Bitcoin may take advantage of TradFi's upward trend to reach new heights.

Author: Jack Inabinet

Translated by: Kate, Mars Finance

If Bitcoin can take advantage of TradFi's upward trend, it may reach new heights.

New all-time high? The S&P 500 index has seen a significant rebound in the past few days, rising 3.7% from Thursday's low and continuing to rise this week. The crypto market may open flat this week, but does the rebound in TradFi indicate future gains?

On Monday, Bitcoin did not rise with the stock market, but it rose 12% from the local low on Thursday and is now attempting to break through the 50-day Exponential Moving Average (EMA), a technical resistance level that the entire TradFi index has struggled to break through since the end of April.

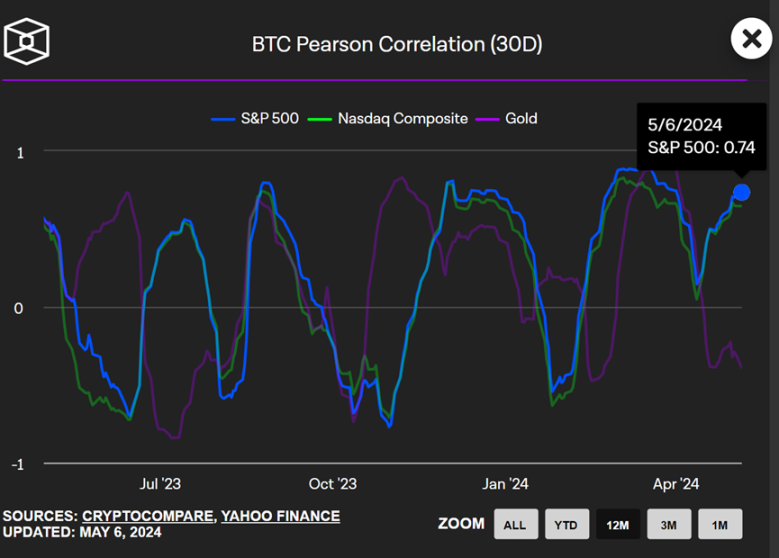

In recent weeks, the correlation between Bitcoin and major indices has strengthened, indicating that the price movements of these different asset classes are moving in the same direction. If the indices continue to rise, assuming the correlation remains unchanged, the price of Bitcoin will start to rise in the short term.

Source: The Block

A decisive breakthrough of the 50-day moving average will allow BTC to eliminate the $65,000 resistance level that has hindered the bulls since mid-April, allowing it to move directly above the mid-range and leaving a path to retest the $72,000 range top.

On Thursday, Bitcoin perpetual swaps saw the longest and deepest negative funding rate since the beginning of this year (i.e., shorts paying longs). Given the recent desire for leverage, this is an abnormal behavior, although funding rates have turned positive again, they have not become a problem for longs like they did at the end of March, maintaining a "healthy" level where longs do not pay excessively high fees to maintain their positions.

Lower funding rates reduce time-based surrender risk and may increase demand for long positions, however, their continued compression throughout April and the recent negative growth rate suggest that we may be transitioning to a structurally lower funding rate regime. This shift may occur simultaneously with price declines.

Undoubtedly, if we are destined to maintain the upward trend that has supported prices since the end of the bear market in 2022, market prices should rebound, but it is important to note that a pullback before reaching new all-time highs may confirm that we have entered a different market phase…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。