total supply, relatively less.

4 Node Token Redemption Period

After tokens are mined from nodes, they are not immediately obtained as tokens for trading on exchanges, but are converted into esXai, vATH, veCARV. There is a certain redemption period to convert them into tokens that can be bought and sold on exchanges.

For Xai, converting esXai to Xai requires a 180-day wait, with two options: if converted in 15 days, only 25% of Xai can be obtained. If converted in 90 days, 62.5% of Xai can be obtained.

Aethir's rule is that within 30 days of redemption, only 25% can be obtained, with the default redemption period being 180 days.

For CARV, converting veCARV to CARV requires a 150-day wait, with the same two options: if converted in 15 days, only 25% of CARV can be obtained. If converted in 90 days, 60% of CARV can be obtained.

Sopon's node release has not been disclosed.

Overall, all three projects have relatively long redemption periods, and all three projects are almost the same. If there are differences, CARV has a slight advantage, with a 150-day redemption period, which is one month shorter than XAI and ATH.

5 Other Token Unlocks in the First Year

In addition to node rewards, we also need to consider other token unlocks because the release of other tokens will increase the inflation rate.

In token allocation, apart from the node mining part, there are often three parts: one part is for project needs, such as for liquidity provision, operational activities, etc. This part is often released in large quantities at TGE, so it does not need much attention. The second part is ecosystem rewards, community, foundation, etc. This part often requires Dao voting for long-term project development. The third part is the release by institutions and teams, which requires special consideration.

In this regard, Xai seems less friendly. The team and institutions start unlocking after 6 months from TGE, releasing about 1.5% of the total tokens monthly. The node reward tokens are open for redemption approximately 2 months after TGE, plus a 6-month redemption period. This means that institutions and teams will have a large number of chips circulating in the market earlier than the nodes.

CARV's investors start unlocking 6 months after TGE, and the team starts unlocking 9 months after TGE. The unlocking conditions are better than Xai, and it is worth noting that CARV's node mining token redemption period is 5 months, so the node tokens are unlocked earlier than the investor tokens.

Both Aethir and Sopon have a 12-month lock-up period for institutional and team tokens. However, in Aethir's token model, 35% of the total supply is for GPUs, released in sync with the nodes, meaning that there are twice as many chips unlocking as nodes.

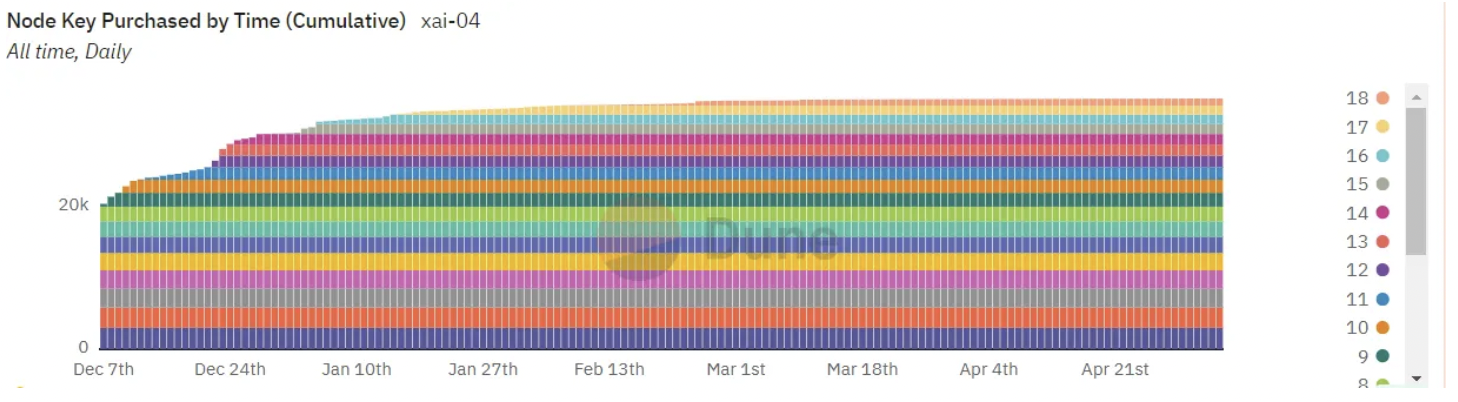

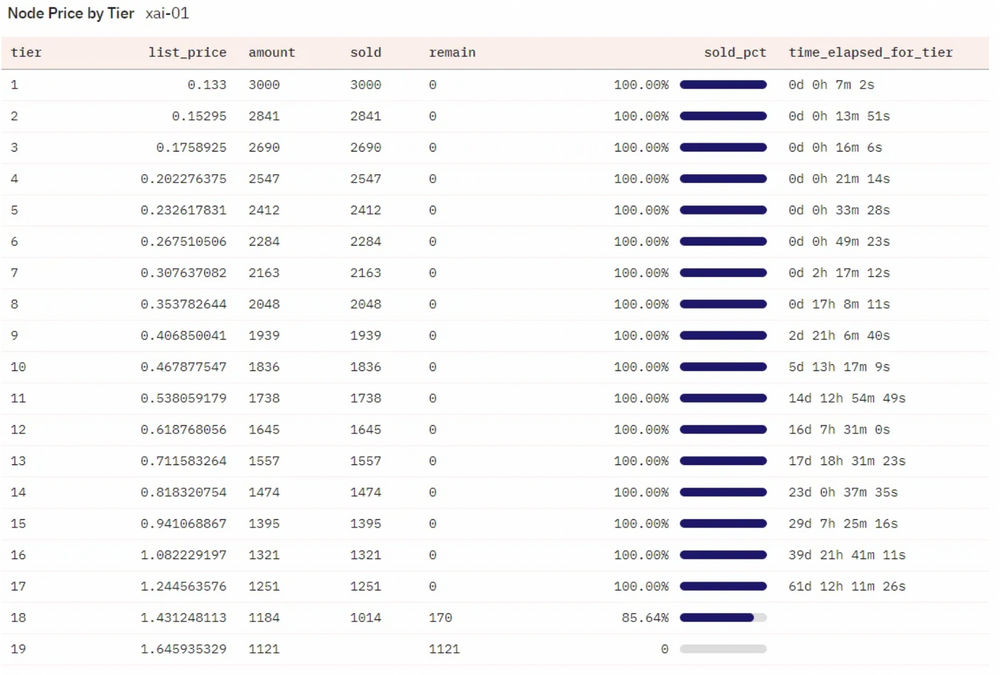

6 Node Sale Situation

In terms of node sales, Xai has sold 35,155 nodes, with a sales amount of 13,080 ETH, worth 40 million USD, and an average cost per node of 0.372 ETH. The node price has risen from a low of 0.133 ETH to 1.43 ETH, an increase of more than 10 times.

Aethir has sold 74,040 nodes, with a sales amount of 41,627 ETH, worth 130 million USD. The average cost per node is 0.56 ETH. The node price has risen from a low of 0.1259 ETH to 1.8232 ETH, an increase of 14 times.

Sophon has sold 121,261 nodes, with a sales amount of 31,087 ETH, worth 96 million USD. The average cost per node is 0.256 ETH.

In terms of node sales, XAI can be said to have started this round, and most of the projects for node sales are learning from XAI. However, XAI's own data is not good because when XAI was sold, the market conditions were not very hot. Additionally, since XAI was the first of its kind, many people had concerns about this form. Moreover, many people who participated in the GALA node in 2021 have not yet broken even. However, after XAI was listed on Binance, the early participants in the node sale reaped substantial profits, bringing many users to later projects for node sales.

Aethir's node sale not only benefited from the profit effect of XAI but also took place during the peak speculation in the AI sector. For other projects with good quality, the possible outcome may be between XAI and Aethir.

7 Conclusion

1 From the perspective of the projects, Aethir, Sopon, and CARV are not in the same race and cannot be directly compared. However, each has its advantages. Aethir belongs to the AI sector and has scarce GPU computing power, which is currently the hottest sector. Sopon's project seems more like a quick gathering during the good market conditions, but it has the backing of the original team of zksync, with a very rich reputation and resources within the industry. CARV has accumulated for many years, grown rapidly, and has a large number of users and ecosystem projects.

2 In terms of node sales, CARV is the most generous, with 25% of the total token rewards allocated to nodes, and it releases 12.5% of the total tokens during the first year of the bull market, more than twice as much as the other two projects.

3 In terms of sales, Sophon sold 30,000 ETH, Aethir sold 40,000 ETH. CARV is about to start, and it is not expected to be too bad. Everyone can use this as a reference.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。