Original | Odaily Planet Daily

Author | Nan Zhi

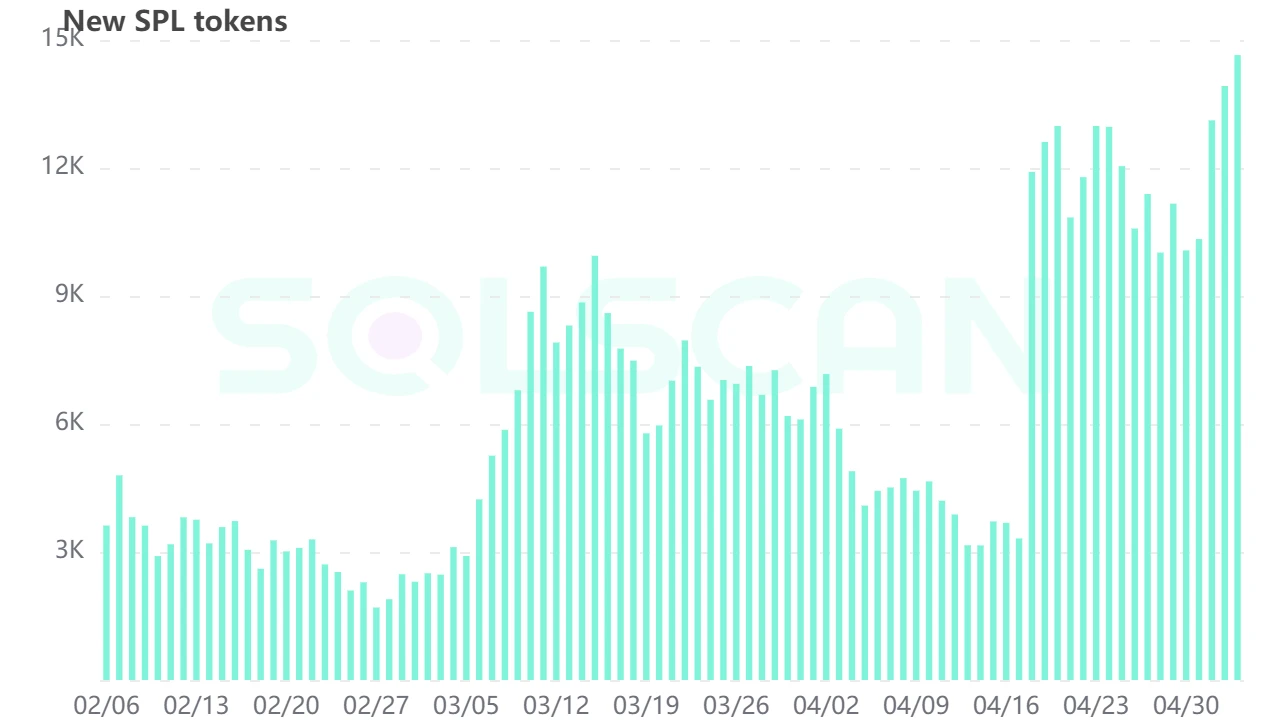

In April, the market experienced a significant pullback, but the Solana market became increasingly hot. On May 4th, the new SPL token reached a historic high of 14,648. More than half of the newly issued tokens came from Pump.fun. Odaily Planet Daily will interpret the platform's functions, data, and this phenomenon.

Introduction to Pump.fun

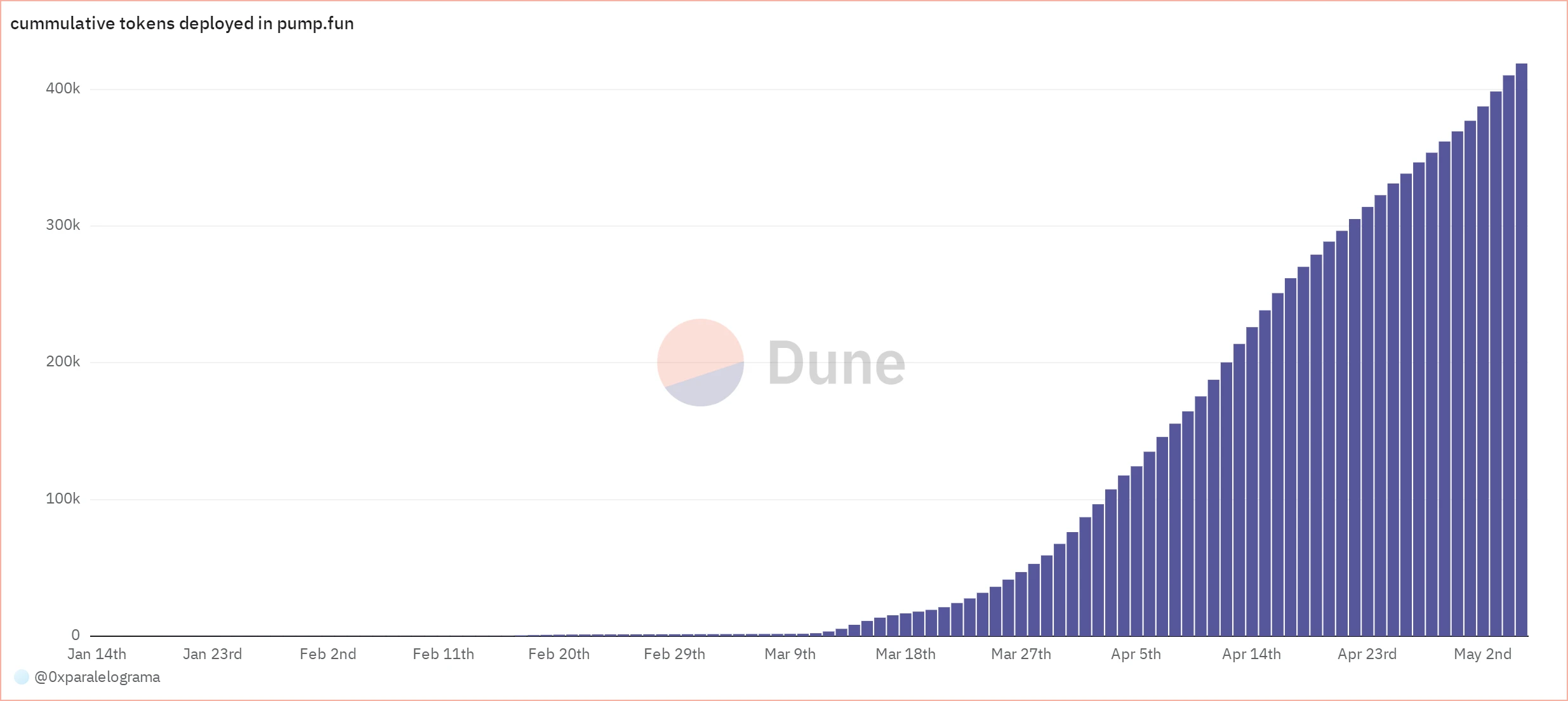

Pump.fun was launched in February 2024 as a one-click issuance platform for Meme tokens. When it was launched in February, it did not attract much attention or usage, but the number of users and usage began to soar in mid-March.

Operating Process

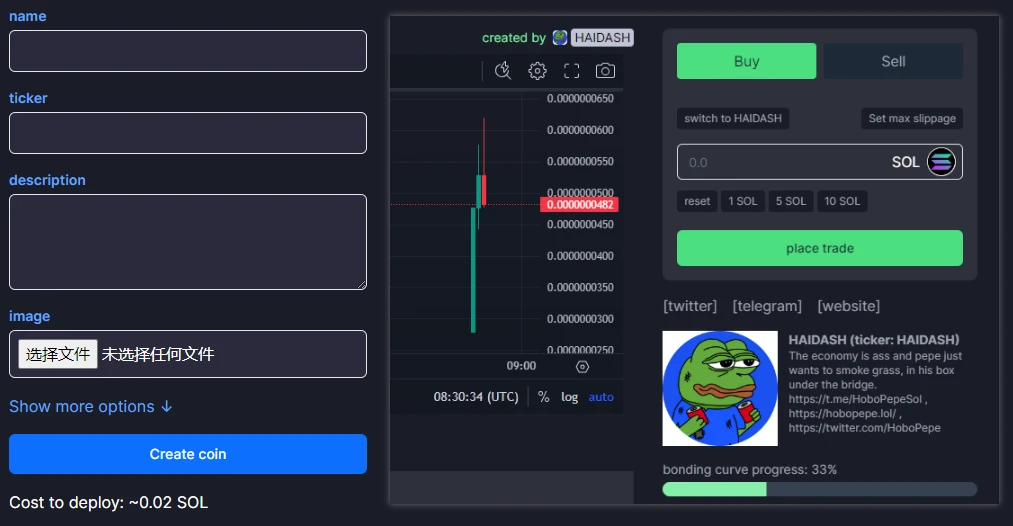

- Token creation: The issuer only needs to enter the token's name, description, and image, and pay approximately 0.02 SOL to start the "fundraising" issuance process for a token.

- Intra-disc fundraising: For users, choosing the token they want to participate in, entering the quantity of tokens they want to purchase is equivalent to participating in the token issuance fundraising, and being able to sell the corresponding shares before the issuance. Pump.fun will charge a 1% fee.

- Price curve: It is important to note that the token's price before official listing on Pump.fun is not evenly distributed, but calculated based on the Bonding curve. Simply put, the token price will rise as fundraising progresses and fall as shares are sold within the fund.

- Token issuance: When a user purchases enough tokens and the market value reaches $69,000, Pump.fun will add $12,000 in liquidity to Raydium (Solana's leading DEX) and destroy LP.

How Pump.fun Stands Out

As of May 5th, Pump.fun has issued 418,936 tokens, with total revenue of $6.9 million. From April 1st to May 1st, Pump.fun's revenue reached $4.99 million, equivalent to an annualized income of about $60 million, and the growth trend shows no signs of decline. So how did Pump.fun achieve this?

Continuation of Fair Narratives

The answer still lies in the narrative of "fairness." Since the rise of Meme tokens in 2021, they have flourished on Ethereum and BSC, but with the emergence of issues such as insider trading, RUG, and scientist front-running, users' enthusiasm for Meme tokens has been severely dampened. As a result, platforms like Pinksale have emerged.

On Solana, there were many Rug tokens in 2023 and earlier, and to avoid excessive losses due to Rug, many users became "10U war gods" and only participated in trading with very small amounts, hindering the development of various ecosystems.

The automatic addition and destruction of LP by Pump.fun align with the fundamental needs of users. Tokens from Pump do not have nominal project parties or managers, so there is no issue of Rug due to super permissions.

Meme and Social Attributes

In addition to the token's name, Pump.fun's tokens also require an image and description, and have a comment function, giving them the ability to quickly and intuitively spread their underlying stories and styles.

Previously, most Meme tokens, project websites, and official media needed to link information through mutual references, but on Pump.fun, this is achieved through a one-click aggregation. This not only allows users to quickly obtain most of the information, but also gives the tokens themselves social and effective dissemination capabilities.

A New Way to "Reap"?

Although born out of the pursuit of "fairness," some mechanisms of Pump.fun have become a tool for some users to "reap." As mentioned earlier, Pump.fun issues tokens very quickly, so the daily increase in the number of tokens is very high. Most users can only judge the quality of projects based on their "social" attributes.

On the other hand, Pump.fun's prices are not evenly distributed. The cost for users who enter the project at the end is usually more than five times higher than that of early users. As a result, some malicious users purchase a large number of chips at the bottom by creating a false impression of high fan count X accounts and high attention, and then quickly exit before the token issuance. Similarly, some influencers create new tokens through their own influence and then use extreme price curves to quickly monetize their influence (reap).

Conclusion

Since the introduction of BRC-20, the clamor for fairness and opposition to high FDV VC tokens has been growing. The momentum of PEPE and WIF breaking into the top ten is the primary representative of this trend, and Pump.fun also upholds this narrative. It is not difficult to foresee that the word "fairness" will run through this bull market and become the starting point for many disruptive projects.

On the other hand, Pump.fun is of great significance to the Solana ecosystem, not only in terms of its $60 million annual income, but also in the tens of billions or even hundreds of billions of dollars in trading volume behind it, which is a considerable growth for DEX and nodes, and is the ultimate weapon for Solana to attract users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。