In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

Yesterday, BTC rebounded to $65,500 in the short term, then fell, presenting significant intraday trading opportunities. Among them:

Strong wealth creation sectors include: AI sector, Solana ecosystem, ETH ecosystem;

User hot search tokens & topics include: friend.tech, Bitget Wallet, RNDR, TRB, Tom Brady;

Potential airdrop opportunities: Tabi, MYX Finance;

Data statistics time: May 7, 2024, 4:00 (UTC+0)

I. Market Environment

Yesterday, BTC led the overall crypto market in a rebound, and after hitting $65,500, it began to fall, currently fluctuating around $63,500. The single-day volatility is high, leading to the liquidation of long positions worth $150 million and short positions worth $70 million at the contract level, making intraday trading opportunities more apparent.

The US dollar index has returned to above 105, with the overall rise of the US capital market, and Nasdaq has risen by 1.19%, providing emotional support to the crypto market. BTC ETF saw an inflow of $217 million yesterday, and GBTC had net capital inflows for two consecutive trading days, temporarily ending the impact of selling pressure from BTC ETF. Subsequently, attention will be paid to the support level of $62,500 for BTC. If it encounters strong support, it may be considered to buy BTC on dips.

II. Wealth Creation Sectors

1) Sector Dynamics: AI Sector (NEAR, AR, RNDR)

Main reasons:

The AI sector is a resilient sector that rebounds quickly in the current market downturn and is also a sector collectively favored by VC in this round. For example, NEAR, AR, and RNDR are leading players in the AI sector's subfields;

Rise situation: NEAR has risen by 10% in the past 7 days, RNDR has risen by 34% in the past 7 days, and AR has risen by 15% in the past 7 days;

Factors affecting the future:

Impact of traditional tech companies: Tech companies continue to deploy AI projects, and there have been recent reports that Microsoft is internally training a new AI model, MAI-1, allocating more talent, funds, and materials to the AI field. The valuation of AI projects in the crypto market has room for growth due to being in the same sector;

Focus on AI narrative: The application of AI not only needs to focus on the narrative aspect to see if there is a high ceiling, but also needs to focus on the actual demand for product landing and user base. Currently, there are multiple AI applications in the crypto field that have already landed, and investors should pay more attention to the demand aspect of the applications.

2) Sector Dynamics: Solana Ecosystem (SOL, KMNO, JTO)

Main reasons: 1. Solana's native token SOL has recently continued to rise, outperforming BTC and ETH, and the ecosystem is in a state of net capital inflow; 2. The second round of FTX's lock-up SOL auction has ended, with SOL auction prices ranging from $95 to $110;

Rise situation: SOL has risen by 14% in the past 7 days, KMNO has risen by 75% in the past 7 days, and JTO has risen by 23% in the past 7 days;

Factors affecting the future:

Contract data: Use tv.coinglass website to understand the movement of main funds through contract data, first observe the incremental net long positions on the contract; observe whether there is a continuous increase in net long positions on the contract, an increase in open interest, and an increase in trading volume. If so, it indicates that the main force continues to buy, and it can be held continuously;

Actions of the project party: Solana has recently promoted the concept of Restaking, referring to Eigenlayer for objective subjectivity certification at the consensus layer level, which has a boosting effect on the entire ecosystem.

3) Sectors to Focus on in the Future: ETH Ecosystem

Main reasons: The ETH ecosystem is relatively undervalued, but with the landing of ETF information and the progress of SEC's prosecution of related DeFi, the ETH ecosystem will become more compliant and have layout space;

Specific coin list:

UNI: The first DeFi Swap project on the blockchain, recently received a Wells notice from the SEC, and Uniswap will soon provide self-certification, creating trading opportunities;

LDO: The leading LSD project in the ETH ecosystem, with a TVL of up to $28.7 billion and a valuation of less than $2 billion, is relatively undervalued;

III. User Hot Search

1) Popular Dapp

friend.tech:

friend.tech stated that it is about to launch new features such as Keydrops, Memeclubs, and Pinned Rooms. Dune data shows that since the release of V2 on May 4th, the number of clubs on friend.tech has reached 107,513.

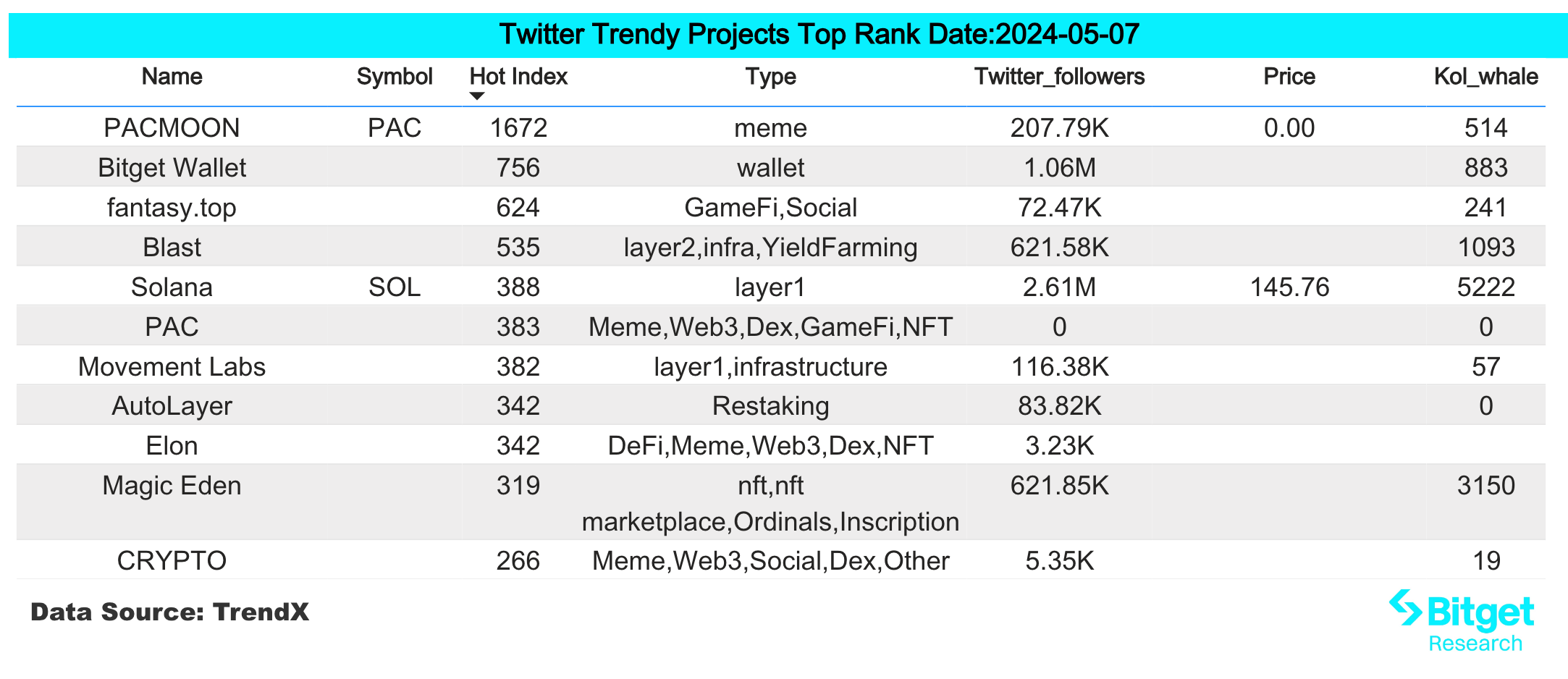

2) Twitter

Bitget Wallet:

Bitget Wallet announced yesterday: the launch of GetDrop, which is a welfare zone for exclusive airdrops to the community, BWB Points, and future token holders by the ecological cooperation project of Bitget Wallet. The first phase of GetDrop, "MEME Party," will be launched on May 7th.

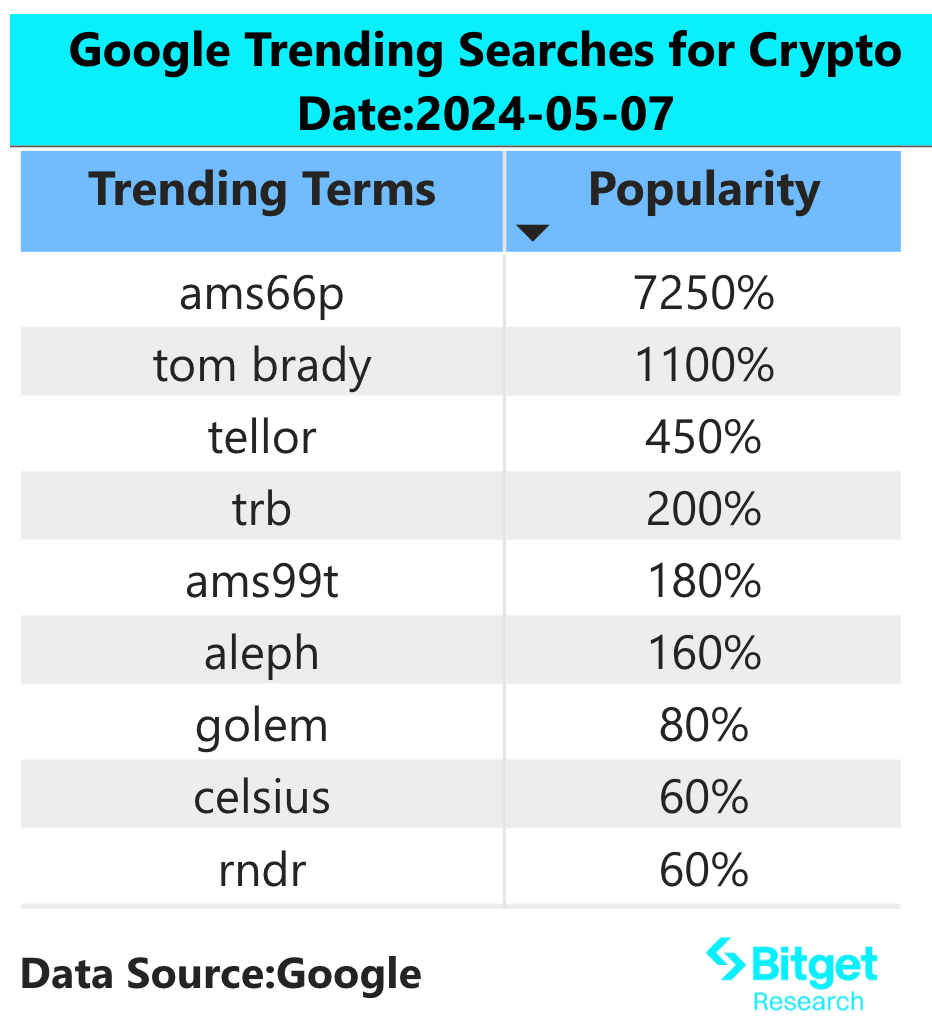

3) Google Search & Region

From a global perspective:

RNDR: Yesterday, including RNDR, AI sector tokens all rose, and RNDR had on-chain transfer anomalies. Apple's Worldwide Developers Conference will start on June 10th, and RNDR may be speculated. Previously, there were significant fluctuations in RNDR's coin price before and after the Apple Vision Pro conference.

TRB: The token TRB, which is strongly controlled by market makers, has surged in the past two days, rising by 72% in the past 7 days. In Q4 2023, TRB experienced two huge short-term pump and dump events, with extremely high contract liquidation volume. Traders need to be aware of the risk of sharp fluctuations in tokens strongly controlled by market makers.

From the perspective of various regional hot searches:

Yesterday, there were significant differences in hot searches in various regions, with no universal regional patterns. The globally popular terms and tokens were Grass, TRB, RNDR, JUP.

However, the term "Tom Brady" appeared in hot searches in multiple regions such as Europe, America, and Asia. Tom Brady got angry on Netflix Roast due to jokes related to cryptocurrency, and he suffered heavy losses in cryptocurrency investments before.

IV. Potential Airdrop Opportunities

Tabi (Zero-Cost Interaction on Testnet)

TabiChain is a game blockchain built on Cosmos with EVM compatibility. Tabi Chain connects the Cosmos and ETH ecosystems through cross-chain functionality to achieve seamless communication. The asset layer concentrates the liquidity of chains and shards, achieving seamless interaction of game blockchains. It used to be the cross-chain NFT market Treasureland.

In 2023, the project completed a $10 million angel round of financing, with investors including Animoca Brands, Binance Labs, Draper Dragon, HashKey Capital, Infinity Crypto Ventures, and Youbi Capital.

Specific operations: (1) Visit the project's official website to claim test coins on the testnet (https://faucet.testnet.tabichain.com/); (2) Complete the Voyage tasks - the first phase has ended, and the second phase is ongoing. You can join the project's Discord to find an invitation code; (3) Complete social media tasks on Galxe; (4) According to the information disclosed by the project, they may sell nodes similar to XAI in the future, which could be the focus of airdrops. If you are bullish on the project, you can purchase and configure nodes, but this requires DYOR (Do Your Own Research).

MYX Finance

MYX Finance is a decentralized derivatives exchange using the MPM model, incubated by D11 Labs, and employing intelligent fees and risk hedging mechanisms to ensure protocol stability and provide sustainable high returns.

In November 2023, MYX announced a $50 million valuation and completed a $5 million seed round of financing, led by HongShan (formerly Sequoia China), with participation from Consensys, Hack VC, OKX Ventures, Foresight Ventures, Redpoint China, HashKey Capital, GSR Markets, Alti5, Leland Ventures, Cypher Capital, Bing Ventures, and Lecca Ventures.

Specific operations: At the user operation level, it is not much different from a general derivatives DEX. Users can trade and provide LP. The project has integrated Linea and Arbitrum, and users can increase activity on the Linea chain to potentially receive Linea airdrops in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。